Original Author: Ans, Krypital Group

Original editor: Krypital Group

This article is for exchange and learning only, and does not constitute any investment reference.

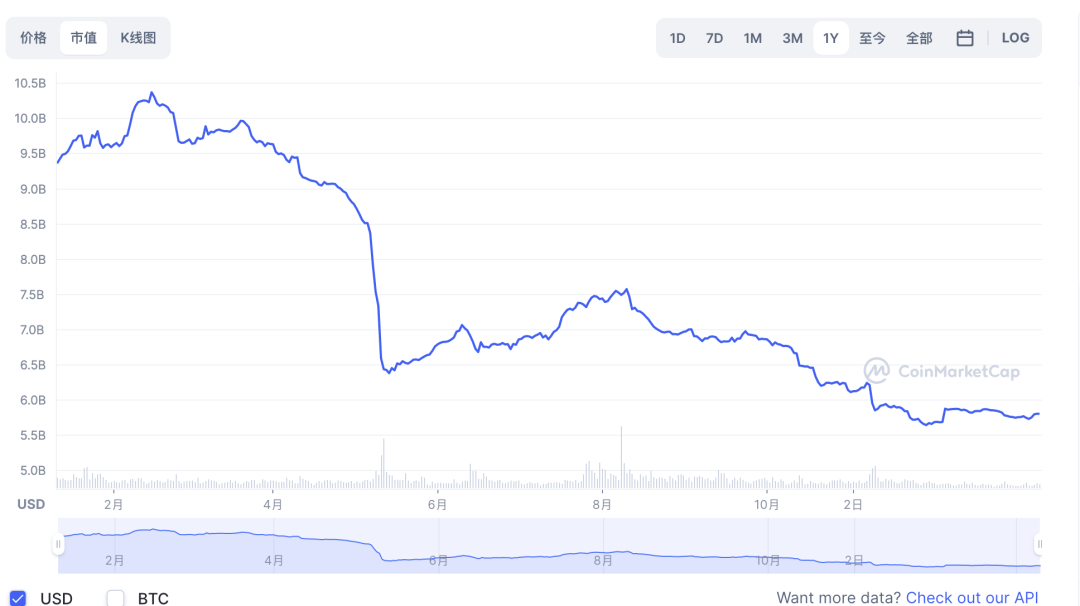

Makerdao is the first DAO organization established on Ethereum and one of the most successful applications of Ethereum. Even in a bear market, the amount of locked-up assets in this agreement has been ranked first for a long time. It was not until recently that Lido briefly surpassed it. Lido has received a lot of attention under the expectation of Eth 2.0 and Shanghai upgrade, and the currency price has also performed very well. In this bear market, although Makerdao is also a constant topic, it first cooperated with Coinbase on lending, and then passed a series of external credit loan proposals. It is constantly trying to increase the income of the balance sheet in various ways, but the performance of the currency price has not been stable. Good, then why such a high tvl did not bring benefits to the Token.

There have been many articles about analyzing Makerdao on the market before, but after its continuous development, it has undergone a lot of adjustments, some of which may bring higher income to it, and may also cause many new problems, such as its Mixed reviews of RWA real-world asset investment strategies. And behind the large-scale foreign investment, where is the source of its funds?

first level title

How Makerdao Profitable

For the convenience of readers who are not familiar with Makerdao before, here is a brief introduction to its mode of operation.

