The market in July is digesting the extreme volatility of the previous two months. The focus of investors' debate is turning to whether the bottom of the cycle is forming. We also have time to look back at what DEFI technology, CEFI thunderstorms, excessive leverage, and the liquidity cycle have brought us. everything of. Before every crisis comes, there are always people who believe that "this time is different", but in fact - we are always repeating history. In the face of the cycle, technological progress may only push up economic expectations, but cannot suppress greed and fear. We have witnessed the destructive power of leverage and the rapid bursting of bubbles. If we can learn anything from the previous two months, it must be the awe of the laws of the market and the scrutiny of speculative psychology.

first level title

crash market

image description

Figure 1 Changes in the price of Ethereum in the current month from June 2017 to June 2022

image description

Figure 2 Changes in the market value and TVL of Ethereum from June 2017 to June 2022

image description

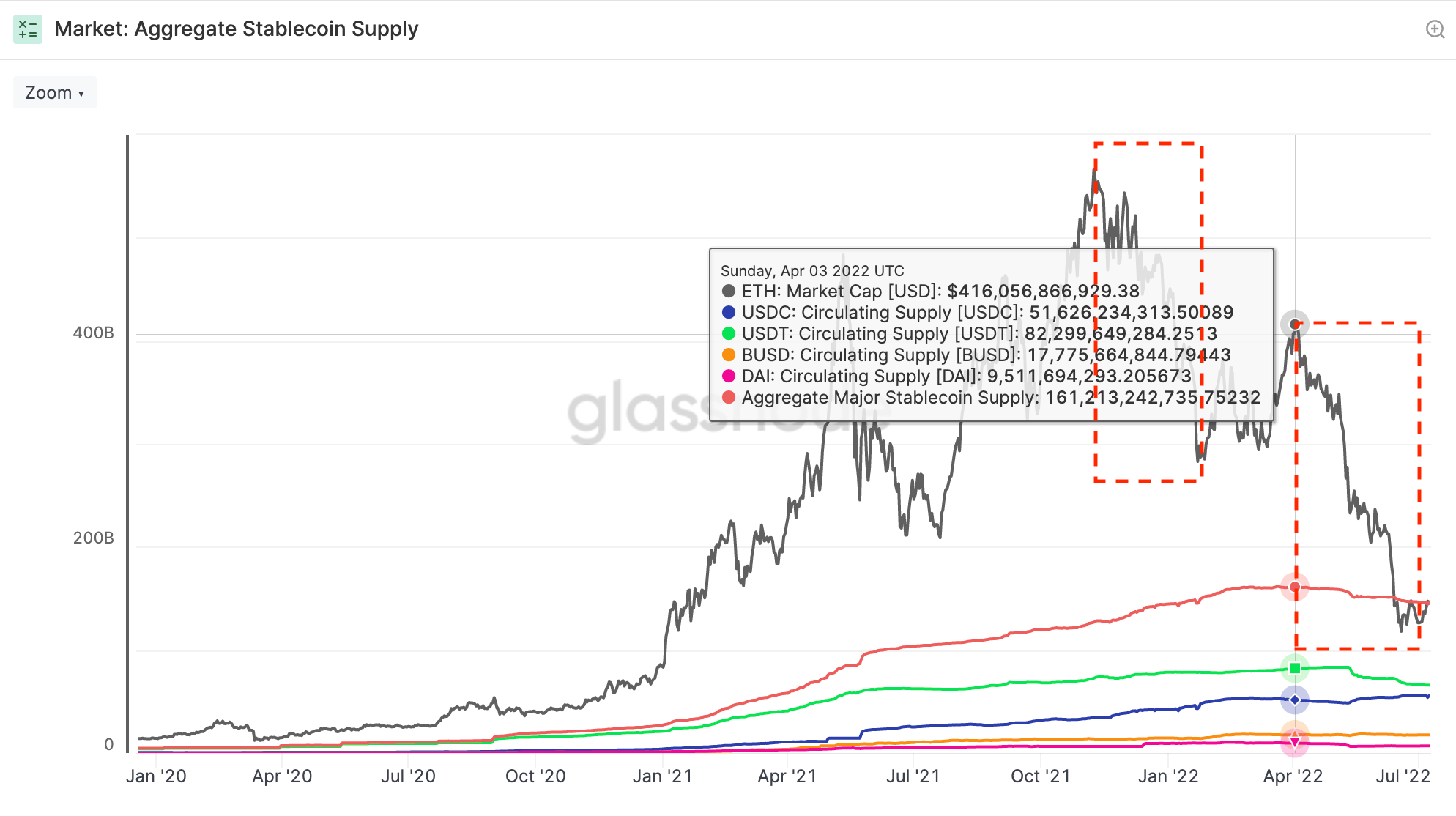

Figure 3 The market value of Ethereum and the supply of major stablecoins from January 2020 to June 2022

