Editor's note: This article is from "Lian News" and is reproduced with authorization.

Since the middle of 2019, the "volume rise or fall" of the encryption market has been largely due to the liquidation of derivatives. Benson Sun, community partner of FTX Taiwan, said that the biggest difference in this drop is that this drop was not driven by “clearing derivatives”.

"In the past six months, most of the momentum in the bitcoin market, up or down, has been driven by derivatives liquidation (Liquidation). After the drop on May 19, the market has liquidated nearly $20 billion, while the open interest in the futures market The remaining amount is about 20 billion US dollars.

Most of the remaining positions are hedging or extremely low-leverage contracts. Therefore, without liquidation capacity, Sunday's decline actually puzzled experienced crypto traders. "

Regarding the doubts in the market, Sam Bankman-Fried (SBF), the founder and CEO of FTX Exchange, compiled some data on Twitter.

SBF said about $20 billion in contracts were liquidated during last week's plunge, leaving about $20 billion in open interest (OI) in the current market. While he believes that these open positions are unlikely to be liquidated, there are still "other types" of liquidations in the market, including spot margin trading, OTC loans, rumors of the Huobi/OKEx exchange.

SBF further explained that the current spot margin collateral amount of FTX is about 1 billion US dollars, which is still stable, while that of Bitfinex is about 2 billion US dollars. Other exchanges may have a larger liquidation volume, which may be due to falling liquidation one of the sources.

In addition, the market rumors that the Huobi/OKEx exchange will shrink due to the Chinese government’s ban (now confirmed) may also be one of the reasons. The combined open interest of these two exchanges may be around 3 billion US dollars . Finally, SBF also mentioned that Chinese miners are selling Bitcoin and Ethereum, but the exact number of sales is still unknown.

Despite collating some of the data, SBF was unable to determine price action.

"Even knowing this, it is impossible to predict future price movements, because anyone can trade at any time.

secondary title

Deleveraging in the spot market

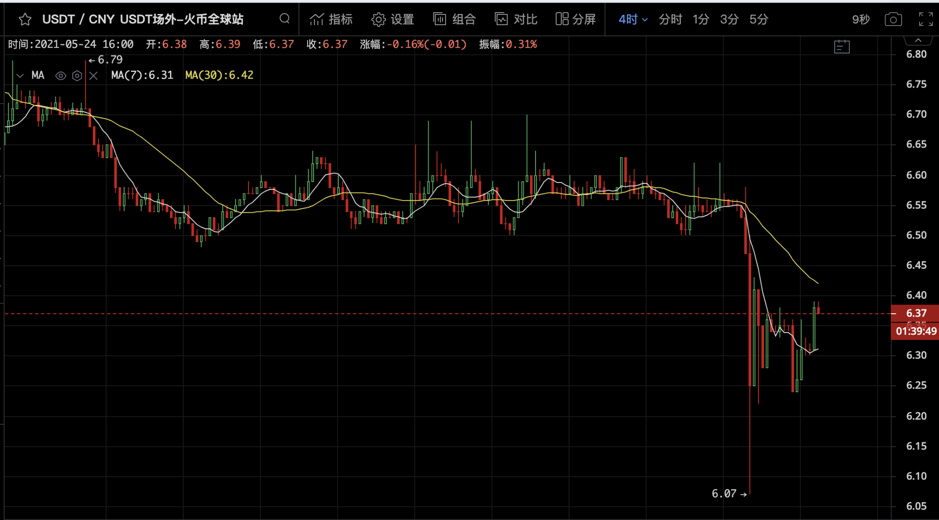

Benson analyzed that, from the collated data,It can be speculated that this decline should not be driven by derivatives, but more likely to be related to China’s regulatory policies. On Friday, the State Council of China set a tone to crack down on Bitcoin’s “mining and trading”. The price plunged instantly (see picture).

He explained that in the past, most of China’s regulations were to restrict financial capital’s involvement in digital currency transactions and to curb the hype of funds. The level is much higher than before. Liu He is currently the highest-level official in China who has publicly ordered a crackdown on Bitcoin. His influence is so great that it cannot be generalized with previous regulatory news.

He believes that this may also explain why Bitcoin will fall infinitely during the holiday. Since the State Council’s news was released at 10 pm last Friday, the relevant policy details will be released this week. There may be some mine owners and traders. Worried that the implementation details would contain major bad news, they rushed to sell coins to cash out during the holidays, causing the OTC price of USDT on major mainland exchanges to change from a premium of 1-2% to a discount. "There is a special force in the weekend market that has been selling coins, and holidays have lower liquidity than weekdays, which may be the reason for the continuous decline of Bitcoin and the plunge of small coins." Benson added.

Benson’s guess also coincides with the tweet released by Wan Hui, managing director of Danhua Capital. On the day the State Council released the news, Wan Hui mentioned on Twitter that some big miners in China are ruthlessly selling coins to cash out:

On the other hand, China's three major financial associations' warnings about bitcoin transactions are likely to be the main reason for the decline.

Not just for the encrypted trading market, the Chinese government has actually implemented a "credit crunch". In order to strengthen risk control, the People's Bank of China has begun to reduce the economic stimulus measures related to the epidemic in advance, and established market discipline for the most vulnerable economic activities, and the encryption market is one of the "fragile" economic activities.

Benson said:

"The deleveraging of the spot market is likely to be the reason for the weak rebound and another decline, which is exacerbated by the credit crunch of the Chinese government. Perhaps this can explain why miners or traders have to pay attention to liquidity and liquidation volume. When it's this low, sell your position."