Original author:Ambcrypto Suzuki Shillsalot

Original compilation: PANews

Original author:

Original compilation: PANews

Which DEXs made a fortune in the "USDC crisis"?

first level title

Uniswap, Curve Finance, SushiSwap emerge as 'big winners' amid market uncertainty

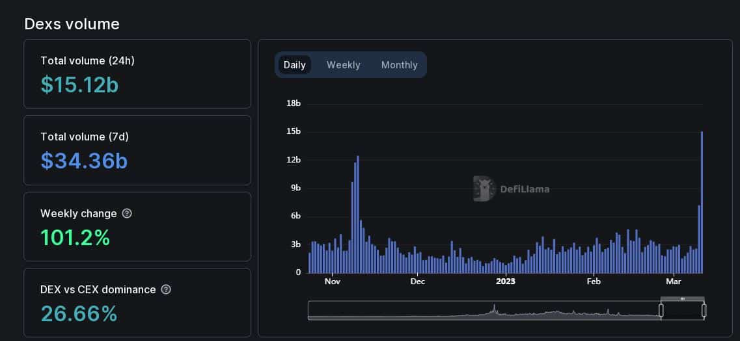

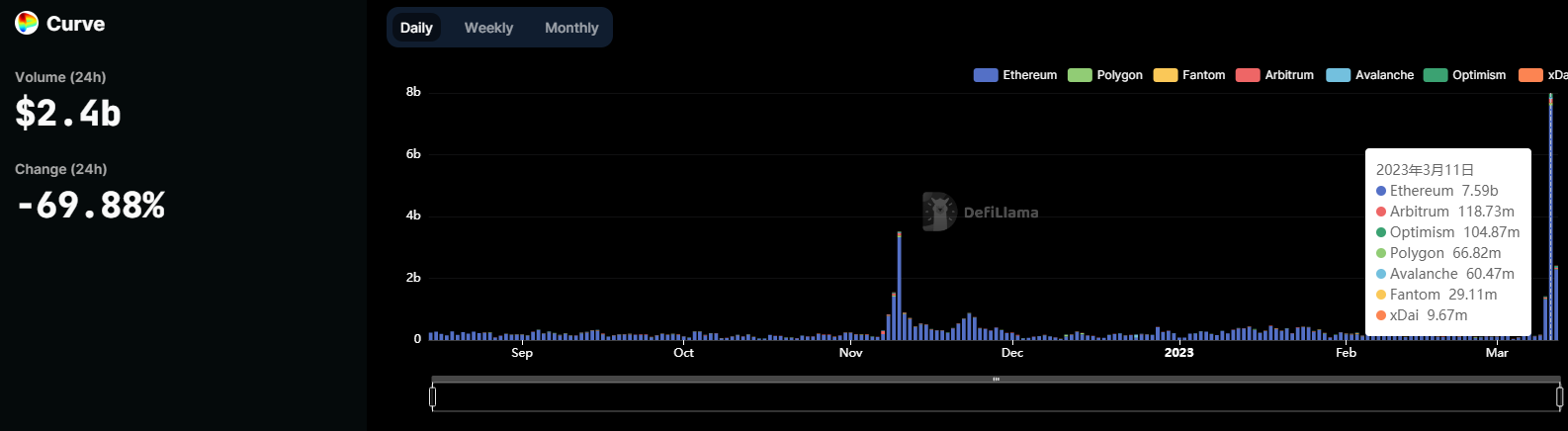

First, as a DEX designed for stablecoin exchange, Curve Finance set a record for the highest single-day transaction volume of nearly $8 billion in the past 24 hours. According to CryptoFees data, due to the surge in transaction volume, the fee income collected on the Curve platform also jumped to $952,000, setting a new high in the past four months.

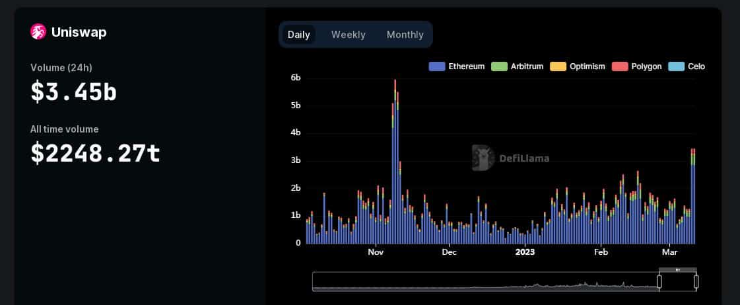

Followed by Uniswap, Uniswap is also one of the DEXs with the largest trading volume in the current encryption market. The transaction volume soared to $3.45 billion within 24 hours after USDC was unanchored, the best performance in the past four months. Transaction fees paid by Uniswap users also rose to $8.75 billion as of this writing, hitting a 10-month high.

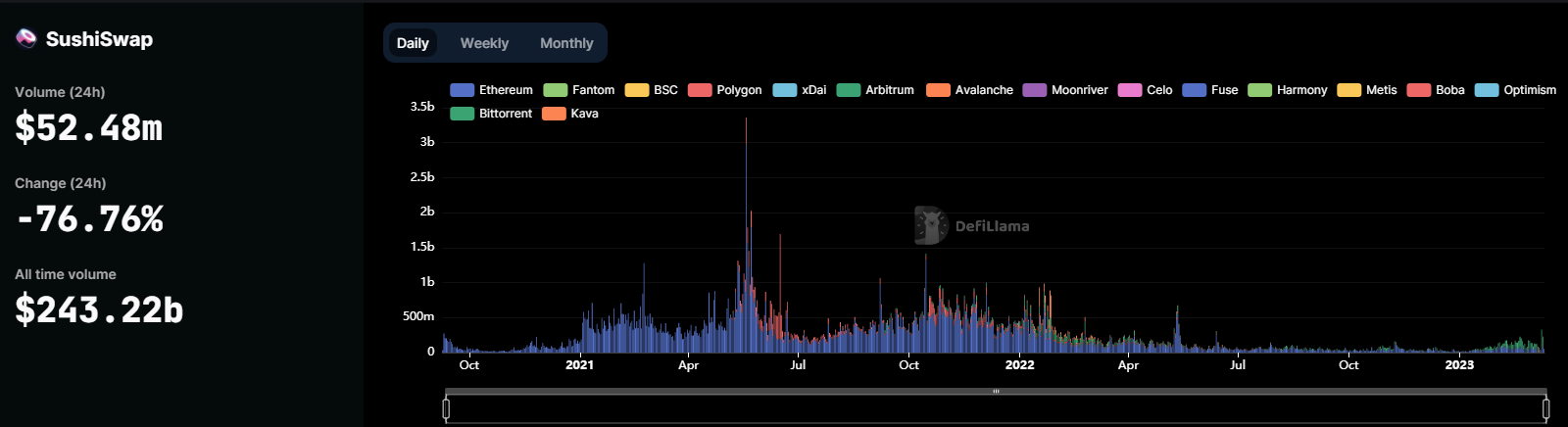

Another popular DEX is SushiSwap, which also saw a surge in activity during the USDC crisis and became one of the most used smart contracts by Ethereum whales.

Which DEXs made a fortune in the "USDC crisis"?

first level title

In the past 3-4 years, DEX has achieved rapid development. The data disclosed by Token Terminal shows that the number of active developers on the DEX platform has been growing steadily, indicating that the fundamentals supporting the future of DeFi are good.

Which DEXs made a fortune in the "USDC crisis"?