2020: The Year of DeFi

2021: The Year of NFTs

2022: The Year of ___?

I bet most of us can't answer the above question.

2022 should have been called the year of the DAO, as many people had high expectations for the mass adoption of DAOs. However, due to the impact of the Federal Reserve's tough monetary policy and multiple black swan events, innovation in the encryption industry in 2022 will be lackluster.

secondary title

Uniswap

Uniswap was founded in November 2018 by former Siemens mechanical engineer Hayden Adams. Like Bitcoin in the encryption industry, Uniswap can be said to be the most symbolic DEX on the DeFi track. Last year, Uniswap Labs raised $165 million in a Series B round led by Polychain capital, at a valuation of $1.66 billion.

In a nutshell, Uniswap is a protocol for trading and automatically providing liquidity on the Ethereum network and its scaling solutions (i.e. Optimism, Arbitrum, Polygon, etc.). Users can trade tokens directly in the liquidity pool via smart contracts.

Over the past four years, Uniswap has experienced volatile growth in monthly active users (MAUs).

So far, Uniswap has gone through many iterations, and each version has greatly improved. Specifically, V1, V2, and V3 will be officially launched in November 2018, August 2020, and May 2021, respectively.

According to Dune Analytics, Uniswap's MAU in December 2019 was about 8.3k, and then increased significantly to 272k in December 2020. This means that its MAU has increased by 3200% in a year, making it one of the driving forces of the year of DeFi. However, in December 2021, Uniswap's MAU growth slowed to 668,000 MAU, an increase of 146% over the previous year. Now, as of the end of December 2022, Uniswap's MAU is about 356,000, a decrease of 46% month-on-month.

Having more than 300,000 MAU (as of December 2022) proves that Uniswap is still doing well even in a bear market. Going multi-chain and rolling out 1 bp fee tiers on most networks is key to retaining its users. Currently, users can trade tokens with only 1 basis point (0.01%) as a transaction fee, except for Arbitrum. The 1 bp fee tier policy is designed to compete with Curve Finance to ensure substantial liquidity for stablecoins. In the future, Uniswap will be deployed on chains such as the Aurora network, zkSync, and Boba Network.

As a leading liquidity provider with more than 65% market volume share for several months in a row, Uniswap needs a larger potential market to expand its reach. Recently, Uniswap announced a partnership with MoonPay (a deposit and withdrawal service provider) to allow users to purchase cryptocurrencies on the Uniswap web app using credit/debit cards or bank transfers. Such actions are expected to bring millions of users to the Web3 world and DeFi.

Moving away from DeFi to other verticals, Uniswap made an acquisition in June by acquiring Genie (the first NFT marketplace aggregator on Ethereum) as part of its expansion (now renamed Uniswap NFT). With Uniswap's newest universal router, NFT traders/collectors are able to buy NFTs with less gas fees (up to 15% compared to other NFT aggregators). In 2021, more than $41 billion in cryptocurrencies were spent on NFT platforms, and about 28.6 million wallets traded NFTs.