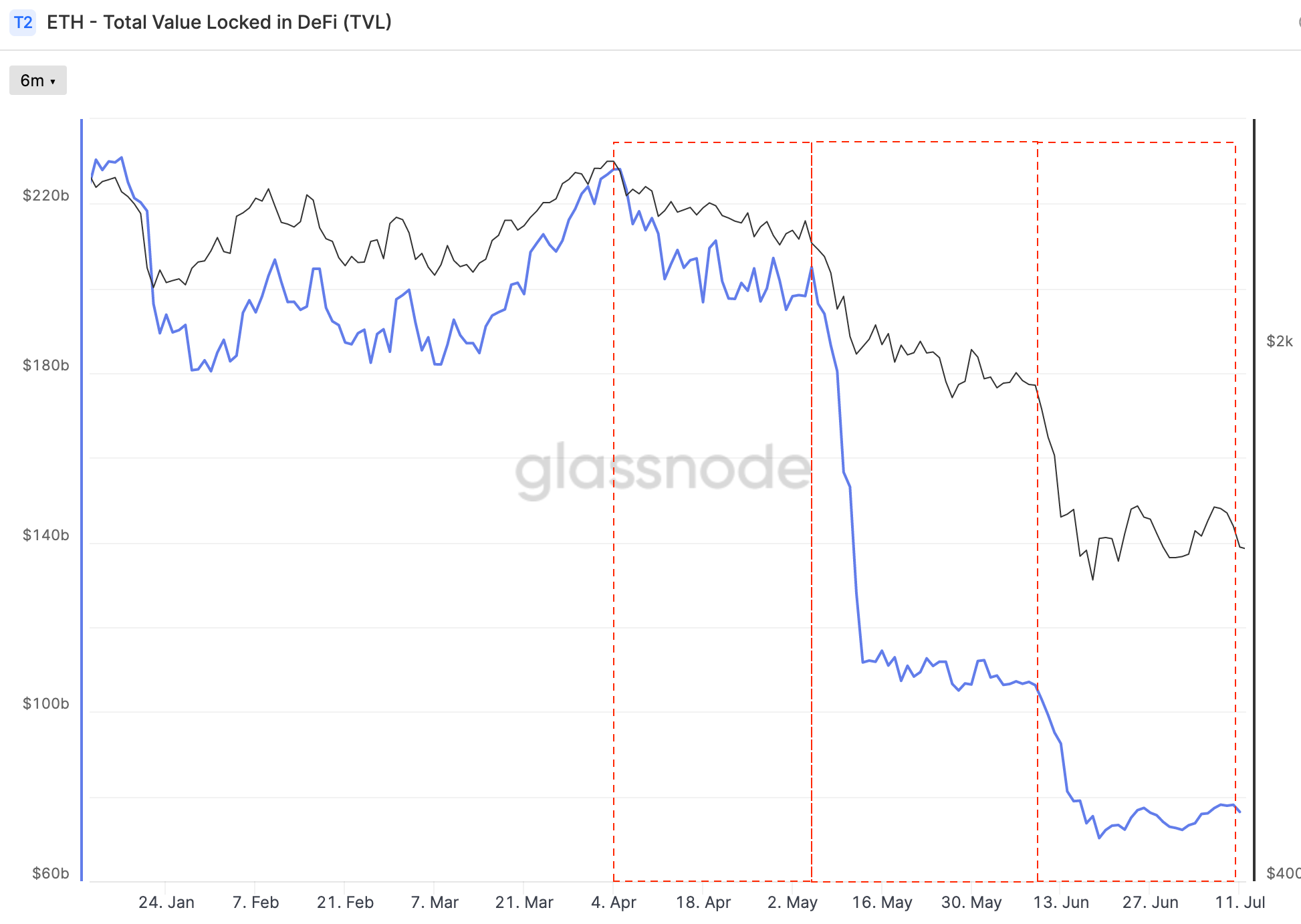

This series of price slumps, TVL tightening, and stablecoin supply declines seem to tell us that this time the market shock is more violent than the decline from the end of 2021 to March 2022-after all, the amount of funds or Liquidity directly reflects market confidence and is the direct driving force of market prosperity.

