Related Reading:Topic | Messari 2022 In-Depth Research Report on Encryption Industry

The original text is from Messari, the original title is "Crypto Theses for 2022", translator | W3.Hitchhiker

Related Reading:

Topic | Messari 2022 In-Depth Research Report on Encryption Industry

The original text is from Messari, the original title is "Crypto Theses for 2022", translator | W3.Hitchhiker

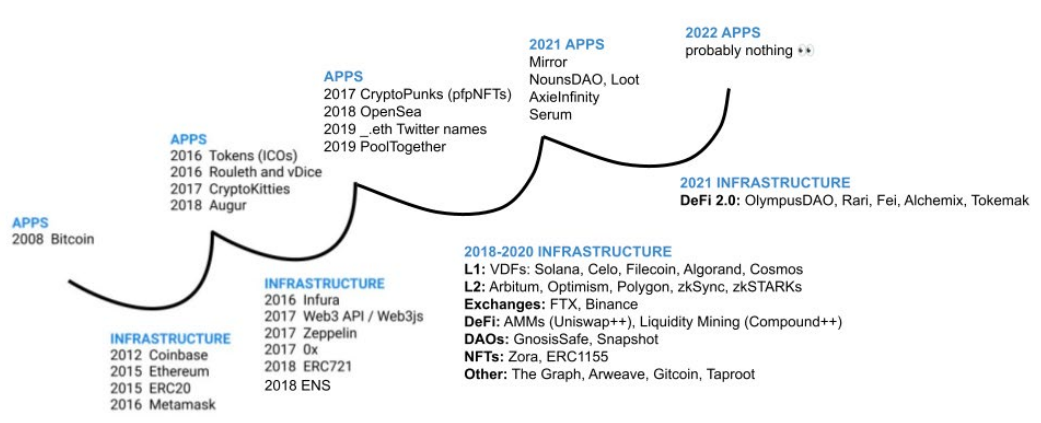

Chapter 7 DeFi 2.0

In the first chapter of this section, we introduced the core pieces of Web3: NFTs (identities and unique digital assets), the blockchain registry “land” of the Metaverse, and the decentralized hardware network that will host it all. The next three chapters are all about how we manage the financial systems of virtual worlds, scale their infrastructure to accommodate billions of users (human and machine), and manage them over time.

We’ll start with the development of decentralized financial systems (DeFi), and while most DeFi blue chips have been through a relative bear market (many down 80% or more compared to ETH YTD), there’s still plenty of new developments this year .Bitfinex’edBefore we dive into DeFi, let’s start with the currency bridging the old and new worlds.

secondary title

1. USDT Bridge

make

And to the chagrin of short sellers everywhere, Tether is unlikely to fail, nor is it likely to end this cryptocurrency bull market. If that happens, the death of Tether's USDT is more likely to be a US government takeover than a bank run by corporate depositors.Things are never what they seem when using Tether, so I understand the mainstream confusion. It's actually quite simple, and I'll reiterate what I said last year on Tether:。

"Tether's de facto supporters (major global crypto exchanges and market makers) are likely to overshadow USDT risk as there is no obvious alternative to the almost universally accepted USD-denominated reserve. This year's settlement (NYAG & CFTC) has little impact on the market Big, which might lead some to conclude that the worst-case scenario for Tether is orderly access to other stablecoins. But moving funds from one platform's perpetual contracts to another is one thing, as we did last year in BitMEX sees it. Transferring sequestered dollar reserves to neobanks is another story.”Tether is the digital Eurodollar, and many people trust USDT not because of the scale and scope of the business they do (although many people do), or because they believe USDT reserves are fully backed, or because they are comfortable with collusion and global conspiracy, but because of the At the end of the day, they have to trust Tether, and the system has worked so far.Calling Tether a liar is inaccurate. It's also a clear way of letting you know you're apeople who don't know what they're talking aboutthere are many

Legitimate companies work with them on a large scale. USDT is still the reserve trading currency of most exchanges and trading pairs in the world, and the liquidity of USDT is an order of magnitude higher than that of USDC or BUSD. evenCoinbase also backed it when it went public this spring, they are the co-founders of USDC!Tether has announced this yearTwo reserve audit reports$18 trillionreturn) and the Commodity Futures Trading Commission ($41 trillion) for a relatively paltry sum that critics denounced as a Madoff-scale Ponzi scheme. After the 2016 Bitfinex hack, the company’s “lie” about mixing funds got

return

, but probably none of them saved the customer (and the industry) in the process. Wouldn't it be better to tell the whole truth and destroy the underlying market? Yes, the company is inFunding adjusted around 2018, to cover up $850 million stolen by a partner, but at least some of it was the responsibility of the US government. If Bank of America had accepted regulated crypto clients in the first place, Tether would not have had to turn to such a desperate counterparty.

I know it sounds like I'm making excuses for bad behavior, but it's not. My point is that we all hold our breath and accept the crypto cowboy status quo - it's a bridge to mainstream adoption.

