Original author: David, TechFlow

The crypto market has its own “crying wolf” story.

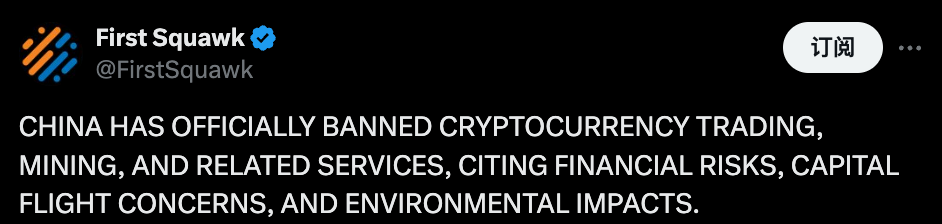

On August 3, First Squawk, a well-known foreign financial news platform, released a message on social media: "China has officially banned cryptocurrency trading, mining and related services, citing financial risks, capital flight and environmental impacts."

Investing.com, Rawsalerts, and other prominent financial accounts with millions of followers abroad have reposted this unverified "breaking news." Clearly, using China's cryptocurrency ban as a pretext has become a common tactic for fake news in the crypto market.

In the comment section of the news, there is a hilarious comment - Grok, tell me, how many times has China banned cryptocurrency?

Old investors have long been tired of this kind of fake news, and the price of Bitcoin has long been immune to this kind of fake news.

However, the crypto market does have an absurd cycle - every once in a while, a highly influential fake news emerges.

You can be immune to the cycle of China's ban, but you may not be immune to all the fake news that appears. When enough people believe a piece of fake news will affect prices, it will really affect prices.

China's "ban" is just the tip of the iceberg of how fake news has impacted the entire crypto market. Looking back at the history of the crypto market, those major fake news stories have actually influenced the direction of crypto assets.

Behind a piece of fake news, you can even see a hidden chain of information dissemination.

A Chronicle of Crypto Fake News: From Amateur to Professional, a Review of Key Events

