By: Sean Butterfield, Messari Analyst

Compile: iambabywhale.eth

On the evening of May 9th, Beijing time, Compound shared on Twitter the news that it had received a B- credit rating from Standard & Poor's. This makes Compound the first DeFi project to receive a credit rating from S&P, and it also marks that DeFi is getting more and more attention from the mainstream market. Let us pay attention to what kind of report card this DeFi "veteran" handed over in the first quarter of 2022.

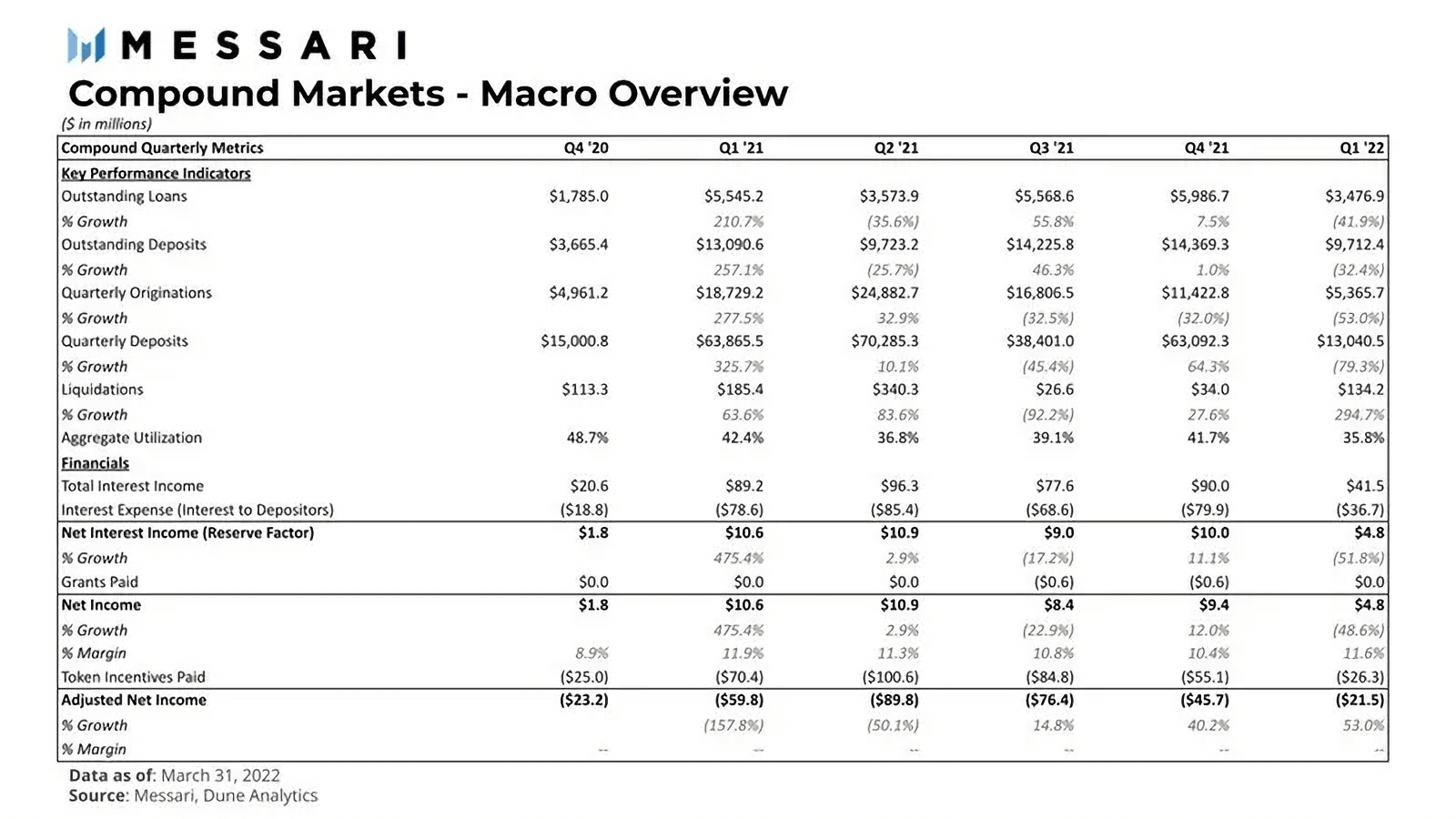

Key data:

Outstanding loans and deposits in transit fell by 42% and 32%, respectively;

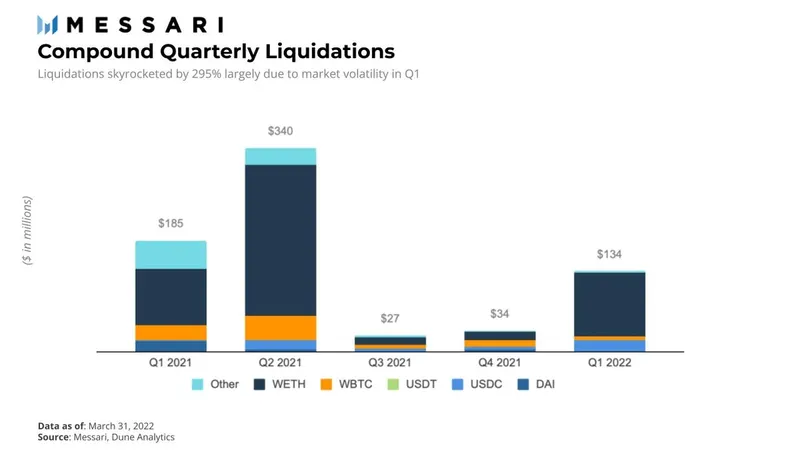

Liquidation indicators increased by 290%, with more than $134 million liquidated in the first quarter;