image description

https://oasis.app/borrow

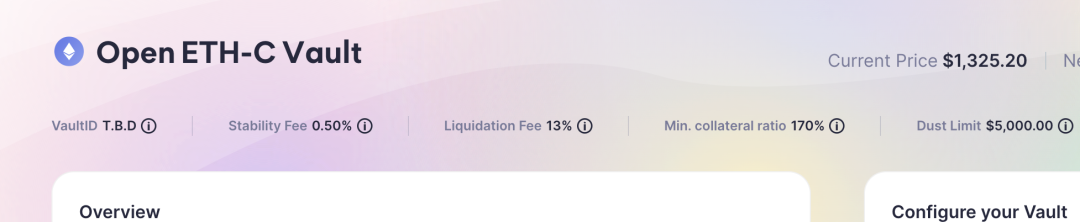

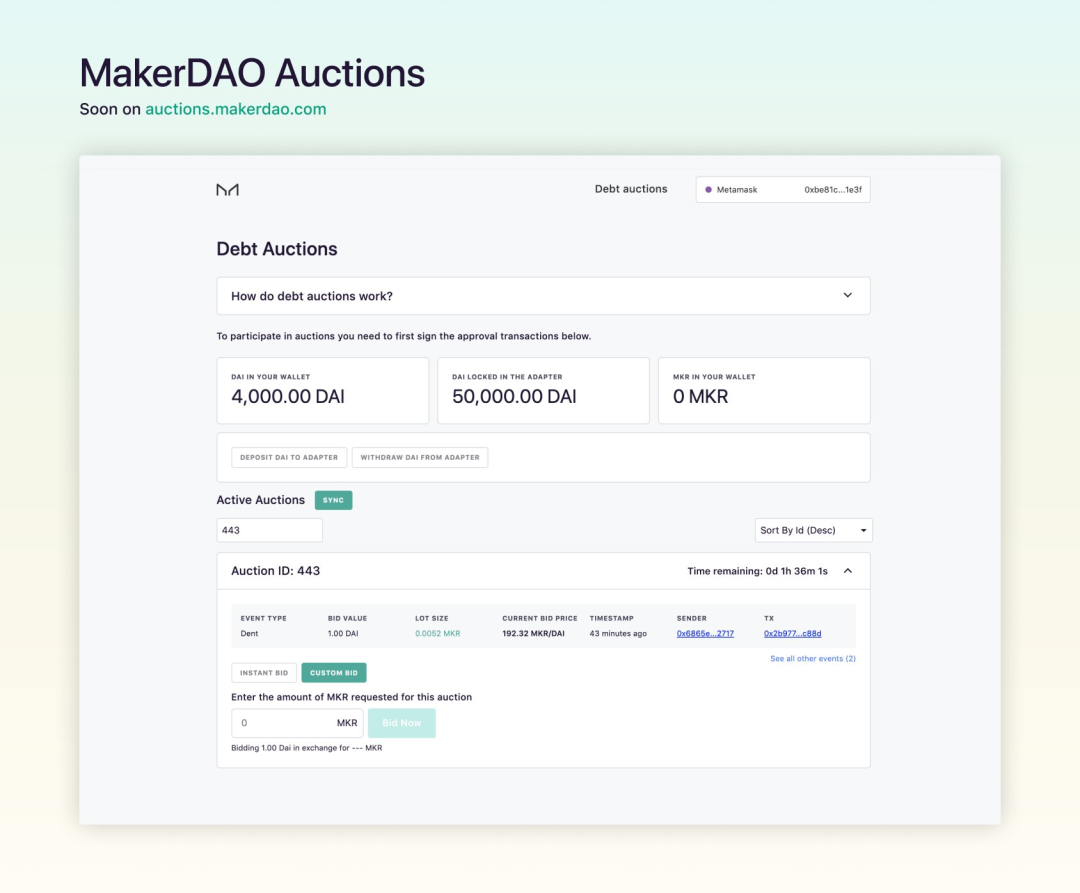

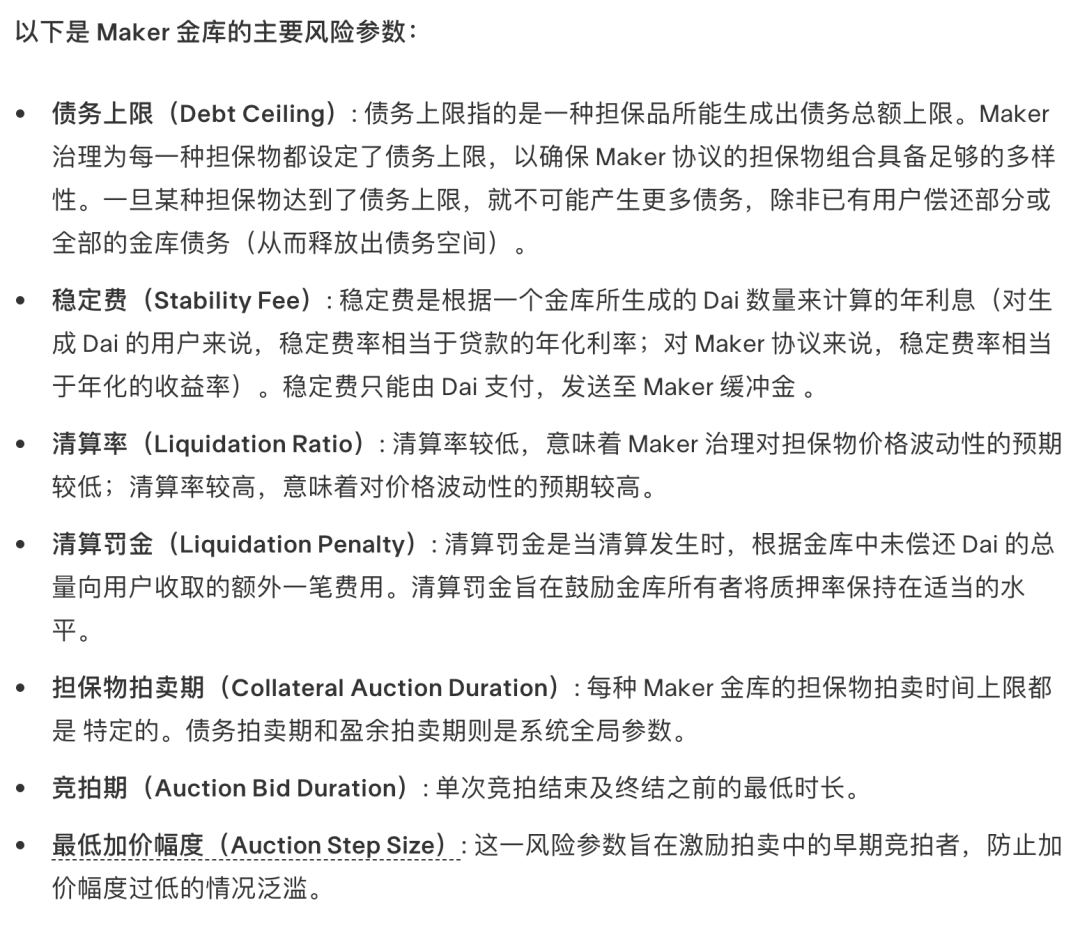

In Makerdao, each position is called Maker Vault. The value of Min. collateral ratio in the Vault represents the liquidation ratio, which refers to the ratio of the overcollateralization you need for the current collateral.

secondary title

Stability Fee Stability Fee

The current fee for staking eth to lend dai is 0.50% annually

If you need to close the position and take out the mortgaged assets, you need to repay the borrowed DAI and the stability fee at the same time

secondary title

Liquidation Fee

If the user's collateral price in the agreement drops sharply, but the user does not close the position or increase the mortgage funds in time, when the minimum pledge rate falls below, the Keepers liquidator in the ecology can send a request to the contract to liquidate these insufficient collateral Positions, at this time, the system will auction these collaterals at a discount, and the liquidator can use dai to bid to participate in the auction of these collaterals, which usually has a 3% arbitrage space.

Taking eth as an example, the current liquidation fee on Makerdao is 13%. If your pledged eth position falls below the minimum pledge rate and is liquidated, an additional 13% of assets will be deducted as a penalty. Part of the fine becomes the source of the liquidator's profit, and the rest belongs to the Makerdao agreement. Last year, Makerdao’s clearing fee income was approximately 27.6 million dai.

