Hotairballoon has selected important information on the crypto market last week, investment and financing status, as well as on-chain data on current popular tracks such as LSD and RWA. It also counts projects with relatively large unlock volumes in the near future for your reference.

1. Important information about the encryption industry last week

A quick look at important industry information of the week.

(1) Policy/Supervision

1. Head of the Innovation Center of the Bank for International Settlements: Whether central banks like cryptocurrencies or not, they need to be prepared

According to news on October 2, Cecilia Skingsley, head of the Innovation Center of the Bank for International Settlements (BIS), said at the New York Fed Fintech Conference: Artificial Intelligence and Digital Assets that the Bank knows that it must stay ahead of the curve and needs to practice it personally.

The mission of the Innovation Center is to research and investigate how new technologies, including cryptocurrencies, are changing the way central banks operate. Skingsley said the BIS knows it cannot ignore the digital asset space. “The experience of Libra in 2019 and everything that followed really made everyone realize that there is so much going on in the tech space that we can’t ignore. No matter what, central banks need to be prepared.

2. The International Monetary Fund proposes a national cryptocurrency risk assessment matrix

According to news on October 2, on September 29, the International Monetary Fund released a working paper titled Assessing Macro-Financial Risks Brought by Crypto-Assets. In the paper, authors Burcu Hacibedel and Hector Perez-Saiz propose a cryptocurrency risk assessment matrix (C-RAM) for countries to discover indicators and triggers of potential risks in the industry. The matrix is also intended to summarize potential responses by regulators to risks they may identify.

3. The U.S. SEC and five other regulatory agencies issued a warning on crypto investments

According to news on October 3, the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), the Commodity Futures Trading Commission (CFTC), the National Futures Association (NFA), the Securities Investor Protection Corporation (SIPC) and the North American Securities Administrators The Association (NASAA) jointly issued multiple warnings about crypto-asset investment, saying that crypto-asset investment may be unusually volatile and speculative, and the platforms through which investors buy, sell, borrow or lend these assets may lack protection.

Regulators warn that those offering crypto-asset investments or services may not comply with applicable laws, including federal securities laws. Additionally, the announcement detailed that crypto asset investors face a number of risks, including unregistered offerings, lack of Securities Investor Protection Corporation (SIPC) protection, and fraud.

4. LayerZero and Conflux have reached a cooperation that will enable China Telecom’s BSIM cards to use other blockchains

According to official news on October 3, the full-chain interoperability protocol LayerZero development team LayerZero Labs announced today that it has reached a strategic cooperation with Conflux Network, which will allow China Telecom’s blockchain-based SIM card (BSIM) users to access LayerZero Full chain functionality on supported blockchain networks. Based on this cooperation, users will be able to use LayerZeros full-chain data communication platform to transfer digital assets and data stored on the BSIM card from the Conflux main network to other blockchain networks. The new BSIM feature will initially be used to transfer cryptocurrencies from the Conflux mainnet (eSpace and Core space) to Ethereum, with more chains and features to be added in the coming months.

5. Payments giant Visa launches $100 million generative AI special investment fund

According to Cointelegraph, payment giant Visa announced on October 2 the launch of a new $100 million generative artificial intelligence fund to invest in the development of generative artificial intelligence technologies and technologies related to commerce and payments. Application company. The investment will be orchestrated by Visa Ventures, Visa’s global corporate investment arm.

6. Macau Judicial Police Bureau: Virtual currencies are not legal tender in Macau, so be careful not to be deceived.

According to news on October 3, according to the Hong Kong Economic Journal, the Macau Judicial Police reminded the public that virtual currencies are not legal tender in Macau, but are only virtual commodities, and the relevant transactions are speculative and extremely risky. The relevant commodities should be recharged first. You should not follow it blindly and be careful to avoid being deceived or being used for illegal activities such as money laundering. The Macau Judicial Police Bureau stated that investment fraud cases have occurred frequently in recent months, many of which involve virtual currencies. The common method used by fraudsters is to recruit Internet celebrities on online social platforms, and after gaining trust, they will lobby the victims to participate in a virtual currency investment plan that claims to have high returns.

7. The judge rejects the SEC’s motion to appeal the Ripple ruling

On October 4, DB NEWSWIRE tweeted that District Judge Analisa Torres dismissed the SEC’s motion to appeal the Ripple case ruling. Torres said in a brief ruling Tuesday that the SEC failed to meet its responsibilities under the law and failed to prove either a legal control issue or good cause for a disagreement. XRP rose around 5% following the announcement.

8. Ripple obtains Singapore’s major payment institution license

On October 4, according to CoinDesk, Ripple’s Singapore subsidiary has obtained a major payment institution (MPI) license from the Monetary Authority of Singapore (MAS), allowing it to provide digital payment token services in Singapore. According to previous news, Ripple received in-principle approval from the Monetary Authority of Singapore in June this year. In addition, Coinbase Singapore has also obtained an MPI license in Singapore.

9. The Bank for International Settlements is working with several European Central Banks to develop a data platform to track cryptocurrency and DeFi fund flows.

According to Cointelegraph reports on October 4, the Bank for International Settlements (BIS) collaborated with the Deutsche Bundesbank, the Dutch Central Bank, the European Central Bank and the French Central Bank to develop a proof-of-concept (PoC) platform ProjectAtlas for tracking cryptocurrency exchanges and public On-chain and off-chain transactions in blockchain, designed to measure the macroeconomic relevance of cryptocurrency markets and DeFi protocols to provide insights, information and economic impact on the industry, while pointing out the lack of transparency and potential risks in the crypto space A unique case of major failure.

