The author of this article: Blockchain Xiaobage, forwarded with authorization.

On the exchange track, there is no eternal strong man, the times create heroes, and heroes follow the trend!

In 2020, DeFi swept the entire currency circle. In just one year, the total amount of locked positions in DeFi soared from 5 billion US dollars to 60 billion US dollars. DeFi projects such as Link, Comp, and Aave frequently increased ten times or even dozens of times. As a person who experienced it personally, I saw community currency friends complaining: "Where can I buy Mkr?", "Why hasn't xx exchange launched Uni yet?".

The exchange's grasp of DeFi imagination and the speed of listing coins largely determine the profitability of retail investors in this round of bull market. Compared with small exchanges, large exchanges have a keener sense of emerging opportunities. Under the background of the DeFi boom, many users of large exchanges have made a lot of money, including FTX exchange.

FTX exchange is also favored by high-frequency traders because of its low transaction fees and zero withdrawal fees. There are data showing that whale-level traders prefer to trade on FTX exchange. In addition to the excellent user experience, the low transaction fee saves millions of money every year. If things go on like this, it is also a fortune. Regarding the FTX transaction fee rate, we will mention it later.

According to The Block Research, FTX is the most active in listing DeFi governance tokens. The most mainstream DeFi tokens on the market were launched almost at the earliest stage. Due to the keen sense of the popularity of DeFi, the prices of the listed tokens are all in the state of not starting or not starting soon, and platform users are also participating in DeFi at a relatively low level. . This is also the most essential currency listing strategy of FTX, which is to launch a large-scale cryptocurrency with a profit-making effect to make profits for platform users.