Keepers liquidator is actually a kind of arbitrage robot on the chain. Anyone in Makerdao can become a liquidator to participate in the auction. The team also provides open source robot code. https://docs.Makerdao.com/keepers/market-maker-keepers

secondary title

Makerdao system surplus and expenditure

secondary title

Buffer Gold Maker Buffer

As we mentioned earlier, if the mortgage rate of a certain position is insufficient, the collateral will be liquidated and auctioned. But when there are some extreme market conditions, or encounter other liquidity problems, such as 312. When the value of the collateral drops sharply and cannot be liquidated in time, the final auction price of certain position collateral may not be able to cover the debt. Bad debts will arise, and at this time, the buffer pool funds will be called to repay these debts to ensure the value of dai.

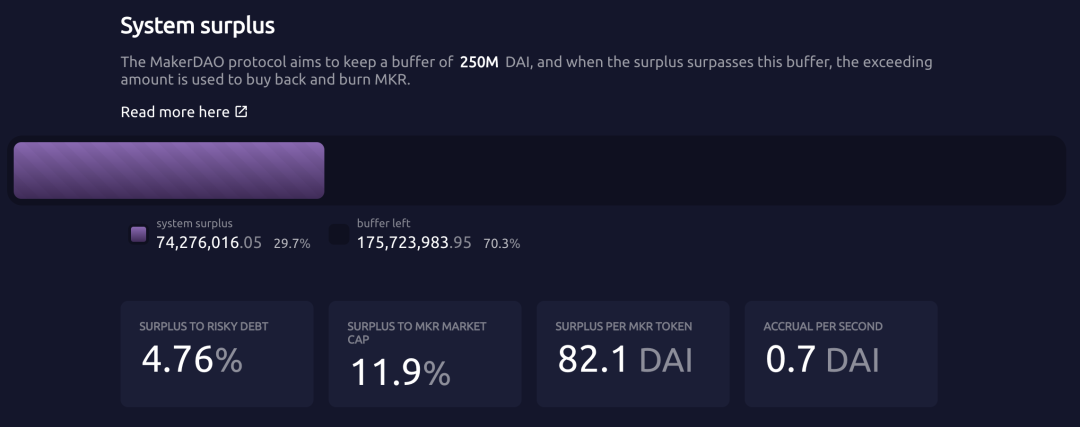

The current setting of this pool is 250 million dai. When the system surplus exceeds 250 million US dollars, Makerdao will start the surplus auction voting, and the excess dai will be auctioned in the market. Bidders can use MKR to bid, and the highest bidder will win. Once the surplus auction is over, the Maker Protocol will automatically destroy the MKR obtained from the auction, thereby reducing the total supply of MKR. (That is, through this mechanism to repurchase and destroy MKR from the market)

On the contrary, if the debt generated is large and the funds in the buffer pool cannot cover the loss, Makerdao will trigger the debt auction (Debt Auction) mechanism. During debt auctions, new MKR is minted (increasing the amount of MKR in circulation) and sold to those users who use Dai to participate in the auction.

