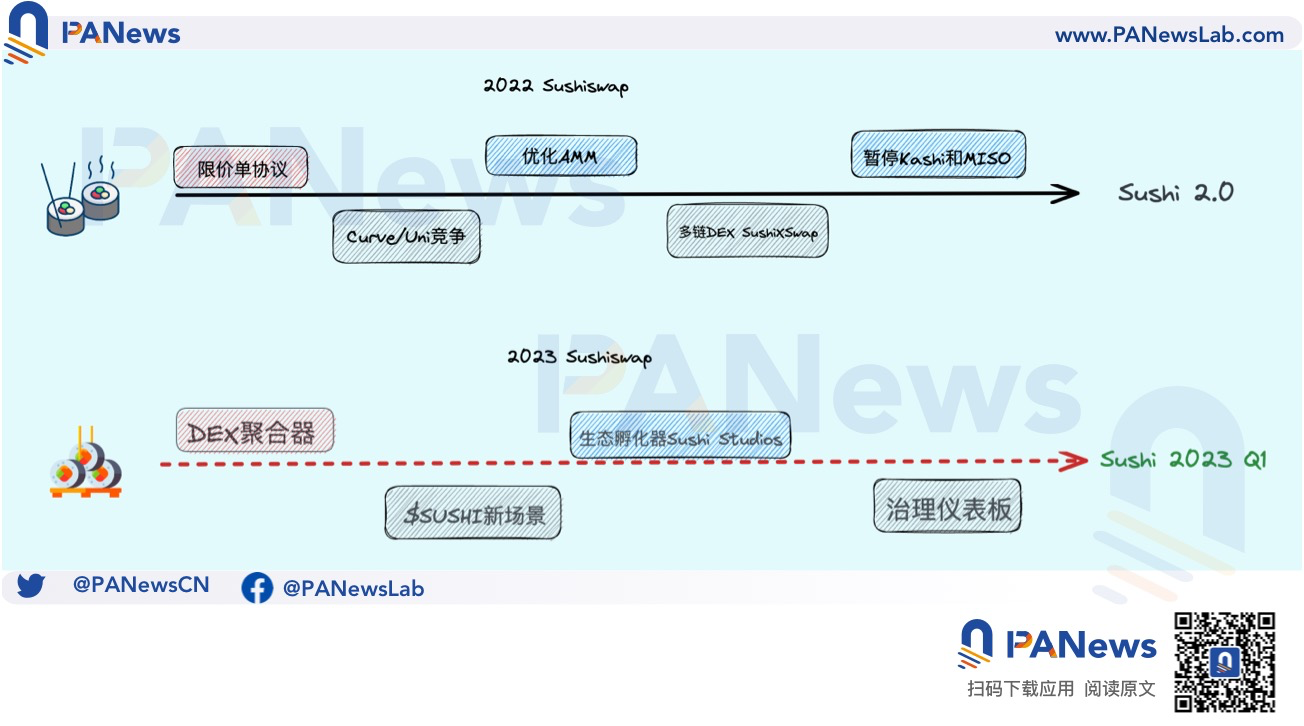

On the eve of the Lunar New Year, on January 17, Sushiswap’s new CEO, Jared Gray, officially announced the 2023 roadmap in the form of an article, and highlighted the main direction of Q1, which will focus on the DEX business itself and empower SUSHI’s value to improve The ability to cope with Curve and Uniswap.

He said that the DEX aggregator will be launched at an appropriate time. This is also the most important move after Sushi launched the multi-chain DEX SushiXswap in 2022, which is closer to 1inch's development ideas.

In addition, starting with exploring more Sushi application scenarios, we will reshape our own token economics to promote more decentralized governance capabilities of Sushi DAO. Judging from the historical performance of Sushi itself taking the lead in issuing coins and occupying Uniswap, Token incentives have always been its housekeeping.

On January 24th, SushiSwap passed the governance proposal of transferring all transaction fees to the DAO treasury, kicking off the Sushi counterattack in 2023. This article will briefly introduce the details of the roadmap based on previous news.

Expand Sushiswap’s share in the DEX market, focusing on user experience improvements;

Launch of new DEX aggregator, based on Jared Gray's vision"10x increase in market share" ;

Decentralized governance structure to enhance Sushi DAO's self-organization capabilities;

Launched a new token economics model: focus on improving liquidity, enhancing sustainability, and returning community ownership;

Launch of Sushi's decentralized incubator: Sushi Studios.