secondary title

FTX is based on DeFi, and the effect of creating wealth is obvious

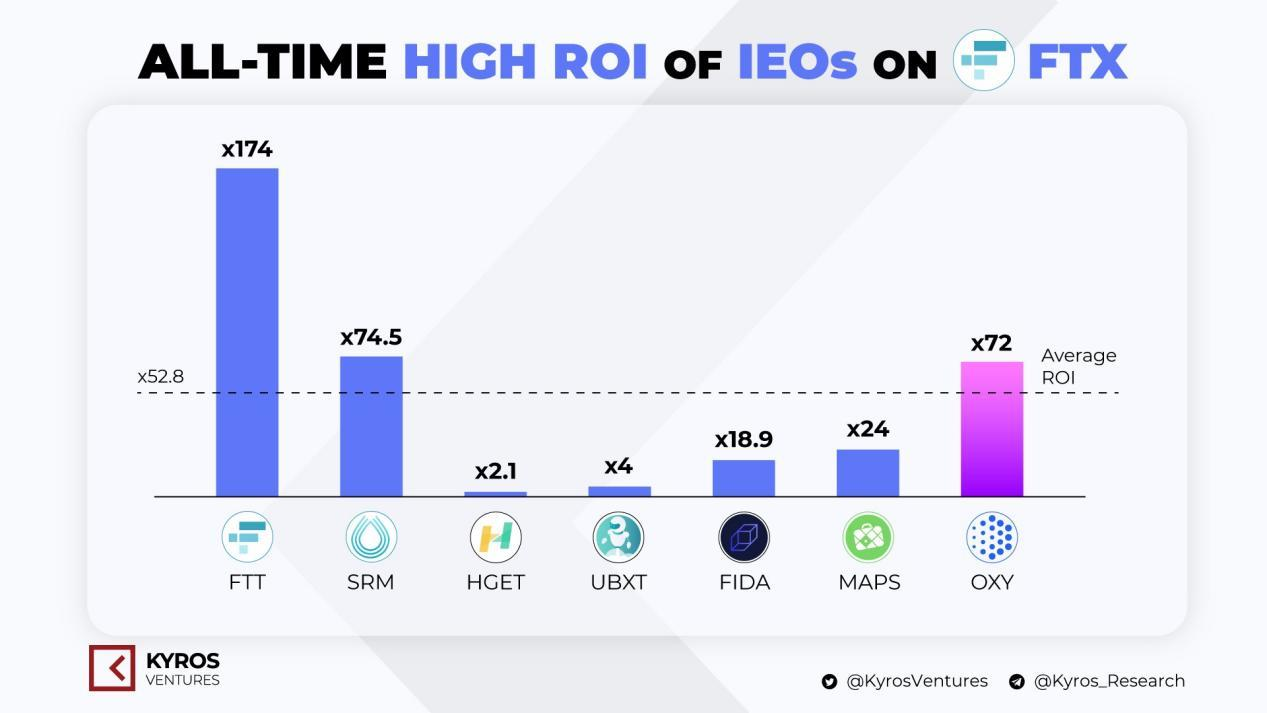

So far, the FTX exchange has launched a number of IEO projects. Unlike the harvesting model IEOs of small exchanges that plummet when they go online, most of the IEOs launched on FTX have achieved good results, and the strong effect of making money has also attracted people in the currency circle. A lot of eyeballs. These include well-known projects such as SRM, FIDA, MAPS and OXY.

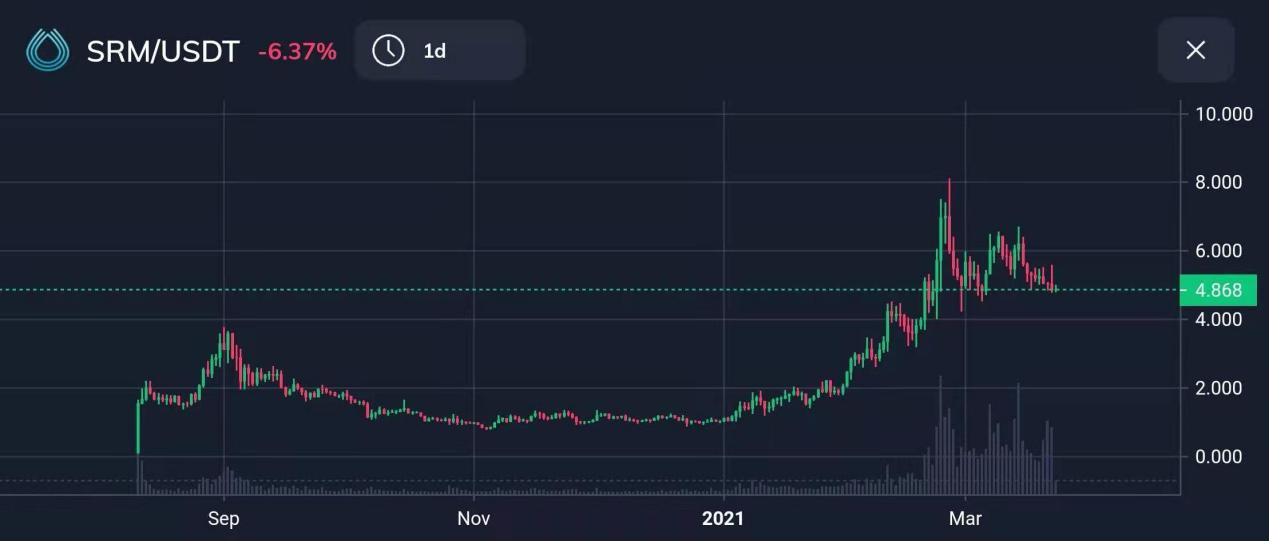

In August 2020, SRM conducted an IEO on the FTX exchange. SRM is the token of Serum, a decentralized finance (DeFi) project. This is a decentralized ecological project based on the public chain Solana, including a complete set of DeFi infrastructure, including cross-chain assets, interoperability solutions, stable coins, etc.

Each participant in that IEO bid for a maximum of 2,500 SRM, and 1,200 successful bidders shared 3 million SRM. The bidding weight is based on the bidder's FTT holdings and trading volume in FTX in the past month. All the SRM obtained from the auction will be unlocked and can be traded after SRM is officially launched on FTX on August 11.

image description

SRM listing trend chart (from FTX exchange)

The opening price of SRM on the FTX exchange was $0.1, and the current price is $4.8, an increase of 48 times.

The later IEO project Maps, Maps is the token of the travel platform Maps.me. Maps.me2.0 is powered by Serum and runs on the scalable, efficient and high-speed Solana chain.

Oxygen, Oxygen is a DeFi service provider, built on the Solana blockchain, the token is OXY, and the basic service measures on the chain powered by Serum.