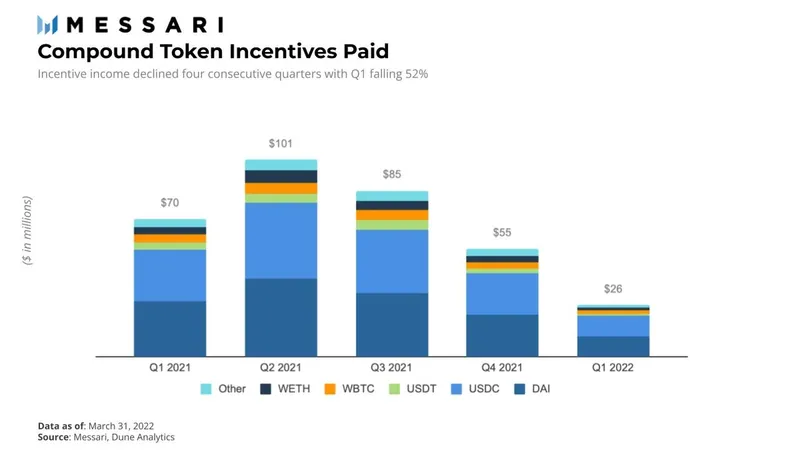

COMP rewards dropped by 50% this quarter and will be reduced to zero by Q2;

Quarterly lending rate and deposit rate are 3.8% and 1.5% respectively;

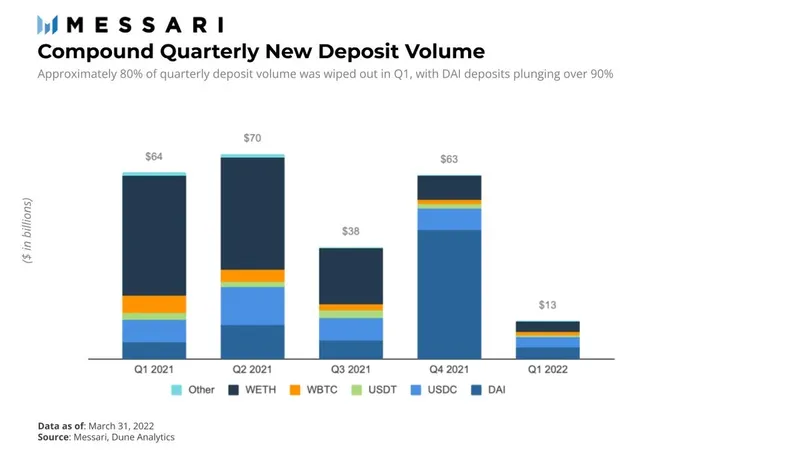

DAI quarterly deposits fell by more than 90% in Q1.

first level title

Compound market macro overview

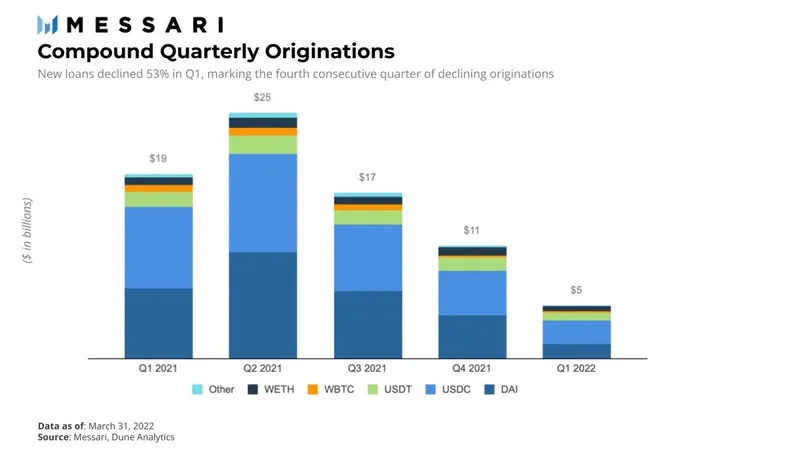

As the first quarter of 2022 came to a close, many of Compound's key performance indicators fell sharply. At the end of the quarter, outstanding loans were down 42%, deposits in transit were down 32%, quarterly deposit volume was down 79%, and quarterly loan volume was down 53% after 32% in the previous quarter. Quarterly deposits hit a trailing 12-month (TTM) low. The only area of growth in the first quarter was liquidations, which rose 295% to a total of $134 million, largely driven by market volatility in late January.

The overall decline in protocol KPIs has also had a major impact on the financial status of the protocol. Net income, which rose 12% in the previous quarter, fell 48% to $4.9 million in the quarter.

Last quarter, the total cryptocurrency market capitalization hit an all-time high of $2.97 trillion. After an overheated end to 2021, the market cooled and lost more than 40% of its value, with the total cryptocurrency market capitalization at the end of January at around $1.68 trillion.