Responding to DEX Competition: Liquidity is King

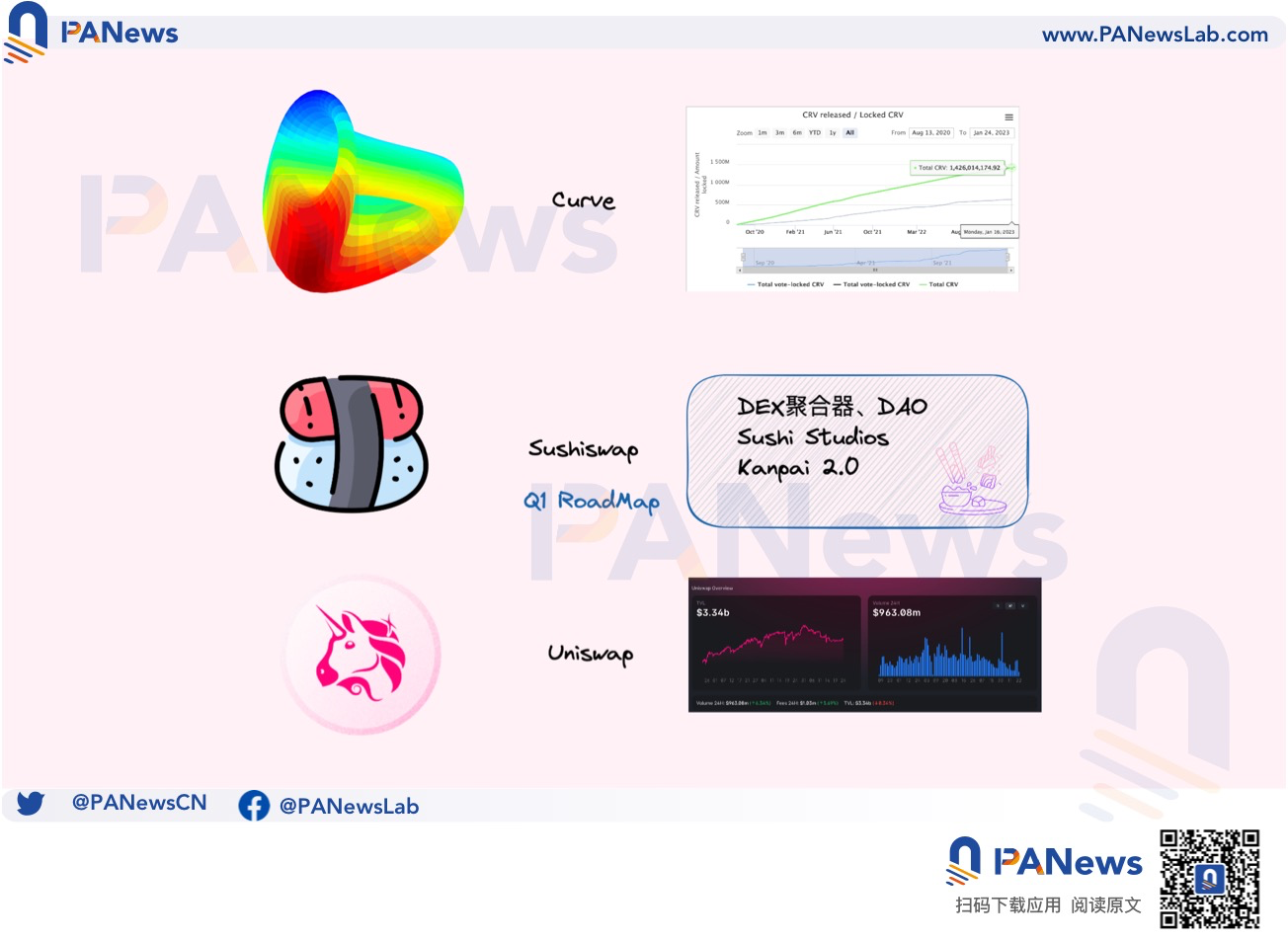

The roadmap of Sushi this time is obviously returning to the original intention of DEX, which is also its response to the dual competition of Curve and Uniswap.

At present, Curve's TVL has surpassed Uniswap, and it is the second time that it has challenged Uniswap's market position in the DEX field, and the first time happened to be the surge in transaction volume brought about by Sushi's preemptive issuance of coins.

The biggest improvement of Sushi's 2023 roadmap is to enhance its centralized trading and market-making efficiency in AMM DEX, so as to regain the DEX market share.

