Compilation of the original text: Bai Ze Research Institute

Compilation of the original text: Bai Ze Research Institute

Think the crypto market has been acting a little weird lately?

Last week, the crypto industry's foremost bank, Silvergate, shut down its trading network, SEN, which was used by large investors, corporations, and stablecoin issuers to move billions in and out of crypto markets 24/7.

The SEN’s shutdown appears to have had a profound impact on crypto market liquidity, while Silvergate’s bankruptcy also raises the risk of regulators accelerating their crackdown on cryptocurrencies.

In this article, we'll start with Silvergate's origins, how it got here, and what its demise means for the crypto industry.

Ten Years of Silvergate Evolution

Silvergate is a California bank founded in 1988. For its first 30 years, Silvergate was a small bank with a few hundred million dollars in deposits. Thanks to the foresight of its executives, Silvergate was not affected by the 2008 financial crisis.

That same year, Alan Lane became Chief Executive of Silvergate. Alan has over 40 years experience in banking in a variety of roles.

That's how the story started, Alan also pivoted Silvergates' business to cryptocurrencies after investing in Bitcoin on a personal basis in 2013.

In an interview in 2019, Alan said that he met a company called SecondMarket at a conference, the company's business is to provide liquidity for illiquid stocks, and they are also exploring providing liquidity for small banks such as Silvergate .

The founder and CEO of SecondMarket is Barry Silbert, who also happens to be the founder and CEO of Digital Currency Group (DCG), the largest company in the crypto industry. SecondMarket approached Silvergate in 2013 in an attempt to get it to provide banking services to DCG.

Crypto companies have notoriously struggled to access banking services historically.

In fact, when SecondMarket first contacted Silvergate, Alan was skeptical. But within a few months, he became fascinated by Bitcoin and quickly realized that the encryption industry was an untapped "blue ocean" market. Immediately began providing banking services to crypto companies.

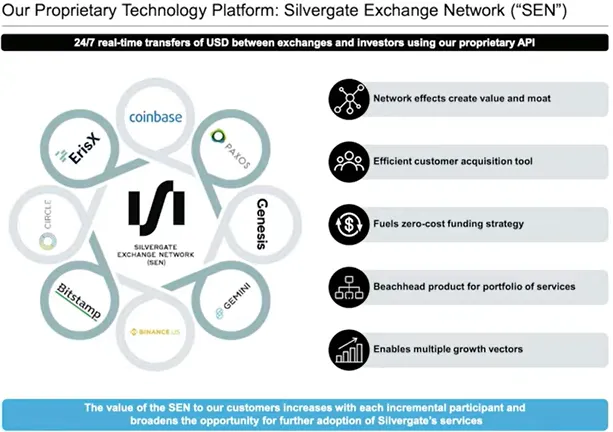

By 2017, more than 250 crypto firms had become Silvergate clients, and their deposits had grown to $2 billion. That same year, Silvergate came up with the idea of developing its own exchange network, which would enable 24/7 transactions of fiat and cryptocurrencies. This is required because crypto markets trade 24/7, but banks only work 9-5 Monday through Friday.

Silvergate's transaction network, the Silvergate Exchange Network (SEN), launched in early 2018. It has attracted another 250 crypto companies as customers of the bank. This enables them to convert fiat and cryptocurrencies at any time, ensuring strong market liquidity.

What's more, Silvergate provides banking services and SEN network access to the largest crypto companies. These include cryptocurrency exchanges such as Coinbase, Kraken, and Gemini, as well as stablecoin issuers such as Circle, Paxos, and TUSD.

In 2019, Silvergate held an initial public offering (IPO), meaning the bank's shares began trading on U.S. stock exchanges. Even though the crypto market was in a bear market at the time, Silvergate continued to grow exponentially.

In 2020, Silvergate's client base grew to nearly a thousand, with hundreds more waiting to join. In early 2020, Coindesk provided Silvergates' client base, "The bank now has 850 cryptocurrency clients, including 61 trading platforms, 541 institutional investors and 48 other clients."It is worth mentioning that the funds of these institutional investor clients account for the majority of cryptocurrency market capitalization and trading volume.

secondary title

Silvergate Falls

Silvergate appears to be doing fine in early 2022. The company announced the acquisition of Facebook's failed digital currency project Diem for $200 million. The idea behind it seems obvious, Silvergate wants to create its own stablecoin, circulated on its SEN network and used for payments. Remember this, it's important in the back.

