Original post by @JamesTrautman_

first level title

Introduction to the Avalanche Avalanche Protocol

Avalanche network is for decentralized applicationsProof of Stake (PoS) Smart Contract Platformfirst level title

Second Quarter 2022 Narrative

After unprecedented growth in 2021, the Avalanche network has seen steady growth in Q1 2022 in terms of usage metrics, infrastructure builds, and financial performance.The first quarter results are attributable to several key factors, including execution of growth strategy, subnetwork development and ecosystem expansion into new industries.The outlook for the second quarter of 2022 is positive, with continued success expected.

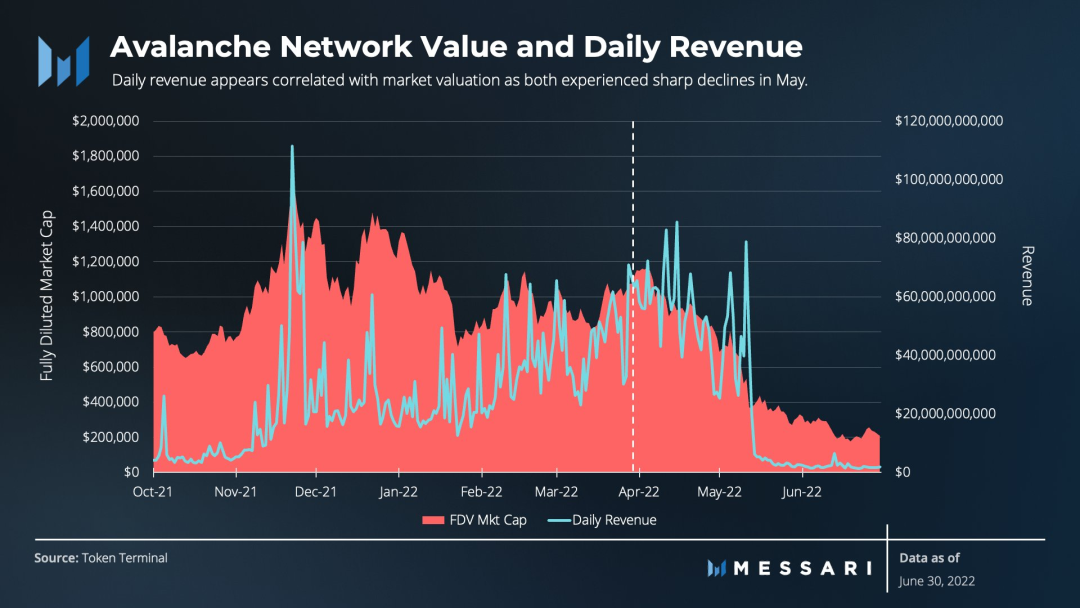

However, in the second quarter, the cryptocurrency market and network activity fell sharply as the Federal Reserve started raising interest rates and the $60 billion terraUSD and LUNA collapsed. Avalanche has also been affected by the macroeconomic environment. Still, the bear market hasn't crippled Avalanche's growth or affected its health and ecosystem. Improving user experience was a top priority heading into the second quarter. As part of this effort, Ava Labs has successfully launched Core; Core is a free, non-custodial wallet tailored for applications on Avalanche, with native support for subnets.Additionally, Ava Labs has successfully enabled native Bitcoin support on the Avalanche Bridge, allowing Bitcoin holders to securely transfer their Bitcoins to Avalanche.first level title

report summary

In Q2, network activity declined as the Fed started raising interest rates and the $60 billion terraUSD and LUNA crashed.Avalanche, while influenced by the macro environment, does not limit the development or health of its ecosystem.

