Original title: "Practical Operation丨How to Borrow and Lend Your NFT?"

Original compilation: PANews

Original compilation: PANews

One of the hottest areas of DeFi right now is the intersection of DeFi and NFTs, also known as NFTFi. One of the biggest applications currently in the NFTFi category is in the NFT lending space. This article will tell you how to use the leading projects in this field to lend and borrow NFT.

Introduction to lending NFTs

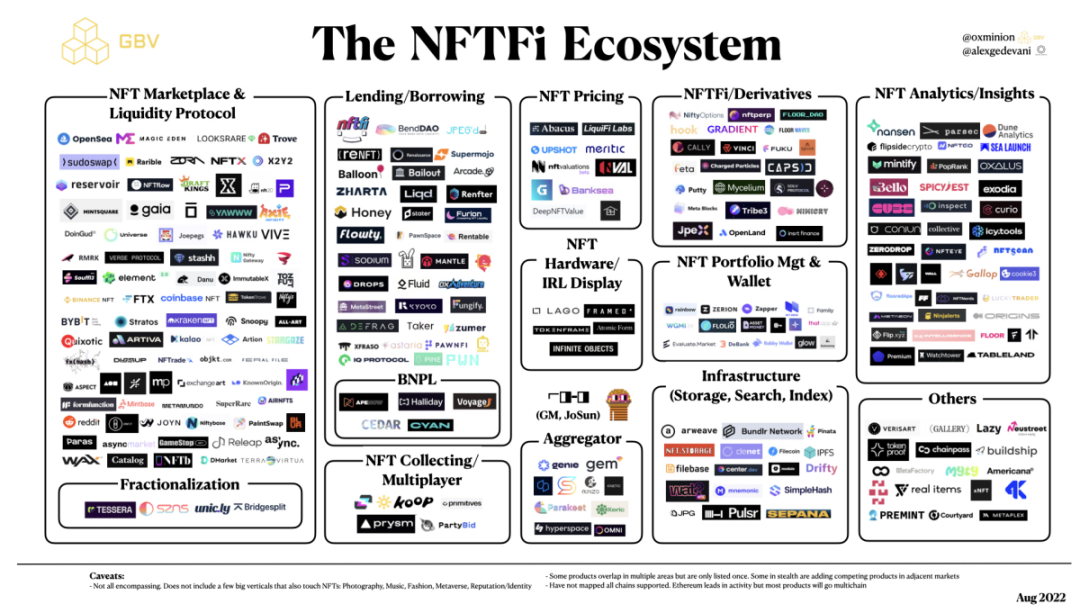

Such as the NFTFi ecological map researched and organized by Twitter blogger 0xminion. There are over 300 projects on the list across different L1/L2 and NFT verticals.

As can be seen from the figure, the NFT market and liquidity agreements accounted for 26% (including fragmentation). Followed by NFT Analytics & Insights accounted for 14.5%, NFT lending accounted for 4% (including BNPL), and NFTFi/derivatives accounted for 7.1%. Other verticals such as NFT portfolio management and wallets, aggregators, NFT tools/IRL display, NFT pricing, infrastructure (storage, search, indexing), NFT management/gallery, content creation, NFT collections/multiplayer games mostly.

There is DeFi, there is NFT, and then there is NFTFi formed by the intersection of the two fields. In the current NFTFi ecosystem, there are already various categories. The biggest ones right now are NFT trading platforms and liquidity protocols like OpenSea, LooksRare, Zora, NFTX, and Sudoswap. After all, people first need to buy and trade NFTs.

There are also NFT derivatives projects, NFT infrastructure projects, NFT pricing projects, and others. People are exploring the future of NFTs, so each of these areas is growing rapidly, but right now the largest category of NFTFi outside of trading platforms is NFT lending protocols.

That said, NFT lending projects come in different shapes and sizes.

For this strategy, we will walk through how to use NFTFi, the largest peer-to-peer NFT lending project, and BendDAO, the largest peer-to-pool NFT lending project.

