Original author: Jerry Sun,Messarikey summary

Compilation of the original text: Karen

key summary

Benefiting from market volatility and healthy arbitrage bot activity, Uniswap’s trading activity declined less than the entire cryptocurrency market in the second quarter.

WBTC trading activity increased as WBTC served as collateral for struggling CeFi institutions.

The Uniswap Grant Program announces Wave 8 grant information.

Uniswap milestones in Q2 included the launch of a fee tier on Polygon with fees as low as one basis point (0.01%) and the acquisition of NFT marketplace aggregator Genie.

macro level

Although the market value of the cryptocurrency market fell by more than 50% in the second quarter, the trading volume of Uniswap only decreased by 8.7% compared with the previous quarter, partly due to the large volatility of the encryption market; another important factor is the number of arbitrage robots in the system. Activity, where bots can account for 75% of all trading volume, is a healthy sign. DEXs have matured over the past two years to the point that activity is driven by price efficiency rather than pure retail speculation.

In addition, the liquidity provided on Uniswap dropped by 37.1% in the second quarter, outperforming the changes in the market value of the encryption market. Considering that liquidity will be largely affected by the price of the underlying token, the decline in liquidity is not considered Seriously, in contrast, the price of ETH fell by nearly 70% in the same period.

Trading volume can be checked from Liquidity Provider (LP) fees. Compared to Q1, fees across all Uniswap networks except Optimism dropped 21.9%. In contrast, in the past 90 days, LP fees on Optimism have increased by 146.9% from $1.4 million to $3.5 million.

The biggest drop in fees was incurred on Arbitrum, which fell 35.9% to $3.6 million in the second quarter. Although the fees earned on Arbitrum were four times higher than those on Optimism in the first quarter, the $100,000 difference between the two in the second quarter was negligible, once again highlighting the influence of OP airdrops in the Layer 2 scaling war. It remains to be seen whether Arbitrum will launch a token and how this will affect trading on Uniswap.

secondary title

Active V3 market

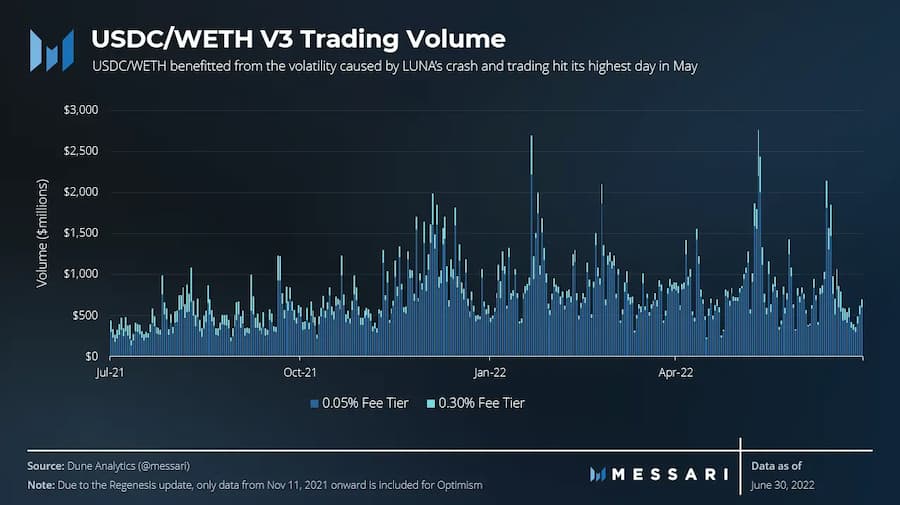

USDC/WETH

text

USDC/USDT

As mentioned earlier, the introduction of the 1 bps (0.01%) fee tier makes Uniswap’s stablecoin exchange pool competitive. However, USDC/USDT transaction volume decreased by 17.4% in the second quarter. It is worth noting that as the market panic caused by the decoupling of UST spread to USDT, the high trading volume during this period may have come from those users seeking to convert to USDC.

WBTC/WETH

The transaction volume of WBTC/WETH in the second quarter was more than three times that of the first quarter. As the chart below shows, the peak daily trading volumes in Q2 were nearly four times higher than at any other point in the past year. This is mostly due to CeFi loans being typically collateralized with BTC, Luna Foundation Guard (LFG), Three Arrows Capital, Celsius, BlockFi, and Voyager liquidating positions from institutions with significant collateralized exposure to BTC, or short sellers pushing prices to hell liquidation thresholds, Data provider Kaiko also pointed out that the trading volume of the WBTC pair has surged during this period, including a nearly 5-fold increase during the market crash in May 2021.

Active V2 market

The three most active markets in Uniswap V2 in the second quarter were USDC/WETH, FXS/FRAX, and APE/WETH.

USDC/WETH

The transaction volume of USDC/WETH pair increased from USD 2.7 billion in Q1 to USD 2.8 billion in Q2, although the quarter-on-quarter increase was not large, it was down from the USD 3.5 billion transaction volume processed in Q3 2021 Not a lot. Compared with the first quarter, transaction costs remained relatively stable.

FXS/FRAX

Quarterly volume for the FXS/FRAX pool increased significantly, to $938 million from $673 million in Q1. On the one hand, it is due to Terra’s decision to include FRAX in Curve 4pool, and on the other hand, the collapse of UST has driven investors to be more cautious about algorithmic stablecoins.

APE/WETH

grant program

grant program

The Uniswap grant program has deployed all the funds allocated to the program, and last quarter's Wave8 was the last round of project grants, with 230 applicants applying for a total of $900,000 in funding. Some highlight projects include:

GFX Labs ($50,000)

Uniswap Grants provided $50,000 to GFX Labs to research how best to implement cross-chain governance for a single protocol.

DeFi Dev Course Creatio ($50,000)

Used to create a new Web3 and DeFi-focused course on learning platform Pursuit.

Uganda Blockchain Club ($15,000)

Designed to fund 10 different university computer science programs in the country.

first level title

Key Protocol Updates

April 10, 2022: 1 bps (0.01%) fee tier deployed on Polygon

April 11, 2022: Launch of Uniswap Labs Ventures

May 15, 2022: Coinbase DApp integration

June 21, 2022: Acquisition of NFT marketplace aggregator Genie