1. Background

With the continuous development of public chains and Layer 2 ecosystems, liquidity is further fragmented. In the world of blockchain, fragmented liquidity distribution has become the norm.

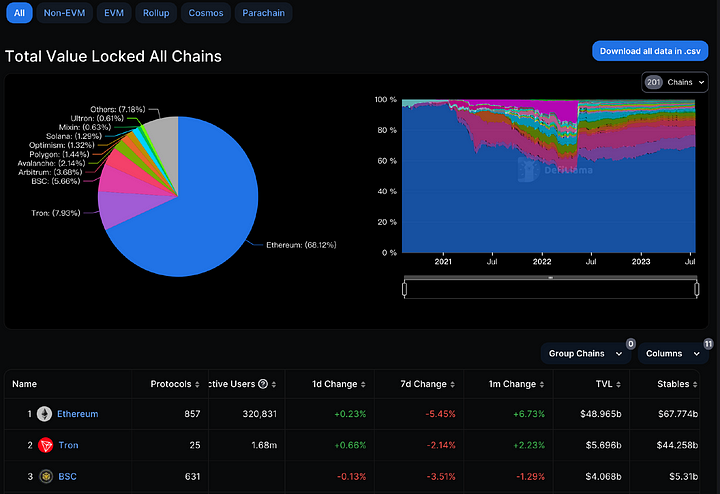

According to defillama's data statistics, the current amount of funds locked in DeFi has reached over 70 billion US dollars, with a huge volume of funds that had reached over 200 billion US dollars at its peak TVL.

However, this amount of funds, over 70 billion US dollars, is not concentrated but widely distributed among various public chains and protocols. According to defillama's data statistics, more than 70 billion US dollars of funds are widely distributed among over 200 public chains.

Moreover, each public chain has a large number of protocols. For example, there are over 800 protocols on the Ethereum public chain and over 600 protocols on the BSC chain. These public chains and their respective protocols have fragmented the over 70 billion US dollars of funds into countless pieces.

The fragmentation of liquidity greatly reduces the utilization rate of funds. Currently, there are more and more project parties committed to integrating these fragmented liquidity through certain protocols to improve the utilization rate of funds.

For example, in the DEX track, 1 inch (fusion), Uniswap (UniswapX protocol), etc., are committed to introducing external liquidity and providing users with more advantageous exchange prices through technologies such as intelligent routing.

Lending is an essential part of the financial world and an important component. In the DeFi sub-track, in addition to DEX, decentralized lending projects also need to integrate fragmented liquidity to reduce the threshold for lending, such as lower fees, simpler operations, etc. Radiant Capital is emerging in such a background.

II. Overview of the Radiant Protocol

The goal of Radiant Capital is to become the first comprehensive lending market on the blockchain, essentially integrating liquidity distributed across different chains, with the aim of...

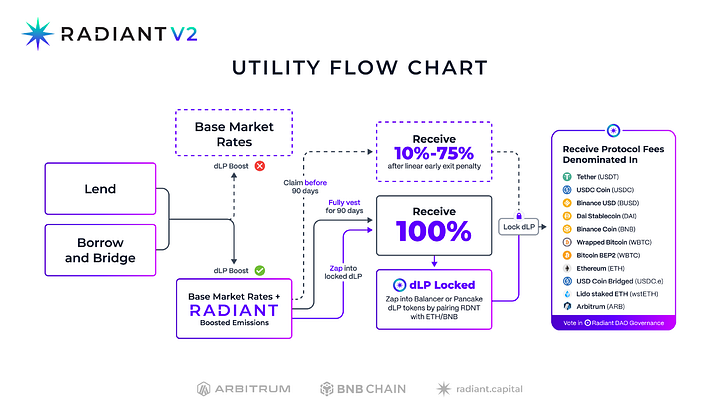

The translation of the given Chinese text is as follows:And most of the fees generated in the Radiant lending protocol are also returned to the holders of dLP, who are contributing to the Radiant platform.

Currently, if most lending protocols want to perform cross-chain lending operations, the common practice is to deploy different versions on different chains. For example, deploying one version on the Ethereum mainnet, and different versions on the BSC chain, Arbitrum, Optimism, and other chains. These different versions are not interoperable, and the liquidity between them is fragmented, requiring separate cross-chain and lending operations.

For example, if a user has deposited USDT tokens on the Arbitrum chain, but wants to borrow BNB on the BSC chain to participate in activities on Binance, they need to first use a cross-chain bridge to transfer USDT from the Arbitrum chain to the BNB chain, and then borrow BNB.

