Author: Monchi | Editor: Monchi

1. Bitcoin Market

From June 21 to June 27, 2025, the specific trend of Bitcoin is as follows:

June 21 : Bitcoin price quickly dropped from about $106,000 to $104,000. After a brief rebound, it failed to stabilize and continued to fall, hitting an intraday low of $102,770 before temporarily easing. Entering the European and US trading sessions, Bitcoin began to fluctuate slightly and rebounded to $104,008 in the evening, but then fell back and closed at $103,605.

June 22 : The market opened weak and quickly fell below the key support level of $102,000. It fell to $101,229 before rebounding to $103,134. However, the upward trend lacked volume support, and the price subsequently entered a sideways consolidation phase, with obvious divergence between long and short positions in the market. Near the evening, Bitcoin fell again in large volume, from $102,780 to $99,131, falling below the important psychological level of $100,000, causing a sharp rise in market panic. The plunge was generally interpreted as a risk response to the potential escalation of the situation in the Middle East. Investors are worried that regional conflicts will further push up oil prices and global inflation expectations, thereby putting pressure on risky assets. According to on-chain data statistics, more than $1 billion of crypto assets were forced to close positions that day.

June 23 : Bitcoin continued its decline from the previous trading day, rebounding to $100,030 at the beginning of the day before falling again, hitting a low of $98,523 this week. With the positive macroeconomic situation and the easing of trade tensions, the market gradually recovered, and then the price entered a shock repair phase. Bitcoin successively stood above the integers of $101,000 and $102,000, reaching a high of $102,480. Although it fell back in the late trading, the overall repair momentum continued, closing at $101,473.

June 24 : Continuing the correction trend of the previous day, the price rebounded quickly after getting support near $100,000 in the early trading, and rose to around $103,000, and then rose further, rising sharply to $106,023, completing the deep repair of the previous decline. It then fell slightly to around $105,000 and fluctuated, but overall it showed signs that the bulls regained control of the rhythm, and market sentiment also clearly warmed up.

June 25 : Bitcoin continued its slow upward trend of the previous day, fluctuating and climbing from $105,285, and remained in the upward channel as a whole. It reached a high of $107,983 in the evening, approaching the stage resistance level, but failed to break through effectively, and then fell back slightly, closing at $107,072 during the day. The overall trend is strong, and the short-term bullish pattern is still continuing.

June 26 : Bitcoin's rise slowed down, fluctuating upward to $108,037 during the session, setting a new high. In the evening, affected by short-term profit-taking, the price fell slightly, reaching a low of $106,782, maintaining a narrow range, and the market entered a high-level consolidation stage.

June 27 : Affected by the pressure from above, the price slightly adjusted back to around $106,600 during the session, and the overall trend remained weak and volatile. As of writing, the price was temporarily reported at $106,712, and the market sentiment tended to wait and see, and the short-term direction still needs to be further clarified.

Summarize

This week, Bitcoin as a whole showed a three-stage market trend of "first selling pressure, then technical repair, and finally high consolidation". From June 21 to 23, affected by the sudden air strikes and the escalation of the situation in the Middle East, the price of Bitcoin fell sharply, from about $106,000 to several key support levels, reaching a low of $98,523, triggering more than $1 billion of crypto assets to be liquidated in a short period of time, and market panic quickly heated up. Subsequently, since June 24, Bitcoin started to rebound rapidly, short-term funds concentrated on covering, and the price strongly rebounded to above $106,000, successfully recovering the decline. From June 25 to 27, the bullish momentum weakened, and the price fluctuated repeatedly around $107,000, maintaining a high consolidation trend overall, and the market turned to wait and see, waiting for new direction signals.

Overall, Bitcoin has shown strong resistance to stress and recovery capabilities this week, and the short-term trend has shifted from extreme panic to a period of stability, but we still need to be vigilant about the continued impact of geopolitical risks and macroeconomic variables on sentiment and capital.

Bitcoin price trend (2025/06/21-2025/06/27)

2. Market dynamics and macro background

Fund Flows

1. Trends of major investors on the chain

Long-term holders have not seen any selling, and chips are highly concentrated

CryptoQuant data shows that long-term holders (LTH) still maintain a strong tendency to hold coins, with almost no obvious signs of selling. The current on-chain holdings are about 14.7 million BTC, accounting for a record high. The Glassnode report further shows that the "LTH expenditure indicator" has continued to decline since June 10, reflecting the market's growing confidence in the medium- and long-term trend. This kind of quiet holding stage has always been regarded as a signal before the start of a big market.

The LTH/STH holding ratio has increased significantly: a big rise is approaching

CryptoQuant analyst Axel Adler Jr pointed out that the current LTH/STH (long-term/short-term holders) holding ratio is entering a continuous upward channel. The previous two rounds of strong Bitcoin rises (28,000 → 60,000 and 60,000 → 100,000 US dollars) occurred within 1-2 months after the LTH ratio rose significantly. Currently in the key price area of 100,000 US dollars, LTH has once again seen a large-scale accumulation phenomenon. If the trend continues, it is expected that there will be a unilateral rise in 4-8 weeks. If a conservative estimation model (1.6 times multiplier) is used, the next round of target range may point to 160,000 US dollars.

