Original source: Messari

Summary

Summary

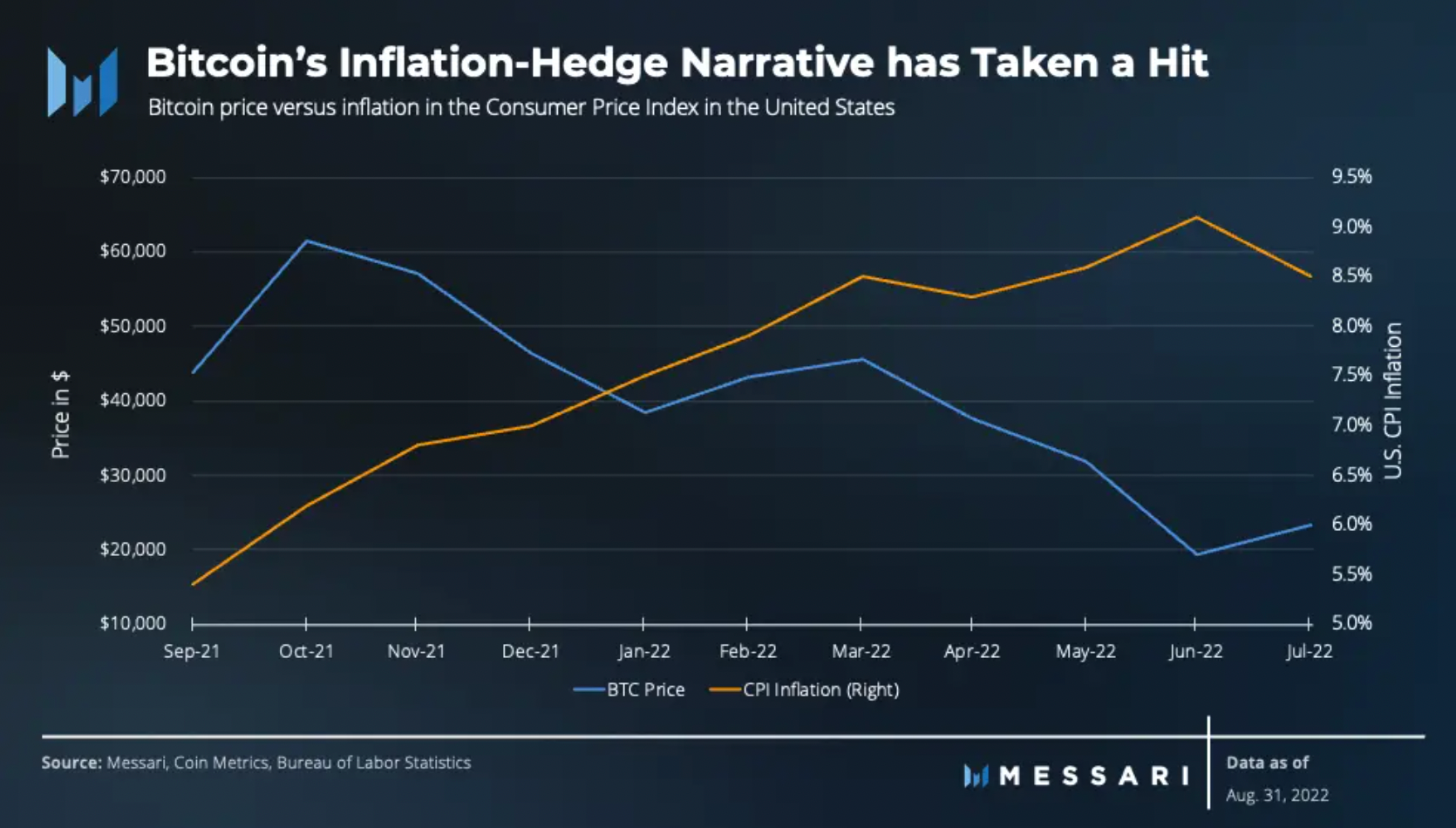

1. In the third quarter, after BTC fell 72% from its peak,Essentially losing the inflation hedge and store of value narrative.

