Original post by Sami Kassab, Messari Researcher

The main points:

The main points:

Many Web3 infrastructure protocols generate steady revenue by providing services inside and outside the Web3 ecosystem. Services range from storage to computing to wireless data transmission;

Web3 infrastructure revenue fell just 10% as the bear market deepened, suggesting strong demand for these protocol services despite a 76% drop in overall protocol valuations;

While Web3 protocols may appear overvalued on a revenue basis, current valuations are more attractive than Q1 2022 given the total addressable market for each industry.

The Web3 industry is often criticized for not having any real use cases outside of the circular economy, but this is not true, and some Web3 infrastructure protocols provide services both inside and outside the Web3 ecosystem. They provide services including decentralized storage, computing, and wireless data transmission to Web3 users and non-crypto-native participants. End users need to pay fees when using these services, and the agreement generates revenue.

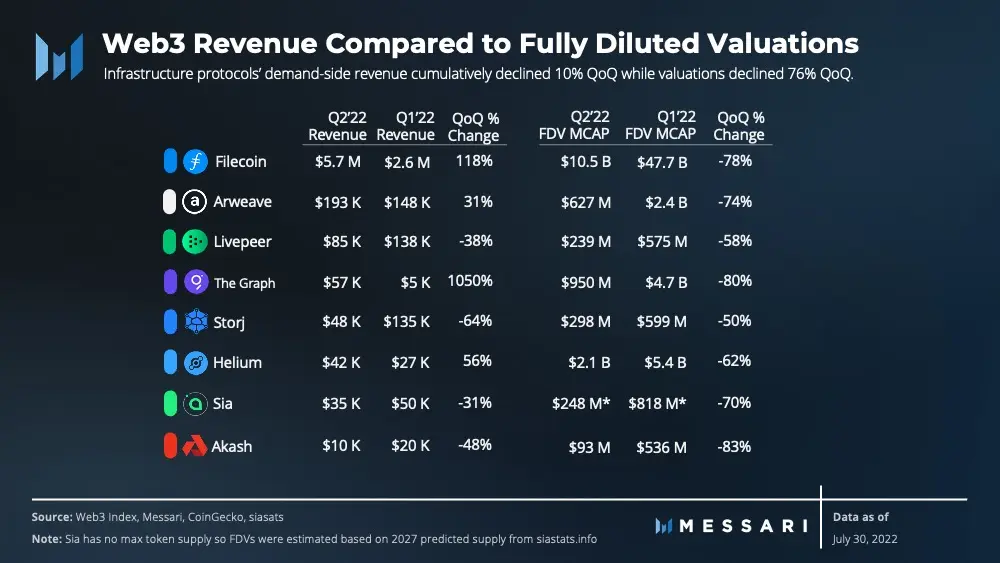

The total cryptocurrency market capitalization fell 59% last quarter, from $2.1 trillion to $860 billion. In the Web3 infrastructure space, fully diluted valuations fell 76% sequentially, from $63 billion to $15 billion. Despite the harsh environment, the Web3 infrastructure protocol continues to operate and generate revenue without interruption.