2. On-chain liquidity and exchange behavior: positive strengthening trend on both supply and demand sides

Inflow/outflow ratio remains high

The 30-day moving average (SMA) shows that the Bitcoin chain inflow/outflow ratio remains at the level when the bull market started at the end of 2023, reflecting that the on-chain demand is still strong. The market has entered a low-volatility "chip redistribution phase", but the inflow pressure on exchanges is extremely low, which is conducive to an upward price breakthrough.

Exchange net inflows remain positive

CryptoQuant data shows that the BTC balance of exchanges has been growing steadily, reflecting the continued inflow of funds from the OTC. Although the activity of whales is relatively low, the main funds have been deployed through OTC or limit price strategies, and the typical feature is that the balance of exchanges has risen slowly but has not fluctuated violently.

3. Market share and capital preference: BTC’s absolute dominance is stable

According to CoinMarketCap data, Bitcoin's market share has rebounded to 62%, a significant increase from 59% at the end of May. The market value of altcoins remains low, investors' risk appetite tends to be conservative, and funds are further concentrated on BTC, forming a strong "risk aversion siphon effect."

4. Spot Bitcoin ETF continued to see net inflows this week

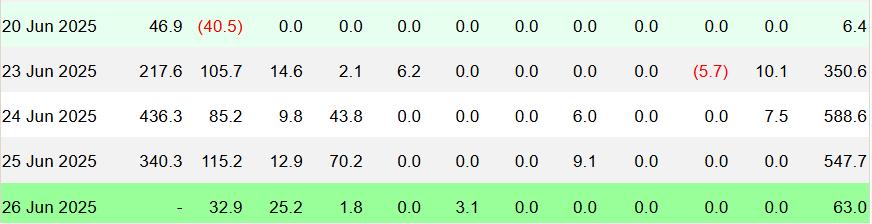

This week's daily ETF inflow/outflow details:

June 23: +$350.6 million

June 24: +$588.6 million

June 25: +$547.7 million

June 26: +$63 million. The total net inflow of ETFs in the first three days of this week exceeded $1.48 billion. Although there was a slight decline on June 26, the overall trend is still in a strong channel.

ETF Inflow/Outflow Data Image

Total holdings and cumulative transactions of spot ETFs

On-chain holdings exceed 1.21 million BTC

As of June 22, the total on-chain holdings of U.S. spot Bitcoin ETFs were approximately 1.218 million BTC (6.13% of the global supply), with a total value of approximately $126.2 billion.

Cumulative transaction volume exceeds US$1 trillion <br>Since its launch in January 2024, the total transaction volume of US spot BTC ETF has exceeded US$1 trillion, with IBIT (BlackRock iShares BTC Trust) accounting for 79% of the market share, with an average daily transaction volume of between US$2.3 billion and US$4.4 billion; the asset management scale has exceeded US$120 billion, and IBIT itself exceeds US$70 billion.

Technical indicator analysis

1. Relative Strength Index (RSI 14)

According to Investing.com data, as of June 27, 2025, Bitcoin's 14-day relative strength index (RSI) was 50.555, which is in the neutral range (50-70). This shows that the current market is in a relatively balanced state of long and short forces, and has not yet shown obvious overbought or oversold signals. RSI is close to the central axis, reflecting that market sentiment is cautious and lacks clear direction guidance in the short term. If RSI subsequently breaks through 60 and continues to rise, it may indicate that buying momentum has increased; on the contrary, if it falls below 50, we need to be alert to the risk of further market correction.

