first level title

Equity Splitting of Asset Prices in Traditional and Crypto Markets

As we all know, in the traditional capital market, stock splits refer to the behavior of exchanging one stock with a higher par value for several stocks with a lower par value. It does not belong to a certain kind of dividend and will not affect the performance of the company. Fundamentals change. However, according to observations in recent years, stock prices after stock splits tend to rise to a certain extent. Although people who believe in the rational market hypothesis will be puzzled by this phenomenon, it does not prevent the market's preference for asset splits.

According to researchers at Bank of America Securities, since 1980, stocks in the S&P 500 that announced splits have outperformed the index by an average of 16 percentage points over the next 12 months, as historical data has repeatedly verified. Correlation between stock splits and stock price gains.

Stock splits are back in vogue due to a variety of factors, and Google parent Alphabet, Amazon, Tesla and GameStop are among the latest batch of companies seeking shareholder approval for stock splits, with each enjoying a jump in their stock prices following the announcement.

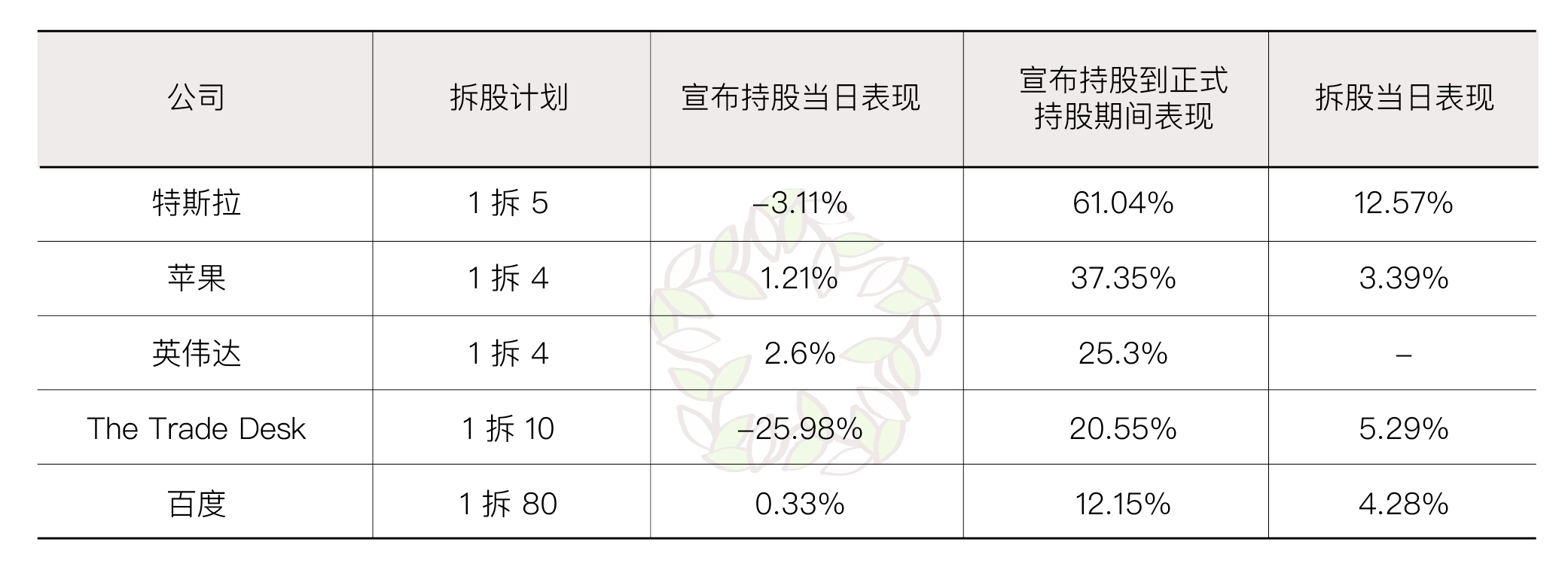

Stock split performance of different companies In the past few years, large technology companies including Apple (Apple), Nvidia (NVDA) and Tesla (Tesla) have announced stock splits. Dow Jones Market Data shows that in the past 10 years, the average annual About 20 U.S.-listed companies split their shares.

