Original Title: "SVB Incident Analysis (Macro Research Diary)"

Original source:

Original source:Wisburg

After waking up this morning, many colleagues sent me information about SVB.

Frankly speaking, it is very difficult for only a few people to track the risks of the financial system in the U.S. dollar zone at high frequency. Under the premise of the Fed’s aggressive tightening, the author has actually done a lot of preparatory work for risk tracking. The sub-areas of interest areCommercial real estate (CRE), CLOs, and reserve adequacy for small and medium-sized banks.This is all tracked when I was doing research on the shadow banking system before the epidemic. At the same time, I have to keep an eye on the issuance of U.S. debt and the credit situation in H.8 at this juncture, which makes me feel exhausted...

Lack of ongoing follow-up makes it difficult to provide a solid view in the short term, so in the case of SVB,first level title

Start with the company's public documents

First of all, we have to thank the media for allowing the event to spread, but we must see the original appearance of the event,First of all, let's avoid media sources and various viewpoints,Go to the investor relations page of Silicon Valley Bank (SVB) to find relevant announcements and PPT information of the day.

This page of information basically contains the whole picture of the facts.

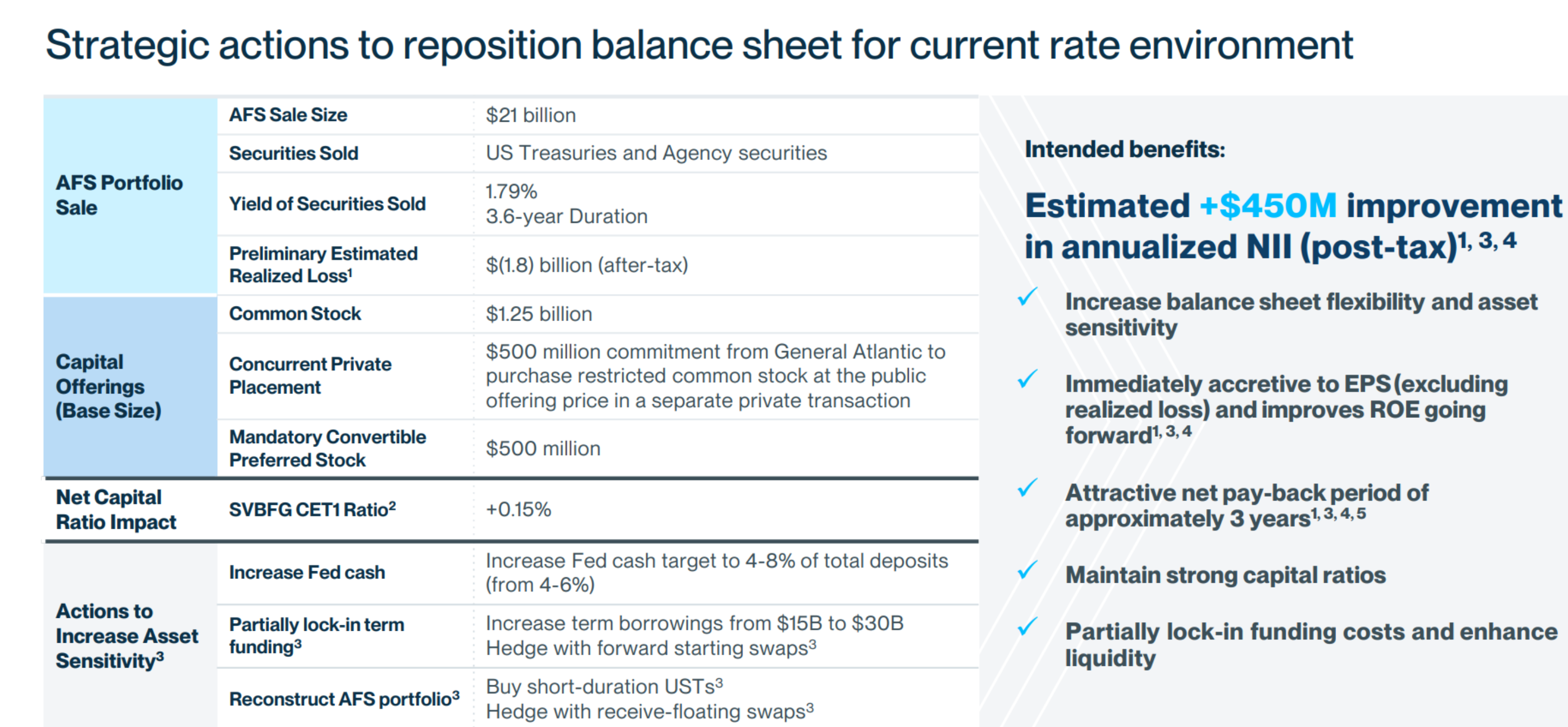

- SVB programSell US Treasuries/MBS in its available-for-sale financial asset portfolio (AFS), with a sale size of US$21 billion.

- This part is soldThe asset has a duration of 3.6 years and a yield of 1.79%. The sale will result in$1.8 billionafter-tax losses.

- Through different forms of equity financingRaised $2.25 billion in funding。

- One-pass operation is beneficial to its own capital adequacy ratio, and at the same timeChange your asset-liability strategy to match the current high interest rate environmentfirst level titleNII。

Investors' ideas need to be verified

Investors' negative interpretation of this incident is very simple and crude:

- sell assets =Buy high and sell low, The fixed-income assets that were bought at the top during the low interest rate period are now sold after the market price falls.

- Why can't you bear it when you can get it when it expires? illustrateThe debt side can't hold on, because the cost of the debt side has become higher with the Fed's interest rate hike.

- At the same time as the maturity mismatch,Loss of assets, running away with liabilities + becoming more expensive,Equity financing is more indicative of a possible lack of money.