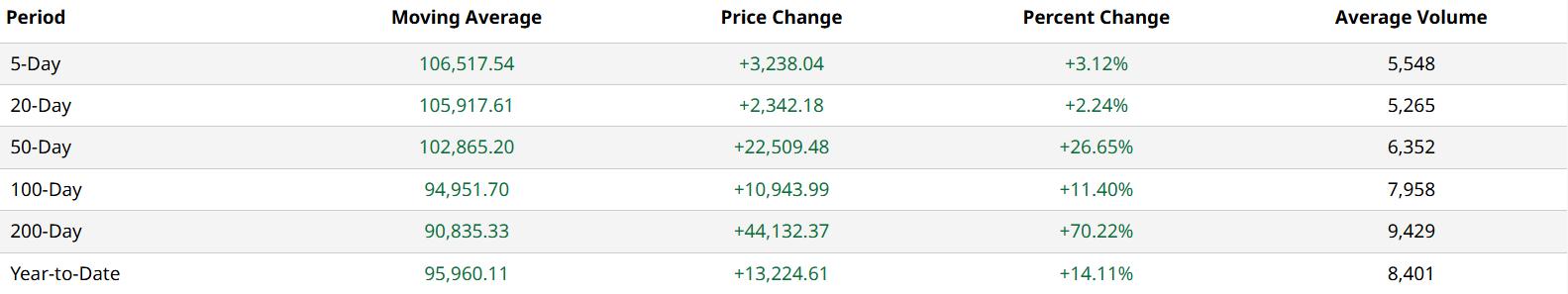

2. Moving Average (MA) Analysis

5-day moving average (MA 5): $106,517.54

20-day moving average (MA 20): $105,917.61

50-day moving average (MA 20): $102,865.20

100-day moving average (MA 100): $94,951.70

200-day moving average (MA 200): $90,835.33

Current market price: $107,296.39

MA 5, MA 20, MA 20, MA 100, MA 200 data pictures

Bitcoin prices are currently running above all major moving averages, showing strong medium- and long-term upward trend support. In the short term, MA 5 and MA 20 are in a bullish arrangement, and prices are running steadily above them, reflecting that short-term buying power is still relatively active. In the medium term, MA 50 and MA 100 are on the rise, showing that the market as a whole is in a structural upward trend. In particular, the current price is higher than MA 50 and MA 100, indicating that the trend has not weakened. In the long term, MA 200 continues to rise, confirming that Bitcoin is still in a long-term bull market structure. However, it should be noted that although the current price is above the moving average system, it is limited to MA 5 and MA 20. If the subsequent volume is insufficient, there is a possibility of a short-term technical retracement to the moving average support.

3. Moving Average Convergence Divergence (MACD) Analysis

According to Investing.com data, as of June 27, the MACD fast line was -32.94, in the negative zone, indicating that the short-term moving average (12-day EMA) has fallen below the long-term moving average (26-day EMA), which means that the market's short-term momentum is weakening. The current MACD sends a "Sell" technical signal, and the MACD histogram shows a negative bar line, indicating that the downward momentum has not yet been completely exhausted.

If the MACD fast line crosses the signal line upward and the histogram turns from negative to positive, it will be regarded as an advance signal that the market has completed its short-term bottoming; otherwise, we need to continue to be vigilant about downside risks.

4. Key support and resistance levels

Support level : Bitcoin's current short-term key support levels are at $105,000 and $106,000. If the price falls further, the next important support area will be concentrated at $98,500 to $100,000. The overall trend remains within the rising channel and has not yet formed an effective correction structure. During the rapid decline in this week's intraday trading, the two supports of $98,500 and $100,000 showed significant buying intervention, successfully curbing the decline and forming a short-term rebound, indicating that the support level has a strong ability to carry on.

Resistance : In the short term, the core resistance level faced by Bitcoin is at $108,000. During the rise from June 25 to 27, the price touched this level several times, but failed to achieve an effective breakthrough. A technical decline followed, indicating that there is strong selling pressure and short-selling defense at this resistance level. If the subsequent price can break through $108,000 with large volume, it will be expected to further test $110,000 and open up new upward space; on the contrary, if it is blocked again, it may fall back to the $105,000 area in the short term to seek support.

Overall , Bitcoin is currently maintaining a high-level oscillation pattern, and the technical side shows a combination of signals that the trend is upward but the momentum is weakening. The price is still running above the major moving averages, indicating that the medium- and long-term rising structure has not been destroyed; but the short-term RSI and MACD signals indicate that the bullish momentum has temporarily slowed down, and there is a need for a pullback. Investors are advised to pay attention to the breakthrough of the $ 107, 000-$ 108, 000 range. The breakthrough direction will determine the short-term trend evolution path. If the pullback does not break the support and is accompanied by a large increase in volume, you can consider following up; if it falls below the $ 105, 000 support, you need to be alert to the risk of further correction. In terms of risk control, it is recommended to pay attention to the macro news and the linkage effect of the US stock market and the US dollar index to prevent sudden emotional fluctuations.

Market sentiment analysis

1. Emotional profile

The overall market sentiment this week showed a state of "first depression and then rise". From June 21 to 23, the price fluctuated downward and fell below the psychological barrier of 100,000 US dollars. Most traders became cautious and wait-and-see. From June 23 to 24, after the key technical support level stabilized, the price quickly rebounded to around 105,000 US dollars. The market sentiment obviously warmed up, some long funds re-entered the market, and confidence was gradually restored. From June 25 to 27, the price of Bitcoin steadily rebounded, showing an upward channel, the sentiment tended to stabilize, and the market as a whole returned to rational optimism.