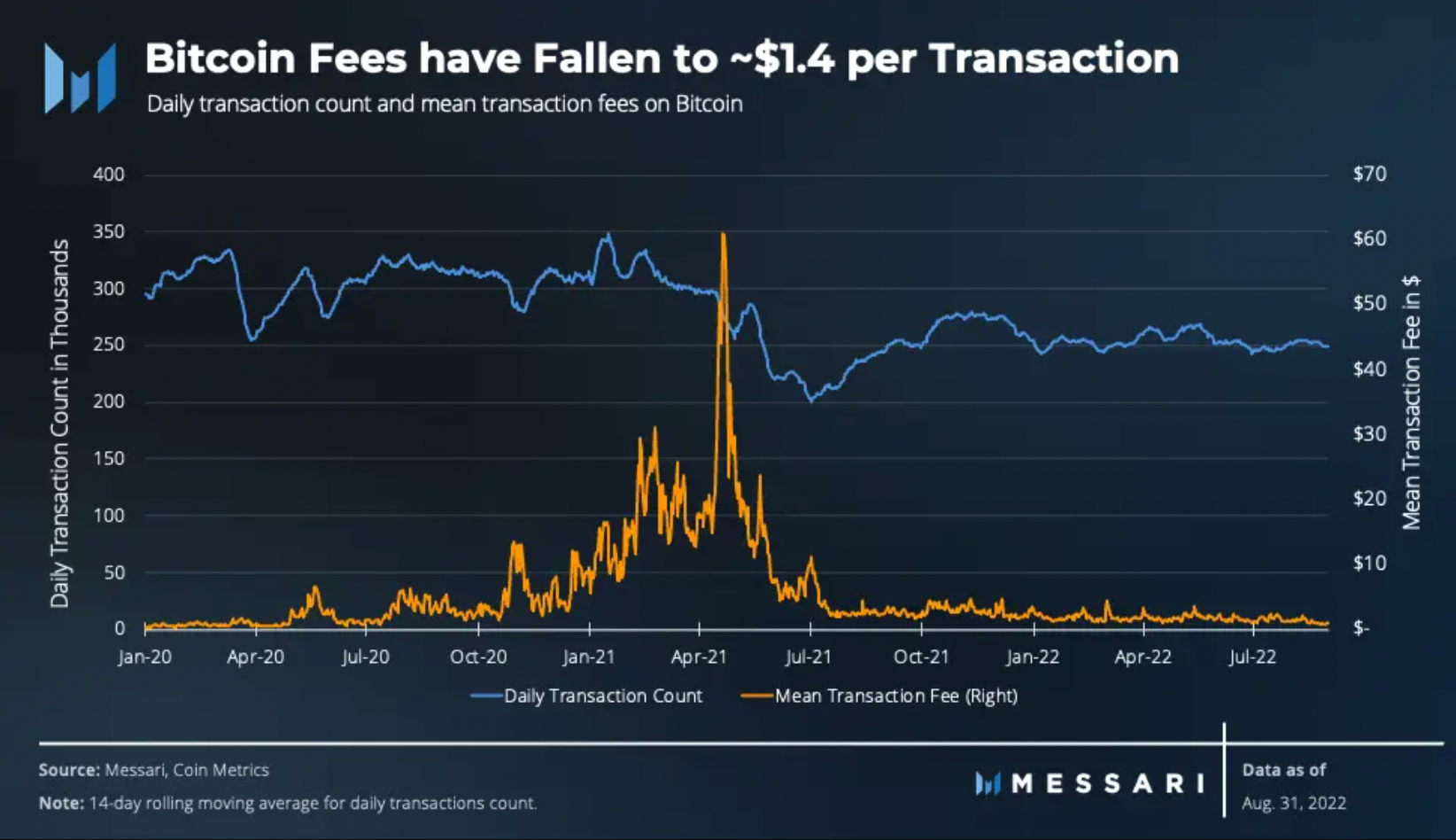

2. As the demand for block space decreased, the number of BTC transactions and transaction fees decreased by 3% and 23% respectively, and the average daily settlement value decreased by 44% month-on-month.

