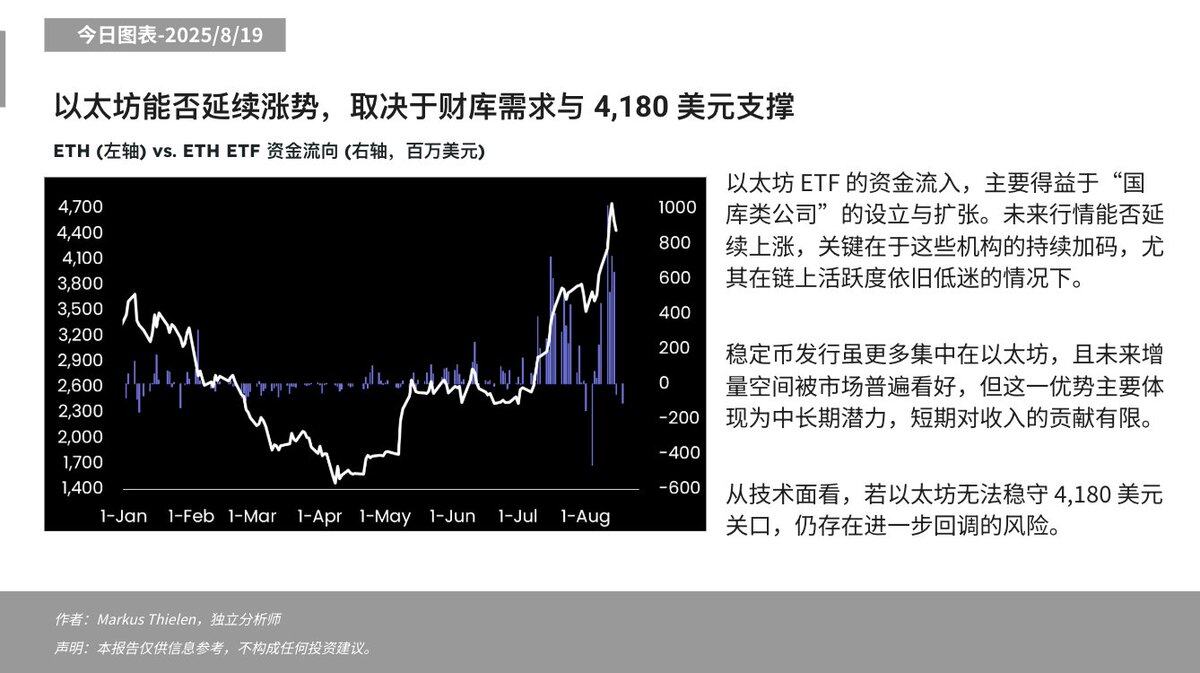

According to Odaily Planet Daily, Matrixport released a chart today stating that the inflow of funds into Ethereum ETFs is primarily due to the establishment and expansion of "treasury-type companies." Whether the market can continue to rise depends on the continued increase in investment by these institutions, especially as on-chain activity remains sluggish.

Although the issuance of stablecoins is more concentrated in Ethereum and the market is generally optimistic about its future incremental space, this advantage is mainly reflected in its medium- and long-term potential, and its contribution to revenue in the short term is limited.

From a technical perspective, if Ethereum fails to hold the $4,180 mark, there is still a risk of further pullback.