Originally Posted by James Trautman, Messari Analyst

Important points:

Important points:

Solana saw continued growth in network usage, developer activity, network infrastructure, and the overall ecosystem during the quarter;

Solana experienced network performance challenges and declining financial results while maintaining growth;

After the Wormhole attack in February, network performance declined further throughout the quarter;

By the end of the quarter, Solana became the second-largest protocol for NFT sales in the secondary market, second only to Ethereum;

Solana's growth strategy revolves around improving user access and user experience, pursuing strategic investments and partnerships, and expanding into several emerging areas;

network overview

network overview

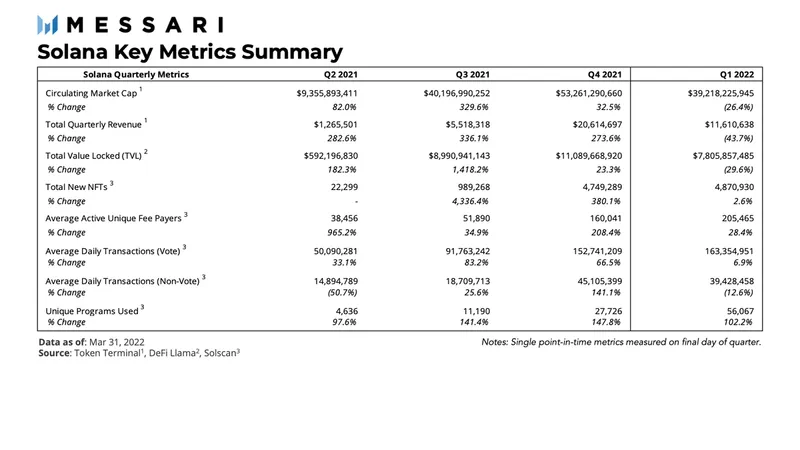

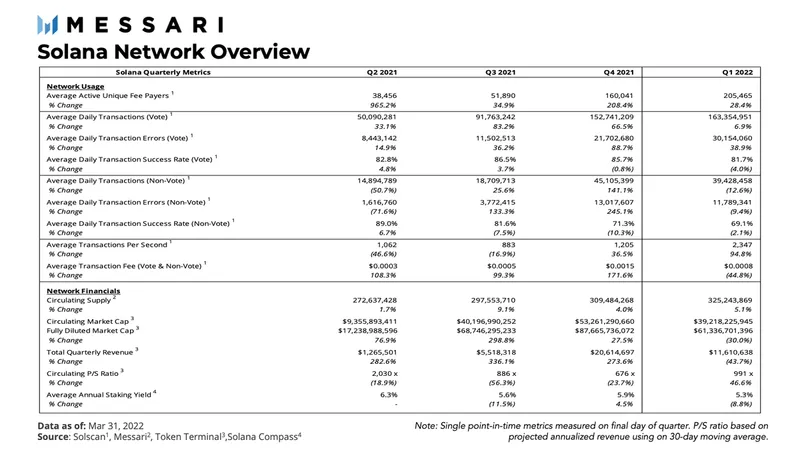

Compared to the previous quarter, Solana's network and financial metrics were up and down. While market capitalization and revenue are down 30% and 43.5% respectively, usage of the network continues to trend upwards, as measured by average active unique fee payers (+28.4%), average transactions per second (+94.8%) and daily Average volume to measure transactions (+4.2%). Intuitively, the drop in revenue (measured by users’ transaction spend) mirrors a drop in average transaction fees (-44.8%). Degraded network performance also puts significant downward pressure on revenue, with daily revenue dropping sharply during periods of network congestion.

The price-to-sales (P/S) ratio is on the rise, rising from 676x to 991x as revenue declines faster than market capitalization. Unlike the previous quarter, network usage continued to grow while financial performance declined.