3. Due to the sharp rise in energy prices, the hash rate hit a record high, coupled with the price drop and the reduction in transaction fees,Miners are finding themselves in an increasingly difficult situation.

4. The White House Office of Science and Technology Policy (OSTP) expressed concern that POW hinders US efforts to address climate change, and that energy-intensive mining has a negative impact on grid reliability and prices.

5. Despite criticizing POW, OSTP's report highlights that BTC mining can help reduce greenhouse gas emissions and help accelerate the transition to a renewable grid.

“BTC is like a mirror, and its hottest narrative reflects what society needs most.”

first level title

secondary title

1. Highlights of the season

The latest market drop has been bad news for BTC, the top crypto assetA narrative bust and a reality check.

inflation hedge- Due to its fixed supply and strong monetary policy, it is believed that BTC should act as a hedge against inflation. Conversely, while U.S. CPI inflation hit multi-decade highs, BTC made new cycle lows.

store of value— Since hitting an all-time high of $69,000 in November 2021, BTC has fallen 72% in a risk-off macro environment. Rather than being a store of value, its price action resembles high-beta U.S. tech stocks. BTC prices have taken a hit as the Federal Reserve shifted to a conservative regime with less liquidity and higher interest rates.

Bear Market Assets Outperform— Even in the throes of a bear market, top cryptocurrencies lose market capitalization dominance. The main reason is that Ethereum has performed very well in the transition to PoS.

Mature institutional asset with low volatility— Many institutions capitulated, most notably, Tesla sold most of its BTC in the second quarter of 2022. The capitulation of large lending platforms and funds further fueled market volatility. As a result, the asset has not yet "matured" into a lower risk spectrum, although some institutions did enter.

Retracements of over 70% are nothing new for BTC and its holders. Everyone knew that BTC would rise from the ashes. While there has been little growth in users and transactions, activity has not declined as much as price. With prices at multi-year lows, retail investors have departed, but the network has moved on.secondary title

2. Market indicators

Since the end of the liquidity-fueled bull market in late 2021,BTC returns are increasingly correlated with U.S. tech stocks.

This quarter, with inflation and rate hikes dominating the narrative, the average correlation between BTC and the Nasdaq 100 was0.6. Surprisingly, digital gold and physical gold are much less correlated. The average correlation between the two assets during the quarter was 0.2.

BTC gradually recovered in the third quarter, and volatility showed a downward trend. The 30-day average volatility in August was 60%, compared with more than 80% in June. Lower volatility has resulted in fewer liquidations across the broad crypto market. Long liquidations totaled $5 billion in August, less than half of June ($10.8 billion).The total amount of short liquidations also decreased significantlyfirst level title

2. Network overview

The number of daily transactions on the network remains basically the same throughout the year, with an average of about 250,000 transactions per day. Average transaction fees have been low since the 2021 bull run. To date, the average fee per transaction is just$1.4, down 21% for the quarter and 55% year-to-date.

The last fee spike occurred in early 2021, when the price of BTC hit new highs. Usually during a bull market, users are willing to pay higher fees to ensure their transactions are included as early as possible.

Network address growth slowed.In Q3, addresses grew by just 1.1%, compared to 2.5% in Q2 2022. On a monthly basis, the number of new addresses declined for the first time in August 2022 after growing for 10 consecutive months.

secondary title

1. Lightning Network

The Lightning Network is a Layer 2 payment channel network based on the BTC protocol. It aims to increase the throughput of the network while reducing transaction settlement times. First introduced in 2015, the Lightning Network’s scaling method has grown in popularity over time and is now considered an effective scaling solution for BTC.