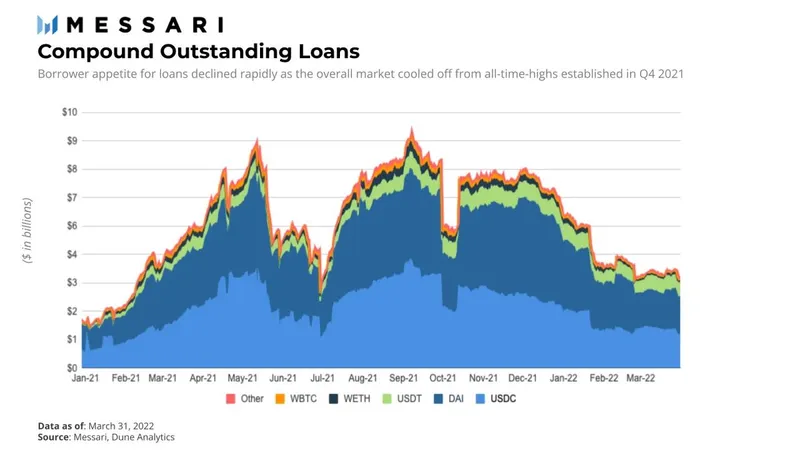

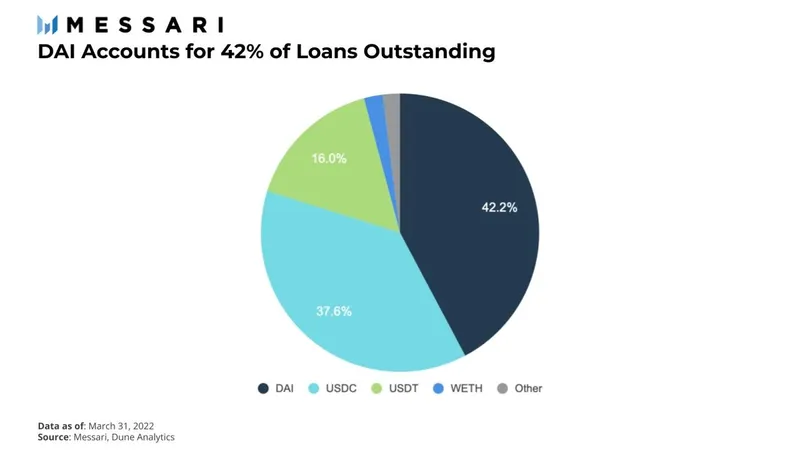

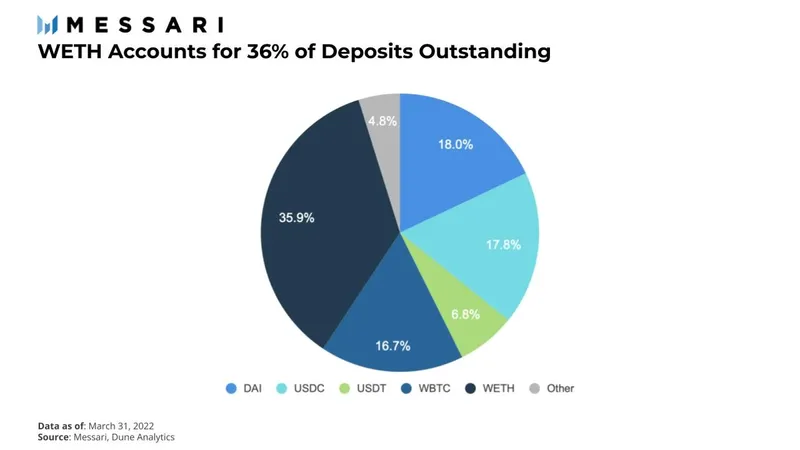

Outstanding loans fell by 42% during the quarter to levels last seen in the first quarter of 2021, when the total cryptocurrency market capitalization was also going through a cooling-off period. Stablecoin loans denominated in USDC and DAI continue to outpace loans denominated in other assets. As of the end of Q1 2022, DAI still maintains its share of Compound's total outstanding loans.