secondary title

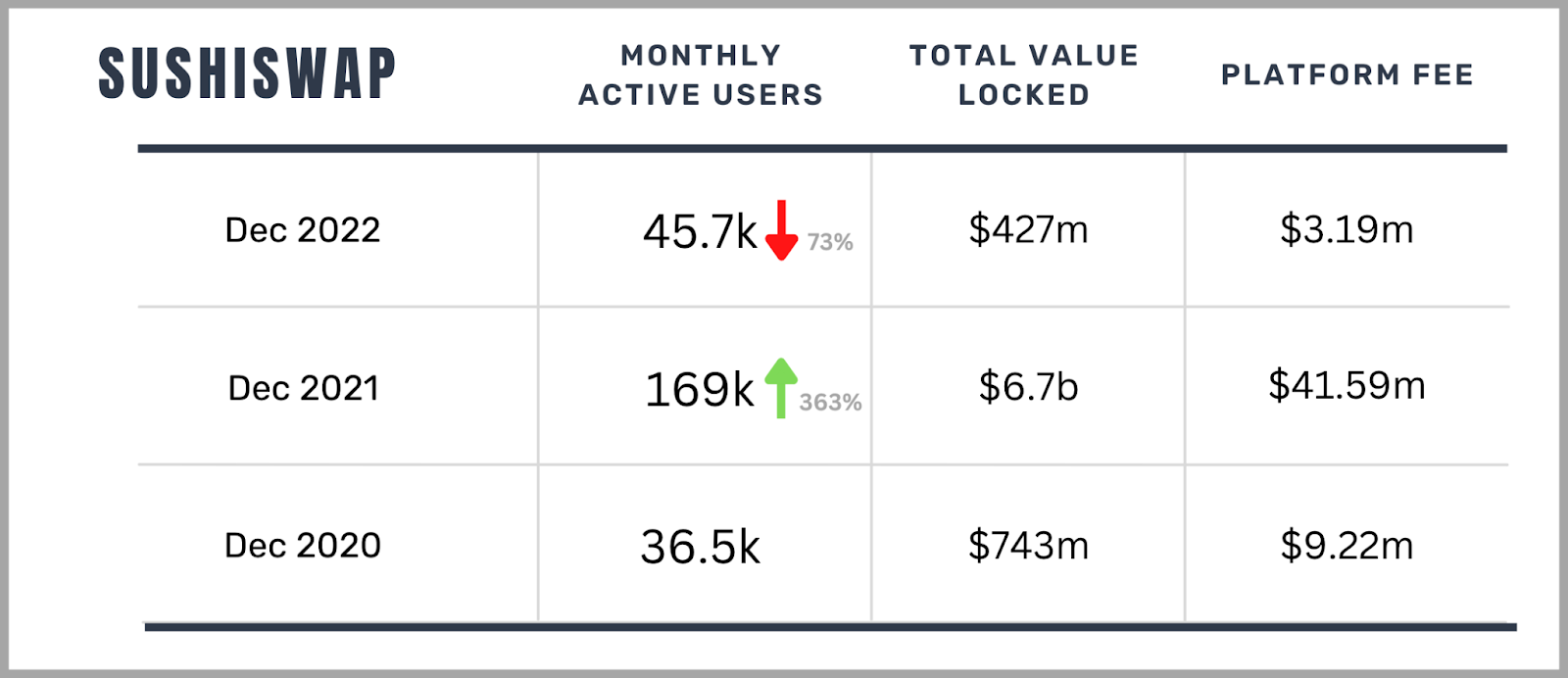

SushiSwap

Founded in 2020 by an anonymous individual or group named Chef Nomi and co-founder 0x Maki, SushiSwap is actually a forked version of Uniswap. The platform launched by copying Uniswap's open source code and by transferring funds from a special pool on Uniswap to SushiSwap. However, before the transfer, Chef Nomi took $13 million from the pool, causing concern among users. Ultimately, the issue was resolved by handing over control of SushiSwap to Sam Bankman-Fried, head of Almeda Research, and Chef Nomi returning funds to the pool and apologizing to users.

Unlike Uniswap, SushiSwap has been in trouble for a long time due to some reasons, causing its current TVL to be even lower than the TVL in December 2020. One of the reasons is that SushiSwap incentivized LPs by releasing tokens, but the incentive plan ended up losing $30 million due to poor performance. Expectations are high for new Chef Jared Gray, a tech executive with a background in computer engineering. Jared pointed out that SushiSwap's current fiscal deficit affects the sustainability of the project. Although the annual spending budget has been reduced from $9 million to $5 million after taking office, there is only enough money in the treasury for another year or so.

Due to lack of innovation and slow response to market changes, SushiSwap almost lost its first-mover advantage in the DEX war. At present, SushiSwap has less than 3% of the AMM market share, and the DEX aggregation market has made no achievements. In order to reverse this situation, an optimized Sushi token economics proposal was released at the end of last year, which introduced a time-locked layer and a destruction mechanism in the revised token economics, striving to obtain an annualized rate of 1-3% when released income, and redistribute the handling fees among multiple parties, trying to rebuild the relationship between xSushi holders and LPs.

