The author of this article is Chain News, please indicate the source for reprinting.

secondary title

Mainstream exchanges are rumored to be shut down

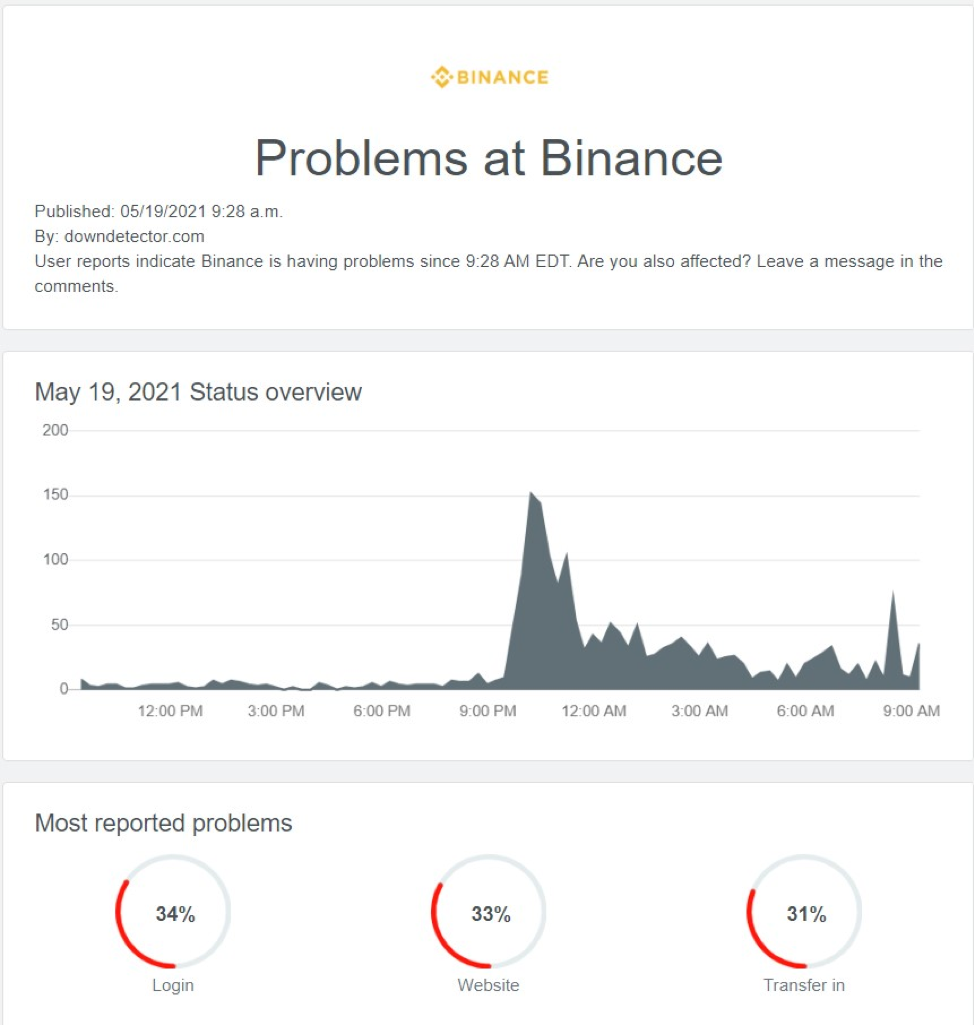

Binance

Binance, Coinbase Outage Reports Surge Late 5/19, Detecting SitesDownDetectorIt shows that users reported hundreds of problems that night.

announcementannouncementSuspend ETH and ERC20 withdrawals.

CoinMarketCap, an encrypted data platform owned by Binance, also showed a gateway error and could not be accessed.