This roadmap will allow LPs (liquidity providers) to set a specific price range to provide liquidity, and will introduce more incentives for LPs, and Sushi will promote deep integration with project parties and provide more Opportunity to access Sushi DEX to help Sushi expand in terms of IDOs.

According to Sushi itself, which currently accounts for 2% of the AMM DEX market but 0% of the DEX aggregator market, Sushi intends to increase its market share by 10 times, or 10%, in 2023.

According to Nansen data, currently the main trading pools in the DEX market are dominated by Uniswap and Curve, and Sushi needs to create more incentives to attract project parties and LPs to settle in.

It can be seen from observation that the above measures are aimed at the competition between Uniswap and Curve. Uniswap is currently focusing on opening the "market fee switch" to improve the ability of LPs to capture transaction fees, and providing the strongest transaction pool in the market is Curve's moat.

Overall, the direction Sushi chooses is still to focus on the spot DEX field, which is in line with its idea of stopping the maintenance of the lending platform Kashi and the token Launchpad MISO, but it frequently abandons existing products and repeats "wheel-making" development New projects also deserve the market's attention to their lasting operational capabilities.

Empowering Sushi: Regaining the advantage of "starting a business"

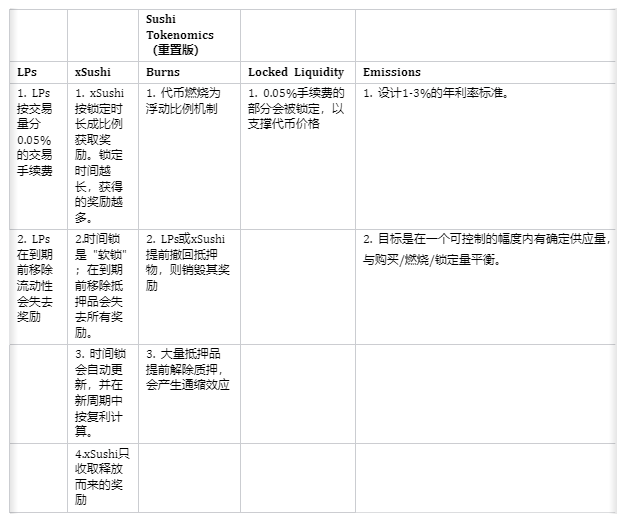

In addition to competing for market share, another part of Sushi's roadmap is the implementation of new token economics, which will focus on developing the usage scenarios of Sushi in its own ecology, get rid of the role of a single governance token, and use This is a breakthrough to enhance Sushi's ecological incubation capabilities.

This empowerment token is intended to enhance the willingness of LPs and project parties to participate, and to prioritize more tokenized scenarios on Sushi. This is also the main direction of its market expansion, and the details are reflected in the new economic model.

The token economics of the reset version is as follows, divided into five parts: LPs, xSushi, Burns, locked liquidity and token release, the main part of which is to give LPs more incentives to encourage their enthusiasm for participating in the formation of trading pools , but it needs to be noted that whether it can be realized in the end still requires team effort.

However, it should be noted that the proposal is still in progress, and according to Sushi's 2023 budget, 82% of its $5.2 million budget, or about $4.3 million, will be used for the salary distribution of key members, leaving only about 92% for DAO governance. Ten thousand U.S. dollars.