10. El Salvador launches its first Bitcoin mining pool, which will use geothermal energy for mining

According to reports on October 6, El Salvador’s renewable energy and mining company Volcano energy and Bitcoin mining software provider Luxor Technology jointly launched “Lava Pool”. This is the first Bitcoin mining pool in El Salvador that aims to exploit the country’s abundant geothermal energy to mine Bitcoin. According to a statement, Volcano Energy will mine exclusively through the mining pool and donate 23% of its net proceeds to the government of El Salvador as part of a public-private partnership.

11. The Basel Committee on Banking Supervision will propose disclosure requirements for banks’ crypto exposures

On October 7, according to CoinDesk, the Basel Committee on Banking Supervision released a report on banking industry turmoil in 2023, agreed to consult on climate and crypto asset disclosure, and stated that banks must disclose their cryptocurrency holdings. Meanwhile, the committee said a forthcoming consultation paper will set out “a range of disclosure requirements related to banks’ crypto asset exposures” to supplement existing digital asset capital requirements established in December. It has said banks should issue potentially prohibited capital for their holdings of unbacked cryptocurrencies such as Bitcoin or Ethereum.

12. Singapore will establish an inter-departmental committee to re-examine the anti-money laundering system

According to official news on October 6, Singapore will set up an inter-departmental committee to re-examine the anti-money laundering system in light of the largest money laundering case recently uncovered in Singapore. Institutions such as the Monetary Authority of Singapore will designate relevant individuals to participate in the committee, and the Second Minister of Finance and National Development of Singapore will serve as chairperson of the committee. Singapore will thereafter re-examine its anti-money laundering regime from the perspective of foreigners purchasing and holding local real estate, as well as the registration and operation of corporate entities.

13. Secretary of the Treasury Bureau of Hong Kong: Until Hong Kong officially regulates stablecoins, retail trading will not be allowed.

On October 6, according to Ming Pao News Network, Hong Kong Secretary for Financial Affairs and the Treasury Hui Ching-yu pointed out in the investment committee interview program that relevant currencies in the market will support their value with US dollars or gold, with the goal of stabilizing prices, but In the past, stablecoins have experienced price fluctuations or even collapse. The reserve management of stablecoin issuers will affect price stability and investors’ rights to redeem fiat currency. Considering these factors, until Hong Kong officially regulates stablecoins, it will not be implemented for the time being. Will include allowing retail sales.

14. The seasonally adjusted non-farm employment population in the United States in September was 336,000, and the unemployment rate in September was 3.8%.

According to news on October 6, according to Jinshi data, the U.S. non-farm employment population in September was 336,000 after seasonally adjusted, compared with expectations of 170,000 and the previous value of 187,000. The U.S. unemployment rate in September was 3.8%, compared with expectations of 3.7% and the previous value of 3.8%.

15. Deputy Secretary for Security of Hong Kong: Hong Kong Customs has no power to supervise virtual currencies

According to reports on October 4, the Security Affairs Committee of the Hong Kong Legislative Council yesterday discussed the latest developments in customs participation in international activities, including the JPEX case and virtual currency supervision issues. Hong Kong Deputy Secretary for Security Cheuk Hsiao-yip said that under the Anti-Money Laundering and Counter-Terrorist Financing Ordinance, anyone operating a currency exchange needs to apply for a license from the Customs and Excise Department, which is responsible for supervising licensed currency service operators. Since virtual currency is not legal tender, customs has no power to control it. As for how to control virtual currency and virtual assets in the future, the government and relevant regulatory agencies are continuing to review the development of the situation and continue to improve the regulatory mechanism.

16. Secretary of the Treasury of Hong Kong: If NFT constitutes a collective investment or securities, it must obtain permission from the Securities and Futures Commission before it can be sold.

According to news on October 7, according to Eastnet, the Secretary for Financial Services and the Treasury of Hong Kong, Hui Ching-yu, revealed when attending the Hong Kong Investment Committee program that the Hong Kong Monetary Authority is preparing for a public consultation on stable currency supervision. In addition, if non-fungible tokens (NFTs) only exist in digital form and are not regulated by the China Securities Regulatory Commission, but constitute a collective investment or securities, they must obtain permission from the China Securities Regulatory Commission before they can be sold to the market. .

(2) Project information

1. The dYdX community voted to pass the $20 million v4 incentive plan temperature check

According to news on October 2, the dYdX community passed the dYdX v4 Launch Incentive Proposal temperature check vote, which proposes to allocate $20 million DYDX from the dYdX Chain community treasury for a 6-month launch incentive program deployed on v4. to incentivize early adopters.

2. Coinbase obtains major payment license in Singapore

According to official news on October 2, Coinbase Singapore has obtained a major payment institution (MPI) license from the Monetary Authority of Singapore. Coinbase will develop and launch products tailored for Singapore and will conduct training and recruitment programs at its Singapore technology center. According to previous news, Coinbase is committed to expanding the scope of services it provides to customers in Singapore. In March this year, Coinbase opened local bank transfer services for free to Singapore users.

3. OpenSea launches one-stop shop OpenSea Studio to support NFT project release and management

According to official news on October 4, OpenSea announced the launch of OpenSea Studio, a one-stop shop for creators to publish and manage projects, which supports the casting of NFTs in their own wallets and building on most OpenSea-compatible blockchains. And allows collectors to mint NFTs using credit/debit cards. OpenSea also announced plans to add new features in the coming months.

