Original title:State of Uniswap Q1 2022

Original title:

Original compilation: iambabywhale.eth

first level title

Important content:

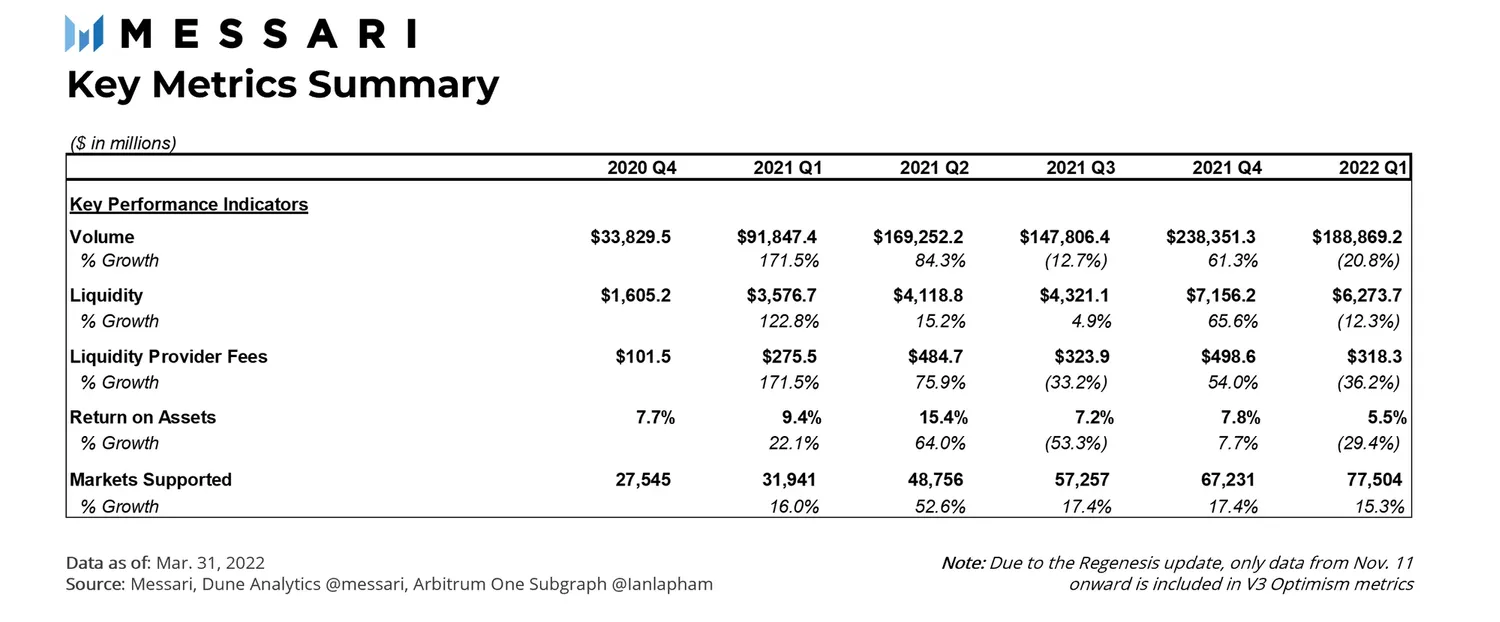

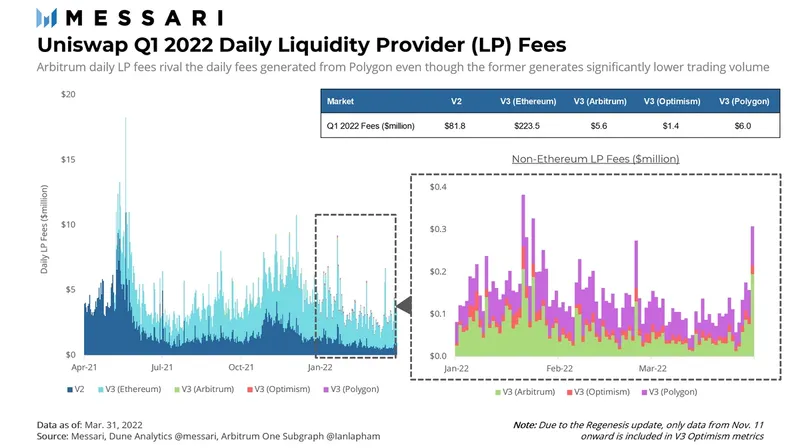

Total trading volumes, and corresponding liquidity provider fees, declined in Q1 2022 due to waning interest in cryptocurrencies and NFTs starting in Q4 2021.