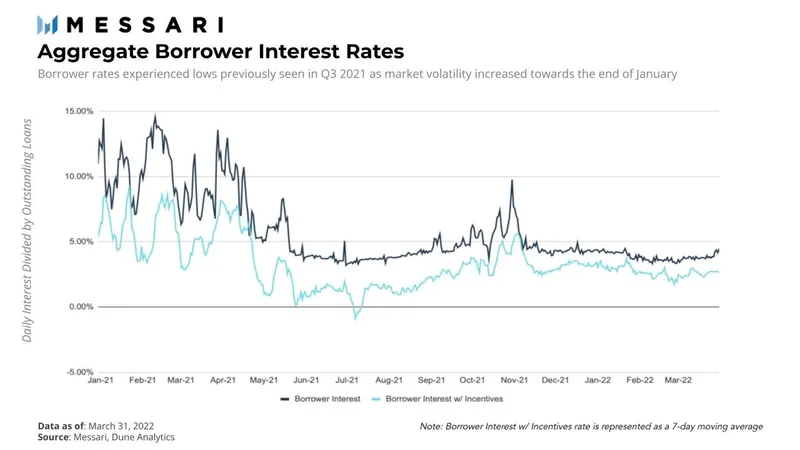

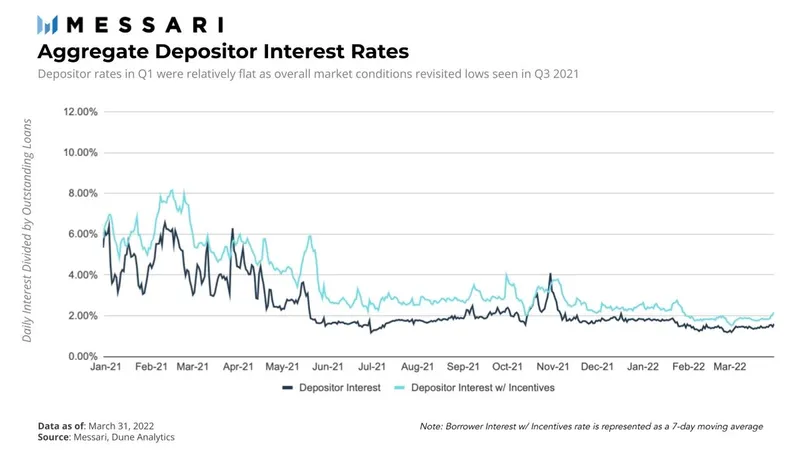

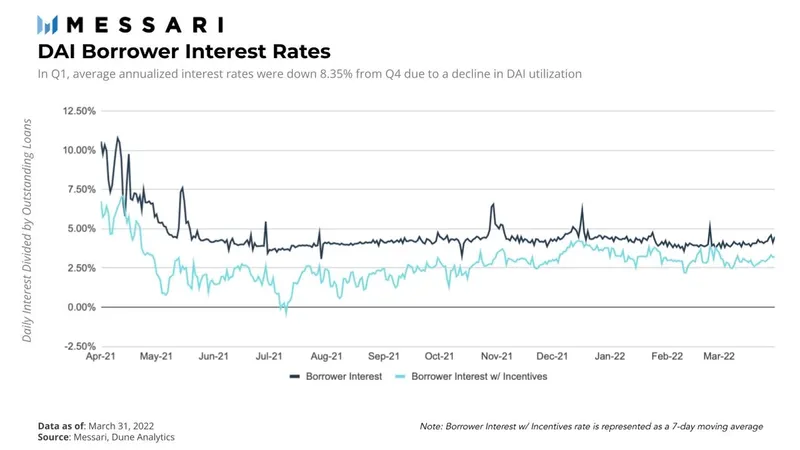

Compared with the previous quarter, borrowing rates were relatively stable, with an average annualized rate of 3.85%, down from 5.02% in the fourth quarter of 2021. As the market cooled in the first quarter, user demand for leverage fell, and rates fell along with it. In addition, COMP allocation issues in Q4 2021 led to asset churn, which impacted supply and pushed up interest rates. Borrowing rates topped out at 4.48% as markets hit year-to-date lows.