In the extreme market on March 12, 2020, due to transaction congestion, the sudden drop in liquidity led to the superposition of dai premiums and other reasons, causing a large number of liquidators to stop participating in the market, resulting in 5.67 million DAI loans undercollateralized.

So on March 19, Makerdao launched its first debt auction since its launch. The auction lasted until the end of March 28, and finally 20,980 MKR were auctioned at an average price of 296.35 dai. A total of 5.3 million DAI was raised and the refinancing was successfully completed with mkr. Among them, the investment institution Paradigm stated that it bought 68% of the MKR in this auction.

In response to the problems in 312, Makerdao subsequently launched the liquidation 2.0 module, which further improved the auction mechanism and replaced the 1.0 English auction system with the Dutch auction system. On May 19, 2021, c. The value of ETH fell by 45% on that day, the 2.0 system processed positions worth 41 million US dollars, completed 177 auctions to liquidate debts, and generated 5.1 million US dollars in liquidation costs, while only generating two Liquidation losses totaling $12,000. It can be seen that the new liquidation system has been well stress tested.

secondary title

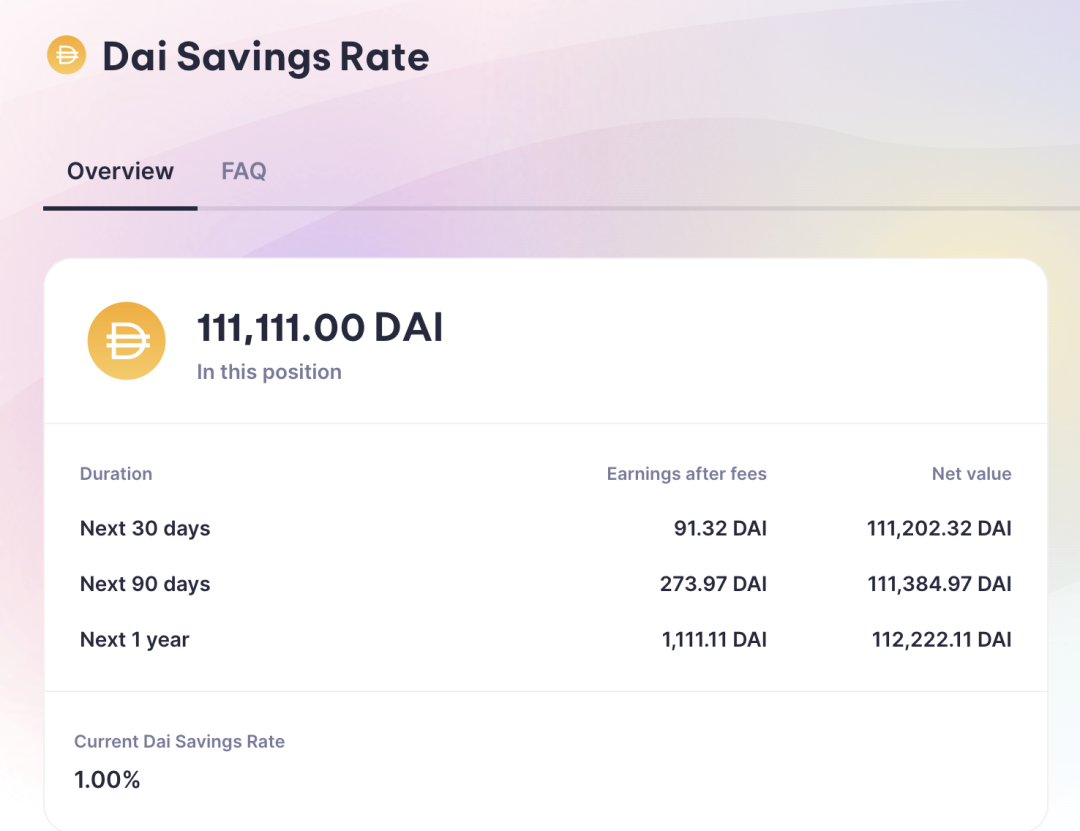

Dai Savings Rate (DSR)

DSR is a system-global parameter that determines the benefits that Dai holders can earn based on their deposits. When the market price of Dai deviates from the target price due to market changes, MKR holders can vote to change the DSR to maintain the stability of the dai price:

https://oasis.app/earn

If the market price of Dai exceeds $1, MKR holders can choose to gradually reduce the DSR to reduce the demand, thereby reducing the market price of Dai to the target price of $1.

