Original article by David D. Kirkpatrick, The New Yorker

Original translation: Luffy, Foresight News

In January 2017, President-elect Donald Trump, at a press conference, directly addressed public scrutiny for the first time regarding conflicts of interest between his business empire and his public office. His company, the Trump Organization, profits from luxury apartments, hotel rentals, development projects, and club memberships around the world. He also partners with various businesses to place his name on various merchandise for licensing fees. Can he be trusted to prioritize the public interest over his own? How can he assure Americans that funds flowing into his businesses won't become disguised bribes?

When asked whether he would release his tax returns, as previous presidents have done, he flatly refused, referring to the presidency's exemption from conflict-of-interest regulations as a "no-conflict-of-interest clause," as if it were a privileged perk. He also revealed that during the transition period, he considered a $2 billion Dubai business proposal from UAE real estate tycoon Hussein Sajwani, but ultimately declined, saying he "didn't want to take advantage." Instead, he entrusted his eldest son, Donald Jr., and his second son, Eric, to manage his businesses. His tax attorney, Sherry Dillon, stated that Trump would not "destroy the company he built" and pledged that his family would never "abuse the power of the presidency."

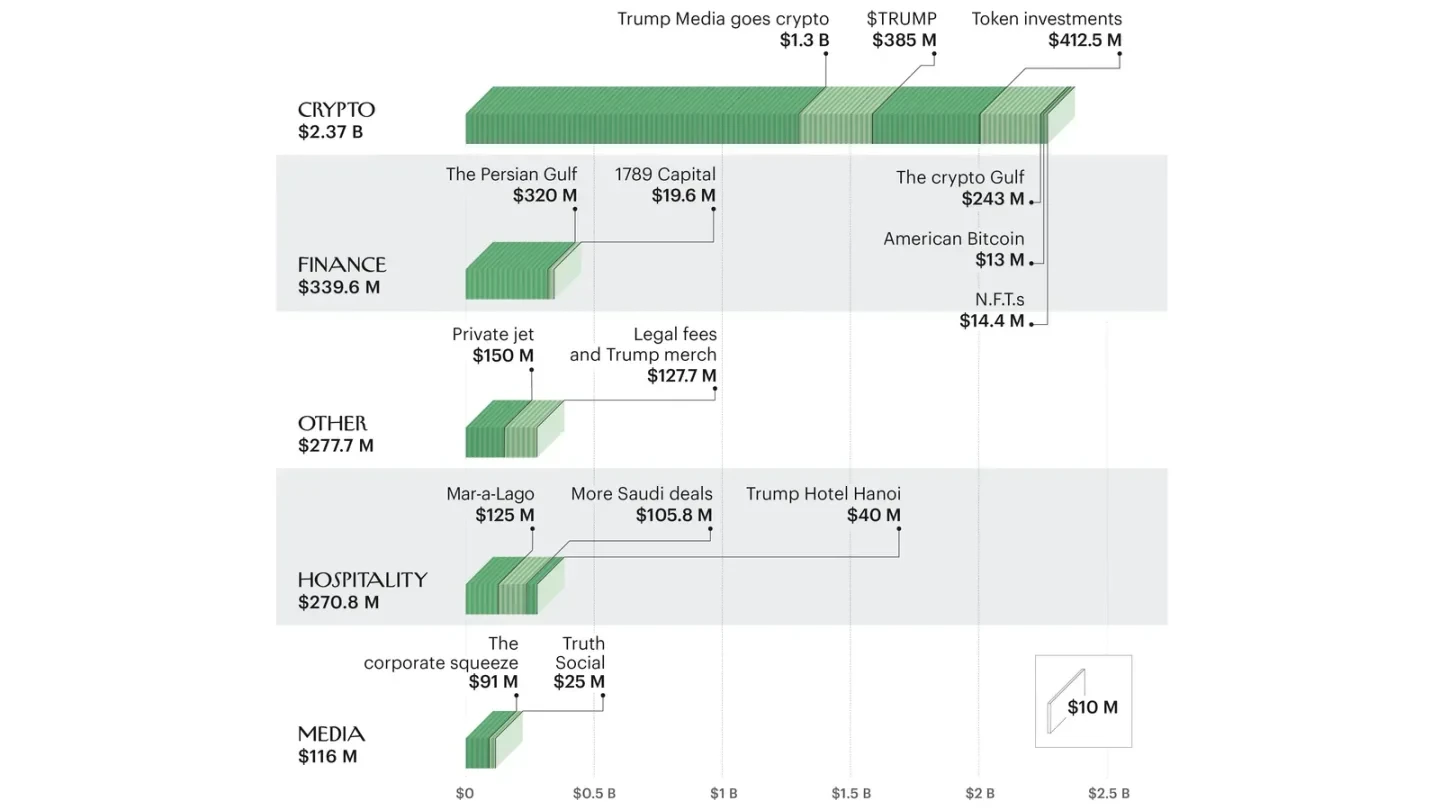

However, these promises gradually collapsed during Trump's political career. After the 2021 Capitol Hill riots, Dillon's law firm terminated its representation; in his second term, the Trump family completely broke their promise of "no new overseas transactions," profiting from five major transactions in the Persian Gulf alone. Donald Jr. bluntly stated that his restraint in his first term did not prevent external criticism, and "there is no need to restrain myself anymore." Today, the scale of funds flowing into Trump and his family is staggering: a $2 billion investment from a fund controlled by the Saudi Crown Prince, a luxury aircraft gifted by the Emir of Qatar, profits from the cryptocurrency business, membership fees for exclusive clubs... Ethics reform advocate Fred Wertheimer commented: "Trump is unprecedented in his use of public office for personal gain."

While Forbes and the New York Times estimate Trump's net worth at over $5 billion and $10 billion, respectively, these estimates include substantial paper profits and assets unrelated to his presidency. Government ethics lawyer Norm Eisen admitted, "We don't know the full amount." Robert Weissman, co-chair of Public Citizen, said, "We'll never truly know."

Indeed, assessing the value of Trump's presidency is a difficult task. But in this article, I aim to fairly and objectively quantify the Trump family's profits from his two presidencies. Mar-a-Lago, the for-profit club that has become a mecca for the "Make America Great Again" movement and a weekend White House, is an obvious starting point.

Mar-a-Lago