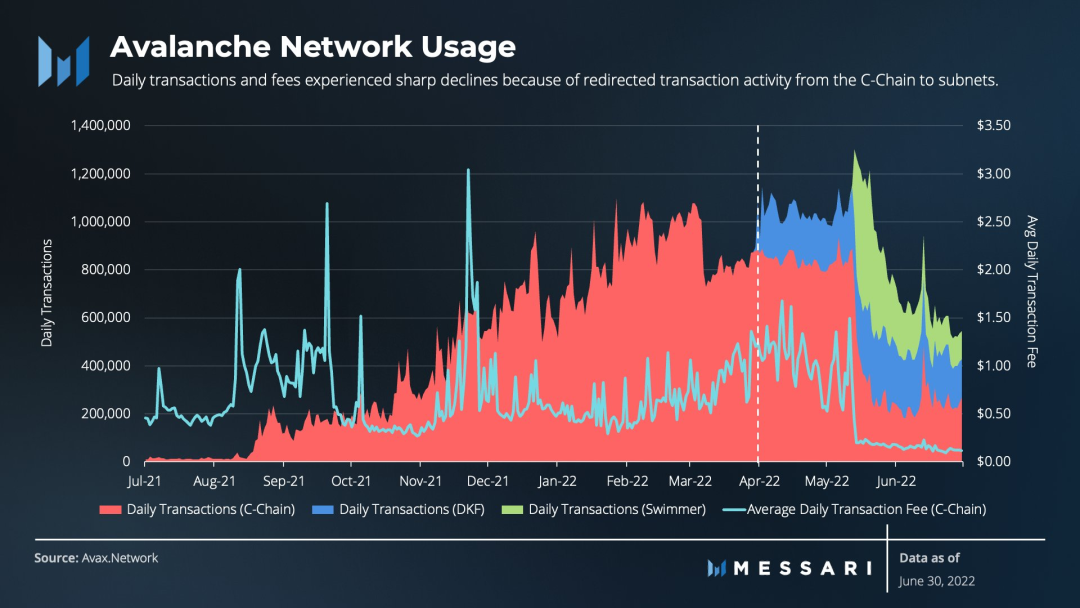

Network usage dropped dramatically due to macro forces and activity redirected from the Avalanche C-chain to the subnet.

The launch of the subnet appears to have put downward pressure on revenue by lowering transaction fees while also reducing the number of transactions processed on the Avalanche network.

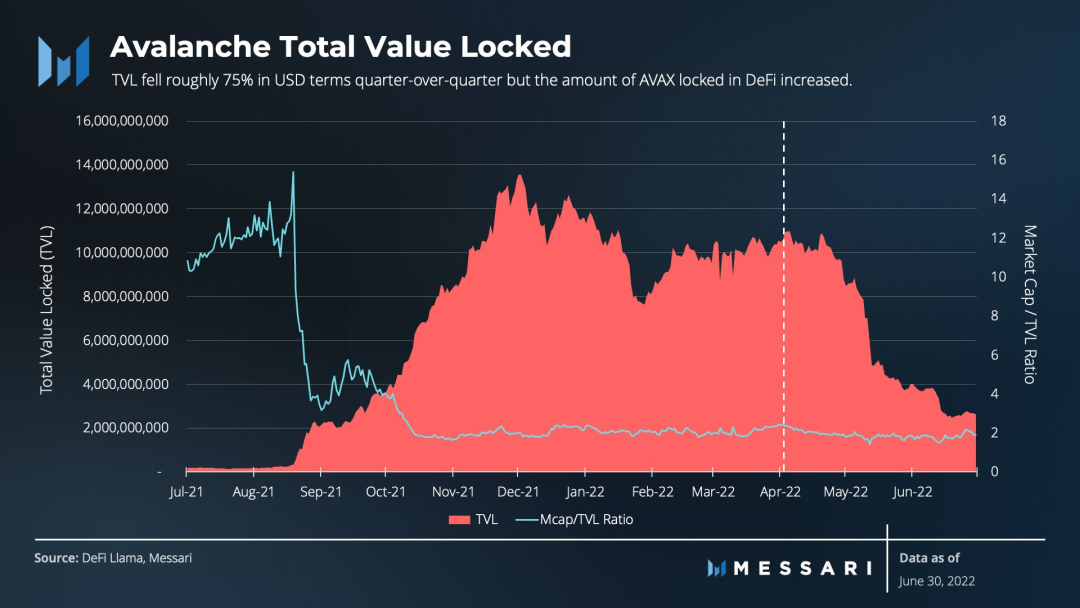

Despite ongoing incentive programs, in dollar terms,Avalanche's TVL fell approximately 75% quarter-over-quarter in the second quarter. At the same time, the amount of AVAX locked in DeFi has increased.The AVAX lockup in DeFi started the quarter with about 115 million AVAX and ended with about 152 million.

