This article is the content of an exclusive interview with SBF, the original text was published onForbes,Please indicate the source.

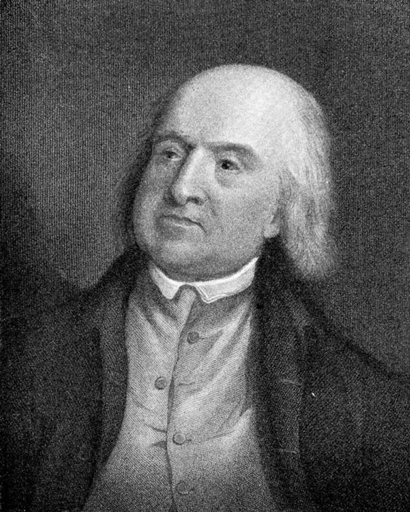

Media coverage of Sam Bankman-Fried (later referred to as SBF) has become commonplace - 29 years old, vegetarian, a few years ago usingjapan and america[PJJ1]The huge price difference of BTC made huge profits, and became a few billionaires in the field of cryptocurrency. Subsequently, he founded FTX, the world's largest and fastest-growing digital asset derivatives exchange. However, after reading more and more reports about him, I gradually found that the mainstream media missed a fundamental point, that is the world view of SBF. He is like Bentham (Jeremy Bentham, British economist, social reformer, and founder of utilitarian philosophy) in the field of cryptocurrency, basing his business philosophy on the principles of effective altruism and utilitarianism advocated by Bentham. basically. What he is after is not just to become the richest cryptocurrency billionaire, but to have the greatest positive impact on the world. Therefore, his greatest motivation to work hard to earn money is to maximize this positive impact.

Brendan Doherty: Welcome to the Forbes Most Powerful People List (Icons of Impact), outsiders of the cryptocurrency world may not know that you founded two fast-growing companies, can you introduce Alameda and FTX to us first?

Sam Bankman-Fried: After graduating from MIT, I spent three and a half meaningful years at Jane Street Capital. After that, I left my job, started my entrepreneurial journey, and chose to enter the field of cryptocurrency.

The first company is Alameda Research, a cryptocurrency quantitative trading company. We found that all indications are that there will be a huge demand for liquidity in the cryptocurrency space, but little liquidity will be available. Everyone was talking about cryptocurrencies during that time. Huge price swings and massive inflows clearly show that people in many different countries are trying to buy different kinds of cryptocurrencies through various methods. While the cryptocurrency market was already expanding rapidly at the time, the phenomenon was only a few months old. This means that most buyers around the world are not yet part of the cryptocurrency ecosystem.

Doherty: So you see a business opportunity in the lack of crypto infrastructure?

Sam Bankman-Fried: Yes, we suspected at the time that the infrastructure to service the cryptocurrency market was not adequate. This means that demand can outstrip liquidity and can lead to large market spreads, creating arbitrage trading opportunities. So I got into the cryptocurrency space to see if my guess was right, and it turned out I was right.

Doherty: After that you started FTX?

Sam Bankman-Fried: A year later, we started creating FTX. When I first started trading cryptocurrencies, if you bought Apple stock, generally retail investors would buy it from a platform like Robinhood, and then pass it through liquidation companies and other institutions. The trading platform at the end of 2018 was a complete mess. They lose an average of $1 million in client equity per day without any perfect features to attract clients. To me, this is just a symptom of the problem, not the core. So that seems to be a huge gap in the market, but also a sizeable market space. I think FTX can do better. I want to combine buyers, sellers and exchanges. So we launched FTX in the spring of 2019 and have grown from scratch to become the fourth largest cryptocurrency exchange in the world today.

Doherty: FTX has had incredible growth. On that basis, I would like to focus the rest of the conversation on one of your areas of work, one that gets little media attention. The media focus is more on the major cryptocurrency transactions related to you, and the rapid development of FTX. But I'm more interested in something else, deeper, which is the driving force behind all of the above, your worldview. You said you wanted to maximize the positive impact FTX has on the world. So can you start by talking about where that influence started?

effective altruismeffective altruism(Effective Altruism), I think this is often overlooked. For FTX, since we look at the entire budget, I think it's easy to lose sight of who is being donated, and what the money is going to be used for. But for me, the most important thing is to find the most effective recipients.

Doherty: You said earlier that effective altruism is about making as much money as possible and then using that money to have the greatest positive impact. I think there is a contradiction here. Some critics will say that part of the reason for the widening gap between rich and poor is that some people think this way. What do you think of this point of view?

Sam Bankman-Fried: Making money first and then making a positive impact is just a simple generalization of effective altruism. All steps to achieve effective altruism have direct and indirect impacts. We must quantify impact in terms of these two factors. There are many professions that are not really good for the world. Even if you can make a lot of money in such a career, it may not be the right thing to do. So, if someone is negatively impacting the world through these jobs, even if they donate those proceeds to a valid charity, it can't be called a good deed. It seems to me that we need to quantify the whole thing, which to me is at the heart of effective altruism. We cannot make a perfect quantification of this world, but we can try to use numbers to roughly quantify everything.