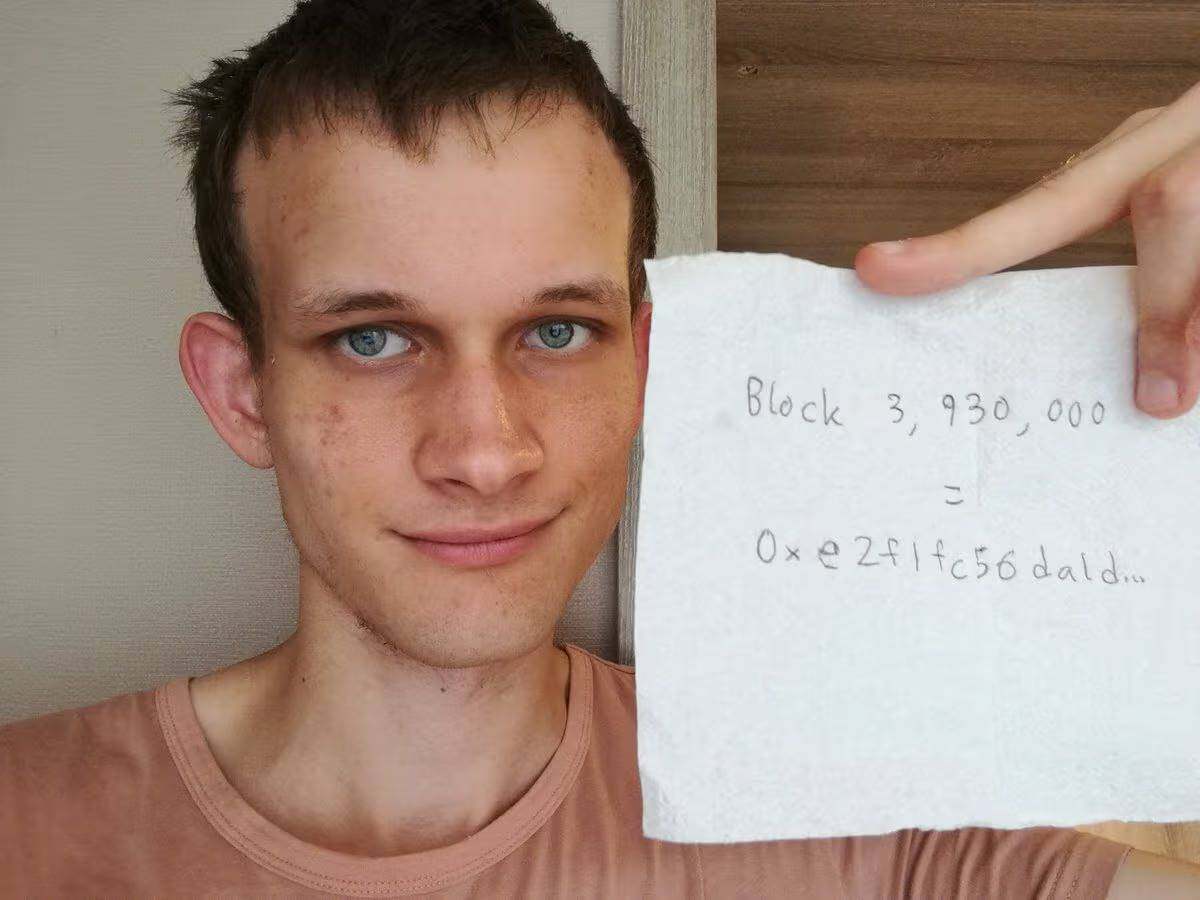

2017: Vitalik’s death, the first lie in the blockchain world

If one were to write an evolutionary history of cryptocurrency fake news, June 26, 2017 would surely be a milestone.

That afternoon, a message appeared on the well-known foreign forum 4chan: "Vitalik Buterin died in a car accident." There was no source, no evidence, and not even any decent details.

But it was this crude rumor that triggered the first fake news-driven market crash in cryptocurrency history in the following hours. At that time, ETH fell from $317 to $216 in 6 hours, a drop of nearly 32%.

Reddit's r/ethtrader forum was flooded with posts asking "Is this real?" and "Can anyone confirm this?" In Telegram groups, holders debated whether to sell immediately.

About 10 hours after the rumor spread, Vitalik himself posted a photo on Twitter holding the Ethereum block number and hash value of that day to refute the rumor, using the blockchain itself to prove that he was still alive.

Vitalik is still there, but your position may be gone.

The market’s reaction at the time revealed a cruel truth: in the early Wild West of the crypto world, an anonymous post could be as destructive as an official announcement.

Early fake news creators were mostly amateurs. They would set up so-called insider groups on Telegram or post on forums like 4chan. This was a market with extremely asymmetric information, leaving retail investors groping in the dark. Any slight change could trigger a stampede.

Fake news during this period was more like a prank by a few people, tied to the founders of the project; the market directly linked the founders' personal safety with the survival of the project.

2018: Goldman Sachs' blunder leads Wall Street to abandon Bitcoin

When fake news is dressed up in a suit, professional "exclusive news" is even more destructive.

On September 5, 2018, the cryptocurrency market was mired in a bear market. At this sensitive moment, Business Insider, a renowned American business website, published a report with a headline that hit the nail on the head: "Goldman Sachs Shelves Plans for Cryptocurrency Trading Desk."

A trading desk is an investment bank's department that buys and sells specific financial products for clients. If Goldman Sachs had established a cryptocurrency trading desk, it would have allowed its institutional clients to buy and sell Bitcoin through Goldman Sachs, which would have been seen as a significant milestone in cryptocurrency's mainstream acceptance. However, the "shelving" of the desk signaled the abandonment of cryptocurrency.