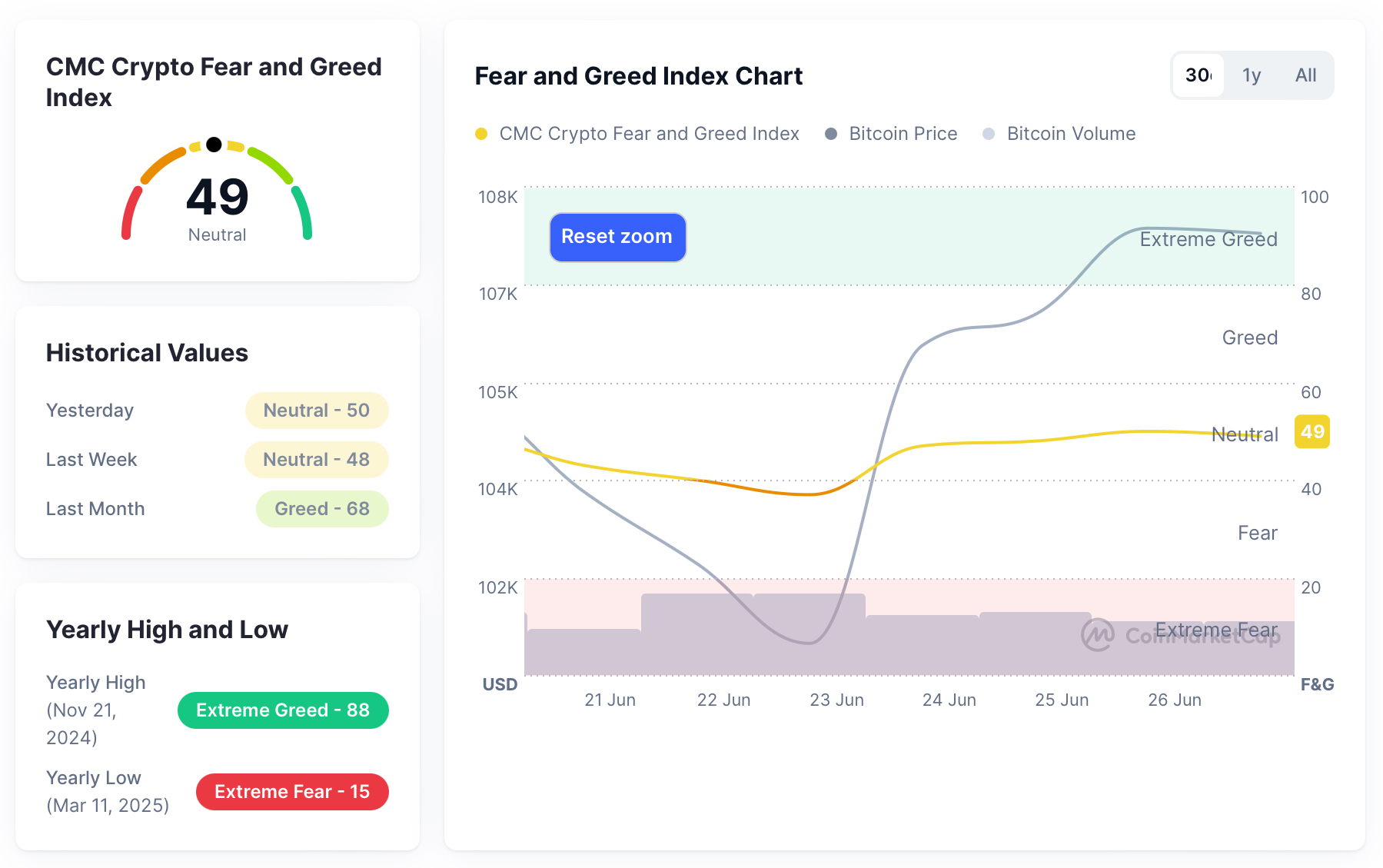

2. Key Sentiment Indicators (Fear and Greed Index)

As of June 27, the Fear & Greed Index was at 49, which is in the "neutral" range. This shows that the overall market sentiment is balanced, investors are rational, and there is no obvious panic or excessive pursuit of rising prices.

Looking back at this week (June 21 – June 26), the daily values of the index were: 43 (neutral), 40 (critical fear), 37 (fear), 47 (neutral), 48 (neutral), 50 (neutral). Overall, the index was in the "fear" range in the first half of this week, reflecting the market's concerns about price corrections; and as the market rebounded, the index gradually returned to the "neutral" level, indicating that market sentiment is recovering and investor confidence is recovering.

Fear and Greed Index Data Picture

Macroeconomic Background

1. Powell denies that the Fed will buy Bitcoin

On June 25, Fed Chairman Powell publicly stated that the Fed "neither has nor seeks to obtain the legal authority to purchase Bitcoin", explicitly denying market speculation that the Fed may directly get involved in Bitcoin assets. This statement draws a clear line between the central bank's boundaries in the field of digital assets, suppresses the expectation of "central bank buying" in the short term, and has a slight negative impact on market sentiment. However, in the medium and long term, the logic of Bitcoin's decentralization and anti-inflation still holds true. It is worth noting that investors should focus more on whether the Treasury Department and the Trump administration will promote a national Bitcoin reserve policy. The Fed's statement does not represent the position of the entire government.