It should be noted that liquidity has two connotations in the macroeconomy, one is the degree of difficulty in realizing assets at the micro level, and the other is the degree of adequacy of market funds at the macro level. In this article, we mentioned The fluidity of all refers to the second connotation.

image description

The first stage

The first stagesecond stage

second stageimage description

The third phase

The third phasefirst level title

history just repeats itself

Roger Lowenstein has a book called When Genius Failed: The Rise and Fall of Long-Term Capital Management, which restores the rise and fall of Long-Term Capital Management (LTCM). There is a saying in it that derivatives are new, but Panics are as old as markets.

That year was 1998.

Derivatives that we are familiar with, including options and futures, were still in the category of financial innovation in that year.

Founded in 1994 by the head of bond trading at legendary Wall Street firm Salomon Brothers, LTCM conducts highly leveraged arbitrage in the bond market. Its board of directors includes Myron Scholes and Robert C. Merton, who shared the Nobel Prize in Economics in 1997 for their development of the famous BS model for option pricing.

LTCM, then in its prime, used what now looks like a simple strategy—mean reversion, betting on the returns they would get when the market would return to the mean, with the implicit assumption that the market would not deviate" norm” for too long. This has been the case for many years, when the market was functioning normally. LTCM delivered annualized 21%, 43% and 41% satisfactory answers to investors in the first three years respectively, making all Wall Street bankers flock to it. Funds entered into thousands of derivatives contracts, almost every bank was their creditor at the time, covering exposures worth more than $1 trillion.

However, this strategy of betting that the market will always return to "norm" has failed-it should be said that they did not wait for the day when the market returned to normal before LTCM collapsed. Black swan events still happen. The global panic caused by the Russian financial crisis has investors around the world selling everything, and LTCM is betting that yield spreads have not returned to normal as they expected, but have widened. Suddenly, tens of billions of leveraged trading strategies were losing money. Funds were forced to liquidate positions, exacerbating systemic risk for all investors.

Many people compare the crisis of Three Arrows Capital with the fall of LTCM.

Although the scale of Sanjian and LTCM cannot be compared, it is reported that Sanjian only had a scale of 18 billion US dollars at its peak, which is far from LTCM, but a careful review of the context is quite similar.

LTCM bets on mean reversion and borrows extensive debt to run its strategy with high leverage. However, a black swan event occurs, the strategy fails and the debt cannot be repaid, liquidity is squeezed, market pricing is distorted, and belief collapses.

Three Arrows bet on LUNA and stETH, widely borrowed debts with low collateral or even no collateral, and operated with high leverage. LUNA collapsed, and stETH was hit at the same time. In order to reduce losses, Sanjian had to sell stETH, facing a wide range of insolvency The repayment of debts has caused huge losses to companies such as Voyager Digital, BlockFi and now Genesis. Even many investors who have nothing to do with LUNA and stETH have chosen to withdraw liquidity. landing".

From 1998 to 2022, during 24 years, the development process is almost the same. Not to mention the dot-com bubble in the middle of 1990, the global financial crisis caused by subprime loans in 2008, history seems to be repeating itself.

When leverage is accumulating, has no one reflected on it, and has no one consulted history?

No, there must be.

It's just that this voice was drowned out by soaring asset prices, and optimists shouted that "this time is different".

In 1998, Wall Street was obsessed with derivatives and Nobel laureates. During the dot-com bubble, people firmly believed that this communication technology could open a new chapter in the world. In 2008, the invention of subprime loans seemed to have liberated humanity.

first level title

The Nature of Technology and the Leverage Cycle

In his book "The Essence of Technology", Brian Arthur, the winner of the "Schumpeter Award", believes that the economy is the expression of technology, and at the same time, the essence of technology is combination and recursion. Composition refers to rapid integration of each other, and recursion refers to directed optimized cloning.

"Composability" is exponential in driving technology and innovation.

