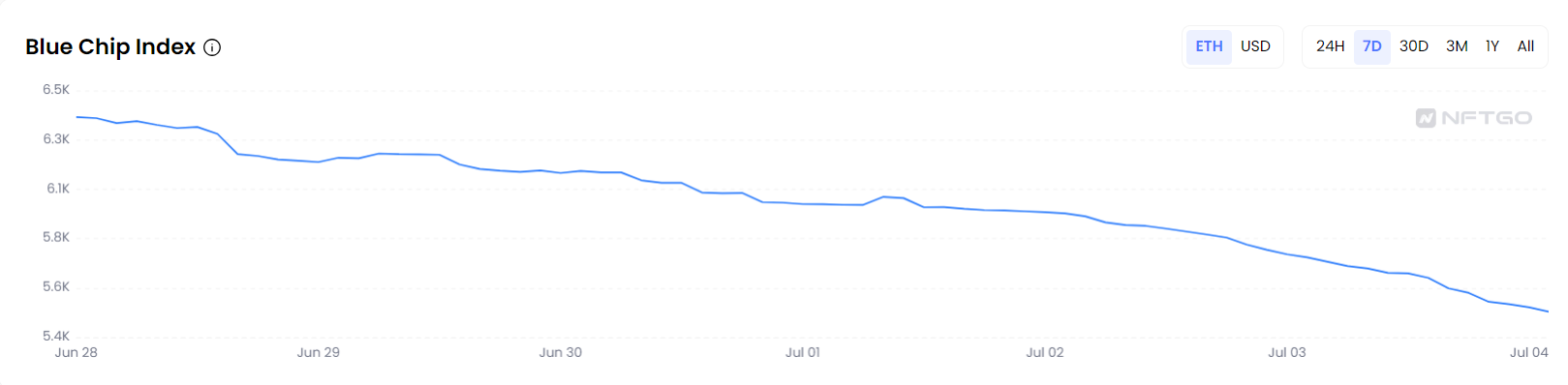

Azuki's aftershocks are still being felt in the industry, not only have major blue-chip NFT collections experienced varying degrees of decline (see "Azuki team scams 20,000 ETH, causing 200,000 ETH loss in NFT market liquidity"), but many derivative platforms based on NFT assets are also under pressure.

NFTGo Blue-chip Index 7-day Change

Whenever Ethereum experiences a significant downturn, we always closely monitor the liquidation level of mainstream DeFi protocols to observe whether the market will enter a new round of spiral stomping. These DeFi protocols have continuously adjusted their mechanisms and improved their products after experiencing multiple extreme situations.

NFTFi became a popular entrepreneurial track last year, and many top players emerged in the lending platform, perpetual contract, and other tracks. However, when the market came under pressure, they faced what kind of challenges, and what further effects would they have?

ParaSpace

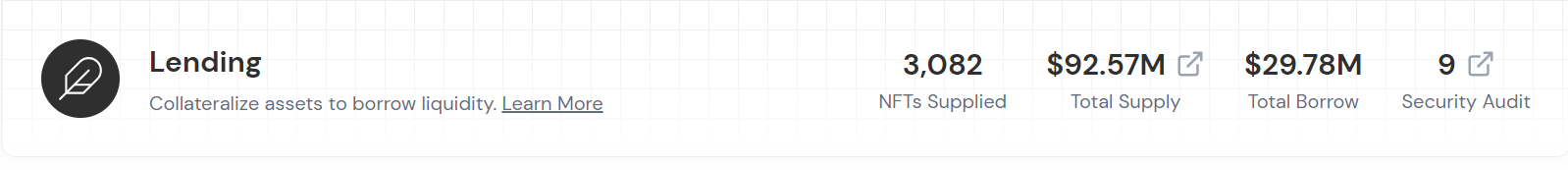

ParaSpace is a decentralized lending protocol that supports users to lend and perform other financial operations on NFTs and fungible tokens. According to its official website, ParaSpace allows users to further invest unused funds and earn returns.

For ParaSpace, the rapid decline of the Azuki series and the decline of blue-chip NFTs have caused the floor price of some NFTs to fall below the debt value. Last night, users observed bad debt in ParaSpace, and multiple Azuki were not liquidated.

According to Odaily's understanding and verification, ParaSpace has indeed temporarily suspended the liquidation of 14 Azuki-related collateral loans. However, the team stated that this measure is intended to give users more time to replenish liquidity, repay loans, and improve health, and liquidation will resume in the future.

In addition, ParaSpace also stated that it has sufficient reserve funds to deal with unexpected situations. The current bad debt is about $100,000, which can be fully covered by ParaSpace's reserve funds.

ParaSpace's current lending and clearing data

The mainstream understanding in the community at present is that although the market has experienced a significant decline, the situation of insolvency is unlikely to occur. This can be seen as an important stress test. At the same time, this challenge also provides an opportunity for ParaSpace's growth, similar to the benign liquidation experienced by the DeFi industry in the past. In this situation, the stability and ability of ParaSpace to withstand risks will be key factors for it to overcome the crisis.