Maps was launched on the FTX exchange on February 1st. The listing price was US$0.125, and the current currency price is US$0.99, an increase of up to 8 times.

As well as the recently launched OXY, the opening price was only 0.125 US dollars, and now it is 2.96 US dollars, which has increased by as much as 23 times.

Such high-growth IEO projects are not uncommon on the FTX exchange, which shows that FTX is more inclined to long-term development in terms of currency listing values. FTX is well aware of the short-sighted behavior of cutting leeks online, such an exchange cannot go far.

While the concept of DeFi exploded, FTX quickly seized the opportunity to grow together with DeFi. For high-quality DeFi projects, FTX uses the resources and funds in its own circle to help them incubate and empower them. FTX uses its status and influence as the global trading overlord in the field of derivatives to further spread the influence and reputation of DeFi products. The high returns that investors can get by as many as 10 times are directly related to the continuous empowerment of FTX.

To a certain extent, the high-quality DeFi tokens launched by FTX also help platform users better understand the nature and value of DeFi. This is more important than why users buy DeFi, and the FTX exchange tells users why they should hold DeFi tokens. Without a correct understanding and belief in the DeFi worldview, investors cannot hold DeFi.

secondary title

Platform Empowerment, FTT Breaks New Highs Repeatedly

In the traditional sense, currency exchanges provide currency transactions, OTC transactions, fiat currency transactions, and leveraged contract transactions. In the past, these basically met the needs of people in the currency circle. However, with the development of the times, the types of transactions also have higher demands. FTX Exchange has its own understanding of the ability of currency exchanges to get out of the circle. FTX Exchange Trading Various types, providing a variety of trading experiences for different groups.

The FTX exchange provides a way to play US stock tokens, allowing people in the currency circle to indirectly hold US stocks by purchasing US stock tokens. Users who are unable to participate in U.S. stocks due to geographical and principal issues can also indirectly participate in U.S. stock transactions on the FTX exchange. In addition, there are prediction market contracts that make FTX out of the circle, which have been widely reported by the media: the Trump coin launched during the US election, the contract on whether the Tokyo Olympics will be held smoothly, etc. The rich and interesting gameplay has attracted many users from other exchanges to come to FTX, and even non-currency users from the traditional financial circle came to open accounts, bringing incremental funds to the currency circle.

FTX has seized the DeFi hotspot, coupled with the wealth-creating attributes of IEO, and the rich and interesting trading forms of the exchange itself have caused a large amount of traffic to flow into the FTX exchange. In 2020, the total transaction volume of FTX reached 10 times that of 2019. At the same time, the number of new users on the platform exceeded hundreds of thousands, and the number of daily active users increased by 786%.

In terms of transaction scale, according to CoinGecko data, FTX’s encrypted derivatives trading volume is 4.57 billion US dollars, ranking third in the world, and its spot trading volume is 550 million US dollars, ranking 9th in the world. This emerging exchange, which was established only two years ago, actually ranks among the top in the world in terms of overall trading volume. These achievements are also reflected in the price of the platform currency FTT of the FTX exchange.