The next day, the story took a turn. When Goldman Sachs CFO Martin Chavez was asked about this at the TechCrunch conference, his response stunned everyone: "Yesterday I was wondering when I made this decision. This is fake news."

But the clarification came too late. In that panicked 24 hours, a large number of investors had already liquidated their positions and exited the market.

As Cointelegraph reported at the time, the prices of Bitcoin and other digital currencies plummeted after this fake news, which was said to come from "insiders", with the total market value falling by $12 billion in an hour, with Bitcoin falling by more than 6% that day.

2021: Walmart and Litecoin fake partnership, news trading begins to emerge

If the previous fake news could be a misunderstanding or negligence, then the fake news about Walmart’s cooperation with Litecoin on September 13, 2021 was an outright premeditated crime .

At 9:30 that morning, an announcement appeared on GlobeNewswire, one of the world's largest press release distribution services.

The headline was eye-catching: "Walmart Announces Major Partnership with Litecoin." The press release was well-made and included all the elements of a professional press release: Walmart's official logo, detailed partnership plans, quotes from executives, and even contact information for the investor relations department.

The press release stated that starting October 1st, all Walmart e-commerce websites will offer the option to pay with Litecoin. It also quoted Walmart CEO Doug McMillon as saying, "Cryptocurrency will play a key role in our digital strategy."

Subsequently, some crypto media began to rush to report this information, and most importantly, the official Twitter account of the Litecoin Foundation retweeted the news.

In that period when the "coin-stock linkage" game had not yet appeared and cryptocurrencies were not so popular, the market reaction was quite explosive.

Litecoin's price began to rise sharply, and trading volume surged. Mainstream media outlets also joined the fray, with CNBC and Reuters reporting on the news. By 10:30 AM that day, Litecoin's price had peaked, having risen by over 30%.

However, just as the market was in a frenzy, Walmart's public relations team discovered something unusual. After urgent verification, they issued a statement: This was false information and Walmart had no partnership with Litecoin.

After the news was reversed, the price of Litecoin fell in free fall. But for the manipulators behind the scenes, the game was over.

Subsequent investigations revealed that abnormal Litecoin call option trading occurred in the market 48 hours before the fake news was released. Through careful planning, the manipulators profited millions of dollars from this scam.

What’s horrifying about this incident is its level of professionalism.

From registering similar domain names and creating fake press releases to choosing the right time to publish and using official accounts to endorse them, every step was meticulously calculated. This doesn't seem like a prank to fabricate Vitalik's death, but rather a more premeditated and organized crime attempt to profit from news trading.

2023: Cointelegraph misreports, grabbing traffic rather than investigating the truth

October 16, 2023, is a day worth reflecting on for the cryptocurrency media industry.

At 1:17 p.m., a screenshot from a Telegram group began circulating in the crypto community. The screenshot showed a message appearing on a purported Bloomberg terminal: The SEC has approved BlackRock's iShares Bitcoin Spot ETF.

This is undoubtedly a historic moment for cryptocurrency investors who have been waiting for years.

The news reached Cointelegraph’s social media team, who, as one of the world’s largest cryptocurrency media outlets, were aware of its significance.

But before publishing, they face a dilemma: should they take the time to fully verify the information and risk being overtaken by other media outlets? Or should they publish the information immediately and seize the traffic?

At 1:24, just seven minutes later, Cointelegraph published this "breaking news" on its official X account. The tweet was very eye-catching: "Breaking: SEC approves BlackRock spot Bitcoin ETF."

The market reaction was immediate and dramatic. Over the next 30 minutes, the price of Bitcoin soared from $27,900 to $30,000, a gain of over 7%. Trading volume surged, straining the servers of major exchanges. The derivatives market was even more frenzied, with $81 million in short positions forced to liquidate during this surge.

However, excitement soon turned to doubt. Careful observers began to question:

Why is Cointelegraph the only one reporting on this? Why is there no announcement on the SEC website, and why is BlackRock silent?

