Regulatory Thunder Drops on Tornado Cash

In addition to the approaching merger of Ethereum, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) has imposed sanctions on Tornado Cash, a privacy mixer built on Ethereum, which is the biggest recent industry hotspot.

As more and more web3 institutions or protocols actively or passively follow OFAC's regulatory policies, they begin to block addresses that have interacted with Tornado Cash, and the community's "poisoning" protests against rough regulatory requirements (referring to Some users withdraw funds from Tornado Cash in large or small amounts to the Ethereum addresses of well-known institutions or celebrities, resulting in these accounts being also affected by regulatory policies), this time Tornado Cash’s regulatory incidents have intensified and sparked a lot of discussion.

In addition to Tornado Cash, the protagonist at the center of the public opinion storm is Circle, an American institution that issues and operates USD stablecoins, because it implemented its blacklist function shortly after OFAC announced sanctions, freezing the USDC in the Tornado Cash protocol , and the eth in Tornado Cash is not only unable to be frozen due to its permissionless nature, but is also used by the community as a "poisoning" intermediary to express dissatisfaction with regulatory policies.

Although both belong to encrypted assets and also run in the permissionless public chain network, the comparison of USDC and ETH's decentralized components in front of supervision is clear at a glance.

Decentralized Stablecoins VS Centralized Stablecoins

The Importance of Stablecoins

USDC’s central coordination role in this supervision has made people re-aware of the importance of those concepts that fundamentalists have always insisted on but have gradually been ignored in recent years-resistance to censorship, permissionlessness, and decentralization.

As the settlement layer of the Web3 economy, the importance of stablecoins surpasses almost all other basic DeFi applications, as reflected in:

The widest user group: If the users of the centralized trading platform are also included, the number of stablecoin holders is the absolute number one

Largest transaction size: Stablecoins have a very high turnover rate as a transaction intermediary, and most of the transaction volume in the crypto world is related to stablecoins

Huge asset scale: the current total market value of stablecoins is more than 150 billion US dollars, second only to BTC and ETH

Therefore, it is no exaggeration to say that stable currency is the most important basic setting above the public chain layer in the web3 economy.

However, since the birth of stablecoins, the pattern dominated by central institutions such as Tether (USDT), Circle (USDC) and Binance&Paxo (BUSD) has always been stable. The market share of centralized stablecoins, whether it is market value, transaction volume or The number of users, the trend of continuous expansion is intensifying.

Although in 2021-22, the decentralized stablecoin UST based on the Terra network and with Luna as the underlying asset once developed against the market, and its market value once surpassed the third largest stablecoin BUSD, reaching more than 18 billion US dollars, but its market value this year The rapid collapse in May has only become a dazzling and short-lived meteor in the history of stable currency development.

There are various reasons for hindering the expansion of decentralized stablecoins, but the most important and simple reason is: Compared with centralized stablecoins, decentralized stablecoins have no obvious advantages in product experience.

"Decentralization", an important concept that allows BTC, blockchain, and Web3 to rise from the ground, does not seem to be so important in the field of stablecoins.

More importantly, the price is stable, easy to use, and easy to obtain.

Until people witnessed the first regulatory thunder that fell on the DeFi protocol Tornado Cash in August 2022.

The decentralized asset ETH was able to get out of Tornado Cash, and the centralized USDC may be left there forever.

The Growth Bottleneck of Decentralized Stablecoins

The Tornado Cash regulatory event is a giant event advertisement for the importance of "decentralization" of stablecoins.

The target of this advertisement is not only ordinary users, but also those decentralized stablecoin projects that use centralized stablecoins as collateral. The representative is the current largest decentralized stablecoin agreement - MakerDAO and its The issued DAI, the current issuance scale of DAI is 6.8 billion US dollars.

Then, will the centralization concerns caused by regulation pave the way for the “decentralization” of the stablecoin market and become a direct driving factor for the increase in the share of decentralized stablecoins?

Before thinking about this issue, it is necessary for us to re-evaluate the bottleneck source of the current market share of decentralized stable currency projects that has been unable to break through.

The market value and market popularity of decentralized stablecoin projects are always affected by two core factors, one is the actual needs of business or scenario construction, and the other is the track narrative that excites the market.

The former is an internal factor for its long-term development, while the latter can drive the influx of short-term users and funds of the project, attract a lot of attention and discussion, and push up public expectations and prices for the project.