2. The US's military action against Iran triggered geopolitical risk aversion, and Bitcoin rebounded after falling below $100,000

In the early morning of June 22, the United States launched the "Midnight Hammer" military operation to strike Iran's three nuclear facilities in Natanz, Fordow and Isfahan. The price of Bitcoin fell below $100,000 on the evening of June 21, reaching $98,000, triggering more than $300 million in long liquidations. But then the market quickly recovered and the price rebounded to the $100,000-105,000 range, showing that the market structure is resilient and geopolitical shocks have not caused sustained selling.

At the same time, the market is concerned that Iran may block the Strait of Hormuz, exacerbating uncertainty in energy supply. The Strait carries about 20% of the world's oil transportation volume. If it is blocked, it will cause sharp fluctuations in oil prices. JPMorgan Chase predicts that oil prices may soar to $120-130 per barrel, pushing up US inflation to 5%, triggering a rise in risk aversion. Although geopolitical conflicts bring short-term downward pressure, they may enhance Bitcoin's safe-haven properties in the medium and long term.

3. Trump's hawkish stance and expectations of a ceasefire in the Middle East are repeatedly intertwined

This week, Trump showed a hawkish stance during the NATO summit and publicly supported military strikes against Iran's nuclear facilities, causing market concerns about escalation. His fierce remarks were called the "Hiroshima moment" by the media, intensifying geopolitical uncertainty and supporting demand for safe-haven assets such as gold and Bitcoin.

On June 23, Trump announced a ceasefire in the Iran-Israel conflict. Although the media pointed out that there was still actual exchange of fire, the news led to a brief rebound in market risk appetite, oil prices fell, and the stock market rebounded. Bitcoin prices also recovered to the range of US$106,000-107,000, showing its high sensitivity to changes in macro expectations.

4. The crypto market has performed weakly this year, and the July CPI has become a key observation point

10x Research pointed out that although more than $63 billion of liquidity has flowed into the crypto market since 2025, Bitcoin has only risen by 13% since the beginning of the year, far below market expectations. In terms of inflation, the US CPI has dropped from 3.5% in April to 2.4% for the current three consecutive months, which is lower than the "risk level above 3%" that Powell warned of. At the same time, the unemployment rate has stabilized at 4.2%, and the labor market has not deteriorated significantly.

In this context, the market is generally concerned about the US CPI data to be released on July 15, which will directly affect whether the Federal Reserve will maintain its hawkish stance or turn to easing in advance. If the CPI falls further, it may bring policy benefits to Bitcoin; on the contrary, if inflation picks up, the enthusiasm of funds in the crypto market may be suppressed.

3. Hash rate changes

Between June 21 and June 27, 2025, the Bitcoin network hash rate fluctuated as follows:

On June 21, the Bitcoin network computing power (hash rate) fluctuated slightly. The overall Bitcoin network hash rate fluctuated slightly, maintaining a range of 880 EH/s to 940 EH/s in the morning, rising briefly to 954.61 EH/s in the afternoon, and then gradually falling back to 844.81 EH/s at the end of the day, indicating a decrease in miner participation. On June 22, the hash rate showed a downward trend, continuing the decline of the previous day, and continued to fall from the opening of 844.81 EH/s, reaching a minimum of 666.02 EH/s. Although there was a slight rebound during the day, it finally closed at 692.02 EH/s, indicating that the network computing power was under pressure. On June 23, the hash rate rebounded mildly, reaching a high of 773.57 EH/s during the day, and then fell again, falling to 688.33 EH/s at the end of the day, and failed to form an effective reversal signal in the short term. On June 24, the hash rate continued its downward trend, falling to a stage low of 632.89 EH/s during the day, and then rebounded, rising to 734.06 EH/s at the close, reflecting that some miners reconnected to the network after the computing power adjustment.

On June 25, the hash rate of the Bitcoin network rebounded significantly, showing a continuous upward trend throughout the day. The hash rate has been continuously restored since 734.06 EH/s, indicating that the access rate of miners has increased, or some mines have completed equipment maintenance and power adjustments. Near the end of the day, the hash rate reached 946.63 EH/s, approaching the previous high range, indicating that network computing resources are rapidly returning and the overall operating status is stabilizing. On June 26, the hash rate continued to rise, rising from 920.76 EH/s during the day, reaching a high of 1071.10 EH/s, setting a recent high. However, after running at a high level, the network computing power fell back to a certain extent, and finally fell back to 949.36 EH/s at the close of the day. It is possible that some computing power exited the network after the peak. On June 27, the hash rate continued to fall from the previous day and continued to fall in the morning. According to current data, as of the time of writing (UTC time), the hash rate has fallen back to around 900 EH/s, indicating that miners' block activity has decreased.

Overall, the Bitcoin hash rate remained low in the middle of this week, falling to a minimum of about 632.89 EH/s, reflecting the low number of miners. According to Bitinfocharts data, the average daily hash rate of the Bitcoin network fell to 661.26 EH/s, a new low since mid-October 2024, down more than 10% from the previous day. Some analysts believe that the sudden drop in computing power may be related to the US airstrike on Iran's nuclear facilities on June 22, which may cause temporary network or power outages in the region's mining farms, thereby affecting the global computing power supply. Subsequently, the computing power has rebounded rapidly since June 25, and briefly broke through 1071.10 EH/s on June 26, setting a stage high. By June 27, the hash rate slightly adjusted back to around 900 EH/s, showing an overall "low-level shock-rapid repair" trend, indicating that the current network is still in a dynamic balance adjustment.