During the 2016 campaign, Trump claimed the presidential campaign had "little impact" on his hotel and resort business, with the exception of Mar-a-Lago. The Palm Beach estate, purchased for $10 million in 1985, had its "best year ever" thanks to the campaign. Unlike other presidents who traded access for campaign donations, Trump directly sold unlimited access to himself and his circle.

Mar-a-Lago claims to have a membership cap of 500 members, with each paying approximately $20,000 annually in the early years. After 2016, the initiation fee soared to $100,000, with plans to increase it to $1 million last year. Financial data shows that annual revenue jumped from $10 million in 2014 to $50 million, while operating costs remained stable between $12 million and $16 million. Based on this, it is estimated that Trump's extra profits from Mar-a-Lago during his presidency amounted to at least $125 million.

Cumulative total: US$125 million

Legal Fees and Merchandise

The Trump campaign has spent more than $20 million at Trump-owned hotels and resorts over the past decade, contributing to Mar-a-Lago's profits. The campaign paid $18 million for the use of his Boeing 757 in 2016 and 2024, comparable to what Obama and Romney spent on their campaign planes.

Trump's innovation, however, lies in operating a private online store, selling merchandise that competes with his team's campaign merchandise, such as $50 "American Bay" baseball caps and $18 beer bottles. Financial disclosures show that these sales have brought him over $17 million, almost all of which is profit. Furthermore, his licensing revenue includes guitars ($1.1 million), watches ($2.8 million), sneakers and perfume ($2.5 million), books ($3 million), and Bibles ($1.3 million), totaling at least $27.7 million.

More notably, Trump used supporter donations through his political action committee (PAC) to pay legal fees totaling over $100 million, covering cases involving sexual assault allegations, hush money fraud, and overturning election results. This amount can be described as a "$100 million personal gift."

Cumulative total: $125 million + $127.7 million = $252.7 million

Washington Hotels

During Trump's first term, the Trump International Hotel in Washington was often portrayed by Democrats as a "center of corruption." Foreign leaders booked entire floors, and lobbyists and officials packed the bar. In reality, the hotel was losing over $70 million annually. While the president's status attracted some clients, it also drove away an equal number of potential guests, deterred by concerns about scandal.

In 2012, Trump agreed to pay the federal government at least $3 million annually for a long-term lease of the Washington, D.C., building (formerly the Post Office headquarters) and to invest at least $200 million in renovations. The hotel opened in 2016, and Trump sold it in 2022 for $375 million. Furthermore, despite receiving US military accommodations (at least $184,000 in the 23 months ending in July 2019), the Trump Turnberry Golf Resort in Scotland remained unprofitable for four years, only turning a profit in 2022. US troops continued to stay at the resort during Biden's presidency. Overall, the spending by government agencies and profit-seekers at Trump hotels offset their revenues, resulting in zero revenue.