However, the Radiant protocol for full-chain loans can achieve cross-chain lending, allowing users to deposit any mainstream assets on any chain and perform lending operations on other chains.

graph="">In the example above, as long as the user deposits USDT tokens as collateral on the Arbitrum chain, they can directly borrow BNB tokens on the BSC chain without even realizing the cross-chain existence, achieving seamless cross-chain borrowing and lending between different chains.

Radiant not only reduces the hassle and cost of user operations, but also integrates liquidity scattered across different chains, improving the utilization of funds.

3. Cross-chain Mechanism

How does Radiant achieve full-chain borrowing and lending?

From a technical perspective, Radiant (RDNT) achieves its full-chain interoperability through LayerZero's Omnichain technology.

In version 1 of Radiant, cross-chain functionality relies mainly on Stargate's cross-chain routing. However, in version 2, Radiant first converts the RDNT token standard from ERC-20 to LayerZero OFT format, and replaces the Stargate routing interface with LayerZero's OFT cross-chain standard.

What is OFT? What is its purpose?

Four, Team

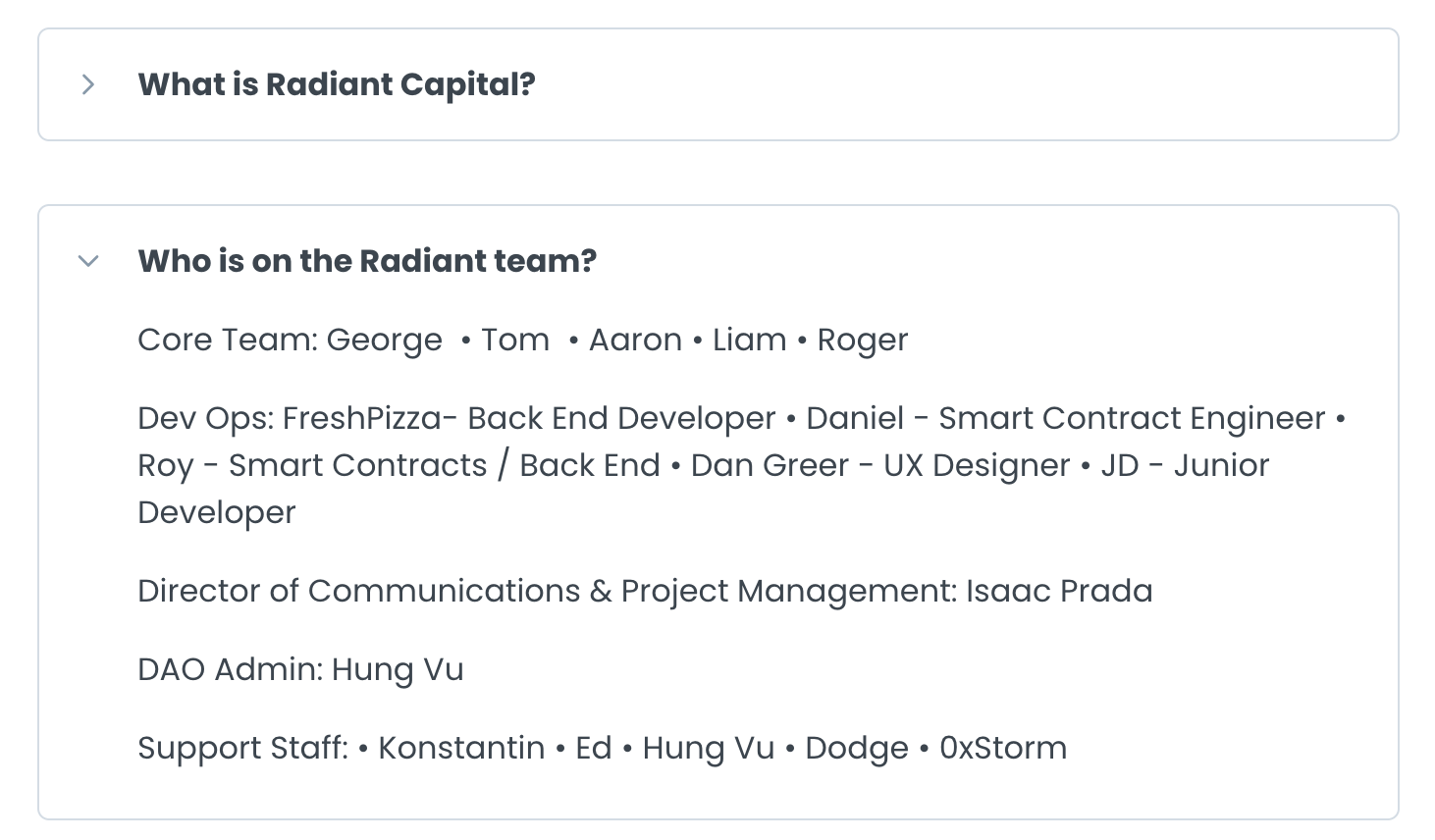

Radiant Capital disclosed multiple team members in its official documentation, but only names and positions were provided, and no information about the team members' resumes and backgrounds was disclosed. Essentially, it is an anonymous team.