If the market price of Dai is lower than $1, MKR holders can choose to gradually increase DSR to stimulate demand and increase the market price of Dai to the target price of $1.

secondary title

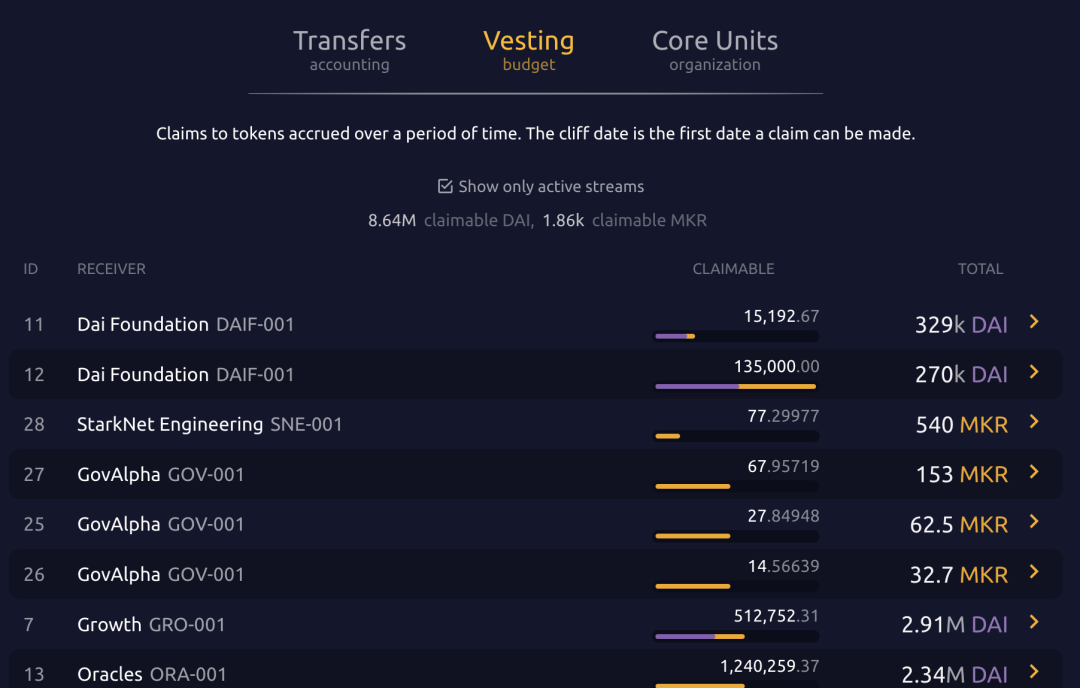

Makerdao team operating expenses

Makerdao currently has over 100 employees maintaining the system. In total, spending last year amounted to more than 45 million dai.

secondary title

https://makerburn.com/#/expenses/accounting

Value-added logic of Makerdao Token

secondary title

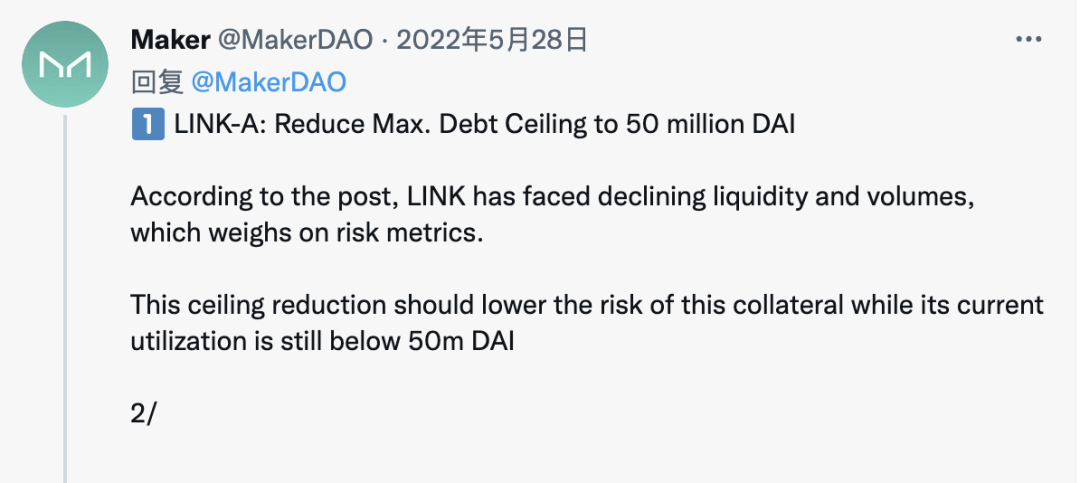

Composition of Makerdao tvl

Therefore, the profitability of Makerdao determines the speed of mkr deflation. From the circulation of dai, it can be seen that since entering the bear market, with the weakening of market demand for leverage and the sharp drop in defi yields, the size of dai has almost halved. Makerdao's stability fee and liquidation fee income are naturally also greatly affected. As of the publication of this article, there are only 74 million dai in Makerdao's surplus pool. Far from meeting the criteria for triggering repo destruction.