1. Bottlenecks in business and scenarios

Data source: Coingecko

Data source: Coingecko

Since Anchor, the previous lending agreement in Terra, has provided a stable currency current interest rate of 19~20% for a long time, the interest rate level is significantly higher than the risk-free rate of return in web3 and the traditional world during the same period, and the Anchor protocol only accepts UST as stable currency deposits. It directly pushed up the demand for UST, making UST grow into the third largest stable currency in just one year, with a market value of 18.7 billion US dollars at its peak.

Of course, the 20% current rate of return has also caused a series of evil consequences:

The scale of UST is expanding too fast, and the debt scale of Terra ecology is too high

The cost of debt is too high

The extremely high rate of return has squeezed the space for other DeFi projects in the Terra ecosystem

In addition to Terra, other protocols that issue decentralized stablecoins also try to create initial demand for their own stablecoins.

image description

Alpaca's automated income products, data source: Alpaca

The above attempts to promote the growth of the stablecoin business through self-created demand were ultimately not very successful.

The failure of UST is mainly due to the loss of control of monetary policy, while AUSD is due to the fact that the business sector used to drive demand has too little energy and insufficient demand, resulting in the inability to provide sufficient demand for stablecoins.

The reason why Terra and Alpaca have to shape their own demand for stablecoins is because it is very difficult for new stablecoins to gain external adoption and obtain better liquidity. In the competition in the open market, there are already enough players, and both users and protocols tend to choose mature stablecoins; the cost of liquidity of stablecoins has also been fully priced through protocols such as Curve, and new stablecoins need to be subsidized , purchasing governance votes, swapping benefits with other DeFi agreements, etc. to exchange for liquidity, the cost is not low.

2. The bottleneck of narrative

There have been two large-scale narrative trends in the decentralized stablecoin track in recent years.

The first is the wave of algorithmic stablecoins driven by Empty Set Dollar and Basis Cash from the end of 2020 to the beginning of 2021, and the second is the wave of public chain stablecoins brought about by the success of Terra, a public chain + stablecoin two-wheel drive model.

For the former, Empty Set Dollar and Basis Cash tried to achieve rapid market value and network expansion with a Ponzi-colored inflation design in a completely unsecured manner, and simply used inflation/deflation to balance the price of stable coins. At that time, It is an imaginative currency experiment, and the representative decentralized calculation and stability project is called "Underground Federal Reserve" by many investors. "Believe it or not, I use a stable currency to outperform your BTC" also became a well-known proverb in the wave of steady wealth creation at that time. But in the end, this type of exploration proved to be a failure. In the early days of the stablecoin project, it was difficult to establish a stable currency value based solely on expectations.

The success of Terra has directly led to the imitation of many public chains issuing their own stable coins. Before the collapse of UST, the projects that announced the launch of their own public chain stablecoins included Near, Secret, Tron, etc. They more or less referred to Terra's minting model, and their market value also had better short-term performance after the announcement of the plan.

However, the failure of Terra has turned the market from admiration to suspicion of the self-operated stablecoin model of the public chain. At the narrative level, the second wave of stablecoins has also been temporarily silent so far.

Like other Web3 business projects, the road to development and expansion of decentralized stablecoins is to look at business in the long run and fight for narrative in the short term. The previous bottleneck of decentralized stablecoins is that on the one hand, the internal and external demand of the business is insufficient, and on the other hand, the market has not found new narrative highlights in the short term.

However, the current market situation and the market variables brought about by the end of regulation may bring a new wave of development opportunities for decentralized stablecoins.

A new spring for decentralized stablecoins?

Spring Sowers: Regulation

From a narrative point of view, the public’s concerns about regulation have become a reality, and centralized stablecoins are the direct grasp of regulation.

A large part of the charm of the Web3 business world comes from the efficient innovation and combination of businesses created by the permissionless environment, as well as the convenient cross-border capital flow. Advocating a decentralized, permissionless encrypted world, if the settlement layer is completely ruled by a centralized stable currency, this is unacceptable to most people. The USDC asset freezing event brought about by Tornado Cash supervision has made the public clearly aware that decentralized stablecoins are no longer as simple as a "regulatory disaster recovery" for centralized stablecoins, but may become a rigid demand for assets.