CoinDesk's Marc Hochstein in his fableA Bridge Called TetherIt illustrates this point. Tether is the most convenient, yet rickety rope bridge that spans the hilltops of the traditional and crypto-financial worlds. It’s designed to be “shadow-as-a-service” — reducing seizure exposure due to judicial arbitrage. It's also possible that it will be replaced at some point, even if the final date remains unclear.I think Taser is the Omar Little of cryptography. Everyone knows Omar broke the rules, but he has his own code of life, everyone in the game respects him (even if they fear him), and the overseers should know by now that when they attack the king, it's better not to miss it.(Must Read: Bloombella

. great

2.DAI VS USDT

Skentic take

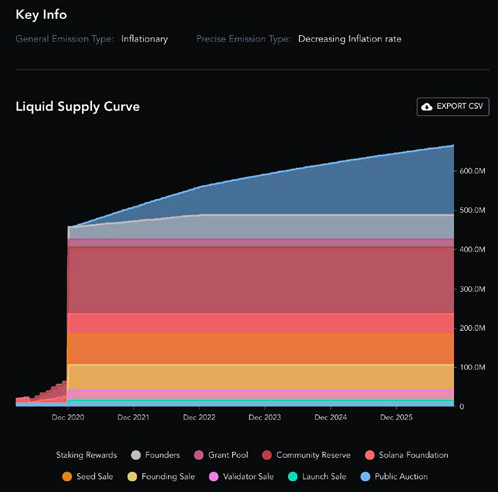

. Omar is Omar. )*USDT’s share of the stablecoin market has dropped from 80% to 50% this year, but Tether’s structural importance to crypto exchange settlements remains the same. USDT really should be in the market infrastructure chapter, and USDC should be in the DeFi chapter (exploding it as a DeFi reserve), but I don't want to separate Paxos and USDC. I'm also tired of editing.secondary titleWormhole V2There have been many attempts to challenge DAl as a decentralized stablecoin for cryptocurrencies, but have so far failed. Is it different this time?

columbus-5 test$20 billion, the test spawned dozens of new applications and enabled Terra to expand its cross-chain reach through Cosmos’ inter-blockchain communication protocol (IBC). A new insurance protocol (Ozone) on Terra helped its community add $3 billion in UST (burned via LUNA) in just a few weeks. Furthermore, cross-blockchain bridges,

Launched support for Terra, bringing Terra UST from Ethereum to Solana. The momentum of UST is accelerating as it is now positioned to be an interchain stablecoin.

$20 billion

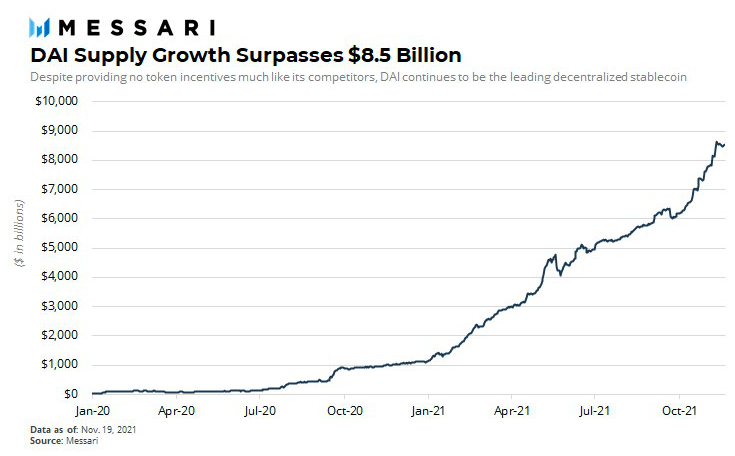

, the supply of DAl recently surpassed $8.5 billion. Most impressively, unlike nearly every other DeFi and stablecoin competitor, MakerDAO offers no incentive to use its platform. All growth is organic.

Despite new competitors, DAl remains the most widely integrated decentralized stablecoin in the industry and the preferred decentralized stablecoin in the Ethereum DeFi ecosystem. That's thanks in large part to its four-year track record. If the most important attribute of a stablecoin is survival. DAl has its own league. It has withstood multiple brutal cuts and has proven toughness that competitors cannot easily replicate.

dai vs UST can be boiled down to Ethereum’s DeFi advantages. One of UST's strengths is that it's not even trying to compete with DAl on its own turf. On the contrary, UST is building its own ecosystem on Terra and actively expanding multi-chain. If cryptocurrencies continue to evolve toward a multi-chain future, the winning decentralized stablecoin could proliferate across the broadest blockchain ecosystem. Terra is heading in this direction, while DAl continues to serve primarily as Ethereum's reserve, there is plenty of room for both.

secondary title3. The revival of algorithmic stablecoinsAfter a mini-hype cycle in Q4 2020, algorithmic stablecoins crashed violently and entered a prolonged trough of disillusionment early this year. But we’re seeing a renaissance in the space today, fueled by two new innovations: fractional reserve stablecoins and “protocol-controlled value.”

First, what do we mean by algorithmic stablecoins?

Here is an article we published earlier

Featured research articles on the field

excerpt of

“The origin of most first-generation algorithmic stablecoins can be traced to a 2014 paper by Robert Sams titled “A Note on Cryptocurrency Stability: Seigniorage Shares.” Sams describes a stablecoin model, The model involves two tokens: a stablecoin and a token that takes a share of the system's seigniorage (profiting from new issuances), and when demand for the stablecoin increases, the stablecoin's As the price rises above $1.00, the supply of the stablecoin must increase. Newly issued shares are distributed to "shareholders" until demand is satisfied and the price returns to an equilibrium of $1. The opposite is true when demand falls. When As the price of the stablecoin falls below $1.00 (shrinkage), the stablecoin will be removed from circulation via a burn mechanism in exchange for the issuance of new seigniorage shares. This model effectively divides the system into two types, one that absorbs A speculative asset that fluctuates and supports the system, and another stable asset that is used for stability.”

This sounds simple and effective in theory, but it introduces two obvious limitations: the downward reflexivity could create a "bank run" on these agreements, and the lack of collateral backing means banks can legally lower interest rates. to zero"

Reflexivity propels early experiments (ESD, Frax) to great heights, then annihilates them on the way down. The seigniorage share in these systems is only valuable if buyers are confident in the continued viability of the system and the positive net present value of the future money supply. When massive redemptions happen quickly, confidence is crushed and reinvestment in equity tokens cools, triggering a death spiral.