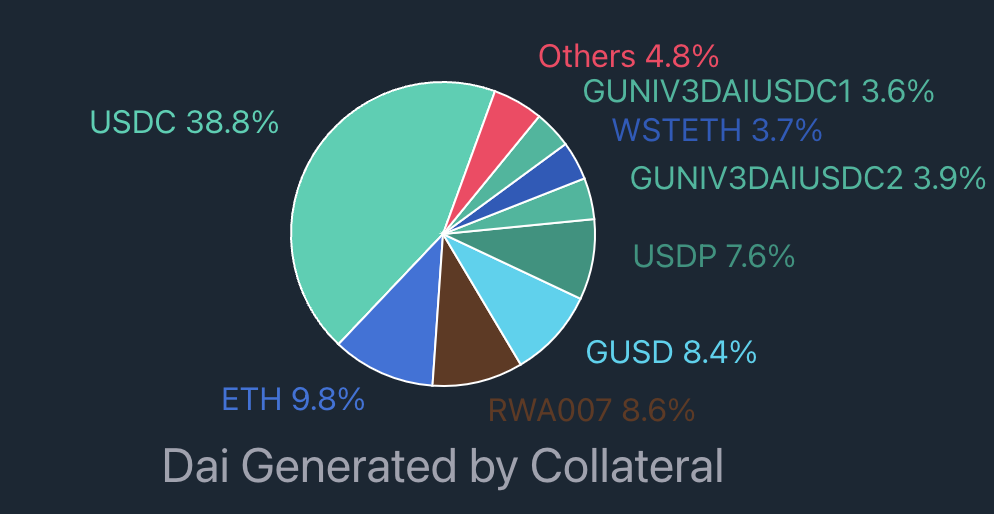

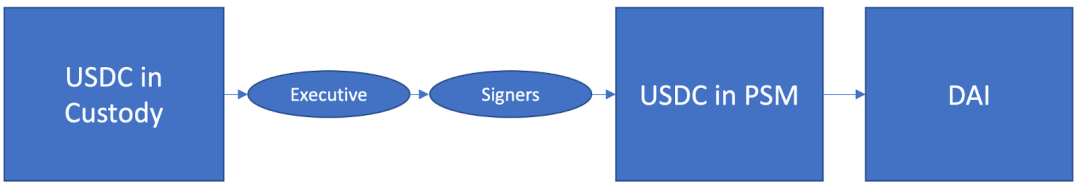

And 54.8% of this part of the circulating dai is minted by the PSM (Peg Stabilization Module) pool. The PSM pool is designed as a fixed-price currency swap agreement, and users can deposit stable assets supported by protocols such as USDC. Token assets, Dai is minted at a fixed exchange rate of 1:1. The USDC deposited in this part will be deposited in the liquidity pool as a reserve asset, and the same user can also exchange Dai 1: 1 back to USDC and other assets in the liquidity pool. Because of the 1:1 fixed exchange mechanism of the psm pool, this part of tvl has no way to bring stability fee and liquidation fee income to Makerdao.

However, the funds in the PSM pool are different from the Maker Vault excess loan position above. Makerdao has the right to vote for the assets deposited in the PSM pool to be stored in other forms, such as treasury bonds. This is also a new addition to Makerdao The main source of funds for the business, this part we will introduce in detail below with specific cases.