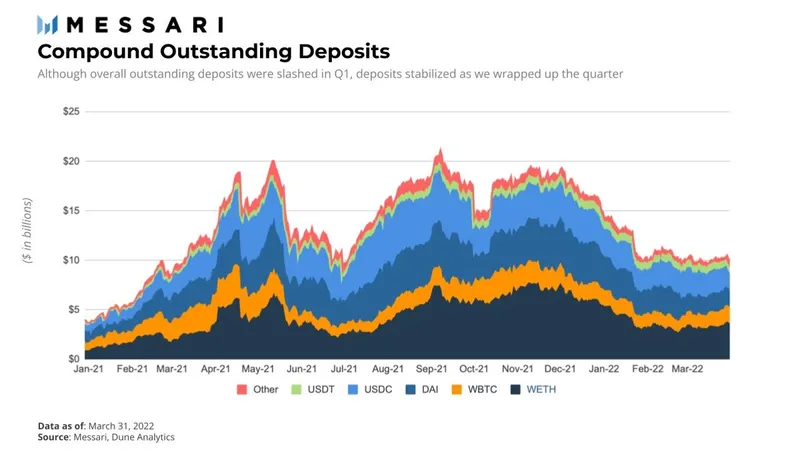

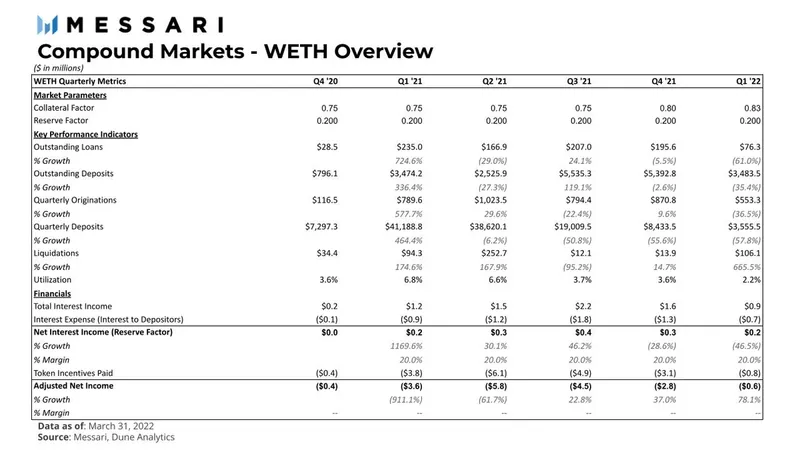

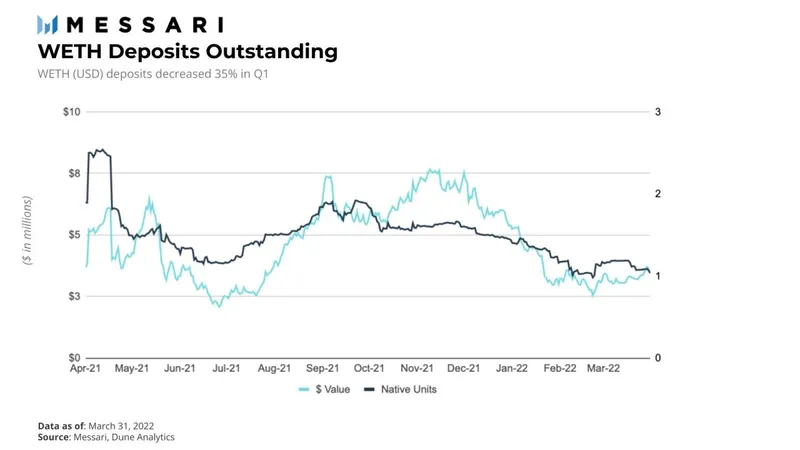

Deposits in transit fell 32% in the first quarter, with the sharpest drop in February. Similar to outstanding loan volumes, deposits are near TTM lows in 2Q21. But deposit volumes rose in March, and depositors still prefer WETH.

Deposit rates remained stable, albeit lower, during the quarter. This can be attributed to the fact that deposits are always matched with the need to borrow. The quarterly average deposit rate was 1.51%, down from 2.04% in the fourth quarter of 2021. The annualized rate hit a low of 1.19% in the first quarter and peaked as high as 1.87%. Rates saw their biggest drop in late January amid market volatility.

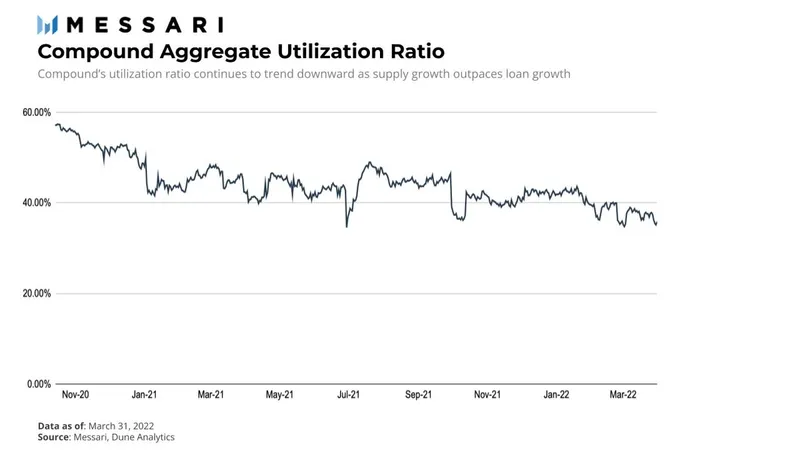

Compound's deposit utilization rate remained relatively flat in early 2022, but gradually weakened as the crypto market experienced turmoil in February. Deposits outstanding declined at a slower rate of 32% relative to 42% of loans outstanding, leading utilization to return to the lows seen in Q3 and Q4 2021.

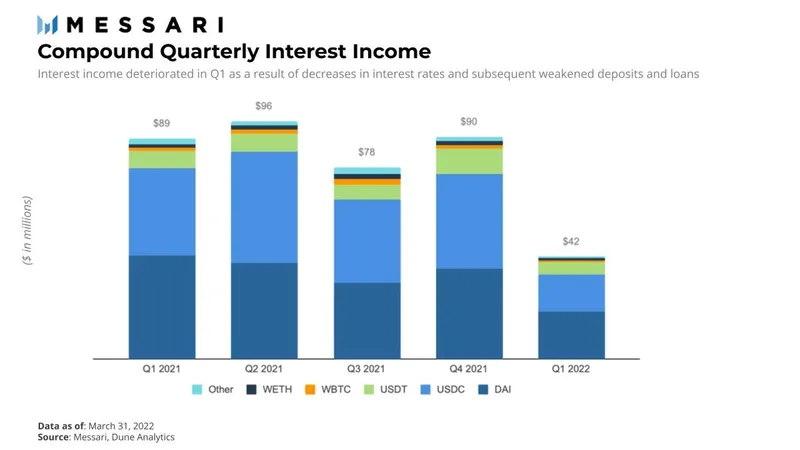

Interest income fell 54% in the current quarter compared to the fourth quarter of 2021. Coincidentally, interest and agreement revenue experienced almost the same percentage change in the first quarter. USDC had the largest drop of 62%, followed by USDT and WBTC, which fell by 50.8% and 50.7% respectively. Quarterly interest income was impacted as market volatility reduced loan demand.

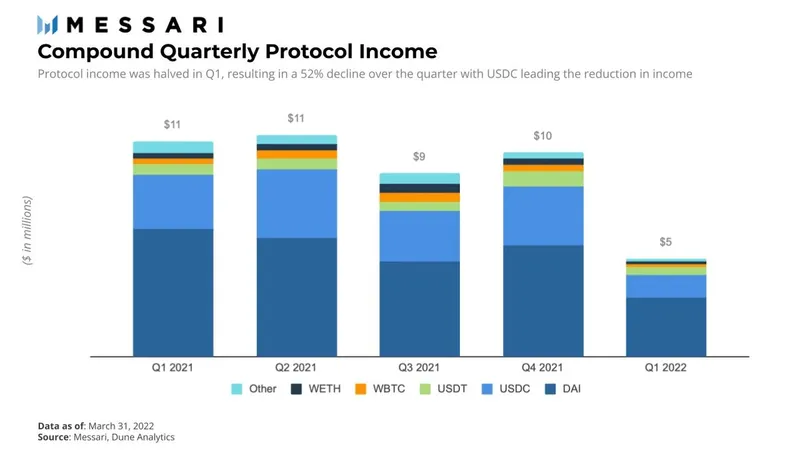

Protocol revenue of $10 million in Q4 2021 fell to just under $5 million in Q1. DAI accounted for more than 60% of protocol revenue in Q1, down 47% quarter-over-quarter.

