Author | Qin Xiaofeng

Editor | Hao Fangzhou

Produced | Odaily

1. Overall overview

Author | Qin Xiaofeng

Editor | Hao Fangzhou

1. Overall overview

Second, the secondary market

1. Spot market

In terms of the secondary market, the current ETH price may continue to consolidate in the short term, with support at $1,000 and resistance at $1,110 and $1,235.

(ETH daily chart, picture from OKX)

According to OKX market data, the price of ETH once fell to $997 last week and closed at $1050 during the week, a month-on-month drop of 14.1%.

2. Large transaction

OKlink dataThe daily chart shows that the price is currently consolidating at $1,100. In the short term, the price may test the $1,000 mark again. If it is supported, it is expected to rebound to around $1,200. The support level is $1,000; the upper resistance level is $1,110 and $1,235.

3. Rich list address

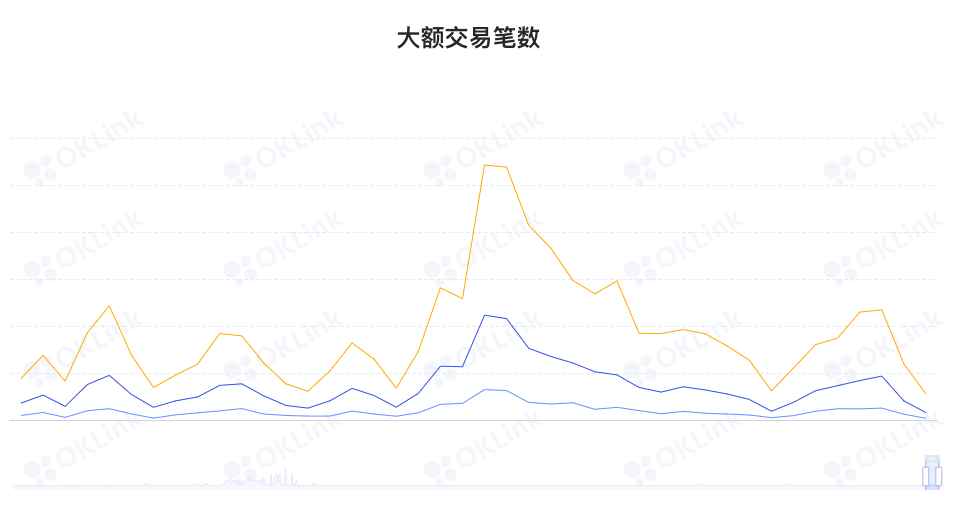

OKlink dataIt shows that the number of on-chain transfers rose slightly last week, with "above 1000 ETH", "above 2000 ETH" and "above 5000 ETH" rising by 1%, 6.7% and 27.5% month-on-month, respectively. The trading enthusiasm of giant whales has picked up slightly.

3. Ecology and technology

1. Technological progress

OKlink data

It shows that from the perspective of the distribution of holding addresses, exchanges accounted for 9.82%, an increase of 0.04% month-on-month; accounted for 39.68%, a decrease of 0.24% month-on-month; other addresses accounted for 33.04%, an increase of 0.19% month-on-month.

3. Ecology and technology

(1) Due to the Besu client bug, more than 20% of the nodes were offline in the 7th shadow fork of the Ethereum mainnet

The 141st core developer online meeting released by the Ethereum Foundation mentioned that the 7th shadow fork of the Ethereum mainnet on June 22 was not going well, and 20% of the nodes were offline when the Merge was activated , and then even more nodes went offline one after another. It was mentioned in the meeting that the storage format problem of the Besu client is the main source of failure in this test. The client team is currently trying to fix this problem, and it is tentatively scheduled that the eighth mainnet shadow fork will be carried out in the first week of July .

Ethernodes.org data shows that the Ethereum mainnet has reached and exceeded the Gray Glacier hard fork upgrade activation block height of 15,050,000. This hard fork upgrade aims to delay the difficulty bomb by 700,000 blocks (approximately 2-3 months).