first level title

Exploration of new business lines

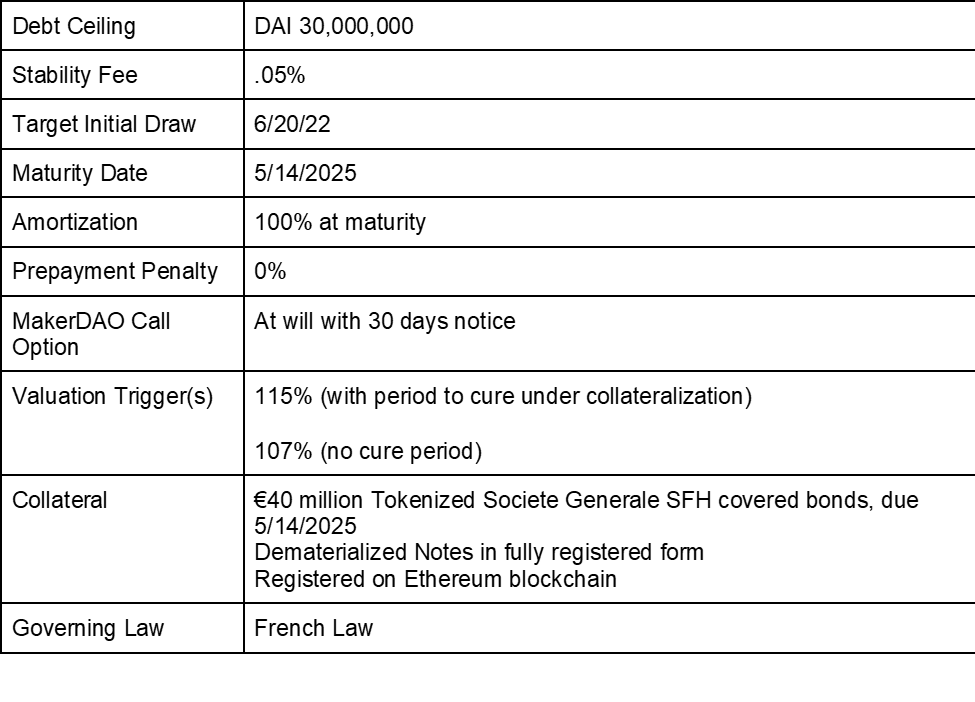

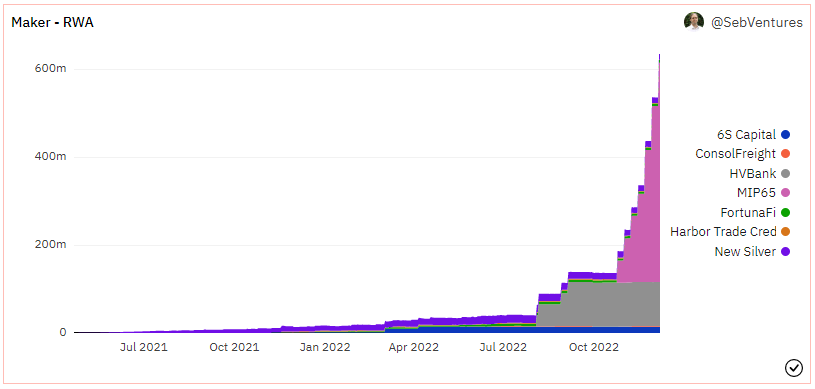

In order to solve the above problems, Makerdao initiated and passed a number of investment proposals in the past six months, with the purpose of diversifying the risk of centralized stablecoin assets in the balance sheet, and at the same time obtaining more benefits, which also increased the RWA reality. Investment in real-world asset.

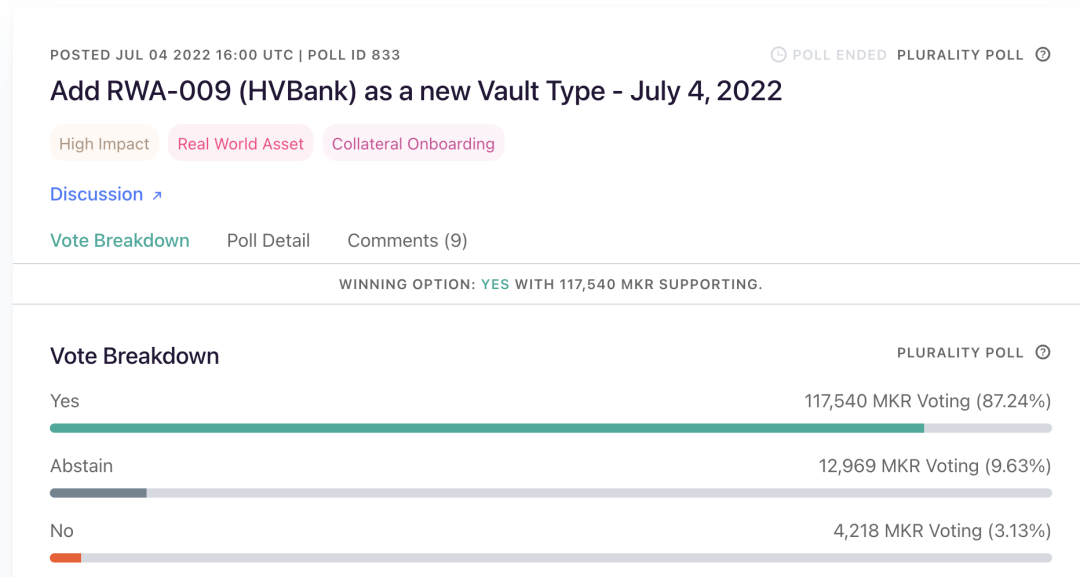

In July 2022, Makerdao voted to approve a proposal to provide a loan of up to $100 million to Huntingdon Valley Bank, a Pennsylvania chartered bank established in 1871, which is expected to net a 3% annual rate of return. Became the first defi protocol to provide loans to traditional US banks.

https://vote.Makerdao.com/polling/QmQMDasC#vote-breakdown

secondary title

https://forum.Makerdao.com/t/sg-forge-socgen-risk-assessment/15638

Coinbase's olive branch

On September 6, 2022, Coinbase launched the MIP 81: Coinbase USDC Institutional Rewards proposal on Makerdao

The proposal means that Makerdao can host part of the usdc in the psm pool to Coinbase Prime, and Coinbase will calculate and distribute interest based on the weighted average of the number of assets in the Makerdao account and the residence time every month, and promise to ensure liquidity, allowing Makerdao to Withdraw all usdc at once within 6 minutes.