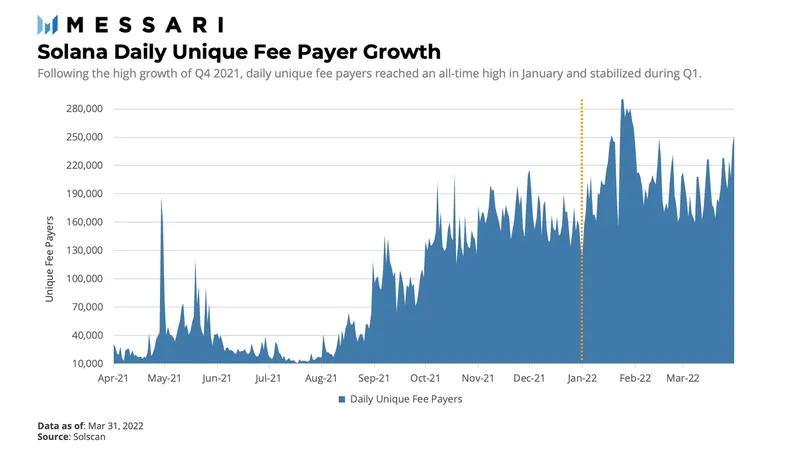

The "Daily Unique Fee Paying Users" metric includes the number of unique accounts that pay at least one transaction fee per day. Web usage continued to rise as the figure hit an all-time high of 280,000 in January. Solana's figures for January topped figures for the entire third quarter of 2021, when the network also experienced triple-digit percentage growth in market capitalization and revenue. The network averaged approximately 160,000 unique paying subscribers in the fourth quarter of last year and stabilized at approximately 205,000 in the first quarter. Growth in unique paying users is in line with growth in NFT and NFT sales, app launches, and transaction growth.

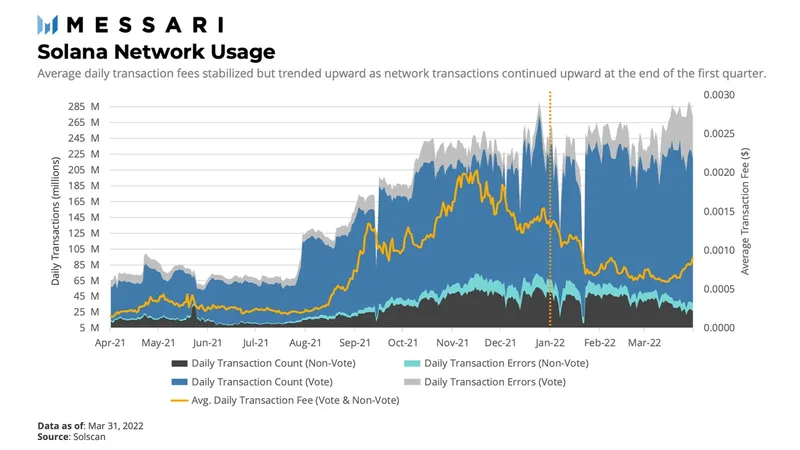

Transactions on Solana can be broken down into two categories: 1) consensus and 2) token transfers and smart contract interactions. Solana's PoS consensus process is different from other smart contract platforms because its consensus votes are recorded as on-chain events. Transactions that do not require voting, similar to transactions on the EVM public chain, represent actual economic activities on the network.

As in Q4, total transaction activity on the network followed a similar pattern to daily unique payment user growth, with some deviations due to anomalies related to network performance degradation in early and mid-January. Solana's average daily vote transaction volume increased from approximately 152 million in the previous quarter to approximately 163 million in the first quarter. However, the average daily non-voting transaction volume fell to about 39 million from about 45 million in the previous quarter.

If the number of validators on the network increases (as it did in Q1), then the number of voting transactions will increase, even if non-voting transactions remain the same. As highlighted later in this report, the Solana DeFi ecosystem contracted during the quarter, likely resulting in fewer non-voting transactions. Overall, however, the total daily transaction volume continues to trend upwards as the number of validators increases.

