On the eve of the annual meeting of Mt.Gox creditors, a new disclosure document restores the possible repayment draft used in the Mentougou case.

According to the Mt.Gox liquidation and repayment draft document released by Nobuaki Kobayashi, the Mt.Gox exchange will pay the creditors in fiat currency, BTC, and BCH to repay their claims. Creditors in the Mentougou case can choose to accept fiat currency or cryptocurrency.

It is worth noting that the compensation of cryptocurrencies only supports BTC and BCH, and other holding assets will be liquidated into cash as much as possible.

A previous data showed that as of March 19, 2019, Mt.Gox had a confirmed deposit balance of 69.553 billion yen (approximately 628 million U.S. dollars according to the exchange rate at the time of publication); On March 18, Mt.Gox held 141686.35 BTC, 142846.35 BCH and a certain amount of BSV.

secondary title

Four key messages of the draft for repayment of creditor's rights

After studying the preliminary liquidation draft sent to creditors by the trustee of Mentougou, Odaily has summarized four points of information worthy of attention:

1. Support three credit settlement methods of "fiat currency", "BTC" and "BCH"

In general, the draft reveals two distribution schemes for claims, one is "fiat currency" cash payment; the other is "BTC" and "BCH" cryptocurrency payment.

【Fiat currency cash payment】

· Mentougou will pay in cash to users who claim legal currency.

Fiat currency claims denominated in foreign currencies will be valued according to the exchange rate, and international remittances will be made through bank accounts. The trustee will pay in Japanese Yen, US Dollars or Euros as requested by the creditor.Remittance fees and foreign currency exchange fees incurred in foreign exchange shall be borne by the creditor.If the creditor does not collect the money, the money will be deposited with the Japan Legal Affairs Bureau.

· For users who claim BTC and/or BCH, Mentougou also allows claimants to accept cash payments.

Calculate the legal currency value of encrypted assets according to the exchange rate of BTC and BCH to Japanese Yen.But the trustee can sell all or part of the debtor's BTC/BCH with the permission of the court.

【BTC/BCH cryptocurrency payment】

· If you do not apply for cryptocurrency payment, the default is to request payment in cash;

· Creditors who require BTC/BCH compensation need to apply within the specified date, and can only apply once, and cannot be changed later.

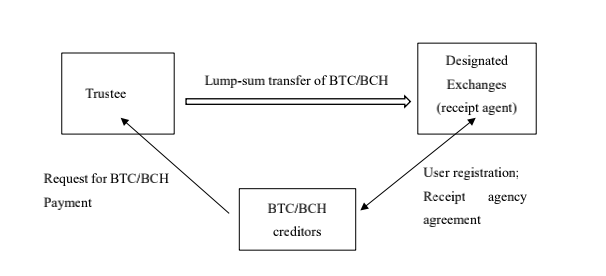

· BTC/BCH compensation requires the user to register an account with other cryptocurrency exchanges and must reach an agreement with the registered exchange. As an agent, the exchange is responsible for receiving the BCH/BTC assets of the creditor, and the Mentougou authorized person will transfer the money to the exchange in one go.

image description

(Repayment logic for BTC/BCH payment)

2. Mentougou trustee does not plan to purchase additional BTC and BCH

It is mentioned in the draft that the holdings of BTC and BCH in Mentougou may not be sufficient for acceptance. If this happens, creditors who request to use BTC/BCH for liquidation will have some assets liquidated with legal currency.

For example, if a creditor who claims in BTC has a claim amount of JPY 1,000,000 and only pays 1 BTC in cryptocurrency, the remaining payment of JPY 250,682 will be paid in fiat currency.

In the example of the BTC claim above, the ratio of the claim amount paid in BTC to the total claim amount is about 75%. (1 BTC x BTC exchange rate (749,318.83 yen) ÷ 1,000,000 yen ≈ 0.75), if this happens, the trustee plans to apply the same rate (i.e. approximately 75%) to all other BTC claims requiring BTC payments.

3. Holding assets other than BTC and BCH will be liquidated into cash as much as possible

As mentioned in the draft, the trustee of Mentougou believes that Japanese yen, BTC and BCH will become the main sources of liquidation distribution, while cryptocurrencies other than BTC and BCH will be liquidated as cash as much as possible.