secondary title

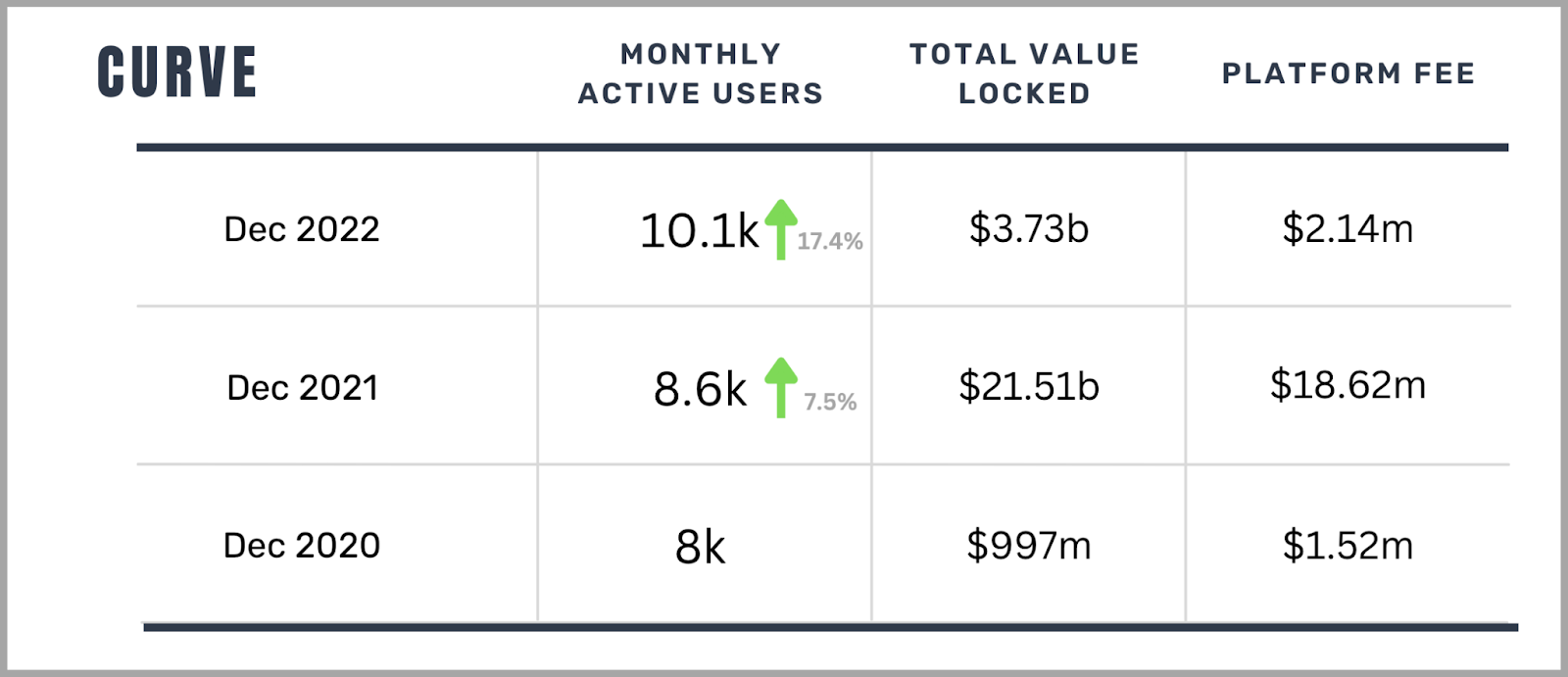

Curve Finance

Launched in January 2020, Curve Finance was founded by Michael Egorov, a former scientist and physicist with a strong background in quantum computing and cryptography. The V1 curve is designed to facilitate efficient stablecoin transactions through a simple AMM formula that offers extremely low slippage. Whereas the V2 curve is designed to trade non-stablecoin tokens with minimal slippage while retaining the essence of the V1 concept. Curve's unique AMM model allows stablecoin traders to exchange large quantities of stablecoins in an efficient manner.

Interestingly, Curve Finance's MAU has been fairly stable over the past three years. Despite having about 10k MAU as of December 2022, Curve's TVL ranks 4th among DefiLlama, even higher than Uniswap (5th). The likely reason for this unique situation is that the majority of users on Curve Finance are stablecoin heavyweights who may remain in the Curve ecosystem due to its underlying mechanisms such as staking and governance. Curve's token economics design was considered revolutionary at the time, which indirectly changed the governance structure of most DeFi protocols. In short, veCRV stands for voting escrow CRV, and users can obtain a certain amount of veCRV by locking CRV tokens. Basically, the longer you lock your CRV, the more veCRV you receive. Locking CRV tokens can also allow users to obtain higher returns (up to 2.5 times). The perfect combination of voting, staking and acceleration mechanisms in veCRV and CRV tokens is one of the key factors for Curve's high TVL.

