Note: The original text comes from Medium, authored by Four pillars, compiled and organized by Bai Ze Research Institute, and slightly deleted due to space reasons.

In January 2023, Casey Rodarmor, a core contributor to Bitcoin, proposed the "Ordinals Theory" and created the Ordinals protocol, which triggered an upsurge on the Bitcoin network, making people think of what happened in Ethereum. NFT minting craze. "Ordinal number theory" allows users to write arbitrary files (images, texts, videos, etc. up to 4 MB in size) on Satoshi (bitcoin's smallest unit, satoshi), thereby storing various files on the chain.

Shortly after, Domo developed a new token standard called BRC-20 based on the Ordinals protocol. Essentially, BRC-20 is a new way to facilitate the issuance and transfer of tokens by writing a text on Satoshi. The standard gained significant traction in April, with the number of BRC-20 tokens skyrocketing, leading to a surge in transaction fees on Bitcoin’s chain on May 8. At the time, the Bitcoin network was facing over 400,000 pending transactions, creating the comical situation where cryptocurrency exchange Binance stopped accepting Bitcoin deposits and withdrawals.

As the BRC-20 tokens gained traction, their prices also saw a surge. The price of ordi, the first token in the BRC-20 standard, started at $0.1 and eventually increased 310 times to $31 on May 8, with a market cap of nearly $650 million. A market cap of this size puts it in the 70th or so position on Coingecko, even higher than Sui and Optimism.

However, this trend was fleeting and is now showing signs of waning. But I have to admit that the emergence of the BRC-20 standard has brought Bitcoin back to great attention after a long period of unfavorable market conditions.

first level title

ordinal number theory

Ordinal number theory is not a new concept that appeared out of thin air, but a derivative of a previous concept: ordinal number, that is, the order of numbers, refers to the sequential numbering of the smallest unit of Bitcoin, Satoshi. According to ordinal number theory, each satoshi is numbered in the order in which it was mined.

In fact, the serial number of Satoshi can be expressed in many ways, including:

Integer notation: 2099994106992659 ——numbers arranged in mining order, since the total amount of bitcoins is 21,000,000, 1 BTC=100,000,000 Satoshi, then the maximum serial number is 2,100 trillion.

Decimal notation: 3891094.16797 — The number before the decimal point represents the height of the Bitcoin block where Satoshi was mined, and the number after it represents the order of Satoshi in the block.

Degree notation: 3 ° 111094 ′ 214 ″ 16797 ‴ — The last set of numbers is the order in which satoshis were mined in the block, preceded by the block height in degrees.

Percentile symbol: 99.99971949060254% — A way of expressing the percentage of satoshis in the total bitcoin supply.

Name: A method of sorting using the letters a-z.

Interestingly, the creators of Ordinal Number Theory also assigned a rarity to each satoshi based on the ordinal number assigned to it:

Common: all but the first satoshi in each block

Uncommon: first satoshi of every block (approximately every 10 minutes)

Rare: First satoshi after difficulty adjustment (appears approximately every two weeks)

Epic: First satoshi after halving event (occurs roughly every 4 years)

Legendary: first Satoshi at the coincidence of difficulty adjustment and halving event (approximately every 24 years)

first level title

Inscription: Write file to Satoshi

Ordinal number theory makes each Satoshi have a unique serial number, and the Segwit and Taproot upgrades of the Bitcoin network make it possible to write files to Satoshi.

SegWit is the abbreviation of Segregated Witness (Segregated Witness), which is an upgrade applied to Bitcoin Core, the Bitcoin network client, in 2017. Although SegWit solved the long-standing transaction malleability problem in the Bitcoin network and paved the way for the operation of the Lightning Network, the most important thing related to this upgrade discussion is the expansion of the block size.