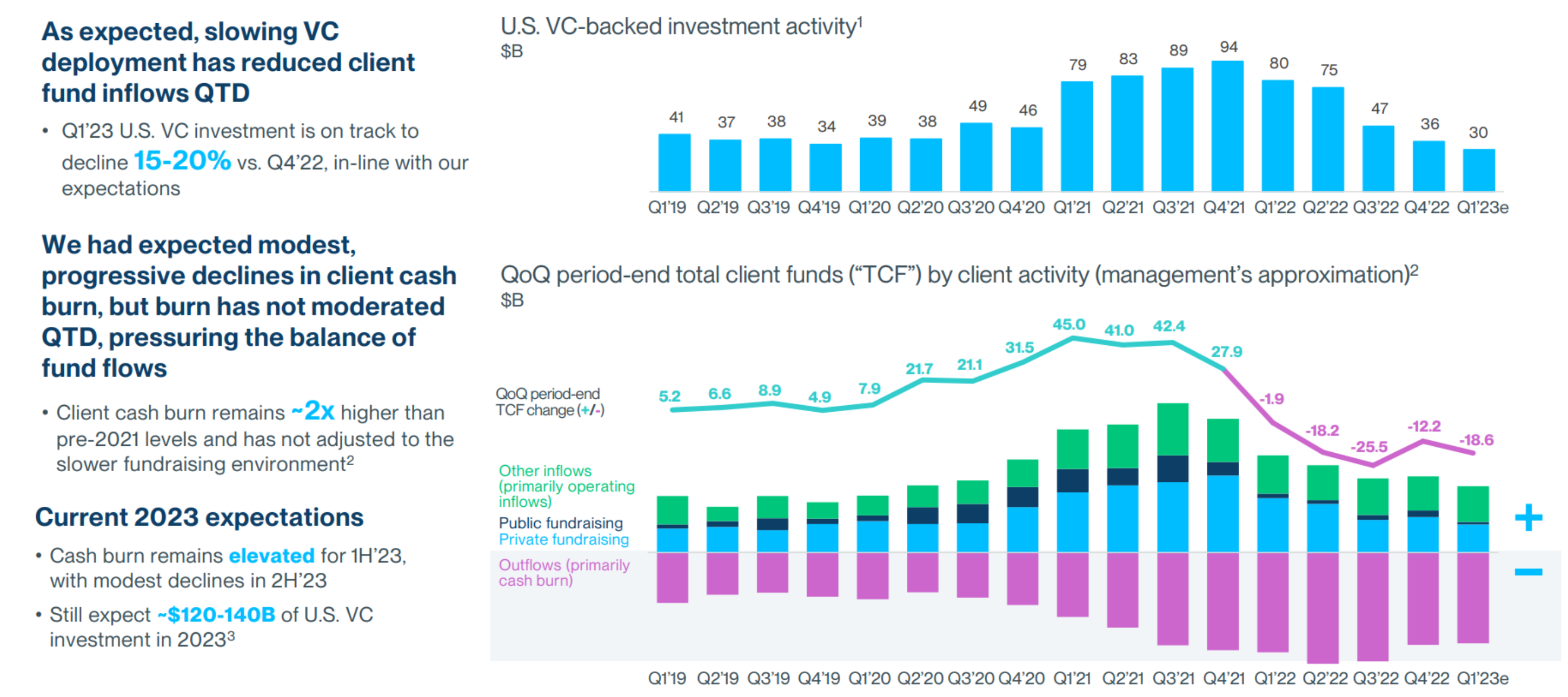

- The primary market is already precarious, Most of the customers are high-tech and medical-related companies, which need to burn money.

Here we need to make it clear that the problem of the financial industry has never been a maturity mismatch.Because finance is all about maturity mismatches.For banks, the tricky things are actually very intuitive - you just earn less on the asset side,Also because the Fed raises interest rates and is forced to pay high interest rates to customers, this business model itself is already unreasonable;In addition, customers request to remit their deposits, and you must remit them. At this time, you need to test your liquidity (reserve) reserves.You must find someone to borrow in the market。

Is there a problem with the interpretation of investors? no problem. Because if you look at SVB’s PPT, they actually know very well what investors are worried about:

What is this page trying to tell you?