2. Project trends

(2) The Ethereum Sepolia testnet is expected to be merged in the next few days

The Ethereum Foundation released the testnet Sepolia merger announcement stating that Sepolia is ready for the merger and will transition to the PoS network when the total terminal difficulty (TTD) is 17,000,000,000,000,000, which is expected to happen within a few days.

If the Sepolia merger does not find any problems, once the client test is completed, Goerli, another EL testnet of Ethereum, will run through the Merge of the Prater CL testnet. After Goerli/Prater has successfully transitioned and stabilized, the Bellatrix upgrade on the mainnet beacon chain will select an epoch and set the difficulty value for the mainnet transition.

2. Project trends

(1) Revv releases the beta version of electronic signature products based on Ethereum wallet

Document workflow automation platform Revv has announced the beta release of its e-signature solution powered by Ethereum Wallet. Revv users can choose their Ethereum wallet to verify identity, electronically sign documents, and use wallet-related audit trails to enforce signature proofs.

Institutional-grade cryptocurrency custody firm Anchorage Digital has announced that it will introduce an ETH staking solution for institutions following Ethereum’s move to proof-of-stake (PoS). Anchorage Digital will provide stakers with dedicated validators for their positions in exchange for a fee on their accrued amounts. (CoinDesk)

In the post-Nitro era, Arbitrum will have greater capacity before congestion occurs. This will make transactions always cheaper and will not affect the user experience even under heavy load. Due to the heavy load on the chain causing higher than normal gas fees, Arbitrum has decided to temporarily suspend Odyssey until Nitro is released so that all communities and projects within Arbitrum can continue to enjoy a frictionless experience. A release schedule for Nitro will be announced soon.

On June 28, the leaseable NFT standard "EIP-4907" launched by the NFT leasing market Double Protocol has passed the final review of the Ethereum development team, becoming the 30th ERC standard with a status of "Final" (final version) on Ethereum. The standard realizes the separation of NFT ownership and use rights through the dual-role setting, and is the first to automatically withdraw the use right when it expires. The application of the "ERC-4907" standard will reduce the development and integration costs of utility NFT rentals such as games, metaverses, and membership cards, and make NFT assets more liquid. It is reported that the number of projects that have confirmed the application of the "ERC-4907" standard has reached 12.

According to official news, Ethereum infrastructure developer ConsenSys announced a partnership with StarkWare, a blockchain software company focused on ZK-Rollup solutions. As part of this collaboration, Web3 wallet MetaMask and blockchain infrastructure platform Infura have integrated StarkNet, aiming to provide developers with more network options for a multi-chain future.

MetaMask has created a StarkNet snap (only available in MetaMask Flask) for developers to build on the network; Infura is offering a private beta for developers to enable Infura network functionality on StarkNet.

Last week, after facing criticism from the crypto community, Lido introduced a governance proposal that limits the amount of ether users can stake. Despite centralization concerns, voting on the proposal has so far been overwhelming: nearly 99.8% of the Lido community voted against the proposal, with less than 0.2% in favor. Voting will close on July 1, 2022. (Decrypt)

(6) ConsenSys and StarkWare reached a cooperation to introduce ZK-Rollups to Infura and MetaMask

According to official news, Ethereum infrastructure developer ConsenSys announced a partnership with StarkWare, a blockchain software company focused on ZK-Rollup solutions. As part of this collaboration, Web3 wallet MetaMask and blockchain infrastructure platform Infura have integrated StarkNet, aiming to provide developers with more network options for a multi-chain future.

(7) Compound Labs released the code of Compound III, a multi-chain lending protocol

Circle, the USDC issuer, announced the official issuance of Euro Coin (EUROC), a fully-collateralized stablecoin backed by euros on Ethereum.

