During the week of November 2nd to November 8th, the events worthy of attention in the progress of star projects include: the Polkadot parachain test network Rococo is about to be upgraded to version V1; the synthetic asset issuance platform Synthetix has its first liquidation; Grin Network suffered a 51% attack .

Star Project Progress

The following are specific project progress and financing events:

Star Project Progress

Rococo, the Polkadot parachain test network, is about to be upgraded to version V1

On November 6, Polkadot co-founder Robert tweeted to share the progress of the Polkadot parachain. Polkadot is currently promoting the consensus code of the V1 version of the parachain. The next step is to deploy the V1 version code of the parachain to Rococo. It also means that Rococo is about to upgrade to V1 version.

Gavin Wood also explained that this is one step closer to the fact that parachains can be deployed on Kusama and Polkadot.

BCH upgrade is imminent, Coinbase officially announced to stand for BCHN

On the morning of November 5th, Coinbase officially tweeted that Bitcoin Cash (BCH) is expected to undergo a hard fork upgrade on November 15th. Prior to the fork, Coinbase will be running a BCHN node with the expectation that it will be the dominant forked chain. Once the upgrade starts, Coinbase.com and Coinbase Pro will suspend the BCH sending and receiving services, and re-enable them after the upgrade is confirmed to be stable. The official reminded that once the hard fork is completed, Coinbase.com and Coinbase Pro will not support the sending and receiving of BCH ABC forked coins.

Synthetix, a synthetic asset issuance platform, sees its first liquidation

Synthetix, a synthetic asset issuance platform, was liquidated for the first time. The official said that the implementation of the entire liquidation process was successful. According to official documents, when the mortgage rate of a SNX staker drops below 200%, it will be marked as risky. At this time, the staker can add more SNX as collateral, or destroy sUSD to raise the stake rate to 600 %, otherwise this part of SNX can be liquidated after 3 days.

2Miners mining pool: Grin Network suffers 51% attack

News On November 8, 2Miners mining pool tweeted that Grin Network is under 51% attack and payment has been stopped. Please do so at your own risk as new blocks may be rejected. Cihat Öztürk, a cryptocurrency analyst, tweeted in the early hours of November 9 that it was unclear how many tokens the hackers had profited from the attack.

MakerDAO initiates votes on adding YFI and BAL as collateral and adjusting the debt ceiling

Governance facilitators and the Maker Foundation smart contracts team have incorporated a series of executive votes into the voting system, including:

1. Add YFI and BAL as new collateral types;

2. Reduce the ETH-A debt ceiling from 540 million DAI to 490 million DAI;

3. Reduce the ETH-B debt ceiling from 20 million DAI to 10 million DAI.

4. Reduce the MANA-A debt ceiling from 1 million DAI to 250,000 DAI.

5. Reduce the USDT-A debt ceiling from 10 million DAI to 2.5 million DAI;

6. Increase the WBTC-A debt ceiling from 120 million DAI to 160 million DAI;

7. Increase the LINK-A debt ceiling from 5 million DAI to 10 million DAI;

8. Reduce the ETH-B stability fee from 6% to 4%.

NEAR developers propose to calibrate inflation rate based on block time

On November 2, Bowen Wang, the core developer of the open network platform NEAR Protocol, put forward a proposal to calibrate the inflation rate based on the block generation time instead of the number of blocks. The reason is that currently 1.2 to 1.3 NEAR blocks are generated every second. If the inflation rate is calculated according to the number of blocks, the inflation rate will be 20% higher than expected.

The Aave community announced the second round of application development funding plan, with a maximum funding amount of 10,000 aDai

The Aave community announced the second round of funding plan, and each team/project can apply for a maximum of 10,000 aDai. Applications below 5,000 aDai will be decided by the grant committee in the Aave community as soon as possible, while grant requests exceeding 5,000 aDai require further review by other Aave stakeholders and team members, so it will take longer.

Lightning Labs launches liquidity marketplace on Lightning Network

Lightning Labs has launched Lightning Pool, a liquidity marketplace on the Lightning Network. According to the announcement, the new non-custodial, P2P marketplace “transforms” Lightning Network liquidity into a tradable asset, allowing users to “buy and sell liquidity.” (The Block)

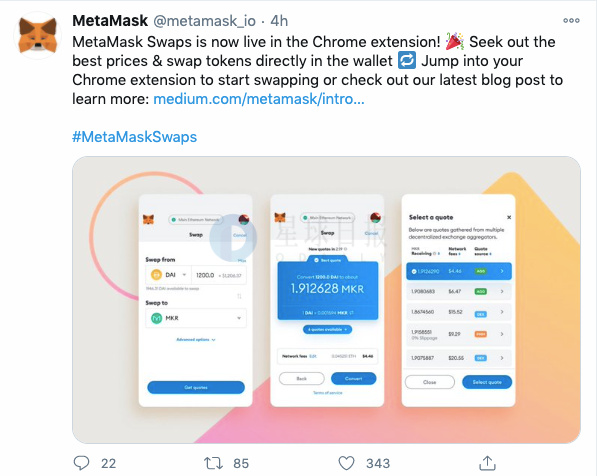

MetaMask Swaps are now available in a Chrome extension

MetaMask announced on Twitter that MetaMask Swaps are now available directly in the Chrome extension.