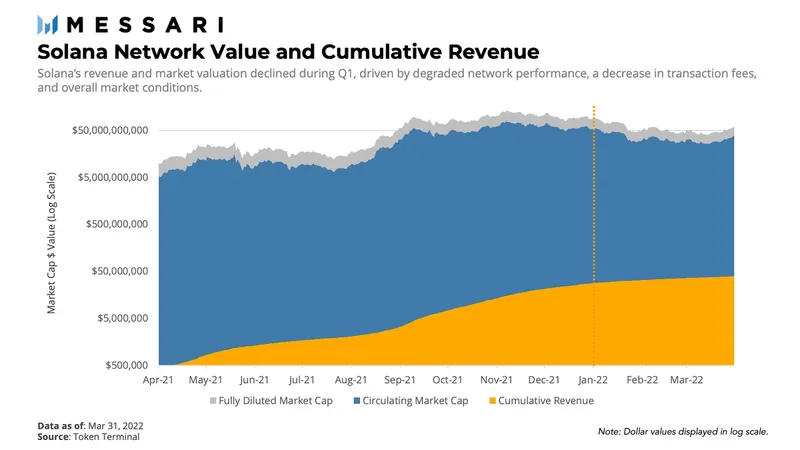

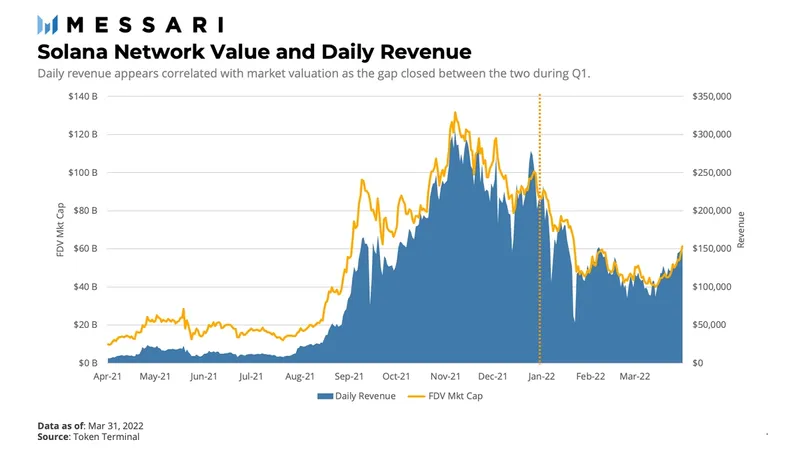

Cumulative revenue decelerates after daily revenue declines as daily unique signers and total transaction volume grow. Despite a quarterly revenue decline of 43.5%, cumulative revenue as a percentage of the network's fully diluted market value (FDV) increased and cumulative revenue as a percentage of FDV was 15 times higher than last year, indicating that fundamentals such as network usage and revenue are collapsing Market values are more consistent.

While fundamental indicators account for an increasing proportion of market value, the question is how statistically significant the difference between fundamentals and market value is. With this in mind, there may be a strong correlation between fundamental usage and market value as fundamental value (as opposed to speculative value) becomes a more important fraction of market value.

Most notably, fluctuations and trends in daily earnings are often accompanied by changes in FDV. The same relationship exists between circulating market capitalization and price. In addition, the gap between daily revenue and FDV narrowed in the first quarter, with occasional peaks and dips in revenue and simultaneous spikes and dips in FDV. Again, this correlation may indicate that the network is closer to its fundamental value than its speculative value.

If this relationship holds, then fundamentals may have a significant relationship with market value (or network value). Therefore, an important area relevant to this relationship is network reliability. As we've seen in 2021 and throughout the first quarter, network performance degradation reduces network usage, which reduces the network's ongoing revenue. If Solana continues to experience sustained, prolonged performance degradation, the resulting drag on underlying usage value could increase volatility and drag down network value.