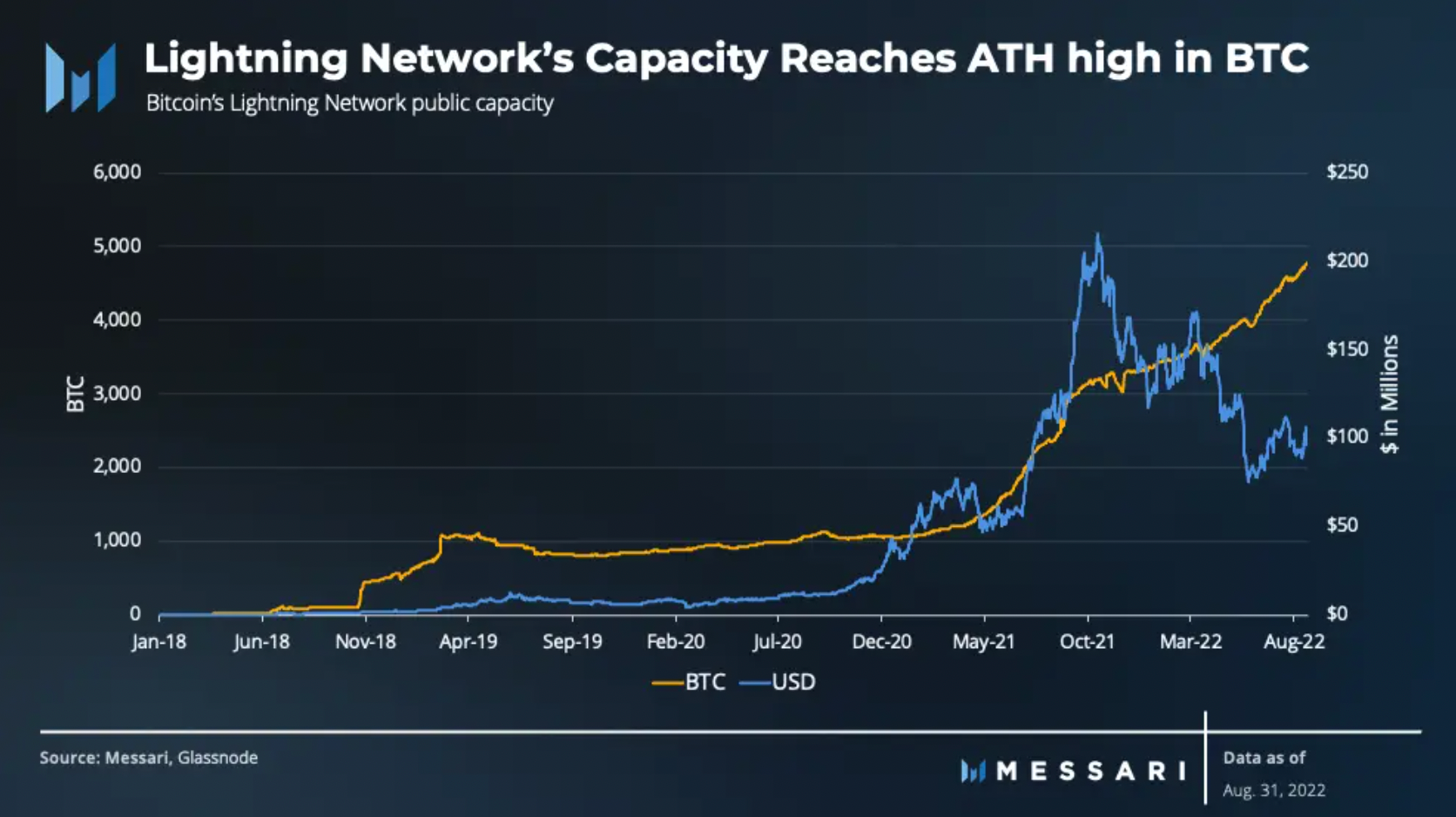

The Lightning Network has been on an isolated bull run for the past year, unaffected by the overall market downturn. Network usage and activity increased as markets fell. While BTC has fallen 57% over the past year, key metrics for the Lightning Network have seen steady growth.

Additionally, Lightning Network adoption is increasing as the network technology matures. also,Many companies have already built the tools and services needed for BTC and the Lightning Network, to meet the needs of mainstream adoption. For example, Voltage offers an easy-to-use cloud hosting service for BTC and Lightning nodes.

