Either FTX's defeat, or a trillion-dollar market crash. Every now and then, there's an incident that proves people's continued mistrust of anything crypto-related.

But the stablecoin space is a silver lining amidst the storm in the crypto market. Stablecoins, as the name suggests, remain stable whether the market rises or falls, maintaining the value of the currency they are pegged to.

I have always believed that those who see cryptocurrency as merely an advanced form of gambling will soon begin to see the potential of a technology that could revolutionize finance. However, as one of the worst crypto storms erupts in 2022, we see the largest stablecoin by market valuation - USDT - shrink, losing about 0.5% of its value.

secondary title

History of Tether

Tether is a blockchain company founded in 2014 by Reeve Collins, Craig Sellars and Brock Pierce.

Tether uses Taiwanese traditional banking partners to convert fiat currency to cryptocurrency and vice versa. The banking partner eventually terminated its relationship with the blockchain company in 2017 due to its widespread use without KYC. However, banks in Puerto Rico and the Bahamas agreed to work with Tether.

The 2017 bull run catapulted the popularity of Tether's stablecoin USDT and made it one of the most traded cryptocurrencies of all time.

secondary title

What keeps the USDT stablecoin stable?

After USDT depreciates slightly in 2022, most people who only use cryptocurrency as a means of cross-border transactions have lost faith in it. If there is any chance of regaining faith in USDT or any other stablecoin, people need to know what keeps a stablecoin stable.

In my interview with Ardoino, he said, "A few bad apples don't represent the beauty of the idea behind blockchain, and the idea behind cryptocurrencies in general." To him, stablecoins allow people to look beyond their assumptions and see to the nature of cryptocurrency.

He explained that Tether was created backed by an extremely liquid asset. “The most important feature of a stablecoin is the return of funds,” he said.

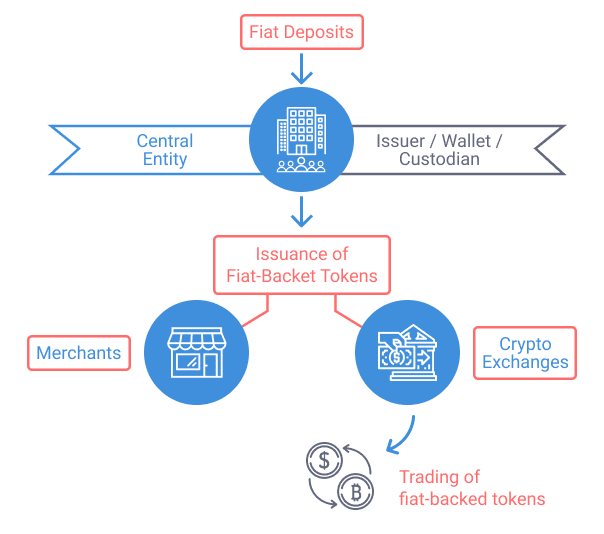

Try to think of stablecoins as glass pebbles. If 100,000 glass pebbles are worth 1:1 in dollars, the creator of the pebble needs to have a reserve of $100,000 to represent each glass pebble. For a stablecoin to maintain its stability, it must provide liquidity for every coin in circulation.

According to Ardoino, when people exchange stablecoins for dollars, you should be able to afford to pay them back.

secondary title

When a $60 Billion Stablecoin Crashes

How do we know that a stablecoin is backed by what they say is a reserve? We don't know and can only trust them. But the cost of trusting the wrong stablecoin can be high.

In May 2022, the crypto market experienced one of the worst crashes ever seen due to the decline of the TerraUSD/UST stablecoin.

Terra is a blockchain network created in 2018 by Do Kwon and Daniel Shin of Terraform Labs. They created TerraUSD, an algorithmic stablecoin. Unlike USDT, which needs to be backed by assets such as U.S. dollars, TerraUSD is backed by a computer algorithm and cryptocurrency Luna, also created by Terraform Labs.

Before the May crash, Kwon and Shin were considered heroes in creating TerraUSD, especially because of Luna's meteoric rise, making some people crypto millionaires in a short time.

However, when $2 billion worth of TerraUSD was dumped, a crisis was brewing. The sell-off shocked markets, sending the TerraUSD token, which was supposed to be worth $1, down to $0.91.

secondary title

How Luna's Crash Affects USDT

Although USDT still exists, it has been affected by the market squeeze caused by the Luna crash. According to Ardoino, the viability of USDT is beyond the reach of even large traditional banks.

After the Luna crash, the cryptocurrency market went into panic mode. Although USDT is fundamentally different from TerraUSD, once the fear strikes, people pay little attention to the facts.

However, even the truth isn’t always on Tether’s side. The market's story about every USDT in circulation has a dollar in reserve has been punched with a serious hole.

In 2019, a lawyer in New York accused Bitfinex — Tether’s sister company — of using $700 million of Tether’s reserves to cover $850 million in losses.

This means Bitfinex has access to reserves that Tether should use to help USDT peg to the dollar.

Bitfinex responded that the court documents were written in bad faith. However, in 2021, New York Attorney General Letitia James said it found that Tether sometimes did not have the reserves to back its cryptocurrency pegged to the U.S. dollar.