The promotion of regulation for decentralized stablecoins is not only at the narrative level, but may also directly bring about the growth of business demand in the future.

If such incidents happen again in the future, or stablecoins such as USDT and BUSD are also forced to join the ranks of sanctions, user dissatisfaction with rough regulation and demand for unlicensed currencies will be further activated.

image description

USDC market capitalization scale, data source: Coingecko

However, the market share lost by USDC has not been taken by decentralized stablecoins at present. On the one hand, the historical performance of decentralized stablecoins as a whole is far inferior to that of decentralized stablecoins in terms of stability and security; After several rounds of exchange; moreover, the largest collateral asset issued by the largest decentralized stablecoin DAI is USDC, which may also be affected by USDC in the future. These deficiencies have resulted in the inability of decentralized stablecoins to directly take over the positions lost by USDC.

Sowers of Spring: Leading DeFi Protocols Come to the Battle

Of course, in addition to the external force of supervision, decentralized stablecoins still have many impressive internal development forces.

After the wave of self-made stablecoins on the public chain from March to May this year, the development of stablecoins by leading DeFi players is becoming a new trend worthy of attention.

Among them, the most representative projects are GHO prepared by the lending agreement Aave, and Curve's stable currency (unnamed, hereinafter referred to as crvUSD).

DeFi protocol self-operated stablecoins are not news. Lending protocols Abracadabra, Venus, and Dforce have all issued stablecoins MIM, VAI, and USX.

image description

DeFi TVL ranking, data source: DeFillama

In addition to TVL, the advantages of Aave and Curve include:

Both have strong dominance in their respective tracks

There are good multi-chain and L2 product deployments

Integrate with numerous external protocols

Long development history, no serious safety loss, excellent brand credit and ecological appeal

These are what other DeFi projects lack.

More importantly, the self-operated stablecoins of the two projects also have clear business motives, not pure narrative hype.

For example, the stable currency issued by Curve will most likely be minted by the user's LP in Curve's core pool as collateral, which creates higher capital efficiency for Curve's liquidity providers and is conducive to improving the attractiveness of Curve's market making It also provides Curve with an opportunity to increase its own TVL through leverage.

In fact, a large part of the ultra-high TVL of MakerDAO and Uniswap is realized by the following circular leverage method:

Users go to MakerDAO to mint DAI

Exchange DAI for part of USDC, conduct DAI-USDC stablecoin market making through the liquidity management platform Arrakis, and obtain G-UNI LP

Lend DAI again on MakerDAO with G-UNI LP as collateral

Repeat the above cycle

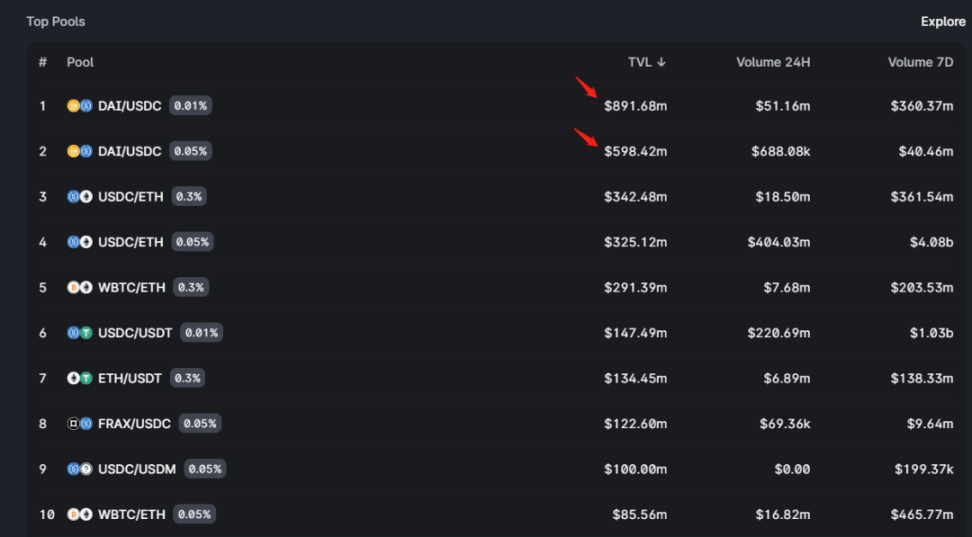

image description

Uni V3 Pool TVL sorting, data source: Uniswap V3

image description

The ratio of collateral sources of minted DAI, data source: https://daistats.com/

If Curve launches its own decentralized stablecoin, it is expected to replicate the above cycle and achieve capital efficiency + TVL improvement.