At 2:03 PM, 39 minutes after posting the tweet, Cointelegraph deleted it. But the damage was done. In less than an hour, the market went through a complete cycle of gains and losses.

According to an investigation report subsequently released by the media, the error was caused by the loss of control of internal processes - the social media editor violated the regulations that require editor confirmation before publishing.

The incident sparked heated discussions within the industry, with one pointed view being that when media prioritize speed over accuracy, they are no longer media but tools of market manipulation.

Crypto media faces immense pressure. It's a 24/7 market, and news can break at any moment. If you're five minutes late, someone else has already snatched up the traffic. In this environment, publishing first and verifying later is a risky yet highly profitable option, but it can also come at the cost of public credibility.

In traditional financial markets, major news is typically released through official channels and adheres to strict disclosure regulations. However, in the crypto market, information channels are fragmented, making it difficult to distinguish true from false. A single screenshot or tweet can trigger billions of dollars in capital flows.

Ironically, when the SEC actually approved a Bitcoin ETF in January 2024, the market’s first reaction was not cheering, but skepticism.

2024: SEC Twitter Incident: Regulators Are Also Victims

In January 2024, an official SEC account, account X, falsely claimed approval of a Bitcoin ETF. According to a subsequent FBI investigation, the attacker gained control of the account through a SIM swap. Bitcoin prices rose from $46,600 to $47,680 following the release of the fake news, before plummeting to $45,627 after the debunking of the rumor.

In October 2024, the FBI arrested the suspect Eric Council Jr. Court documents showed that this was a premeditated financial crime and the attacker had established a large number of Bitcoin long positions before releasing the fake news.

Over the past decade, cryptocurrency fake news has evolved from an "accidental mistake" to a "deliberate crime." The technical barriers to entry, the scale of funding, and the level of organization have all increased. You might have avoided fake news one time, but there's no guarantee you won't be caught the next time.

Three people make a tiger, when the truth is diluted

In the crypto market, tracing the source of a piece of fake news is often a futile effort.

When news such as "China bans cryptocurrencies again" stirs the market, a large number of reposts, algorithmic recommendations and the increase in the voice of self-media make it impossible for anyone to tell where the information originally came from.

