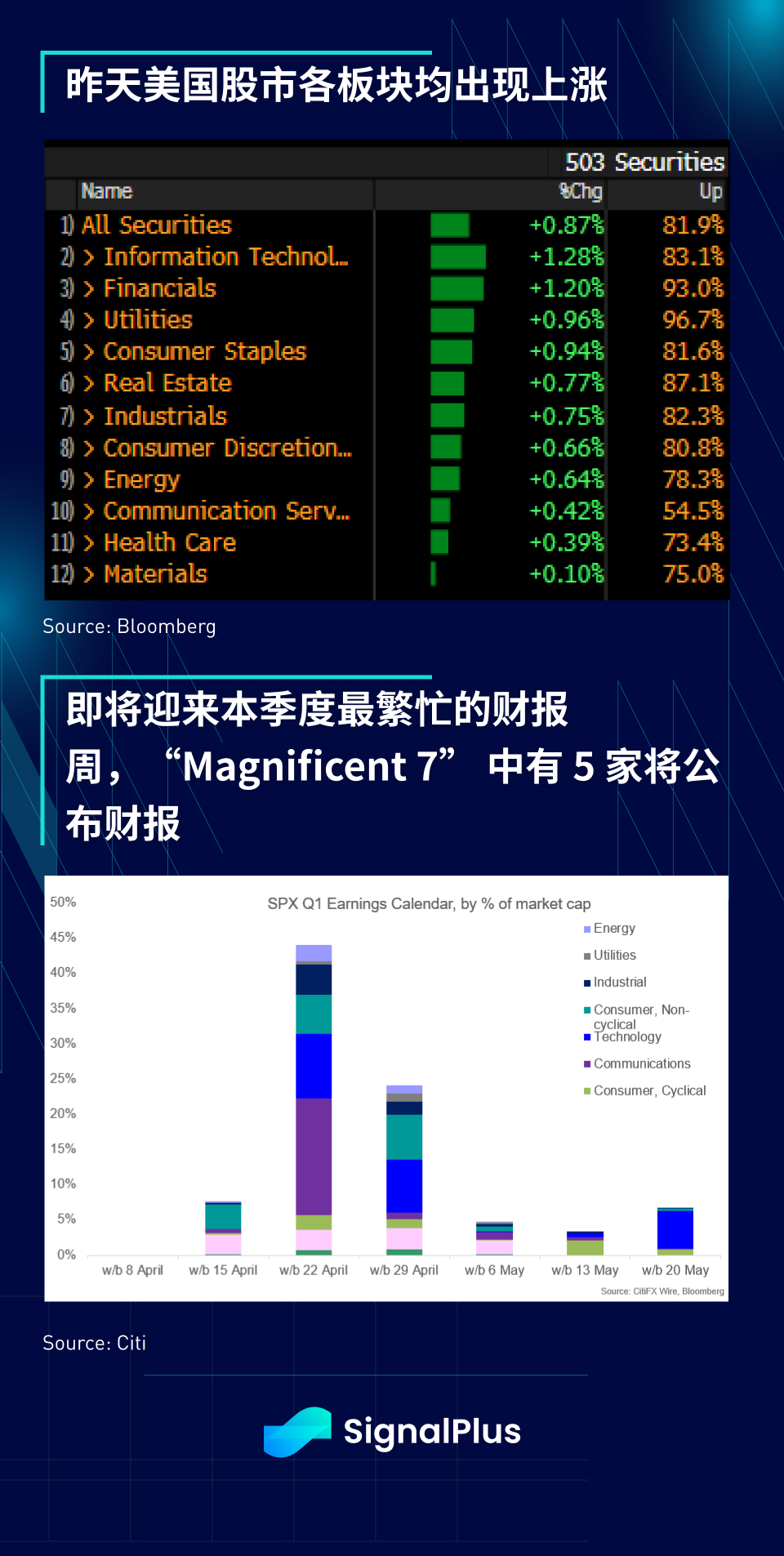

Risk markets rose across the board yesterday as geopolitical tensions did not escalate further over the weekend and risk rebounded from oversold positions. Fixed income investors seem to be choosing to stay on the sidelines ahead of Friday's PCE data, the FOMC meeting in 8 days, and the SPX's busiest earnings week of the quarter, with trading activity still light despite positive price action, with fixed income volumes at only 60-70% of normal levels. 44% of SPX companies will report earnings this week, including 5 of the "Magnificent 7", with Tesla on Tuesday, Meta on Wednesday, and MSFT, Google, and Amazon on Thursday.

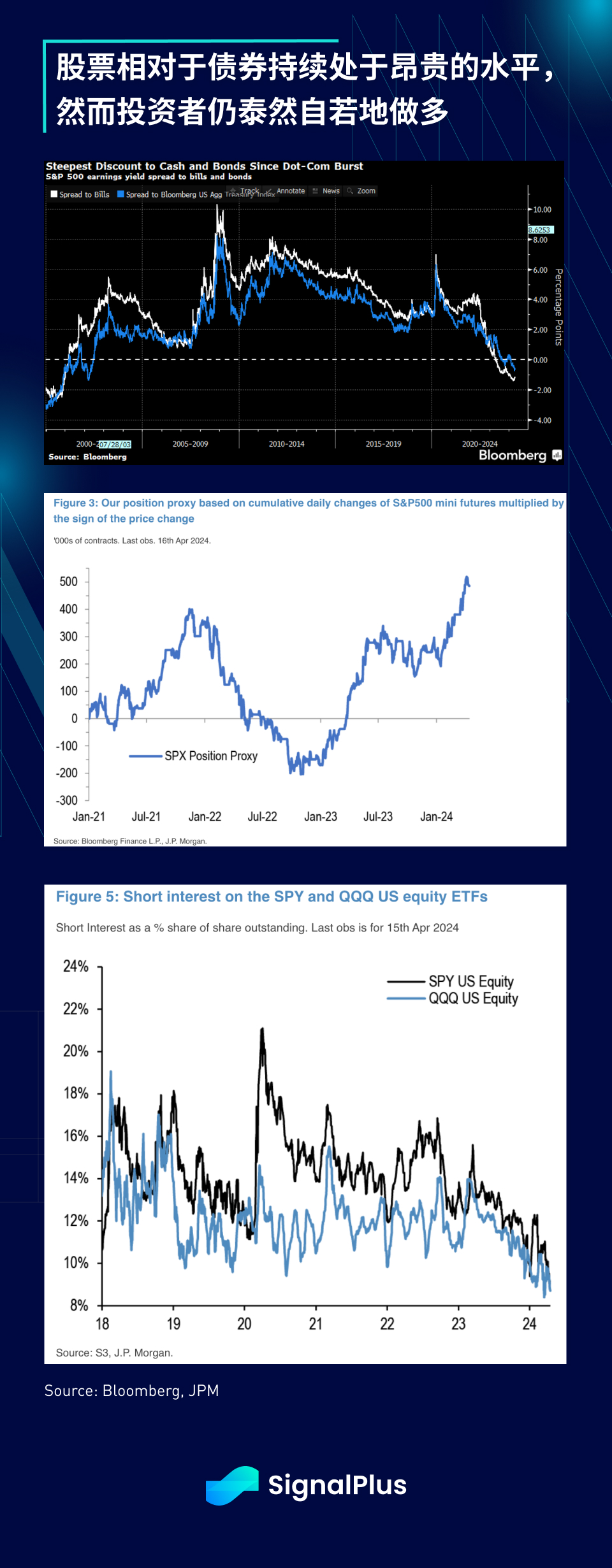

As bonds sold off last week, stocks continue to be quite expensive at all-time highs relative to fixed income (based on implied yields), but Wall Street believes that investors are still comfortable with long positions, with the long positioning indicator reaching a 4-year high and the SPX/Nasdaq short ratio reaching a nearly 10-year low.

However, the negative price action last week still caused some technical damage to the stock, and SPX futures have fallen below the 55-day moving average, and are still more than 5% away from the next 200-day moving average support. On a weekly basis, the slow stochastics have turned negative and accelerated downward, while the SPX monthly candlestick may also form a bearish outside monthly line at a record high, which needs more attention during the earnings season.