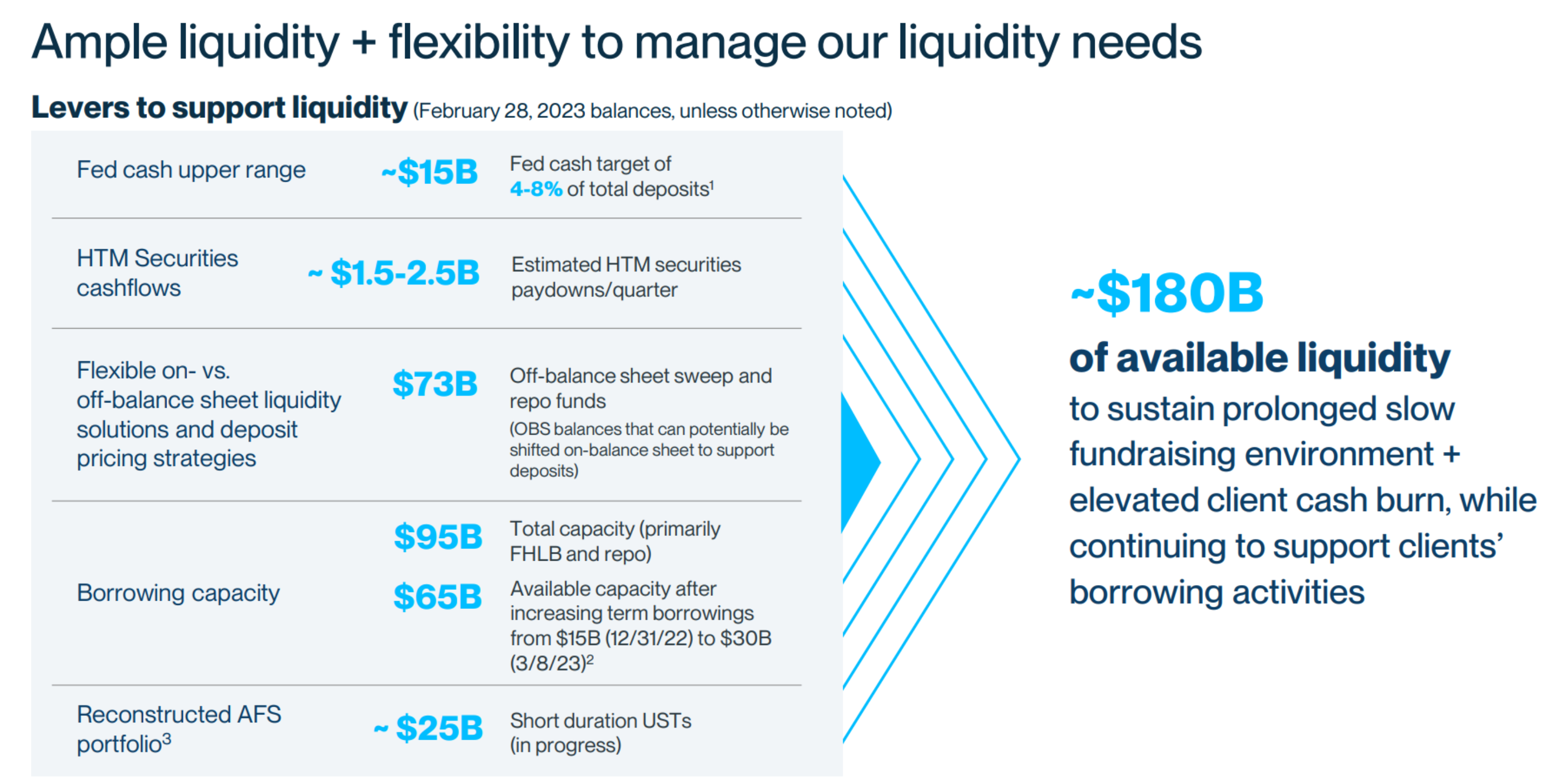

- We have ample liquidity reserves - that is, reserves at the Fed

- As part of our holdings of securities mature, there will be compensatory payments paid to us

- We have liquidity off-balance sheet

- We can borrow from FHLB, or use assets as collateral for repurchase financing

- At worst we can sell our short-dated debt inventory

- We have a total of 180 billion U.S. dollars in reserves, and it is a small case to deal with some risk situations!

first level title

The big one is coming?

Investors and self-media are mostly keen to create "the big one is coming", and then have further associations with the SVB event:

- whether customers of SVB will startrun on deposits? Just like the previous Crypto fieldDollar Bank Silvergate like that?The run on deposits here does not mean that customers go to the bank to queue up to withdraw cash, but that customers ask SVB to send money to some safer big banks, such as Chase.Once the customer has a request for withdrawal and remittance, the bank's payment obligation will cause it to need to remit money (reserve) to the target bank designated by the customer, which will constitute its liquidity pressure.

- Is SVB's credit asset quality also questionable? If the customers who make deposits are some technology companies,Will the loans to these technology companies be at risk?

We can still find verification inside the PPT...

