Author: ADAM

Compilation of the original text: Deep Tide TechFlow

The original Solidly decentralized exchange, now colloquially known as ve(3,3), has garnered a lot of attention in the DeFi space. This is a compelling DEX innovation and design that offers an incentive system superior to primitive automated market makers (AMMs) such as Uniswap and Sushiswap. These ve(3, 3) protocols require veNFT holders, partner protocols, and LPs to interact on a weekly or more frequent basis to maximize yield, liquidity, or other goals (such as attention share).

Bearish pressure and high emissions have created ongoing downward price pressure on ve(3,3) DEXs across various ecosystems. However, in the long run, I still believe that an engaged staker base and consistency across protocols will lead to a sustainable flywheel.

first level title

Is more ve(3, 3) DEX a bad thing?

Every new DEX seems to be a fork or overhaul of Solidly. Guru Network has built a nice comparison dashboard to keep track of the best Solidly Visions comparisons!

According to DeFi Llama, there are now 31 Solidly forks across multiple chains, with Velodrome accounting for more than 35% of the TVL.

I don't think this is a bad thing. Clearly, competition is always beneficial to market players. Best order execution gives buyers and sellers the best prices and DEX aggregators are enabling this (Firebird is my personal favorite - $FBA is a low market cap alpha). However, most forks are unsuccessful. Teams without a unified business strategy outreach and community buy-in will fail.

One of the DeFi paradigm shifts pioneered by Olympus DAO is the concept of Protocol Owned Liquidity (POL). Now, this concept has become extremely popular in new protocols because it can generate income (capital efficiency).

first level title

ve(3, 3) Differentiation of DEX

Building a ve(3,3) DEX requires more than secure smart contracts, effective user experience, and novel token designs. It becomes increasingly important to contribute to the brand's mission/vision/values to attract the right partners. As the number of DeFi DApp teams increases, my prediction is that teams expect their POL to be managed by a ve(3, 3 ) DEX team with consensus, an easy-to-read track record, and the ability to manage relationships consistently and thoughtfully.

first level title

The future of ve(3,3) DEX

As these protocols continue to build TVL and strengthen partnerships with various teams in each ecosystem, we will see modular power on top of ve(3, 3) DEXs leading to higher fees and sustainability .

Here are some ideas I have for the ve(3, 3) builder:

Launchpad for new project tokens - this makes perfect sense. ve(3, 3) Team and NFT holders to DD/whitelist projects using DEX for IDO. POL is listed on ve(3, 3) DEX, and the experience is very smooth. These DEXs will build strong network effects as they bring an informed and motivated audience of voters/investors. Fundraising via ve(3, 3) would be a win-win.

treasury management. Many protocols manage a range of assets, and a ve(3,3) DEX can help improve this efficiency. By pooling liquidity and perpetual contracts, delta-neutral strategies can generate returns without risking impermanent losses.

A ve(3, 3) stablecoin backed by veNFT and LP tokens. Why? Because we like capital efficiency and leverage.

veNFT AMMs are used to swap locked positions and perform liquidations. Bug Finance is building a new mechanism that allows exiting veNFT positions.

Self-repaying loans for veNFT holders.

first level title

I ve(3, 3) choose

Thena- Has sustainable income from Fusion (centralized liquidity), Alpha (partnership with Deus), forks and advisors in various ecosystems, strong front-end designers, and excellent BD. Plus BSC is a huge ecosystem with huge potential.

Chronos- The best DeFi ecosystem is Arbitrum, Chronos has a strong brand and team. Their maNFT and no rebase should result in consistent TVL and lock-in as long as the bribes come in.

Velodrome— The biggest DEX on Optimism is ready, and with the Optimism Bedrock upgrade looming, Coinbase’s launch of Base gives Velodrome an opportunity to take to the skies. Velodrome V2 is coming soon and will provide a much needed upgrade to generate protocol fees.