4. Oasis Network will launch a synthetic version of its native ROSE token, syROSE, in the fourth quarter

On October 4, CoinDesk reported that the privacy computing network Oasis Network will launch syROSE, a synthetic version of its native ROSE token, in the fourth quarter of 2023. Oasis will work with SYNTHR to bring ROSE to six blockchain networks, including Ethereum, Arbitrum, Avalanche, Polygon and BNB Chain. By enabling seamless swapping, staking, lending, and more on various Web3 blockchain platforms, syROSE will enable Oasis users to quickly and easily transfer their tokens to ecosystems outside of Oasis.

5. MakerDAO has increased RWA assets by US$169 million in the past week, and the total RWA assets of the agreement are approximately US$3.278 billion.

According to news on October 4, makerburn.com data shows that MakerDAO has once again increased its RWA assets by $169 million since September 28, including more than $127 million in RWA assets through BlockTower Andromeda, and $38 million in RWA assets through Monetalis Clydesdale. BlockTower S 3 increased RWA assets by $3.61 million and decreased RWA assets by $130,000 through New Silver. In addition, current agreement RWA total assets are approximately $3.278 billion.

6. Immutable releases the Immutable zkEVM roadmap, which will be launched on the mainnet from December this year to January next year.

On October 5, Immutable released its mainnet launch roadmap. A rebuild of the Immutable zkEVM testnet is planned for November, upgrading its first EVM client from Polygon Edge to Geth, ensuring Immutable zKEVM is as close to Ethereum as possible while being fully compatible with the entire Ethereum tool ecosystem. The zkEVM mainnet will be launched from December to January next year, and developers will be invited to join in groups before it is opened to the public. In 2024 Immutable will offer a dedicated application chain with the same technology stack and functionality as Immutable zkEVM, but with a unique level of customization. Finally, zk-prover will be introduced and provide a trustless Ethereum and Immutable zkEVM cross-chain bridge.

7. Ethereum’s latest conference: Devnet-9. The current network participation rate is close to 90%, which is a positive indicator of the health of the test network.

According to news on October 7, Christine Kim, Vice President of Galaxy Research, published a document summarizing the 119th Ethereum Core Developer Consensus Conference (ACDC). This meeting mainly discussed the current progress of Devnet-9 (the current network participation rate is close to 90%, this is a test Positive indicators of network health. Testing of MEV related tools, etc.), Devnet-10 launch time (if known problems are fixed, we can consider trying to launch it as early as next week. This is most likely to be the last developer test network, and will later enter the public The test network stage is mainly used to test EIP-7514, that is, setting the upper limit of the validator activation queue Max Epoch Churn Limit to 8, slowing down the growth of the ETH pledge rate, and exchanging time for designing a better validator reward scheme), Dencun test time (The last meeting agreed to test Dencun on Goerli before Holesky. Many developers also agreed to release Dencun on the public test network before Devconnect, the Istanbul Ethereum Developer Conference in mid-November this year. Currently, developers are not sure whether achieve that timeline).

8. Chainlink officially releases one-stop data solution Chainlink Data Streams

On October 6, Chainlink officially announced that Chainlink Data Streams, a one-stop data solution developed specifically for the DeFi industry, has been officially released. This solution combines two functions, including low-latency data transmission and automated transaction execution, to improve response. Speed and user experience.

9. Optimism: 230 million OP tokens will be transferred to institutional custodians for security purposes

According to news on October 6, Optimism tweeted that approximately 230 million OP tokens are expected to be transferred on October 5. These tokens belong to core contributors and are being transferred to institutional custodians for security purposes.

10. StarkWare postpones initial token unlock to April 2024

According to CoinDesk reports on October 4, Ethereum Layer 2 developer StarkWare has postponed the first unlocking of its native StarkNet (STRK) token to April 2024. Etherscan shows that the new unlock date has been pushed back from the original November 29, 2023, to April 15, 2024. A StarkWare spokesperson said the team is focused on technical development and is updating the roadmap as needed, including updates to lockdowns. It is unclear how many coins will be affected by the delay.

11. Solana v1.16 version update introduces “confidential transfer” function and enhances user privacy

According to reports on October 8, Solana’s v1.16 version update introduced the “Confidential Transfers” function, which enhances user privacy through encrypted SPL token transactions. This is a new token program introduced by Token 2022 and is designed to enhance Solana’s current token functionality. This allows people to conduct blockchain transactions without revealing key details of the transaction, such as the transaction amount.

(3) Others

1. CertiK: 184 safety incidents occurred in the third quarter, causing losses of nearly US$700 million

News on October 2, according to a report by blockchain security company CertiK, a total of 184 security incidents occurred in the third quarter of this year, resulting in a loss of nearly US$700 million in crypto assets, exceeding US$320 million in the first quarter and US$313 million in the second quarter. dollar, the “most financially damaging” quarter of the year.

Of the various attack types, private key compromise was the most devastating, with 14 security incidents costing more than $204 million. Additionally, exit scams and oracle manipulation were prevalent during the quarter. There were 93 exit scams during the quarter, with more than $55 million in digital assets lost, and 38 oracle manipulation incidents, with more than $16 million in cryptocurrency lost.

2. Data: Ethereum Futures ETF’s trading volume in the first few hours was less than $2 million

According to news on October 3, Bloomberg EFT analyst Eric Balchunas tweeted that the trading volume of the Ethereum futures ETF in the first few hours was quite flat, less than $2 million. This figure is low compared to the $200 million in trading volume on ProShare Bitcoin futures in the first 15 minutes. According to previous news, ProShares, VanEck and Bitwise launched Ethereum futures ETFs on Monday. Investors can purchase ProShares ETFs through a brokerage account without the need for a cryptocurrency custodian, exchange account or wallet.