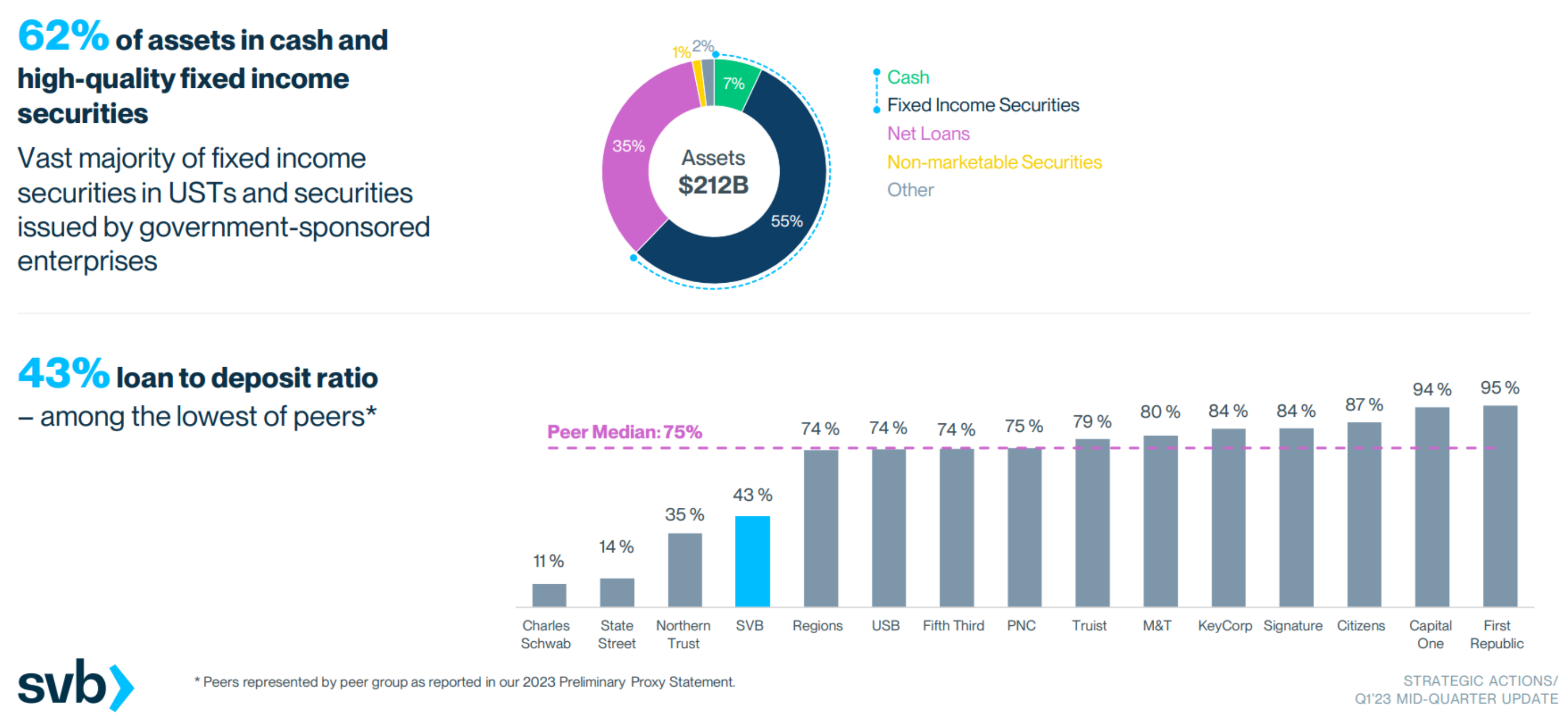

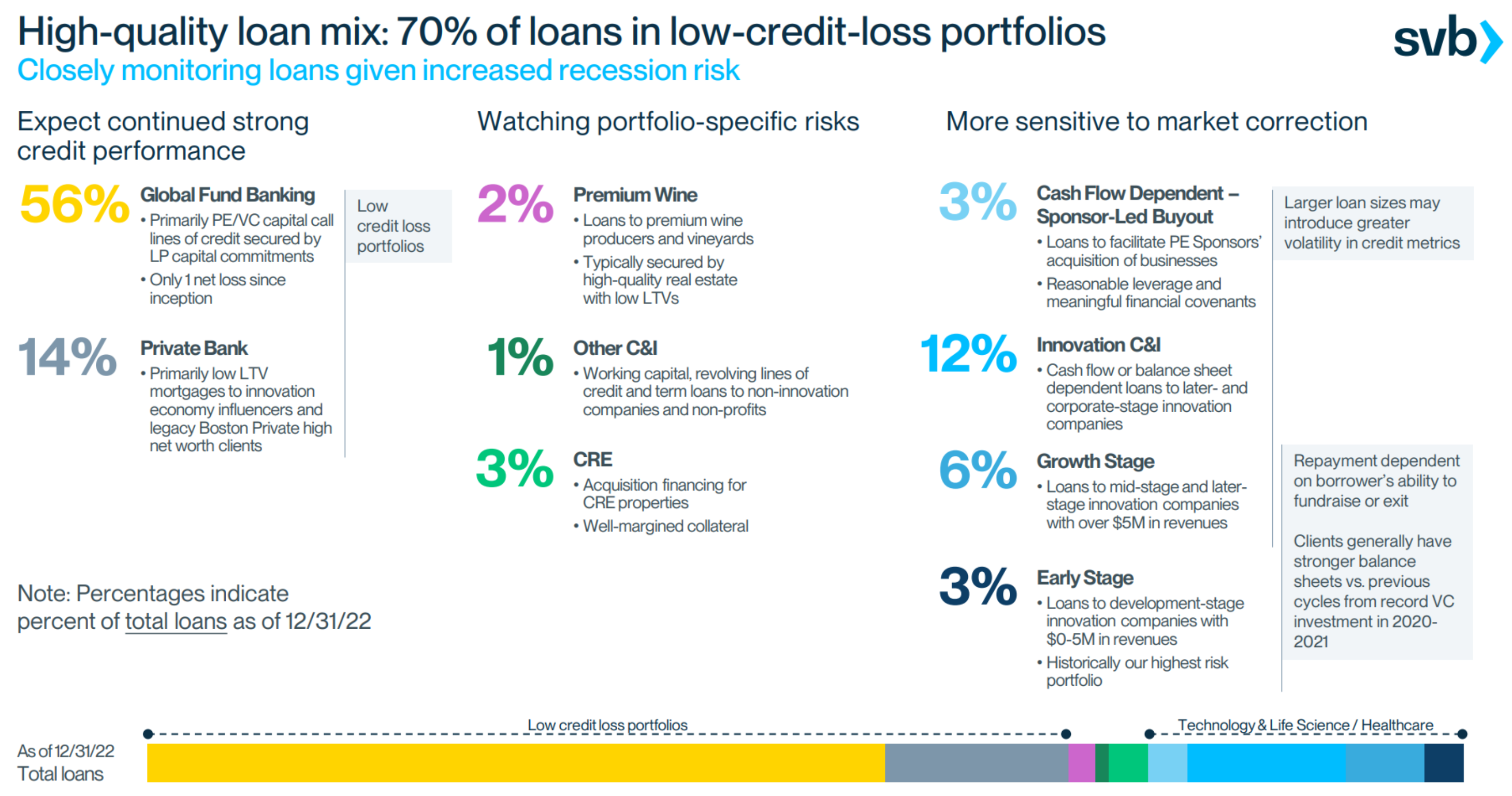

In short, the credit ratio of its asset portfolio is not high, and nearly 60% are recognized as "safe assets", but it was a loss.

The direct credit exposure to technology and medical care accounts for less than 30% of the credit, mainly loans to PE/VC in the primary market.

the author thinks,It is an exaggeration to assert that SVB's credit asset quality is not good based on the information of credit structure alone.

But... the pressure on the liability side is obviously significant, because in an environment of tight liquidity and high interest rates, it will become more and more difficult for companies to finance, and correspondingly, their account opening banks will get less deposits. At the same time, technology Enterprises also have extremely high capital expenditure needs, and their bank accounts are forced to remit money to other banks on behalf of customers.

Figure: SVB is well aware of the plight of its customers in the industry,first level title

Is there a bigger one?