AltLayer, an Ethereum expansion project, completed a $7.2 million seed round of financing, led by Polychain Capital, Jump Crypto and Breyer Capital, Polkadot founders Gavin Wood, Balaji Srinivasan, former Coinbase CTO Balaji Srinivasan, Circle co-founder Sean Neville, Synthetix Co-founders Kain Warwick and Jordan Momtazi participated in the investment. The financing is being used to grow its existing team of around 10 to around 25 people and launch its platform later this year. (The Block)

3. Borrowing

Defipulse(9) The OpenLeverage Token contract has been deployed to Ethereum, and 7.35% of the initial total supply will be airdropped

AltLayer, an Ethereum expansion project, completed a $7.2 million seed round of financing, led by Polychain Capital, Jump Crypto and Breyer Capital, Polkadot founders Gavin Wood, Balaji Srinivasan, former Coinbase CTO Balaji Srinivasan, Circle co-founder Sean Neville, Synthetix Co-founders Kain Warwick and Jordan Momtazi participated in the investment. The financing is being used to grow its existing team of around 10 to around 25 people and launch its platform later this year. (The Block)

(data from etherchain.org)

etherchain.orgThe data shows that the value of locked-up collateral on the chain fell from US$52.91 billion to US$50.02 billion last week, a week-to-week decrease of 5.4%; the net increase of US$2.8 billion in the previous week was a net decrease of US$28.9 last week, a month-on-month increase of 0.3%. Specifically, the number of ETH mortgages dropped from 4.4 million to 4.681 million last week, an increase of 6.3%. From the perspective of individual projects, the top three lock-up values are: Maker 7.56 billion US dollars; Aave 6.21 billion US dollars; Lido 4.49 billion US dollars.

4. News

4. Mining

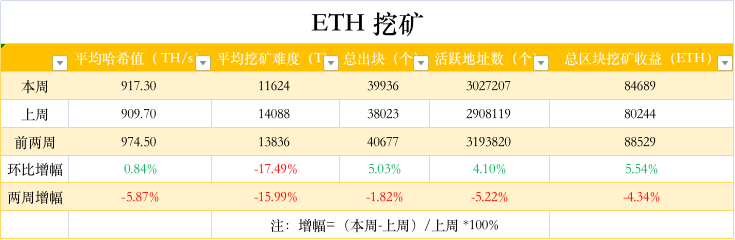

image description

The data shows that last week, the average computing power rose by 0.8% month-on-month, temporarily reporting 917TH/s; the average mining difficulty decreased by 17.5% month-on-month, temporarily reporting 11624T, mainly due to the hard fork upgrade on June 30, which delayed the "difficulty Bomb”; the activity on the chain increased by 4.1% month-on-month, and the total mining revenue increased by 5.5% month-on-month.

4. News

(1) Data: Grayscale Bitcoin holdings fell to 637,000, the lowest since December 2020

According to Coinglass data, Grayscale’s bitcoin holdings fell to 637,000, the lowest since December 2020, with a discount of -29.26%. The holdings of Ethereum Trust dropped to 3.0774 million, with a discount of -29.26%.

(2) Morgan Stanley: If Ethereum switches to PoS, GPU demand may slow down

Morgan Stanley (Morgan Stanley) stated in the report that if Ethereum moves to the PoS mechanism as planned, it will eliminate the need for miners, slow down the demand for GPUs, and significantly reduce energy requirements. However, moving to PoS will not solve the Ethereum scaling problem. According to the report, over the past 18 months, crypto mining has had a huge impact on the gaming GPU market and is expected to drive 14% of revenue in 2021, while also largely causing GPU shortages. GPU demand should slow down, but Nvidia (NVDA) has been less affected by cryptocurrency mining demand than it was in 2017-2019. Additionally, the bank noted that crypto mining demand, which led to a shortage of graphics cards, began to decrease in the first half of the year.

The bank said that Ethereum miners are most likely to sell their GPU equipment after the merger (Merge), because it is currently unprofitable to mine other cryptocurrencies. It is expected that the net supply of Ethereum after the merger will decrease, and may even turn into a deflationary state, so it is unlikely that all miners will become stakers. (CoinDesk)

(3) Meta has started testing Ethereum and Polygon NFT on Facebook

A Meta (former Facebook) spokesperson said that it has begun testing Ethereum and Polygon NFT for some US creators on its flagship social network Facebook, and will soon add support for Solana and Flow NFT.