Tether and Bitfinex eventually agreed to settle with the attorney for $18 million.

Luna's crash in 2022 puts Tether's reserves to the test.

“Tether is the biggest gateway in terms of fiat currency in the crypto industry. A lot of people want to redeem Tether, we redeemed $7 billion in 48 hours, 10% of our reserves.”

To provide context, Ardoino referred to the bankruptcy of US bank Washington Mutual (WaMu) after paying 11% of its reserves ($16.7 billion) within 10 days.

This has made it impossible for banks to carry out their day-to-day activities. However, falling home prices in the U.S. and its large, impoverished customer base also contributed to the bank's failure. WaMu paid 11% of its reserves within ten days, but Tether had to pay 10% within two days. According to Ardoino, the redemption lasted one month and three days, during which time Tether redeemed 25% of its reserves — more than $20 billion. For more, FTX’s $6 billion withdrawal surge was partly responsible for the cryptocurrency exchange’s bankruptcy. For Ardoino, Tether's ability to honor all withdrawals means the company's reserves are real.

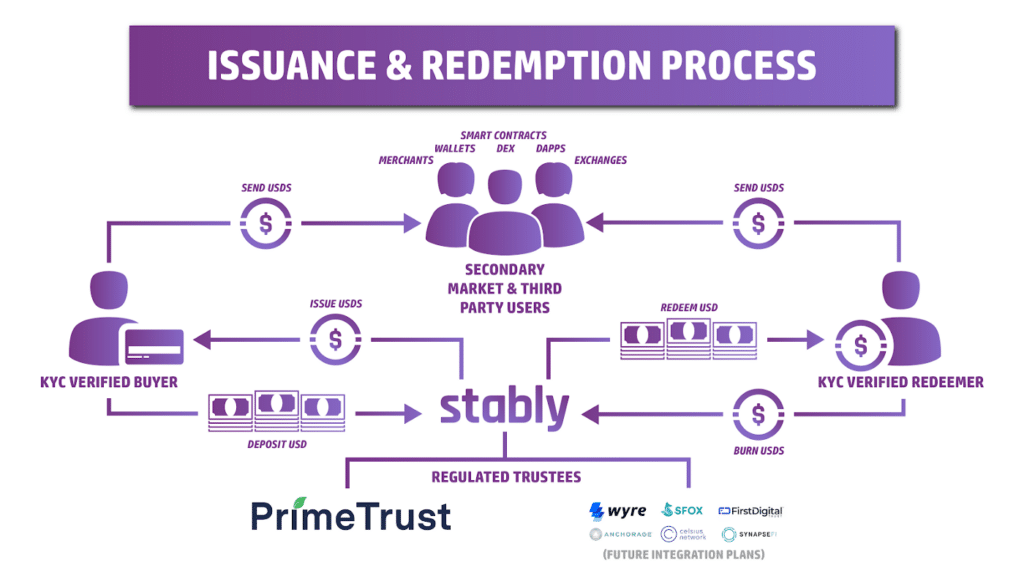

Interestingly, some of the withdrawals were not out of fear, they were simply a way for some participants to make money from market panic. For retail cryptocurrency traders like me, stablecoins help us get in and out of the market. For example, if I make a profit of $100 on a bitcoin trade, I will exchange that profit for the equivalent USDT so that I don't lose my profit due to market volatility. Then I can sell that $100 USDT for naira. However, institutional traders or investors with large funds would go to what Ardoino described as the USDT primary market and exchange their USDT for real dollars. The market allows no less than $100,000 in transactions and must be registered to use.

When the value of USDT drops in May 2022, people buy it for less than $1 on the secondary market and trade it for $1 on the primary market.

"Tether is always redeemed and redeemed at $1. So you bring your Tether tokens to our platform, and sign up, and we pay you $1 per USDT. In the secondary market and trade So, people can sell Tether for any amount.

“Fir Tree and other hedge funds don’t believe that Tether has all the money (reserves), so what they do is borrow massively, we’re talking hundreds of millions of dollars in USDT from companies like Genesis, and then sell it on the secondary market sold online, so that would cause problems. That’s how we ended up redeeming $7 billion.”

Selling USDT at a lower than usual price puts artificial pressure on assets in the secondary market. This allows arbitrageurs — people who profit from price inconsistencies in different markets — to take advantage of the situation.

Fun fact: Genesis — one of the companies that lent USDT to hedge funds — recently filed for bankruptcy.

"Before you attack a company like Tether, you should really make sure you understand how it works because we are solid and resilient, and we've proven that over the past eight years."

On February 2, 2023, the Wall Street Journal (WSJ) published an article that once again tested the blockchain company's resilience. The Wall Street Journal stated that in 2018 Tether had only four people, but controlled 86% of Tether.

Controversy and scandals have plagued the stablecoin company over the past eight years, but Ardoino has confidence in the reserve and the company's leadership. He believes Tether will be around for a long time.

Article source: https://techpoint.africa/2023/02/08/what-makes-usdt-stablecoins-stable/