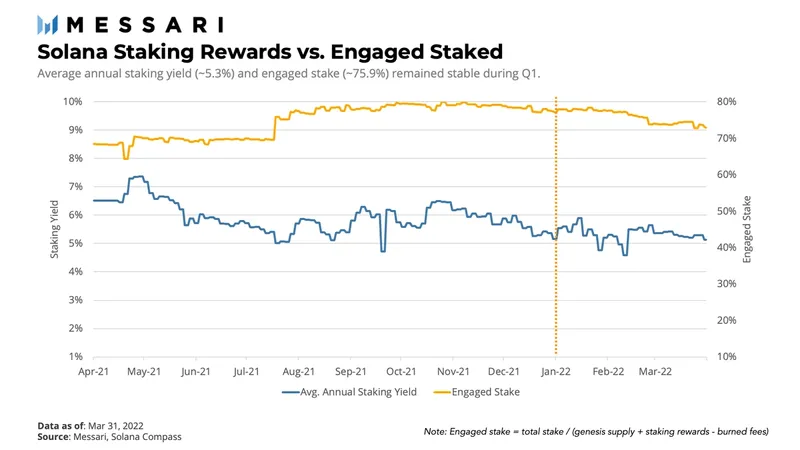

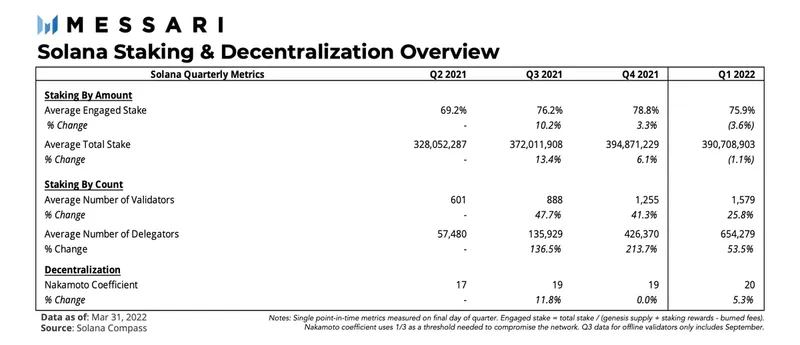

Since April 2021, the pledge rate and pledge rate of return have remained stable, with an average annualized rate of return of approximately 6%. If the staking rate fluctuates, so will the earnings, but Solana's staking rate has held steady at around 75% over the last year. The stability of participating in the pledge alleviates the fluctuation of the network value to a certain extent, and more verifiers and delegators going online are also conducive to decentralization.