Bitcoin network hash rate data

4. Mining income

According to YCharts data, the total daily income of Bitcoin miners this week (including block rewards and transaction fees) is as follows: June 21: $46.57 million; June 22: $34.17 million; June 23: $34.61 million; June 24: $39.24 million; June 25: $48.33 million; June 26: $53.55 million. It can be seen that the average daily total income of miners this week is roughly maintained between $34 million and $54 million, approximately in the range of $44M±10M, showing an overall "first fall and then rise" trend. The lowest point this week occurred on June 22-23, and then continued to rise to a new high at the end of the weekend.

This income fluctuation is mainly affected by Bitcoin price fluctuations and hashrate adjustments. As Bitcoin prices fell below $100,000 in the middle of this week, on-chain transaction activity slowed down, resulting in a decrease in the proportion of transaction fees in some time periods, which in turn lowered total revenue. However, in the latter part of this week, due to the increase in Bitcoin network congestion and the increase in unit hashrate revenue (Hashprice), miners' daily income quickly recovered. It should be noted that structural changes in the network and changes in miners' behavior still have a significant impact on income.

From the perspective of Hashprice (income per unit of computing power), the overall trend this week showed a state of rebound after decline. According to Hashrate Index data, on June 23, the Bitcoin network-wide Hashprice fell to $49.65/PH/s/day, hitting a low point this week and close to the monthly low. On June 27, Hashprice recovered to $54.47/PH/s/day. The fluctuation of Hashprice is due to the superposition effect of Bitcoin price changes and global computing power adjustments, especially reflecting the direct impact of geopolitical events on areas with highly concentrated computing power. It also further highlights the key significance of multi-regional computing power layout and power supply stability when mining companies formulate mining strategies.

From an industrial perspective, mainstream listed mining companies in the United States achieved considerable profit growth in May. According to data disclosed by investment bank Jefferies this week, the overall mining profit of listed mining companies in May 2025 increased by nearly 20% month-on-month. Among them, Marathon Digital (MARA) had the highest output, reaching 950 BTC, followed by CleanSpark, with an output of 694 BTC. Overall, the total output of listed mining companies in the United States reached 3,754 BTC in May, an increase of 14.5% from April, and the market share also increased from 24.1% to 26.3%.