Without any collateral backing to offset the spiral, algorithmic stablecoins rely on external “lenders of last resort” to bail them out during severe crunches. Users (package holders) need to step in to save the system, otherwise shares and stablecoins will be forgotten.

Then there is a self-guided challenge.

Fractional reserve models and “protocol control values” change the calculus of algorithmic stablecoins.

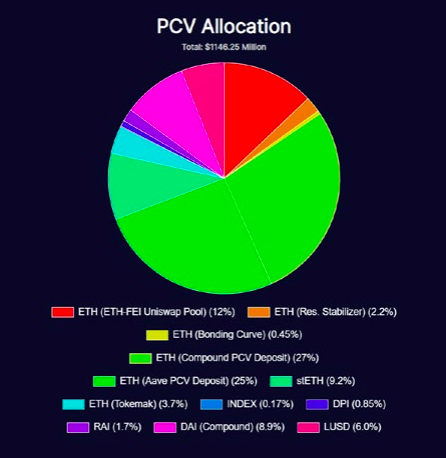

Protocol Control Value (PCV), pioneered by Fei Protocol, functions like a giant MakerDAO library. Fei is different in that it is the protocol owning assets that users deposit into the system, rather than individual individuals who are collateral in a vault. FEl is not a mortgage, it is actually a mortgage that is sold in exchange for a stablecoin. The system has two assets — Tribe (a governance token that can provide support in “bank runs,” similar to MKR) and FEl (stablecoin). Fei can deploy capital on its balance sheet into loan and equity pools across DeFi, or purchase other reserves. This flexibility creates organic demano for its stablecoin and reduces reflexivity (so far).

It’s unclear whether these improvements will be enough to challenge DAl’s decentralized stablecoin hegemony, but Fei and Frax’s iterations appear to be a step in the right direction.

secondary title4. The emergence of non-pegged fiat currency stablecoins (defi2.0 representatives)text

When Bitcoin was born, it captured the imagination of early adopters, who began to seriously consider the potential of non-sovereign digital currencies. Bitcoin’s promise as a currency is long-term — it may remain volatile for a long time, but its believers believe it will eventually stabilize once it builds its user numbers and liquidity. Even today, Bitcoin remains incredibly volatile — despite its $750 billion market cap, it plunged more than 30% in a single day in May this year. Given the inelastic nature of Bitcoin's supply, it's unclear whether it can achieve stability.

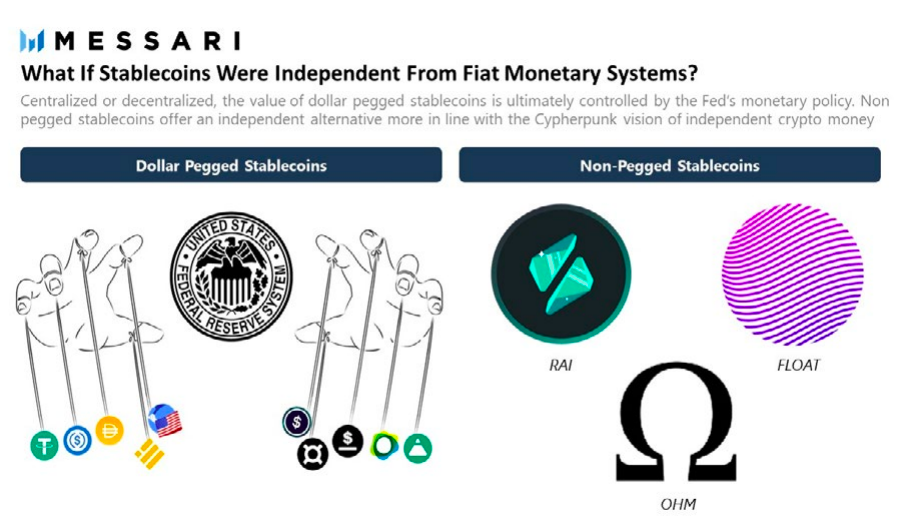

Builders of the crypto economy won't wait for Bitcoin to stabilize. To bridge this gap, we have witnessed the growth of USD-pegged stablecoins, which address the volatility vulnerability of cryptocurrencies and facilitate the adoption of blockchain applications beyond HODLing. But early iterations brought a new problem — stablecoins make our blockchaindollarized, and in the process put the entire crypto-economy at systemic risk. A currency that is ultimately linked to and controlled by the Federal Reserve and the Treasury limits our ability to create a truly sovereign monetary system.

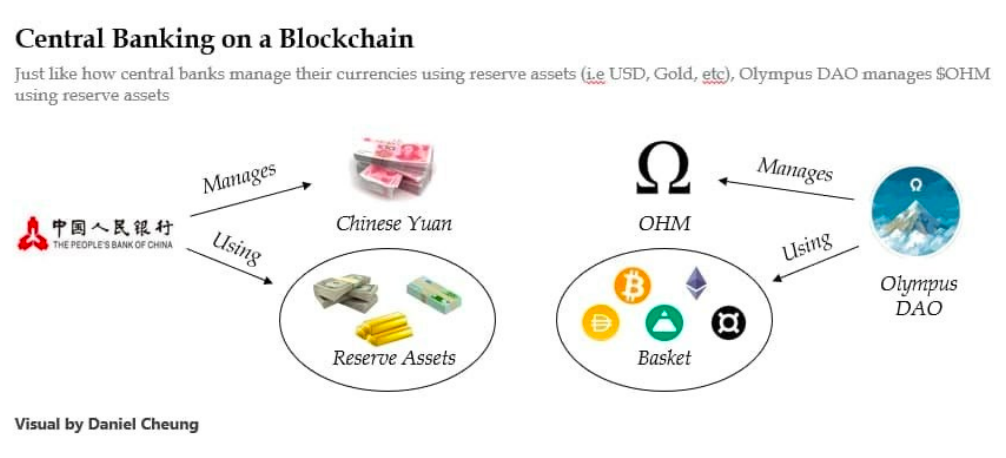

This has led to a wave of new projects launching this year aimed at creating free-floating stablecoins that are not pegged to fiat currencies. Non-pegged stablecoins offer an opportunity for the crypto-economy to achieve stability while removing reliance on the U.S. dollar.The controversial but undisputed leader of the movement isOlympus DAO is now a foray