NFTfi

NFTfi is a P2P marketplace for NFT collateralized loans.

In other words, the project lets borrowers come up with desired NFT loan parameters, and crypto lenders can then opt in to accept those terms on a person-to-person basis.

The advantage of this approach is that it lets you fully customize and choose to accept your NFT loan parameters. The downside is that it can take a long time, if ever, to find another party willing to take your loan.

How to take a loan on NFTfi:

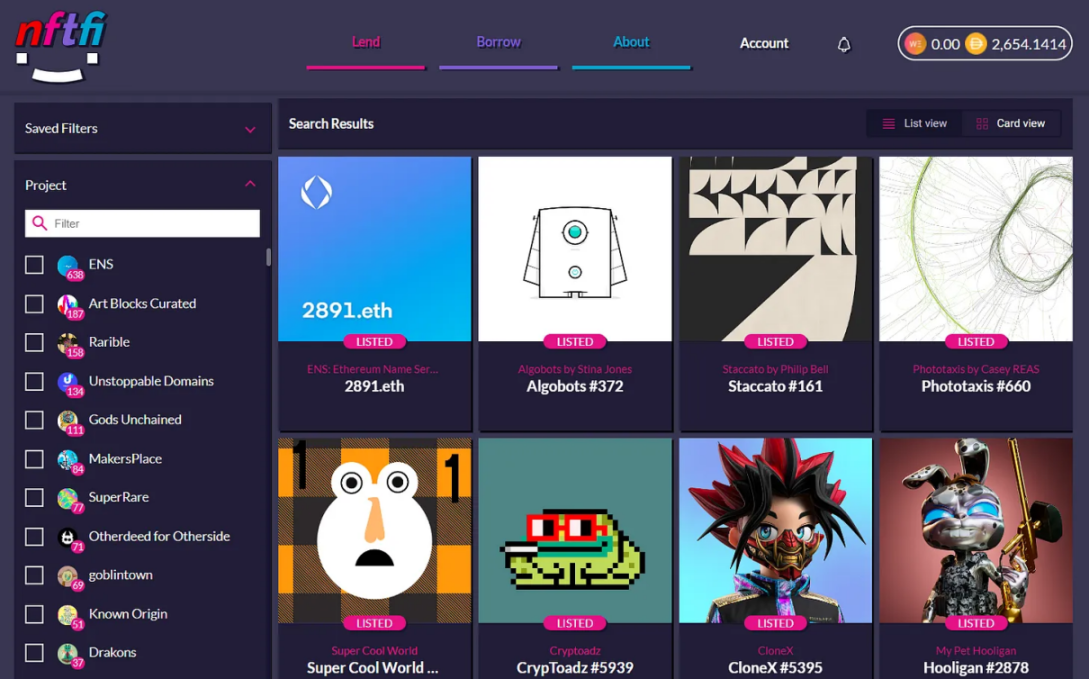

1) Go to app.nftfi.com/lend/assets and connect your wallet

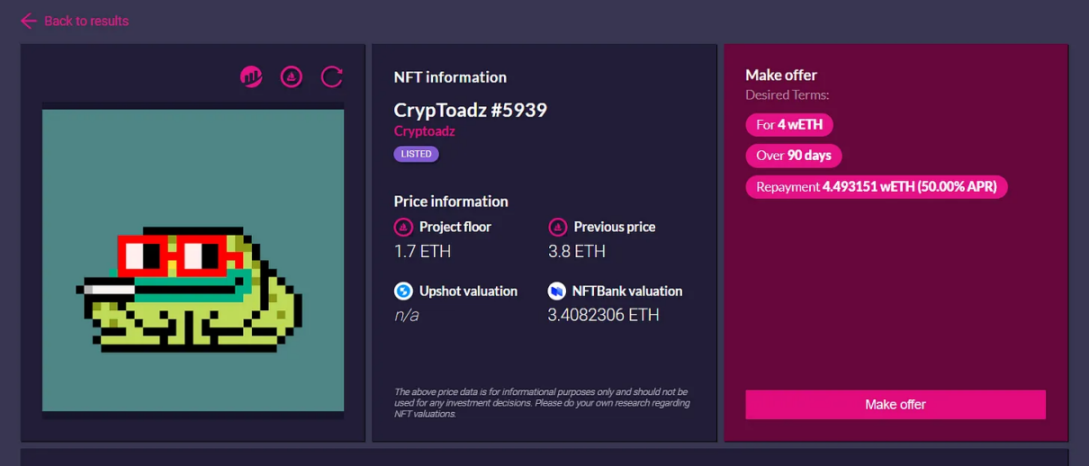

2) Click on the NFT loan proposal you are interested in

3) Continue to click the "Make Offer" button and choose to accept the borrower's suggested terms or customize your own terms (amount, repayment, schedule, etc.).

4) Next click on the "Grant" button and use your wallet to approve NFTfi to use your funds (this is a one-time transaction).

5) Then sign the wallet to confirm your loan proposal, and that's it. Your counterparty has seven days to consider the proposal before it expires.

How to borrow on NFTfi:

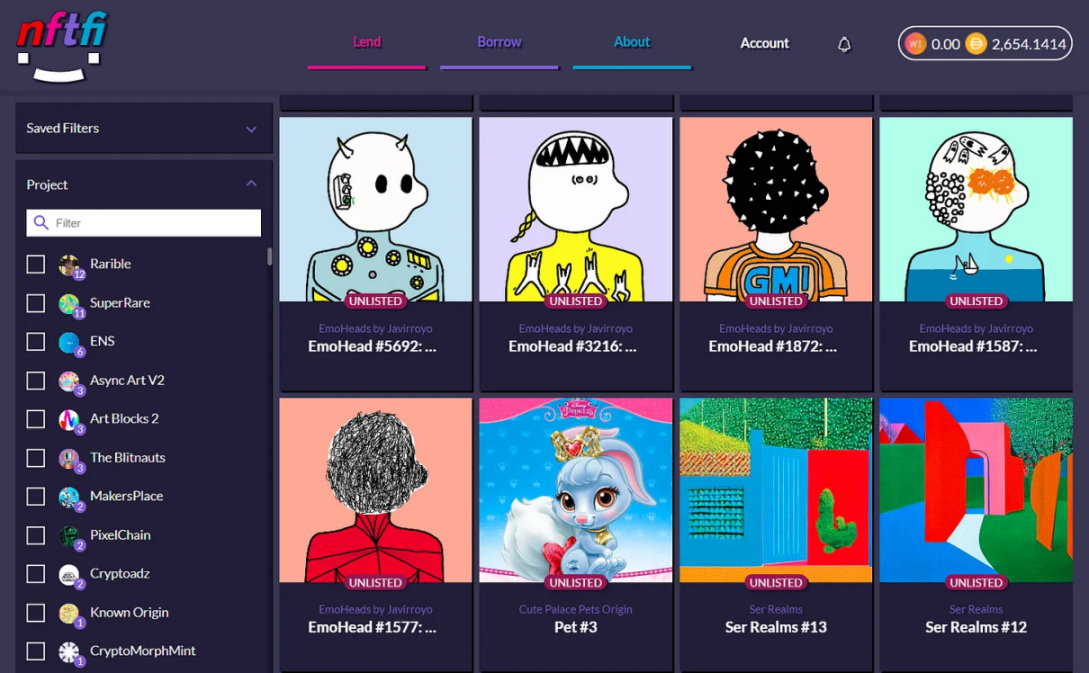

1) Go to app.nftfi.com/borrow/assets and connect the wallet.

2) Using the filters provided, find the NFT you want as collateral in your wallet

3) In the next interface, specify the loan amount you want, loan schedule, interest rate, etc.