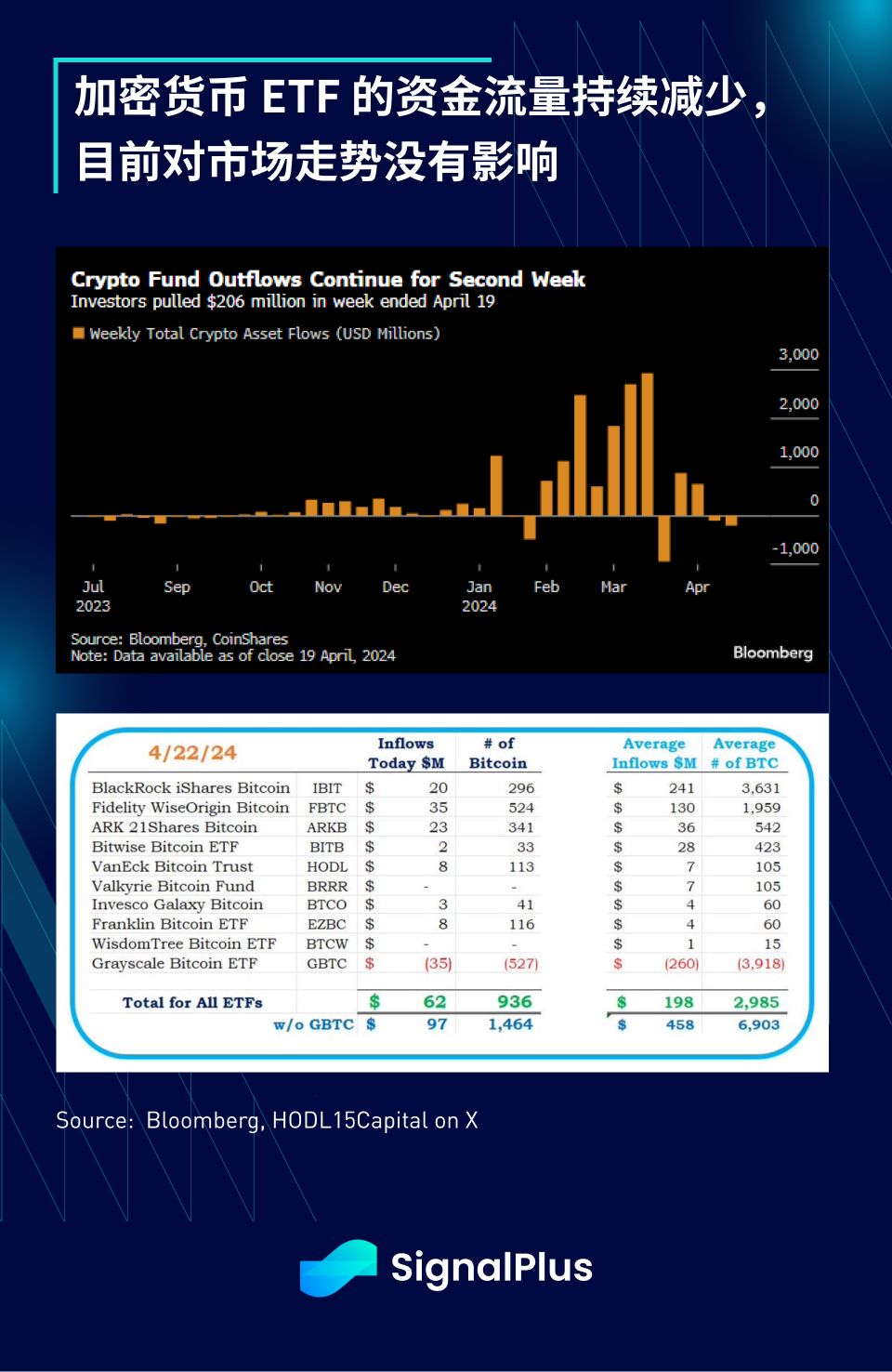

In terms of cryptocurrencies, based on CME futures contracts, JPM believes that BTC positions are also overweight, and ETFs have experienced outflows for two consecutive weeks (although on a smaller scale), and mainstream momentum has weakened significantly. Fund inflows rebounded slightly to +62 million US dollars on Monday, but there was no impact on the market. We will continue to pay close attention to market trends.

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com