Hashprice data

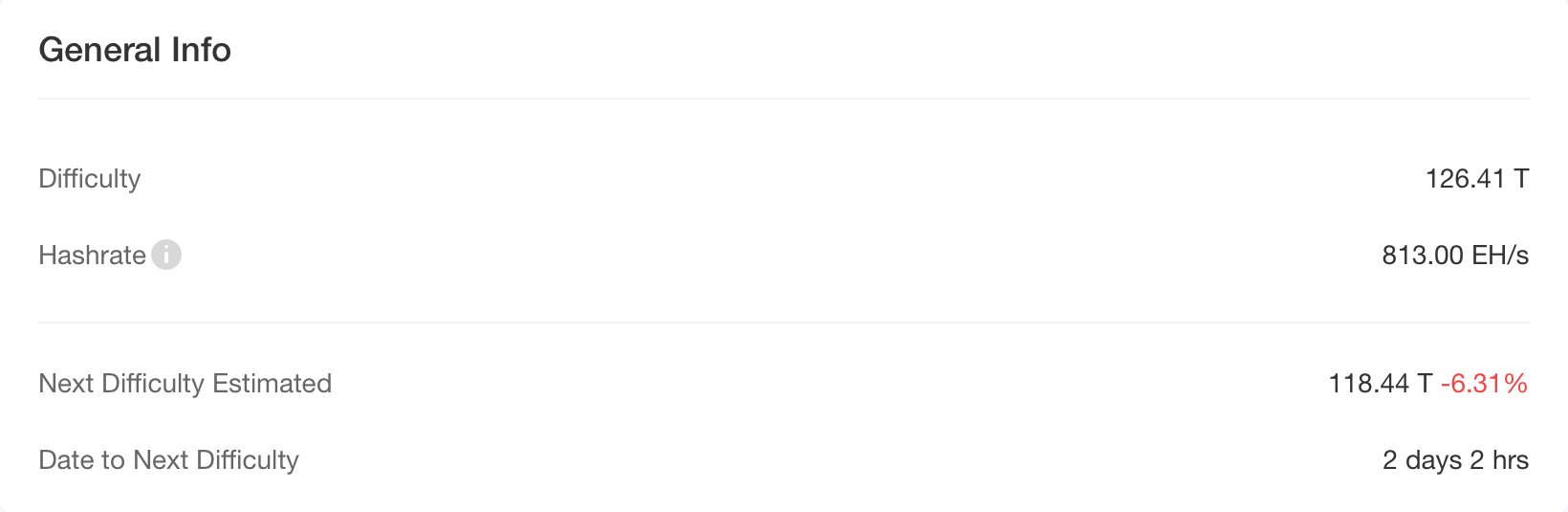

5. Energy costs and mining efficiency

According to CloverPool data, as of the time of writing on June 27, 2025, the total hashrate of Bitcoin has reached 813.00 EH/s, and the current mining difficulty of the entire network is 126.41 T. The next round of difficulty adjustment is expected to take place on June 29, with an estimated reduction of 6.31%, and the difficulty will drop to 118.44 T. In addition, according to CoinDesk on June 24, the next difficulty adjustment may reach about 9%, which will be the largest single reduction since China implemented the mining ban in July 2021. This sharp drop in difficulty marks that the mining ecosystem is undergoing an important turning point. The reduction in mining difficulty is a big boon for miners, because it directly means that the probability of producing blocks per unit of hashrate will increase, and the marginal benefits of miners will increase accordingly. At the same time, for mining farms with higher marginal costs of electricity prices, difficulty adjustments also provide a certain buffer space, which helps them optimize their operating strategies.

Recently, the May financial reports of mainstream listed mining companies in the United States showed steady growth in profits. Many mining companies have accelerated their expansion pace, adopting strategies such as mergers and acquisitions of mining sites, introduction of more energy-efficient S 21 mining machines, and optimization of the power supply chain, focusing on reducing marginal costs and increasing the value of unit computing power. The competitive landscape of the industry is increasingly showing a "stronger, stronger" trend - capital and technological barriers have become the core competitiveness of large mining companies. Through scale effects and technological upgrades, these mining companies can not only effectively cope with the risks of difficulty and price fluctuations, but also have the ability to lead the next round of industry development.

Overall, the Bitcoin mining industry is entering a new round of optimization and adjustment. The significant reduction in difficulty will ease the pressure on miners in the short term and improve the overall profitability. At the same time, energy efficiency improvement and cost control have become the key to the survival and development of mining companies. As large mining companies achieve scale expansion through capital and technology dual-wheel drive, the industry as a whole shows a trend of intensified differentiation. In the future, only miners who continue to improve the computing power energy efficiency ratio, optimize the power structure, and master flexible scheduling capabilities can maintain their leading position in the fierce market competition. For investors, focusing on mining companies with technology upgrade capabilities and stable power supply guarantees will be more likely to achieve long-term stable returns.

Bitcoin mining difficulty data

6. Policy and regulatory news

Texas signs bill to build Bitcoin reserve, ready to buy $10 million in BTC

On June 24, Texas Governor Greg Abbott signed Senate Bill No. 21, formally establishing the nation's first state-level Bitcoin reserve backed by public funds. Texas will allocate $10 million to purchase Bitcoin, unlike Arizona and New Hampshire, which only authorize but do not fund it. The supporting bill HB 4488 also stipulates that the reserve cannot be diverted to general fiscal revenue.

Texas passes SB 1498, authorizing the seizure of criminal-related Bitcoin and digital assets

On June 24, according to Cointelegraph, Texas officially signed SB 1498 into law, allowing the state to seize Bitcoin and digital assets related to specific crimes. The seized assets will be deposited into a confiscation fund.

Related images

Powell: Fed neither has nor seeks legal authority to buy Bitcoin

On June 25, Federal Reserve Chairman Powell said that the Federal Reserve neither has nor seeks to obtain the legal authority to purchase Bitcoin.

Ohio Rep: After Passing HB 116 to Ease Crypto Taxation, Next Step Will Be Creating a State Bitcoin Reserve

On June 25, according to Bitcoin News, after passing the HB 116 bill to ease cryptocurrency taxation, Ohio Congressman Steve Demetriou said the next step would be to establish a state-level Bitcoin reserve. A new bill, HB 18, would allow state treasurers to invest up to 10% of specific public funds in “high market value” cryptocurrencies.

Related images

Arizona passes Bitcoin reserve bill HB 2324, awaiting governor’s signature

According to Bitcoin Laws, Arizona passed the Bitcoin Reserve Act HB 2324 on June 25. The bill aims to establish a reserve to store assets obtained through criminal asset forfeiture. If signed by Governor Hobbs, the bill will become the second reserve bill formally passed by Arizona.

White House Digital Asset Policy Advisor: The United States is working on building infrastructure for strategic Bitcoin reserves

On June 27, FOX Business reporter Eleanor Terrett said that White House digital asset policy adviser Bo Hines confirmed that the United States is working on building infrastructure for strategic Bitcoin reserves.

He noted that while Trump’s executive order in March does not compel the Treasury Department to publish a report on the current U.S. government’s Bitcoin (BTC) holdings, the administration may choose to do so publicly, adding that the administration is “very inclined” to increase its Bitcoin holdings in a budget-neutral way.