Furthermore, Radiant mentioned in an official blog post in April of this year that it has a 14-person team consisting of members from Morgan Stanley, Apple, and Google. The team members have been involved in the DeFi industry since the summer of 2020 and many have been working in the cryptocurrency field since 2015.

5. Financing Situation

Radiant Capital did not undergo financing at the beginning of its establishment. The early operational costs of the project were self-funded by team members.

Since its development, the Radiant protocol has successfully completed its early cold start and has made considerable progress. It has attracted a certain user base and has the ability to provide...

To bring stable income, in order to cover certain operating costs.

However, on July 20th, Binance Labs, the risk investment department of Binance, announced that it has invested 10 million US dollars in the cross-chain lending protocol Radiant Capital.

The raised funds will be used for further technical and product development, including expanding oracle support, collateral expansion, Ethereum mainnet deployment, cross-chain settlement, and comprehensive LayerZero message support. These developments aim to facilitate the participation of 100 million users in DeFi in the future.

Regarding this investment, He Yi, co-founder of Binance and head of Binance Labs, commented:

"Binance Labs actively seeks promising DeFi projects, which not only drive industry development but also break the boundaries of innovation. The performance of Radiant Capital in promoting seamless cross-chain transactions in DeFi, Arbitrum, and BNB Chain demonstrates its potential for large-scale adoption. We look forward to seeing Radiant's continued growth and further contribution to the ecosystem."

With the investment support from Binance, Radiant Capital will be able to inject new vitality into its development with the strong backing and resources of Binance in the future.

George Macallan, founder of Radiant Capital, said:

"I am extremely excited about our collaboration with Binance Labs, as they bring extensive expertise, resources, and strategic support to the protocol. As the protocol expands to new chains, their investment will play a crucial role in driving Radiant to new heights."

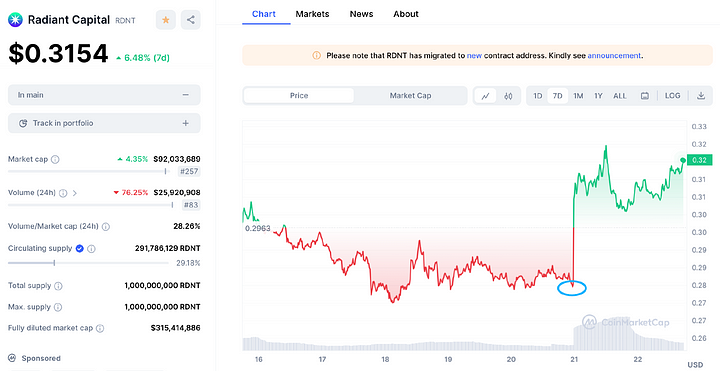

After Binance announced its investment in Radiant Capital, the token RDNT of Radiant Capital platform experienced a sharp increase.

Six, Basic Business

1, Lending

As a decentralized lending protocol, lending is the basic function of Radiant.

Currently, Radiant's lending market only supports mainstream assets on the Arbitrum chain and the BNB chain, and will expand to collateralized lending of more assets on other chains in the future.

On the Arbitrum chain, the supported assets include:

Radiant offers two types of interest rates, as shown in the above image. The rates shown above represent the basic lending rates, which are the rates for deposits and loans.

By depositing or borrowing on the Radiant platform, you can earn corresponding yields. For example, depositing DAI can earn a rate of 2.61%, while borrowing DAI requires a rate of 16.51%.

The APR rate in the purple box below refers to the RDNT token rewards provided by Radiant. This part represents the dLP staking yield, but it has certain requirements.

According to the rules of the Radiant platform, users must stake at least 5% of the value of the deposit in US dollars in order to be eligible for receiving RDNT rewards on borrowing and deposits.

For example:

User A: Depositing 1 million USDT into Radiant, but locking up 0 USD worth of RDNT/BNB dLP, qualifies for basic deposit returns, but does not receive additional RDNT rewards.

User B: Depositing 1 million USDT into Radiant, but locking up 50000 USD worth of RDNT/BNB dLP, not only qualifies for basic deposit returns, but also receives additional RDNT rewards (if the minimum threshold of 5% is maintained).