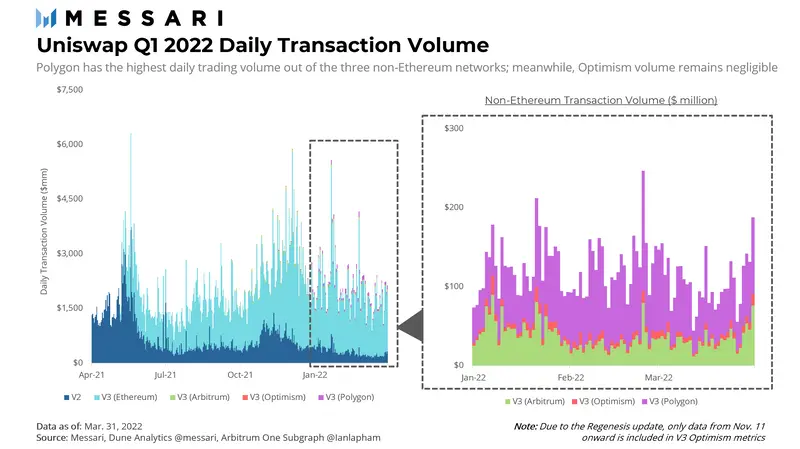

Polygon, the last blockchain supported by Uniswap V3, has seen transaction volume on it become the largest Uniswap V3 market after Ethereum; additional liquidity mining incentives in the next quarter should continue to help drive continued increase.

first level title

macro level

macro level

Overall, Uniswap volume in Q1 2022 is down 53.5% from the previous quarter. This echoes the global crypto market peaking at $3 trillion in market capitalization in the fourth quarter of 2021, before falling back to $2 trillion. When the price of the token rises, the trading volume usually increases with the interest of retail traders; when the price of the token falls, the retail investors lose interest. Unlike the NFT resurgence in Q4 2021 and the all-time highs in Bitcoin and Ethereum prices, Q1 2022 will see quieter trading activity.

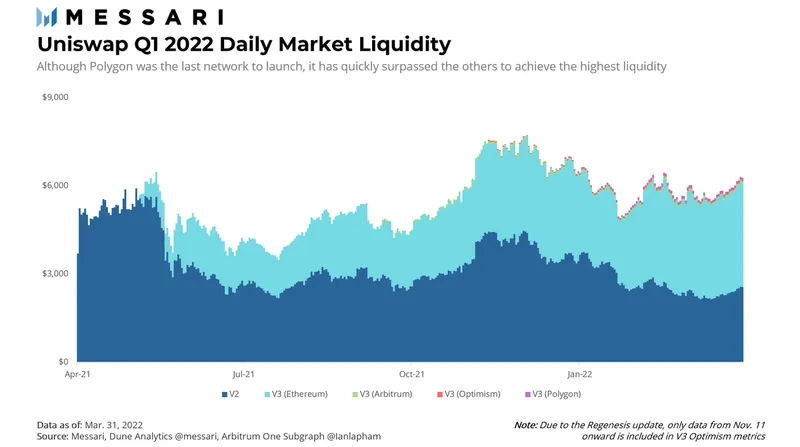

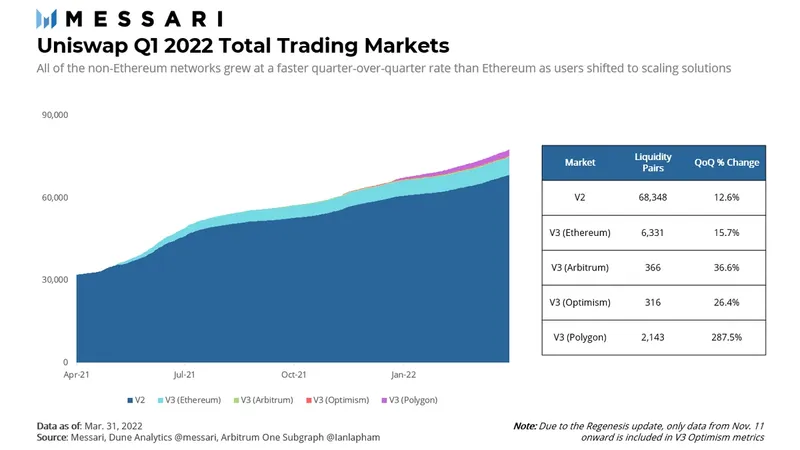

Overall market liquidity declined in the first quarter of 2022, but less so than volume. Uniswap V2 was the only network to experience a drop in liquidity during the quarter, down 25.7%, while all other networks saw small nominal increases. The drop in V2 liquidity did coincide with a drop in retail trading volume as V2 included more long-tail token pairs. At the same time, market liquidity has grown significantly in Uniswap's so-called scaling solutions, especially Polygon. Liquidity on Polygon has increased by nearly 81.7% compared to the end of the fourth quarter when it was just launched, and liquidity on Arbitrum and Optimism has also increased by 72.9% and 34.7%, respectively.