SegWit introduces a new concept - block weight, which changes the block size unit from Bytes to vBytes, where 1 vByte is equivalent to 4 weight units. Therefore, the maximum block size has been changed from 1 MB to 1 vMB. In addition, the existing transaction data is divided into two parts: a. transaction data, b. witness data. Transaction data contains information about sender, receiver, input, and output; while witness data contains information about script and signature data.

Afterwards, the Taproot upgrade advanced by updating the scripting language used in the Bitcoin network to Tapscript. After the upgrade, a wider range of transactions became available on the Bitcoin network, which is what Ordinal Theory uses to record various documents on Satoshi through witness data.

Essentially, each Satoshi has a unique serial number and can store data, functioning like an NFT. However, unlike most NFTs in the Ethereum ecosystem, the inscription process records all data, making it a more authentic "blockchain-native" NFT than Ethereum NFTs. Users can record files on Satoshi using the Ordinals protocol, and Satoshi containing files can also be traded (exchanged) like ordinary Bitcoin.

However, to do this, a significant challenge is that users must use an Ordinals-compatible wallet. Although inscriptions are recorded on satoshis, which can be transferred to any bitcoin wallet, the challenge comes from the inability to distinguish these inscribed satoshis from other bitcoins. Therefore, there is a risk of accidentally paying satoshis with written files as miner fees during regular BTC transfers. Therefore, Ordinals users should choose a wallet that facilitates the control and selection of Satoshi.

example

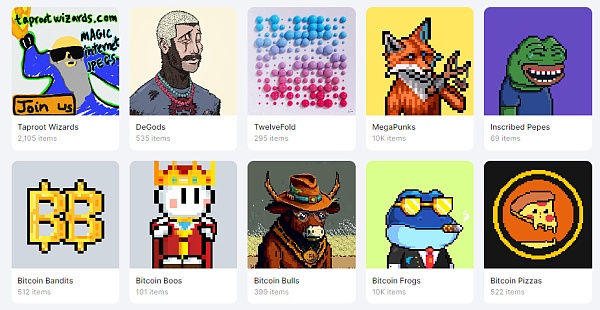

So far, early users have created various Bitcoin NFTs using the Ordinals protocol. The earliest were all using pictures, the first recorded inscription is Satoshi 727, 624, 168, 684, 699 with the image of dickbutt.

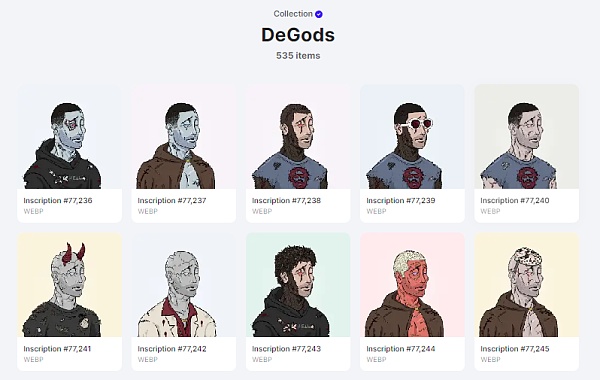

Dustlabs packaged their 535 DeGods through the Ordinals protocol into a single block (block #776408), while Yuga Labs, the developer of Ethereum's well-known NFT "Boring Ape", put a set of generative art called TwelveFold into Bit on the currency network.

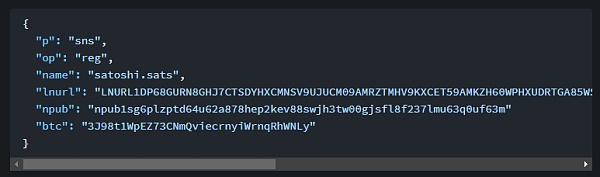

In the meantime, there's been a lot of interesting experimentation with text. Apart from BRC-20 which we will highlight below, Sats Names is a good example.

