Related Reading:Topic | Messari 2022 In-Depth Research Report on Encryption Industry

The original text is from Messari, the original title is "Crypto Theses for 2022", translator | W3.Hitchhiker

Related Reading:

Topic | Messari 2022 In-Depth Research Report on Encryption Industry

The original text is from Messari, the original title is "Crypto Theses for 2022", translator | W3.Hitchhiker

first level title

Chapter 6 NFTs & Web 3

Get used to hearing the term "Web3," as it may eventually replace "crypto" as the byword for the decentralized technology movement. It appeals to new audiences better, sounds less scary to regulators, and is a faster and more accurate word.

Mason defines Web3 as a "paradigm shift to a more democratized Internet" governed by collectives. Chris Dixon said that Web3 gives us "the opportunity to upgrade the network to a crypto-asset-centered economy and build a system where the incentives for network owners, network participants, and third-party developers are fully aligned." I like these definitions. Re-architecting Internet services and products to favor users rather than gatekeepers is a clear and urgent task, and Web3 captures exactly the breadth of what we are trying to do.

For this reason, I start the second half of this report with: Explosive Web3 applications in 2021, non-fungible tokens ("NFTs"); social networking); and an overview of the physical pipeline of our future metaverse.

In investing, there’s a saying that “early = wrong,” which is why it’s important to delve into what’s next for Web3, to see if some networks can finally materialize now and be a huge success.

The 2020 DeFi boom provided "throughput infrastructure," i.e. self-hosted, permissionless transactions (such as routing and bandwidth in Web1), which allowed NFTs to take off. The explosive growth in demand for NFTs (and DeFi) drove the need for more scalable layer 1 and layer 2 networks earlier this year. All of this will spur the growth of DAO infrastructure in the new year. NFTs provide DAO contributors with on-chain identity and reputation; DeFi provides DAO members with large pools of liquidity to manage; and scaling solutions will make on-chain governance economically viable.

In Web3, cryptocurrencies (Chapter 3) and NFTs (Chapter 6) are digital commodities of the new economy, DeFi

(Chapter 7) is the native financial system, the layer network (Chapter 8) is the rail that drives everything, and the DAO (Chapter 9) is the way to govern the new domain.

It's all happening, and it's going to be absolutely wonderful.

secondary title

1. NFTs: digital goods on the global ledger

Let's start with this year's breakout asset class: NFTs. They’re like the ICOs of this cycle: sky-high hype, crazy volatility, lots of early winners, and utter garbage. But as a new asset type and class, they will change the world.

NFTs are cool because they represent digital property of verifiable scarcity, portability, and programmability. An NFT can be a share of stock, a virtual sword in an MMORPG, or a personal photo on social media. A new piece of digital art, a piece of land in metaspace, or a record of your data on Facebook. The potential of NFTs is basically limitless, as the blockchain will become a global transaction ledger for local virtual property and physical property (or at least its digital receipt).

A "real world" version of an NFT might be something like a deed to my house (verifiable scarcity), if I could prove ownership to my insurance company by having a receipt for my deed (a digital representation of the property) ) wallet to sign a transaction with an NFT (programmability) I can allow Airbnb guests into the house, or I can apply for a home equity line of credit and stake the NFT as collateral on a peer-to-peer lending platform (portable sex).

That's another story. The toy version will appear first:

I log into a VR casino with my virtual identity (verifiable scarcity) and pull up to a chair that the dealer will recognize as my TBI (digital representation of property). Since this is my 10th time at the casino and I've been using the heater, my player card flashes heat (programmable) to indicate that other players should come and join me at the table. The casino loves this and decides to send me a virtual "drink ticket" that can be used at Uber, Eats, Drizzly, or any app that recognizes these NFTs as credit (portability).

If you have a little imagination, you will see that the opportunity is enormous.

If you want a visual of how NFTs work and why we're so excited, you can watch these two ten-minute videos. It will prepare the rest of this section

Welcome back! I hope you've been brainwashed. Especially NFTs are so intuitive that even the New York Times understands. Here's a column from Ezra Klein this summer:

"Think of it this way. The Internet we have allows for the easy transfer of information. We can exchange news articles, music files, video games, pornography, GIFs, tweets, and more without breaking a sweat. The Internet makes information almost free. But it is For this reason, it's terrible at making information expensive, which is sometimes needed. What the internet specifically lacks is verification of identity, ownership, and authenticity — the very things that make it possible for creators to get credit for their work and get paid."

If a large part of our future lives is living in a global, virtual, interconnected world (the metaworld), then NFTs are some of the main building blocks of everything in that world. You don't want to live in a virtual world where your entire identity is at the mercy of a big tech corporation. If you've ever switched social media platforms and had to re-build your audience and reputation from scratch, you'll know this well. Or if you've ever purchased virtual items in a game, only to find out later that the game maker controls all the trading rules, and you can't sell the goods you've earned or take them elsewhere. Or if you're a VR believer but shudder at the unattended prospect of Zuckerberg's meta-utopia (more on that later).

NFTs can transcend their underlying blockchain and metaverse.

You also don't want to live in a virtual world where everyone looks the same and there is no recourse for identity theft. So you need some third party. To avoid "one size fits all", you need scarce digital objects that have real value. And you might be willing to pay a talented creator for certifiably unique merchandise.

As an example, if there are 1000 unique South Park avatars, each can be minted with 1 ETH. You can send ETH to the SPA NFT contract and mint a new cousin for Cartman and TBI, but only if the contract status reflects that less than 1000 avatars have been minted so far.

Thanks to the ERC-721 standard, these little South Park dots can be traded on the Ethereum blockchain just like other NFTs based on the standard. This is 100x better than the way most virtual goods are purchased today (via centralized, siled platforms, where scarcity exists only in the eyes of the game maker).

In contrast, NFTs trade:

Connecting the worlds of users and creators;

lower cost;

Provide provable virtual asset ownership to both parties;

This is true whether we're talking about digital art, digital identities, community memberships, game merchandise, or financial assets. Almost every smart person in the crypto space agrees that most NFTs will go the way of most ICOs in 2017... to zero.Two Hour Must Read, Exploring the NFT Stack, NFT Q2 Report)

But a few early-stage projects will succeed on a massive scale, and the entire asset class will explode over the next decade. NFTs will affect every part of the economy, and kids will have more things that "look like NFTs instead of the real thing." You're bound to feel the impact of NFTs well into 2040, even if you don't care about them today.

Let's start looking into the future of NFTs, a little bit of teardown.

(Other NFT primers.

secondary title

2. A $69 million Mona Lisa JPEG

Whether or not you are bullish on NFTs as a transformative new technology, you may be shocked by the fact that people are already spending millions of dollars on "jpegs".

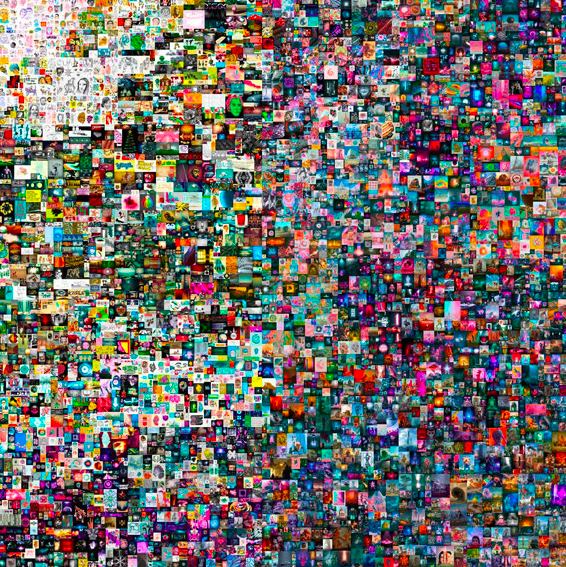

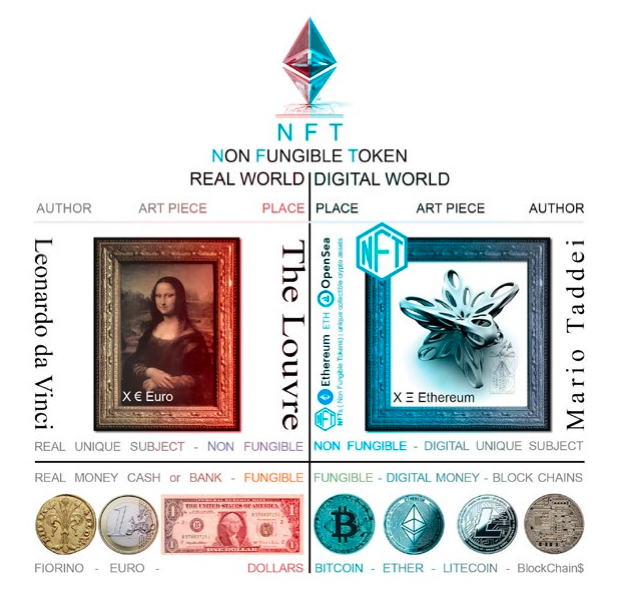

To understand why this is not completely crazy, we should start with one of the most famous works of art in history - Leonardo da Vinci's Mona Lisa, and consider its "essentials" - its history, its rarity. Hype value, artist reputation, fundamental market dynamics of real assets.

More importantly, however, it has some "off-chain" properties that make it popular. Its home is the most famous museum in the world - the Louvre. It was the target of the most famous art theft of all time. Due to its simplicity and enigmatic smile, it has become a hype point in pop culture.

Others wanted to be photographed with the Mona Lisa for a travel badge on social media. As the most famous exhibit of the Louvre, it can also be said to be a kind of capital asset. The Mona Lisa brings in tens of millions of dollars in tourism revenue every year*.Christies, or the blockchain)

In short, it's a cool painting with an even cooler backstory.

image description

(source:Mario Taddei)

Beeple's "Everydays — The First 5,000 Days" has all the key elements that make it the Mona Lisa of digital art. famous artist? Yes. Beeple had 2.5 million followers at the time of the sale. Proof of scarcity? Yes. Because the painting represents the culmination of 14 years of daily devotion, it is difficult to reproduce. A novel backstory? Yes. It wasn't stolen, but it made history by becoming the first NFT piece of art to pass auction at Christie's, and the price tag itself ($69 million) contributed to the rarity of the artwork, even if Beeple's artistic reputation is compromised in the future. Hit, also won't change the novelty and fame of his Everydays first auction.

So, is this a one-off, or is Beeple's success replicable? Let's take a look at the fundamental market dynamics of digital art.

image description

(source:

Physical art is a $1.7 trillion asset class with around $60 billion in annual sales. According to DappRadar, at the end of the third quarter, the NFT market capitalization was only $14 billion. (Excluding "personal photo collections," which we'll discuss in the next section), digital art NFTs have totaled less than $2 billion in sales to date, less than 1% of the physical art market, and digital art is just One-tenth of the total NFT market.

Do these numbers remind you of any assets from four years ago?

Although today's NFT market is hot, this early migration from physical art to digital art may end up like the Bitcoin "bubble" in 2013, which collapsed by more than 80% in 2014, but also marked Bitcoin's ten-year history. The beginning of a crackdown on physical gold. Bitcoin's market capitalization surpassed that of gold by 0.1% in November 2013. The non-homogeneous digital art market is now also exactly 0.1% of the physical art market.

I predict that the digital art/NFT market crash will end up being worse than the Bitcoin bear market of 2015 (since these assets are highly illiquid), but the 10-year trajectory for the entire market will be the same: 100x+.

Speaking of which. Before you stud digital art, there are a few things to keep in mind!

The market value of Bitcoin may have reached 100 times in 8 years, but if you have been holding, you can only make 60 times, because of the dilution brought by the newly minted bitcoins during this period. Across the entire crypto market, you've only made 30x as other new crypto assets like Ethereum entered the market and eroded Bitcoin's dominance over the past few years.

I raise this question because the space for NFTs is significantly larger than that of homogenized currencies.SuperRareEven if you invest in Beeple's original project or other top projects, it may not be able to keep pace with the growth of the total NFT market capitalization. Therefore, I like to invest in infrastructure in the NFT field. In the long run, this is a more profitable investment than investing in blue-chip NFT projects.*(As a bystander, if you go to the Louvre, the Marriage at Cana is more impressive than the Mona Lisa. I spent 30 seconds watching the Mona Lisa, while Spent 90 minutes staring at The Wedding at Ghana. Vinos is my friend. That took many nights and weekends. He was the same age when he painted it and when he finished it, I daresay he hated the 130 people he drew as much as I hated the report).。)

3.PFPs: Punks vs. Apes

(Must read: Mason on

article, this one about NFT

master class

secondary title

If aesthetics are purely your thing, Beeple and other digital artists might be for you. But you’ll be missing out on the bigger movement in NFTs — around community-owned avatar pictures, or “PFPs,” whose sales have exploded to $5 billion by the third quarter of this year. The value of PFPs comes entirely from its early community and meme effects.

The visuals themselves aren't very satisfying (the 100 ETH sells for 7 figures and is actually based on free clip art).

But thousands of people are spending real money on PFP to show they:

Participated in the joke early on;

Understand the full history and background of NFTs and why these specific PFPs are worth investing in;

Desperately needing friends and having plenty of money to burn;

All of the above.

It makes sense that we're seeing interest and enthusiasm for PFPs take off. They're a good fit for CryptoTwitter and the emerging Metaverse. The PFP project relies on deeply engaged and talented core community members who contribute to the project's culture and economy (such as Punks' early NFT adopters) and will attract other members. Their owners may even gain priority access to new projects and events, share in community revenue (via airdrops), take on management tasks, and utilize their PFP as a capital asset (if they have sufficient liquidity). If NFTs continue, more influential people will want PFPs with the oldest and rarest attributes, the earliest on-chain records and the strongest meme qualitiesCrypto Punks, Bored Apes and Pudgy Penguins may represent a person's digital identity A major component of and future reputation for anonymity. (I can't believe I just wrote this.) Just like brands rely on memes like slogans, images, brand ambassadors, tokenists can leverage NFTs in a similar way. Because they have a way of wrapping an entire subculture in one PFP.

It's hard to understand PFPs unless you accept that these meme-like virtual goods are already ubiquitous. They are part of our identity. As Fred Ehrsam told Vanity Fair:

“Imagine that you live on the Internet. The way the world recognizes you is not primarily by your face or your clothes, but by your digital avatar. Of course, you are willing to pay a lot of money for something like CryptoPunk: it is Your face in the digital world. Plus, it’s your key to a small, unique internet club. Being a CryptoPunk owner as a native coin has the same effect as an old-school businessman being an Augusta member.”

CryptoPunks are valuable because they represent the first PFPs to be minted on the Ethereum blockchain, a historical fact that cannot be replaced. These 10,000 pixelated Punk jpegs, each with a different combination of “attributes,” are all part of cryptocurrency history. They have a magical origin story, as they were fairly introduced, then largely forgotten, and then resurfaced thanks to their indelible "firsts." The boom in NFTs, the virality of Punks as twitter avatars, and their ever-increasing prices make them quite compelling.

I recommend reading the full interview on the history of the Punk 7804, which was sold by the founders of the company Figma for $7.8 million. From Epic NFT 101 Explained:

About purchase. "There's one that I'm obsessed with, I'm really salivating, I'm really drawn to it. I think it has a lot of power. Out of 10,000 CryptoPunks, there are only nine aliens. And out of them, I The one that really resonated was #7804, which was a picture of an alien smoking a pipe. It was totally captivating to me. I couldn't stop thinking about it. So I saw who had this The guy who drew it sold several others. I figured if I bid high enough, they would. So I bid 12 ETH, which was $15,000 at the time.”

About the sale. "After selling 7804, I believe that CryptoPunks are art more than before, which is very appealing. Especially after parting with it, I do feel emotional. I feel sad. It's not just sad, 'oh man , this is the digital Mona Lisa, I can make more money at some point. "It's part of my identity. It's a mask. What are masks? They're something you can project onto your personal identity. And with 7804, this smart alien, I feel a little different wearing it."

As it happens, 7804's new owner, a buyer who goes by the pseudonym Peruggia (after the thief who stole the Mona Lisa), wrote about his purchase in similarly unabashed language.

This makes sense! If enough people associate your digital self with a particular avatar, it will indeed become part of your identity. If you don't believe it, you can only believe the good Mr. TBI himself. This is the ultimate paradox of PFP: many NFTs may become an unsalable part of your identity.

Every successful collector who has invested in their tribe wears the jersey and is less likely to sell it because they are more closely associated with a specific community, or a specific PFP with who they really are.

If the network is dense with talent and the parties are cool, that might be a good thing (Jay-Z, Snoop, Serena, and OBJ have punk), but if the values of this community start to diverge from your own, and your avatar Start to feel more like a red letter, and that's trouble.

A couple of things keep me away from PFPs.

I don't know what I'll be doing with PFP, and I hope to be a meaningful contributor to any future plans by the South Park creators. (It would be very disappointing if I wasn't involved, as my avatar hasn't changed in eight years, which is four years, and my avatar is as generic as a regular punk.)

As someone who has planned and organized community meetings, I can tell you that high price points are a great filter, but not a panacea for community quality. As long as we're in a less over-the-top market environment, people will start flocking more to invitation-only elite groups rather than paid ones.

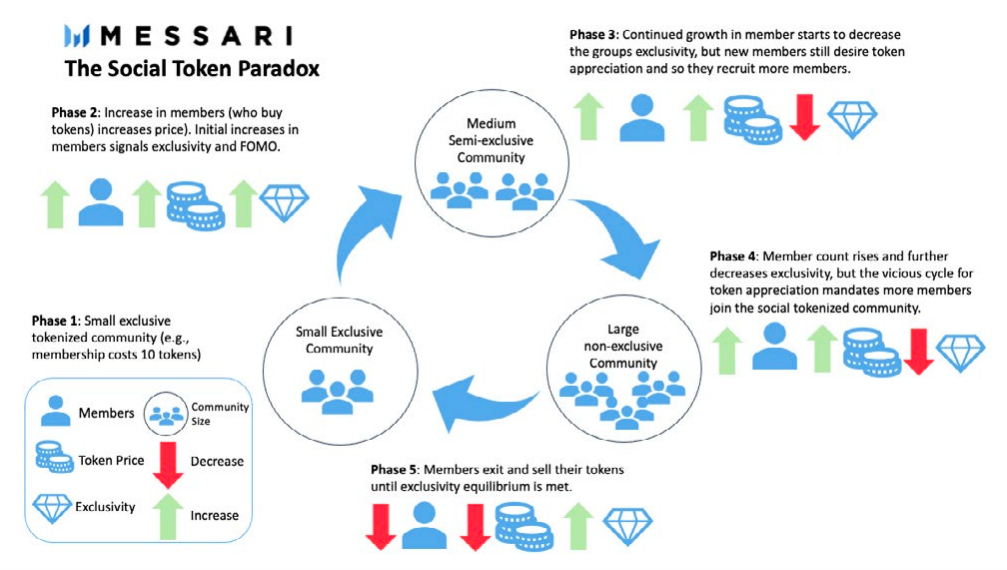

Along these lines (we'll touch on DAOs and social tokens later), I'm really excited about being accepted into the "Friends With Benefits" community. More than anything else in the PFP field, I look forward to being accepted by the "Friends With Benefits" community. Earning acceptance (as opposed to buying access) is a feel-good mechanic, and I also think it will help mitigate the social token paradox, which applies to any community NFT or social token.

If you're still keen on buying PFP, you should choose your tribe wisely and be prepared to use it as a consumable luxury rather than an "investment" to write off. If you'd rather find other ways (other than PFP) to identify yourself, you could also try digital art (back one section), Loot bags (back three sections), or a nice piece of land in the metaverse.

I've seen less convincing criticism of PFP programs, but this one is slightly more plausible - the concern that "community benefit" promotion is similar to MLM schemes. Sure, Bored Ape Yacht Club and Pudgy Penguins don't have unique historical features that make them special, but you don't own a work of art in isolation...it's a community, man. The problem is, once you get into small paid affiliates, the benefits of "community" drop off precipitously. Real communities either have unshakable histories or elements that earn them reputations.《Apes as an Asset Class》Since my writing doesn't have the issue of starting a nuclear war, I'll end with this. Bullish Punks, Neutral Apes,Look down on Penguins and everything else. If you are not first, you are last. (unless you port your project to a new(must read:

. Also, penguins as an item

in the new york times

, it really gave me that "everyone's getting rich and you're not" kind of feeling. )

secondary title

4. Fan Tokens

We've covered a lot in these last few sections, I hope I haven't lost you yet. Let’s recap the meta NFT theory: Attention is finite, the internet is huge, we’re tribal creatures driven by meme lust, , we’re building a crazy parallel financial system that may have found its way to celebrities and the masses bridges, realized through encrypted art and collectibles. When you add it all up, NFTs allow you to "own a piece of the internet".

Consider what might have happened to NBA Top Shots to illustrate.

Top Shots is a collection of virtual playing cards capturing iconic moments from NBA players and games. Dumb V1 by Top Shots? They're collectibles like old baseball cards. But what about V2, V3...V8? Top Shots collectors may be invited to VIP player events during the offseason, or to the All-Star Game. Maybe they'll get their favorite home team's playoff seat in the lottery. Or have a say in the league's new jersey designs.Social Tokens and Creator-Centric Economies)

Or in music, let’s say you bought one of the first 1,000 NFTs for your favorite indie band’s new album. They went mainstream, and now you've got a backstage pass (via your NFT) to their next tour in your city. You get a royalty from a Netflix documentary about their rise. In effect, your NFT gives you voting rights in a DAO that votes on royalties. Your NFT gives you voting rights in the DAO that votes on royalty transactions. Maybe this NFT will get you an Audius airdrop.

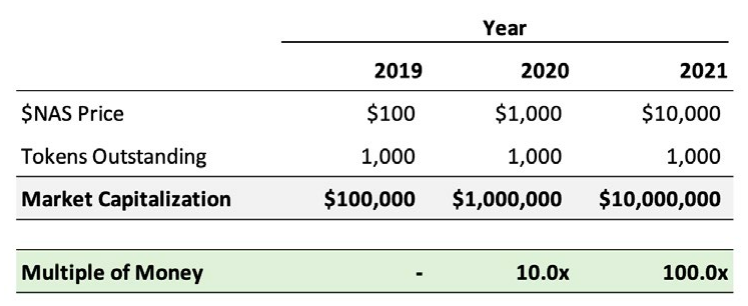

What if Lil Nas X staked a token? His Spotify followers went from 900 to 50 million in two years. If you were one of those 900, would you have bought (or been airdropped!) a $NAS token back then to help him promote his early single? $NAS can track an early "true believer" and allow fans to share in his financial success.

image description

(source:

"Win and help win" is a great model for both fans and celebrities, and it works for niche creators, too, with much smaller audiences ("1000 real fans"). EDM DJ 3LAU dropped an NFT and made $12 million. A team of documentary filmmakers has raised $2 million to tell the story of Ethereum.

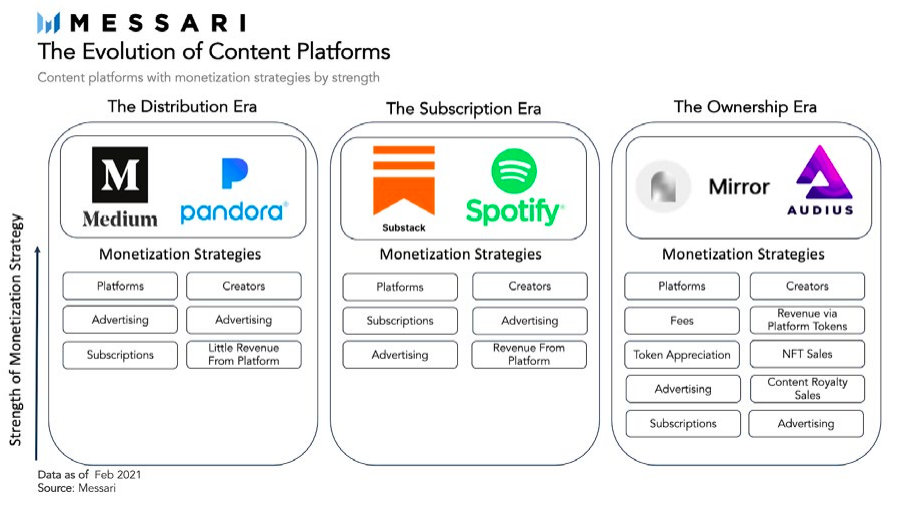

Fan tokens, whether NFTs or fungible social tokens (like those on Roll*), could be the ones that help cryptocurrencies cross the chasm and become mainstream adoption. If digital art and PFPs are good news for visual artists, fan tokens open up a whole new value stream for other sectors of the entertainment industry (film, TV, music). They also break the shackles of LA on film and music, better connect newcomers, increase the pie for all creators, and reduce the "yield" of LA producers by 50%-75% or more.

I like the Uniswap vs Binance comparison.Stripe)

Los Angeles (Binance?) might be good at catering to users who only want access to the most famous acts. But if your interest is outside the top 100, as a fan, you might be better served by the peer-to-peer NFT marketplace. The market is better for you.

image descriptionAudius, The Evolution of Content Platforms, The Evolution of Blockchain Based Music,

The Collegiate Athlete Economy, The Sport of Speculation, The Social Token Bible, and The Value Capture of Social Tokens)

(source:

The jump from "fan tokens" to "IPOs" or "revenue sharing agreements" may be short, controversial, but probably inevitable. I expect the fan token boom to lead to a creative resurgence (interest and viability) of ISAs. We will see “fan tokens” empowering potential students to drop out of school and start working in the Web3 space.

(must read:

secondary title

5. Axie Infinity and the “P2E” Revolution

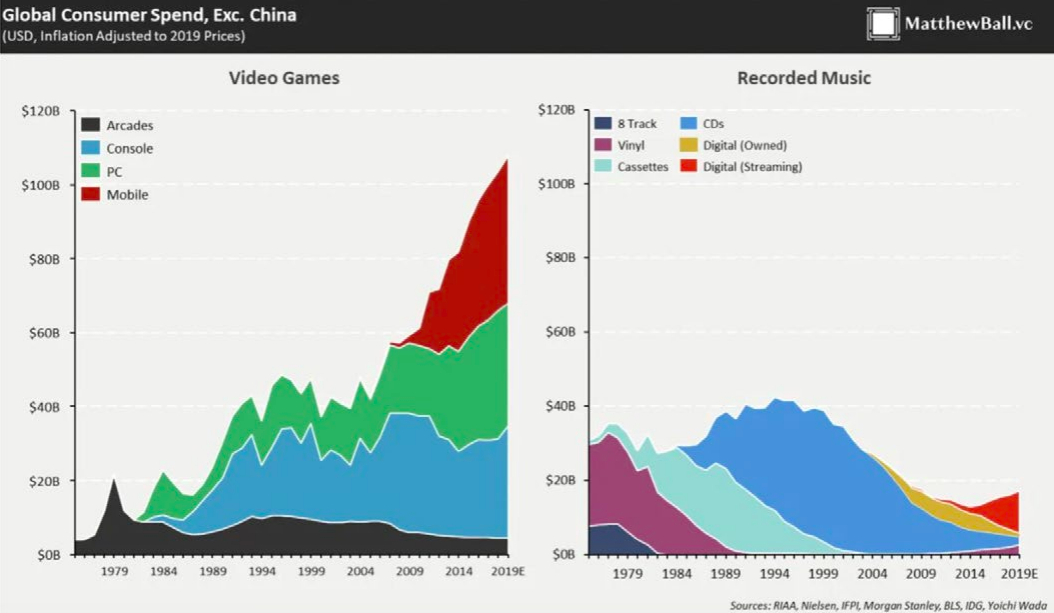

The game industry dominates the entertainment industry (bigger than the movie and music industries combined), which is related to its early embrace of the new medium (streaming media) and business model (free and commercial) of the Internet. It would be an irony if these (gaming) industries missed out on cryptocurrencies. Especially when the growth rate and revenue generation of chain games are no longer theoretical. It is heartwarming.

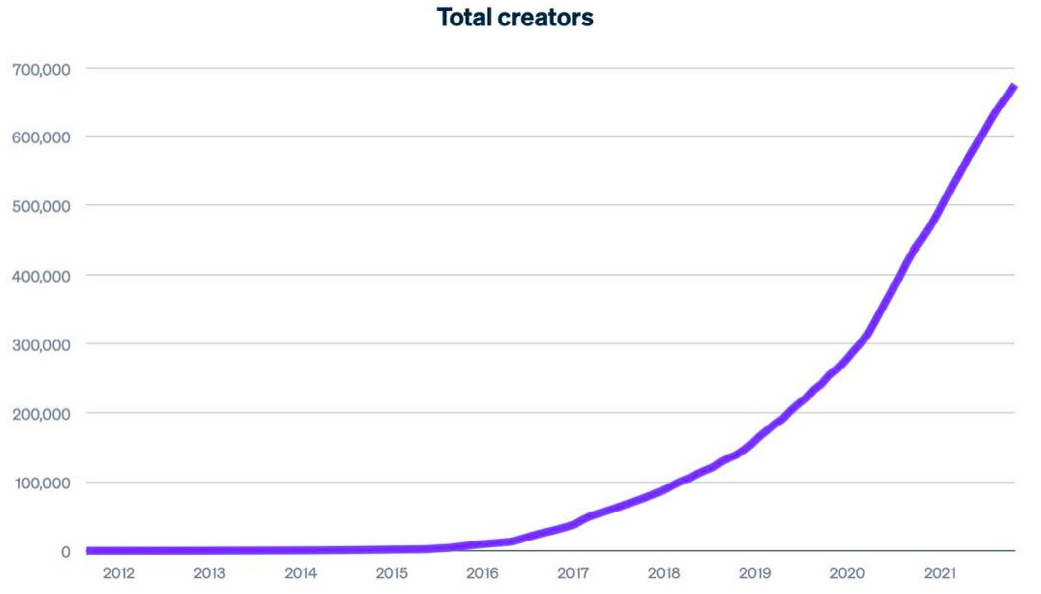

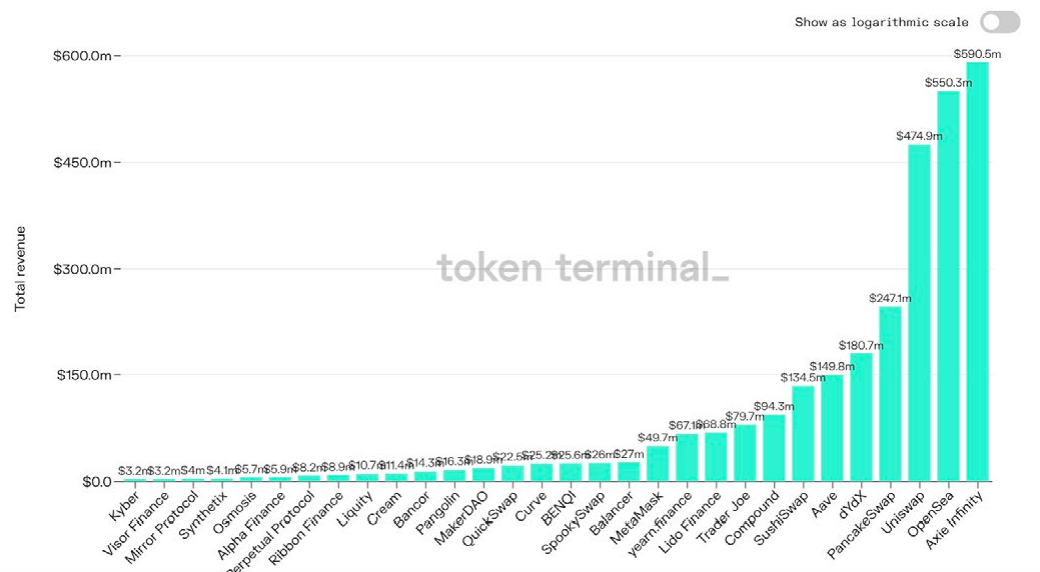

Consider the economics of the top three revenue-generating apps on Ethereum last quarter: Axie, OpenSea, and Uniswap. Axie and OpenSea have generated more than $500 million in revenue in the past three months. Uniswap came in second with around $475 million. After that, the respective scale of Axie and OpenSea exceeded the sum of the following five Ethereum applications.

Axie's growth is finally showing signs of waning, but the P2E gaming trend it started is here to stay. The amount of money raised by these platforms is huge, and regardless of whether the industry frenzy subsides next year, they are ready for the entire cycle of iteration and development. a16z invests $150 million in Mythical Games. Enjin announces $100 million gaming fund. FTX and Lightspeed invest $21 million in Faraway Games.

I don't think the early reluctance will last. My bet is that a top five game studio will get into crypto in a meaningful way next year, most likely by acquiring other Web3 games. Benefits of getting in early in a decade-long trend, capitalizing on the NFT craze, gaining an edge in the upcoming talent war) is very attractive to all), and all market leaders will Can't sit still. A batch of smaller deals could allow incumbents to sandbox the bet's ecosystem and figure out what's wrong with it before bringing the technology into their full sphere. It's not just opportunism that drives them. The threat of inaction is also real.

Going into 2022, this graph should appear on the first slide of every game maker CEO's board of directors documents.Epic Games Primer)

(must read:Play-to-Earn 101, Colossus Research, The Complexity of Axie’s Economy)

(Source: Matthew Ball's

(must read:

secondary title

6. Looted: Composable NFT

text

word on black text. This summer’s Loot sale was a Rorschak test of NFTs. Either you think this is a new kind of "combinable" NFT original for digital gamers, or you think it's Billy Madison-esque silliness. Honestly, probably a little of both, but I got some positive takeaways from Loot. (For example, an "urgent" newsletter from a VC firm should be minted as an NFT.)

Something like Loot seems like it could be the backbone of a new line of Web3-native games. If you look at the amount of money raised for digital goods, one critic might point out that it more likely amounts to a massive transfer of wealth from ETH investors and gamblers to creators and “decentralized game” studios.

Cynics probably underestimate how big a project like Loot is, and I say this as someone who hates V1, and hates other rational people bidding on wordlists at the same rate, not a company someone else built in 4 years (ahem) .We Like the Loot, Our Network’s “Emergency” Issue, Time Scarce NFTs)

But I'm not a cynic. My biggest takeaway from Loot is that it echoes what I say about the PFP community more generally. Someone who is three weeks late on Loot but otherwise relatively early into the world of the crypto game seems less likely to value a project's word list than a bunch of hoarding VCs.

I'm pretty sure there will be a superior earn-by-play version of Loot, with utilitarian, cross-play fair merchandise. You will find that Loot's successor is the topic of the project written by the gamer V, not the shout list of the Twitter speculators/V.

(must read:

secondary title

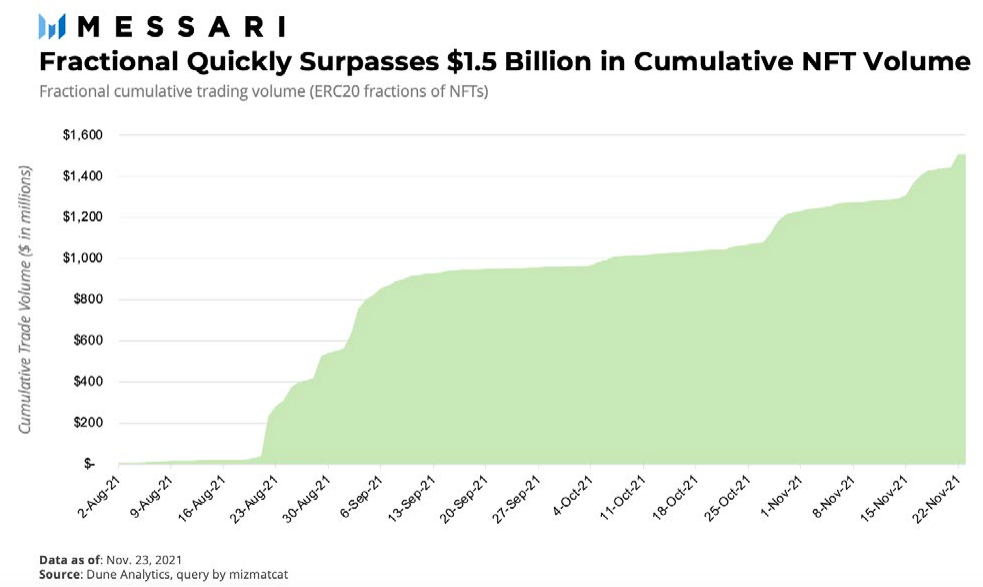

7. Financialization of NFT

Unique assets are, by definition, less liquid than homogeneous assets. This brings some challenges to price discovery in the NFT market, not only secondary sales, but also collateralization of virtual assets. There have been some early attempts to address this challenge, and this will be one of the most important areas for NFT infrastructure development. NFTs are very volatile and there may be no bids in a bear market. Is it possible to borrow against NFT as collateral to hedge the price risk of a specific project?

Maybe, but only if you can get lenders happy with those baskets.

Projects like WHALE bundle together NFTs from one collector and tokenize that portfolio. PleasrDAO and PartyDAO are building collective bidding infrastructure to help groups start public bidding on NFTs (fragmentation). Pricing derivatives and collateral outside of floor prices can be disastrous, as many "floor prices" actually have no bids at all.

On the other hand, Punk FLOOR tokens. Seems like a better way. This is a bit of a misnomer — the purpose of the token is to track mid-range Punk prices. The token aims to track the price of mid-range punks by aggregating and splitting ownership of 104 punks of varying rarity. Conceivably, FLOOR could be a buyer of last resort in a bear market (fleeing to the most liquid collectibles), and a seller of inventory in a bull market (when bidding is fiercest). Meanwhile, the token is trading at a 20% premium to today’s Punk floor price. This option is great if you want to get Punks but don't have $500,000 in your pocket.

This reminds me of Matt Levine's hottest take on some NFTs:

"Owner: I bought this unique pointer to an image of a dog for $4 million.

Public: Ahaha, well done, congratulations, money well spent.

Owner: I also fragmented my interest in it and sold it for $225 million.

It's two jokes, so it's worth 55x. I have no idea! "The Financialization of NFTs, Fractionalization Landscape, Value Drivers, How to Fractionalize NFTs)

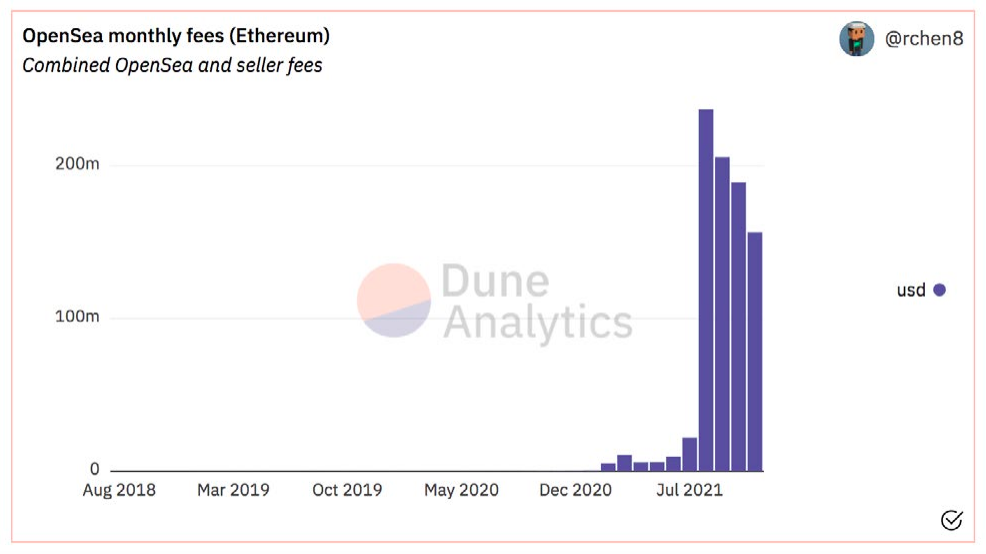

8.OpenSea & Friends

It will take time to get NFT fragmentation on track, and I predict we will see earthquakes in some projects that overvalued their collateral. But in the long run, starting with PFPs, art collectibles, and metaverse lands, it will be a huge release for the crypto economy.

(must read:Richard Chen on Dune Analytics)

secondary title

Over the past 18 months, OpenSea* has enjoyed the fastest revenue ramp-up of any business in history. They've gone from a seed stage startup to a potential billion dollar company, and I think they could end up being a $100 billion company (or network). This chart highlights their staggering earnings.

image description

(source:The Reasonable Revolutionary, A Beginners’ Guide to NFT Marketplaces)

The answer may be straightforward — OpenSea and virtual goods pure play may dominate the virtual goods space, while exchange affiliates dominate the virtual goods space. You would buy and sell Punks and Decentraland parcels on OpenSea, but you would buy and sell FLOOR tokens and collateral LAND on Coinbase or FTX.

In this way, the US Securities and Exchange Commission (SEC)'s hostile cryptocurrency regulations may be the most powerful boost to OpenSea, because there will be no concerns about violating securities regulations due to the explosive growth of the NFT market, leaving mines to Exchanges and their in-house brokers.

(must read:

*Again: I'm an early investor. I want to invest in more NFT infrastructure like OpenSea.

secondary title

9. Cryptoverse

Matthew Ball defines the Metaverse as a virtual realm with seven qualities: Persistence (a permanent, always-open global gathering); Liveness (real-time, just like the physical world); Unlimited user "coexistence" ( like a stadium); economic robustness (NFTs are commodities, fungible tokens are money and commodities); relevance across the digital and physical worlds (home without walls); interoperability (portable commodities, identities , IP); user-driven evolution ("content" and "experience" are created openly, not through a central company).

If you believe there is such a place and understand that we will spend more time there in the future. Then it is clear that we will gradually assign greater value to digital products and physical products.

The only question then is, in which direction will Metaspace go? Is it bastion-centric (tech giants), or edge-centric (open, cloud-based, cryptographically secure)?

Alison McCauley’s article compares recent Decentraland and Roblox festivals, illustrating how the two might evolve in the short term:

"In the past week, two global metaverse festivals have been held simultaneously, giving us a glimpse of the fierce battle for control today. One is produced by an established game company; the other is a decentralized metaverse pioneer. created by.

These two events allowed us to see how digital technology can enhance the event experience; how to integrate live performances smoothly; and how we can come together globally no matter where we are. However, they also give us a glimpse of future tradeoffs.

Eth Apps VS Web 2.0 App Stores:View this NFT on OpenSea

The Roblox experience is uncompromisingly flashy, with an enterprise high-budget design digital experience. In partnership with the Electric Daisy Carnival (EDC) in Las Vegas, this virtual experience not only incorporates EDC's live stages and impressive lineup, but also offers gaming, virtual and artist meet and greets.

Decentraland's music festival is well-designed and arranged, including performances by more than 80 artists such as Deadmau5 (an NFT wearable device store), and even digital mobile toilets. Decentraland Festival feels like its community project — more creative, less productional.

Anyone who hasn't been to these festivals might think "there's no scarcity in digital art because you can right click to save a jpeg". But those right-clickers would be technically or socially impossible in the Metaverse, where digital art, avatars, land, etc. are seamlessly connected to the blockchain.

(must read:Metaverse Primer,The Open Metaverse OS, Stratechery’s Metaverses)

Can you imagine wearing knockoff costumes at a Decentraland party? What if the real master shows up? When she walks around in her authentic glow, your deceit will be revealed on the spot, nailed to your avatar like a flashing red cone of shame. How ugly.

Speaking of the metaverse, my short-term bet is on the crypto world. Mid-term in Fortress World (tech giant). In the long run, however, the situation is reversed. Next let's talk about why.

secondary title

The Fight For The Metaverse:View this NFT on OpenSea

10. I said Metaverse, not Meta

The metaverse doesn't have to be a utopia, with a Web3 backend we could live in a world where designers compete in a competitive marketplace of fee-based services for the right to host you and monetize your data . "We'll make it 100x easier to sell your data, but keep 20% of the profits" seems like a fair mid-term deal that will lure users into the crypto world and put pressure on Web2 companies to cut their margins. When it comes to an open metaverse, I don't think most modern tech giants offer a compelling alternative to cryptocurrencies. But Meta is an exception.

I, like everyone else on the internet, think a lot about Facebook/Meta. I agree with Qiao that the purpose of the renaming is to get rid of the toxic Facebook brand. I agree with David Sacks that the media persecution of Zuckerberg - mirroring their own bad behavior - is orders of magnitude worse. I also agree with Balaji that Zuckerberg's resilience is impressive, and he deserves to be bet on and trusted, at least to a degree, when it comes to the Metaverse. Yep, Zuckerberg is probably the only one on this Odaily that makes such a shocking announcement of Meta's renaming feel more like devastation than excitement. But $10 billion a year is a huge, necessary investment that will lay the foundations of the Metaverse, just as fiber optics were laid in the early 2000s. Meta Corporation can forcefully push the path of hardware, graphics software and mobile bandwidth to make Metaspace truly immersive.

(must read:The Zuck Interview, Stratechery on Meta)

Ever since I sketched out my first virtual octagon with an Oculus Quest last year, I've been excited about what Facebook might build in VR. Before this, I had only experienced two moments of technological excitement: riding my first Uber, and reading the Bitcoin white paper. I'd be even more excited if the Meta Company kept their promise to keep their Metaverse work open.

The company's success will depend on its sincerity, and that should be its preferred path. The value of having a dominant platform in an undeveloped plot is obviously much greater than having a castle on that plot. I think Zuck knows this, and he's saying the right things. Ben Thompson's interview with him, worth reading in full

(must read:

secondary title

11. Non-Fungible (Unforgeable) Credentials: Your Modular Identity

Since 2018, I have been interested in the concept of curation markets and token-curated registries as a digital alternative to credentials. NFTs may prove to be the missing building block that makes them work in the end, as they:

Granularize achievements;

There are technical specifications that make it easy to integrate on various platforms;

are composable, which means they can evolve over time.

Take for example digital diplomas, which in a 1.0 world of token-curated registration would reflect a binary pass/fail outcome and inappropriately discriminate against otherwise qualified candidates through bribery to enter the registry or through mob rule, It is easy to compromise the integrity of a diploma.

When you need to prove your identity, you won't need to enter your driver's license every time, your digital signature will unlock access to your NFTized license, or your health records, or your insurance, whatever, We're talking about a 1000x improvement in the portability of our identities and the consistency and comparability of our certificates.

(must read:Examining the Types of Crypto Curation)

The potential to visualize credentials and reputation through artistic representations of NFTs is eye-opening. At a virtual party, you might choose to display credentials directly on your avatar's lapel (a speaker or VIP could wear an NFT registration badge), and at a social gathering, you might choose to wear a different honorary ( Isn’t that what fashion is all about?) to signal status (rare looking) or modesty (ESG-branded virtual clothing).

It can be said that the role of NFT is like a picture is worth a thousand words. One of the biggest trends we'll see in 2022 is NFTs, and if your cryptocurrency wallet becomes a universal digital identity, NFTs will represent all sub-parts of your identity. Composable memberships, earned semi-transferable NFTs, and yes, TCRs are coming back.

(must read:

secondary title

It’s clear that cryptographic name services are a killer app for managing identities on the Web3. An integral part of the internet’s infrastructure is domain name registration. Web domain names make IP addresses human-readable symbols, and many blockchain-based addresses will do the same. If PFPs make digital wallets more visual, registries like ENS and Handshake make them more interoperable and trustworthy.

(must read:Deep Sea Dive Into Ocean, A Primer on ENS, Decentralization of Identity)

Before the protocol airdropped $1 billion to its early adopters last month, nearly 500,000 ENS domains were squatted. It is conceivable that the network could one day rival centralized DNS maintainers such as Verisign ($27 billion market cap). Verisign manages nearly 85% of the domain names of the 200 million websites in the world, but the domain size of identities in Web3 may be 2–3 orders of magnitude larger, because there are 40 times the number of people and the number of devices connected to the Internet. 5 times the number of people, and there are quite a few citizens of the earth who would not necessarily trust Verisign (because there are decentralized options).

Clear identifiers will also make it possible for people and their devices to extract value from their data. According to the International Data Corporation, between 2012 and 2020, less than 1% of the world's data was actually used and analyzed, although the amount of potentially useful data increased from 20% to 40%. The market for data analytics will expand to nearly $100 billion by the end of next year, and corresponding case studies including Netflix's $1 billion big data/customer retention investment will become more extensive. Companies and users alike want to better monetize their data. In Web3, protocols like Ocean provide these benefits by encouraging the open sharing of data and securing the monetization of data, as well as better price discovery through liquid data marketplaces. Packets provide packaging. The addressable market size is FAMGA's ad revenue (it's a big market), so it's about a lot of things.

(must read:

secondary title

13. DeSo Lottery

Still, the core concept is sound: financially reward users for anything that goes viral. TikTok does this well (promoting users' early posts, keeping users hooked), but without token rewards. A Web3 startup will do this much more correctly.

(must read:Twitter Tips, NFTs and the Twitterverse, The Rise of Crypto Media)

It’s not just users who benefit, the DeSo protocol will incentivize dozens of competing Dapp developers to create protocols to compete for custody rights of users and their data—either through token incentives (attention mining?), or by optimizing user Killer products that you really want and are willing to pay for, like personal growth, security, peace of mind, etc. The front end can recommend the following similar assets and NFTs based on the owners of other similar assets and NFTs, allowing you to sell or auction NFTs directly from your user profile, or create a better social relationship graph.

I could see Adobe preparing a feature as an NFT in the latest version of Photoshop, minting a bunch of early winners in DeSo's viral spread. Content certificates are certificates compatible with NFT marketplaces, such as on the OpenSea platform, which can attest to the authenticity of the source of art and make the creation and distribution of new NFTs 100 times easier. Navel said it well: "DeSo is waiting for its Satoshi Moment." Now, the field is open, and I will spend a lot of time in 2022 on emerging platforms.

(must read:

secondary title

14. Physically decentralized (permanent) network

We can make all the castle-in-the-sky predictions we can about cryptocurrencies taking over the entire internet industry and becoming an unstoppable force. But the truth is, our physical survival depends on the decentralization of hardware. The war against censorship will be fought in the cloud, and how effectively we wrest control of that infrastructure from today's dominant monopolies will be the difference between an open internet and a police state.

Of the various components of the Web3 hardware stack, decentralized storage is arguably the most powerful.

As the first blockchain project dedicated to file storage as the first blockchain project dedicated to file storage, Filecoin creator Protocol Labs received a large amount of funding, which it used to fund a series of ecological Programs, accelerators and developers. So far, Filecoin has the lead over its competitors when it comes to data stored on the network.

This year, Arweave and Sia emerged as formidable competitors. Each network uses its own blockchain (or blockweave for Arweave) as the base layer for its decentralized data and application solutions. These networks make different design tradeoffs, but can generally be grouped into two categories, storage on demand (Sia and Filecoin) vs. permanent storage (Arweave). Although there is a premium for data stored on Arweave (because users pay for lifetime storage). The protocol has already gained traction in the NFT space as a permanent solution for storing NFTs and their metadata. Arweave has become the storage layer of choice for Solana NFT projects in particular, which has seen Arweave’s network growth surge over the past two quarters. Arweave applications such as Koi and Kyve are enhancing the potential services Arweave can provide to other blockchains and users.

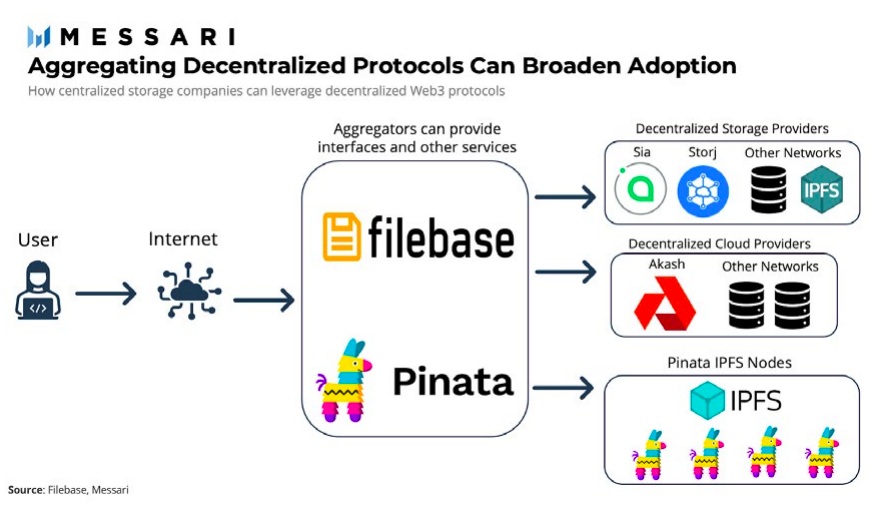

Distributed storage is a key layer of Web3 infrastructure that will steadily steal profits from existing Internet infrastructure providers, especially with the rise of distributed storage aggregators like Filebase and Pinata, which offer new customers Provides the interfaces, optimizations, and service layers required for custom storage solutions. (CeDeWeb3?)

Just like Coinbase provides DeFi services for protocols such as Maker and Compound, these abstract services will make Web3 storage protocols more accessible to new audiences.

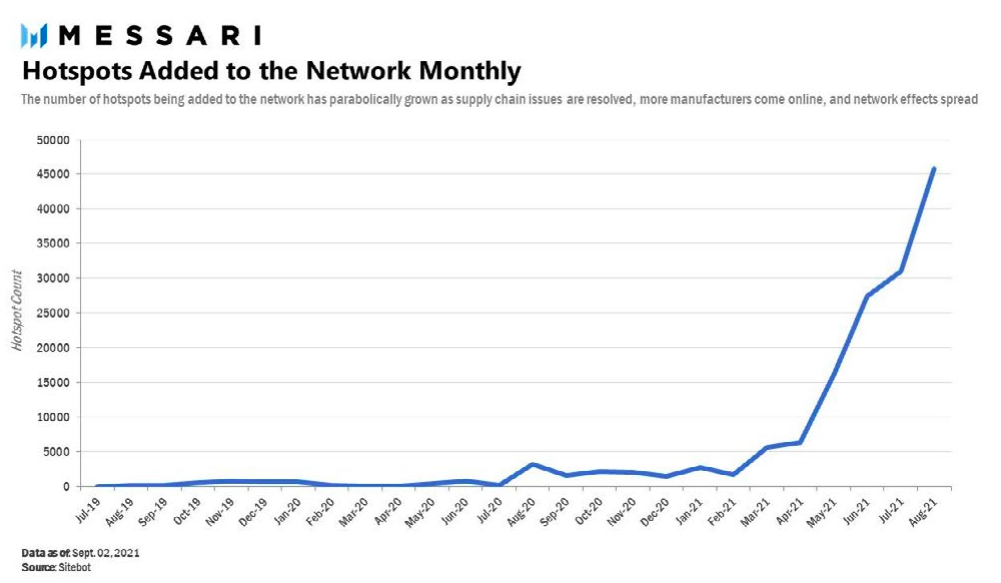

15. Expansion of the physical network

(must read:Web3 Network Revenue, Helium’s Exponential Coverage, The Storage Layer &Importance of Metadata, Arweave: Permanent Censorship Resistant Storage)