Doherty: You gave an example earlier to make a good distinction between people like Elon Musk making billions of dollars through Tesla, and Exxon Mobil making billions of dollars using fossil fuels, that is Different. Both have reaped billions of dollars, but their external impacts have been very different.

Sam Bankman-Fried: Yes, it's almost impossible for us to say that there is any global negative impact on Tesla's business. Some people think that Elon Musk has made great contributions by creating green technology. Those who disagree with Tesla may argue that this is just a waste of resources and that Tesla will fail. But in any case, Tesla will not destroy the world.

Doherty: I agree too. Now let's talk about philanthropy. I see that you have introduced a different perspective of doing philanthropy, especially through the concept of crowdsourcing. What does it mean to involve your consumers, audience, and community in the decisions of the FTX Foundation?

Sam Bankman-Fried: Originally our plan was to donate 1% of the money FTX makes to charity, but that wasn’t the biggest factor in ultimately determining how much I could donate. We thought, is there any concrete and feasible public-facing program that can be implemented immediately to get people involved in charitable activities? So there is the current plan, users can vote to decide where the funds of the foundation will go, and they can also donate to the foundation. We were really blown away by the enthusiasm of the users. Our users have donated $5.6 million. There are a lot of people in the cryptocurrency space who have made a lot of money over the past dozen years, and it's only natural for them to think about what they can do to make a positive impact on the world. Therefore, I think the cryptocurrency space has considerable potential in motivating people to contribute more to noble causes. So crowdsourcing is an easy way to get people involved in philanthropy and practice effective altruism.

Doherty: Let's talk about utilitarianism, a concept you bring up a lot as the basis for a lot of your thinking. Can you talk about your views on utilitarianism and how it has changed your behavior?

Sam Bankman-Fried: To me, utilitarianism means making the best use of all the money I make to be the happiest person in the world. This might sound a little too idealistic or even silly, and of course everyone wants to be like that, but it's actually a pretty powerful concept with strong implications in many situations. Utilitarianism is all about maximizing everything. Some people say that as long as we don't do bad things, we are fine. But I think just as important as not being evil is finding what you can contribute to the world. We should be thinking about what we want to do with our lives, and what choices we have to make the world a better place as much as possible.

image description

Jeremy Bentham, 1748 - 1832, British philosopher, jurist and social reformer, founder of utilitarian philosophy. (Image credit: Bildagentur-online/Getty Images)

Sam Bankman-Fried: Yes, they're both utilitarian, or at least utilitarian. So I was exposed to this philosophy as a child.

Doherty: Indeed, usually very early on! I selected some of your previous remarks and would like to hear your interpretation. You said: "Money is the measure of caring for others." Can you elaborate?

Sam Bankman-Fried: There are many ways to contribute to the world and one of them is donating money to a good cause, and while donating money is not always the best way to do it, money is really powerful and can be exchanged for Other required supplies. Another advantage is that when trying to compare the quality of two different interventions, it will be much more convenient if we can use the same unit of measurement, otherwise it is difficult to quantitatively compare different concepts. And it is also conducive to the implementation of measures to use a certain currency as a unified unit to measure. If we have money, how much good can we do with it? We will turn money into good deeds. When we are making various trade-offs, we can consider how much extra income this can bring to this public welfare undertaking.

Doherty: Exactly, and money can be more targeted to meet needs. You've also said before that you were "notorious for starting some new, big project at random." What is the next project you want to build?

Sam Bankman-Fried: Now there are some projects that haven't been specifically publicized. FTX is giving staff raises and I spend a lot of time on this. Although this is actually just an internal sub-project of FTX, I think more about the future of the company. What is the best situation in the future? How do I achieve such a future? It's easy to be misled into thinking that everything we're doing is the limit of what we can do, but we don't think about the broader picture of everything we can do. As far as FTX is concerned, we can focus on getting more core users, but there will be limitations. I'm also thinking about how we can reach other populations we've never reached. How to build a great global brand while maintaining the existing corporate culture, industry reputation and user favor requires more time and effort to achieve. These tasks are new challenges for us, but they are critical to realizing FTX's ambitions.

Doherty: I agree with you that we all need to think about how we can live life to the fullest rather than just being complacent. Thank you for sharing so many wonderful perspectives with us.

Although the "kimchi premium" at that time was a 30% price difference between the Korean and American markets, SBF should have used the 10% price difference between the Japanese and American markets at that time. Reference Information:https://www.chainnews.com/articles/700029039565.htm(Chinese translation)https://nymag.com/intelligencer/2021/02/sam-bankman-fried-biden-donor.html(Original English text)