Overview of Ecology and Development

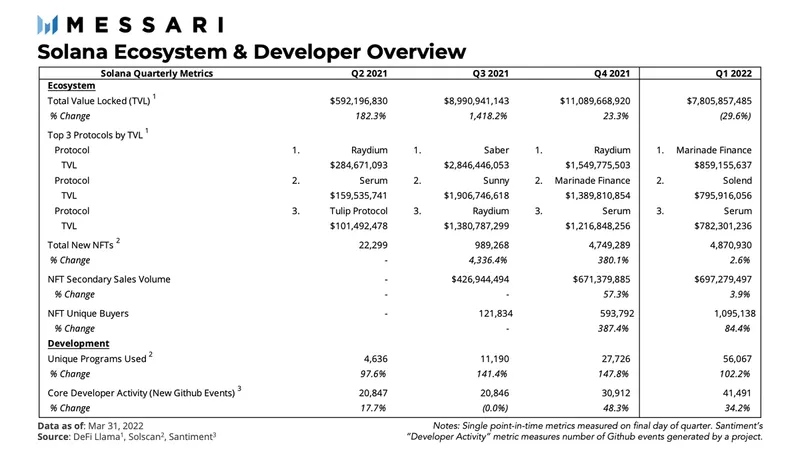

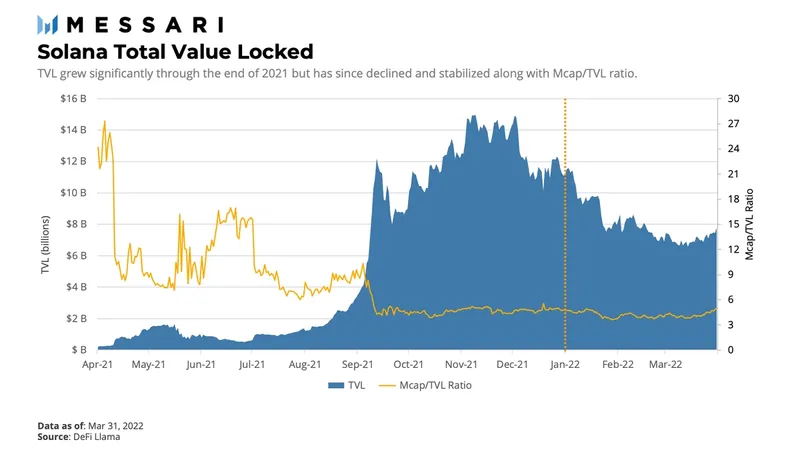

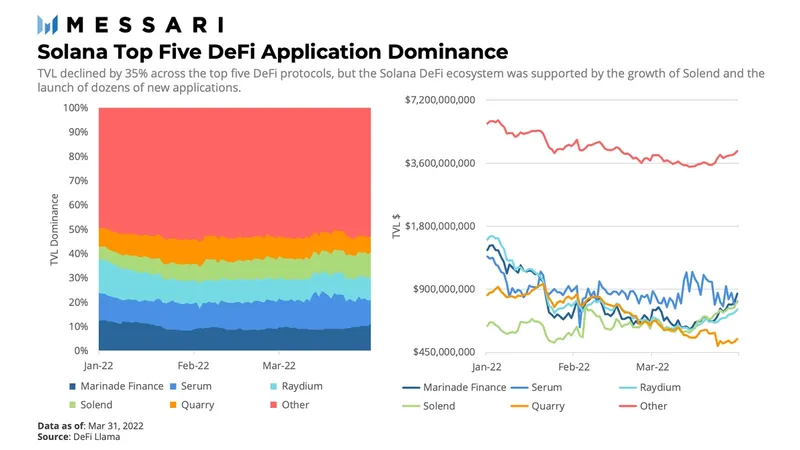

Going into 2022, DeFi on Solana has experienced a TVL decline (-29.6%), which is very similar to many other Layer1 public chains, but the decline rate is about twice that of the top chains in TVL. With this in mind, Solana has developed some strategies to mitigate the contraction of its DeFi economy. One such strategy comes from Serum, the limit order book that powers most of DeFi on Solana. Serum announced in January that it was raising $100 million to expand its business.

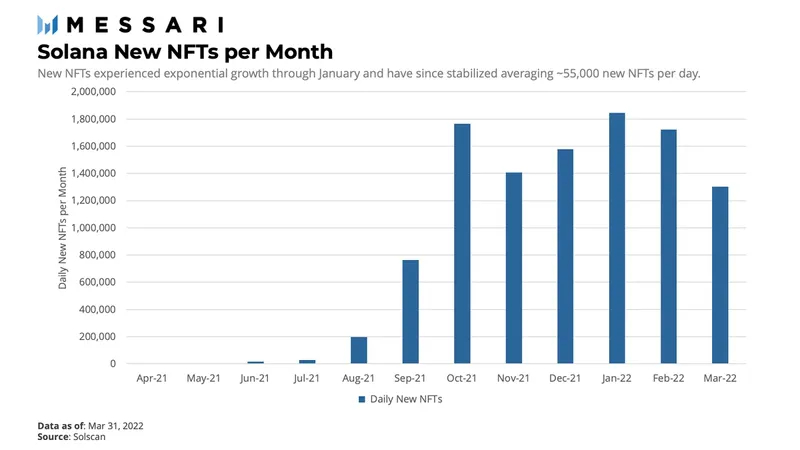

Unlike the DeFi space, the Solana NFT market continues to accelerate after experiencing exponential growth in Q4. The growth was fueled by the number of new projects, secondary market sales, and independent NFT buyers. Overall, total Solana NFT sales surpassed $1 billion in mid-January.