The Lightning Network capacity reached a new high of 4,618 BTC, worth $93 million. Increased adoption and increased integration have resulted in a dramatic 96% increase in capacity over the past year. Companies adopting the Lightning Network in 2022 include Cash App, Kraken, BitPay, and Robinhood.

secondary title

2. Mining

2021 is an extraordinary year for BTC miners. Almost all mining operations are profitable as prices rise faster than the network’s hash rate. During the 2021 bull run, many mining companies took advantage of rising BTC prices to expand their operations by issuing new equity and debt to raise funds. Mining stocks rose along with BTC.

However, the broader macro environment has caused this excitement to come to a screeching halt in 2022.

The biggest expense for BTC miners is their energy costs. Just this year, energy prices across the U.S. have risen 15% year-over-year. As global energy prices rise,Many miners find themselves under pressure, especially those miners without a Power Purchase Agreement (PPA).

Going into 2022, approximately $5 billion worth of ASIC purchase orders will be delivered to miners. With the BTC price trending down, miners are rushing to plug in their machines as new ASICs arrive in order to start recouping their costs.This drives up the computing power and difficulty of the network.

secondary title

3. Miner income

Miners have two sources of income: block rewards and transaction fees. Their income depends on the price of BTC and the demand for BTC block space. In the fourth quarter of 2021, miner revenue peaked at $4.8 billion, but has since declined along with BTC prices.

In the first and second quarters of 2022, the quarterly revenue of miners fell by 28% and 22%, respectively. If the price of BTC remains range-bound by the end of the third quarter, given high energy prices,Quarterly revenues for miners are likely to continue their downward trend.

BTC's block rewards account for the bulk of miners' income. During the quarter, miners earned a total of 1.7% from fees. Although the fee level rose by 0.1% from the previous quarter, it is far below what miners will earn during the 2021 bull run.

secondary title

4. Computing power

In June 2022, as energy prices continued to rise, hashrate began to drop, causing some miners to unplug their machines. Hashrate levels are now near all-time highs as ASICs continue to be delivered to miners who ordered machines in 2021. As the hash rate increases during BTC declines, miners may be forced to abandon their HODL strategies and sell the BTC held on their balance sheets.

secondary title

5. Energy consumption

Due to its decentralized nature, it is nearly impossible to determine the exact power usage of the BTC network. The Cambridge Center for Alternative Finance (CCAF) used real-time models to estimate the daily electricity load of the BTC network within a range of assumptions.

first level title

3. Sentiment Analysis

Short-term holders (under 6 months) are at multi-year lows, holding just 23% of the BTC supply as of Aug. 31. Short-term holders of BTC have bottomed out 6 times in the past 7 years, and they have always produced positive returns the following year.