Planters of Spring: The DeFi Ecosystem

In addition to the driving force of regulation in terms of narrative and business, as well as the self-operation of top DeFi, another opportunity for the development of decentralized stablecoins may come from the overall promotion of projects that are capable of building a DeFi ecosystem.

If we say that the interaction between MakerDAO and Uniswap is just a kind of business cooperation based on composability. Then at the beginning of the business design and construction of the DeFi ecosystem, the collaboration between the various businesses in the ecosystem will be placed at the core.

The essence of the construction of the DeFi ecosystem is the vertical integration of the ecological chain, that is, the integration of the upper and lower reaches of the ecosystem that have business synergies.

At present, there are two exploration directions for this vertical integration.

The first way is to integrate multiple projects together through mergers and acquisitions and in-depth control of the governance rights of collaborative projects to form a DeFi ecology or matrix. AC (Andre Cronje), a well-known DeFi developer and founder of the Yean protocol, is an active practitioner of this method. Since the beginning of DeFi summer in 2020, AC has either created itself, or supported sponsorship, or deeply participated in governance, and has almost integrated A DeFi ecosystem including multi-track projects such as public chain (Fantom), DEX (Solidly, Sushiswap), lending (Abracadabra, Cream), aggregator (Yearn), and cross-chain bridge (Multichain) has been established.

However, it is not easy to coordinate multiple projects with inconsistent interests, users, and core teams. This attempt has not been successful, and AC has announced its withdrawal from the circle in frustration.

Similarly, the merger and acquisition of the lending project Rari capital by the stablecoin protocol Fei Protocol has not been successful so far.

Another way is to build a self-built ecosystem. Binance is the best practitioner of a self-built ecosystem in the Cefi field. In the DeFi field, the representative project of the self-built ecosystem is Frax. The business segments of Frax that have been launched or will be launched soon include: decentralized stable currency (FRAX), Swap (Fraxswap), lending (Fraxlend) and Staking business (fraxETH). Based on the above business segments, superimposing Frax’s governance influence on Convex (Frax has become the largest single holder of CVX) and Curve, and its flexible currency tool module AMO, can Frax build its various business segments into a mutual The accelerated flywheel, driving the long-term development of its decentralized stablecoin, is also one of the experiments we are quite concerned about these days.

The dangers of decentralized stablecoins

Of course, although we have found various development incentives for the spring of decentralized stablecoins in the current market, there are still some unresolved issues that deserve our attention, such as:

The underlying assets of many decentralized stablecoin projects are centralized assets such as USDC. For example, among the issued DAI, 51.9% of the DAI comes from USDC (the USDC in G-UNI LP is not included here). The initial collateral of Frax is also USDC, but the current actual collateral of the FRAX stablecoin is not pure USDC, most of which are LPs of the Curve stablecoin pool, which means that unless Circle blacklists the Curve protocol, it cannot freeze the collateral of Frax physical assets. However, will DeFi protocols such as Curve become the next target of sanctions?

Balance sheet expansion. If the decentralized stablecoin protocol still adopts an over-collateralization mechanism, the scale of collateral such as ETH will become the ceiling for the expansion of the protocol's balance sheet. Of course, since the advent of MakerDAO's D3M module and Frax's AMO V2, they can directly output DAI and FRAX through protocols such as Aave without collateral. When users lend DAI and FRAX from Aave, the collateral is provided by the user, which improves the efficiency of protocol capital expansion. But even in this way, it is difficult to meet the monetary demand scale of the entire Web3 business.

write at the end

write at the end

The "disaster recovery value" of decentralized stablecoins as the settlement layer of Web3 has been further revealed after the Tornado Cash incident. Of course, we believe that Circle will try its best to restrain itself when assisting the supervision to crack down on it. If USDC blacklists Tornado Cash, it is justifiable. When it starts to attack the next DeFi such as Curve, it may be better than the one it sanctioned. The protocol completely lost the trust of Web3 users earlier and was forced to withdraw from this market.

But the question is, by then, will decentralized stablecoins be ready to take on the users and funds that have fled from centralized stablecoins?

Apparently not yet.

Original link