In the recent blockchain circle or currency circle, apart from Filecoin's space race (with a reward test), the most popular ones are various lock-up mining and liquidity mining Defi projects. In the community and circle of friends, new and old leeks who have caught up with this wave of Defi are constantly seeing their income: 10 times in 3 days, 2000U becomes 320,000U, and a small profit of 5 times the income...

Dare to play Defi is to pick up money?

As a person who advocates value, I have always felt that Defi’s method of issuing new coins to encourage old coins to recharge and pledge, and to increase the price of old coins is not new. This process did not create much value. It is reasonable to stop playing for a long time. , so there has been no focus on participation.

However, since one after another story of getting rich overnight by participating in defi liquidity mining appeared, my face was really hurt from being "slapped".

first level title

Defi initial experience sharing

Unwilling to miss out on the defi trend and get slapped in the face without making money, I decided to give it a try and invest a little money to experience Defi. Not long ago, I just saw my Tron "Sun Cut", who "arrived late", announced for the SUN platform of his own defi project. Seeing my "Sun Huo" so hard to call everyone on TRON to "plant the sun", I decided to support me "Sun Huo" and participate in the Defi project of TRON.

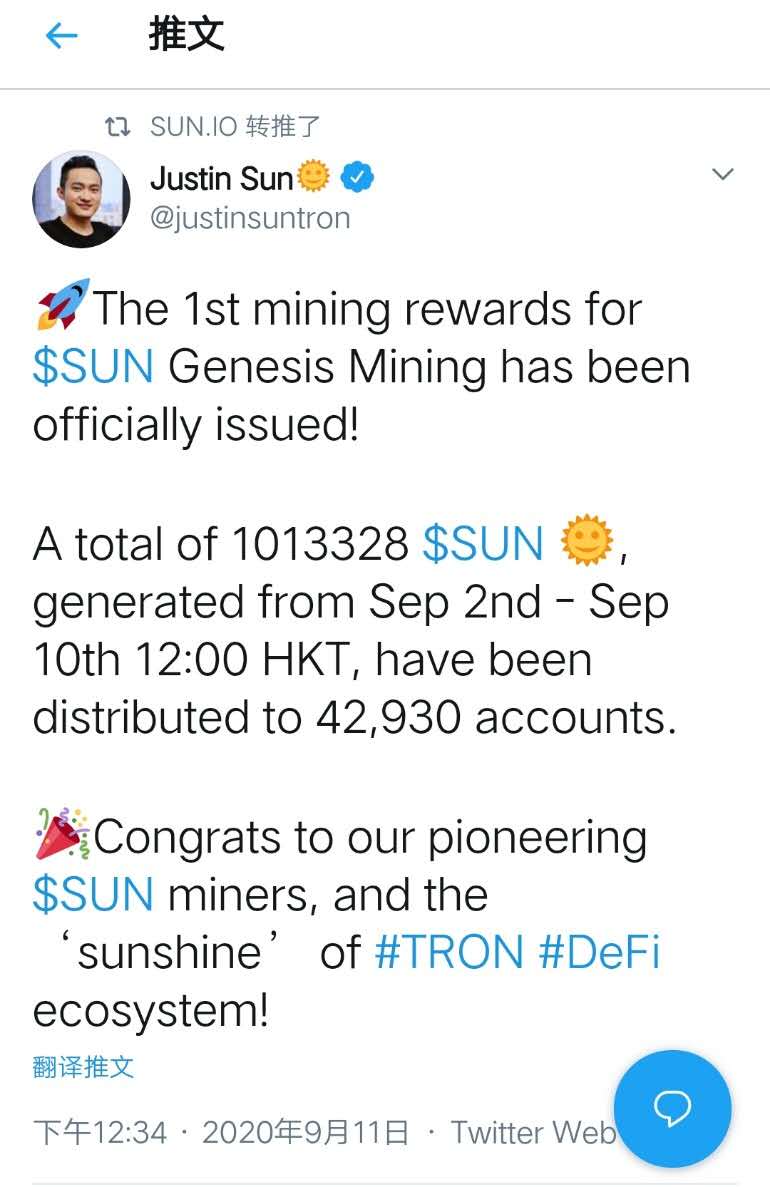

TRON’s Defi project SUN will start staking Genesis Mining immediately after its launch. Participating users need to pledge TRON-related currencies to the prize pool to share SUN’s Genesis Mining. The 14-day pledge will jointly share more than 1.86 million SUN .

The ratio of the user's pledged mining income to the amount and time invested in TRX is determined. The more pledged, the longer the pledged time, and the greater the amount of SUN that will eventually be distributed.

Although TRON launched SUN when many other mining-related Defis were hot, it was inevitable that there would be some hype, but considering that SUN is my "Sun Cut" who worked so hard to promote Defi. On September 2, I exchanged some idle USDT for 7,600 TRX, and participated in pledge mining and liquidity mining with small funds. The price of TRX was 0.0385U at that time.

As of now (September 15), the total amount of pledged TRX is 8.763 billion. I pledged 7600TRX, and the total amount of SUN dug out is 1.941. I have withdrawn 2 times before and after cashing out, and the mining income obtained is 58.5U. The pledged 7600 TRX were sold at a price of 0.0295, and I participated in SUN’s genesis mining within 15 days. My total income was: 7600×(0.0295-0.0385)+58.5U=﹣9.9U

The first time I experienced Defi, I was ruthlessly cut off. Dare I hear the stories of participating in Defi mining to get rich, are they just stories?

first level title

How does Xiaobai choose a Defi project

The DeFi project began to attract attention in June this year, and the volume of development increased sharply in July, reached a climax in August, and then began to show signs of enthusiasm retreating in September. In this wave of Defi boom, in just 3-4 months, hundreds of thousands of users in the currency circle participated, bringing a market value of Defi worth tens of billions of dollars.