If not for the horizontal expansion of the DeFi industry, the decline in TVL may be even greater. The decline in DeFi TVL on Solana was lower than that of the major DeFi protocols Marinade Finance (-38%), Serum (-39%), and Raydium (-53%). Their total TVL fell by 44%, more than 15% greater than Solana's total TVL drop. This suggests that the growth of smaller protocols in the DeFi ecosystem offset the negative impact of market forces on the TVL of other protocols. Nonetheless, TVL appears to have stabilized at around $7 billion heading into the second quarter.

The launch of the Serum DeFi Incentive Program and the growth of emerging DeFi protocols contributed to the stabilization of Solana TVL at the end of the quarter.SolendTVL rose 33 percent to move up to No. 2. Meanwhile, the fastest-growing DeFi protocol to break into the top 10 isLido, an 82% increase in the quarter.

Another notable trend in Q1 was the stabilization of long-tail protocols (with at least $1M TVL) among DeFi protocols on Solana. Entering the first quarter, there were 30 agreements exceeding $1 million in TVL, compared to 17 in the previous quarter. At the end of the first quarter, 35 agreements maintained their TVL above the $1 million mark. Despite the overall decline in quarterly numbers, TVL diversity remains healthy, with the "Other" category accounting for 50%. Additionally, the number of apps recording TVL increased from 40 to 60, representing a 50% increase in its DeFi base.

After breaking out in Q4 2021, Solana NFT activity has maintained its momentum amid a decline in network DeFi activity. In the quarter, it maintained a level of nearly 5 million new NFTs per day, a quarter-on-quarter increase of 2.6%. Newly minted NFTs reached 85% of the 2021 minting volume. By mid-January, total sales exceeded $1 billion, and by February, Metaplex was minting 2,000 NFTs per hour. By the end of the quarter, Solana became the second-largest protocol for NFT secondary market sales, second only to Ethereum.

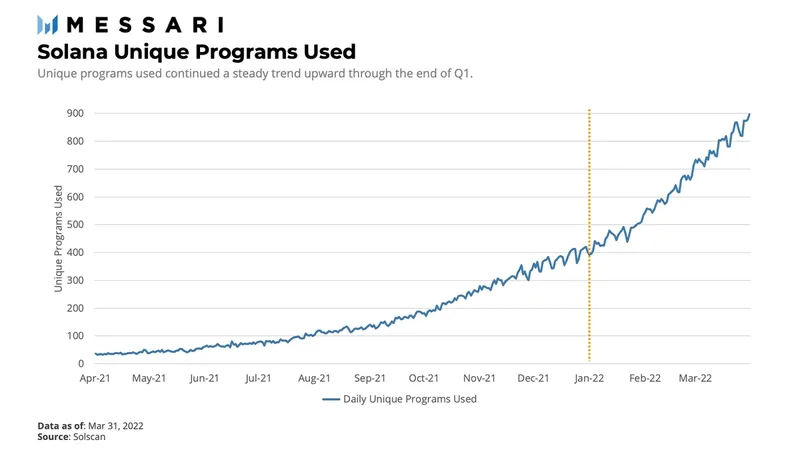

Another indicator of ecological development is the number of independent programs used in a given period of time. The stand-alone program metric represents apps with at least one successful interaction per day based on a single program address. The number of standalone programs in use is growing steadily every month as more apps launch and expand their user base.