NEM new chain Symbol is expected to be released on December 17

News NEM released an announcement about the snapshot and release of Symbol (XYM). Snapshots will be generated as early as 2 days before the release, depending on the release date, which is expected to be between December 15th and 17th. The exact block height will be announced at least 5 days before the release.

Zenlink will integrate Chainlink oracles to provide data feed price for Polkadot's cross-chain DEX

According to official news, Zenlink, a cross-chain DEX network based on Polkadot, will integrate the data feed system of the decentralized oracle machine Chainlink. The Chainlink price oracle system will be used for financial product services built on top of Zenlink, such as lending, automated trading, and various other DeFi products. Chainlink will also play a role in the native protocol functionality of the ZLK token.

On November 5, the money market protocol Percent Finance announced that certain money markets of the protocol have encountered problems that may cause users' funds to be permanently locked. Specifically, USDC, WBTC, and ETH markets were frozen due to an incorrect rate model update made earlier today. Funding, borrowing, repayment or withdrawal from it is not currently possible. The net money (supply-borrow) in these markets is locked in contracts. The locked amount is: 446,000 USDC + 28 WBTC + 313 ETH. At current market prices, that totals about $966,000, about 50% of which belongs to the community mod team wallet.

Investment and financing overview

Investment and financing overview

Crypto derivatives exchange Opium received $3.25 million in financing from investors including QCP Soteria, Kenetic Capital and Alameda Research.

Opium founder and CEO Andrey Belyakov said that Opium was created to solve three problems in the traditional derivatives market: transparency, barriers to entry, and cost-effectiveness. All three of these problems can be solved with blockchain, because then “everyone can run their own derivatives.” Belyakov said, “We are improving the efficiency of DeFi in the short term, but our long-term goal is to compete with traditional derivatives in this huge market.”

Last month, Opium launched a USDT credit default swap product. The company also plans to launch different credit default swaps to compete with other solutions in the insurance market. (CoinDesk)

Alameda Research invests $3 million in crypto trading platform 3Commas

Alameda Research has invested $3 million in cryptocurrency startup 3Commas. It is reported that 3Commas provides retail traders with the ability to build automated robots to trade cryptocurrencies on multiple trading venues. (The Block)

Terra Virtua, a platform for digital collectibles, announced the completion of US$2.5 million in private equity financing, with participation from Woodstock, Hashed, NGC Ventures, LD Capital, YBB foundation, AU21 Capital, Twin Apex Ventures, Amplifi.vc, and Rarestone Capital. It is reported that the funds raised in this round will be used to further build Terra Virtua's NFT ecosystem.

News Mask Network announced the completion of a new round of financing, jointly led by HashKey and Hash Global. Participating institutions include Youbi, Alameda Research, Sino Global, IOSG, SNZ, SevenX, EverNew, etc.; individual investors include Liang Xinjun, Alex Pack, Josh Hannah, Balaji Srinivasan, Erik Trautman, Chen Yuetian, Scott Moore, Hongbo Tang, Qinwen, Steve Guo, Sun Ming, Liu Jie, etc.; previous round investors The Force and Shata Capital continued to invest.

Mask Network (formerly known as Maskbook) is a bridge to help users seamlessly transition from Web2.0 to Web3.0. It allows users to seamlessly send encrypted messages, cryptocurrencies, and even decentralized applications (such as DeFi, NFT, and DAO) on the platforms of traditional social giants.

The decentralized exchange Switcheo (SWTH) announced the completion of a US$1.2 million strategic financing led by cryptocurrency investment institution DeFiance Capital, with participation from Three Arrows Capital, Digital Assets Capital Management, DeFi Capital and MXC Exchange (Matcha Exchange).

NGC Ventures invests in Tidal Finance, a customizable insurance marketplace

Tidal Finance, a customized insurance marketplace for Xunke, received investment from NGC Ventures. Tidal Finance is a Balancer-like insurance market built on Polkadot. It has the function of creating a custom insurance pool for one or more assets in multiple chains, and maximizes capital efficiency by giving pool creators part of the deposit income as a reward .

The open market nature of Tidal Finance will greatly increase capital efficiency by facilitating competition between different pools of funds. Users can create a vault by selecting one or more contracts. For example, an insurance pool could be a mix of different tokens from different platforms (Compound Dai, Uniswap ETH, Aave YFI, Balancer ETH, mStable USDC, etc.). Pool creators have the option to choose any asset from any platform currently on the market, as well as set coverage periods, leverage, and more.

NIFTEX, a platform for creating and trading NFT fragments, raised $500,000 in financing led by 1kx

NFT fragment creation and trading platform NIFTEX received $500,000 in financing, led by 1kx, with participation from CoinFund, MetaCartel Ventures, Sparq, and Digital Currency Group. NIFTEX hopes to use the funds to give anyone who owns an NFT access to the platform and leave something tradable without sacrificing ownership of the original work.

NIFTEX co-founder and CEO Joel Hubert said that the company launched the Alpha version five months ago, with a total transaction volume of more than $2 million. NFT is going through a second value discovery cycle. In addition, Hubert also revealed the roadmap of the platform, which will design and build the second version, and move towards decentralization in early 2021, possibly releasing governance tokens. (CoinDesk)