Loan volumes fell 53% during the quarter, led by a $2.9 billion (66%) drop in DAI. USDC and USDT continue to be strong, but are still down sharply by 48% and 47%, respectively. USDC continues to dominate in terms of loan volume compared to the previous quarter. WBTC was the only asset with an increase in loan volume during the quarter, growing by $1.7 million (17%).

flash loanflash loanArbitrage between Aave and Compound drove quarterly deposit growth of 587%. Subsequently,another market makerThe removal of DAI from the protocol in Q1 caused deposits to spike quarter-over-quarter.

Quarterly deposit volumes for DAI, WETH, and USDC were $4 million, $3.6 million, and $3.5 million, respectively. Compared with the previous quarter, USDC narrowed the gap with WETH deposits in this quarter.

Liquidations on Compound peaked at the end of January, growing 295% month-on-month. This activity was mainly driven by a 270% and 665% increase in liquidations in the WETH and USDC markets, respectively. WETH liquidations increased from $14 million in Q4 to $106 million in Q1, mainly due to ETH volatility in late January. The USDC market saw an increase of $13 million in liquidations during the quarter, compared to almost zero DAI liquidations in Q1 compared to $3 million in the previous quarter.

COMP token incentives, a key driver of depositor and borrower activity, fell sharply by 52% in Q1. Compound governance passed a proposal at the end of Q1 to reduce the COMP incentive by 50% and plans to remove the incentive (The proposal failed). Given these plans, COMP token incentives should drop rapidly in Q2.

The five largest marketplaces on Compound

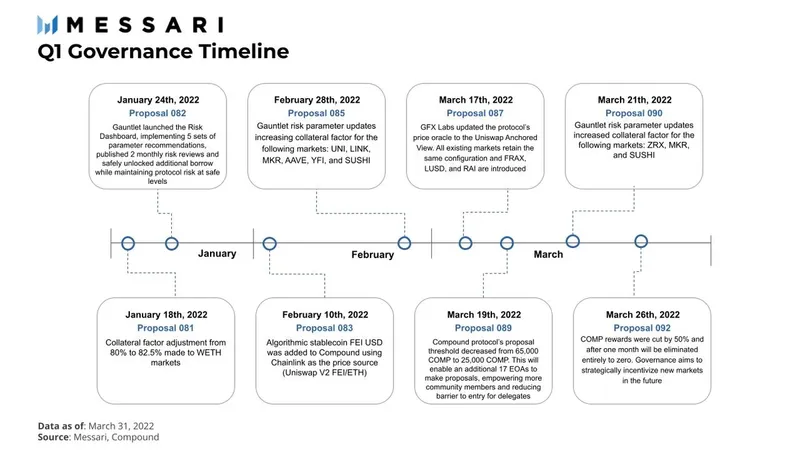

Through governance, the Compound market has experienced various changes during the quarter. Gauntlet facilitated collateral factor adjustments across eight markets, GFX Labs introduced a new price oracle, and a new algorithmic stablecoin market, FEI, was added to the protocol. Borrowers continued to favor loans in stable assets, continuing last quarter's trend.

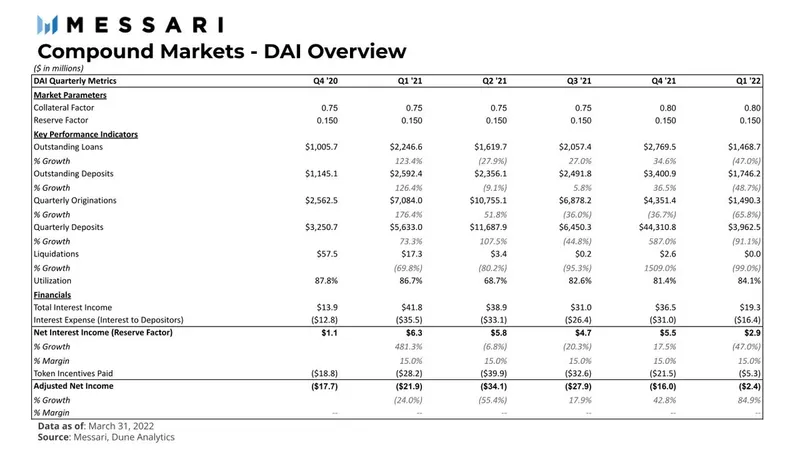

While KPIs fell across the board in Q1, DAI remains a key market for Compound, leading in metrics such as outstanding loans, deposit volume, interest income, and protocol revenue. DAI loans outstanding fell 47%, from $3.4 billion to $1.5 billion, while DAI in-transit deposits fell at a slightly higher rate of 49%, from $3.4 billion to $1.75 billion. Quarterly loan volumes fell 66%, from $4.4 billion to $1.5 billion. DAI liquidations were virtually non-existent this quarter.