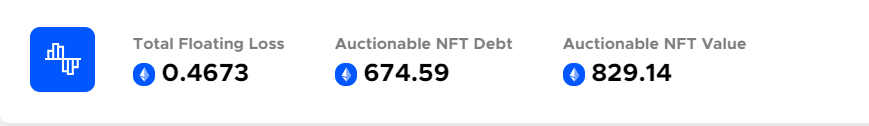

BendDAO

The NFT lending protocol BendDAO has also experienced a certain degree of bad debt. Several Azuki and Doodles have entered the auction process, which has also led to a significant decline in the native token BEND, with a decrease of over 7.5% in the past 24 hours.

BEND recent trend. Source: Coinmarketcap

Although facing losses, BendDAO quickly initiated crisis response procedures: On July 3rd, BendDAO released a proposal on the community, stating plans to participate in auctions with treasury assets to cover potential losses, ensuring that the entire lending process does not incur significant losses and to prevent possible runs. Currently, the proposal has been passed on Snapshot, with a support rate of 100%. Considering that BendDAO's potential losses are smaller than ParaSpace, the recent market downturn should not have a major impact on BendDAO's overall lending process.

In response to the potential bad debts caused by BendDAO previously adopting Opensea's floor price, which resulted in actual liquidation prices higher than Blur, BendDAO tweeted in the past few days that the project's oracle detected significant fluctuations in Azuki's floor price, triggering the alert mechanism. When the floor price of the trading market fluctuates too much, the algorithm will automatically increase the weighting of Chainlink data to avoid significant fluctuations causing pinning incidents, thus maintaining the stability of the prices and health of NFTs on the platform.

It should be noted that although BendDAO and ParaSpace both provide NFT lending services, they have differences in terms of liquidation mechanisms. The former is a regular auction, while the latter is a Dutch auction.

NFT debt data auctionable on BendDAO

In addition, on July 3rd, NFT perpetual contract DEX nftperp tweeted that the market downturn of Milady was caused by an error in the update of the liquidation calculation engine, and users who were mistakenly liquidated will receive a refund.

AzukiDAO

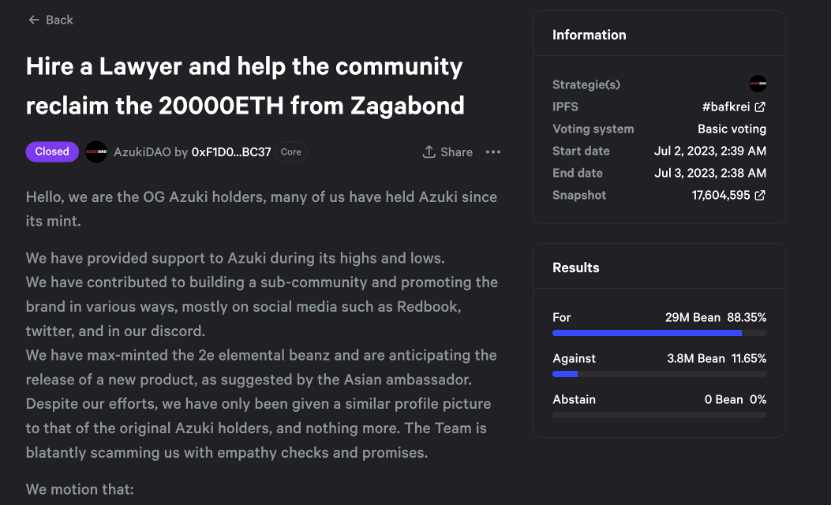

NFTFi project apart, AzukiDAO (a DAO organization composed of Azuki's OG holders) also responded to this crisis. Due to Azuki's position in the center of the storm, and the fact that the holders are stakeholders, their proposals appear to be more radical - Snapshot shows that community proposals include:

Hiring lawyers to take legal action against Azuki's founder Zagabond, accusing him of "fraud" in multiple projects, and recovering about 20,000 ETH. The total value of the recovered funds is $39 million, which is the total amount of ETH sold in the Azuki Elementals series.

1. Azuki DAO hires a lawyer and sues Zagabond, accusing him of fraud in multiple projects.

2. Azuki DAO attempts to recover a refund of 20,000 ETH and allocate it to the DAO to promote the growth of the entire Azuki community and provide rewards and incentives for artists, content creators, and developers.

3. Azuki DAO provides financial support to the 20,000 E DAO, which will be used to form a research team to support the lawsuit.

Currently, the support for this proposal is significantly higher than the opposition.

In addition, on July 3rd, AzukiDAO tweeted that due to the impact of a hacker attack, they will close the governance token contract and propose to transfer all tokens to the DAO treasury, and then select multisignature contributors from the community. According to previous reports, AzukiDAO's governance token contract was attacked due to vulnerabilities, and two attackers profited 35 ETH from exploiting the loophole.

AzukiDAO's proposal. Source: Azuki DAO Snapchat

Anyway, this time the Azuki effect will have a profound impact on the entire NFT industry, and it also brings some enlightenment—calling on regulatory agencies and industry practitioners to strengthen compliance and risk management measures to ensure the health and sustainable development of the market. Although this incident has brought turmoil to the market, it may also serve as an important lesson for the entire industry, urging industry participants to handle these emerging assets more cautiously and maturely, continuously iterate emergency protection mechanisms, and accumulate risk control experience.