It took Silicon Valley Bank just over 40 hours from the liquidity crisis to the declaration of bankruptcy, much faster than the 2008 financial crisis. As a leading bank in the venture capital circle, it connects with 600 venture capital institutions and 120 private equity institutions around the world, and has a market share of more than 50% in the start-up credit market. Many start-up companies have capital exposure to Silicon Valley Bank. The Ray incident knocked down the first domino, and the chain reaction it triggered will not only affect the traditional financial industry, but also plunge the already scarred encryption market into crisis again.

The bankruptcy of Silicon Valley Bank triggered panic selling of USDC

This morning, Binance, Tether, Paxos and other institutions, Blur, Axie Infinity and other project parties have stated that they have no exposure to Silicon Valley Bank, and their funds are safe. There are also NFT projects such as Yuga Labs and Azuki that hold a small amount of capital exposure. , but operations are not currently affected.

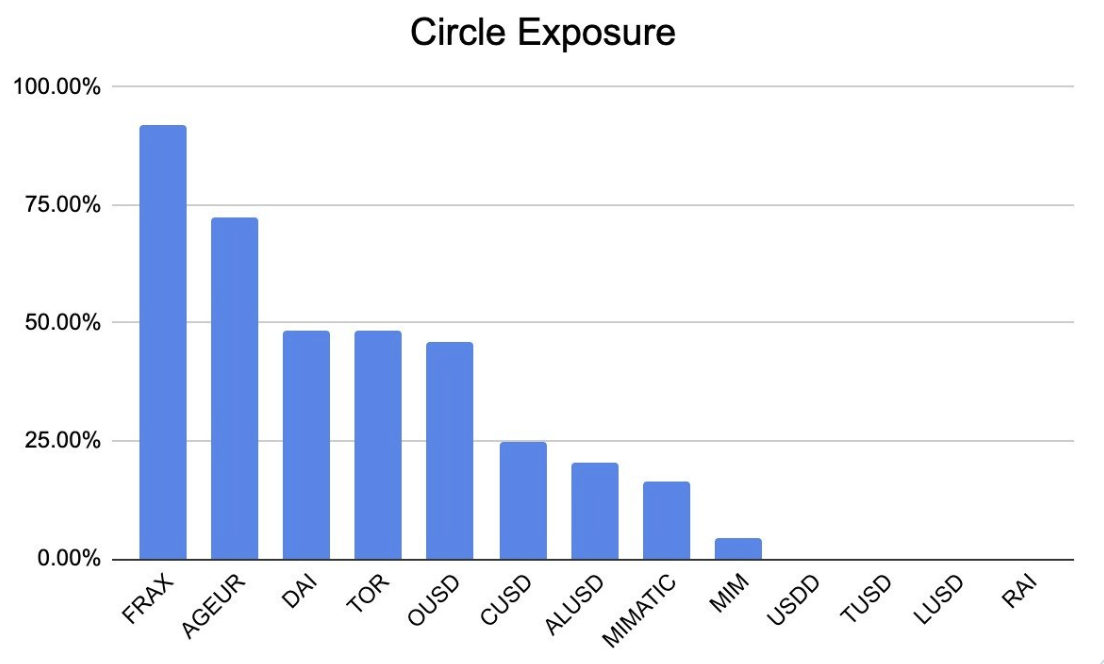

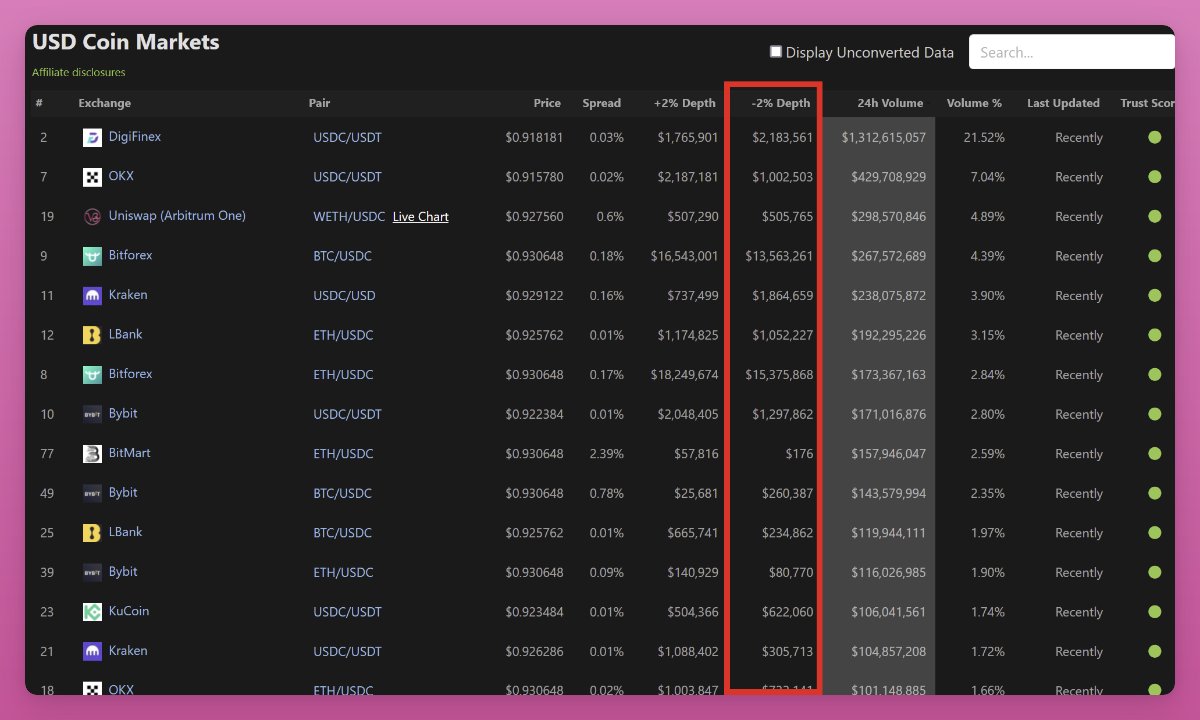

Things aren't so rosy for Circle, however. Since Silicon Valley Bank is one of its six banking partners and $3.3 billion of Circle's approximately $40 billion in USDC reserves is deposited in Silicon Valley Bank, the bankruptcy of Silicon Valley Bank may affect the stability of USDC. For a