1. Overall overview

1. Overall overview

The Beta version of the Polygon zkEVM mainnet will be released on March 27. Polygon did not specify what the beta network will contain, but said that the team will release more details in the coming weeks. Last October, Polygon launched its zkEVM testnet, which deploys the Ethereum Virtual Machine (EVM) for its ZK rollup, allowing Ethereum developers to transfer their smart contracts from the main blockchain without using a different Language reprogramming. In December last year, Polygon zkEVM launched the final testnet version.

Second, the secondary market

Second, the secondary market

1. Spot market

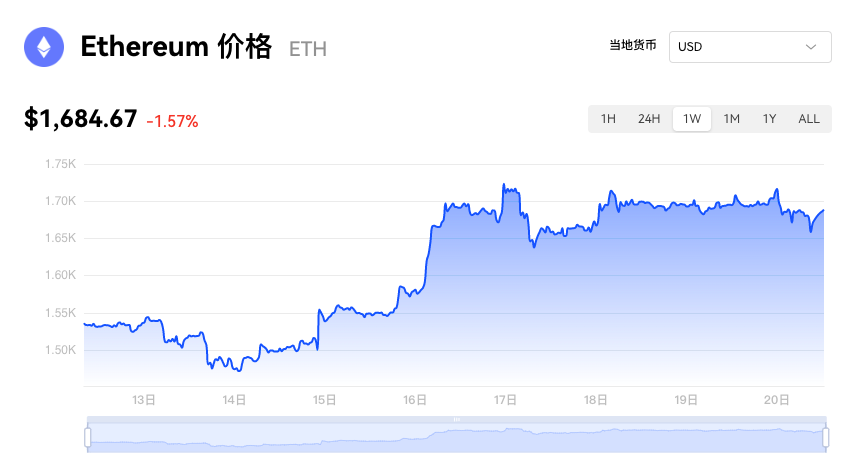

According to OKX market data, the price of ETH once rose above $1,700 last week and closed at $1,716 during the week, an increase of 11.7% month-on-month.

image description

The daily chart shows that the price is currently consolidating around $1,680. In the short term, the price may continue to test $1,700 upwards. If the support is valid, it is expected to continue to hit $1,800. The lower support is $1,650.

2. Network operation

etherchain.org3. Large transaction

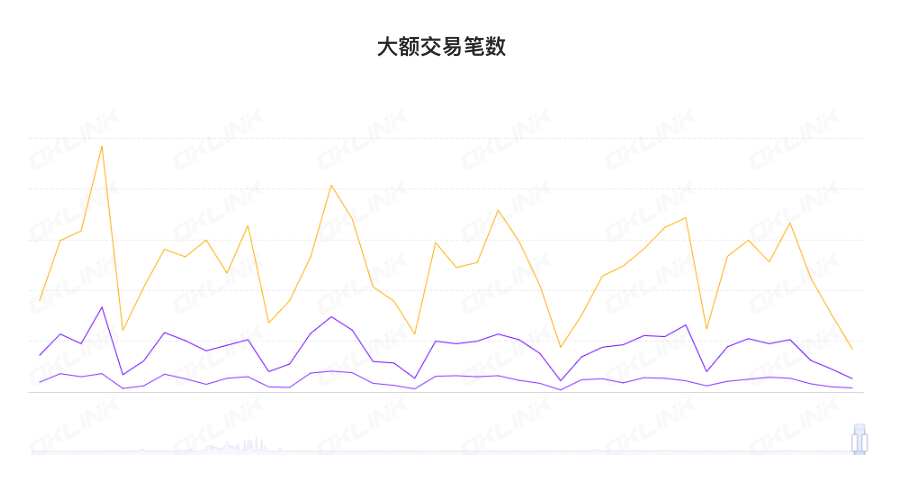

3. Large transaction

OKlink data4. Rich list address

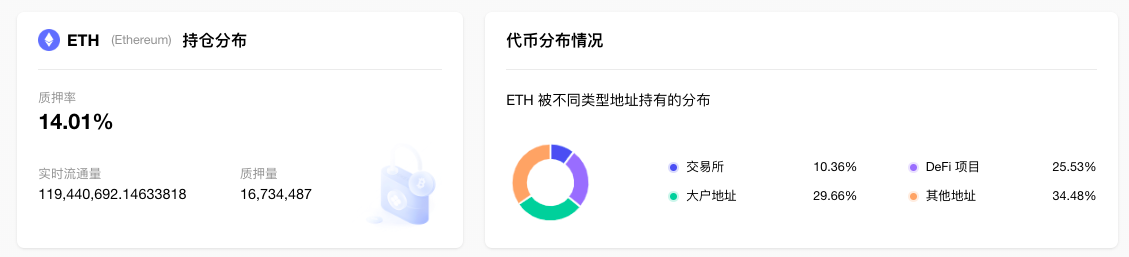

4. Rich list address

OKlink data3. Ecology and technology

3. Ecology and technology

1. Technological progress

Ethereum developer: There is a problem with the Shapella withdrawal test, and the development team believes that it will not affect the Sepolia upgrade time