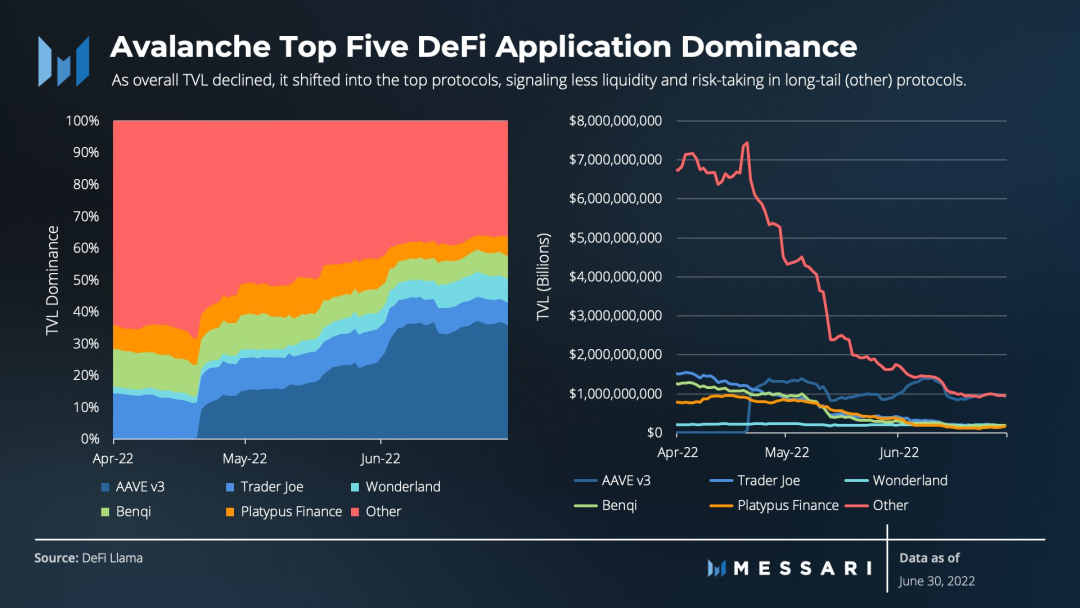

As the overall TVL declines, the Avalanche DeFi ecosystem shifts towards the top protocols, indicating that liquidity and risk-taking is reduced through liquidity mining in the long-tail (other smaller) protocols.

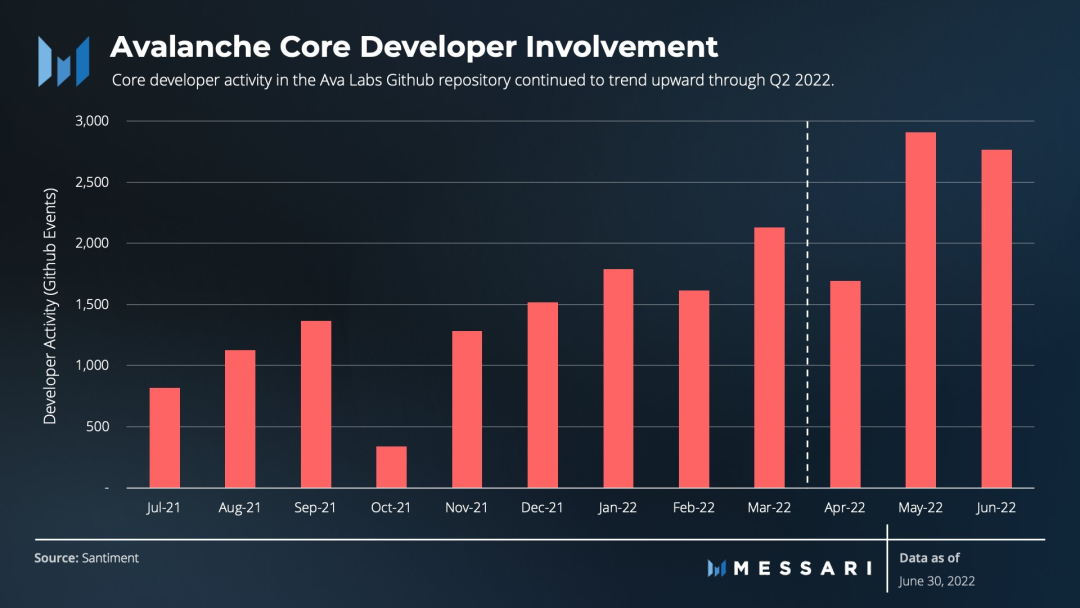

Despite the current (unfavorable) market conditions, the number of events in Ava Lab's Github repository grew significantly (33.1 %) throughout Q2. With this being the second largest increase to date, the network’s core contributors appear to be succeeding in building out the infrastructure.