while, the market panic continued to rise, and USDC broke the anchor and continued to intensify. From the short-term unanchoring to $0.98 range to further aggravating the lowest anchoring to $0.88, USDC fell by more than 11.4% in 24 hours, and its market value fell below the $40 billion mark. The market reaction has already shown that Circle’s reserves are not satisfied worry.

The short-term de-anchoring forced Circle to choose to destroy USDC to maintain a stable price. According to PieDun monitoring data, Circle destroyed 2.7 billion USDC in the past 24 hours, of which 70% (about 1.65 billion US dollars) was destroyed in the past 8 hours of.

Panic also caused a large number of users to flood exchanges for exchange. According to 0xScope data, 7.66 billion USDC was withdrawn from CEX in the past 24 hours, Jump cashed out 150 million USDC, and Coinbase cashed out at least 1.78 billion USDC. Wintermute and FalconX will USDC was deposited into Coinbase, and 2.4 billion USDC were destroyed in the past 24 hours. Binance has suspended the automatic conversion of USDC to BUSD due to the large amount of USDC assets flowing into the exchange, which has increased the burden of automatic conversion. And Coinbase also announced that it will suspend the conversion between USDC and US dollars when banks are closed on weekends.

USDCs that cannot be redeemed on centralized exchanges try to choose "chain escape" through market liquidity.