3. Grayscale September Market Report: Bitcoin remains strong despite global market turmoil

News on October 5, according to the September market report released by Grayscale, Bitcoin performed well amidst the global market fluctuations in September 2023. Bitcoin rose 4.1% in September, while most traditional assets suffered heavy losses. , especially in the context of rising U.S. bond yields, showing the characteristics of Bitcoin as a store of value and a crisis haven. Reports further suggest that the next price catalyst for Bitcoin could come from the approval of a Bitcoin spot ETF. In particular, the SEC has until October 13 to seek a rehearing of Grayscales defeat in the courts recent ruling. If the SEC abandons the appeal, it will reconsider Grayscales application to convert GBTC to a spot ETF, as well as other related bits. Coin spot ETF application.

4. Federal Reserve data: Bitcoin performs better than the U.S. dollar in fighting inflation

According to Cointelegraph, the St. Louis branch of the Federal Reserve in a blog post compared the inflation resistance of Bitcoin (BTC) and the U.S. dollar (USD) in purchasing eggs, and the results showed that Bitcoin is resistant to inflation. outperformed the US dollar. The author of the article measured the price of a dozen eggs in Bitcoin and US dollars using data from January 2021 to the present. Despite Bitcoin price volatility, the number of sats required to purchase the same amount of eggs with Bitcoin has decreased more than USD since its peak in December 2022. As of August 2023, Bitcoin holders need 70% fewer Bitcoins to purchase eggs, while USD has fallen 58%.

5. Data: Total investment in crypto companies has shrunk to approximately $7.3 billion in 2023, and the recent employment rate has fallen by more than 5%

News on October 6, according to Bloomberg, data from data company PitchBook showed that as of September 19, the total number of investment transactions in cryptocurrency and blockchain projects this year has shrunk to approximately US$7.3 billion, approximately in 2021 and 2022. A quarter of the total annual transaction volume. At the same time, jobs in the crypto industry are shrinking. Although the crypto industry’s workforce grew at a rate of more than 18% in early 2022, employment rates have declined throughout the year, according to workforce intelligence firm Revelio Labs based on data from 35 large companies. , the latest decline was more than 5%.

6. In the past year, the North Korean hacker group Lazarus Group laundered more than $900 million through cross-chain bridges

According to news on October 7, Yonhap News Agency reported that during the year from July last year to July this year, the North Korean hacker group Lazarus Group laundered more than $900 million (approximately 1.2 trillion won) in cryptocurrency through cross-chain bridges. Accounting for about one-seventh of the total money laundered through cross-chain bridges in the past year ($7 billion).

7. Vitalik posted: Changes to the protocol and pledge pool can improve decentralization and reduce consensus overhead

According to news on October 7, Ethereum co-founder Vitalik Buterin just published a blog post titled “Changes to the protocol and pledge pool can improve decentralization and reduce consensus overhead.” The article explains the two types of participants in the emerging two-tier staking model (node operators and delegators), the two main flaws of the status quo (node operators’ centralization risk and the lack of consensus layer burden), and the operation of two-tier staking. Way. The article also analyzes the importance of having a principal from a protocol perspective. The article proposes three ways to expand delegate suffrage: better voting tools within pools; more intense competition between mining pools and sealed delegations. and specific consensus participation.

2. Investment and financing situation last week

(1) DeFi

1. Cicada Partners, an on-chain credit risk management company, completed a $9.7 million Pre-Seed round of financing, led by Choppa Capital.

Cicada Partners, an on-chain credit risk management company, announced the completion of a $9.7 million Pre-Seed round of financing, led by Choppa Capital, with participation from Bitscale, Bodhi Ventures, and Shiliang Tang.

2. Crypto startup Ostium Labs completed US$3.5 million in financing to develop perpetual contract transactions for digital commodities.

Cryptocurrency startup Ostium Labs has raised $3.5 million in funding to develop a perpetual swap protocol for digital commodities. Diversified investors including General Catalyst, LocalGlobe, SIG and Balaji Srinivasan provide support.

3. Solana ecological DEX Convergence RFQ completed a pre-seed round of financing of US$2.5 million, led by C² Ventures

Solana ecological DEX Convergence RFQ completed a pre-seed round of financing of US$2.5 million at a valuation of US$30 million, led by C² Ventures, with participation from Big Brain Holdings, Israel Blockchain Association, Auros Global and others.

4. RWA tokenization platform DigiShares completed US$2 million in financing and plans to raise another US$1.2 million

DigiShares, a real-world asset (RWA) tokenization platform, announced the completion of US$2 million in financing. Specific investor information has not yet been disclosed. DigiShares is raising an additional US$1.2 million through the crowdfunding platform Republic.

5. L1 Advisors completed a $1.6 million seed round of financing, including a $1 million strategic investment from VanEck

On-chain wealth and asset management protocol L1 Advisors completed a $1.6 million seed round of financing. This includes a strategic investment of US$1 million from VanEck, with participation from Ironclad Financial, Ismail Jai Hokimi and others.

6. Liquidity staking platform Accumulated Finance V2 completed financing, with Curve and others participating in the investment

The Accumulated Finance team announced that the liquidity staking platform Accumulated Finance V2 has completed a new round of private placement financing. Curve, De Facto Capital, Stake DAO, etc. participated in the investment, and the financing amount has not been disclosed.

(2) Chain Games

1. GameFi platform NexGami completed a seed round of financing of US$2 million, with a post-money valuation of US$20 million.