The average annualized interest rate on borrowings fell from 4.5 percent in the fourth quarter to 4.12 percent in the first quarter. Borrowing rates hit a low of 3.58% during the quarter and peaked at 5.10%. Utilization rose 3.24% in the first quarter, leading to volatility in borrowing rates. DAI outstanding loan volume accounted for more than 42% of all outstanding loans at the end of the quarter.

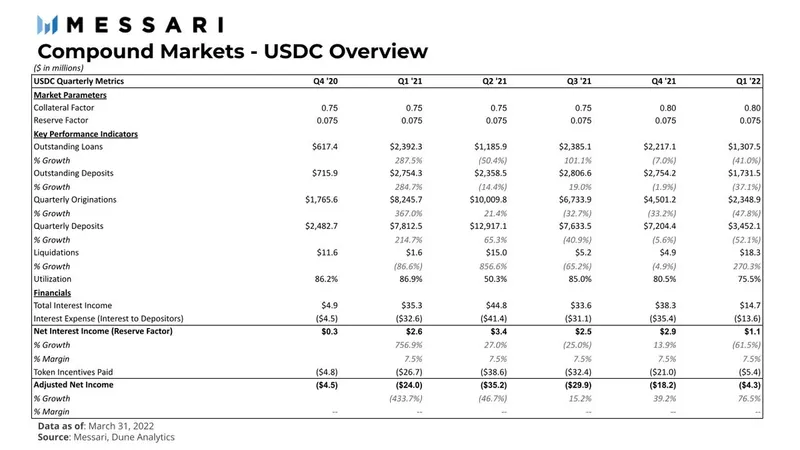

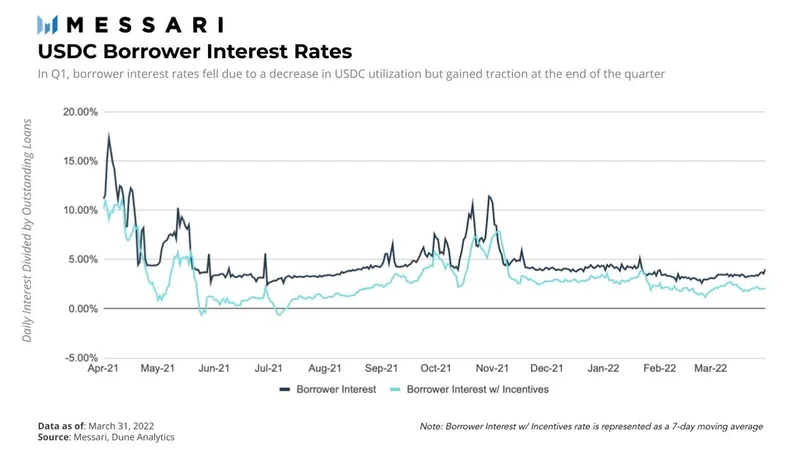

USDC remains Compound’s second-largest lending marketplace, with $1.3 billion in loans outstanding, down 41% from $2.2 billion in the previous quarter. Deposits in transit fell 37%, resulting in a 6.2% decline in utilization. Compared with the previous quarter, USDC borrowing rates were much less volatile, with an average annualized rate of 3.56% in the first quarter. This quarter, the highest interest rate was 5.09%, and the lowest was 2.62%.