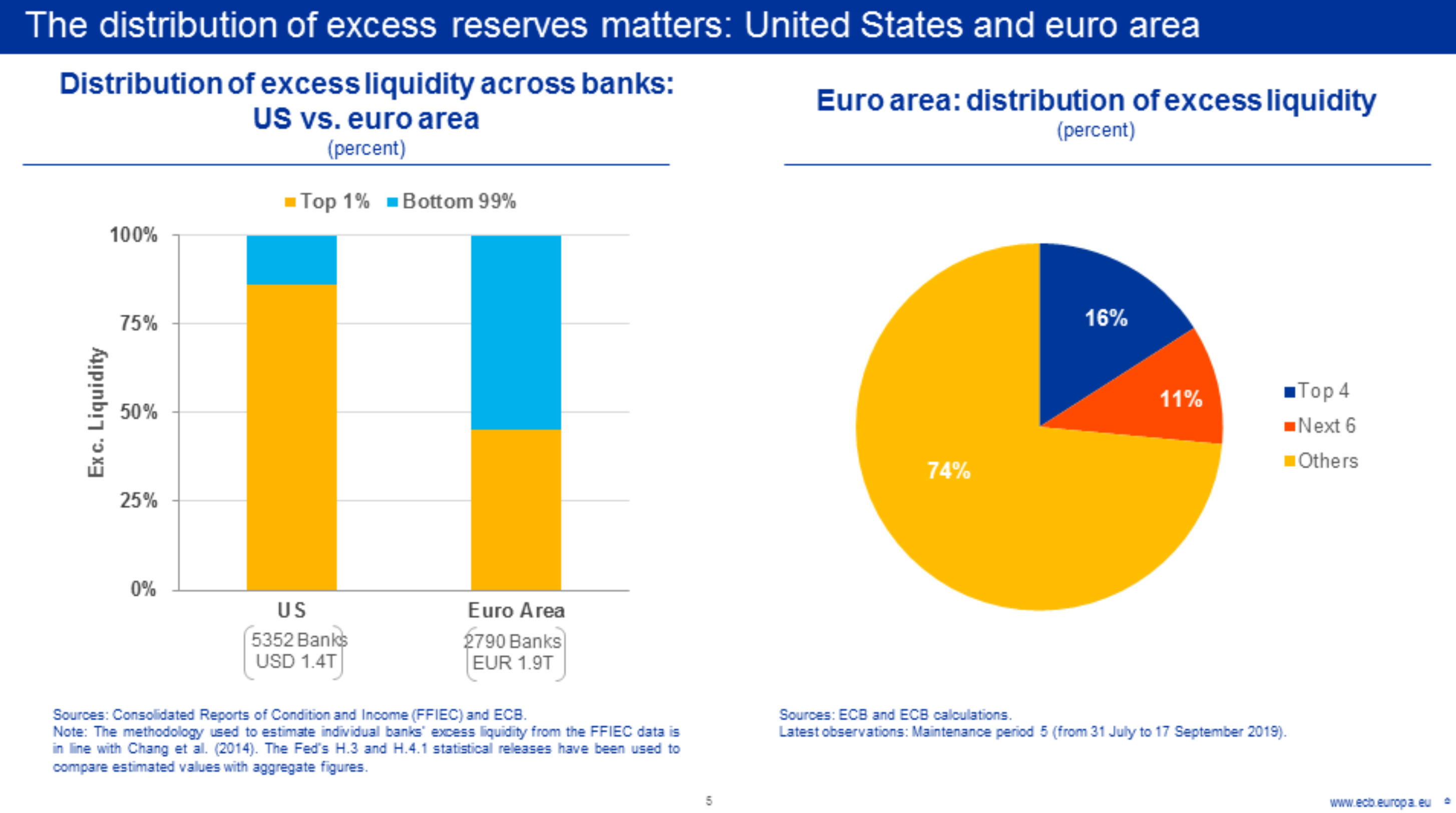

As a researcher of the U.S. dollar system, my job orientation is to capture those "bigger" information... In recent months, I have been thinking about whether the liquidity reserves of small and medium-sized banks in the United States are sufficient. During the period of shrinking the table (2018-2019), when I was translating the speeches of European Central Bank official Corey, I found that liquidity researchers always pay too much attention to the total amount and ignore the structure, and Corey talked about the distribution of liquidity Questions are also very important.

picture:The holdings of excess reserves in the U.S. financial system are highly concentrated.According to data from the Federal Deposit Insurance Corporation (FDIC),86% of excess reserves are held by just 1% of US banks. Just four banks account for 40% of total U.S. excess reserves.(end of 2019)

Therefore, since the Fed launched QT, the liquidity adequacy issue of small and medium-sized banks has been echoing in my mind. Investors can indeedTracking the Fed's Discount Window Facility and SRF Facilityto observe urgent liquidity needs in the market, butUsually when the central bank reaches this step, the liquidity situation is already quite urgent.

Since Zoltan does not continue to cover the liquidity conditions of the money market and the US banking system, I can only use some three-legged skills I learned from him in the last cycle to observe the liquidity pressure of the entire system. There are already some signs of tightening in currency markets.

- Sponsored buybacktransactions are on the rise

- FHLBsThe balance sheet is expanding rapidly (FHLBs are similar to the Fed in the US banking system)

- Financial institutions in the Fed'sovernight overdraftOn the Rise (Overdraft)

- Local banks inBorrowing in the fed funds market is on the rise

- The liquidity level of small banks hasdown to 2019 levels

Of course, the above signals only show thatThe current tightening by the Federal Reserve has been very effective, and liquidity is indeed very tight, but to draw the conclusion that "the big one is coming", I am afraid that we still have to see the three major emergency liquidity tools of the Federal Reserve being invoked to be reasonable.

Long story short, this is the end of the SVB issue. The question of whether the Fed will be forced to change is another story.