Polygon’s liquidity growth is particularly impressive given the lack of liquidity mining incentives for users in Q1. For context, when the original governance proposal was proposed, the Polygon team set aside a whopping $15 million for liquidity mining, with an additional $5 million set aside to support the ecosystem. These incentives are now live as of the first week of April. Only time will tell how much of a boost it will be to Polygon's existing success.

For all trading pairs on every non-Ethereum network from Uniswap V2 on Ethereum to Uniswap, the total number of trading markets also continued to climb from the previous quarter. Uniswap V2 continues to account for the vast majority of the overall market. Uniswap V3 on Ethereum and Polygon accounted for 11% of the active market, while Optimism and Arbitrum remained negligible. Like market liquidity, Polygon saw the fastest growth in Q1, up almost 300% from the previous quarter. Given all the data, it's clear that Uniswap has found a "new home" on Polygon.

first level title

micro level

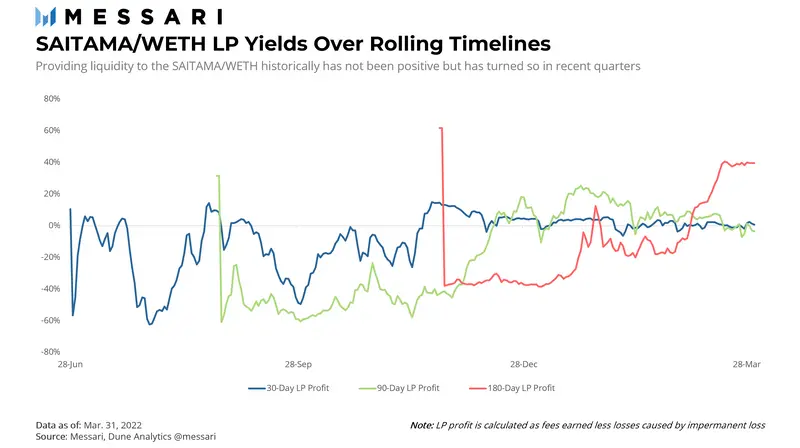

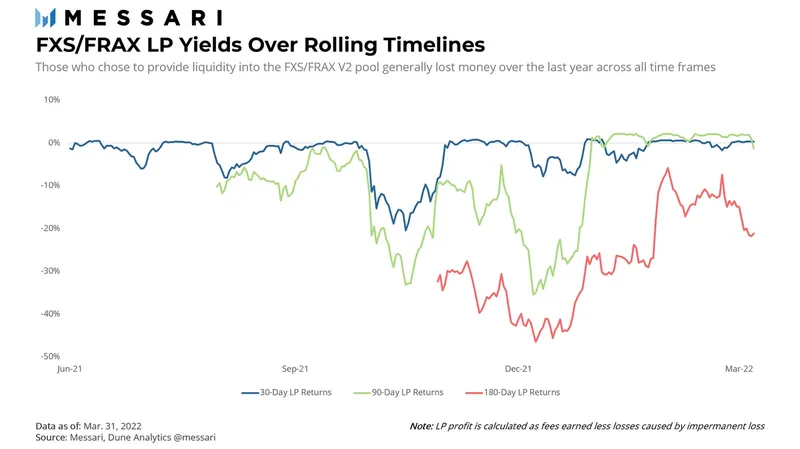

The four most active markets in the first quarter of 2022 are USDC/WETH, USDT/WETH, SAITAMA/WETH, and FXS/FRAX. Among them, the editor thinks that the more important data is the relationship between the income of providing liquidity and the impermanent loss.

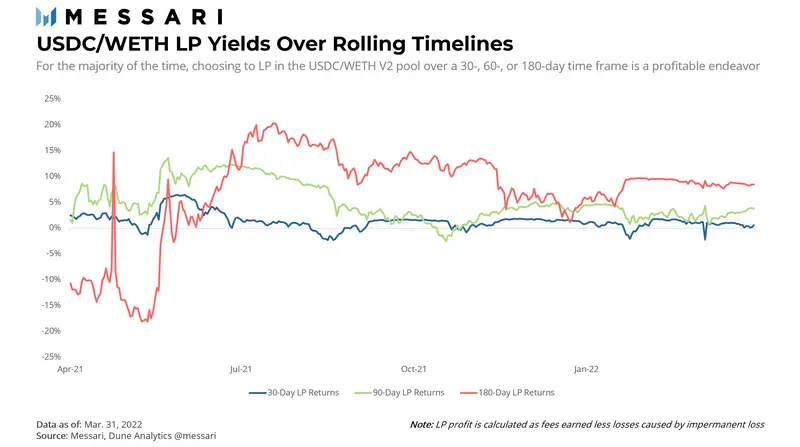

Messari distinguishes three situations when measuring LP income, that is, assuming that users provide liquidity for 30 days, 90 days, and 180 days respectively, the income on the day when liquidity is withdrawn minus the impermanence of the token value before liquidity is provided Loss is LP's rate of return.

