This article comes fromdecrypt, original author: André Beganski

Odaily Translator |

This article comes from

Odaily Translator |

On March 2, Silvergate Capital Corporation, the holding company of the crypto-friendly bank Silvergate Bank, announced the delay in submitting its annual 10-K report to the US Securities and Exchange Commission (SEC), while claiming that it may face insufficient capital and is re-evaluating its business. Silvergate claims that accounting firms and independent auditors have requested more information in response to a potential US congressional inquiry and subsequent investigations by the Justice Department and bank regulators.

After the news came out, the entire digital asset industry expressed their desire to keep a distance from Silvergate, and Silvergate's stock also fell like a waterfall version. It fell to $5.72 at the close of trading on Thursday, a drop of 57.69%. The all-time high of $222 created during a wave of encryption bull market has shrunk by more than 93%.

1、Coinbase

secondary title

2、Crypto.com

The Crypto Industry Is Ditching Silvergate

3、Bitstamp

Silvergate has confirmed that a series of recent incidents may affect its ability to continue operations. This situation is obviously not what the encryption industry wants to see. As soon as this news came out, many encryption companies and exchanges expressed their stances and distanced themselves from their relationship with Silvergate. .

4、Gemini

Coinbase was the first crypto exchange to announce that it would no longer cooperate with Silvergate. On the evening of March 2, Coinbase announced on social media that in view of recent developments and out of caution, it will no longer accept or initiate payments with Silvergate, and will no longer Get Silvergate as your USD banking partner for Prime customers. Coinbase also admitted that it has minimal corporate exposure to Silvergate and has switched its US dollar banking to Signature Bank, a change that does not affect payment orders in British pounds or euros.

5、Circle

Crypto.com, a Singapore-based cryptocurrency exchange, also announced that it would also refuse to transfer funds to and from the platform through Silvergate, and a spokesperson for the exchange also confirmed that "deposits and withdrawals through Silvergate are suspended."

6、Paxos

On March 3, Bitstamp issued a statement on its official blog stating that the Luxembourg-based cryptocurrency exchange has temporarily canceled the Silvergate Exchange Network (SEN) service for all users, as well as all USD wire transfer support through Silvergate Bank, For instant USD payments, Signature Bank's SigNet service is currently required. In addition, Bitstamp clarified that its platform customer funds are safe, Bitstamp has no significant risk to Silvergate Bank, the exchange works with 17 banking partners around the world, and has implemented alternative banking services to ensure minimal disruption to customers.

7、Tether

The cryptocurrency exchange "Gemini" Gemini stated in its official Twitter that it is actively monitoring the Silvergate Bank situation, but no GUSD and customer funds are deposited in the bank. In addition, the exchange has stopped customer deposits/withdrawals through ACH, The transfer of funds from Silvergate Bank to Gemini has also been suspended.

8、Galaxy Digital

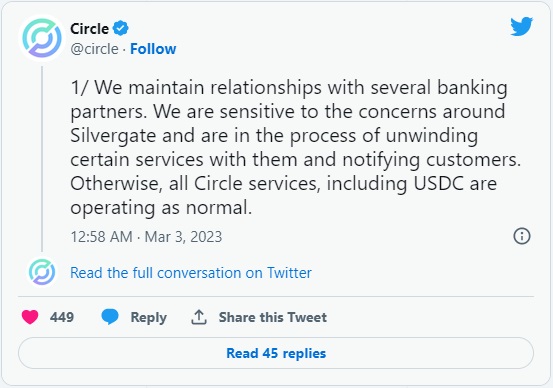

Circle, the issuer of the US dollar stablecoin USDC, posted on social media that Circle has kept in touch with a number of banking partners, and is currently paying close attention to market concerns about Silvergate, and is releasing some of its services with Silvergate. Circle said that it will notify customers of relevant progress in a timely manner. Currently, all Circle services including USDC are operating normally. Circle has multiple reserve and settlement bank partners who are responsible for managing USDC's cash reserves and providing strong liquidity management.

9、Cboe Digital

On the evening of March 2, Paxos, the issuer of the US dollar stablecoin BUSD, issued a statement to Silvergate Bank on social media, stating that the company has no substantive contact with Silvergate, and that Paxos’ top priority has always been to protect its customers’ funds and assets, and to utilize A diverse network of banking partners.

10、MicroStrategy

Galaxy Digital, Mike Novogratz’s crypto investment firm, tweeted that in light of recent developments, Galaxy has stopped accepting or initiating transfers of funds to Silvergate. As a company, Galaxy has no material contact with Silvergate and this action was taken out of an abundance of caution and as part of a risk management process to ensure the safety of customers and company assets.

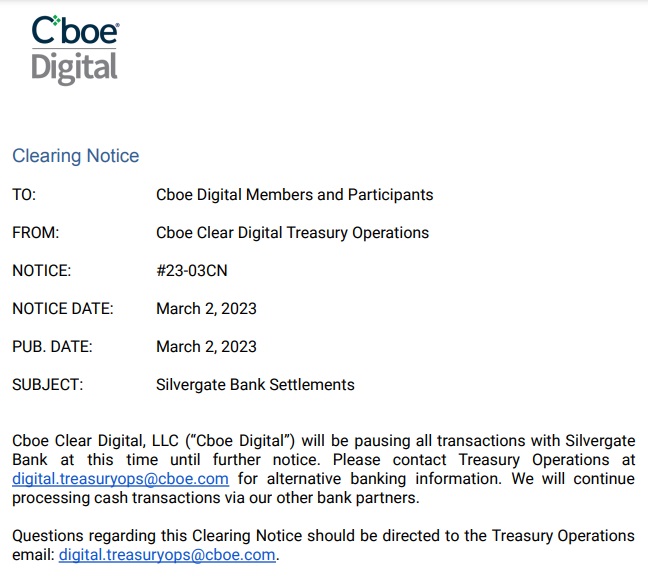

Cboe Digital also immediately issued a clarification to its members and participants that it will suspend all transactions with Silvergate and use other banking partners to process cash transactions.

As the listed company holding the most Bitcoin, MicroStrategy confirmed that there is a loan from Silvergate, but it will not be due until the first quarter of 2025. The company stated that this loan will not accelerate the progress of Silvergate's bankruptcy, while confirming the Bitcoin collateral Not hosted by Silvergate and has no other financial relationship with it other than this loan.

secondary title

Another "casualty" of the FTX debacle?

Silvergate is actually another "victim" of the FTX collapse. Due to the collapse of FTX, Silvergate bank deposits have fallen sharply. It previously reported that it processed a large number of withdrawal transactions in the last fiscal quarter of 2022. In January alone, $8.1 billion was withdrawn. The run was filed, accounting for 68% of its deposit balance. In order to meet the high demand for withdrawals in the crypto market, Silvergate had to obtain a $4.3 billion loan from the Federal Home Loan Bank and sold debt securities worth about $5.2 billion.

The poor performance of Silvergate Bank even aroused the anger of members of the US Congress. Senator Elizabeth Warren had led a letter to Silvergate CEO Alan Lane, asking for stricter scrutiny of Silvergate's transactions with FTX and Alameda. The FTX exchange deal would "further introduce crypto market risk into the traditional banking system."

In January, the U.S. Department of Justice launched an investigation into Silvergate's handling of account funds for FTX, specifically allowing FTX to deposit deposits, including user funds, into Alameda Research accounts.