existSilverGateexist

At the moment when FUD was encountered due to failure to submit the 10-K report on time, Signature Bank, which is also an encryption-friendly bank, submitted the 10-K report on March 2, and announced the 2023 Q1 mid-term financial status update on the 3rd, proving to the market own ability to continue operating.

The two banks are inseparable from the FTX thunderstorm incident, and both have been questioned and accused of participating in it or not reporting it. However, Signature Bank announced in Q4 of 2022 that it will reduce the deposit share of encrypted customers and obtain loans of more than US$10 billion during the same period to alleviate the liquidity crisis caused by user withdrawals.

So far, the financial status of Signature Bank has gradually stabilized, and institutions such as Coinbase and Circle have "abandoned Silvergate and transferred to Signature". This article will summarize the 10-K report and the essence of the 2023 Q1 interim report to glimpse the future direction of the leading encrypted bank.

Crypto deposits account for 20% of total deposits

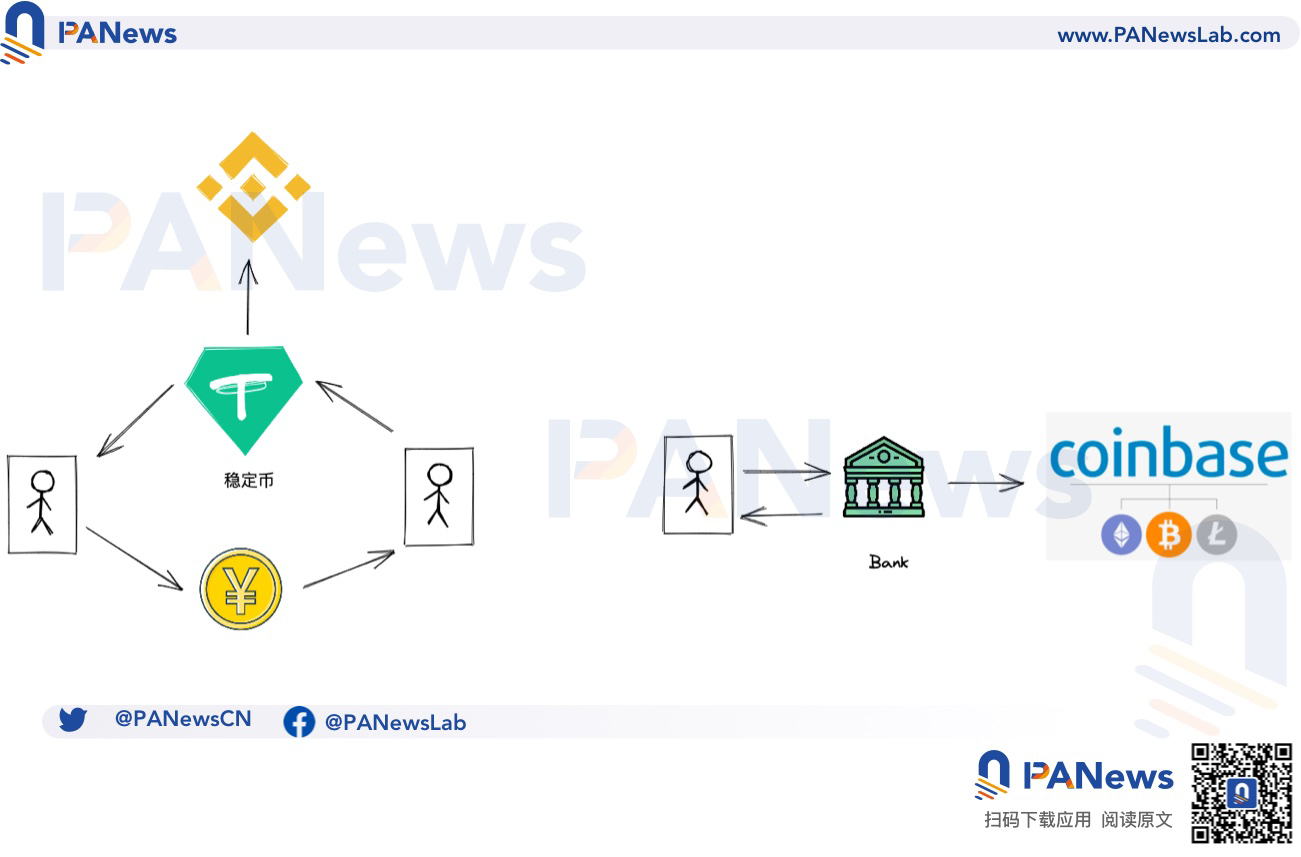

Signature Bank is an important part and pillar behind the American encryption ecology. Different from the C2C deposit and withdrawal models of Chinese exchanges such as Binance, Huobi, and OK, encryption-friendly banks have given customers in the United States and other regions legal currency deposit and withdrawal channels. In other words, in Chinese-based exchanges, stablecoins such as USDT are the core of market operations, and they take on the dual roles of fiat currency deposits and withdrawals and encryption market trading pair pricing, while in overseas exchanges such as Coinbase, Kraken, and FTX, The foundation of the entire architecture is the bank, whether it is Silvergate's SEN or Signature's SigNet, they all act as bridges connecting cryptocurrencies and fiat currencies.

Encryption friendly bank Signature "soft landing": Tighten users and actively reduce the scale of encrypted deposits