The proposal has been voted by dao. Makerdao currently has 1.6 billion usdc stored in Coinbase Prime, which is expected to bring in an annual income of 15 million U.S. dollars.

https://forum.Makerdao.com/t/mip 13 c 3-sp 12-declaration-of-intent-invest-in-short-term-bonds/13084

MIP 82 Proposal

During the same period, Makerdao also passed another coinbase-related proposal MIP 82, which allows coinbase to use ETH and BTC as collateral to obtain a USDC loan of USD 500 million, with an expected annualized rate of return between 4.5% and 6%. , interest is paid monthly.

https://vote.Makerdao.com/polling/QmRVN 2 SB

Mip 65 Liquid Bond Investment Proposal

secondary title

https://mips.Makerdao.com/mips/details/MIP 65

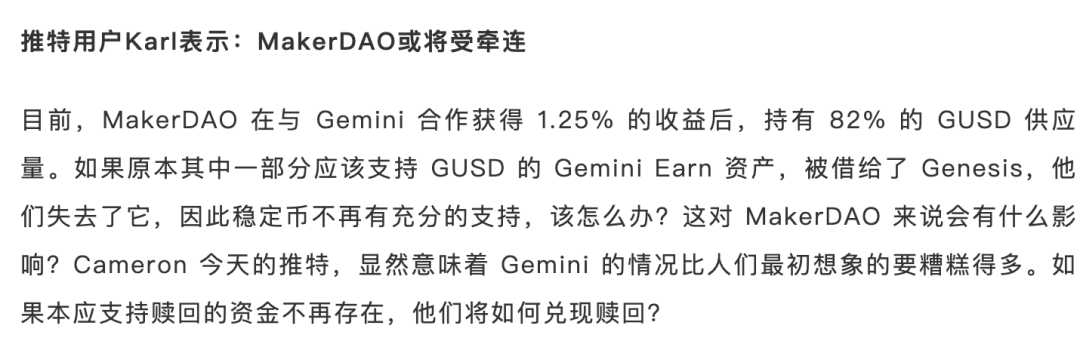

The impact of the Gemini turmoil?

Recent rumors about a recent deal with another exchange, gemini

It has been verified that this activity was a marketing activity conducted by Gemini CEO Tyler Winklevoss on September 29 to promote the GUSD issued by his own exchange.

https://forum.Makerdao.com/t/gusd-Makerdao-partnership-announcement/18140

first level title

Outlook and Summary

Part of the market's demand for Makerdao stems from the distrust of centralized stablecoins and the leverage needs of some investors, while the other part of the demand comes from major defi protocols. During the Defi summer period, a large number of defi agreements had mining yield tilts for dai (this is inseparable from the strength of the investment institutions behind Makerdao). At that time, the supply of dai was in short supply, making it at a premium for a long time. That's why the psm pool started attracting a lot of money at that time. The demand for leverage in the bear market encryption market has declined, and there is still a tvl as high as US$6.6 billion, which proves the market's demand for dai. As the market picks up, the demand for leveraged products on the chain will also pick up, and its tvl is expected to return to the first place.

At present, more and more protocols are beginning to support dai, or use dai to make various derivatives. In order to increase the application scenarios of dai, Makerdao itself is also constantly developing new modules, such as the leveraged derivative Oasis Multiply. The development of Maker Teleport, a DAI cross-chain infrastructure, was launched a few months ago, aiming to realize fast withdrawal of dai and L2 interoperability. And it is no longer limited to the Ethereum ecology, and actively embraces major new public chains.

After the Tornado Cash incident, Makerdao accelerated the adjustment of the funds in the psm pool. In addition to the above-mentioned cases, Makerdao has made a number of investments in the past six months, and many investments have been distributed in real-world assets. Great changes have taken place in its income structure. The community predicts that in the next year, 75% of Makerdao's income will come from investing in real assets.

The huge capital base of the PSM pool enables Makerdao to obtain more potential profits, thereby benefiting tokens. Therefore, the calculation of the income of the psm pool will be an important reference factor for the valuation of Makerdao token in the future.

first level title

new question

1. It is the risk of regulation. This is also a heated discussion point in the Makerdao community. These assets in the real world may be more likely to be regulated. Thus making dai lose the credibility of decentralization.

2. The risk of loan default. We can see that Makerdao currently involves credit loans in addition to mortgage loans. Rune, the founder of Makerdao, also suggested gradually increasing more hawkish investment positions in the future. Undoubtedly, the risk of loss is increased.

Of course, as a dao, the team can only initiate investment proposals, and whether it can be passed in the end still needs to be decided by voting. Makerdao currently has established a mature dao management mechanism, and community members have a high degree of governance activity. Each pool position has been isolated and has a debt ceiling to prevent black swan events to the greatest extent.

In addition to monthly and weekly fixed risk management meetings and financial reports. Every investment and expenditure, every parameter adjustment, will also produce a detailed evaluation report. It is a learning case of many project parties. Of course, this is inseparable from manpower and material resources, which is also one of the sources of the high operating costs mentioned above.

secondary title

Krypton Capital

Founded in 2017, Krypital Group is a world-leading venture capital firm and blockchain project incubator. Through the in-depth integration and strategic layout of resources from investment institutions, digital asset exchanges, top law firms and world-class community resources, Krypton Capital has incubated more than 100 projects so far.