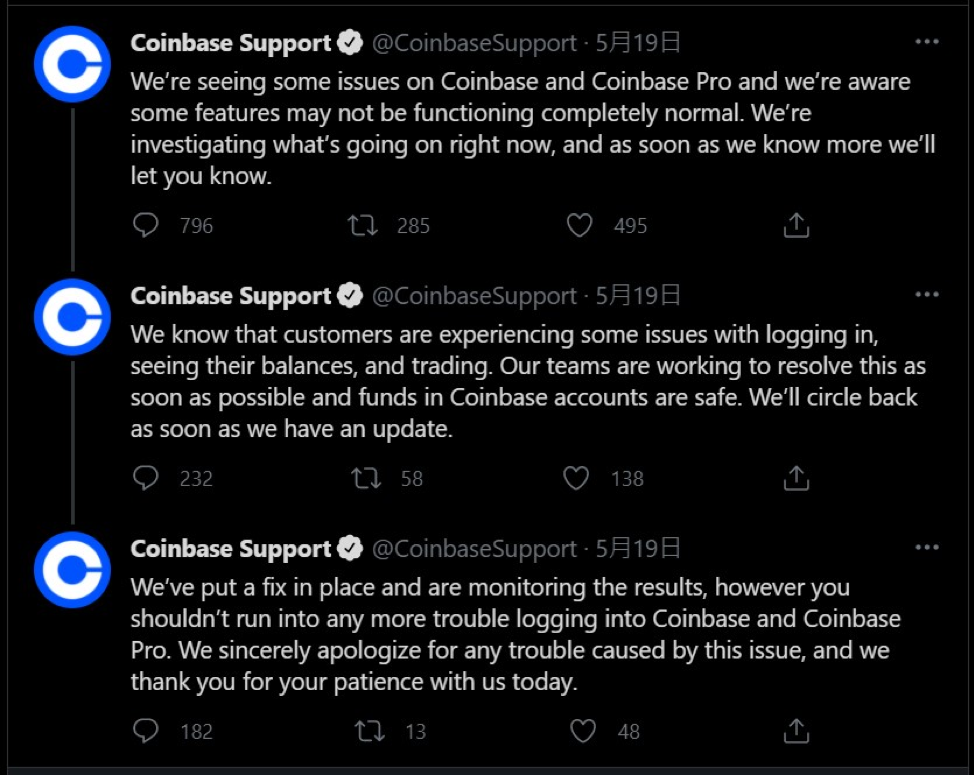

Coinbase

Coinbase announced on Twitter that it is known that users cannot log in, view asset balances and trade normally, and are working hard to solve related problems.

Although TikTok was once squeezed out of the U.S. App Store rankings and jumped to the first place, its stock price fell below $200 (208.44) on 5/19 in the face of successive currency market declines and exchange shutdowns.

Gemini, KuCoin, and Revolut are also listed

Cryptoasset bank Revolut said it was unable to buy cryptocurrencies that night after users claimed they could not buy cryptocurrencies.ReplyThere is a problem with related functions, and it is actively being repaired.

pausepausetracktrackGemini also had a failure, and many users complained loudly under the official push.

Mr. Whale, who is followed by more than 180,000 people on Twitter, compiled a list of crashes, including Coinbase, Bitfinex, Binance, and Kraken.

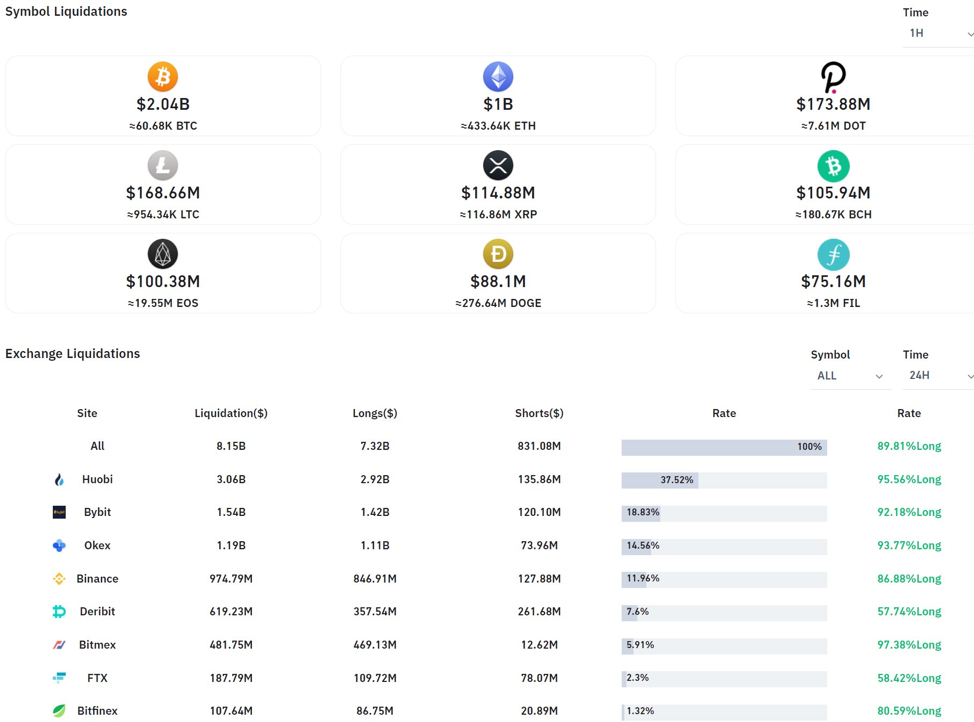

SBF posted pictures? The liquidation rate is only 2%

releasereleaseAccording to the data of the entire network liquidation, the market liquidated 8 billion US dollars in just one hour, but perhaps the bright spot he wants to show is the extremely low liquidation rate of FTX.

According to encrypted data platformSkewJudging from the contract data, the contract trading volume of the entire network on that day was 241 billion U.S. dollars, and FTX was 14 billion U.S. dollars, accounting for 5.8%, while the liquidation rate was 2%.

Huobi, which ranks first, accounts for 17.01% of its trading volume, but its liquidation rate is more than double that of 37.52%.

Its main competitor, Binance, accounted for 33.6% of the transaction volume and 37.52% of the liquidation rate.

In addition, FTX also did not have a downtime problem this time, and the SBF of Longxin JoyRetweetMany users tweeted that the same token had also opened contracts on Binance, but Binance’s positions were liquidated.

analyzeanalyzeThe cause of the market crash, apart from vague regulatory rumors from China, is more likely to be a natural correction, and the result of excessive leverage has led to a large number of liquidations in the market.

Previously 4/18collapsepointed outpointed out : One thing I can never understand is why is everyone so convinced that Bitcoin's rise to $60,000 was driven by the spot market?