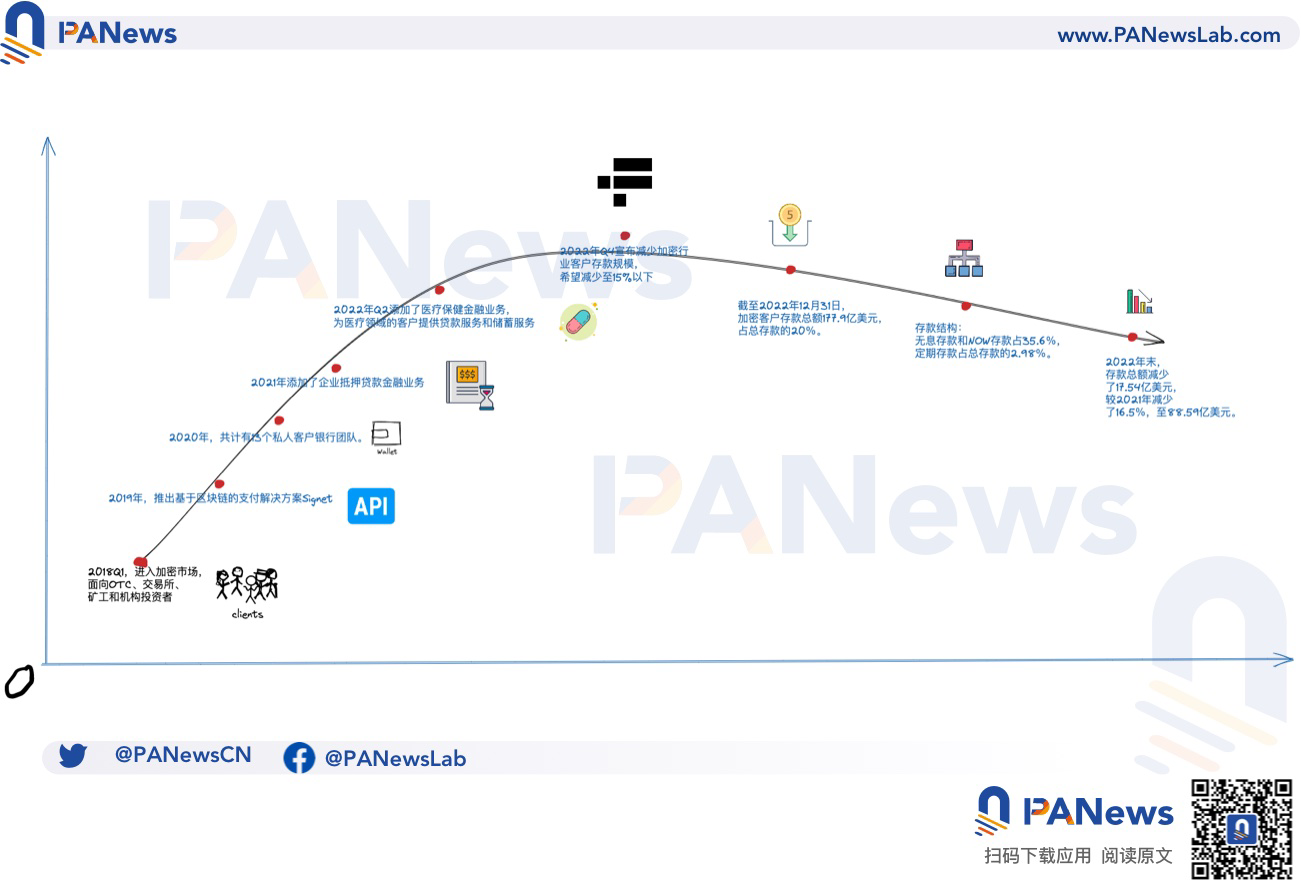

The rise of Signature is inseparable from the cryptocurrency market, especially exchanges. In 2018, Signature entered the encryption market, mainly providing services to exchanges, investment institutions, Bitcoin miners and OTC, as well as market makers and stable currency issuers. In 2019, the blockchain-based Signet network was launched, which has also become the main means of attracting crypto customers.

After the FTX incident, most crypto-friendly banks have encountered operational crises. In the current information disclosure, Signature detected the possible fraudulent behavior of FTX as early as June 2020, but chose to ignore it for its own benefit. In Q3 of 2022, most crypto-friendly banks experienced serious deposit loss. In terms of deposit amount, in Q3 of 2022, the two largest crypto banks, Signature Bank and Silvergate, reported quarterly declines of 8.9% and 10.8%, respectively.

In the fourth quarter of 2022, Signature announced that it will gradually reduce the share of cryptocurrency deposits, and gradually withdraw from the stablecoin market business, and liquidate some small-scale accounts. The ideal goal is to drop it below 15%, and it plans to reduce it by 8-10 billion US dollars. As of December 31, 2022, total Signature deposits decreased by $17.54 billion, of which crypto assets decreased by $12.39 billion, total deposits fell to $88.59 billion, and crypto deposits totaled $17.79 billion, accounting for about 20% of total deposits

Currently, Signature has $110.36 billion in total assets, a total of $88.59 billion in deposits, $74.29 billion in loans, $8.01 billion in equity capital, and $5.17 billion in assets under management. In terms of deposit structure, interest-free deposits and NOW deposits (negotiable payment order accounts, interest-bearing demand deposits) accounted for 35.6% of the total deposits on December 31, 2022, and time deposits accounted for 2.98% of the total deposits.

image description

A glance at Signature's important development nodes

Unstable cash flow, but sufficient solvency