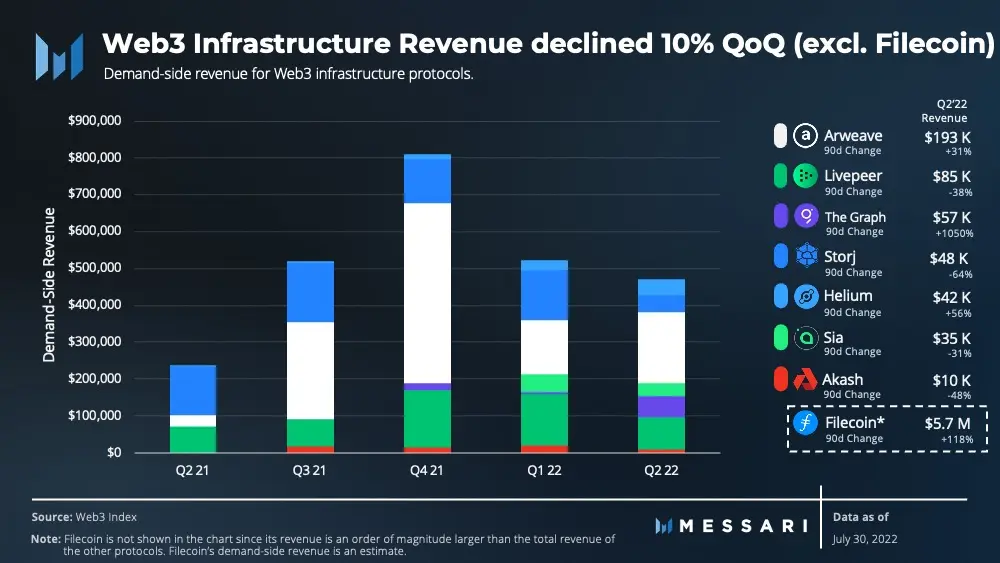

In Q2 2022, Web3 infrastructure protocols generated $5.7 million in revenue. Excluding Filecoin, which has the highest proportion, the remaining Web3 infrastructure protocols generated a cumulative revenue of $470,000 in the last quarter. Compared to the first quarter of 2022, it is down 10%.

data from

data fromWeb3 Index, which tracks the demand-side revenue of infrastructure agreements, primarily includes what end-users pay to use the network and its services. This metric measures actual usage of the network, while metrics such as total revenue can include revenue from supply-side participants. and inflationary token rewards, which do not reflect network usage.

Filecoin is the only protocol not included in the Web3 Index in this report because itHas a unique revenue framework. The demand side of Filecoin pays for updating storage transactions and retrieving data services provided by storage providers. Unlike storage transactions, data is retrieved off-chain through the storage provider, so the retrieved fee data is unknown. Since storage fees are subsidized by the protocol, users only need to pay a base fee and possible additional fees to initiate or renew transactions when transacting on the network. Filecoin's demand-side generated revenue can be estimated by assuming that 45% of network transaction fees come from demand-side participants (assuming an estimated half of network transactions come from supply-side participants).

storage

storage

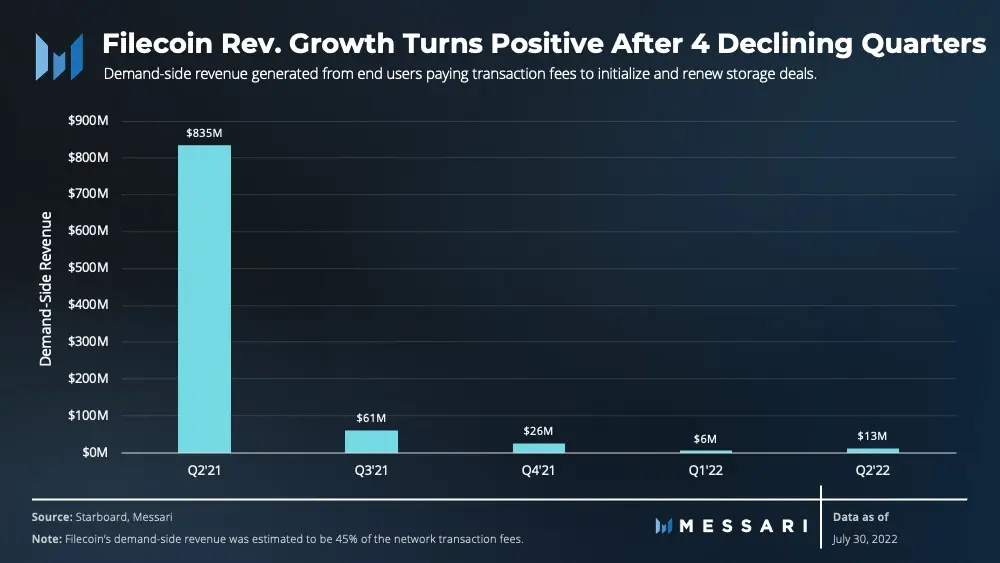

Calculated by storage and network capacity used,Filecoinhave the largest market share. Its income corresponds to the demand for block space (higher demand means users pay higher transaction fees), rather than the amount of data stored on the network. Therefore, in order to increase revenue, the volume of transactions generated for storage needs needs to exceed the capacity of the network.