The Ethereum Name Service (ENS) is the naming service on the Ethereum network, while Sats Names is the naming service on the Bitcoin network. To register a name, simply enter text according to the JSON syntax, as shown above.

first level title

BRC-20

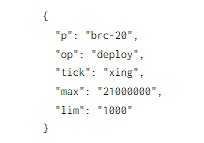

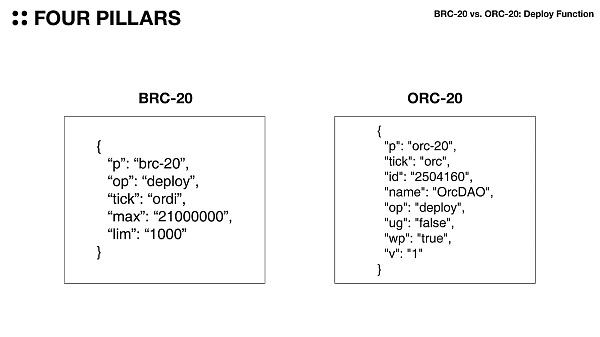

BRC-20 is an experimental token standard proposed by Domo in March 2023, allowing anyone to issue new tokens on the Bitcoin network by inscribing text.

Unlike Ethereum ERC-20, which can issue and transfer tokens immediately after smart contracts are deployed, BRC-20 tokens are not actual tokens, but satoshis that record specific text. Therefore, as with Sats Names, a separate indexer is required to know the status or balance of BRC-20 tokens.

deploy:

deploy:

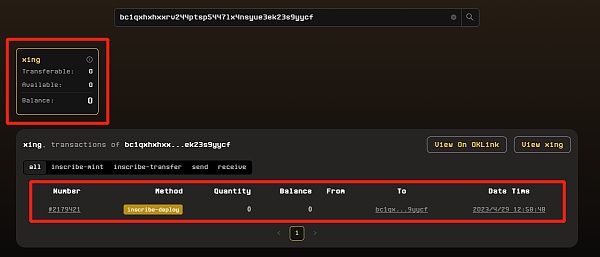

The deployment of the XING token was recorded by bc 1 qxhxhxxr v2 44 ptsp 5447 lx 4 nsyue 3 ek 23 s 9 yycf (deployer) in satoshi number #1934771250000000. However, since this deployer has only deployed XING tokens and not minted them, we can see that his XING token balance is zero.

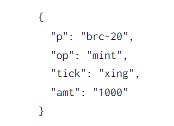

coin:

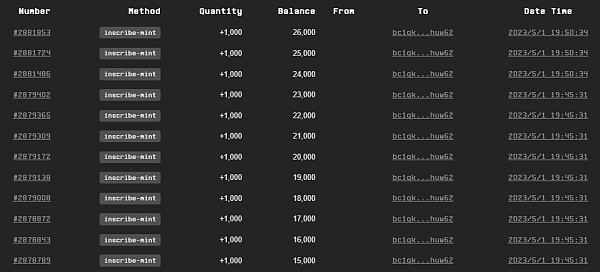

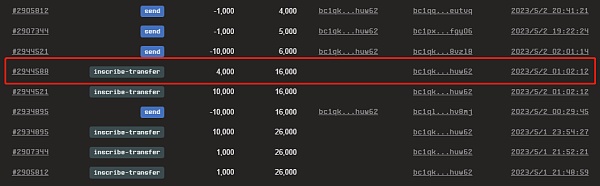

A minter bc 1 qk 3 fqhw 8 txe 5 ev 0 s 8 n 7 rj 2 e 3 z 564 uw 02 hfhuw 62 inscribed the above text into 26 different satoshis, minting a total of 26,000 XING tokens ,As follows. The reason why 26,000 tokens are minted in 26 Satoshi rather than all at once is because the deployer set a maximum minting amount of 1,000.

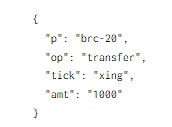

transfer:

To transfer 26,000 XING tokens, bc 1 qk 3 fqhw 8 txe 5 ev 0 s 8 n 7 rj 2 e 3 z 564 uw 02 hfhuw 62 inscribed the above text in 5 Satoshi to transfer 22,000 XING tokens currency.