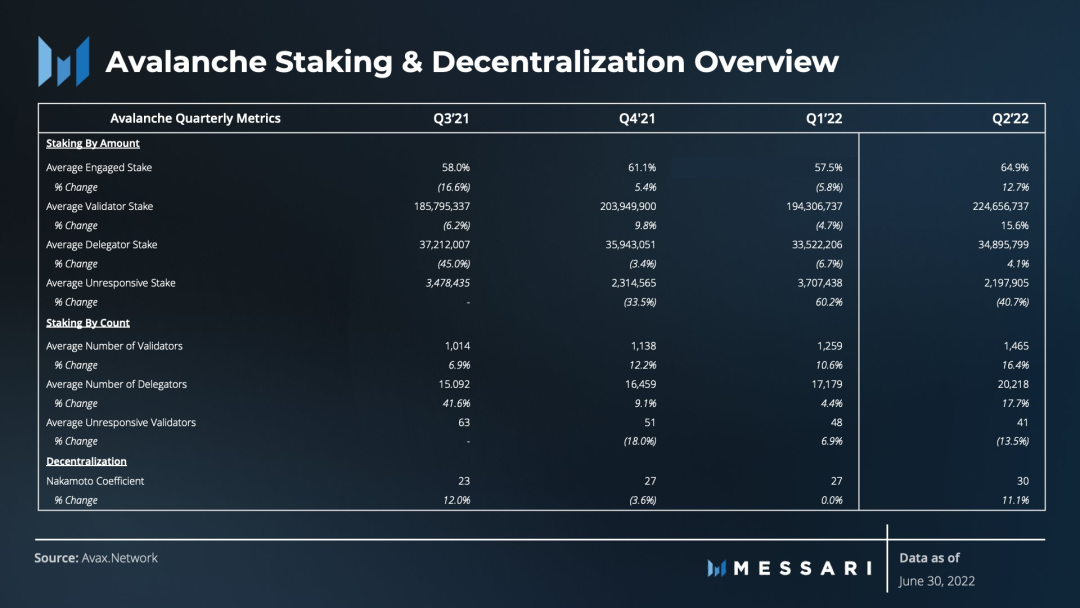

While the macroeconomic environment may have had a negative impact on the Avalanche ecosystem, theThe Bear Market Hasn't Diminished the Network's Health. Despite recent market volatility, theStaking and decentralization of the network remains strong.

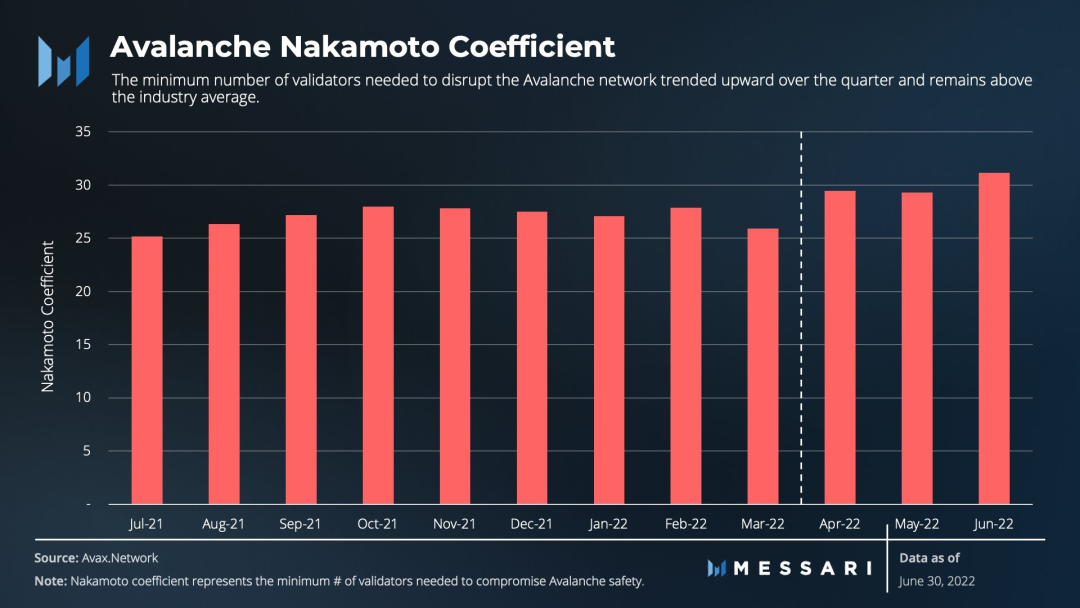

Avalanche's Nakamoto coefficient hovers around 30 throughout 2021. In the first quarter of 2022, it drops to around 25. But it recovered to 30 in Q2 due to increased validator numbers and stake. This improvement continues to place the Avalanche above the industry average.

Community concerns about redirecting activity to subnets became common, but Avalanche highlighted AVAX's value accrual mechanism.Ultimately, the strategy of continuing to expand the network worked well in the second quarter.

Original link