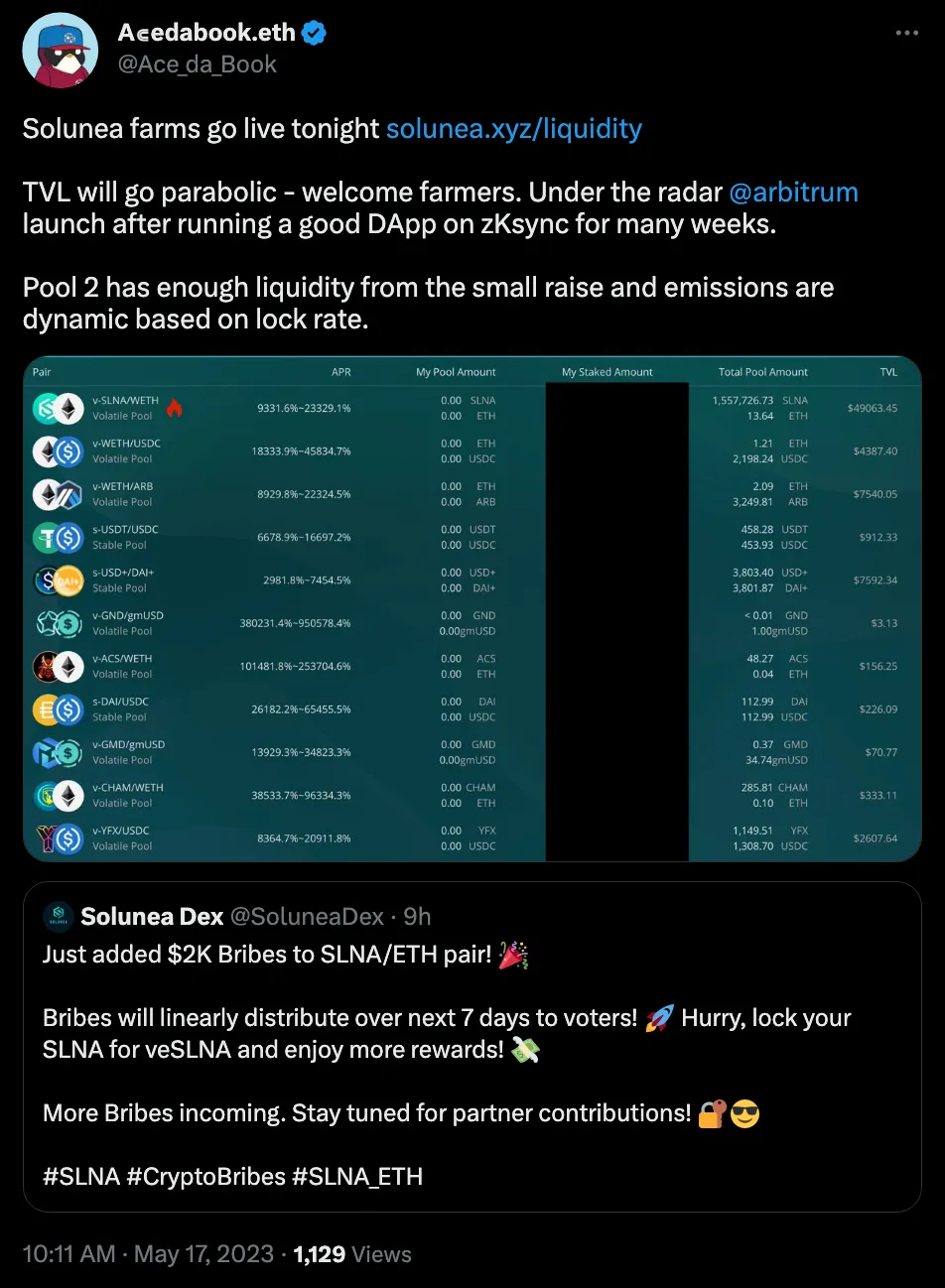

Solunea- Small project just launched on Arbitrum. Dynamic emissions should keep LP's APR stable (high lock-in leads to high emissions, low lock-in reduces emissions). SLNA's liquidity mining starts today: