After the collapse of the Terra/UST algorithmic stablecoin system, the United States has stepped up its focus on stablecoins. September 21,in the mediaThe relevant content of the stablecoin bill proposed by the US House of Representatives has been reported, and the algorithmic stablecoin similar to TerraUSD (UST) will be banned.

As required by the draft bill, it would be illegal to issue or create new "endogenously collateralized stablecoins." This definition also applies to the sale of stablecoins that can be converted, redeemed or repurchased for a fixed amount of monetary value and rely on the value of another digital asset of the same creator to maintain their fixed price.

first level title

endogenous collateral

a16z once mentioned "endogenous mortgage stable currency" in an article on stable currency, which refers to the use of collateral created by the issuer, such as governance tokens, as collateral for the issuance of stable currency.

In a bull market, this mechanism would spiral upwards in collateral prices and the number of stablecoins issued. Governance tokens appreciate in value, users can mint more stablecoins, the rise in data leads to appreciation of governance tokens, and stablecoins can also be used to further purchase governance tokens.

Similarly, a death spiral can also be triggered by liquidation in a bear market. A typical representative of Terra/UST is the failure in the death spiral. For legislators, such a mechanism is risky.

first level title

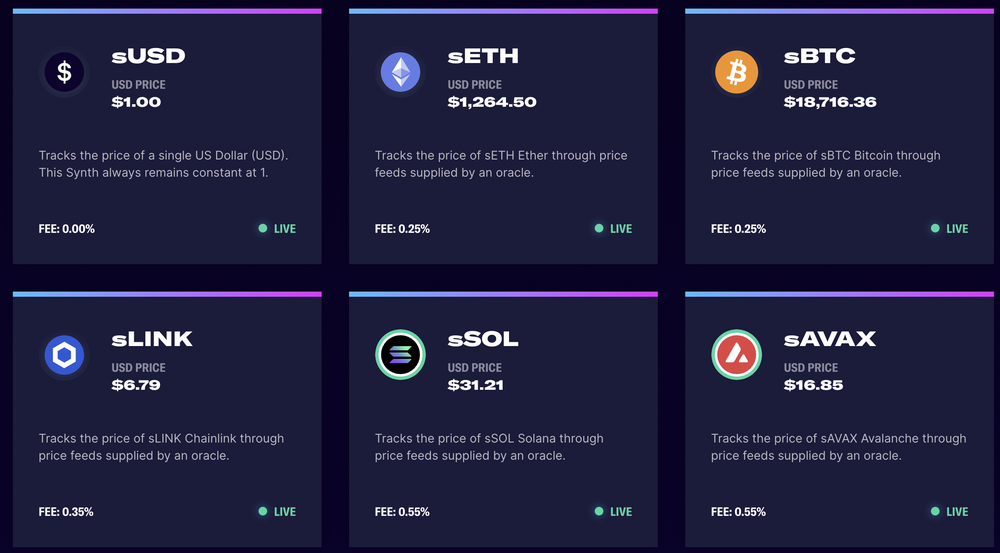

Overcollateralization: sUSD, aUSD

Some projects use their own governance tokens as collateral to over-mortgage stablecoins. Although the projects have their own risk control mechanisms, they meet the description of "endogenously mortgaged stablecoins".

For example, in Synthetix, the governance token SNX is used as collateral to mint the stablecoin sUSD with a mortgage rate of 400%. If SNX appreciates, the collateral can mint more sUSD. If SNX depreciates, sUSD will most likely remain safe due to the higher mortgage rate.

first level title

Similar mechanism to Terra: USDN

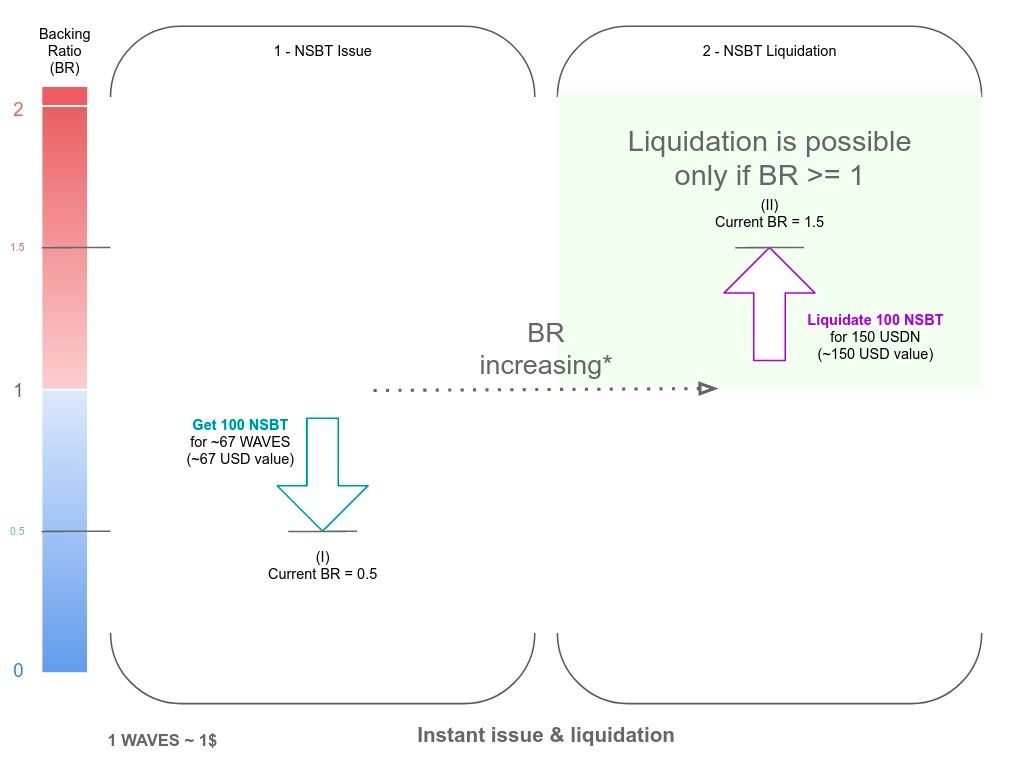

The mechanism of Neutrino Protocol is similar to that of Terra. It is built on the Waves blockchain. The price has been slightly below $1 for a long time, and it is more likely to face regulation.

Users can lock $1 of WAVES tokens in a smart contract, mint 1 USDN, and redeem 1 USDN for $1 of WAVES. As time goes by, the value of WAVES locked in the smart contract may no longer be equal to the issued USDN. At this time, it is necessary to adjust the value of the reserve fund through auctions, and the original token NSBT may be issued.

Although Neutrino that issues USDN and Waves that issue collateral do not belong to the "same creator", the main function of WAVES is to serve as collateral in Neutrino. Even without considering this, the value of USDN needs to be maintained by NSBT issued by Neutrino. Therefore, Neutrino's information is more in line with the judgment of the ban.

first level title

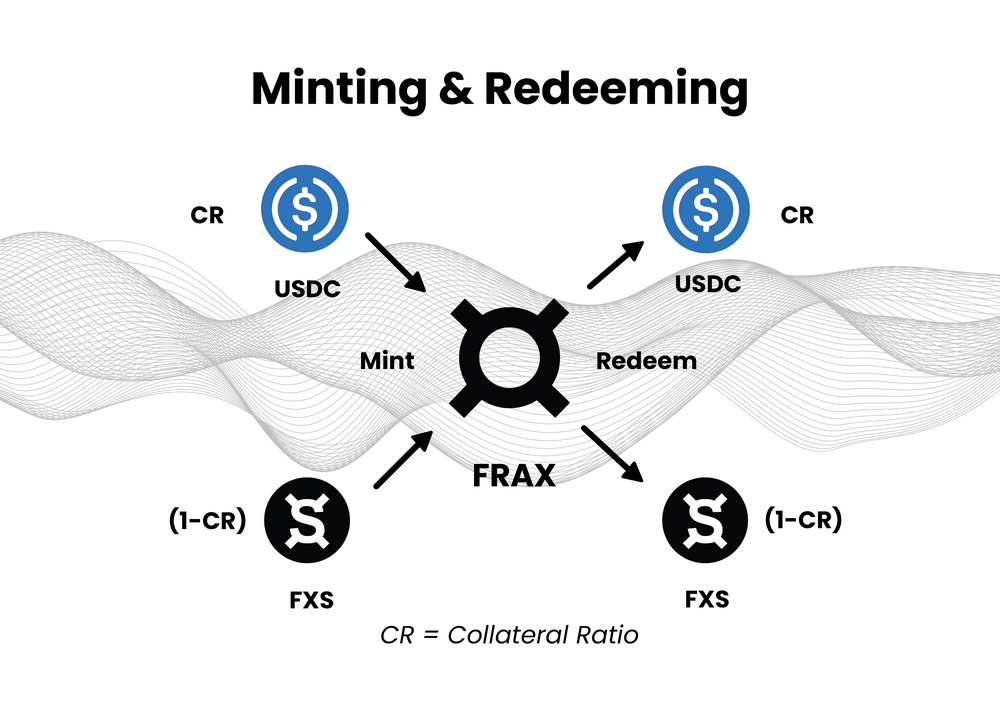

Partial Algorithmic Stablecoin: Frax

Although the current Frax mortgage rate is as high as 92.5%, there is also a large amount of liquidity on Curve, and the possibility of a death spiral is very low, but Frax may also meet the definition of the bill ban.

Frax is a part-algorithmic stablecoin. To mint 1 FRAX needs to consume a total of 1 USDC and FXS, where USDC is used as collateral and FXS represents the algorithm part. If the demand for FRAX is high, the weight of the algorithm part will increase, and the weight of USDC will decrease; otherwise, the weight of the algorithm part will be reduced, and the weight of USDC will be increased.

There are two extreme situations here. When the mortgage rate is 100%, Frax is the same as MakerDAO’s PSM, and 1 USDC is directly used to mint 1 FRAX. When the mortgage rate drops to 0, Frax will use the same mechanism as Terra to mint 1 FRAX with 1 USD of FXS, and 1 FRAX can also be redeemed for 1 USD of FXS. In the latter case, Frax is undoubtedly the subject of the Act's prohibition.

If understood literally, since Frax contains USDC collateral, strictly speaking, it does not meet the description of the ban on "relying solely on another digital asset from the creator to maintain a fixed price".

secondary title

other

Legal currency collateral

secondary title

Other Decentralized Stablecoins

summary

summary

For decentralized stablecoins, it is considered illegal to issue new endogenous collateralized stablecoins, which may include a large number of relatively safe stablecoins, such as Frax, sUSD, etc. For centralized stablecoins, the bill clarifies regulators, and it may become more common for banks to issue their own stablecoins.

The bill is still in the form of a draft and may be discussed as early as next week. It may still change during the period, and it will take time until it actually takes effect.