7. Mining News

Satoshi Action Fund Co-founder: The US government should provide funding or incentives for the development of Bitcoin mining

On June 23, Dennis Porter, co-founder of Satoshi Action Fund, wrote, “The U.S. government should provide funding or incentives for the development of Bitcoin mining, just as it provides funding or incentives for batteries or renewable energy. Bitcoin mining is one of our most powerful tools to balance the power grid and advance U.S. energy goals. We can eliminate energy poverty.”

Canaan Technology announces strategic reorganization to focus on crypto infrastructure and Bitcoin mining

On June 24, according to official news, Canaan Technology announced that it has launched a strategic reorganization. Its chairman and CEO Zhang Nangeng said that it will focus on the fields of crypto infrastructure and Bitcoin mining, including Bitcoin mining machine sales, self-operated mining business, and consumer-oriented mining products. In addition, Canaan Technology disclosed that the revenue from the sale of edge computing products in fiscal year 2024 was approximately US$900,000. The unaudited operating expenses related to this business accounted for approximately 15% of the company's total operating expenses in fiscal year 2024.

Bit Digital announces full transformation into Ethereum staking and treasury company, raises $150 million to buy ETH and exits Bitcoin mining business

On June 26, Bit Digital (code: BTBT), a US-listed company, announced a strategic transformation, planning to gradually withdraw from the Bitcoin mining business and fully turn to Ethereum staking and asset allocation, and is committed to becoming a "pure Ethereum staking and treasury company." To accelerate the transformation, Bit Digital raised $150 million at $2 per share through a public offering, and provided an additional 11.25 million options to underwriters. The funds raised will be used to purchase ETH, which is one of the largest Ethereum financial commitments on the public market. In addition, the company will sell shares and spin off its high-performance computing subsidiary WhiteFiber. As of the end of March this year, Bit Digital held more than 24,000 ETH and 417 BTC, and operated one of the world's largest institutional-level Ethereum staking infrastructures.

Related images

8. Bitcoin related news

Global corporate Bitcoin holdings dynamics (statistics for this week)

1. El Salvador: According to mempool data on June 22, El Salvador currently holds 6,215.18 BTC, equivalent to approximately US$637 million.

2. BlackRock: According to news on June 23, BlackRock's spot Bitcoin ETF IBIT held 683,017.53 BTC as of June 18, accounting for more than 3% of the total Bitcoin supply.

3. Cardone Capital: On June 23, Cardone Capital has purchased about 1,000 BTC and plans to increase its holdings to 4,000 this year.

4. Strategy (formerly MicroStrategy): On June 23, Strategy added 245 BTC, bringing its total holdings to 592,345 BTC.

5. Méliuz SA: On June 23, Brazilian listed company Méliuz purchased an additional 275.43 BTC, bringing its total holdings to 595.67.

6. The Blockchain Group: On June 24, European listed company The Blockchain Group purchased an additional 75 BTC, bringing its total holdings to 1,728 BTC.

7. Australian Monochrome ETF: According to news on June 24, Australia's spot Bitcoin ETF Monochrome (IBTC) held 877 BTC as of June 23.

8. The Smarter Web Company: On June 24, the British listed company The Smarter Web Company increased its holdings by 196.9 BTC, bringing its total holdings to 543.52 BTC.

9. Vinanz: On June 24, the British listed company Vinanz purchased an additional 37.72 BTC, and its total holdings increased to 58.68 BTC.

10. Bitmax: On June 24, South Korean listed company Bitmax purchased an additional 49.06 BTC, bringing its total holdings to 300.08, making it the listed company with the largest holdings in South Korea.

11. ProCap Financial (including ProCap BTC): On June 25, ProCap and its Bitcoin-native financial services company ProCap BTC purchased 1,208 Bitcoins, bringing their total holdings to 4,932. ProCap acquired 3,724 Bitcoins on June 24. The company expects that the total value of Bitcoin assets will reach US$1 billion after the business merger is completed.

12. Matador: On June 25, Bitcoin and RWA financial technology company Matador purchased an additional 8.4 BTC, bringing its total holdings to 77. The amount of this increase is approximately US$878,000 as part of its long-term Bitcoin funding strategy.

13. Metaplanet: On June 26, Japanese listed company Metaplanet purchased an additional 1,234 BTC, bringing its total holdings to 12,345 BTC, surpassing Tesla's 11,509 BTC, becoming the world's seventh largest listed company to adopt a Bitcoin treasury strategy.

14. NanoLabs: On June 26, Nasdaq-listed company NanoLabs purchased an additional 600 BTC. The company holds 1,000 bitcoins in its reserve fund. The relevant bitcoins came from the first round of investment in its $500 million convertible bond transaction.

15. Bitcoin Treasury Capital: On June 26, Bitcoin Treasury Capital, a Canadian listed company, announced that it had acquired 66 bitcoins with a total value of approximately US$7 million (approximately 66 million Swedish kronor). The company said that the acquisition marked the official launch of its long-term reserve strategy.