secondary title

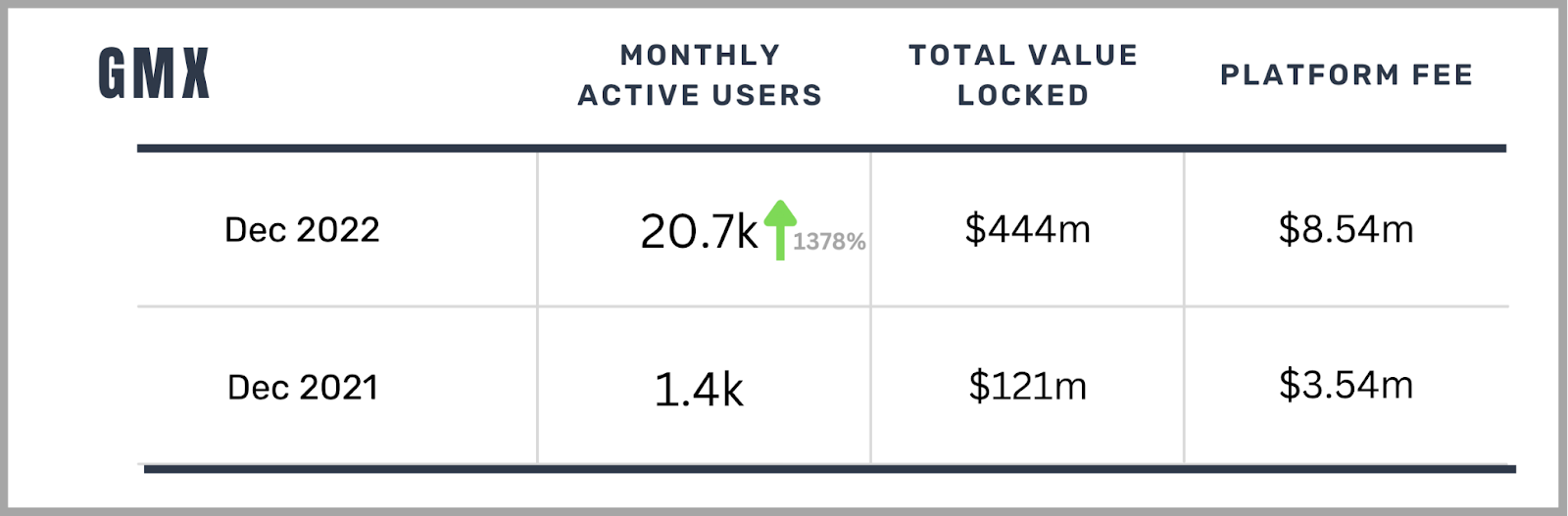

GMX

As for the last DEX to be discussed in this article, it is none other than GMX. As the most high-profile emerging DEX, GMX was officially launched on Arbitrum in September 2021 and deployed on Avalanche in January 2022 a few months later. GMX was founded by a completely anonymous team that previously developed two other protocols (namely XVIX and Gambit).

In short, GMX is a decentralized spot and perpetual exchange with smooth transactions, low handling fees, and minimal impact on transaction prices. Trading is backed by a unique multi-asset pool that earns liquidity provider fees from market making, trading fees and leveraged trading. It features a dynamic pricing mechanism powered by Chainlink oracles.

In view of the current market situation, as of December 2022, GMX's MAU has exceeded 20,000, a year-on-year increase of more than 1300%, and its performance is still amazing. GMX's TVL has almost quadrupled, platform fees have more than doubled, and it is the leading decentralized exchange (derivatives) with the highest TVL on Arbitrum. Part of its success can be attributed to its unique payment mechanism and the high leverage (up to 50x) it offers traders. As for LPs, GMX's mechanism is considered very friendly and low-risk (almost no impermanence loss).

Additionally, there are several reasons why GMX's TVL has gradually increased steadily throughout the year:

1. Provide high APR by staking GMX (governance token) and/or GLP (LP token) to the earning pool.

2. As a basket of assets, GLP aims to hedge certain blue-chip assets (such as WBTC, ETH, etc.), and stable coins are also an important part (currently stable coins account for 50%).

3. All transaction fees will be distributed to the pledgers of these two tokens, which is a good mechanism for compounding interest on token pledges.

in conclusion

in conclusion

The performance of the aforementioned DEXs is somewhat predictable and predictable. As we know, some projects aggressively bring out new ones, while others struggle to survive a bear market. With the continuous development of the encryption industry, people's expectations for DEX will soon be more than just AMM with basic functions, multi-chain development, more complex token models, robust AMM models with high capital efficiency, vertical expansion, etc. Will soon become the development target of DEX.

first level title

Reference

https://techcrunch.com/2022/10/13/uniswap-labs-raises-165-million-in-new-funding/

https://twitter.com/Uniswap/status/1605251408155906048

https://twitter.com/uniswap/status/1597953712319709184

https://drive.google.com/file/d/1 gpxJ 2 zPRCZ 1 Ik 7 I 7 HfrwVhiglz 89 Xhd 7/

https://jared-grey.medium.com/sushi-revitalized-f 2 e 9161 d 293 f

https://resources.curve.fi/crv-token/understanding-crv

https://github.com/curvefi/curve-stablecoin/blob/master/doc/curve-stablecoin.pdf

https://medium.com/@gmx.io/x 4-protocol-controlled-exchange-c 931 cd 9 a 1 ae 9

https://dune.com/lako/lako-labs-gmx

About Jsquare

Jsquare is an investment research and technology-driven investment institution, focusing on empowering Alpha projects in the Web3 industry to promote the large-scale application of blockchain technology. At present, our own capital management scale exceeds 150 million US dollars. Portfolio includes CeFi (CoinList, 3 iQ, Republic, FV Bank), Gaming/NFT (Efinity, Big Time, Thetan Arena, Apeiron), Infrastructure/Tools (Pocket, Render, ChainSafe, GSN), etc.

Twitter|@JSquare_cowww.jsquare.co

Twitter|@JSquare_co