Balance:

So what is the final amount of XING tokens held by the wallet address in the above example?

bc 1 qxhxhxxr v2 44 ptsp 5447 lx 4 nsyue 3 ek 23 s 9 yycf (deployer): Only XING tokens were deployed, they were not minted, so the balance is 0.

bc 1 qk 3 fqhw 8 txe 5 ev 0 s 8 n 7 rj 2 e 3 z 564 uw 02 hfhuw 62 (caster/sender): Search this address on ordiscan, the number of XING inscriptions held is 26. However, this address minted 26,000 tokens and sent 22,000 tokens, why does it still have 26 inscriptions? This is because for BRC-20 tokens, the transfer is not to transfer the existing coin inscription, but to engrave the XING transfer text in another satoshi, and then complete the transfer. In other words, when the transfer process occurs, the sender's balance is deducted and the XING transfer inscription is added to the receiver's balance. So even though bc 1 q…uw 62 still retains the mint inscription of 26,000 tokens, the final confirmed balance is 4,000 because the XING transfer inscription of 22,000 tokens was sent to another address.

All in all, BRC-20 introduces a new way to handle fungible tokens (FT) on the Bitcoin network, and with the recent rise of memecoins (such as PEPE) on the Ethereum network, it has also received a lot of attention .

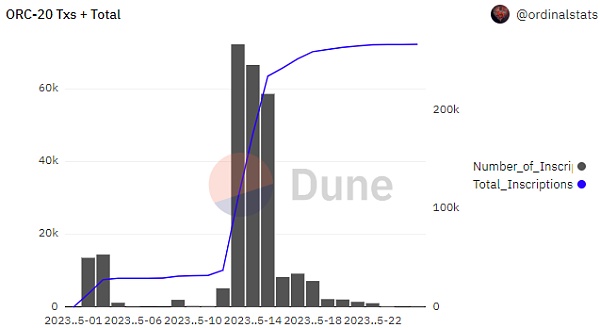

Nearly 50% of transaction fees generated on the Bitcoin network in the last two months were related to ordinal numbers, specifically BRC-20. As of May 9, 2023, the number of deployed BRC-20 tokens is 1,599, the total network fees related to minting are 628.7 BTC, and the total network fees related to transfer are 46.8 BTC. It can be seen that BRC-20 has triggered a huge of network usage.

The first BRC-20 token, ordi, started off at $0.1 and soared as it was listed on various centralized exchanges, reaching a high of $31. Additionally, other tokens such as nals, meme, pepe, and piza have market caps between $10 million and $40 million.

Without smart contracts, is the trading market of BRC-20 centralized?

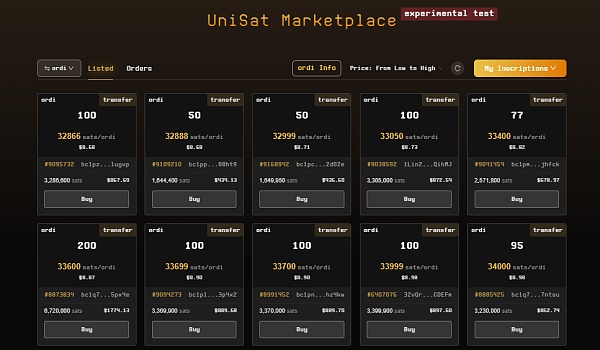

How does BRC-20 token trading work? As we all know, the Ethereum network supports smart contracts, allowing the establishment of decentralized market agreements through smart contracts, but it is impossible for us to establish similar smart contracts on the Bitcoin network.

If you have used the UniSat Marketplace, you will have found various BRC-20 token exchanges listed on the platform, and buyers can connect their Bitcoin wallets to make purchases. In addition to secondary market trading of BRC-20 tokens, this is also happening on various marketplaces that trade Bitcoin NFTs (e.g. MagicEden). Are all existing Ordinals marketplaces using a centrally hosted approach?