Although it is full of bubbles caused by Fomo sentiment in the short term, it is more about the valuation premium of many valuable and promising Defi projects. So, which projects have more room for long-term development, and how does Xiaobai choose Defi projects.

secondary title

The imitation market with high demand in the market that will be launched soon

secondary title

The old public chain is about to launch Defi application

In the entire chain circle, the popularity of Defi has once again pointed out an application direction for many public chains. With the launch and enrichment of the Defi applications of Ethereum and Tron, other public chains have also announced their Defi development plans one after another. NEO, Ontology, Nervos, Polkadot Ecology, etc. will all promote their Defi projects, and it is expected that the second/third wave of Defi will continue.

Grasp the Defi application opportunities of these head copycat public chains, join early, and there is a high probability that there will be good profits.

secondary title

Ambush star projects that have passed the limelight in advance

Defi naturally fits the technical characteristics of the blockchain, and can be used as a supplement to Cefi, which has certain practical value. Some Defi star projects born in the early days have first-mover advantages in terms of community, governance mechanism, technology, etc. Although they may no longer be in the limelight, with the improvement and popularization of the Defi ecosystem in the future, there is a high probability that the former star projects will have the opportunity to lead The development of DeFi. The tokens issued by these projects and the new mining mechanism in the future are worthy of attention.

first level title

Some thoughts and predictions about the future of Defi

In the short term, the hotspots and price trends in the blockchain circle are more the result of irrational hype, but in the medium and long term, projects that continue to generate and output value will return to their value itself. The medium and long term of Ethereum The price trend can well verify this logic. Therefore, looking at Defi from a medium and long-term perspective, we can undoubtedly see a bright future.

I personally think that in the future, Defi will have the following major trends (only represents my personal opinion, and it is very likely to be slapped in the face)

Defi has changed the relationship between asset issuance and asset circulation at the institutional level, bringing innovation to the financial industry.

At present, the Defi we are talking about mainly includes three types of applications: stable currency, decentralized lending, and decentralized trading platform. These applications delegate the power of asset issuance and circulation from sovereign financial institutions to the public. In the future, everyone can issue digital assets , everyone can open the exchange.

Although financial model design and risk control require a certain degree of professionalism, Defi applications have the opportunity to modularize all aspects of asset issuance and circulation through more complete smart contracts, and issuers can freely combine designs. Professionalism does not hinder publishers, it will only become a condition for screening and eliminating publishers.

The developer ecology of the public chain will determine the migration and prosperity of DeFi applications.

Why is this round of Defi explosion concentrated on the Ethereum platform instead of EOS or TRON? The core of which is that the Ethereum ecosystem has gathered more developers, and the improvement and enrichment of various contract standards for Defi application development.

Developers are the suppliers of Defi applications. The more Defi developers gather, the richer and more mature the Defi applications will be. At present, the prosperity of the Polkadot ecosystem will pose a threat to the development of the Defi ecosystem of Ethereum.

New opportunities will emerge around Defi's supporting facilities.

The development of Defi can refer to Cefi to a certain extent. In the traditional centralized financial field, the production, circulation, insurance, guarantee, transaction and other links of financial assets can be corresponding to the Defi field. At present, there are asset issuance platforms (public chains), issuance agreements (smart contracts), asset transactions (decentralized exchanges), data import and recognition (oracle machines), mortgage lending, and risk transfer (decentralized insurance), project vulnerability and security assessment (third-party audit), asset management and traffic entry (wallet), etc. The development of DeFi will inevitably generate these supporting demands.

Connecting with traditional financial markets will determine the prosperity and scale of DeFi.

At present, the total market value of the Defi industry is only tens of billions of dollars, accounting for about 3% of the cryptocurrency industry, and it is only a drop in the bucket in the market value of the traditional financial industry. Therefore, if the Defi industry wants to obtain a larger market value space, it needs to transform and absorb part of the capital flow of the traditional financial industry through Defi mechanism and model innovation, thereby attracting more capital injection.

Looking back at the past few months, the Defi circle has been staging a new project launch contest where you sing and we take the stage. Each Defi project with different models appeared in a fresh cloak, gaining the inflow of funds and users, until the early dividends were divided and eroded, and abandoned by users and funds as the next hot project went online.

If Defi is always performing the "Russian nesting doll" trick, always spinning around in the currency circle or the chain circle, it will only be a matter of time before it dies.

Back then, Alipay launched the wealth management product Yu’E Bao, which broke the original solidified sales channel of wealth management products, allowing the public to access wealth management products more conveniently and transparently. This bottom-up transformation not only allowed Yu’E Bao’s fund size to quickly reach 200 billion, but also put pressure on many banks to change from resistance to active cooperation.

Defi's mechanism innovation will also have the opportunity to threaten the monopoly position of traditional financial institutions, and at the same time force them to gradually become open and transparent, thereby improving the efficiency of capital circulation. This will be the value and outlet of Defi. Therefore, how Defi will break the circle in the future, and how to serve or transform the financial scene of traditional industries will determine the space for the development of the Defi industry.