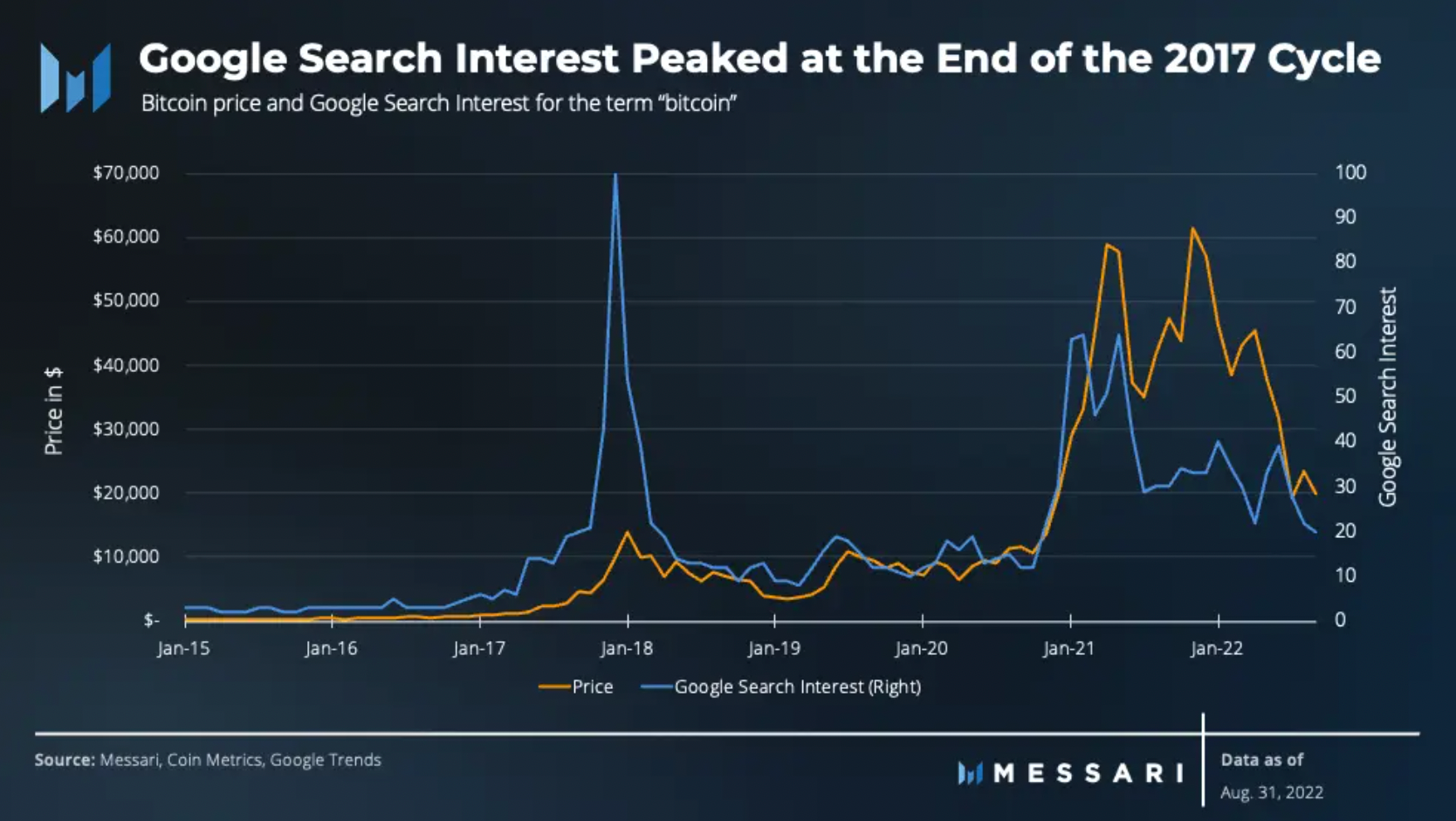

Historically, the number of short-term holders has been a leading indicator of BTC price peaks. As BTC starts hitting new highs, it enters the news cycle and attracts more buyers. However,The last peak in November 2021 did not attract new investors in the same way, possibly due to macro-environmental factors.

Market Cap to Realized Value Ratio (MVRV) This metric compares the current market cap to the value of all BTC in circulation when BTC was last changed. Therefore, it represents the cumulative profitability of the holder.

At the end of August, MVRV fell below the key level of 1, which means that holders are generally in the red. The disposition effect of behavioral finance shows that the more investors hold a loss-making investment, the more they hope to hold it until it turns into a profit. Therefore, MVRV below 1 is often regarded as the accumulation area for long-term investors.

Google search trends help reinforce the idea that there weren't many new entrants in the last cycle.

Typically, the number of Google searches falls as the price of BTC falls. However, searches for BTC have been low since 2017. On top of that, the second wave of bull market in 2021 has only half the search interest of the first wave.first level title

secondary title

1.POW

As energy prices rise and climate change becomes an increasingly important issue, BTC's energy consumption and environmental impact are receiving increasing attention.

On September 8, 2022, the White House Office of Science and Technology Policy released a report on the climate and energy impacts of crypto mining. Overall, the report raises concerns about how proof-of-work is hampering U.S. efforts to combat climate change and how energy-intensive mining can negatively impact grid reliability and prices.