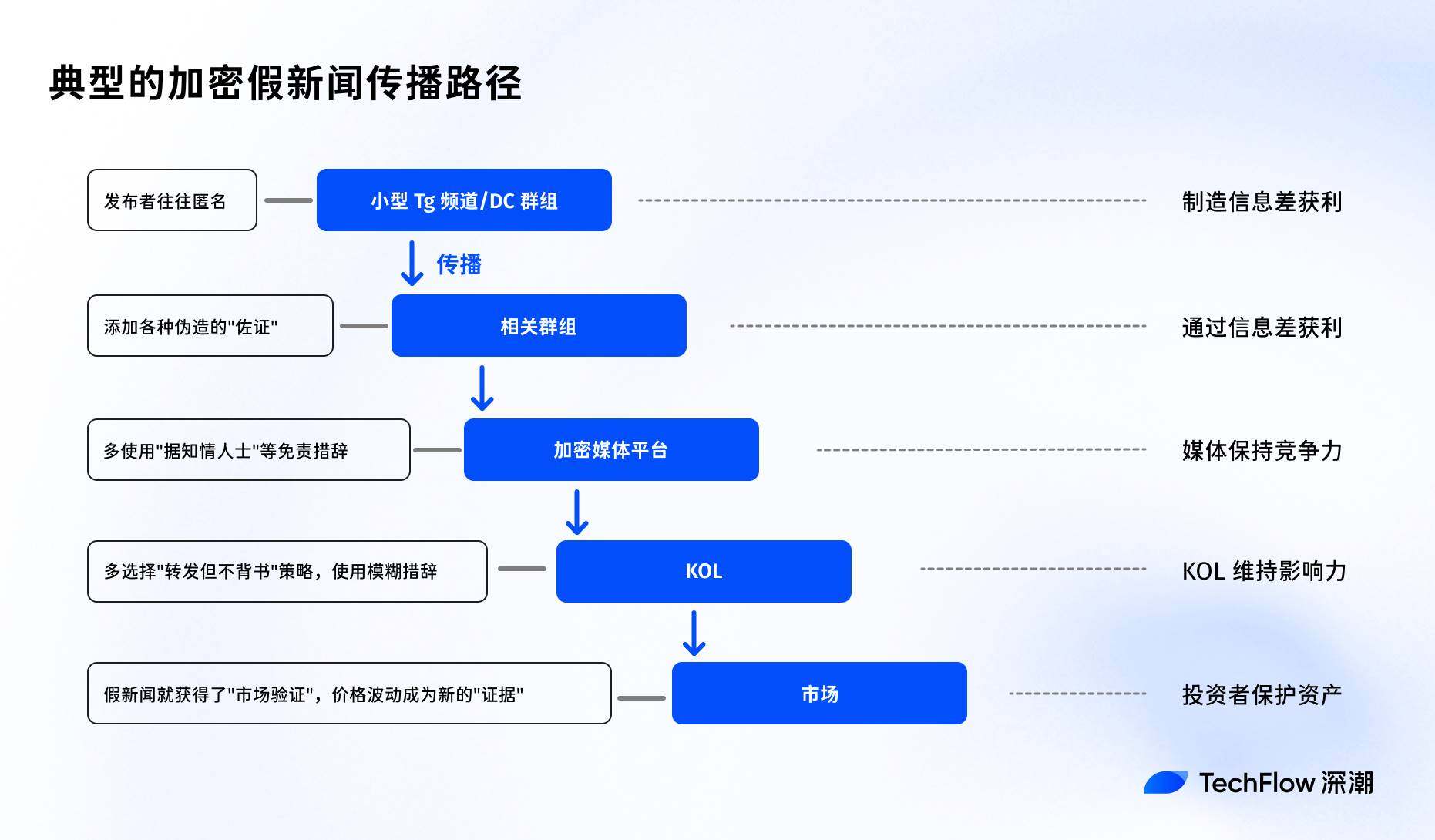

A typical crypto fake news propagation path might be as follows:

The first-tier sources are usually small Telegram channels or Discord groups, making them nearly impossible to track down. The publishers often use anonymous accounts, meaning they have nothing to lose even if they are exposed.

The second layer of the story spreads among several related groups, and begins to add "evidence" - photoshopped pictures, fabricated details, specious logic, etc.

The third layer of encrypted media platforms gives news a "quasi-official" tone. Even if disclaimers such as "according to insiders" are used, readers often choose to ignore them.

The fourth level, KOLs, enter the conversation. When a message reaches a certain level, they face a choice: to publish or not? Most opt for the strategy of "reposting but not endorsing"—using phrases like "it's said" or "according to sources."

The fifth level of market reaction: once prices begin to fluctuate, the fake news is "verified by the market." The decline itself becomes "evidence" of the news's authenticity.

Once a message has passed through multiple layers of transmission, tracing its origin becomes nearly impossible. Each layer adds new “details” and introduces new interpretations until the original message is completely diluted.

In the crypto market, rumors can spread quickly and irresponsibly, but refuting them requires rigorous evidence and logic. Spreading panic/exclusive news may bring trading opportunities, but spreading rumors to refute them does not bring any direct benefits.

Each participant is acting rationally in his or her own self-interest, but all these "rational" choices add up to create a collectively irrational outcome.

The markets are fooled again and again by fake news, but no one seems able or willing to break the cycle.

This may be the new meaning of "three people make a tiger" in the era of encryption: it does not become true when three people say it, but when enough people believe that it will affect the market, it will really affect the market.

In this process, the truth itself becomes less important.