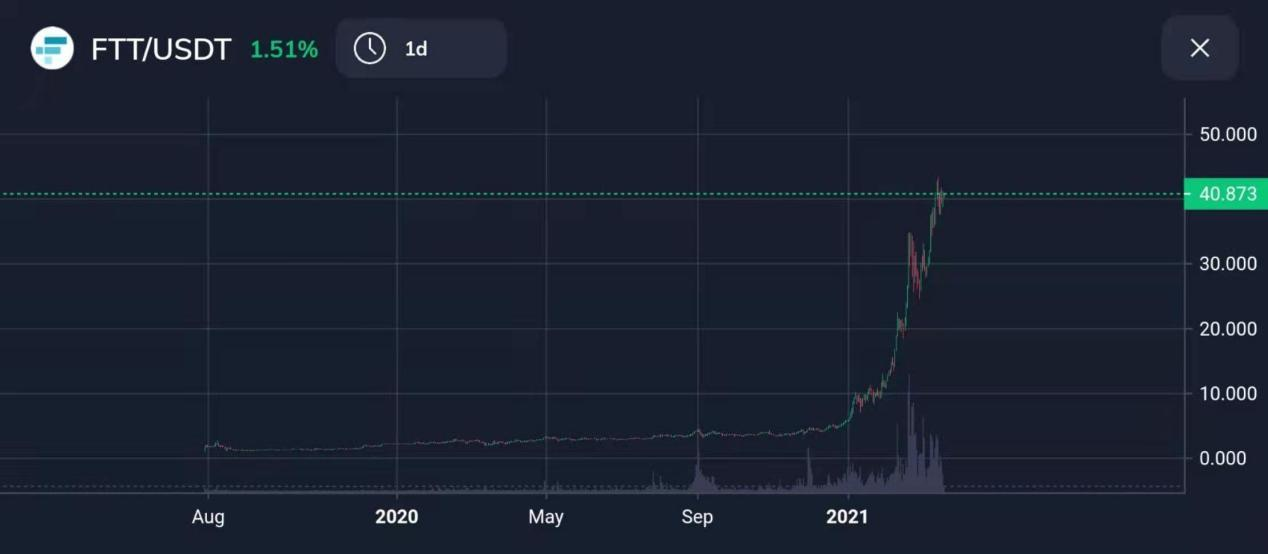

FTT is the platform currency of FTX, with a total of 350 million pieces. FTT can be understood as the equity certificate of the FTX exchange. The FTT platform currency launched two years ago, the issue price is only 1 US dollar, and now with the FTX exchange continuously empowering the FTT ecosystem, such as participating in the platform IEO according to the holding and trading volume, and holding FTT to reduce transaction fees , Using platform revenue to repurchase FTT for destruction, etc., the intrinsic value of FTT has been continuously improved, and the price has also risen.

For example, the reduction or exemption of transaction fees. For high-frequency traders, the fee is often the main reason why they are afraid of frequent operations. On the FTX exchange, if the 30-day trading volume exceeds 5 million US dollars, the pending order fee is only 0.01%, and the taker fee is 0.055%; if the trading volume exceeds 10 million, the pending order fee is reduced to 0.005%; if the trading volume For more than 25 million, the order fee is 0. Compared with exchanges in the same industry, FTX Exchange helps high-frequency traders reduce expenses and lock in profits.

On the basis of transaction volume, FTX also adopts the currently popular tiered fee rate. The more FTT you hold, the higher the transaction fee discount you can enjoy. You only need to pledge 150 FTT to get a minimum -0.0005% pending order rebate.

Moreover, the destruction mechanism of FTT is also one of the important factors that promote the realization of the value of FTT tokens. Every week, FTX will use 33% of the FTX contract fee income (the main repurchase fund), 10% of the net increase in risk margin, and 5% of other fee income on the FTX platform to repurchase FTT and destroy it until the FTT reaches the total Half of the circulation, so as to achieve a token economic model in which the supply decreases within a limited range. As a result, FTT is becoming more and more rare. As FTT is used in a wider range of scenarios, it is understandable that its value will rise.

After FTX has empowered FTT a lot, capital has poured in. The currency price of FTT has also risen, and now it has touched 40 US dollars, an increase of 40 times in two years. Compared with OKEX's platform currency, OKB has increased by 13 times since its birth; Huobi's platform currency, HT has increased by 12 times since its birth. FTT's return on investment of 40 times ranks among the top among similar exchanges.

write at the end

write at the end

Personally, I think that the layout of the platform currency is a must for everyone in the currency circle. The tokens of the project party may be unclear, but the platform currency actually has the logic of making money. Therefore, it is especially necessary to reserve some platform currency in the position, such as BNB, such as FTT, which still has a lot of space.

For users, over the past two years with FTX, the platform has been "doing things" personally, whether it is keeping up with the DeFi wave or actively exploring its own DeFi ecology; whether it is high-quality coins on IEO or its own platform currency FTT skyrocketed. We see an exchange that remains humble and continues to grow. FTX has not stopped, but is more active through ecological layout, constantly creating applicable scenarios for FTT, and accelerating the appreciation of FTT.

In the future, I am still optimistic about FTX or overtaking in a corner, becoming the world's top exchange, continuing to provide fresh blood for the industry, and setting an example for the industry.