The answer is PSBT (Partially Signed Bitcoin Transaction). PSBT is a feature introduced by BIP-174 that allows users to sign only certain inputs. As such, UniSat and other Ordinals marketplaces utilize PSBT to enable buyers and sellers to transact in a trustless and non-custodial manner.

first level title

ORC-20

While BRC-20 paves the way for a new method of issuing FT using Ordinals on the Bitcoin network, it is a very early experiment and has many drawbacks:

First, when the BRC-20 token is initially deployed, the total supply and maximum number of tokens per mint are fixed and cannot be changed. While this can be beneficial in some cases, it does have the downside of limiting the flexibility of the token model.

The second disadvantage is that the name of the BRC-20 token can only have 4 characters. In contrast, ERC-20 tokens have names of varying lengths. Removing the limit on token name length will allow more projects to create tokens.

A third disadvantage is that the transfer of BRC-20 tokens is entirely dependent on an external, centralized indexer. Since the inscription process itself simply writes data to Satoshi, there is no way for the Bitcoin network at the consensus level to prevent inscriptions that violate the BRC-20 standard.

For example, if the maximum supply of BRC-20 ordi tokens is 21,000,000 and all 21,000,000 tokens have been minted, minting additional ordi tokens is invalid according to the BRC-20 token standard Yes, but the minting transaction will be recorded anyway because the transaction pays the fee. Therefore, it is entirely up to the external indexer to determine which inscription is valid or invalid, which has led to the attacker exploiting the weakness of the UniSat market to conduct a double-spend attack on BRC-20 tokens, causing financial losses.

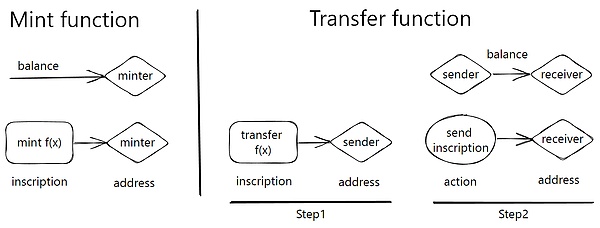

It can be said that ORC-20 is an upgraded version of the BRC-20 standard, which solves some shortcomings of the BRC-20 standard:

1. Token identification

The ORC-20 standard brings substantial enhancements over the BRC-20 standard. One such improvement is the inclusion of identifiers (IDs) that can identify a particular token. In the BRC-20 standard, if a token with the same name is deployed, the external indexer considers the first deployed token as "legal". In contrast, in the ORC-20 standard, even tokens with the same name can still be distinguished, since the inscription number includes "ID" when deployed, allowing identification.

2. Token name of any length

Second, ORC-20 allows the creation of names of any length, unlike the BRC-20 standard, which only allows the creation of four-letter names. For example, ORC, the first ORC-20 token to be deployed, has a three-letter name.

3. Upgradable

Third, the ORC-20 standard introduces the ability to modify the total supply and modify the maximum number of tokens per mint. While this flexibility may be exploited by deployers, it also opens up opportunities for various tokenomics experiments. These experiments may include gradually reducing the maximum number of coins minted per mint, simulating Bitcoin halving.