4. Priority payment of fiat currency claims and small claims

mentioned in the draft,The policy given by the trustee is to give priority to paying legal currency claims and small claims。

· Small claims: Mentougou Trustee plans to provide each creditor with small claims of no more than 200,000 yen. Small claims are mainly aimed at users with relatively low claims or less than 200,000 yen.

· If each creditor has both fiat currency bonds and BTC/BCH claims, the small claim will be used to pay the fiat currency claims first, and if there is still a balance, it will be used for BTC/BCH claims.

Generally speaking, the liquidation draft proposed in the Mentougou case can be regarded as a very conscientious plan.

From the plan given by the trustee Nobuaki Kobayashi, it is not difficult to see that the trustee’s attitude may be more inclined to the creditor’s choice of legal currency to pay the repayment.

On the one hand, cryptocurrencies other than BTC and BCH will also be liquidated into cash, that is, converted into legal currency to support legal currency claims. On the other hand, it also promises to provide priority payment channels for users who choose legal currency to claim compensation. In addition, even if the holdings of BTC and BCH are difficult to redeem and the holdings of fiat currency are more, they will not buy new BTC and BCH with fiat currency for repayment, but convert the part that cannot be redeemed into fiat currency for cash payment .

secondary title

BTC, BCH, BSV or facing the risk of crashing?

In fact, the assets involved in the Mentougou theft case have long been considered a ticking time bomb.

As mentioned in the previous part of the interpretation, in the cryptocurrency plan, the trustee of Mentougou only recognizes two cryptocurrencies, BTC and BCH, and the rest of the cryptocurrencies other than BTC and BCH will be liquidated into cash. BTC, BCH assets may encounter conjectures of selling.

In this draft incident, the biggest ambiguity comes from how Mentougou will liquidate non-BTC and BCH funds. Especially forked currency assets such as BSV and BTG in the Mentougou account.

According to a statistics published on the Internet, Mt. Gox once held nearly 202,000 BSV (market value 35 million US dollars). Since BSV is not included in the option of repaying creditors, this means that the BSV held by Mt. Gox is facing a sell-off Risk or has been sold off. The opinion of foreign media Trustnodes is also that if this draft is passed, about 135,000 BSV will be sold or have been sold by the trustee.

image description

Previously

Previouslycointelegraphvaluesoldvaluetens of millions of dollarsbitcoins. Coincidentally, during the same time frame, the price of Bitcoin plummeted, starting on May 4, and by the end of June, Bitcoin fell from $10,000 to $5,912, a drop of more than 40%. This point of view believes that Mt. Gox’s liquidation may have indirectly caused the plunge of Bitcoin.

But then trustee Nobuaki Kobayashi released a report in March aboutQuestions and Answers on the Report of the Tenth Meeting of CreditorsThe content also emphatically responded to this question.

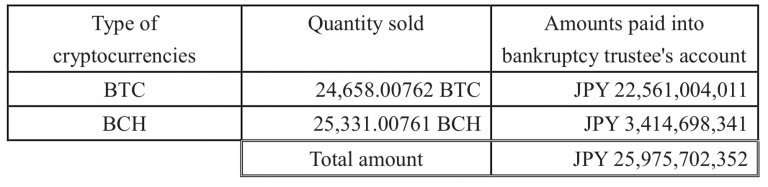

Nobuaki Kobayashi explained that BTC and BCH were sold between December 2017 and February 2018, and that BTC and BCH were sold in cooperation with a cryptocurrency exchange based on the market price at that time.

Nobuaki Kobayashi said that BTC and BCH were sold after consulting with cryptocurrency experts, not through ordinary sales through exchanges, but in a way that avoids affecting market prices, while ensuring the security of transactions as much as possible. The method of selling BTC and BCH has also been approved by the court. The transfer of assets in BTC and BCH addresses does not necessarily mean the sale of BTC and BCH.

According to previous experience, if the Mentougou trustee wants to liquidate non-BTC and BCH cryptocurrencies, it is very likely that they will also adopt the method adopted in 2018, perhaps through OTC and other methods.