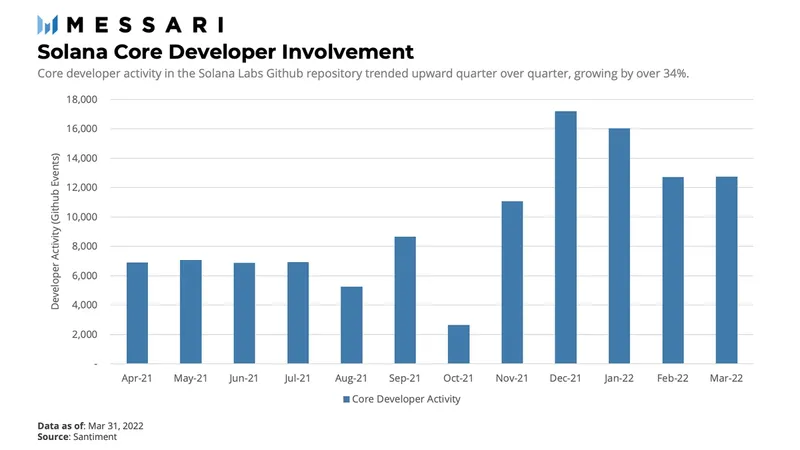

Events in the Solana Lab Github repository continued to grow sequentially (34.2%). Although in a downward trend on a monthly basis, the quarterly event numbers indicate that the core of the network is generally stronger than in previous quarters.

Staking and Decentralization Overview

The security of a PoS network like Solana requires users to lock up the network's native token and participate in validating duties. A distributed network of validators and active participants ensures that the network functions as intended.

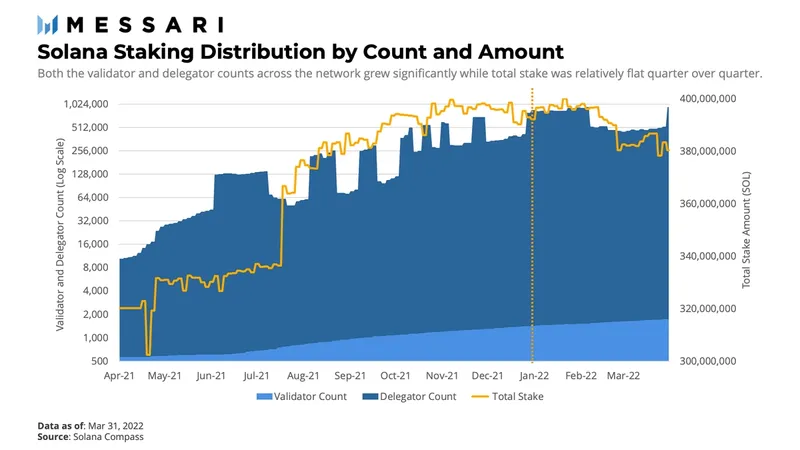

As stated earlier in this report, the average participating stake in Solana remained around 75% last year. This stability moderates fluctuations in network value to a certain extent. Stability also allows the network infrastructure to scale as the number of validators and delegators (i.e. active stakers) increases. Growth in infrastructure combined with a relatively flat total shareholding count suggests a greater shareholding distribution and thus diversification.

Staking volumes in Q1 were relatively flat, with average staking volumes varying by single-digit percentage points quarter-to-quarter. This predictability and volatility of total stake is generally good for network health.

While the average stake was relatively flat, the average number of validators and delegators increased substantially. The average number of validators increased from 1,255 to 1,579, representing a 25.8% increase in network security participants.

The average number of delegates increased significantly from 426,370 to 654,279, an increase of 53.5%. For Solana, delegators are referred to as active stakers, measured by the number of accounts earning staking rewards. Because most wallets have only one staking account, the number of delegators is a rough indicator of the number of individuals staking.

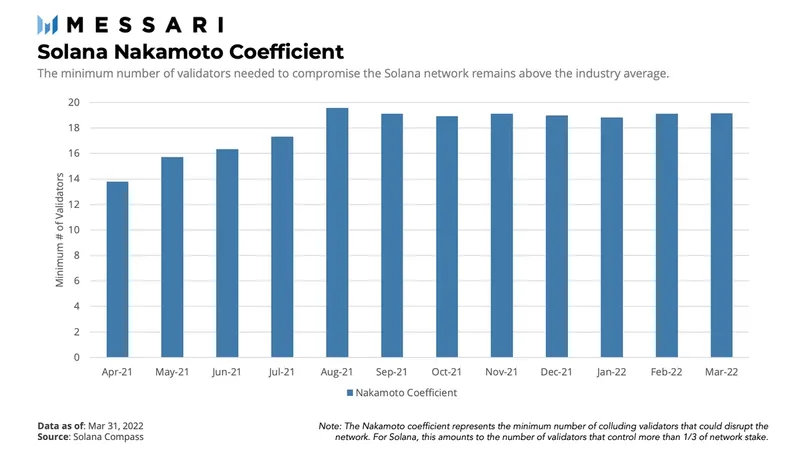

Nakamoto coefficient is Balaji SrinivasanIntroduced for the first time to measure the degree of decentralization of blockchain networks. This coefficient represents the minimum number of colluders necessary to compromise the network. For Solana, the Nakamoto coefficient is equal to the number of validators controlling one-third of the stake in the network.