Cumulative total: $252.7 million (unchanged)

Persian Gulf

The Gulf Arab monarchs' dual roles as heads of state and major buyers of American assets present unique business opportunities for the Trump family. During Trump's first term, his son-in-law, Jared Kushner, supported Saudi Crown Prince Mohammed bin Salman, securing a $2 billion investment from the Saudi sovereign wealth fund after leaving office.

Kushner's Affinity Partners subsequently raised funds from UAE, Qatari, and Taiwanese businessman Terry Gou, bringing its assets under management to $4.8 billion. By industry standards, the firm would have earned $81 million in annual management fees, totaling $810 million in revenue over ten years. Conservative estimates suggest Kushner personally received between half and two-thirds of the proceeds, currently valued at approximately $320 million.

Cumulative total: $252.7 million + $320 million = $572.7 million

Licensing and Management Agreements in Saudi Arabia and the Gulf Region

The Trump Organization's dealings in the Gulf region exemplify the "premium of presidential status." In November 2022, after becoming the Republican presidential nominee, Trump reached an agreement with the Saudi real estate company Dar Al Kan to manage hotels and golf courses in Muscat, Oman, and receive a share of villa sales, signing a rare 30-year contract. Following his re-election, Donald Jr. and Eric signed agreements with the company for multiple projects in Riyadh, Jeddah, Dubai, and Doha.

Referring to the revenue model of Dubai golf courses (annual profits exceeding US$1 million), it is estimated that Trump's management income, licensing fees, hotel management fees, etc. in the Gulf region total at least US$105.8 million, with a cumulative total of US$678.5 million.

Cumulative total: $572.7 million + $105.8 million = $678.5 million

Private jet and media settlement

In May 2025, Trump returned from a visit to the Persian Gulf with a Royal Boeing 747-8, a "free gift" from the Emir of Qatar. He stated that he would hand it over to the Air Force for management until it was transferred to his presidential library foundation after leaving office. The aircraft has a list price of $367 million and a secondary market value of approximately $150 million. Although security upgrades could cost over $1 billion and might not be completed during his term, it was still considered a "personal favor."

Additionally, during his presidency, Trump reached settlements with media companies through lawsuits: ABC News paid $15 million, Meta paid $22 million, X paid approximately $10 million, and CBS News paid $16 million, all of which went to his presidential library foundation. Melania also received $40 million in documentary rights fees from Amazon, of which she personally received approximately $28 million. The total settlement was $91 million.

Cumulative total: $678.5 million + $150 million + $91 million = $919.5 million

social media

In October 2021, Trump announced the launch of the social media platform Truth Social, attempting to rebuild his influence after mainstream social platforms restricted it. To quickly take the platform public, he merged with Digital World Acquisition Corp. through a special purpose acquisition company (SPAC) to form Trump Media & Technology Group, acquiring approximately 60% of the shares and becoming its largest shareholder.

Despite the platform's limited user base (approximately 400,000 daily active users) and ongoing losses (over $400 million last year), its stock price skyrocketed among retail investors due to its "Trump connection," becoming a classic "meme stock" with a market capitalization of as much as $6 billion. Trump Media's stock price fluctuates with small investors' sentiment toward Trump and has nothing to do with any underlying value. If Trump attempted to cash out, it would undoubtedly trigger panic selling, depressing the stock price before he could abscond with the funds. Forensic accountant Bruce Dubinsky, using valuation criteria for similar social media companies and combining its revenue scale (approximately $1 million per quarter), estimates that Trump's stake is worth approximately $25 million.

It's worth noting that Trump leveraged his presidential status to drive traffic to the platform, releasing major announcements exclusively through Truth Social and even using it as a channel for policy dissemination, creating a closed loop of "using public office to divert traffic to the private sector." While the platform's profitability remains uncertain, this model of "power endorsement + capital speculation" has still generated quantifiable paper profits for Trump.

Cumulative total: $919.5 million + $25 million = $944.5 million

1789 Capital and the Executive Club

Donald Jr. co-founded the "Executive Branch" club with his friend Omid Malik (a Trump donor and Mar-a-Lago member), initially capping membership at 200. According to insiders, the 20 founding members paid $500,000, with the remaining members paying nearly $100,000, generating a total of $28 million in revenue. Although the club was considered a "social vanity project," after deducting renovation costs of $1,000 per square foot, there was still $19 million left. Assuming Donald Jr. receives at least one-fifth of the profits, the club generated over $3.8 million in profits before its opening alone. Donald Jr. also serves as a partner in Malik's 1789 Capital, which is raising $1 billion to invest in high-tech and defense sectors and is seeking funding in the Persian Gulf. According to industry standards, partners are expected to share at least $200 million in profits over a 10-year period. As the third-ranking partner, Donald Jr. was expected to receive 10% of the profits, or $20 million (currently worth $16 million), plus an annual salary of $200,000 (currently worth $1.6 million). The combined earnings from these two items totaled $19.6 million.