Additionally, Barnabas Busa launched the latest withdrawal Devnet for stress testing Shapella. The Devnet has 600,000 validators, 360,000 of which performed withdrawal credential updates at the time of the fork. Clients are seeing a spike in RAM + CPU usage, and the devops team will be monitoring the dev network over the next few days to see how many credential update messages are being included and lost. The test also revealed a Prysm Besu issue, where Besu limited the number of responses it sent over RPC to prevent DoS, but Prysm was expecting a higher number of responses than Besu's current limit. The Besu team is currently investigating the matter. In addition, the developers are planning another mainnet shadow fork, on which some Mev-Boost tests will be done.

2. Voice of the Community

The Ethereum address that has been silent for 7.5 years is activated, containing 100 ETH

The sudden activation of the dormant address sparked mixed reactions from the cryptocurrency community on Twitter. Some believe that the owner of the address may be planning to stake ETH, while others believe this may be the start of more dormant addresses being reactivated. Some Twitter users expressed concern about the sudden activation of dormant addresses. "Time to sell," tweeted user @nawttrolling, while others speculated that the sudden activation could be a sign of a market correction or manipulation. (U. Today)

3. Project trends

(1) Polygon zkEVM Mainnet Beta will be released on March 27

(2) The Lido DAO community is discussing multiple proposals including "sell or pledge $30 million worth of ETH"

The Lido community is discussing two governance proposals submitted by Steakhouse Financial, the financial arm of the Lido DAO, that would require the project to stake or sell ether held in its treasury.

Lido DAO holds 20,304 Ethereum worth $30 million as part of its $350 million treasury. These funds are held in the project's Aragon contract like funds in other treasuries. Lido has held these ETHs since completing the fund diversification process in April 2022.

(3) The Rocket Pool community has voted to pass a proposal to limit the proportion of its own ETH pledge

The proposal initiated by the Ethereum liquidity staking protocol Rocket Pool to limit its own ETH pledge ratio to 22% was passed with a support rate of 99.55%.

(4) Rocket Pool has been invested by Coinbase Ventures

(5) The Aave community initiated a proposal to freeze BUSD on the Aave V2 Ethereum market

(6) OFAC-compliant blocks on Ethereum hit a three-month low, dropping to 47%

(7) The Symbiosis community voted to approve the proposal on "transferring SIS tokens from Ethereum to BNB chain"

(8) The Graph has completed the first phase of the Arbitrum One expansion plan, and index rewards will be enabled in the second phase

According to official news, the decentralized index protocol The Graph has completed the first phase of the Arbitrum One expansion plan, aiming to increase the speed of user participation in the network and save Gas fees through L2 expansion.

The Graph's plan to expand on L2 using Arbitrum One is divided into three phases. The first phase of deployment and activation of the protocol is now complete. The protocol will coexist on L1 and L2, but the GRT token smart contract will continue to exist on L1 , GRT can only be used across the chain from Ethereum to Arbitrum through the GRT bridge, and currently index rewards cannot be used.

(9) Gnosis Chain Lianchuang proposed a proposal to reduce external dependencies and increase the security of GNO tokens

Martin Köppelmann, co-founder of Ethereum sidechain Gnosis Chain, has proposed plans to reduce external dependencies and increase the security of the GNO token on Ethereum and Gnosis.

(10) Infrastructure provider Flashbots launches new protocol MEV-Share

MEV-Share is a new protocol that allows Ethereum users to benefit from the profits generated by MEV and become part of the transaction supply chain. Robert Miller, product lead at Flashbots, said that by introducing a new entity called a "matchmaker," MEV-Share can match transaction packages from searchers with user transactions, allowing searchers to further optimize their MEV capture works. Sensitive user transaction details such as wallet addresses will remain private, the team said. (The Block)

4. Borrowing

DeFiLlamaThe data shows that the value of locked collateral on the chain rose from $27.88 billion to $29.62 billion last week, a 6.2% increase in the week. Specifically, the number of ETH mortgages dropped from 18.4 million to 17.63 million last week, a drop of 4.1%. From the perspective of individual projects, the top three lock-up values are: Lido 8.82 billion US dollars; MakerDAO 7.49 billion US dollars; Curve 4.69 billion US dollars.

4. News

(1) Interactive Brokers launches cryptocurrency trading in Hong Kong, supporting BTC and ETH

(2) The Ethereum Foundation distributed $948,000 in rewards to 22 projects in the Layer 2 community

(3) Data: The number of addresses holding more than 100 Ethereum hit a new low in nearly a month