I believe this is the main reason why DEFI has been sought after for so many years since it came out. Because the essence of DEFI technology is the superposition of Lego blocks. This stacking will shorten the innovation cycle - we always stand on the shoulders of giants. Imagine how difficult it would be to build a ve (3,3) from scratch if OHM is not open source and curve is patented. It is precisely because of its syntactic composability, protocol reusability, and tool compatibility that since Uniswap ignited DEFI Summer, we have seen its remarkable development in the encryption track. We don't have to start from scratch, we only need to concentrate on the places where technological breakthroughs are most needed.

Look back at how dominoes are quickly erected and quickly toppled.

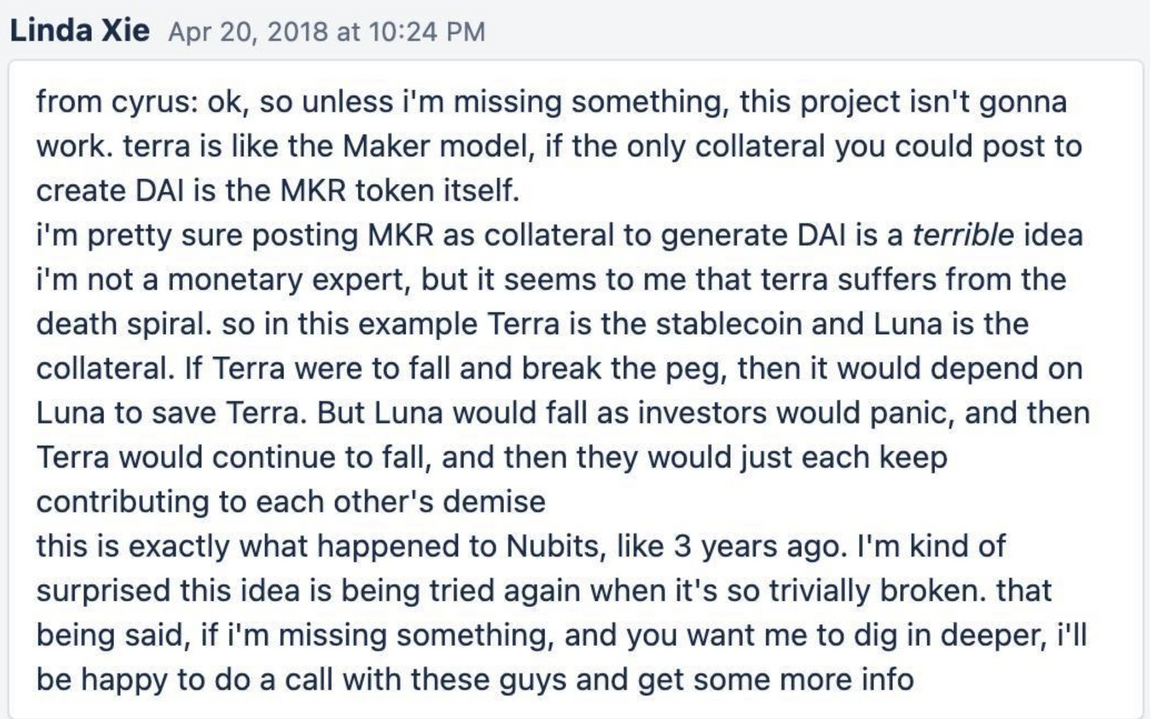

When the LUNA-UST algorithmic stablecoin protocol was launched, there were endless debates. Many people accused it of being just a Ponzi in another sense, and another group of people accused this mechanism of just stepping on the right foot with the left foot. This is a new set of narratives and a new technical way to maintain anchoring—realize the one-to-one exchange with the U.S. dollar through an algorithm, and abandon the asset pledge guarantee method that USDC, USDT and even DAI insisted on in the past. Delphi even created a DEFI paradise for this narrative—Anchor, with a 20% risk-free return—to carry the whereabouts of these assets created out of thin air.

No endorsement, decentralization, algorithms, agreements, just like the Bible says, this is a new heaven and a new earth, and the sea will no longer exist.

image description

Figure 6 Cyrus explains the death spiral of terra, the picture comes from Twitter

However, until 2022, the price of LUNA is still rising, and Do Kwon even made a bet with confidence on Twitter. Time seems to prove that LUNA and Nubits are different-this time it is different.

The reason for the difference is mainly from: Anchor and LFG.

In fact, from the very beginning, the story of DEFI has always revolved around liquidity.

