This article comes fromCoindesk, by Krisztian Sandor

Odaily Translator |

Odaily Translator |

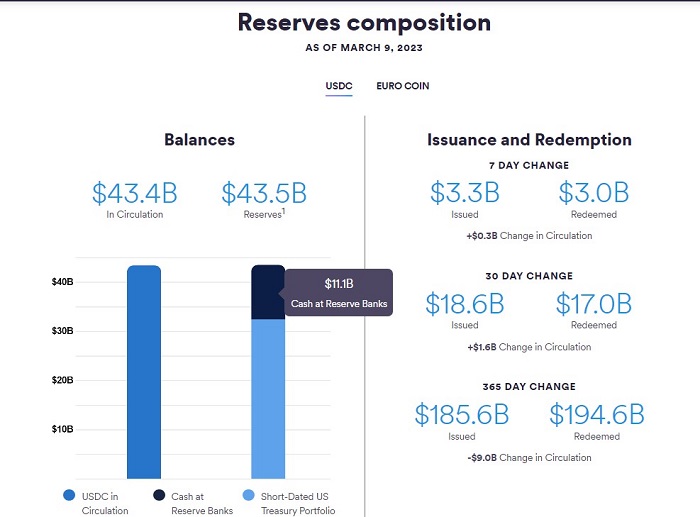

Circle is the issuer of USDC, the second-largest U.S. dollar stablecoin by market cap, with a circulating supply of $43 billion and is said to be fully backed by government bonds and cash-like assets.

Currently, USDC-approved blockchains consist of Algorand, Avalanche, Ethereum, Flow, Hedera, Solana, Stellar, and TRON blockchains, and are used by companies to issue and redeem USDC, allowing but unissued tokens to exist on Hedera and Solana blockchain and is not currently issued to USDC holders.

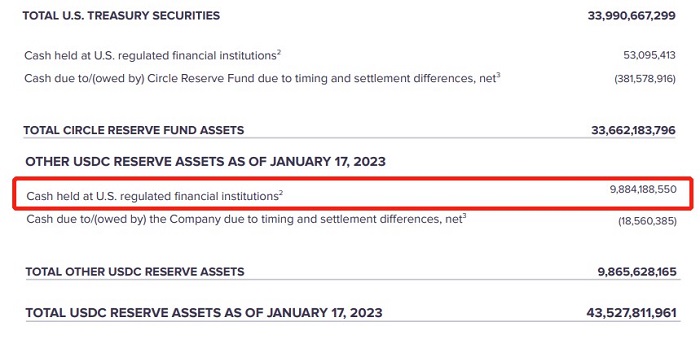

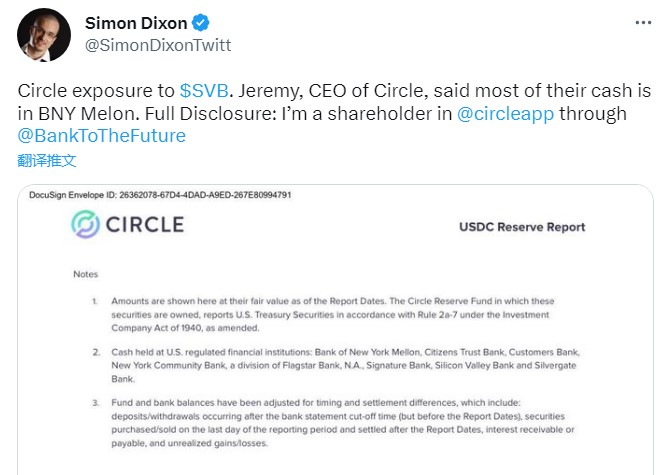

According to Circle’s previously released January reserve report (as shown in the figure below), it currently holds approximately US$9.88 billion in cash reserves, and holds Circle cash in regulated financial institutions in the United States, including: Bank of New York Mellon, Citizens Trust Bank (Citizens Trust Bank), Customers Bank, New York Community Bank, a division of Flagstar Bank, NA, Signature Bank, Silicon Valley Bank (Silicon Valley Bank), and Silvergate Bank -- yes, that includes Silicon Valley Bank, which just announced its collapse.

According to Circle’s previously released January reserve report (as shown in the figure below), it currently holds approximately US$9.88 billion in cash reserves, and holds Circle cash in regulated financial institutions in the United States, including: Bank of New York Mellon, Citizens Trust Bank (Citizens Trust Bank), Customers Bank, New York Community Bank, a division of Flagstar Bank, NA, Signature Bank, Silicon Valley Bank (Silicon Valley Bank), and Silvergate Bank -- yes, that includes Silicon Valley Bank, which just announced its collapse.