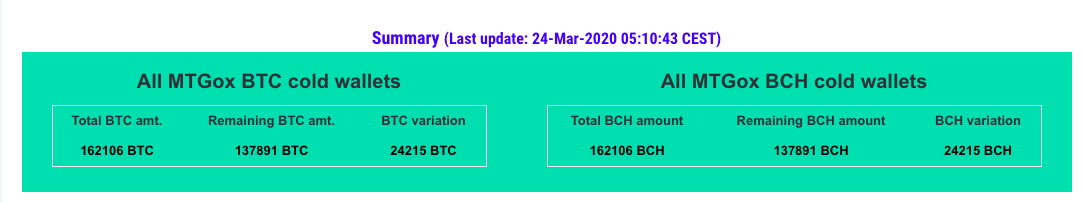

Check out OdailyCRYPTOGROUNDAccording to the tracking data of multiple cold wallet addresses in Mentougou, there are currently 137,891 BTC and 137,891 BCH in the Mentougou BTC and BCH cold wallets, respectively. It also found that the most recent transfer in the two cold wallets of BTC and BCH occurred on May 10, 2018.

secondary title

Are markets really overreacting?

Looking back on the past few weeks, the market is still oscillating to find its direction, and a strong positive event is urgently needed to boost the halving bull market.

But in turn, each extreme decline has been more or less confirmed to be related to selling behavior. For example, Plustoken, which must be blamed every time it falls, runs away and transfers assets. For example, a ten-year-old miner sold off and left the market some time ago. These events are reminding investors to be wary of the "time bomb" of large-scale selling.

Today, the trend of the market may still depend on how the creditors handle the coins in their hands.

The tokens locked in the Mentougou incident are definitely the next bomb. From the point of view of the panic-stricken people, former Mentougou users bought bitcoins at a very low cost, and once they get the same amount of bitcoins, the price is high for them. If you no longer trust the cryptocurrency market, there is a high probability that it will be sold quickly, forming a selling pressure on the market.

Foreign media Trustnodes also mentioned in the article that, overall, creditors are expected to recover 25% of the BTC/BCH and fiat currency investment that year. Theoretically speaking, creditors exchanged 1 dollar of that year for 25 cents today, and their assets have shrunk by three quarters.

But Trustnodes believes that despite this, these creditors have made considerable profits, because the bitcoin has not been moved since 2014, during which the price of bitcoin has risen a lot.

Maybe we can calculate together, under this undecided plan, whether the Bitcoin holders in Mentougou lost money.

On February 7, 2014, Mentougou suspended bitcoin withdrawals. Bitcoin plummeted below $800 that day. But before February 2014, the highest price of Bitcoin did not exceed $1,200, that is to say, the cost of these creditors holding Bitcoin should not exceed $1,200. On March 25, 2020, the price of Bitcoin fluctuated around $6,700. According to calculations, the price of Bitcoin rose by at least 458% during the shutdown of Mentougou.

If a creditor holds 1 bitcoin before the service of Mentougou is closed, the current price is estimated at the highest $1,200. After unlocking now, 1 bitcoin should be converted into 0.25 bitcoin, which is worth $1675 based on the current price of $6700.

In other words, calculated according to the lowest income method, it is still profitable for creditors to choose to sell after they get their hands.

It is foreseeable that if this draft is officially passed at the creditors' meeting on the 25th, 140,000 BTC and BCH are likely to flow directly to the market, impacting the current circulation. Odaily believes that investors should pay close attention to the trend of the Mentougou incident and be alert to downside risks such as collective selling.

The deadline for the submission of the Mt.Gox aftermath plan is March 31, 2020, which means that the Mt. Gox incident, which has been entangled for six years, will soon be settled.

What will happen on March 31st? It may be that this draft is officially passed, or it may be a new plan that overthrows and starts over, and it is more likely that the submission date of the aftermath plan will be postponed again. Odaily will continue to track and report on the follow-up processing plan and market impact of the Mt.Gox incident, bringing first-line interpretation, readers are also invited to pay attentionMt.Gox related topics。