The troika of DEFI: DEX, Lending, stablecoin. Translate with liquidity: DEX is a liquidity exchange place, Lending is a liquidity pricing place, and Stablecoin is a liquidity anchor.

If you want to create anchored myths, you need to think about where these liquidity will go after they are created out of thin air. If liquidity is compared to water, then the market needs to find a sponge to absorb the water and lock it somewhere. Based on this consideration, in July 2020, LUNA created Anchor, and Nicholas Platias described this protocol on Medium.

He conceived of a savings agreement with the following characteristics:

principal protection: Anchor implements a liquidation protocol to liquidate the borrower's collateral when the loan is at risk, thereby protecting the depositor's principal.

Instant withdrawal: Terra deposits can be withdrawn instantly - no lock required.

stable rate: Anchor stabilizes deposit rates by transferring a variable portion of block rewards from collateralized assets to depositors.

Ultimately, their stabilization rate was set at 20%.

That's a yield that, under normal circumstances, would have alarmed anyone educated as an investor.

The simplest reason is: Capital Asset Pricing Model (CAPM), for a given asset, the relationship between its expected rate of return and the expected rate of return of the market portfolio can be expressed as, the rate of return of the portfolio is only related to the system related to sexual risk. The 20% fixed rate of return provided by Anchor for UST is obviously significantly higher than the market risk-free rate of return. The implication of this difference is that its 20% yield cannot be risk free.

When the market was hottest, the market value of UST was as high as 18 billion U.S. dollars, of which more than 14 billion was locked in the Anchor agreement, and it needed to bear 20% APY every year. No matter how the bottom layer could achieve this income through pledge and borrowing-this is the market Simple, without taking corresponding risks, you cannot obtain returns higher than the risk-free rate of return. Then, LUNA needs a way to supplement the yield difference.

In January 2022, another mechanism echoing Anchor, LFG was launched. On January 19, 2022, Do Kwon announced the launch of the Luna Foundation Guard, an organization "mandated to establish a backing dollar-pegged reserve in volatile market conditions" and to "allocate resources to support the growth and development of the Terra ecosystem" through grants . According to estimates, Anchor at that time burned more than 4 million US dollars in LFG every day.

In May 2021, according to the mechanism of LUNA-UST, a death spiral has been triggered. LFG (Luna Foundation Guard) injects capital into the market with its strong financial strength, pulling UST back to the anchor position, and also invisibly for The formation of market consensus gave a boost.

Anchor provides a rate of return that exceeds the market's risk-free interest rate level. LFG provides the market with fanatical confidence. People begin to forget the simplest financial principles, and funds start leverage operations: burn LUNA to form more UST and deposit them in Anchor , Mortgage the certificate into other agreements (such as Edge), and then borrow UST, and then deposit this part of UST into Anchor for Loop. Every layer in this matryoshka process is adding bricks and tiles to the flat and high-rise buildings of UST.

Individual investors have limited investment opportunities in terms of relatively limited access to capital and information, while sophisticated "arbitrageurs" (CEFI institutions) are better off than individual investors due to greater access to capital and better investment opportunities information on investment opportunities. Leverage allows arbitrageurs to take larger positions. However, even arbitrageurs can face financial constraints due to margin requirements — and in the process, Sanjian has employed incredible leverage, even borrowing assets unsecured.

When people began to summarize the success of LUNA and the major public chains competed to imitate, the market gathered a kind of unfounded confidence, and it drove unsustainable speculation. As the credit bubble grew, speculators appeared and began to frenzy Seriously, just scroll through twitter a few months ago and you'll see countless LUNAtics preaching this amazing grail story to lure later investors into the same spiral.

However, if there is bad news, the value of the asset will drop along with the wealth of the arbitrageur. Leveraged arbitrageurs face margin calls and are forced to sell assets to meet margin calls. Selling pressure on asset sales further results in loss of asset value and wealth for arbitrageurs. Increased volatility and uncertainty lead to more margin calls, leading to further forced asset sales. The resulting change in profit margins means a reduction in leverage. Therefore, due to leverage, the price falls more than it would otherwise.

Overleveraging in good times and overdeleveraging in bad times.

first level title

Greed has nothing to do with centralization

When we are in social and economic life, we have to face the dilemma of distrust in many parties, especially in financial activities. The way traditional finance solves this problem is to provide "trust services" by notaries, lawyers, banks, regulatory compliance officers, governments, etc., which is a hidden cost imposed on every participant.