Cumulative total: $944.5 million + $19.6 million = $964.1 million

NFT sales

The Trump family's cryptocurrency investment began with NFTs (non-fungible tokens). In 2022, Trump launched NFTs featuring his image, including designs like a "superhero" and a "motorcyclist," selling them on Truth Social for $99 each. Financial disclosures show that he earned $13.18 million from NFT licensing fees, while Melania Trump earned $1.22 million from her own NFTs, for a total of $14.4 million. These NFTs are essentially proof of ownership of digital images. Leveraging the premium placed on Trump's presidential status, most buyers are his supporters, resulting in near-zero transaction costs and profits approaching 100%. Cryptocurrency skeptic Molly White commented, "Trump's NFTs are a direct monetization of his personal image, consistent with the logic of his business empire: selling names rather than physical goods."

Cumulative total: $964.1 million + $14.4 million = $978.5 million

Crypto projects and stablecoins

Donald Jr. and Eric launched World Liberty Financial, a crypto project, in September 2024. Focusing on "decentralized finance," they billed themselves as "the only crypto company inspired by Trump." Their website featured a photo of Trump pumping his fist, calling him "the chief cryptocurrency advocate." The company raised funds through the sale of tokens, with a shell company controlled by the Trump family receiving a 75% share of the proceeds, initially holding a 60% stake that was later reduced to 40%. Chinese-American cryptocurrency tycoon Justin Sun purchased $75 million worth of tokens and served as an advisor, helping the project raise $550 million. The Trump family received approximately $412.5 million in revenue. Furthermore, the company launched the USD 1 stablecoin. A company affiliated with the UAE ruling family used $2 billion of USD 1 to acquire shares in Binance, resulting in a $243 million profit for the Trump family. Stablecoins, backed by U.S. Treasuries and offering annual returns exceeding 4%, are considered a low-risk, high-return "power-linked business."

Cumulative total: $978.5 million + $412.5 million + $243 million = $1.634 billion

American Bitcoin

The Trump brothers partnered with stockbroker Kyle Wuerl to establish American Bitcoin. Through a merger with Hut 8 (a publicly traded Bitcoin miner), they acquired a 13% stake, currently valued at approximately $13 million. Eric Trump, serving as "Chief Strategy Officer," declared at a cryptocurrency conference that the company "will rewrite the rules of the industry." Bitcoin mining relies on computing power competition and is limited in its total supply (95% has already been mined). However, the Trump family, leveraging their presidential status, has hyped up Bitcoin, calling it "digital gold" and encouraging "ordinary Americans to buy whatever they can." Industry insiders suggest that the company's stock price is overvalued by investors, and that the Trump brothers' stake is worth far more than the equipment itself, currently estimated at $13 million.

Cumulative total: 1.634 billion + 13 million = 1.647 billion US dollars

Trump Media's Foray into Cryptocurrency

Trump Media & Technology Group (the operating entity behind Truth Social) capitalized on the new administration's relaxed cryptocurrency policies by selling crypto assets to ordinary investors through a cryptocurrency ETF, becoming the only investment channel "connected to the president." The company also raised $2.3 billion through private sales of stocks and bonds to purchase Bitcoin and options. As of the first quarter of 2025, it held $3.1 billion in liquid assets (including Bitcoin). Trump holds approximately 42% of the shares, valued at $1.3 billion. Despite ongoing losses, Truth Social's ability to "convert meme stock into cash" through cryptocurrency investments has been described by accountant Bruce Dubinsky as a capital game "slightly better than selling snake oil."

Cumulative total: 1.647 billion + 1.3 billion = $2.947 billion

Issue Meme Coin

Three days before his second inauguration in 2025, Trump launched the TRUMP token, quickly raking in $65 million in profits from sales and transaction fees. Even more controversially, Trump announced an exclusive dinner for the 220 top TRUMP holders, with the top 25 receiving trips to the White House. This move drove a short-term rally in the token's price, generating further revenue from transaction fees. Separately, Melania Trump also launched the meme token MELANIA. Despite significant price fluctuations, cryptocurrency research firm Chainalysis estimates that the combined profits from both tokens are approximately $385 million.

Cumulative total: 2.947 billion + 385 million = 3.332 billion US dollars

Summarize

The Trump family's business profits, ranging from Mar-a-Lago membership fees to the cryptocurrency Meme Coin, encompass physical assets, licensing agreements, financial instruments, and more. Their core logic remains the "premium value of presidential status." Their cumulative $3.4 billion in profits not only breaks the record for power monetization in American political history but also blurs the line between public office and private interests.