Last week, Circle said it had severed ties with Silvergate Bank, a crypto-friendly bank that ceased operations, and said it would "voluntarily liquidate" its assets earlier this week. But the good times didn’t last long. Just when the Silvergate Bank turmoil had not subsided, Silicon Valley Bank came again with "bad news". Due to insolvency, it had been closed by the California State Regulatory Department, and the US Federal Deposit Insurance Corporation (FDIC) subsequently issued a statement confirming that it had become Silicon Valley Bank bankruptcy administrator.

secondary title

Will Circle's $3.3B exposure to Silicon Valley Bank start a knock-on effect?

On March 11, Circle confirmed in a post on social media that the company had initiated a wire transfer application to transfer the balance from Silicon Valley Bank on Thursday, but it has not yet been processed, and $3.3 billion of its approximately $40 billion USDC reserves are still in the balance. Stay at Silicon Valley Bank. Like other customers and depositors who rely on SVB for banking services, Circle requires SVB to maintain continuity in the U.S. economy and will follow guidance provided by state and federal regulators.

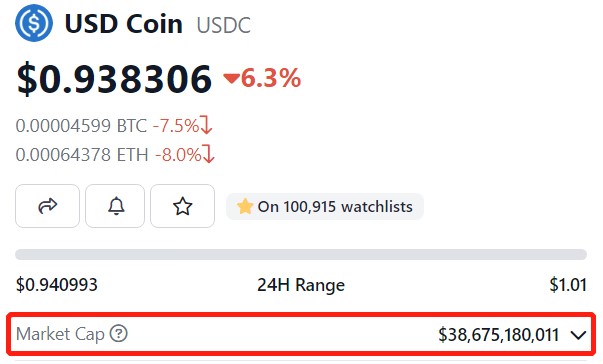

After this news was released, USDC's de-anchoring situation was further exacerbated. In fact, before Circle announced that $3.3 billion was trapped in Silicon Valley Bank, USDC had already broken its anchor for a short time and fell to the range of $0.98. After the news was released, Coingecko data showed that USDC quickly dropped to $0.938, a 24-hour drop of more than 6%, and the market value has fallen below the $40 billion mark-apparently, the market reaction has shown concern about Circle's reserve status.

The short-term de-anchoring forced Circle to choose to destroy USDC to maintain the stable currency price. According to data disclosed by the blockchain analysis company Nansen, Circle has destroyed USDC worth 2.34 billion US dollars in the past 24 hours, of which 70% (approximately 16.5 billion) were destroyed in the past 8 hours.

However, USDC’s de-anchoring has triggered a wave of encrypted exchanges. Perhaps because of concerns about the risks of holding USDC, a large number of users poured into Coinbase to convert USDC back to US dollars, forcing Coinbase to announce that it will suspend USDC and US dollars when banks are closed on weekends. conversion between. At a time of high exchange activity, conversions rely on U.S. dollar transfers cleared by banks during normal business hours, and Coinbase said it plans to restart offering conversions when banks open on Monday.

There is no doubt that the bankruptcy of Silicon Valley Bank has had a huge impact on USDC, and even the broader crypto market.

secondary title

Will Circle be the next victim of a Silicon Valley bank collapse?

Dante Disparte, Circle's global policy director and chief strategy officer, said that Circle is currently protecting USDC from the black swan event of the US banking system. Silicon Valley Bank is an important bank in the US economy. Wider implications for business, banking and entrepreneurship.

Fortunately, the US government has taken action.

According to the latest announcement of the Federal Deposit Insurance Corporation (FDIC), the agency has created a new entity called "Santa Clara Deposit Insurance National Bank (DINB)" and transferred Silicon Valley Bank deposits to this entity to protect customers , all insured depositors will have fully utilized their insured deposits by the morning of next Monday, March 13th, the FDIC will pay uninsured depositors prepaid interest within the next week, and uninsured depositors will receive the remainder of their uninsured funds Receivership certificates, with the FDIC selling Silicon Valley Bank's assets, could lead to future interest payments to uninsured depositors. The FDIC also confirmed that as of December 31, 2022, Silicon Valley Bank had total assets of approximately $209 billion and total deposits of approximately $175.4 billion. At the time of closing, the amount of deposits in excess of the insurance limit has not been determined. Banking activities will resume no later than March 13, including online banking and other services, and official SVB checks will continue to clear.

If all goes well, Silicon Valley Bank's treasury business will restart on March 13, which means that Circle's request to transfer the $3.3 billion balance of Silicon Valley Bank's $3.3 billion balance initiated by Circle this Thursday may also be processed.

Another piece of good news is that the funding in Silicon Valley Bank accounts for only a fraction of Circle's capital. According to Simon Dixon, CEO of online investment platform BnkToTheFuture, on social media, Circle CEO Jeremy Allarie revealed that the company's "majority of cash" is deposited in Bank of New York Mellon, not Silicon Valley Bank (Note: BnkToTheFuture is Circle's investors and shareholders).