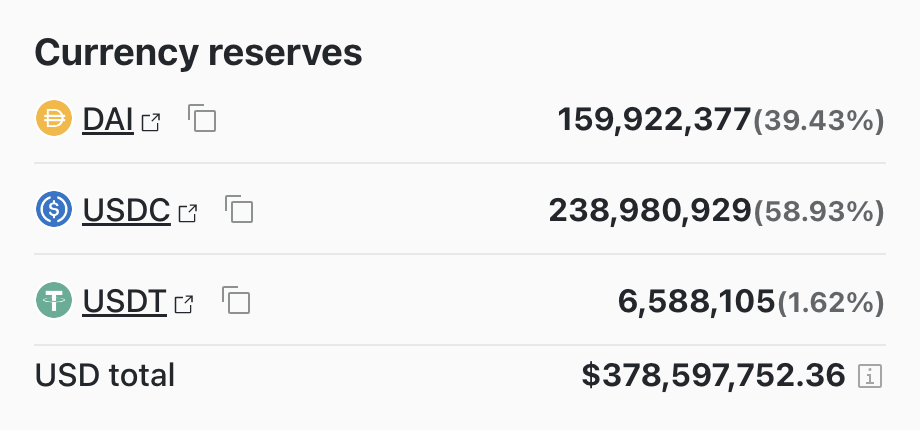

In the past 24 hours, nearly $137 million worth of liquidity has been sucked out of the 3 CRV fund pool, and users are selling them in exchange for USDT. At this time, USDC in the 3 CRV pool accounted for 58.93%, and DAI accounted for 39.43% , while USDT only accounted for 1.62%, theoretically the three should each account for 33%. The serious inclination of the ratio makes USDC dying, and it will also lead to more serious unanchoring.

In addition, since some USDC can mint DAI 1:1, USDC unanchoring will trigger a large number of investors to sell the minted DAI through the PSM mechanism, which will cause DAI unanchoring. According to MakerDAO, in the past 24 hours, a total of 736 million DAI was minted by USDC. At present, DAI is also experiencing continuous unanchor phenomenon, and has now fallen to $0.92, a 24-hour drop of 7.8%.

secondary title

There are giant whales using USDC arbitrage

As the saying goes, "Others panic, I am greedy." While a large number of users are frantically exchanging USDC, some giant whales are using USDC for arbitrage. Of course, every time there is such a panic in the market, some arbitrageurs will find a speculative opportunity in it. According to the data on the chain, the giant whale czsamsunsb.eth is using USDC to unanchor to play a big game. First, it borrowed 27 million USDT from Aave with stETH and ETH, then exchanged it for 28 million USDC, and then exchanged USDC 1: 1 Change it to DAI and deposit it in Aave, and use the revolving loan method to continue to exchange USDC. If the USDC peg is restored, the address will make a profit of about 1.3 million US dollars.

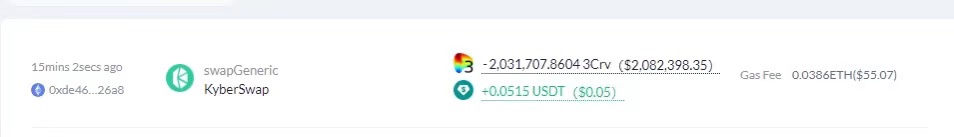

When faced with "opportunities", there was also an unlucky guy who exchanged 2 million USDC into USDT on the chain, but was accidentally paid by an MEV robot for a gas fee of 45 US dollars and a gas fee of 39,000 US dollars because no slippage was set. MEV made a net profit of 2.045 million USD after bribing money, while the user traded 2.08 million USDC but only received 0.05 USDT.

Will Circle Survive Silicon Valley Bank Collapse?

According to DefiIgnas, currently, USDC is not listed on Binance. Therefore, most sellers are selling to exchanges with low liquidity, and low liquidity does not guarantee successful redemption.