When the encryption market began to enter the "winter" in early 2022, Alan began to receive questions from customers "about the solvency of the bank". That's because Silvergate provided USD loans backed by BTC and lent over $200 million to MicroStrategy with BTC as collateral. Obviously, this is quite risky.

Alan gave a simple answer to all skeptics, which is that when the crypto market starts to crash, SEN has the ability to immediately sell any BTC used as collateral. Not only that, Silvergate is solid compared to normal banks, it only holds cash, and customers’ cryptocurrencies and cash.

There's just one problem: FTX and Alameda Research.

Alameda Research opened an account with Silvergate in 2018 and apparently passed the bank's investigation. FTX used Alameda's Silvergate account to transfer client funds, and Silvergate seems to have sensed that something bad was going to happen shortly before FTX and Alameda went bust.

Shortly before FTX and Alameda’s bankruptcy, Silvergate issued a statement assuring customers that its SEN network was still functioning, and in this statement, Alan made it clear that the bank has the ability to withdraw funds from the U.S. Federal Reserve if any liquidity problems arise. Housing Loan Bank Borrowing.

On the same day that FTX and Alameda collapsed, Silvergate released another statement confirming that FTX itself had an account with the bank, but FTX deposits accounted for less than 10% of all deposits.

While Silvergate stock rallied on the lack of FTX exposure, the recovery was short-lived. In December, US politicians began calling for an investigation into Silvergate's ties to FTX and Alameda.

In January, Silvergate revealed that it had experienced a whopping $8.1 billion bank run following the FTX crisis, which wiped out all the profits it had made since 2013. Silvergate also had to lay off 40 per cent of its staff to stay afloat and later revealed it had taken out a loan from the Federal Home Loan Bank.

Curiously, BlackRock, the world's largest asset manager, took advantage of the opportunity to buy on the dip, taking a 7.2% stake in Silvergate, while another asset manager called Stake Street also took a 9.2% stake around the same time.

In February, the U.S. Department of Justice announced that it was investigating Silvergate for the FTX and Alameda incidents. Silvergate subsequently became the most shorted stock on the market.

Earlier this month, Silvergate announced it was delaying the release of its annual report, acknowledging that it could face more investigations and acknowledging that it may not survive. Last week, Silvergate shut down the SEN network as its highest-profile clients of top crypto firms abandoned it for other crypto banks.

The latest news is that Silvergate is scaling back operations and liquidating assets. Silvergates' assets could be bought by a major bank like JPMorgan Chase, giving Wall Street control of the crypto industry's most valuable financial infrastructure. So now that Silvergate is out of business, what happens next?

"Abandon Silvergate to Signature" is not the optimal solution

As I mentioned a few sentences ago, most of Silvergate's top clients quit and went to other crypto banks. In theory, this sounds like a good solution for customers, but in practice, it creates two more problems.

Knowing that Silvergate is the only crypto bank with a 24/7 fiat and crypto trading network is much needed. Moreover, there are only two other large crypto banks in the US, Signature Bank and Metropolitan Bank.

Until January this year, due to regulatory pressure from Operation Chokepoint 2.0, Metropolitan Bank announced that it would withdraw from the encryption industry. (The original "Operation Chokepoint" campaign was a joint crackdown on companies deemed high-risk by U.S. regulators. By putting pressure on the banking industry to stop doing business with companies in specific industries, it completely marginalized the company. 2.0 is the crypto community A term coined to refer to all the financial regulators in the U.S. that have been attacking crypto businesses over the past few months and don’t seem to be interested in policing cryptocurrencies, but in shutting them down.)

This makes Signature the only viable option for most crypto companies. That's why most of Silvergate's top clients have recently switched to Signature.

The problem is that Signature announced back in December that it wanted to halve its exposure to the crypto industry. The scary thing is,Signature has since limited banking services to some of the largest crypto firms.As some may recall, Signature restricted USD trading to Binance US in January. Well, they recently did the same with Kraken, which is truly unprecedented considering its reputation. If that wasn't bad enough, according to reports,Signature received $10 billion from the Federal Home Loan Bank in the fourth quarter of last year. That's almost three times the amount the Commonwealth Bank has lent to Silvergate.