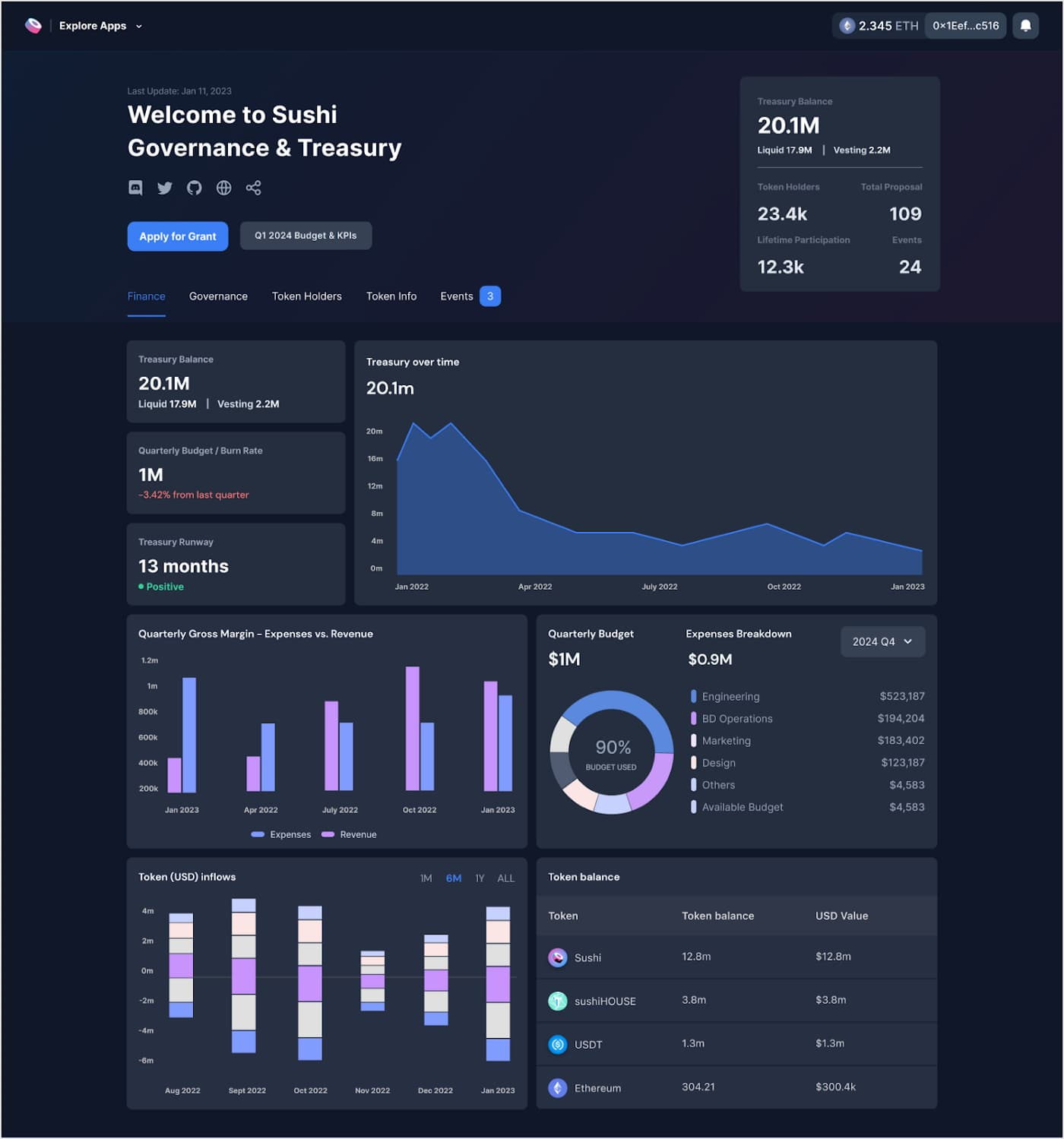

In the context of insufficient financial capacity, Sushi DAO passed the governance proposal of transferring all handling fees to the DAO treasury on January 24. The advantage of doing so is that it will enhance DAO's ability to capture funds, but it will also simultaneously lead to self-seeking. Lee's Pandora's box.

In order to enhance the hematopoietic ability of DAO, Sushi's roadmap refers to creating more transaction fees and market share from the project's currency listing. Sushi Studios is Sushi's decentralized incubator and will launch independently funded projects to support the ecosystem. The growth of the system, and will reduce the burden on the DAO's finances.

At the same time, in order to promote the transparency of governance capabilities, Sushi will launch a governance dashboard (Governance Dashboard) in Q1 to display the audit results of Sushi DAO's budget, project wallets, and treasury expenditures, beyond the current simple community discussion and voting governance measures , focusing instead on fiscal transparency.

epilogue

epilogue

Sushiswap’s roadmap for 2023 shows that it chooses to enhance the parallelism of LPs and $Sushi. According to Cryptorank data, Uniswap’s various chains and versions account for a total of 4% of the spot market share, while Sushi only has 0.06%. The two sides are no longer the same weight level players

references:

references:

SUSHI REVITALIZED SUSHI IN 2023 & BEYOND

Sushi's 2022 Development Recap

SushiSwap Executive Reveals Roadmap for 2023, Says ‘Interesting Suprise’ Coming to SUSHI

SushiSwap DAO Budgets $ 5.2 M, With 82% Going to Salaries

Decentralized (DEX) crypto exchanges

Have you tested out @nansen_aiTokens Paradise yet?

SushiSwap’s new DEX aggregator will ‘ 1 0x our market share’ — Head Chef