Solana's Nakamoto coefficient hovered in the early 10s starting 2021 but improved to 19 by the end of the year. As the number of validators grows and the total amount of pledges stabilizes, the coefficient further increases and remains stable at 20, which is relatively high for Solana compared to the average of 10 in other Layer1 networks.

ecological challenge

While the second half of 2021 was critical for the Solana network, it came with growing pains that continued into the first quarter.network performance issuesHappening on December 13th, January 7th and January 21st. In each case, throughput decreased and resulted in a large drop in TPS and an increase in failed transactions. As mentioned earlier, these incidents appear to have had a negative impact on network value.

shareshareprovides details on network congestion issues observed on the network. Gulfstream, an alternative to Solana's mempool for pending transactions, currently allows bots to propose any number of transactions, making block producers check all transactions before making a block. This can lead to users submitting transactions that are not included in the block, because producers cannot process all transactions before the block is finalized. Eventually, due to the high number of transactions proposed by the bots, block production was affected and network performance degraded.

Anatoly Yakovenko then also outlinedNetwork Congestion Mitigation Strategies. The Mainnet Beta v1.10.x series will include QUIC, a feature that will allow block producers to instruct bots to only propose a small number of transactions at a time. Block producers will be able to parse all transactions and select valid ones. QUIC is also not designed to solve network congestion problems alone. Additionally, Solana is developing a fee-first mechanism to allow users to skip transaction queues as they propagate through the network. To this end, both QUIC and fee prioritization help reduce bot spam on the network.

In addition to network performance degradation, the ecosystem has also experienced the cross-chain bridge Wormholestolen. On February 2, the Wormhole team stated via Twitter that 120,000 WETH had been stolen from the network. Publishedincident reportIt shows that the attacker minted 120,000 WETH on Solana by exploiting the signature verification vulnerability in the Wormhole network. These tokens are not backed by Ethereum deposits on the Ethereum side of the Portal cross-chain bridge. The attacker then bridged 93,750 tokens to Ethereum, withdrawing unwrapped Ethereum from the contract. By February 3, the vulnerability was patched and Porta was back online. Additionally, Jump Crypto complements ETH and restores WETH/ETH support.

the road ahead

Currently, Solana has no update roadmap for the public. However, the Solana ecosystem is expected to continue working hard to drive growth through its growth strategies and incentives.

Core platform upgrades are expected to continue. Solana launched its mainnet beta in March 2020. Since the beta launch, the development team has been working on optimizing the network. Although still in beta, Solana is fully functional, if still subject to further development. Anatoly Yakovenko, co-founder of Solana, said such development and network congestion mitigation strategies show the difference between the beta version of the network and the production version. With this in mind, once Solana is fully released and further ongoing risk mitigation plans are in place (such as QUIC and fee prioritization), some concerns about network performance may be resolved. Currently Solana has not set a date for a full mainnet release.

Another major development involvesNeonend summary

end summary

In some respects, the first quarter of 2022 was positive for Solana, but it also brought some challenges. As the quarter came to a close, network usage, financial performance and network infrastructure stabilized. Several factors contributed to the Q1 results, including continued growth in new NFTs and the NFT marketplace, diversification of TVL, improvements in user experience, and new applications in multiple areas beyond DeFi.

While the network hit new highs on several fronts, the ecosystem experienced the Wormhole attack in February and the fact that network performance declined throughout the quarter. Core platform upgrades are expected to continue as mitigation strategies progress. Once Solana is fully released, these network performance issues should be largely resolved.

Original link