Therefore, the current USDC price fluctuation will continue until USDC 1: 1 redemption resumes. And Coinbase suspended redemption transactions today. In addition, Curve 3 pool currently only has 5.9 million US dollars of USDT left, which can be used to exchange about 380 million DAI+USDC, which does not help the current market situation much.

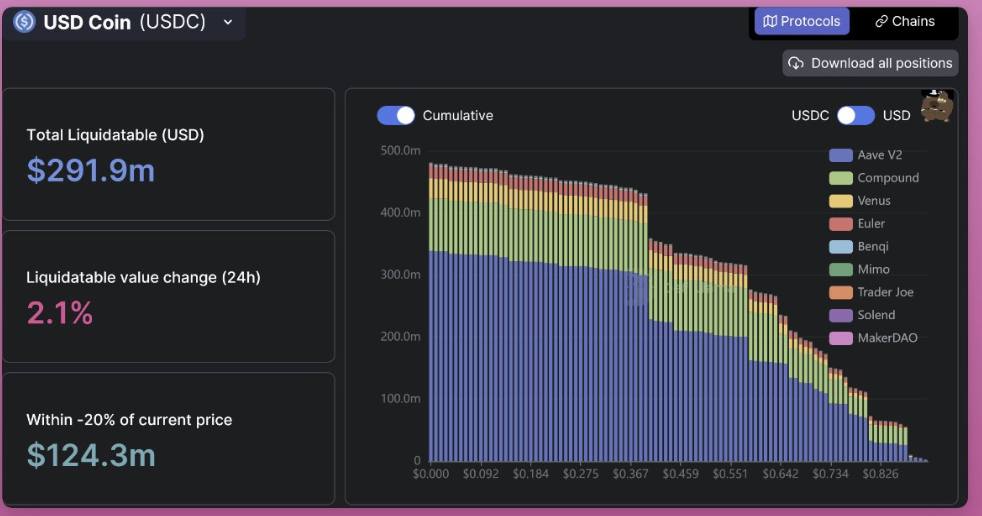

Worst of all was the cascading liquidations on lending markets like Aave and Compound — $124 million in USDC liquidations in the -20% price range.

Therefore, from the perspective of the secondary market, the liquidity of USDC on CEX and DEX is very poor. If USDC cannot be redeemed 1:1, its spot price will continue to fluctuate, and the crisis will be further strengthened.

However, from the perspective of Circle’s reserve asset structure, 0xLoki believes that the possibility of Circle’s thunderstorm is extremely low, because USDC needs to meet three conditions for a real thunderstorm:

(1) There are enough funds in Silicon Valley Bank and three medium-risk banks;

(2) The debt recovery ratios of these banks are sufficiently low;

(3) USDC cannot bear the loss or cannot find financial support to solve the problem.

At present, from the perspective of capital flow reserves, it has sufficient liquidity, and it will not suffer too much loss even if it is forced to discount. Additionally, Circle's exposure to Silvergate Bamk can be considered zero. Therefore, the probability of problems with Circle is not high, and even if there is a problem, it will not be as serious as FTX.

And @mindaoyang is pessimistic about it. He believes that USDC reserves are 43.2 billion US dollars, cash reserves are 11.4 billion US dollars, there are 8 banks, the bulk is in NY Mellon (assuming 50%), and the rest is assumed to be 2 billion US dollars in SVB, assuming 100% loss, the limit will affect USDC. Unanchored to 0.87, normal estimation, assuming the deposit is only 1 billion US dollars, 80% recovery, theoretically unanchored to 0.99. (Of course, this does not add to the actual de-anchoring that is magnified by panic runs.)

Regardless of the outcome, USDC's current unanchoring situation is continuing. Once Coinbase opens withdrawals on Monday, the run will continue to intensify. Will it affect the entire stablecoin ecosystem and cause a wider chain reaction? Odaily will also continue to pay attention.