Taking the USDC/WETH market as an example, in the past 365 days, users who provided liquidity for 180 days had a negative rate of return on 52 days of withdrawing liquidity, while for users who provided liquidity for 30 days, this figure was 45 , providing 90-day liquidity is only 12. In the first quarter of 2022, only users who provided 30-day liquidity will suffer losses when they withdraw liquidity from January 22 to 27 and March 5, and LP positions in other cases will make a profit.

As for the two trading pairs of SAITAMA/WETH and FXS/FRAX, it is not optimistic. The data shows that although the trading volume of these two trading pairs is at the forefront, their liquidity providers are in a state of loss most of the time. FXS/FRAX even just realized the break-even of some LP positions in the first quarter, while the long-term The liquidity providers have been in a state of loss.

As for Uniswap V3, the most active trading pairs are USDC/WETH, USDC/USDT, and WBTC/WETH. The three contributed 61% of the V3 market trading volume, respectively reflecting the Ethereum, stablecoin market and The relationship between the two largest cryptocurrencies by market capitalization Three market movements.

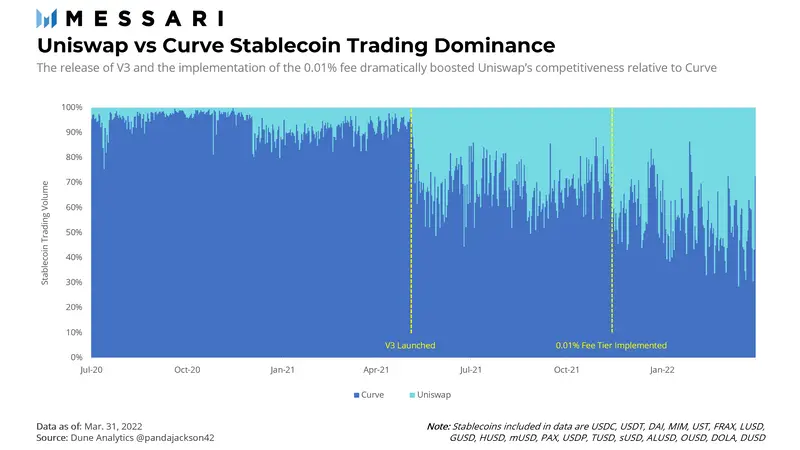

For the USDC/WETH trading pair, Uniswap V3 has a yield of 12%, which is 3 times the yield of the same trading pair in V2. For the USDC/USDT trading pair, after the implementation of the 0.01% transaction fee, the trading volume of this trading pair has increased considerably. In the first quarter of 2022, the trading volume of USDC/USDT trading pair increased by 60% month-on-month, and increased by 114.1% compared with the third quarter of 2021, which more than tripled within 9 months. 87.3% of the total trading volume came from 0.01 Liquidity pool with % fee. At the same time, liquidity increased by only 11.2%.

For the WBTC/WETH trading pair, the volume of the liquidity pool with a transaction fee of 0.05% decreased by 28.9%, but the liquidity increased by 57.3%, and the volume of the liquidity pool with a transaction fee of 0.3% was almost flat, but the liquidity only increased 13.7%. This indicates that due to the cooling of the market, investors may choose LP positions such as Bitcoin and Ethereum that can generate continuous income, and re-evaluate market conditions when better opportunities arise.

first level title

Uniswap released the sixth and seventh rounds of Grant plans in the first quarter of 2022. The funding provided by the sixth round of Grant reached US$2.4 million, an increase of more than 2.5 times compared to the previous highest amount of US$946,000. Notable projects include the off-chain governance project Other Internet ($1 million), Unigrants ($250,000), the Uniswap community analysis program, Team Secret ($112,500), an e-sports team, and Art Basel ($112,500). Cryptocurrency Booth, $68,500).

first level title

first level title

Summarize

Summarize

Uniswap's main focus in the first quarter of 2022 includes growth on Polygon, exploring multi-chain layouts, and the decline in the overall trading volume of the encryption market. The question is, if there is less trading activity, will that be bad for Uniswap?