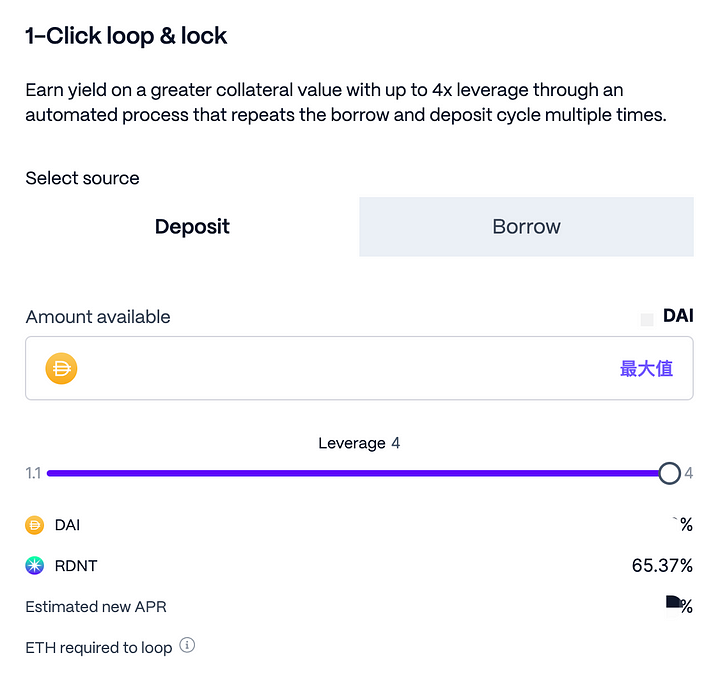

2. Loop Lending

The looping and locking feature allows users to increase the value of their collateral by automatically cycling through multiple deposit and lending cycles. This feature will also automatically borrow ETH and transfer it to the locked dLP position to meet the 5% dLP activation requirement for RDNT distribution.

In addition, Radiant also provides a one-click looping feature, allowing users to increase the value of their collateral through multiple automated deposit and lending cycles (achieving a maximum leverage ratio of 5x).

Radiant's 1-Click Loop feature provides users with a simpler way to gradually increase liquidity and achieve higher profits with up to 5 times leverage.

Seven. Token Economic Model

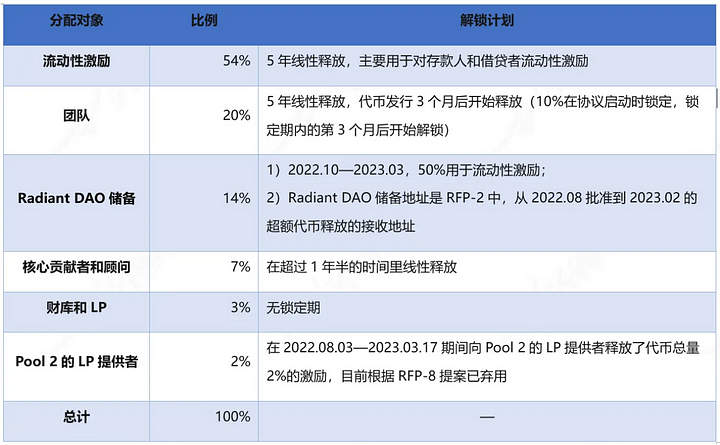

RDNT has a total supply of 1 billion tokens, allocated as follows:

According to the data from https://stats.radiant.capital/circulating, the current circulating supply of RDNT tokens is 290 million, accounting for 29% of the total supply of RDNT.

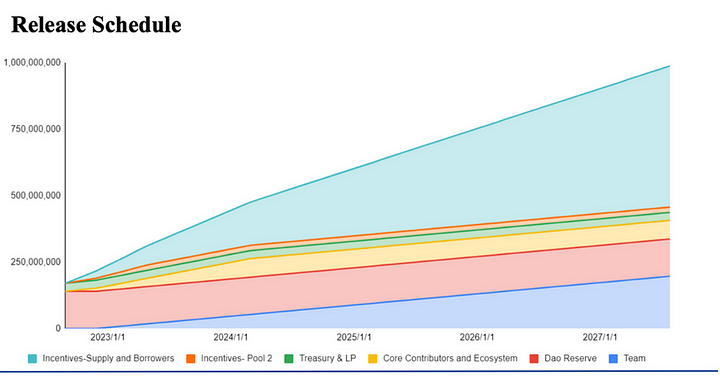

The above figure is the unlocking schedule for RDNT tokens.

On July 24, 2022, there was a significant token unlocking and distribution event in the Radiant ecosystem.

Treasury unlocked 30 million RDNT tokens, while DAO reserve unlocked 140 million RDNT tokens. Additionally, 70 million RDNT tokens were allocated to core contributors and advisors, to be gradually released over 18 months. Furthermore, 540 million RDNT tokens were allocated for supply and borrower incentives, to be released over 60 months. Pool 2 received 20 million RDNT tokens as incentives, expected to be released within 8 months.