While Filecoin storage capacity and utilization have been increasing over the past year, revenue has been declining until the most recent quarter. Filecoin saw a sharp drop in revenue after Q2 2021 due toHyperDrive upgradeIncrease the throughput of the network by 10-25 times, thereby reducing transaction fees. Therefore, revenue numbers are not expected to return to Q2 2021 levels any time soon.

After four quarters of declining revenue, Filecoin generated $5.7 million in Q2, a 118% increase quarter-over-quarter. This is due to a significant increase in active transactions (i.e. the amount of data currently stored on the network): an 80% increase in the last quarter. Filecoin is in a class of its own as its revenue is several times that of other storage protocols.

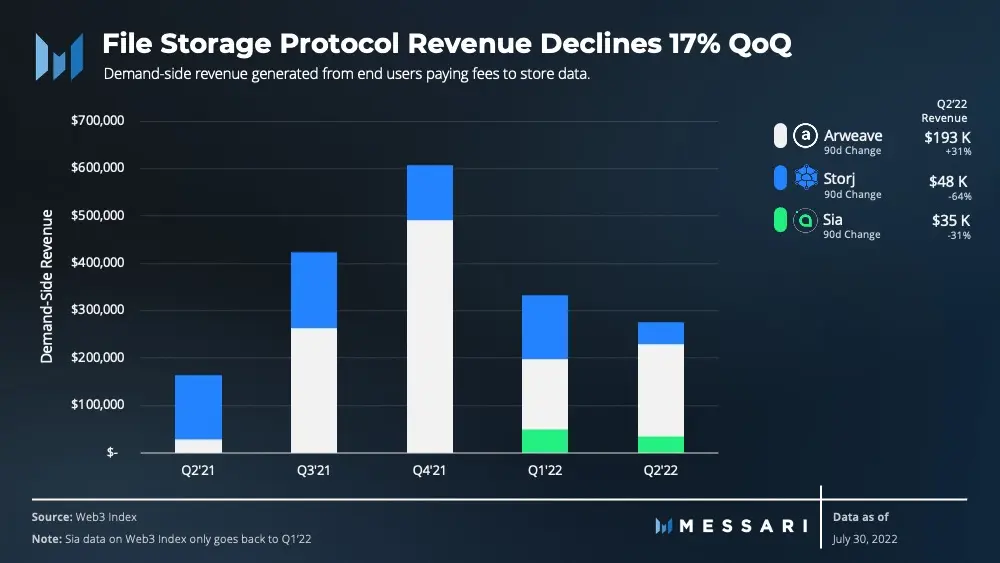

Arweave, a protocol focused on persistent storage, generated the second-highest revenue among storage protocols during the quarter at $193,430, up 31% quarter-over-quarter. Its storage grew 33% quarter-on-quarter. Meanwhile, Storj and Sia posted negative revenue growth of -64% and -31%, respectively. However, storage volumes for Storj and Sia grew 9% and 36% sequentially, respectively.

Market-set average storage prices fell quarter-on-quarter despite Sia’s increased storage volumes63%, leading to a decline in income. Storj, on the other hand, charges a flat fee of $4 per TB while giving users 150 GB of free storage. Storj's revenue declined in the quarter due to storage growth due to free storage plans.