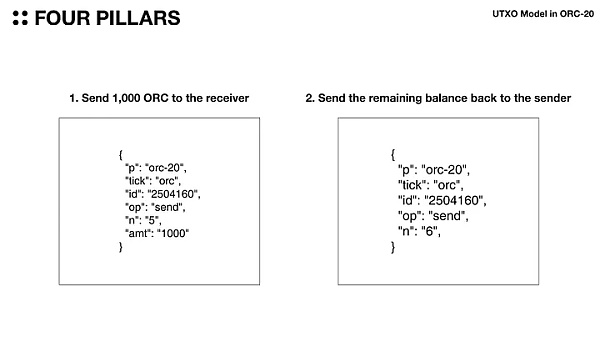

4. UTXO model

Fourth, and most importantly, ORC-20 adds the concept of UTXO to transfer tokens. For example, A sends $2 to B, who already has $1 on hand. Under the account model, B's balance will show as $3 -- $1 and $2 combined. But under the UTXO model, B's balance will have two separate UTXOs, one for $1 and one for $2. If B sends $2.5 to C, the UTXOs of $1 and $2 are merged and split into UTXOs of $2.5 and $0.5, of which $2.5 goes to C and $0.5 stays in B. The advantage of this improvement is that UTXO can only be used once, which essentially prevents double spending. ORC-20 adds the concept of UTXO in token transfer, which is the biggest difference from BRC-20.

To send ORC-20 tokens, the sender must write the step 1 text in the image above into Satoshi, and the receiver needs to write the step 2 text in order to send the balance back to the sender. This is the same process as UTXO. Therefore, for wallets or markets adopting ORC-20, it is necessary to wait until the ORC-20 transfer transaction is completed.

ORC-20 Ecosystem and Status

While ORC-20 has not been around as long as BRC-20, we can see that it is gaining some traction, with a total transaction volume involving ORC-20 to date of approximately 260,000 with fees of approximately 19.5 BTC.

first level title

SRC-20

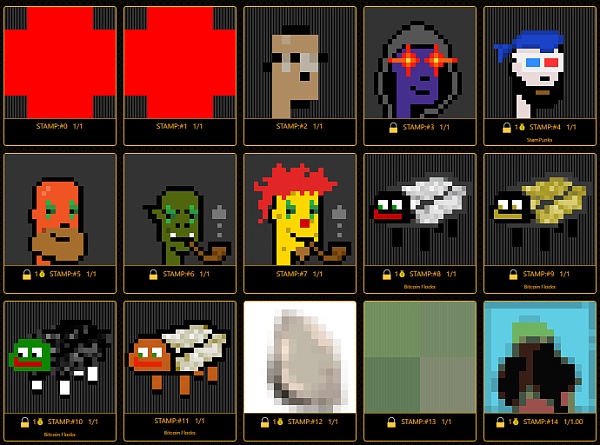

While the ORC-20 standard can be thought of as an enhanced version that corrects the limitations of the BRC-20, the SRC-20 standard uses Stamps to inscribe text, quite differently from the previous two standards.

BRC-20 and ORC-20 are based on ordinal number theory, and the principle is to write arbitrary files in the witness data of Bitcoin transactions. However, this process consumes most of the distributed ledger's capacity, enabling nodes to prune or eliminate witness data. Furthermore, not all nodes are required to persist or propagate this witness data.

However, in the case of Stamps, since the information is stored in UTXOs, every full node must store them, making them more durable than ordinals, or doubly "blockchain-native". While this is an obvious advantage, the space for storing data is limited and only accepts 24 x 24 pixel images or 8 color depth PNG, GIF.

Summarize

Summarize

Starting with Sats Names, to the recently popular BRC-20, to ORC-20 and SRC-20, there are even efforts to incorporate staking functionality into BRC-20 tokens. Why are there so many experiments on the Bitcoin network?

First, utilization is very low compared to the strong security of the Bitcoin network. The nature of the scripting language limits the execution of complex smart contracts on the Bitcoin network, thereby limiting its application. However, its superior level of security encourages developers and users to constantly test and utilize its features. Of course, with such a high level of security just for storing and transferring funds, it would be great to be able to use that security for a variety of other use cases.

Second, texts have unlimited expressive potential. Just like the early days of the PC, when many games were text-based, text could spark the imagination and represent a wide range of concepts. Sats Names, BRC-20, ORC-20 and SRC-20 tokens use text only to symbolize intangible entities and use external indexers to give them a tangible feel. While these standards are still in their infancy and have their own limitations, there is no doubt that they will form the basis for a great deal of innovative experimentation in the future.

Another problem is that these"X"According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.