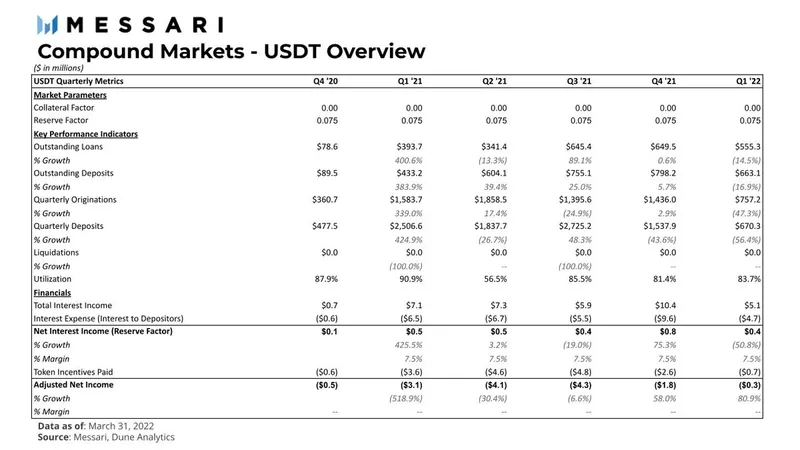

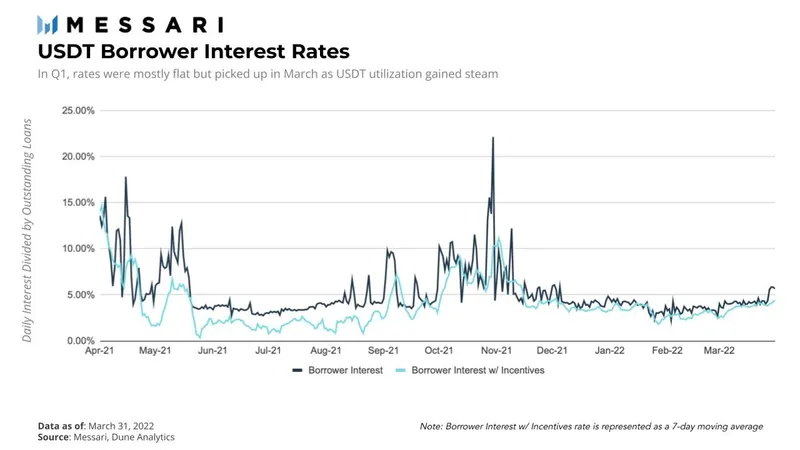

Compared to DAI and USDC, outstanding loans and deposits in USDT have decreased slightly. Among them, loans fell by 14.5%, from US$649 million in the fourth quarter of 2021 to US$555 million in the first quarter, and deposits fell by 17% to US$663 million from US$798 million in the fourth quarter. The usage rate increased by 2.9% this quarter, and the average USDT borrowing rate was 3.85%. After hitting the floor at 2.25%, rates began to rise, reaching 5.85% by the end of the quarter.

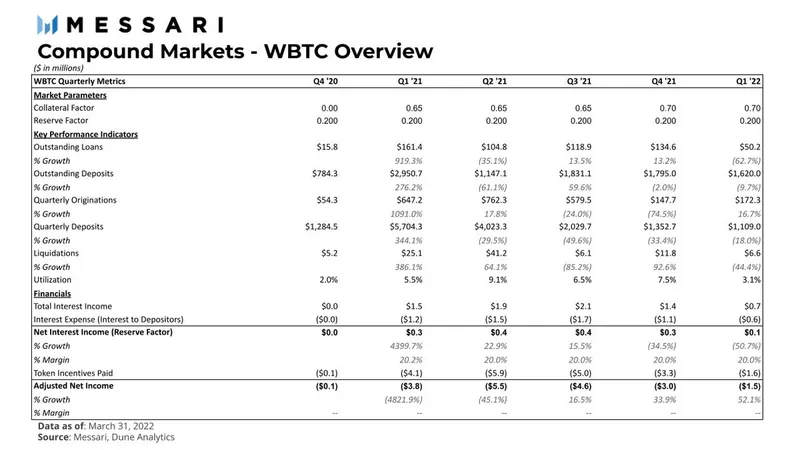

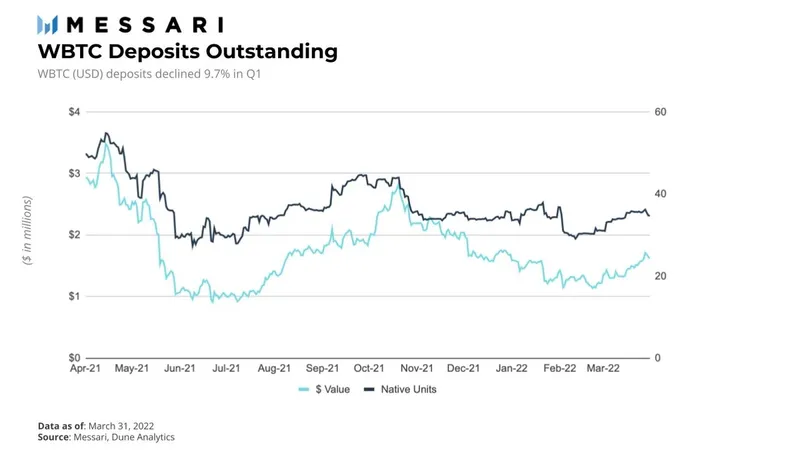

WBTC was the only asset in the protocol’s top five markets to see a 9.7% drop in outstanding deposits, from $1.8 billion in Q4 2021 to $1.6 billion in Q1 2021. In contrast, outstanding loans fell 62.7% from $134 million in the fourth quarter to $50 million at the end of the quarter.

governance proposal

governance proposal

route map

route map

epilogue

epilogue

Compound's overall activity was largely affected by the volatility of the broader market during the quarter, with user demand for loans and deposits falling sharply in the first quarter, which was also the main driver of the decline in borrowing and deposit rates, as well as protocol revenue, and consequently, liquidation volume It has nearly tripled compared to the previous quarter.

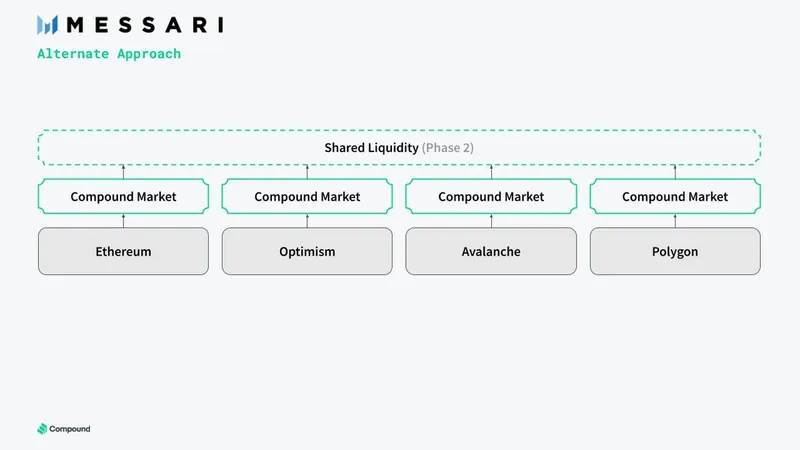

Changes to Compound’s incentive model are aimed at optimizing the market across the board and introducing effective incentives to launch new markets. These actions should have a positive impact on COMP token holders, leading to a healthier and more sustainable protocol.

Original link