calculate

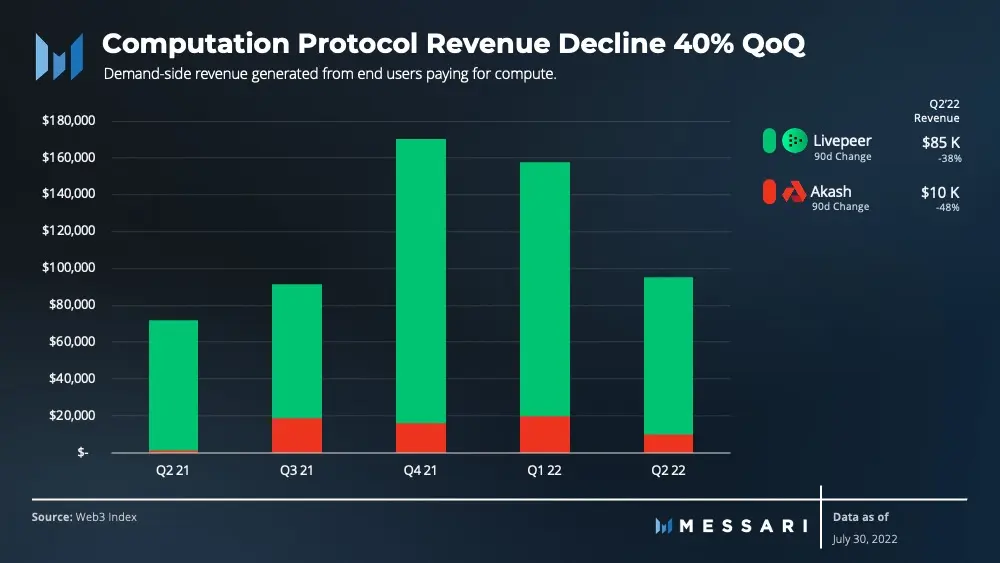

Computing resources are required for a range of applications and services including rendering, hosting, and transcoding. The Web3 Computing Protocol allows supply-side participants to be paid for renting out their GPU and CPU resources to end-users in need.

Livepeeris a decentralized marketplace for streaming applications that require video processing services. The network relies on miners using GPUs to provide video processing services to the network. Livepeer's Q2 2022 revenue is down 39% QoQ, but Livepeer handlesSame number of videos as Q1 2022. Considering that Livepeer is an open market where fees are set by nodes, node operators compete with each other and demand stagnates resulting in lower fees.

Akashis a decentralized cloud marketplace that connects users seeking computing resources with providers who have spare computing capacity. Akash's revenue fell 50% in the second quarter of 2022, but active leases (i.e., the number of agreements that lease computing resources) on the network increased 11%.

In order to lease resources on Akash, suppliers and end users will agree in advance on a monthly price denominated in AKT, and the price agreement will not be automatically adjusted due to AKT price fluctuations. As AKT fell 83% in the second quarter, this naturally led to lower dollar revenue. To solve the problem of price stability, Overclock Labs is developing aStable settlement mechanismwireless network

wireless network

HeliumIt is an economic system and platform for building distributed wireless networks. The agreement started with IoT networks and is currently being developed for 5G networks. The Helium Network incentivizes supply-side participants to deploy hotspots through which end users can transfer data.