This is very bad and could lead to a scrutiny of Signature by regulators. While Signature's clients don't appear to have questionable crypto firms, if Silvergate officially collapses, regulators and politicians will have the "crypto-threat banking" excuse to crack down on Signature and any other remaining crypto banks.

Even if the few remaining crypto banks were somehow allowed to operate without scrutiny, it still wouldn’t change the fact that the SEN network was shut down. I want to reiterate that a network like SEN is necessary for the proper functioning of the crypto market.

Without it, it is very difficult for institutions to enter and exit the crypto industry. What's more, without it, the flow of funds to banks is limited by business hours, which would be a disaster for the 24/7 crypto market.

Therefore, the encryption industry urgently needs a new transaction network like SEN. But so far, only one crypto company seems to be brave enough to stand up.

A few days ago, the CEO of UK-based cryptocurrency payments provider BCB Group announced that the company is researching an alternative to SEN. BCB Group hopes to have the SEN replacement up and running in the second quarter of this year, possibly in a few months.

Ahead of the launch of this new network, it should come as no surprise that the crypto market continues to experience strange price action. If you are lucky, whoever acquires Silvergate's assets will be able to restart the SEN network faster.

Recently focused on reviewing Silvergate, perhaps attributable to SEN

Finally, I would like to touch upon an aspect of the Silvergate affair that seems to have been overlooked. No one is asking why regulators and politicians have targeted Silvergate specifically recently. After all, FTX and Alameda have accounts at multiple crypto banks in the United States.

FTX and Alameda have accounts at a small country bank called Farmington, in which both firms have invested.

Farmington quietly withdrew from the crypto industry in January, and did so without any scrutiny.

In any case, the excessive scrutiny of Silvergate makes no sense on its face.

Back on BlackRock and Stake Street. Silvergate is working with two of Wall Street's largest institutions to develop a cryptocurrency trading platform. That's presumably why BlackRock and Stake Street are trying to help save Silvergate.

So my question to you is: what really sets Silvergate apart from all the other crypto banks?

The answer is on the horizon: Silvergate's SEN network. An ability to transfer fiat and cryptocurrencies 24/7.

Let's get back to the topic of the Silvergate stablecoin. Remember, Silvergate is preparing to launch its own stablecoin, which will run on SEN. In the 2022 interview, Alan explained that Silvergate’s stablecoin ambitions come from observing the operation of stablecoin issuers for many years and having the ability to facilitate the issuance and redemption of their stablecoins.

Alan noted that the main use case for stablecoins is cryptocurrency transactions. He also realizes that regulators are reluctant to see stablecoins issued on smart contract blockchains being used for anything else.

Alan eventually realized that SEN was an ideal private network for issuing a stablecoin that could be used for payments, as it would provide instant settlement 24/7. The Silvergate stablecoin was supposed to launch by the end of 2022, but that didn't happen due to the bankruptcy of FTX. Interestingly, FTX is planning to launch its own stablecoin around the same time. Both Sam and Alan have stated that they are working with companies in the crypto industry to launch their respective stablecoins. It is possible that they will work together to realize the ambitions of these stablecoins.

Take a moment to consider that Alameda was once one of the largest market makers in the crypto industry. Due to their stature, they have close ties to all the biggest companies in the industry. This includes the largest exchanges, stablecoin issuers, and of course virtually every crypto bank.

As for Sam, he has had close ties to regulators and politicians. He has met with Gary Gensler (Chairman of the US SEC) more than any other crypto company.

Thanks to Alameda and FTX, Sam has a lot of sensitive information about the crypto industry. This particular state of affairs is why I suspect that Alameda's real purpose is to help regulators collect sensitive information about the crypto industry in order to plan the current crackdown on the crypto industry. In this case, I suspect that Sam may have shared information about the Silvergate stablecoin with US authorities.

I suspect that when they saw that the Silvergate stablecoin was built for payments and provided 24/7 settlement, they realized that it looked the same as FED Now, the Federal Reserve's upcoming fast payment system.

So they need to get rid of Silvergate and SEN as soon as possible. Simply put, the upcoming Silvergates stablecoin could be seen as a competitor to the Federal Reserve’s upcoming payments system. Unlike commercial banks' private and regular stablecoins, the Silvergate stablecoin will see rapid adoption with the support of the SEN and its Wall Street institutions.

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.