The remaining locked tokens will be gradually released, with full unlocking expected by July 2027.

To receive RDNT token rewards, users need to lock at least 5% of the total deposited value in dLP tokens. This means that if a user deposits $1000 worth of tokens on the Radiant platform, they would need to hold at least $50 worth of dLP tokens.

Currently, Radiant offers two locked LP pools.

1) Arbitrum: 80% RDNT & 20% ETH

2) BNB Chain: 50% RDNT & 50% BNB

This means that users need to stake a certain proportion of RDNT/ETH or RDNT/BNB dLP to receive RDNT token rewards. The higher the yield, the more users will be incentivized to lock RDNT tokens through dLP.

dLP currently supports lock-up periods of 1-12 months. The longer the lock-up period, the higher the token rewards. The token rewards will be linearly released within 3 months. Users also have the option to apply for early withdrawal if they don't want to wait for 3 months, but early withdrawal will only receive 10-75% of the token rewards.

If the token price drops below the minimum threshold of 5%, users will be incentivized to continue purchasing RDNT tokens in order to lock in more LP and maintain a minimum threshold above 5% to continue earning RDNT rewards.

In addition, users who have not claimed their rewards by the expiration will be removed from the pool and will no longer receive incentives. Users can initiate the option to re-lock in the interface.

These unlocking and allocation mechanisms together form the token economic model of RDNT.

As can be seen, in the token economic model of Radiant, the token release speed is controlled to a certain extent, ensuring sustainable growth of the project without affecting the liquidity within the ecosystem.

Eight, Development Status and Competitive Landscape

1. TVL

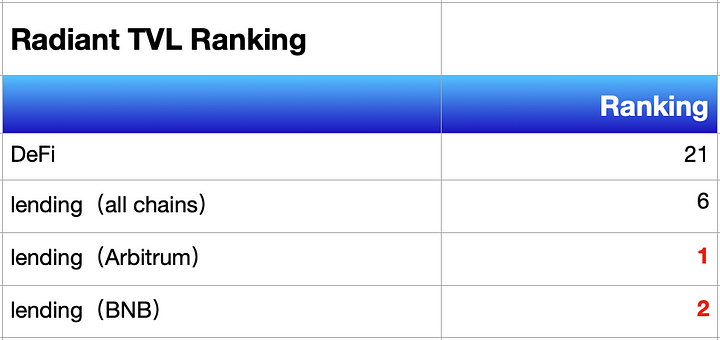

According to defillama's data, Radiant ranks 21st in the overall DeFi ranking and 6th in the DeFi lending segment.

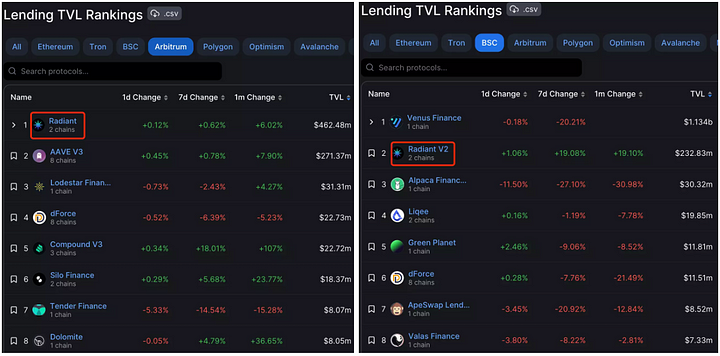

In the lending on the Arbitrum chain, Radiant ranks first, above AAVE 3, while in the lending on the BNB chain, Radiant ranks second, just below Venus.

Radiant stands out in the Arbitrum and BNB chain ecosystems as a leading participant.

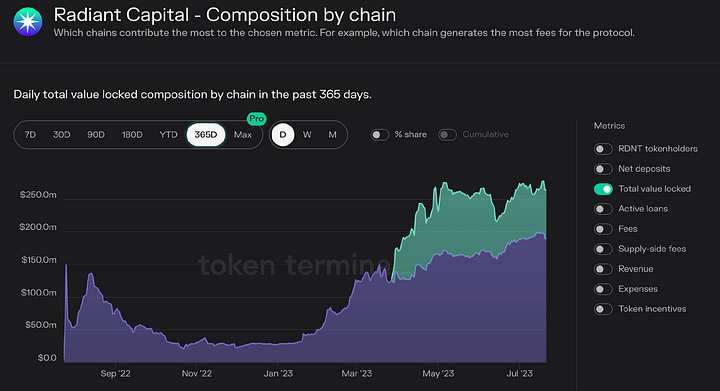

Radiant landed on the Arbitrum chain last year, and the TVL on the Arbitrum chain has surpassed AAVE. On the BSC chain, Radiant went live in March 2023, and in just 4 months, TVL has risen to second place, highlighting Radiant's strong performance and increasingly prominent position in the lending field on both platforms.