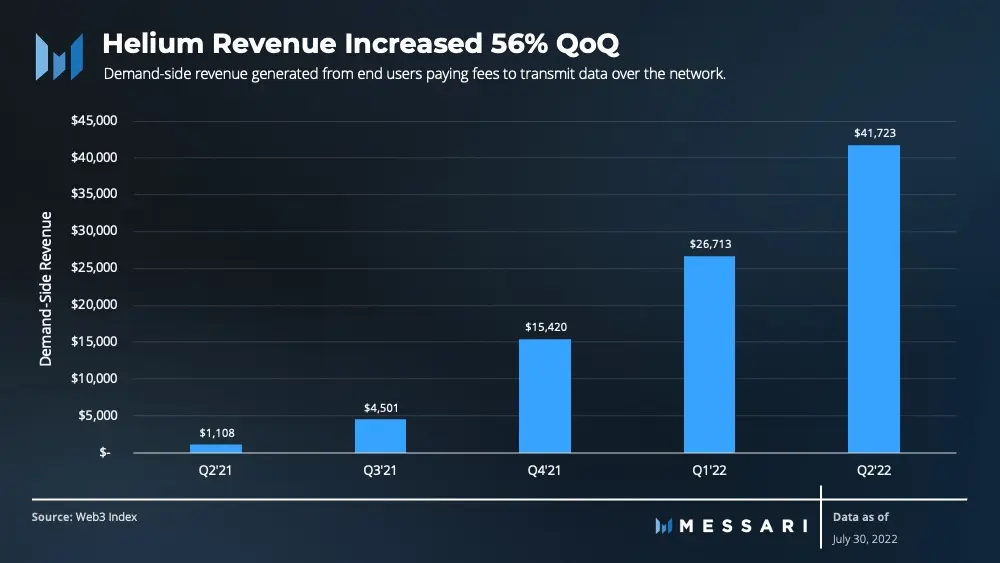

The cost of transmitting data over Helium's IoT network is $0.0001 per 24 bytes. Last quarter, end users spent $42,000 to transfer data over the network, a 56% increase from the previous quarter. While revenues from end-user transmitted data are fairly low relative to Helium's fully diluted valuation, the rollout of 5G is expected to significantly increase the amount of data transmitted over the network. Additionally, the Helium community plans to launch many other networks, including WiFi, VPNs, and CDNs. If these networks turn out to be successful, the total data Helium transfers over the network should continue to increase.

data index

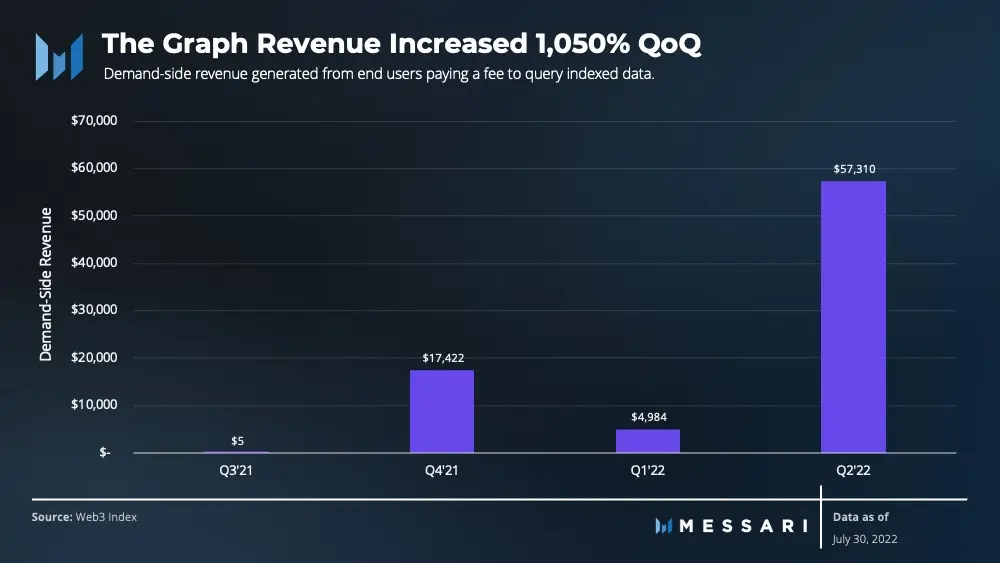

The Graphis a decentralized protocol for indexing and querying data from blockchains. Its end user is typically an application developer, who pays for each query from the subgraph (data index) to the web indexer. In the beginning, The Graph offered indexing and querying through a centralized escrow service, where queries were fully subsidized. However, after the migration of subgraphs to the decentralized network, the number of subgraphs migrated since March 2022 has increased by40%, which led to a 1050% quarter-on-quarter increase in revenue from query fees. Revenue generated from The Graph's end-user fees should continue to increase as more and more subgraphs migrate off of hosting services.

Thoughts on Fundamentals

Evaluating Web3 infrastructure protocols requires examining the actual usage of the network. The revenue of the network on the demand side shows the total amount paid by end users to use the network and its services. This metric excludes token rewards for inflation and revenues for supply-side participants, which do not reflect network usage. After assigning a reasonable multiple to these revenues, the current protocol appears to be overvalued. However, the current valuation is more attractive than it was three months ago, considering that the fully diluted valuation of the Web3 infrastructure protocol has fallen by 76%.

Despite a 76% drop in valuation, revenue excluding Filecoin was only down 10%. Including Filecoin, the total revenue generated on the demand side increased by 97%. Given the sharp drop in valuations, this suggests that demand for Web3 infrastructure protocols remains steady in a bear market.

Original link