GameFi platform NexGami announced the completion of a $2 million seed round of financing, with participation from Polygon Ventures, Fundamental Labs and Ledger Capital, with a post-money valuation of $20 million.

(3) Infrastructure Tools

1. Blockchain product development company Trinetix completed US$10 million in strategic financing

Blockchain product development company Trinetix has announced a $10 million strategic investment from investment fund Hypra. The new funding will enable Trinetix to further expand into Latin America, enhance its operations for North American customers, and expand its Latin American market.

2. TON received tens of millions of dollars in investment from MEXC Ventures

The decentralized blockchain platform The Open Network (TON) received tens of millions of dollars in investment from MEXC Ventures, a venture capital company under MEXC. The specific amount was not disclosed. At the same time, MEXC and the TON Foundation have established a strategic partnership aimed at promoting global Web3 accessibility by lowering barriers to entry.

3. AirDAO announced a $7.5 million investment from DWF Labs

AirDAO announced in the official blog that it has received a US$7.5 million investment from DWF Labs (with a one-year lock-in period and an unlock period of 36 months) to promote wider adoption of the AirDAO ecosystem, following the acquisition of DWF Labs 200 in September 2022 Continuation and expansion of partnership following $10,000 investment.

4. Privacy protocol Fairblock completed a pre-seed round of financing of US$2.5 million, led by Galileo

Privacy infrastructure provider Fairblock completed a $2.5 million pre-seed round of financing, led by Galileo, with participation from Lemniscap, Dilectic, Robot Ventures, GSR, Chorus One, Dorahacks and Reverie.

(4) Venture capital institutions

1. CMCC Global’s new fund has completed US$100 million in fundraising and will invest in Hong Kong blockchain companies

CMCC Global, a Hong Kong venture capital institution focusing on cryptocurrency, announced that its newly established fund Titan Fund has completed the first round of fundraising of US$100 million. Block.one, Yingke Group, Winklevoss Capital, Jebsen Capital and Animoca Brands founder Yat Siu More than 30 investors are waiting to participate in the investment.

(5) Others

1. Web3 catering platform Blackbird completed US$24 million in Series A financing, led by a16z

Web3 restaurant loyalty app Blackbird announced the completion of a $24 million Series A round of financing, led by a16z Crypto, with participation from QED, Union Square Ventures, Shine, Variant and multiple restaurant groups. The round brings Blackbird’s total funding to $35 million, which the company plans to use to scale its business.

2. Web3 social application Phaver has completed a seed round of financing of US$7 million, with a valuation of approximately US$80 million.

Web3 social application Phaver announced that it has completed a US$7 million seed round of financing, with participation from Polygon Ventures, Nomad Capital, Symbolic Capital, dao 5, Foresight Ventures, Alphanonce, f.actor, Superhero Capital, SwissBorg and other institutions.

3. Fountain, an art brokerage company on the chain, announced the completion of financing. Flamingo DAO was incubated, and 6529 Capital and others participated in the investment.

Fountain, an on-chain art agency, announced the completion of financing, with an undisclosed amount. Fountain was incubated by Flamingo DAO, with participation from Collab+Currency, Sfermion, VonMises, Cozomo de Medici, 6529 Capital, etc.

3. Main track data last week

(1) RWA

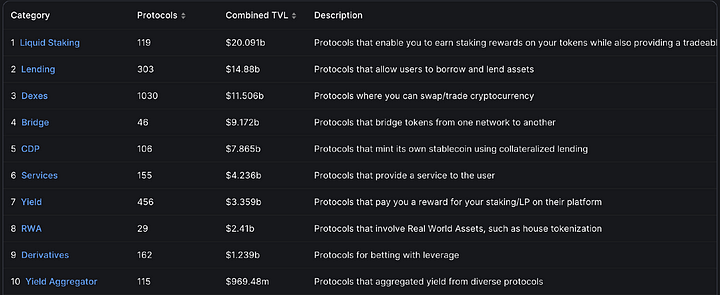

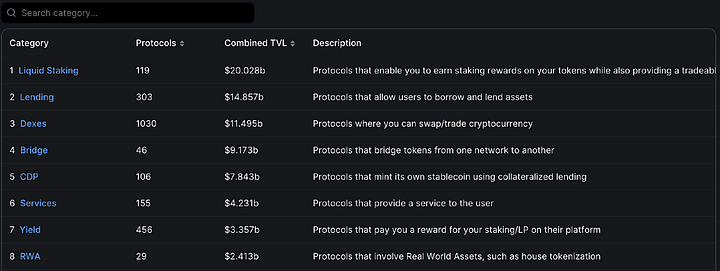

According to the statistics of defillama, the current total TVL of the RWA track has reached 2.41 billion US dollars, a slight increase from last week, and the total lock-up volume (TVL) ranks 8th. Defillama has included a total of 29 RWA protocols, which is slightly higher than last week. Added 1.

Among these RWA (real world asset) tokenization projects include the tokenization of U.S. Treasury bonds and real estate tokenization.