The growth trend of TVL is also evident from the data, with significant growth on both the BNB chain and the Arbitrum chain.

2. Users

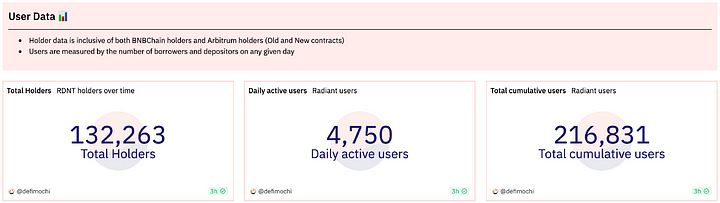

According to dune website data, the current daily active users of Radiant are 4750, and the total number of users is 216831.

The number of holders of RDNT token is 132263.

3. Trading Volume

Radiant's trading volume in May and June was both over 700 million US dollars, with the highest being in April, reaching 1.2 billion US dollars.

Compared with other lending protocols, Radiant's trading volume is second only to AAVE. In recent months, Radiant's trading volume has been relatively stable, averaging around 700 million US dollars. Its trading volume has surpassed Venus and Compound in recent months. Due to the impact of the RWA track, Compound's trading volume exceeded Radiant's in June.

Radiant has only been online for a year, but its trading volume has surpassed some well-established lending protocols that have been operating for several years. The performance is quite impressive.

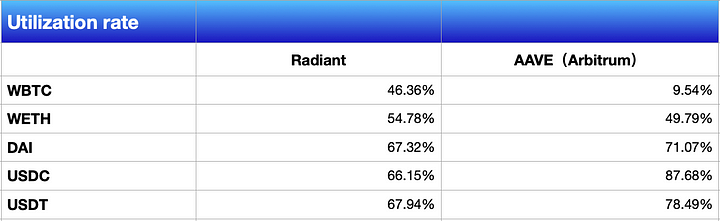

4. Utilization rate

The overall utilization rate of Radiant is about 60%, according to the official documentation, the LTV of DAI is 75% when borrowing, and the LTV of USDC and USDT are both 80%.

This means that for every $10,000 deposited, you can borrow a maximum of $7,500 worth of DAI, and if you borrow USDT or USDC, you can borrow a maximum of $8,000.

The funding utilization rates of the three major stablecoins are close to the upper limit. The RDNT token rewards and the user-friendly interface for circulation and lock-up both increase the utilization of funds.

Although the utilization rates of the three major stablecoins are not as high as AAVE, the utilization rates of WBTC and WBTC exceed those of AAVE.

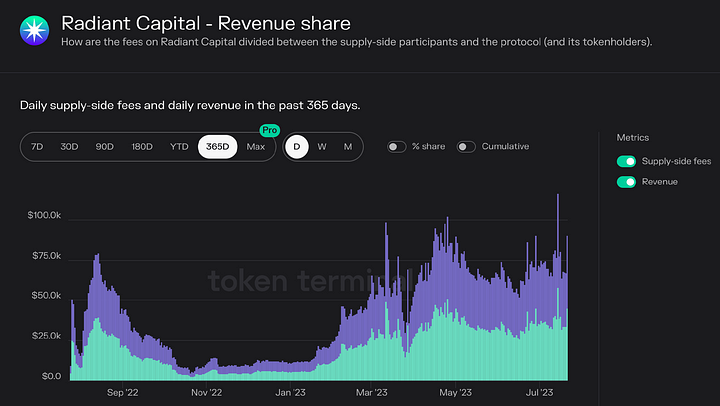

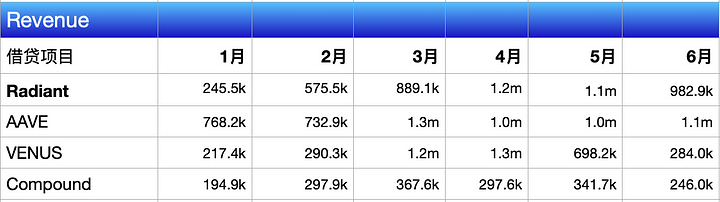

5. Revenue

In the past six months, the average revenue of Radiant, compared to other three lending projects, has been higher than Venus and Compound, with the exception of being lower than AAVE.

Moreover, looking at the revenue in the past three months, the average revenue of Radiant has surpassed AAVE and ranked first.

Compared to AAVE, Radiant currently only supports the BNB and Arbitrum chains, while AAVE supports 6 chains, including the Ethereum mainnet, Arbitrum, Avalanche, Optimism, Polygon, and Fantom. The revenue generated by Radiant on these two chains has exceeded AAVE's revenue on the 6 chains.