The technology stock bubble in the late 1990s was the golden age of stock splits. From 1997 to 2000, an average of 65 American companies split their shares every year as the stock market peaked. Stock splits were on the rise again in the years leading up to the global financial crisis, and again at the end of another bull market.

In the field of encrypted assets, this rule is also followed, and the split of TOKEN will lead to a further increase in the price of the secondary market.

It can be seen that the splitting of asset prices leads to an increase in the amount of holdings and a rise in prices, although the causal relationship cannot be demonstrated, but it can be used as a benefit to holders, thereby stimulating more buying in the secondary market. a de facto connection.

first level title

NFT Fragmentation vs EIP-3664

We can see that NFT is facing a bottleneck in development. For example, the current PFP, artwork and collectibles sectors are still the main narrative direction of the NFT track, and the top assets of these sectors have high unit prices. However, we have seen that after the overall bearish market, they still lack liquidity and have no market. Many holders (investors who want to profit from them) complain that the utilization rate of funds is too low. Although some people propose to "fragment" NFT, use these "fragments" for derivatives or sell them to more potential investors, fragmenting NFT is also very important for the further development, evolution, and narrative of the NFT sector and NFT assets Significantly, we see that there has been no in-depth progress in this direction.

What's interesting is that NFT assets exist as a very special kind. The price of each asset is a complete individual and a unique existence. It is impossible to directly copy stocks and the splitting path of FT assets. But we can see that there are still many attempts to split its assets in the market. For example, the fragmentation of NFT, which once entered the vision of investors, essentially hopes to split NFT. But unfortunately, NFT fragmentation cannot split the block ID with the split fragments at the same time, nor can it return to the original complete ID after the fragments are combined. The fundamental reason is that after the fragmentation of NFT, although the number of splits has been completed, the nature of the assets has changed, from NFT to FT. Even if the mirror is broken and reunited, NFT is not the original NFT.

Although fragmenting NFT seems to be "advanced" because it has not been adopted on a large scale so far, we have seen that as early as May 2021, the DRepublic team proposed a protocol solution called EIP-3664 (also known as EIP-3664). It is called the NFT attribute extension protocol), which uses a more ingenious way to further solve the mainstream NFT standards such as ERC-721 or ERC-1155, etc., which are not expressive enough in attributes, and it is difficult to integrate between NFTs. Centralization (currently mainly stored on the server), and this proposal further realizes the dynamic expansion of NFT attributes.

In the EIP-3664 solution, there is no need to modify the existing ERC-721 protocol and ERC-1155 protocol. It supports NFT attach attributes in the callback function of the IERC721Receiver or IERC1155Receiver of the NFT mint method, and can also be used by the override mint method. Define the way to implement as NFT attach attribute, an NFT can attach any number of attributes infinitely.

All attributes in EIP-3664 implement the IERC3664 interface, and the basic attributes contain several basic fields: ID, Name, Symbol, URI, Balance.

Although many readers have a vague understanding of some technical terms, it can be seen from the above information that EIP-3664 tokenizes the attributes of NFT, that is, we can think that each attribute is also a kind of NFT, which leads to sub-NFT The concept of NFT nesting NFT, NFT nesting FT, this feature seems simple, but it actually provides NFT with infinite variety of properties, and makes NFT more widely used.

The update, transfer, and evolution of attributes can be realized by extending the basic EIP-3664 protocol. At present, EIP-3664 has realized six core attribute operations: upgradeable, modifiable, addable, removable, and scalable. Split, can be combined.

An important feature of the splitting of NFT is to take into account the differentiated personality and integrity after splitting. On this basis, further quantitative fission is a very interesting attempt. We believe that the EIP-3664 protocol is of vital importance to the development of NFT. At present, EIP-3664 is also being tried by some innovative NFT projects. This article will briefly list the projects that use this technology.

1. MM3NFT

secondary title

MM3NFT is authorized and supported by the Monroe family (also an IP manager), and Base's teams in the United States and Europe have rich brand resources. The CGI Monroe NFT with the same theme has cooperated with FENDI, Miumiu, Balenciaga, YSL and other first-line brands to land on VOGUE and CR FASHION BOOK. It is also the first NFT project officially released to the market based on EIP-3664.

How does MM3NFT realize the further splitting of non-standard assets from financial attributes?