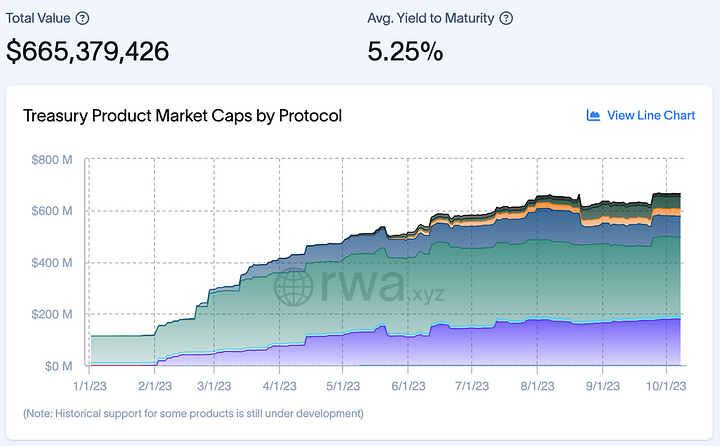

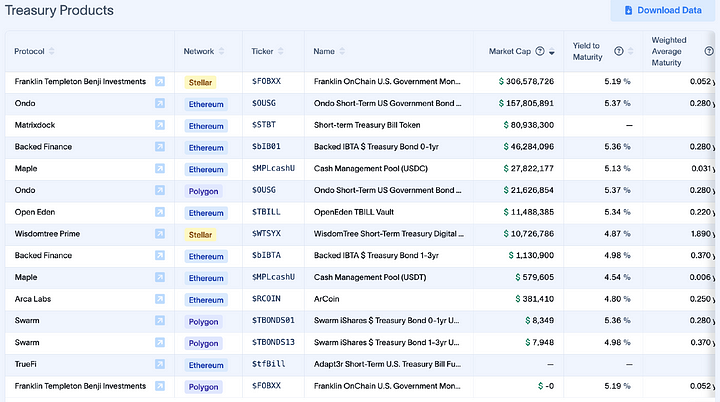

According to statistics from the rwa.xyz platform, the tokenized scale of U.S. Treasury bonds has reached $665 million, a slight increase from last week, with an average yield of more than 5%.

Among these U.S. debt tokenization projects, Franklin Templeton Benji Investments Market Cap on Steller has the highest market value, reaching $306 million, with a yield of 5.19%.

MakerDAO

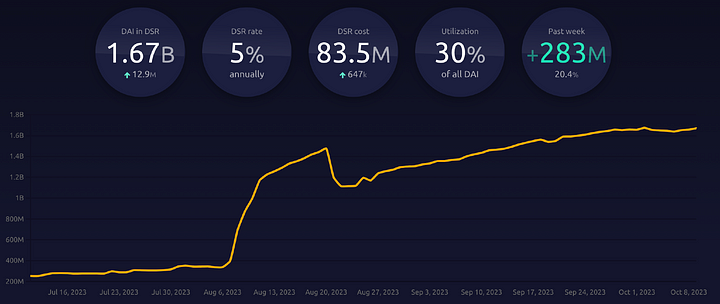

As of the time of writing, the size of Dai in DSR has increased by 283 million from last week to 1.67 billion. The total amount of Dai has increased to 5.56 billion, a slight increase from last week. The DSR deposit interest rate is 5%.

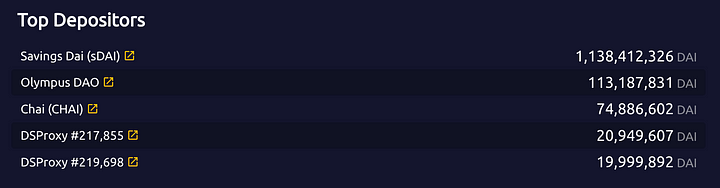

Among them, sDAI was 1.138 billion, a slight increase from last week.

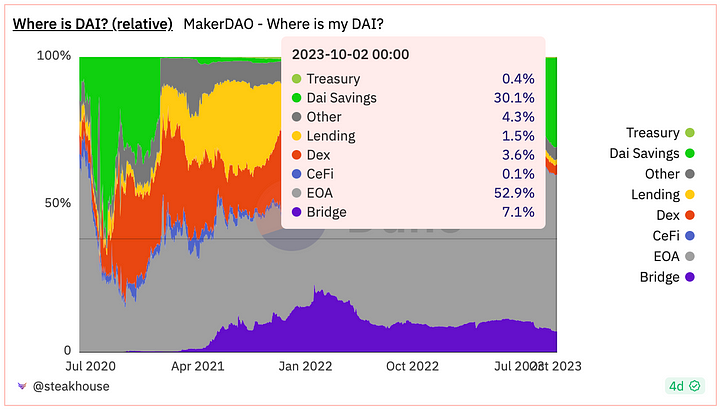

Lets take a look at the distribution of DAI.

The share of DAI in DEX and Lending has been declining since October 2022, while the holding rate of DAI in EOA accounts has been rising, reaching 52.9%, a slight decrease from last week. Since the DSR adjusted the interest rate, The share of DAI Savings is getting larger and larger, currently reaching 30.1%.

Currently, the ones with the highest proportion are: EOA, DAI Savings and Bridge.

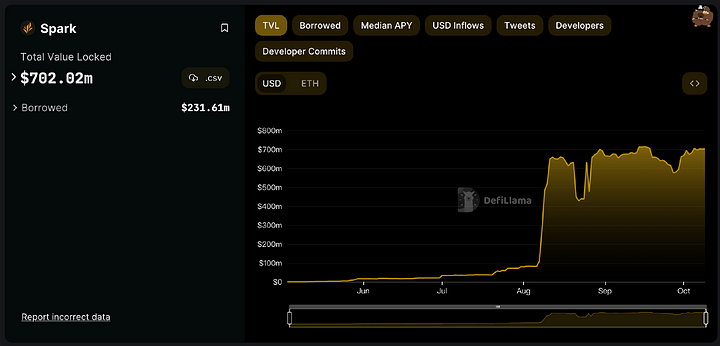

Maker’s own lending protocol Spark’s TVL reached 693 million, an increase of nearly 700 million from last week.