DEFI, short for "Decentralized Finance", is another solution to the problem of trust between people. Aiming to create a financial world without financial intermediaries, it inherits the spirit of Bitcoin and expands the use of blockchain from simple value transfer to more complex financial use cases. Its connotation can be summarized as follows: censorship resistance, immutability, verifiability, accessibility and social consensus, translated as: censorship resistance, immutability, verifiability, accessibility and social consensus. It promises an open and permissionless financial future. Anyone can access a variety of financial services, understand the transparent risks involved and trust that their money will not be stolen or frozen.

However, even with the claimed benefits of DEFI, cryptocurrency investors are still dealing with CEFI institutions.

Before proceeding, let's define CEFI. Here we abandon traditional centralized financial institutions, such as banks, brokerages, etc., and only discuss centralized financial institutions in the cryptocurrency field, such as CEX such as Binance, FTX, etc., and lending institutions such as BlockFi.

The reason is that CEFI provides some of the benefits of DEFI, as well as some of the ease of use and security of traditional financial service products. Therefore, even at the risk of counterparty risk, hacker risk, fraud risk, etc., users still transfer their assets to a black box on the chain controlled by 100% secret keys. In this process, users seem to be weighing, choosing, and transferring. They transfer 100% ownership of their funds in exchange for more convenient and easy-to-use services.

These black boxes, when dealing with customers' funds, should compensate for market fluctuations according to systematic risk measures, such as over-collateralization, such as controlling leverage, such as ensuring liquidity, but when human greed is out of control, it is difficult to have suitable means Early warning of these signs in the CEFI black box.

So what about DEFI, which claims to have immutability, verifiability and accessibility, can it restrain human greed and fear?

In 2013, V God foresaw the future of smart contracts applied to complex financial applications.

Control by software and algorithms that regulate how we interact — “code is law” — is another form of regulation in which private actors can embed their values in technological artifacts. This brings multiple benefits, such as legal automation, such as a priori enforcement rules and regulations happen automatically. Blockchain technology, the greatest example of this practice, brings many new opportunities to translate law into code. By translating legal or contract terms into "smart contracts" with enforcement guarantees, those rules would be automatically enforced by the underlying blockchain network, always as planned, regardless of the wishes of the parties.

As Robert Leshner, who founded the DEFI currency market protocol Compound, once said: there is no human judgment, no human error, no process, everything is instant and autonomous.

Relying on technology as a means of constraining individual behavior, as a means of automatically enforcing rules, sounds like yes. Many supporters of "code is law" seem to think that DEFI is completely outside the legal framework, rather than simply becoming a way for financial institutions to disintermediate.

However, just because all of this is happening via the blockchain doesn't mean that centuries-old legal procedures suddenly and magically cease to apply. Because there are important limitations and flaws in regulation through codes, which may generate new problems related to fairness and due process-the code itself is the reflection of human will. Before there is no stronger binding force, it is difficult to imagine that someone will Stop your own greed with the confinement of technology.

Let’s mention LUNA again. The arbitrage mechanism of LUNA-UST is completed by the code, so as long as the network is not congested, the arbitrage process is automatic, smooth and fast. However, this is only a technical progress. In fact, what this mechanism does not solve are the problems other than arbitrage - the problem of risk, the problem of leverage, and the problem of bubbles.

This is a more rapid bubble extrusion process than any previous hard landing, involving the DEFI protocol on the chain and the CEFI institution off the chain. In less than a month, no one was spared. In the face of the leverage cycle, we The difference or future between DEFI vs CEFI that has been debated, which is better, who will save who, is not worth mentioning.

references:

references:

1.https://www.theblockbeats.info/news/30901?

2.https://min.news/en/economy/31b8631378008cf22a291ba7537495b1.html

3.https://www.nasdaq.com/articles/ltcm-and-other-history-lessons-for-crypto

4.https://medium.com/alpineintel/stop-saying-decentralized-a-plea-for-purging-cf4002d96c95

5.https://studio.glassnode.com/dashboards/8a7eca2d-efd9-4260-5554-74dfce400c34?&utm_medium=website&utm_source=defi_analysis_EN&utm_campaign=defi_deleveraging_2022_2022

6.https://insights.glassnode.com/the-week-onchain-week-26-2022/