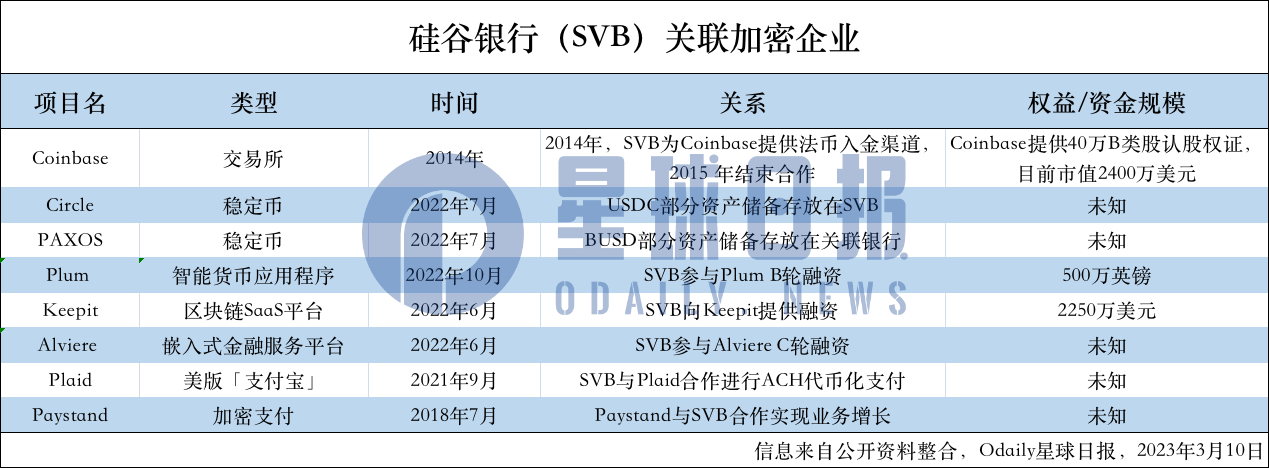

Today, affected by the imminent collapse of Silicon Valley Bank (SVB), the encryption market fell across the board, and Bitcoin fell below $20,000 to a new low in nearly two months. For the latest market analysis, recommended reading"Bitcoin fell below $20,000, Silicon Valley Bank dragged down the encryption market? "。

secondary title

Coinbase

according to

according toCoinbase ProspectusAt that time, there were very few financial institutions willing to provide banking services for encrypted trading business, and SVB was one of the few; Coinbase used SVB's ACH (Automated Clearing House) service in order to open up legal currency deposits, and paid 400,000 shares to it warrants. The warrants allow SVB to buy 400,000 Class B shares for $1 -- Class B shares can be converted 1:1 to Class A shares at any time, but have 20 times the voting power of A shares.

According to the data, the IPO price of Coinbase was US$250, and the highest listing price was close to US$350. At one point, the peak market value of the shares held by SVB was close to US$140 million; the current Coinbase stock price is at US$58, and the value of SVB’s holdings is close to US$24 million.

secondary title

Circle

According to the audit report of the stablecoin USDC issuer Circle in January this year, part of its reserves are deposited in the custody of SVB, Silvergate and other compliant banks. The report was reviewed and certified by Deloitte.

According to Circle's 2022 annual report, in terms of asset reserves, about 80% of USDC reserves are 3-month U.S. Treasury bonds; by the end of January 2023, these reserves will be managed by BlackRock and will be managed by Bank of New York Mellon (the world's largest custodian). ) hosting. In addition, about 20% of the asset reserve is cash, which is held by 8 banking partners regulated by the United States, including SVB and Silvergate.

secondary title

Paxos

according to

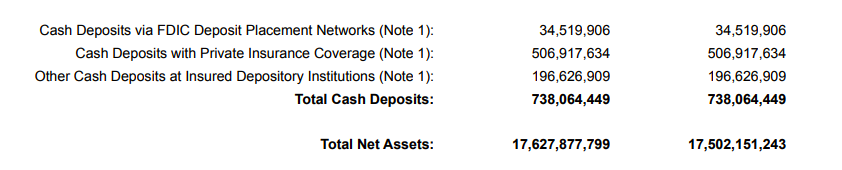

according toPaxos Report 2022, As of June 30, its total net assets exceeded US$17.5 billion, and its reserves included US Treasury bills of US$10.589 billion, US Treasury Department's proposed repurchase agreement of US$6.175 billion, and cash deposits of about US$738 million. Among them, the cash reserves are scattered across multiple deposit networks: $34.51 million attributable toFDIC Insured Deposit Distribution Networksecondary title

Plum

London-based smart money appPlum, which received £5 million in debt financing from SVB in October 2022. The original intention of Plum is to help users manage financial management and control the cost of living. The product has gained 1.4 million users in just two years after its launch.

secondary title

Keepit

Last June, SaaS data protection platform providerKeepitReceived $22.5 million in debt financing led by SVB and Vaekstfonden.

Founded in Copenhagen, Denmark in 2007, Keepit is a leader in cloud backup and recovery and the world's only independent provider "Neutral Cloud" dedicated to SaaS data protection. Its blockchain verification solutions are sold globally, including Microsoft 365, Microsoft Azure AD, Google, and Salesforce. NOTE: The Keepit website ishttps://www.keepit.com/secondary title

Alviere

In June last year, the embedded financial platformAlviereAnnounced investment from SVB, the exact amount is unknown. Alviere has previously completed two rounds of financing totaling 70 million US dollars. Alviere offers a complete embedded financial platform that makes it easy for any brand to offer a full suite of financial products and services to customers, fans and employees.

Last March,Coinbase Primesecondary title

Plaid

In September 2021, SVB announced a partnership with the US payment companyPlaidPartnering to allow customers to use Plaid to instantly verify bank account information and securely generate payments through tokenized payment solutions. SVB is the first bank to offer ACH account tokens integrated with Plaid.

The joint solution connects Plaid's instant account verification and SVB's ACH API capabilities through a tokenization system to minimize the handling of beneficiary's sensitive banking data. Together, Plaid and SVB offer customers an efficient and secure way to process payments directly from their SVB accounts. The integration also enables federated clients to comply with Nacha requirements related to WEB debit and data security fraud detection standards.

secondary title

Paystand

The intersection of blockchain-based B2B payment company PayStand and SVB can be traced back to 2018 at the earliest. At that time, PayStand, as a start-up company, was supported by the SVB accelerator incubation, successfully acquired a number of early customers, and survived the crypto bear market.

It is understood that Paystand's blockchain and software as a service (SaaS) can improve all aspects of the business payment lifecycle, from accounts receivable to invoice reconciliation; by automating corporate payments, PayStand enables businesses to conduct transactions globally , accelerate access to working capital and realize bottom-line cost savings.

After several years of development, Paystand has gradually grown, doubling its annual operating income; in 2022, Paystand was selected as one of the fastest growing private companies by Silicon Valley Business Journal.