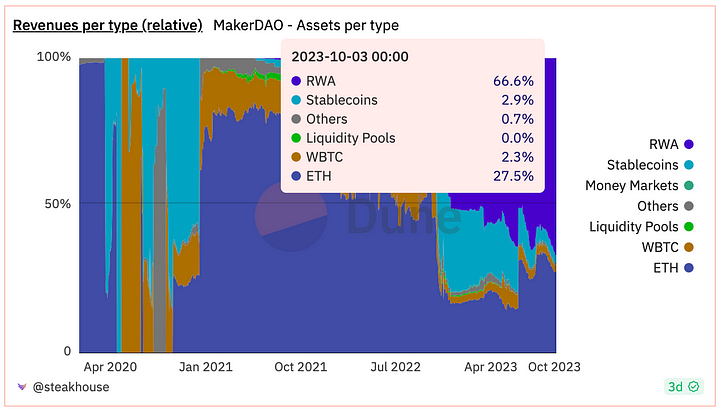

According to statistics from the dune platform, RWA accounts for 66.6% of MakerDAOs revenue, an increase of two percentage points from last week. The high proportion is related to MarerDAOs vigorous layout in the RWA track.

(2) LSD

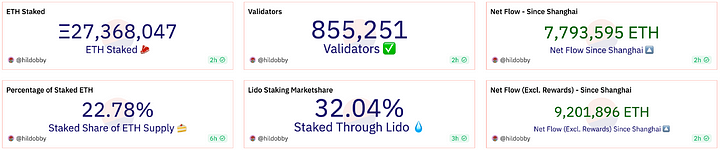

Currently, the amount of ETH pledged in the beacon chain has reached 27.36 million ETH, a slight increase from last week, accounting for 22.78% of the total supply of ETH, and the number of nodes is 850,000.

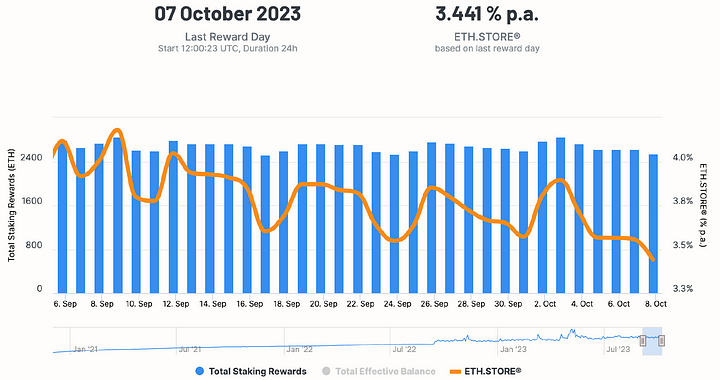

The current ETH staking yield is about 3.44%. As the quality increases, the yield is declining.

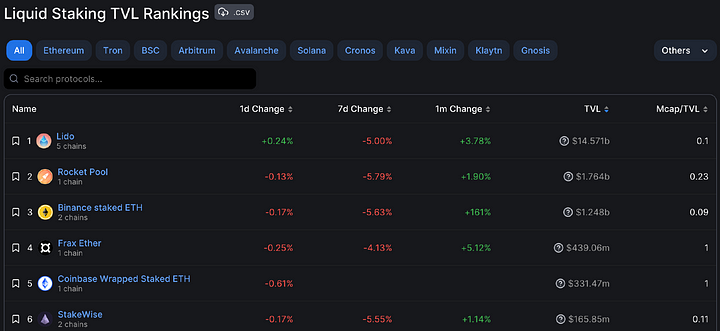

Among the three major protocols, in terms of ETH pledge volume, Lido increased by 3.78% in a week, Rocket Pool increased by 1.90% in a week, and Frax increased by 5.12% in a week.

Judging from the price performance of the three major protocols, LDO fell by 4.6% during the week, RPL increased by 8% during the week, and FXS price fell by 5.36% from last week.

(3) Ethereum L2

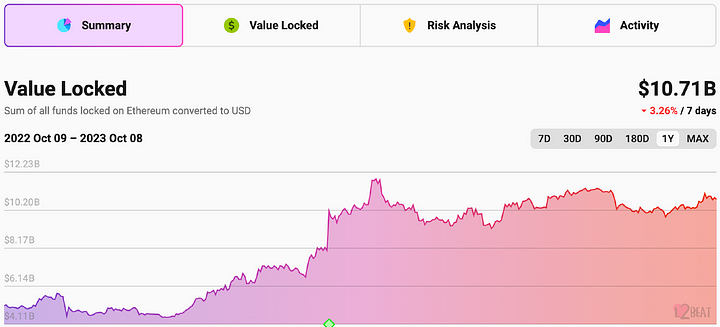

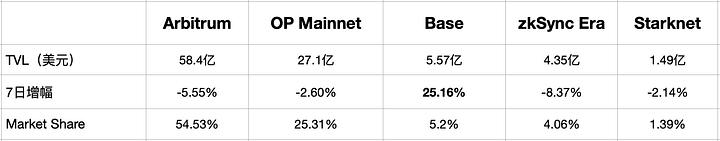

According to statistics from the l 2b eat platform, Ethereum Layer 2 TVL has decreased by 3.26% in the past week, and the current TVL is US$10.71 billion.

Among Ethereum Layer 2, Arbitrum still has the highest TVL, accounting for 54.53%. Of course, Base has the fastest growth recently. TVL increased by 25.16% in the past week, reaching US$557 million.