When the user mints, he will get an avatar A wearing an accessory, but the user can disassemble the accessory into separate NFTs, and these split accessories A can be assembled with other avatars B, and the original NFT can still be maintained. The ID does not change. That is to say, the holder of avatar A can get more benefits by selling the accessories NFT; the holder of the avatar B can improve the fundamentals of the original assets by purchasing the accessories NFT, because the avatar after combining the new accessories The attributes have changed and the scarcity has been improved, but at the same time the original ID remains unchanged, and the combined new assets will not become asset C, which means that the number of NFTs will not be diluted. All detachable accessories about MM3NFT will be automatically generated in the MM3 Component market on OpenSea.

In fact, the detachable elements make the NFT market very interesting. Looking at all the blue-chip NFTs on the market, the price is determined according to the rarity of each NFT. Only a few NFTs are purchased by users for personal hobbies. All NFT projects have been fighting against the floor price for a long time, resulting in insufficient liquidity, which has also dragged down the price of the less popular NFT of this blue-chip project.

Due to the multiple expectations of the MM3 avatar series, the project partners seem to be top-tier fashion circles, such as FENDI, which has emerged this year. Having the opportunity to obtain brand-named accessories further opens up the imagination space for the future of MM3. According to market observations, with the expectation that luxury and traditional brands will enter the Web3 market to drive incremental liquidity, MM3NFT has completed the first batch of OG disk openings, and once ranked eighth in the OpenSea daily trading volume rankings , In the community, although the public sale information has not been announced, the community's concern about it remains high.

2. MetaCore

secondary title

The technical solution of EIP-3664 was proposed by the DRepublic Labs team, and based on the EIP-3664 protocol, the team launched MetaCore, a composable NFT platform, and Legoot, an NFT product based on this system.

It is understood that the MetaCore system is a one-stop platform that integrates identity systems, unlimited splicing, unlimited combinations, and NFTs with variable attributes. MetaCore allows all users and project parties to create their own splittable and combinable NFTs, and share them Mount on the MetaCore identity system. In addition, MetaCore also enables all businesses and users to create their own composable modular NFTs and hook them to MetaCore identity attributes.

At present, users are expected to split some NFTs based on the MetaCore system and Legoot products, and are expected to combine them with other NFT fragments to give new vitality and value to NFT assets.

3. Cradles

secondary title

Cradles is a role-playing and action GameFi game set in a prehistoric environment, and introduces new concepts such as time and entropy increase. Cradles is also the first chain game to apply the EIP-3664 protocol in the GameFi field. Cradles enters the game in the same way as World of Warcraft, and enters the game by purchasing monthly cards through subscription, which means that the game focuses more on long-term operations, rather than short-term high profits through NFT.

Interestingly, Cradles is also a game developed by DRepublic Labs. Compared with the previous P2E, it emphasizes gameplay and players' active maintenance of the game ecosystem, and the quality is high. In the GameFi I have seen so far The quality of the game is among the best, and the sense of picture and impact is very good, not losing to traditional games.

Cradles received US$5 million in private equity financing in February this year. This round of financing was led by Animoca Brands, Huobi Ventures, Mirana Ventures, Folius Ventures, Everse Capital, Meteorite Labs, Spark Digital Capital, Foresight Ventures, D1 Ventures, YOUBI Capital, Old Fasion, DUX, Unix Gaming, Infinity Force, Good Game Guild, PIF DAO and other well-known institutions participated in the investment. As early as October 2021, Cradles announced the completion of a $1.2 million seed round of financing. Cradles with EIP-3664 features are obviously attracting high attention in the industry.

first level title

EIP-3664 Market Expectations

Based on EIP-3664, NFT has not only truly become an "item" on the blockchain that can be split and combined flexibly, players no longer have to be limited to buying static pictures, and as NFT is split and combined, many NFT Market The display style of NFT has also changed accordingly. Although EIP-3664 is not widely used at present, such a flexible system gives us the derivation and expansion of future NFT functions.

The journey of Web3 is a sea of stars, and innovation is happening all the time. Like MM3 and MetaCore, based on EIP-3664, the new NFT ecology of technological revolution realizes the detachability of NFT without changing the nature of assets. It not only has actual interactive application scenarios as support, but also satisfies users' avatar replacement, social interaction, etc. Demand provides a decentralized identity system with continuously updated attributes for the ecology, and also provides greater financial flexibility and imagination for the transaction depth and expansion of the NFT secondary trading market.