The report calls on several federal agencies to develop standards to minimize negative environmental impacts and ensure energy reliability. If these measures prove ineffective, the report states that Congress and the administration should explore limiting or eliminating PoW mining.

Despite White House criticism of PoW mining, the report does mentionHow PoW mining can positively impact the climate through alternative mining.secondary title

2. Supervision

Over the past few years, the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have disagreed over who should have regulatory authority over the crypto industry. In August 2022, the Digital Commodities Consumer Protection Act was introduced to the U.S. Senate, which would give the CFTC direct oversight of the spot markets for BTC and ETH.

In early September 2022, Gary Gensler of the US SEC expressed support for handing over non-security tokens such as BTC to the CFTC.secondary title

3. Environmental, Social and Governance (ESG)

From an ESG perspective, BTC mining appears to be troublesome. BTC mining consumes a lot of energy and produces a carbon footprint about half that of the data center industry. However, mining, in the right circumstances, can reduce greenhouse gas emissions and accelerate the transition to renewable electricity grids, as the White House mining report states.

Even with the benefits observed from BTC mining, the industry is pushing for a more sustainable energy mix. The BTC Mining Council (BMC) is a voluntary global forum of miners that has been working since June 2021 to bring transparency and best practice to the mining industry. BMC consists of 45 mining companies from five countries, accounting for 50.5% of the network hash rate. In its second-quarter report, BMC reported that,The global BTC mining network has a 59.5% sustainable (carbon neutral) electricity mix.Compared to other countries, BTC has the largest sustainable energy mix, with Germany in second place with 48.5%.

According to BMC, due to increased reliance on renewable energy,The network's sustainable electricity mix has increased by 62% over the past 18 months.

However, the BMC data has been questioned because it is based on self-reporting by miners. To confirm the development of the network towards more renewable energy, Daniel Batten conducted an independent analysis using publicly available information. He found that over the past 18 months,The network’s sustainable energy mix has increased by at least 10.9%secondary title

4. Protocol and ecological development

Bear markets are for building. Contrary to popular belief, the BTC ecosystem has evolved in many ways:

BIP-119, designed to give users more control over how they spend their BTC.

BIP-300 and 301The purpose is to expand functionality by opting for sidechains without changing the base layer. These proposals could bring smart contracts to BTC and provide a viable way to maintain agreement through transaction fees.

Tarois a new protocol powered by Taproot launched by Lightning Labs. Its purpose is to bring stablecoins and other assets to the Lightning Network.

Lightning Pool and MagmaMake it possible to generate income in a non-custodial way.

During the quarter, several developers left the Bitcoin Core development team:

secondary title

5. Capabilities of smart contracts

To reduce the scope of potential vulnerabilities, BTC's functionality is limited by design. While Bitcoin does have the capability of smart contracts,it is not turing complete, which means it does not allow logical loops. Instead of changing the base layer of Bitcoin and sacrificing security for programmability, one option for introducing smart contracts into Bitcoin is to use Layer 1 to build a bridge with BTC.

V. Conclusion

V. Conclusion

In the third quarter of 2022, some narratives about BTC failed to hold true.Over the past year, BTC has been neither a hedge against inflation nor a store of value.

On-chain metrics show a slowdown in transactions, new users, and active users. However, there has been a significant increase in development activity and usage of off-chain BTC ecosystems such as the Lightning Network.

On the mining side, a dark cloud looms over the industry as energy prices and inflation continue to rise amid a low-liquidity macro environment. In addition, with the hash rate hitting a record high and BTC struggling to stay above $20,000,Miner revenue is approaching unprofitable levels. If prices remain range-bound or fall further, some miners and companies will be forced to sell additional BTC to pay down debt and operating expenses.

Having said that, BTC has historically seen worse.Eventually, new narratives may emerge to replace old ones.

Developers are building new protocol features and providing smart contracts for BTC. Bitcoin mining could also be a way to fight climate change by reducing emissions and strengthening the grid. Given the unpredictability of BTC,The next cycle may be driven by the narrative of BTC as an ESG asset.