analyzeanalyze, and predicted that SI is about to usher in a round of short-squeeze and skyrocketing prices.

Odaily Note: The content of this article is the combing and explanation of @laobuggier's views, not investment advice, DYOR.

To understand this story, you need to start with the background of Silvergate.

Silvergate is a banking institution that is friendly to cryptocurrency institutions, and its clients include Circle, Coinbase, and the former FTX and many other well-known institutions in the circle.

Driven by cryptocurrency-related businesses, Silvergate's stock price briefly broke through the $200 mark during the 2021 bull market. However, the good times didn't last long. As the cryptocurrency market continued to decline, especially affected by the FTX black swan incident, Silvergate's performance was also severely impacted.

Earnings records released in early January showed Silvergate's net loss of $1 billion in the fourth quarter of 2022, resulting in a full-year loss of about $949 million, compared with the agency's 2021 net income of $75.5 million.

The main reason for the loss came from cryptocurrency-related businesses. According to financial reports, Silvergate’s cryptocurrency-related deposits plummeted by 68% in the fourth quarter of last year, and in order to meet the surge in demand for withdrawals, Silvergate was forced to sell assets at huge losses. The total loss of this part is as high as 718 million US dollars.

At the same time as the performance collapsed, Silvergate was also forced to lay off staff and cut business. The bank originally said in early January that it had laid off 200 people, accounting for 40% of the total number of employees.

In general, Silvergate's fundamentals can't be worse, and its stock price is not going to look any better. According to MarketWatch data, the SI has been trending down almost all the way over the past month, hitting a low of $11.55 on Jan. 9.

So why is @laobuggier predicting a big rally for a stock that looks so bad? But wait, let's talk about this script by @laobuggier.

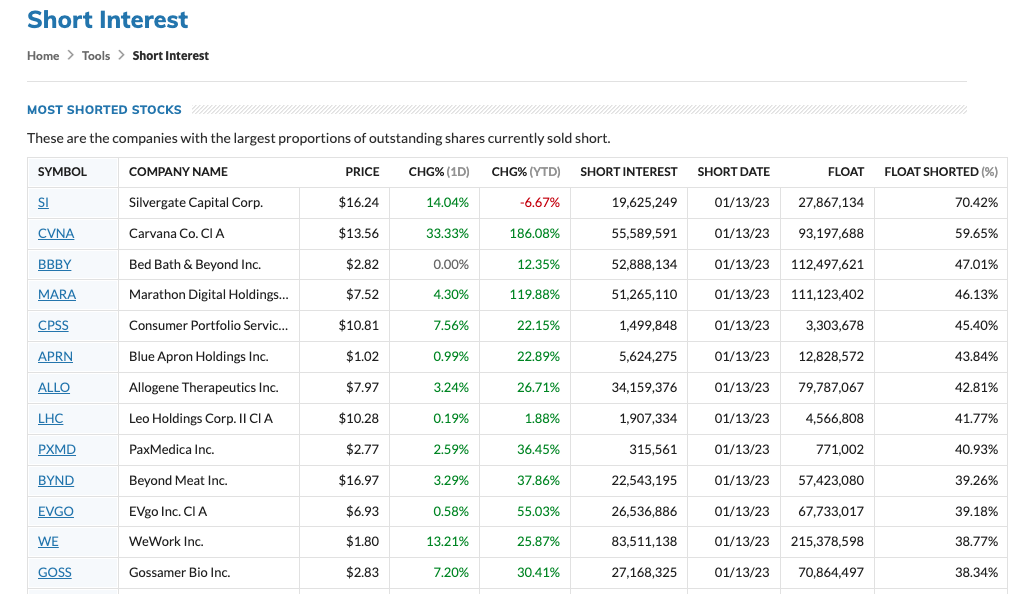

Since the market can see that Silvergate's life is not going well, a large number of investors have chosen to short it.MarketWatchAccording to the data, SI is the stock with the largest short selling ratio of outstanding shares in the current market-the short selling ratio is as high as 70%.

@laobuggier added,The current circulating market value of SI is only about 450 million US dollars, Such a high short selling ratio gives the bulls a good opportunity to attack.

Twitter analyst @Sn/Fr-axgener 20 0x also agrees with @laobuggier's point of view, adding that at least 22% of SI's outstanding shares are controlled by Blackrock, Blockone and BM (yes, the EOS Nabo people) In the hands of institutions such as BlackRock, and considering that BlackRock has a tendency to increase its holdings, institutions such as B1 are the bottom of FTX's after-the-fact copying (around $25), and these tradable shares will most likely not flow into the market.That means the actual number of shares outstanding is at most 78%, and 70% are being sold short right now...

Market data shows thatThe opening price of most short positions is between 20-30 US dollars, and SI has recently ushered in a relatively large rebound - yesterday's closing price was 16.24 US dollars (an increase of 14.04%), and today's pre-market price was 17.85 US dollars ( Up 9.91% ) - If the trend continues, short sellers can only choose to buy in order to prevent losses, and since the short selling ratio of tradable shares is as high as 70%, it is likely to cause a race among short sellers.

As a result, we will most likely witness a massive short squeeze.

@laobuggier took the last sip at the end of the post. Although Silvergate was hit hard by the FTX incident, the institution has not completely collapsed. Head institutions such as Circle and Coinbase are still cooperating with Silvergate and will continue to bring huge amounts to the bank business and profit. andAs the cryptocurrency market has recently begun to recover, Silvergate's fundamentals are also expected to rebound somewhat.

Finally, let’s add another shield. The content of this article is the combing and explanation of @laobuggier’s views. It does not represent Odaily’s views, nor does it constitute investment advice. Please analyze and judge by yourself.