The main problem of Signature is that the cash flow is still not stable, and the securities investment business of about 26 billion cannot respond to the liquidity needs in a timely manner, mainly MBS (Mortgage-Backed Security, real estate mortgage-backed securities), and there are still a large number of loans that need 2 years The above payment cycle does not immediately respond to withdrawal requests. As of December 31, 2022, while Signature stated that approximately 98% of financing loans had collateral, there were also some unsecured loans, often to individuals with substantial net worth.

Earlier in January, the Wall Street Journal reported that FHLB (Federal Home Loan Bank) had provided Signature with a $10 billion loan in the fourth quarter of 2022. With the support of this loan, Signature can still maintain normal operations, providing deposit and loan services to customers. But at the same time, Signature is also required to hold 1.0% of the total principal amount of outstanding residential mortgage loans and related debts in Federal Savings Bank stock at the beginning of each year. As of Dec. 31, 2022, FHLB held $10.21 billion in commercial real estate loans and $18.45 billion in securities, some of which were used as collateral.

Judging from the 10-K report, Signature Bank's diversified business is successful, and it has not really given up on the encryption market. It still maintains cooperation with most mainstream exchanges, and its current cash flow is relatively sufficient. . However, because Signature restricts small-amount activities, Binance, Coinbase, and Kraken are gradually implementing restrictions on non-enterprise or retail accounts that cooperate with Signature, which is not friendly to retail investors and means that there is one less channel for capital in and out .

On March 3, Signature announced its financial update statement for Q1 2023, with the main focus on updating the deposit structure. Average deposits in Q1 2023 were $88.79 billion, up from $88.59 billion on Dec. 31, 2022, but down from $98.6 billion in Q4 2022. Net deposits decreased by approximately $826 million, with deposits increasing by $682 million, but withdrawals amounted to $1.51 billion.

In addition, the scale of loans has been continuously reduced to ease cash flow pressure, reduce the loan balance of larger business lines, reduce the amount of spot mortgage loans by about 1.71 billion US dollars, and ensure that encrypted assets will not be used as loan collateral.