(source:Daniel Cheung)

(source:If this all sounds weird to you, that’s normal, there’s a lot about non-pegged stablecoins that eludes you and is questionable. The protocol has something like Game Theoretic Properties of Ponzi Schemes, (Recommended reading:)

The Art of Central Banking on the Blockchain: Non-Pegged Stablecoins,

Mount Olympus: Fact and Fiction

Olympus Pro: Protocol-owned liquidity as a service

secondary title

5. Worldcoin's firm vision

Launched this fall, Worldcoin has garnered some impressive backers and an audacious goal: to exchange a fair-issue digital currency by tying a billion people's retinal scans to a unique, verified identity. into their hands. They use zero-knowledge cryptography to secure on-chain identities, and an incentivized network of “Orb operators” who log new users for $10 each in return for viewing the metal scanners. Early results sound impressive.

I know it sounds bad.

Yes, it involves a metal iris-scanning sphere built by the folks at OpenAl.

Yes, the online model relies on door-to-door tech Mormons who are being offered $10 in return for storing their biometrics on these new devices.

asYes, the manufacturer's name wasn't revealed, which could end badly.Yes, the side of the orb does look like the Death Star, but it has a new wax, and the digital currency that passes the eye scan is also the currency of the Galactic Empire (I think).

But what if it works?

Balaii pointed out

,” FacelD scans hundreds of millions of faces every day. Can we explain the difference between it and Worldcoin or any similar opt-in technology for proving human existence? If you run a service with multiple trusted users, you will Immediate discovery requires proof of a certain type of person. Nor necessarily outdated and bureaucratic KYC enforcement by the state, but 'something'. Otherwise you have bots, scammers, trolls, fakes, etc."

In the minds of him and supporters, you want to be able to distinguish good users from bad users to protect the identity and privacy of community members, while also powering the new pseudonymous economy. That means "progressives figured out that you can build stateless money. Libertarians figured out, and then you have to rebuild something like an organization: identity, exclusion, anti-fraud, custody, trust, community..."I haven't been able to make a decision yet because if this early experiment is successful there will be 2nd and 3rd order effects that we can't predict (good and bad)secondary title6. Uniswap v3 VS The WorldNow we'll dive deeper into DeFi, so this section will assume you have a basic working knowledge. If you haven't, I encourage you to read my

last year's paperThe DeFi chapter written in , learn amm, farmland, vault, temporary loan, oracle machine, impermanent loss and so on. This report is long enough, so I assume you have some prior knowledge. For this particular section, here's aDecentralized exchanges and how they work

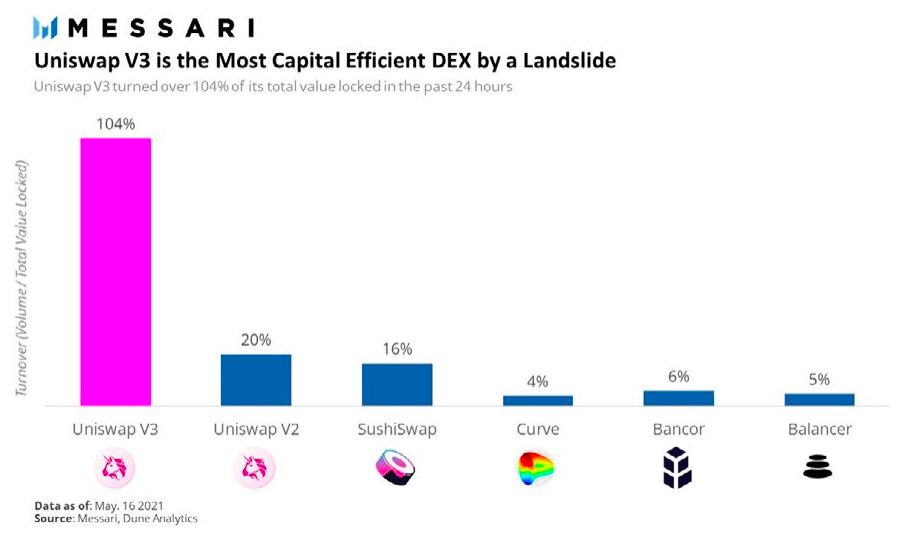

A good review.However, we will only discuss one specific DEX today, as some believe that Uniswap v3 may eventually encompass all other Ethereum DEXs. They certainly had a head start, even if squashed thanks in part to Ethereum's bloated chain. But most of the recent focus has been on providing the infrastructure and tools to drive more liquid markets and more competitive market-making. This is a smart development as the DeFi world becomes more wallet-centric than destination-centric. (Uniswap has3 million+ users, Metamask has more than 10 million users)。

The biggest difference in v3 is that liquidity providers are active. Rather than depositing assets into a pool that passively provides liquidity along a deterministic price curve, liquidity providers actively adjust their buying and selling liquidity ranges, which are then aggregated by the Uniswap AMM. Known as "concentrated liquidity". By better concentrating liquidity around current market prices, these

narrower range

Helps improve capital efficiency. They also reward professionals,

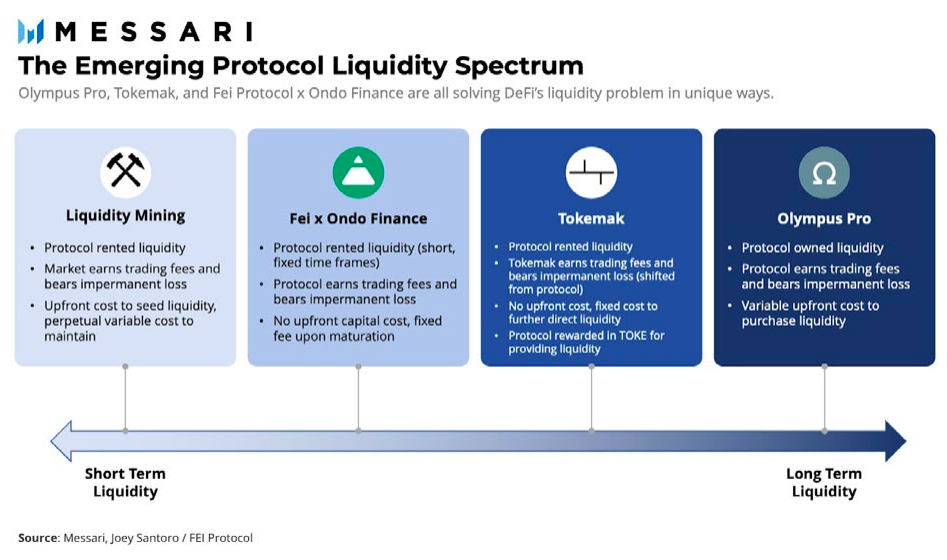

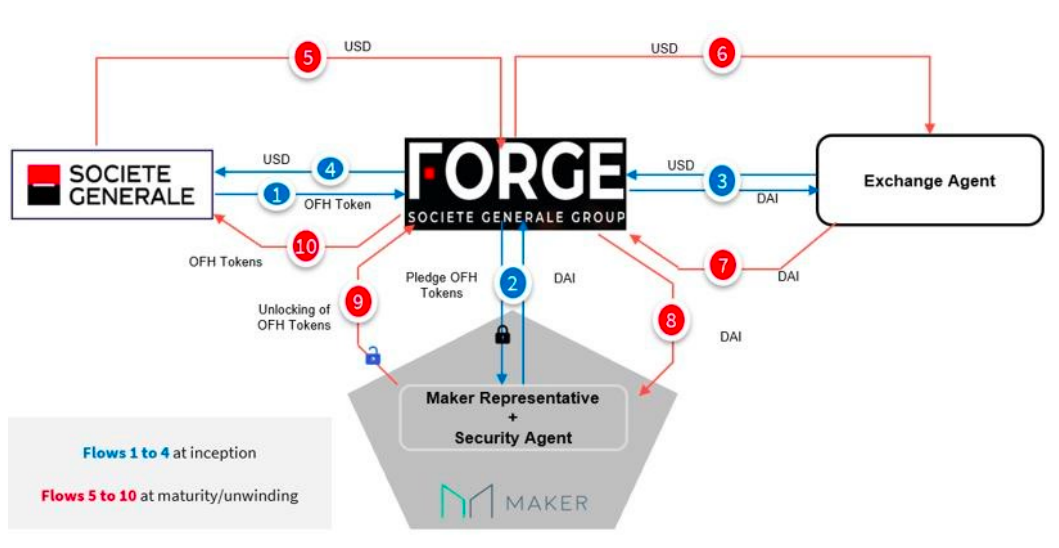

V3 allows limit orders for market makers and introduces customizable transaction fees (30 basis points, 10 basis points, 5 basis points, 1 basis point) to incentivize liquidity providers to build on otherwise illiquid pairs new market. These upgrades should combine to attract more professional market makers who actively monitor short-term liquidity positions (inert liquidity provisioning will no longer be profitable), and help Uniswap better integrate with other centralized and decentralized exchanges Previously, Uniswap failed to keep pace with these exchanges due to lower expected spreads (like peer pairs on Curve).101, Uniswap, Sushi, CAKE, Bancor, Loopring, Serum, Curve, 7.Perp VS. dydx Centralized liquidity is clearly the future of amm, as illustrated by the early success of V3. Since its launch, Uniswap has increased its DEX market share to over 70%.Whether the characteristic order book model of non-amm DEX will prevail in the end is up to you to decide. It's one of the sectors we cover most thoroughly in Messari Pro, as the loot for success is very high.(Recommended reading: secondary titleYou may have seen a crazy headline on Bloomberg last month: New DeFi perpetual contracts platformdydx briefly surpassed Coinbase in trading volume . Yes, early token incentives and transaction rewards helped, but it also came from a newer network that even excluded US customers from using the protocol. Perpetual contract trading volume on centralized exchanges dominates spot trading volume, and I expect DeFi to be no exception. This makes Perp and dydx attractive.For decentralized derivatives exchanges, the biggest unlock this year is the launch of L2s. Historically, these exchanges have not been feasible on the Ethereum base layer, as this slows down transaction settlement times and has high cost requirements for perp development (frequent oracle updates, liquidations, etc.). The Perpetual Protocol was developed on the Ethereum sidechain xDai and launched on Arbitrumv2 version, DYDX released its own application-specific zk-rollup earlier this year. In both cases, increased transaction throughput, lower latency, and lower fees allow these types of projects to finally work.Derivatives other than perpetual contracts are another story. They are complex, non-linear, difficult to price, and often less profitable when demand is low. There are some experiments worth noting, such as Antimatter's " "and TracerDAO's bull and bear tokens, attempting to neutralize "volatility decay" (Defi Q2, 101, Perp, Mango) Arthur Hayes can explain it better than I canMolly). But the real action will continue in the perpetual contract, and the real battle lies in the perpetual contract between dex and cex. (Recommended reading:Scsecondary titleThe easiest path analysis I've seen from DeFi 1.0 to 2.0 comes from, but judging by where we are in the crypto cycle, it’s not too bad: If you talk to people in DeFi circles, you'll hear that the hottest token families are DeFi 2.0 teams and anything with "protocol control value". oopy tries to and Sam tried Explain this better than I can, but I'll try to explain it briefly here. First, on some background. The DeFi craze started 18 months ago with Compound’s yield farming initiative. Then (and still is), one of the preferred incentive schemes in DeFi projects was to provide liquidity providers (“LPs”) with native token incentives for the underlying DeFi protocol. This energizes early liquidity in these systems and flocks to risk-adjusted returns from market makers in AMMs in Uniswap, lenders and borrowers in Aave, vault holders in Yearn, etc. The highest protocol, which includes protocol earnings and token-denominated liquidity mining rewards. These capital providers are crucial in the startup phase of DeFi. But over time, their values have diminished because they are fickle: The capital they provide is hot money, which they transfer from one project to another. LPs are more like locusts than lowly farmers, as they create perpetual spending and relentless sales pressure on the protocol treasury. Some projects see this and realize that yield farming 1.0 is not sustainable. Instead of creating native treasury token yield farms, they started creating “liquidity-as-a-service” schemes that “rent liquidity” from other protocols. We've already talked about how Olympus and Fei utilize this model. The Olympus DAO pioneered "bonds," which sold native OHM tokens at a discount in exchange for LP shares in Olympus. Fei’s partnership with Ondo opens the door for projects to make their native treasury token function as a collateral asset in Fei, where Fei will match contributed collateral with its stablecoin FEI in exchange for a fixed period of liquidity. Tokemak has created a decentralized market maker that is directly connected to the DAO treasury, and the DAO treasury lends native tokens to DEX in exchange for TOKE. In all these cases liquidity is now provided at the DAO level rather than at the liquidity provider side. Protocol-controlled liquidity is a subset of protocol-controlled value. If protocol-controlled liquidity is about DAOs using their token vaults to provide liquidity, then protocol-controlled value is about DAOs monetizing their balance sheets more broadly. As previously mentioned, the Olympus DAO now has a vault worth over $700 million in non-native assets. And put those assets into DEXs, lending protocols, yield aggregators, and even venture capital. This increases the DAO's rate of return (its treasury assets generate yield) and lowers its cost of capital (the DAO does not pay external resources for its liquidity). Higher income, lower cost, this is the biggest innovation of DeFi 2.0.In addition to new models of liquidity provision and balance sheet monetization, this year also brought the emergence of "automatons", "intensifiers" and "extenders". The automated protocol rebalances liquidity positions between the AMM and the first layer, reclaims rewards, and provides "automatic compounding" services. Convex Finance is one of the leading examples - they "recycle" $CRV and Curve LP tokens to boost rewards, transaction fees, and governance tokens.Enhancer is a protocol that does not introduce a new operating model for DeFi, but recycles the output of existing protocols to optimize the return of DeFi. Recycle the output of existing agreements to optimize returns for end users. A good example of this is Abracadabra.money. It is similar to MakerDAO, but with the important difference that it creates CDPs from yielding assets and has looser risk controls. Critics will point to subprime mortgages and other derivatives, and point out that "DeFi 2.0" will have a significant "garbage in", "garbage out" problem, and the associated risk of failure. Others will greedily invest inDefi 2.0, Rari, Alchemix, and Tokemak) ($5 billion in liquidity in six months). I haven't figured all this out yet, and whether this is lunar math or a new sustainable financial model. (further reading: secondary title 9. Fat Applied Theory Cryptocurrencies are moving toward modularity at an accelerating pace. Ethereum plans to rely on second-layer execution platforms such as Optimism, Arbitrum, StarkWare, and ZKSync. Ethereum competitors such as Solana and Avalanche have developed a strong parallel DeFi layer and user base. Cosmos has unlocked cross-chain communication, bringing its multi-chain IBC universe to life, and Polkadot’s parachain auction has finally begun. In other words, the shift to a multi-chain future has arrived, and it creates a huge opportunity for existing DeFi brands to expand into new ecosystems. For those looking to capture the majority of cryptocurrency growth dividends, an Ethereum-only strategy may not be feasible. When most basic deals aren't a good deal on tier 1. A liquid, trusted marketplace for financial services will reward multi-chain applications when users are at Layer 2 or a competitive Layer 1. Most DeFi blue chips have figured this out. Although they are generally divided into four types. Broad layout and prayers. Protocols deploy copies of their contracts to any EVM-compatible chain or layer-one sidechain (e.g. Sushi will launch anywhere... except Tron). Targeted EVM compliant chains. Protocols deploy copies of their contracts to EVM-compatible chains or as soon as these networks show some initial promise, protocols deploy copies of their contracts to EVM-compatible chains or sidechains; usually with a native flow Sex mining programs (Curve and Aave have always been open compared to Uniswap, but more strategic than Sushi)Kris Kay DeFi hub (independent chain). The protocol launches a new, independent chain, potentially interfacing with multiple networks (compound chains being the main example). There is no perfect solution, and each approach has obvious tradeoffs. image descriptionSource: * *The Ethereum-centric approach aligns with the vision and values of Ethereum believers, the largest and wealthiest user base in cryptocurrency, and in theory, brand recognition should enable these applications to dominate their respective Marketplace, no matter where they are deployed, this seems to have been the case with Uniswap V3, as its daily transaction volume has surpassed that of other DEXs built on Optimism and Arbitrum. But an Ethereum-only strategy prevents Uniswap from capturing breakout assets traded on other networks. The wide-cast approach often rewards one of the first applications on a new network, (increasing their chances of capturing a market in that ecosystem), and if executed well, can increase overall volume and fee revenue. It requires more work for potentially negligible returns, fragments liquidity, and introduces more technical debt. A prime example of casting a wide net is sushi, which has launched on 14 (14!) different chains. Despite such efforts, 95% of its total liquidity is on Ethereum, Arbitrum, and Polygon. Sushi does not have the largest transaction volume on most chains, suggesting that this model may not be optimal. Targeting newer chains once they show sufficient user growth is a sound strategy. It ensures that new chains have some organic demand, and projects often get rewarded in exchange for their migration. Curve and Aave employ this strategy to near perfection as they leverage external incentives (and their prominent brands) to become some of the largest applications on each new base layer chain they join. This strategy is not foolproof. It works for DeFi blue chips, but may not be suitable for new applications. And it is likely too passive to effectively capture Early growth to small networks (Moonriver).The last approach is the most interesting — launching an independent, application-specific chain that becomes a protocol’s hub for cross-chain integration and liquidity. The nature of a sovereign chain is chain-neutral, potentially improving the project's defensibility (difficult to fork), token economics (proof-of-stake verification means tokens have fee capture and security properties), and its potential to be a hub of activity . Substate-based Compound Chain is an example of a DeFi blue chip that goes beyond the EVM framework. The up-front cost of technical and economic resources required to develop a new chain is high, but this is probably the most profitable route.“Interoperability of state and value could put price pressure on layer-1 blockchains without monetary premiums, while enabling strong middleware protocols to achieve cross-chain, winner-takes-all dominance in their respective services.” DeFi bear market16 months, so it's worth betting on fat app theory's recovery. I still think Chris Burniske will be vindicated in the endsecondary title 10. Tokenized Funds and Index Partnerships One recent evening, I was readingIndex Co-OpFour years of speeches by Hester PierceOne thing I learned at the time was that the ETF itself was less than 30 years old. I also didn't expect ETFs to account for basically all of the growth and innovation in the fund space since 2000. The number of mutual funds has been declining, while ETFs have risen to 20% of global open-end fund assets under management (the rest are mutual funds).It's rather shocking that the now $30 trillion fund market hasn't had any innovation since the dawn of the internet. Especially for the "financial capital of the world". that's what i likeBEDandGMIOne of the reasons for projects like this is that it makes it simple to create a custom token index using smart contracts. The index methodologists are rewarded for carefully designing and marketing new products, and are incentivized to make these products applied in defi, an early example is DeFiPulse How to monetize its index DPI , and how Bankless helps createandToken. All of this is established through basic market capitalization weights. This seems to be just the tip of the iceberg. To illustrate how much customization we can see in the cryptocurrency index space, consider credit rating agencies and WokESG ratings. Moody's and Fitch may have helped cause the Great Recession, and their negligent behavior with subprime mortgages may have helped cause the Great Recession, but at least they played by similar rules.ESG suppliers are everywhereMirrorWhere are the downsides of building a more creative and subjective index in DeFi?$75 billionsmart beta product, industry-specific applications, portfolio copy trading, and more. Probably the biggest near-term opportunity is in synthetic assets like we've seen with Synthetix,With a 10-fold increase year-on-year, you have the foundation to do great things. Reliable oracle data, synthetic stocks, Co-Op smart contracts, all we need is CNBC to spread the word. We are full stack, maybe (must read:Enhancing the Token Index, Index Coop & The Next Generation of Funds) , but promising.David Vorick, Skynet (must read: secondary title11. Two sides of DEFI"Defi has a dirty secret. While the smart contracts themselves are completely decentralized. Developer teams still have substantial control over users through their control of the front end. We are pleased to announce Homescreen, Skynet's A new application that allows users to fully decentralize their web3 frontend." -We know from this summer that those in power are generally not fans of DeFi. My guess (as you know in Chapter 4) is that things will get worse before they get better, and we'll see DeFi split into CeDeFi (known teams) and AnonFi (anonymous developers). More often than not, this split will be in the tools on the front end, rather than barriers at the protocol level.We see Uniswap lab Delisted certain tokens from its frontend , which is obviously a submission to external legal pressure. Then 1inch (has criticized other projects in the past for not adhering to the ethics of DeFi)HomescreenGeo-segregate US users using its front end , noting that they will soon launch the 1inch Pro product, "designed specifically for the US market and global institutional investors, meeting all regulatory requirements".When the front-ends of popular DeFi products are tied to centralized DNS or ENS names controlled by the core team, censorship risks and security issues arise (some front-end products can insert malicious code, such as stealing user funds). In either case, DeFi will lose credibility with regulators who will say: "Well, obviously you do have the ability to comply with our rules, so you must be an issuer of securities", or "This is fraught with fraud, Bad for investors."This is what prompted Sia's Skynet team to announce a new project called " I think Homescreen (or a similar standard) will be critical in the U.S., because U.S. DeFi developers . In three years, half of DeFi development could be anonymous, cutting-edge, open research, while the other half could be CeDeFi integration points. Both are good!In my opinion, AnonFi and a truly permissionless frontend are the limits we should be fighting like hell and testing the code and the law. No one wants to defend a developer and maintainer who provides illegal services to dark web customers. We do want to defend those teenage hackers exploring the magic of internet money, creating new primitives for global finance. They are heroes.secondary title 12. CeDeFi crazeOne of the most exciting events of the year occurred when French banking giant Société Générale submitted a public proposal through MakerDAO’s governance forum to convert theirNew Bond Token Approved as Collateral for $20M in Dai. That's the bull case that many of us made in our bull case for the ubiquitous public blockchain that institutions would be like they were in the peer-to-peer lending market practice, and enter the field legally and with sufficient liquidity to do so safely. That doesn't make this flowchart any less maddening.SocGen isn't the only one. EY prepares to launch licensedPolygon chainDeFi Tokens as. Visa plans to build a "layer 2" stablecoin network linking public blockchains and future central bank digital currencies, it appearsmore ambitious than anything else . This is something we should be excited about because it normalizes stablecoins and at the same time gets central bankers excited.asWhat Stani said I bet most DeFi users will be KYC in the next few years. This seems positive (and arguably the only sustainable medium-term path), and it could develop products like fractional reserve banking and off-chain credit scoring (if we want those things, TBD). This still leaves the question of whether institutional entry into DeFi will move protocol governance so firmly in a "regulated" direction that projects start to "fork". So much so that the project started to fork in the compliance code at the core level, becoming . Don't tell me this is slander, and don't tell me that proof-of-stake systems are resistant to coercion by the majority rule. I'm not saying I like this potential future, just that it seems like a risk that cannot be ignored.secondary title13. Governance VulnerabilitiesCompound has been a huge contributor to the whole DeFi craze and bull run for the past 18 months, so I think we can get away with their gigantic shenanigans of accidentally sending $160 million worth of tokens.This fall, during a routine protocol upgrade, they accidentally sent users the value $160 million in tokens, and then race through a series ofGovernance Recommendations for Compensation. They got some back because of the trust of the community.They're not the only ones with problems. Uniswap came under fire for its $20 million unconditional grant (with no minimum holding period), resulting in a quick sale of 50% of UNI. The community doesn't want a massive dump of tokens, even if you spend your money onpolicy work that really matters)。 . Cryptocurrency analytics company Flipside saw this and said, “Hey, we’re not going to dump you, just give us $25 million in collateral for “community-driven analysis.” We’ll HODL, stake, and Make money off the float." Pretty clever, but alas, it's also (from an angry competitor), the proposal failed. (a16z has a nice (Required Reading: a16z Open Sourcing Delegation, UCal’s Guide to Defi Governance) We will discuss governance more in Chapter 9 on DAOs. Now I just want to say that I am super bullish on the governance infrastructure, the improvement of the protocol library deployment, and the ongoing DAO, the deployment of the protocol library, and the ongoing DAO distribution model to users, individual contributors, commercial companies and DAOs Make a payment. This is the foundational tool that will cause DAOs to replace most companies.secondary title。 Come ON! 14. Safe and Dark ForestDeFi governance looks more like Veep than a house of cards today. Nothing nefarious (so far), just serious contributors working on how to make decentralized operations less scary. We haven’t found many governance vulnerabilities yet, but there are still plenty of contract vulnerabilities, MEV front-running, flash loan manipulation, and runaways to keep security researchers busy at night.Users' funds are often at risk, even in "safe" browser wallets. The exchange was hacked. Keys are lost in accidents, SIM cards are duplicated, protocols are exploited, and risks are exacerbated by the system itself is complex You are not investing in cryptocurrencies for risk-free. If you buy DEX-listed tokens through Metamask, you are more than average in complexity. And you recognize that technical risk is part of the cost of risk that you need to take on for participating. Being taken advantage of is bad. I hope it doesn't happen to me (or anyone), we need to mitigate the effects of mega-bugs as much as possible. Vulnerabilities do have a role, however, and contribute toStrengthen the security immune system of the wider ecosystem。 , which is important because we're still on the fringes with more risk-conscious end users. Now is the perfect time to be a security researcher or insurance salesman. We now have over $250 billion in "total value locked" in smart contracts across various protocols. This is a big question. Ethereum security researchers are busy enough, and now high fees are pushing more risky assets onto entirely new chains with uncomplicated user security stacks. ethereum isFrom a TVL of 98% down to 67% todayThere are three things to focus on this year. Smart contract insurance, like Nexus, which became the first cryptocurrency insurance unicorn, but I'm sure not the last. Proven secure smart contract library and security as a service. For example, Forta provides a "Enterprise-grade runtime security platform, by detecting system-wide threats through the network of nodes, by incentivizing node operators to pay attention to foul behavior". That information is sent quickly to the correct brain, potentially acting as a circuit breaker. honestly, , and no one in MSM found it. Samczsun discovered a $350 million bug in SushiSwap that he remembers stole the original code from Uniswap Labs, a Paradigm-invested company, and possibly saved the project and its users. He is the Mr. White Hat we need, not the one we deserve.(I think the bZx team is holding a grudge against me because I said in last year's paper that this project is a "bug bounty as a service". Not nice! But smart! Plus, they got hacked again.)secondary title 15. Unlocked and fully diluted value "Fully diluted value" is a pretty lame metric for well-run DAOs compared to centralized foundations, and I say this on behalf of a company that helped popularize this metric and used related research in multiple Some pretty ugly stuff has been found in projects, and in general, I don't buy tokens from projects that still have a lot of tokens locked because I have a normal IQ. A better way to think about token unlocking is that the better way is more nuanced, kind of like you would expectHow the board thinks about new stock offerings, except that the board here is a large, distributed community. Coinbase has 10,000,000,000 authorized shares of Class A common stock, but only 155,243,470 outstanding shares. That doesn't bring their fully diluted valuation to $5 trillion. The same goes for many protocols. What matters is dominion and control over the tokens. You want to know how much of a given token supply is controlled by whales. For foundations, founders, venture capital firms, etc.,It is important to understand their lockup, position size and their intentions. But seeing concentrated chips in a particular network is not an absolute negativity.Despite Joe Lubin having a lot of chips early on, Ethereum is doing okay, you might like SOL because you know SBF has 30% of the supply. (It's not true, I'm just complaining here).People started to accept "8.The Alchemix of DeFinance (2.0)

magic internet cash

This argument is not yet mature, the infrastructure to enable seamless multi-chain usage is immature, and the base layer continues to grow. But since we are now in

Unlawful

closely watched

walled garden

"No" vote

This is the most epic story of the year