(4) DEX

TVL

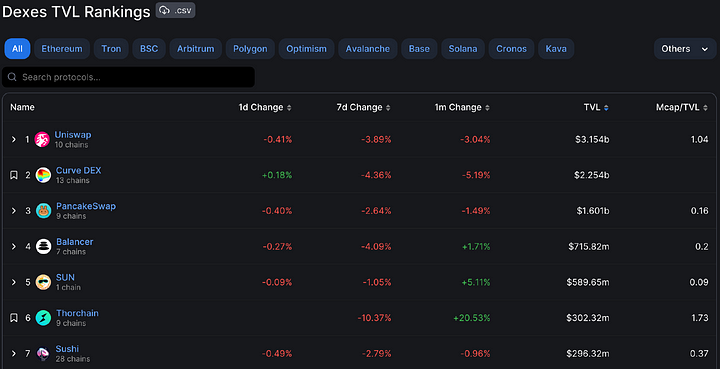

According to statistics from defillama, the total locked-up volume on the DEX track is US$11.495 billion, a slight decrease from last week.

Uniswap ranks the highest in lock-up volume, followed by Curve, PancakeSwap, Balancer, SUN and Thorchain. The TVL of most DEXs has declined compared with last week.

Among them, the DEXs with the highest TVL on the Ethereum mainnet are Uniswap, Curve, Balancer, Sushi and Loopring.

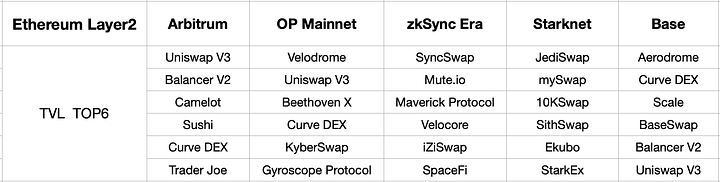

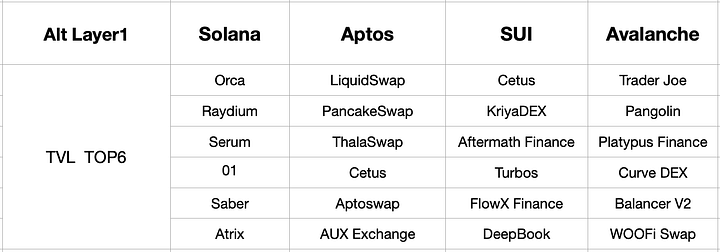

The above are the top 6 TVL DEXs on Arbitrum, OP Mainnet, zkSync Era, Starknet and Base chain.

The above are the top 6 TVL-ranked DEXs on other Layer 1 chains.

Trading volume

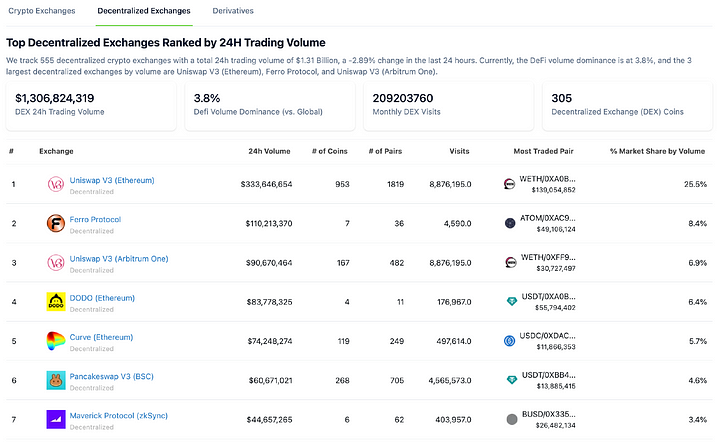

The trading volume of decentralized exchanges (DEX) in the last 24 hours was nearly US$1.31 billion, which was a decrease from last week. The total trading volume of global cryptocurrency exchanges in the last 24 hours was US$34.5 billion, of which DEX trading volume accounted for Only 3.8%.

(5) Derivatives DEX

TVL

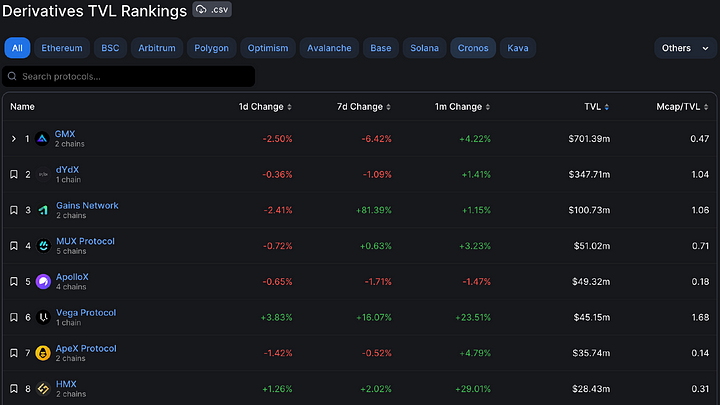

Judging from the data of defillama, most derivatives DEX TVL have increased recently, mainly due to the increase in token prices.

In the derivatives track, GMX has the highest TVL, followed by dYdX, Gains Network, MUX Protocol and ApolloX.

Trading volume

According to statistics from the coincko platform, the decentralized derivatives trading platform with the highest trading volume is dYdX. The trading volume in the last 24 hours has reached US$275 million, which is much higher than the trading volume of other decentralized derivatives platforms.

4. Recent token unlocking

The recent token unlocking of 6 projects is worthy of attention. Among them, the unlocking amounts of APT and SWEAT are relatively large.

Follow hot air balloon @HorairballoonCN on Twitter to explore more industry news:https://twitter.com/HotairballoonCN