On March 11, Circle, the issuer of USDC, stated that USDC’s3.3 billion deposits out of 40 billion reservesAt Silicon Valley Bank, which was previously closed for "illiquidity and insolvency"forced to close, and designated the US Federal Deposit Insurance Corporation (FDIC) to take over.

Although Circle is only affected by a small part of the funds, because the bank does not work on weekends, the large-scale purchase of USDC to redeem the US dollar arbitrage mechanism has failed, and Coinbase has also closed the USDC withdrawal channel for USDC, USDC, DAI, FRAX, MIM Wait for the stablecoins to be unanchored one after another. In the case of violent market fluctuations, there are also some opportunities.

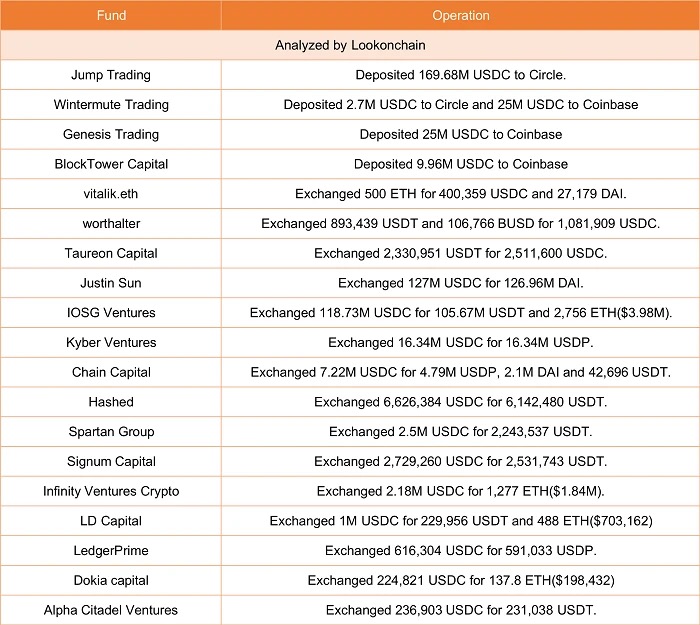

Institutional Operations of Lookonchain Statistics

Buying the bottom: USDC’s losses are limited and there is a high probability that it will return to around $1

The simplest operation is to wait for the USDC to fall before buying bottoms. The basis is that the proportion of USDC reserves affected by Silicon Valley Bank does not exceed 10%, then the current theoretical value of USDC should exceed 0.9 US dollars, and USDC falling below 0.9 US dollars is a suitable opportunity to buy bottoms .

This has considered extreme cases such as Silicon Valley Bank being liquidated and unable to recover funds at all, and Circle sitting idly by. In fact, Silicon Valley Bank also has many supporters because of its good reputation in the venture capital industry. According to Bloomberg,More than 100 banksSigned a statement of support for SVB, and investors will continue their relationship with SVB if another entity acquires SVB.

March 12,Circle also announced that, if SVB funds are not 100% repaid, Circle will use corporate resources to make up the shortfall to support USDC. USDC liquidity operations will return to normal after U.S. banks open next Monday.

With excessive FUD sentiment, some investors may worryother US banksIt could also follow in the footsteps of Silvergate and Silicon Valley Bank, with shares of First Republic Bank (FRC) down more than 50% at the open on Friday. According to Bloomberg,Federal Reserve and FDICA fund is being considered to provide deposit guarantees for struggling banks.

Investors who directly buy bottoms also need to pay attention to the dynamics in real time, so as not to put themselves in an unfair position. For example, when the FTX risk was just exposed, the ratio of the capital gap to the total deposit was not high, but because many people withdrew in full, and after the withdrawal was closed, FTX also opened withdrawals to some people through special channels, resulting in no People who withdraw money can lose 100% of their funds.

Even if there is a risk, there is a high probability that USDC will recover to a price close to $1 on Monday.

Hedging: USDC swaps with BUSD and DAI

After USDC is de-anchored, you can choose to exchange USDC 1: 1 for other stable coins, hoping that the issuers of other stable coins can cover the bottom line. If USDC recovers to $1, there will be no loss; if USDC continues to de-peg, issuers of other stablecoins may also make up for the shortfall of USDC.

The first is the swap between BUSD and USDC. By default, Binance converts the USDC recharged by users into BUSD. Therefore, in the early days of USDC de-anchoring, BUSD and USDC can still be swapped at Binance at a ratio of 1:1. In the case that USDC has been unanchored, BUSD is theoretically less risky than USDC, and it may have Binance's pocket. The fact is also true. As the USDC de-anchor continued, Binance closed the swap channel between USDC and BUSD. Since then, the negative premium of BUSD has remained at around 1%, while the negative premium of USDC has exceeded 10%.

The second is the swap between DAI and USDC. Maker's stable anchor module allows the swap between DAI and USDC. In the absence of other channels to avoid risks, DAI is also a better choice than USDC, because some DAI is minted with over-collateralized cryptocurrencies, and MakerDAO may cover the bad debts in the agreement.Justin Sun, Founder of TRONThis was also done, and MakerDAO did take aggressive steps afterwards, with DAI having a negative premium lower than USDC.

Arbitrage: price differences between different chains and DEXs

When the price of USDC fluctuates, there are also many arbitrage opportunities in the market. The core of this idea is to observe the price difference of the same asset between different chains and centralized exchanges.

For example, the price difference between the ETH/USDC trading pair on Optimism and Arbitrum and the price on OKX requires the use of trading aggregators such as 1inch. Even if the price of ETH/USDC on a single DEX is the same as that of the exchange, it can also be arbitraged through the composability of DeFi . One of the operations is to use USDC to purchase ETH through Optimism's 1inch, and then exchange it for USDC on OKX, Bybit and other platforms. When USDC depreciates, the transaction goes through the path of "USDC-sUSD-sETH-ETH", and is completed through Synthetix's atomic transaction. The core reason may be that after the price of USDC fell, the price of the USDC/sUSD trading pair on the chain did not change, and Stableswap would lead to liquidity accumulation, thus providing considerable liquidity.

Since OKX supports the deposit and withdrawal of more assets on different chains (such as Optimism, Arbitrum’s USDC), and has opened more trading pairs with good liquidity (such as ETH/USDC), more funds have flowed in in the short term. Afterwards, Binance also resumed the USDC/USDT trading pair, and stated that it will open trading pairs such as ETH/USDC.

Finally, PANews would like to remind everyone to be careful when operating on the chain.a negative teaching materialYes, a user sold more than $2 million of Curve 3 pool LP tokens through Kyber's aggregation routing and only received 0.05 USDT. The reason is that the user neither followed the procedure (the liquidity should be redeemed directly through Curve), nor paid attention to the price when exchanging, and finally earned more than 2 million US dollars in profit by the MEV robot.