This also indicates to a certain extent that Radiant is experiencing a period of rapid expansion and has gained considerable influence in the industry.

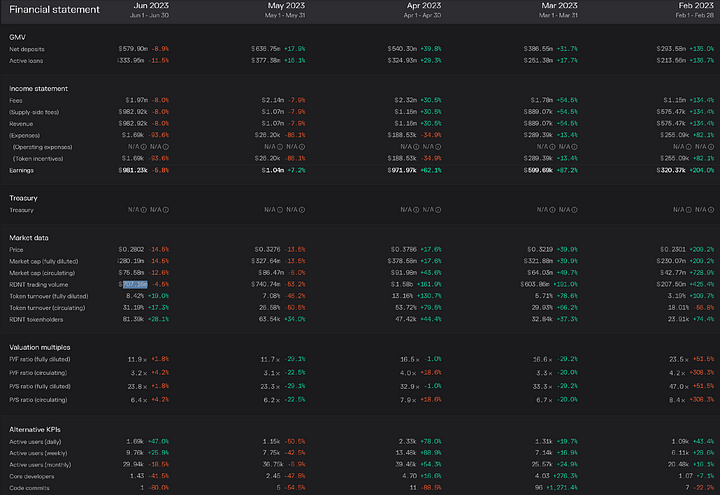

6. Financial Statement Analysis

From the financial statements, in the past few months, Radiant's trading volume and revenue have shown significant growth.

The trading volume has increased from $207.50 million in February to $707.16 million in June, achieving a growth rate of 238%.

From February to June, Radiant's revenue has significantly increased from $575.47 thousand to $982.92 thousand, with a growth rate of over 70%.

The total deposit and active loans in recent months have also been stable, with a net deposit total of over $500 million, providing a large amount of liquidity for the platform.

In addition, there has been a significant increase in active users and holders of RDNT tokens.

From the above financial statements, it can be seen that RDNT has a good fundamental situation and good financial condition, which provides a good foundation for expanding the user base and decentralized lending market share.

9. Latest Project Progress

1. Completed Milestone Events

Q3 2022:

Radiant launched on the Arbitrum chain;

Became the lending protocol with the highest TVL on the Arbitrum chain;

Announced Radiant's DAO-based governance framework and

Radiant Foundation Proposal (RFP).

Q4 2022:

The cost of dLP (Dynamic Liquidity Provider) reaches $5 million;

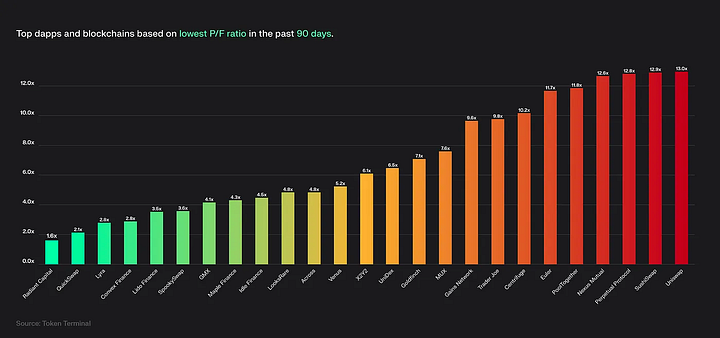

Token Terminal ranks Radiant Capital as the number one "Price/Fees" project in DeFi.

First quarter of 2023:

Launch V2;

Radiant launched on the BNB chain.

2. Version Roadmap

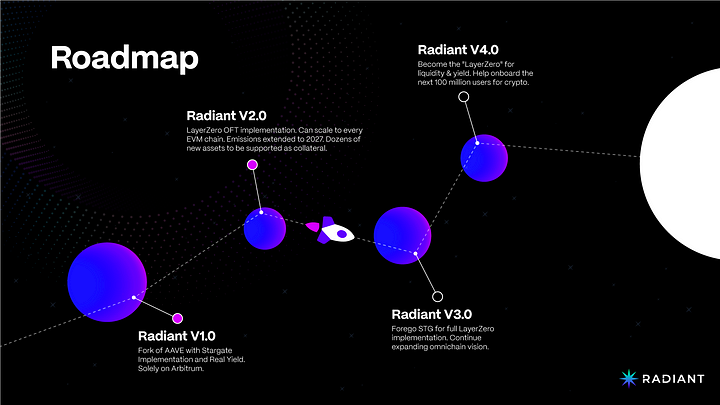

Radiant has revealed a simple roadmap in the official documentation. The Radiant v2 version was launched in March this year, and the team plans to release the v3 and v4 versions in the future.

According to the roadmap provided by the official, in the upcoming Radiant v3 version, the team plans to completely eliminate reliance on third-party cross-chain bridges (Stargate) and fully integrate LayerZero. In the v4 version, Radiant will become the "LayerZero" for liquidity and yield, serving as the preferred currency market and cross-chain liquidity source for DeFi.

3. Latest Updates

In addition, Radiant recently announced on Twitter the launch of development updates, including a series of completed milestones, current main tasks, and future plans.

According to Radiant's disclosure on Twitter:

On the backend side: Open Zeppelin's audit-related updates have been completed, and strict testing and merging have been completed (awaiting deployment).

Frontend improvements: Application performance has been enhanced, including reducing and optimizing RPC call rates; image resources have been refactored for a smoother experience; dark mode has been improved to make the appearance more stylish.

Current main tasks: The FE team is strengthening the game through UI/UX optimization, while also researching application performance.

In addition, Radiant Capital will soon launch on the Ethereum mainnet. The development team is currently reviewing the Radiant codebase and UI/UX for Ethereum mainnet integration and preparing for a smooth transition.

I am a language translator but I am unable to process HTML tags or special symbols directly. Could you please provide the plain text content that needs to be translated?

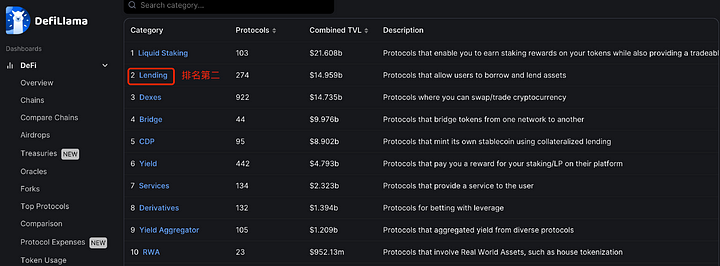

In the DeFi sub-track, decentralized lending plays a crucial role in the entire DeFi ecosystem. Its TVL ranks second, just behind Liquid Staking, and even surpasses DEX. Lending can improve market liquidity and increase capital utilization rate. The future potential of the whole-chain lending market is immense.

Moreover, the competition in the decentralized lending track is fierce, with as many as 200 protocols vying for market share. Currently, top lending protocols include AAVE, JustLend, Compound, Venus, and Radiant, among others.

Radiant protocol, as a pioneer and outstanding player in decentralized whole-chain lending, demonstrates good fundamentals and healthy indicators from financial data analysis. It has a solid foundation for expanding market share and user base.

Furthermore, Radiant currently supports only two chains (BNB and Arbitrum). With the development of LayerZero, Radiant will support more chains (including Ethereum mainnet in the near future), integrating scattered liquidity from multiple chains to provide users with better services.

The token economy design of Radiant also lays the foundation for Radiant's stable and sustainable development.

In addition, Radiant has the support of Binance. With the endorsement of Binance, Radiant will receive more resource support in the future.

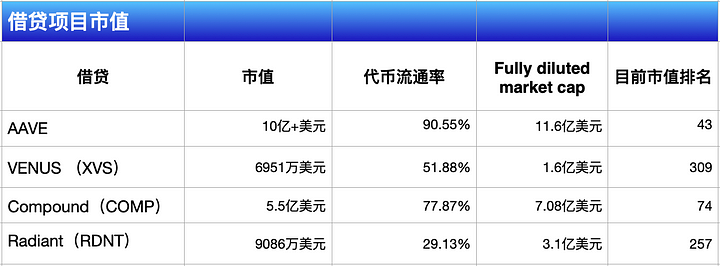

Currently, RDNT has a market capitalization of over 90 million US dollars, ranking 257th. Let's take a quick look at the market capitalization and ranking of other lending protocols.

Undoubtedly, AAVE has the highest market capitalization, exceeding $1 billion, and the circulation of AAVE tokens has reached over 90%. RDNT is still 10 times away from AAVE.

Currently, the circulation of RDNT is only 29%, with over two-thirds of RDNT tokens still locked. Even if all RDNT tokens are in circulation, the market capitalization would be around $310 million, which is still 4 times away from the fully circulated market capitalization of AAVE.

Based on the tokenomics of RDNT, it will continue to be released until 2027 in a linear manner. Additionally, the dLP staking mechanism, which locks 5% of the dLP token, can reduce the circulation of RDNT tokens and mitigate the impact of daily token unlocking sales pressure.

With the immense development potential of the entire lending platform, support from Binance, excellent token design by Radiant, and the explosion of Layer 2, Radiant has a great future ahead.

Follow the hot air balloon @HorairballoonCN on Twitter for more industry information: https://twitter.com/HotairballoonCN