4) Then use the "List as Collateral" button to complete.

5) Wait for the lender who accepts your proposal to close the deal.

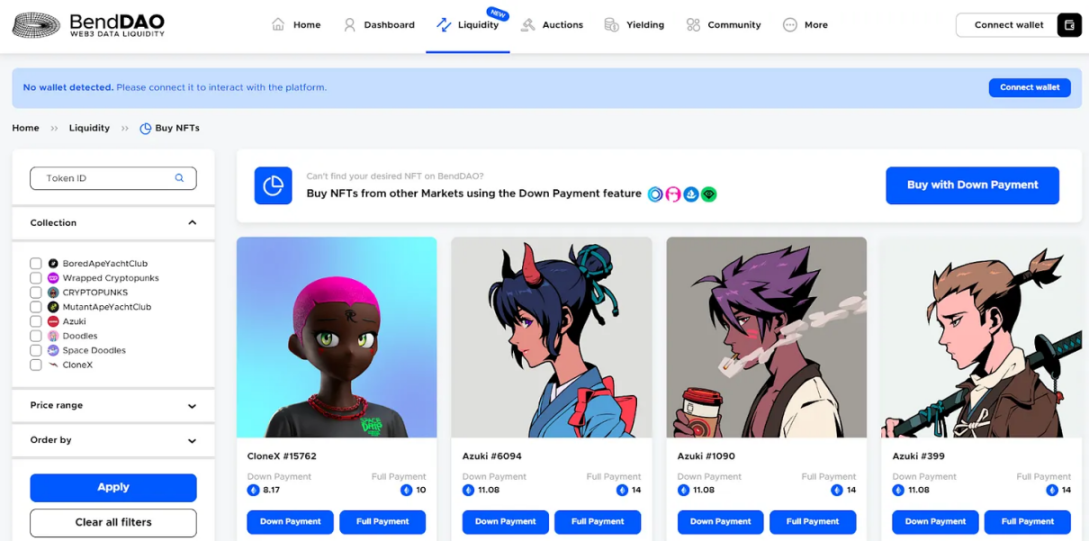

BendDAO

BendDAO is a peer-to-peer NFT lending protocol. In other words, depositors of BendDAO provide ETH to liquidity pools to earn interest, and borrowers of NFT projects can then obtain instant NFT-backed loans through these pools.

How to lend your assets on BendDAO:

1) Go to benddao.xyz and connect your wallet

2) Sign to verify your address

3) Click the "Liquidity" option, and then click the "Deposit ETH" button

4) Enter the amount of ETH you want to deposit, and press"Deposit"button.

5) Sign the wallet to complete the transaction, and then wait to earn income - the current loan annual interest rate is 8.5%.

How to borrow on BendDAO:

1) Go to benddao.xyz/liquidity/batch-borrow and connect your wallet

2) BendDAO currently accepts deposits in Azuki, BAYC, CloneX, CryptoPunks, Doodles, and MAYC NFTs - if you have one of these and want to proceed, click"Deposit NFT"button.

3) Signature authorizes two transactions, one is to authorize debt tokens, and the other is to authorize NFT

4) Enter the amount you want to borrow and press "Borrow ETH"

5) You can then repay your loan as needed through BendDAO's borrowing dashboard

NFTFi is just getting started

When Bitcoin and the first cryptocurrencies came out, you could send them from address A to address B, and so on.

Ethereum is a smart contract platform, and its emergence makes digital tokens composable, interoperable, and usable in various ways.

We see a similar trajectory from simple to advanced in NFTs. At first, you can basically only buy and sell NFTs, and while this is a start, it's the start of everything possible.

The rise of DeFi's NFTFi space is beginning to pave the way for a variety of more advanced use cases, such as NFT derivatives, NFT loans, NFT pricing agreements, and others.

Today, NFT borrowing and lending projects like NFTfi and BendDAO make it easier for people to get funds with their ETH, or to get NFTs by offering ETH.

Original link