Related Reading:Topic | Messari 2022 In-Depth Research Report on Encryption Industry

The original text is from Messari, the original title is "Crypto Theses for 2022", translator | W3.Hitchhiker

Topic | Messari 2022 In-Depth Research Report on Encryption Industry

The original text is from Messari, the original title is "Crypto Theses for 2022", translator | W3.Hitchhiker

first level title

Chapter V Market Infrastructure

secondary title

Bitcoin futures ETF approved in mid-October sucks for non-Wall Street investors. Despite a nominal fee of only 65–85 bps, these toxic assets are likely to cost investors close to 5–10% per annum in hidden costs based on their structure and Bitcoin’s continued volatility and the market’s long-term bullish trend.

Bloomberg even pointed out that "Crypto's money printing machine is on again" as funds like Proshares' BITO, Van Eck's XBTF and Valkyrie's BTF are required to be liquid on the underlying Bitcoin futures, whose long-dated contracts have been trading at a premium Price transactions for short-term contracts. This "contagious bleeding" has resulted in immediate losses for Wall Street market makers and direct losses for ETF holders.Arthur Hayes wrote an article about how these work in plain language)

Arguably, this futures structure is necessary for ETFs that track physical commodities like oil, where it is difficult or impossible to take physical delivery of the underlying asset (remember last year oil futures suffered from supply chain issues and storage costs And the chaos that fell?). But a similar structure is insane for an asset like bitcoin, which has both a healthy spot market and a simple mechanism by which investors can host physically-settled futures: bitcoin wallets! We knew from day one that the new Bitcoin ETF was a loser. We only need to look at similar structured commodity ETFs to see how likely cash market underperformance is: Oil futures ETF USO is down 38% over the past five years, while the underlying asset is up 62%.

image description

(Source: Bloomberg,

Joe Orsini

Raoul Pal explains it best:

“Issuing a BTC futures ETF is a good step, but it basically gives hedge funds a huge arbitrage opportunity because futures will trade at a huge premium during the bull market phase, and they can reap those returns. It’s an old trick in financial markets — you Now have to add multiple new intermediaries that are profitable - ETF providers, clearinghouses, futures brokers, administrators, auditors, law firms, CMEs and hedge fund ARBs. Wall Street gets richer again, retail investors loss."

Wall Street loves products they can profit from, and spot ETFs, as good as they are, can't get the traditional players in those products on board. Like piglets to the manger, can BITO et al finally get banks in on the crypto action? Benchmark deals offer free money that they can pursue within their strict regulatory boundaries. I guess that could be a long-term positive? Meanwhile, if anyone other than brokers wins, it will be Coinbase retail users. Not a loser of BITO/BTF/XBTF

Ben Thompson also pointed out that at least we now know the net cost of regulation: hundreds of millions of dollars worth of product spending on contango/backwardation that means nothing except that they are "regulatory possible". Spot ETFs are the lower cost option in this crazy situation, and Gary Gensler is unlikely to approve a spot ETF anytime soon (see last chapter), which is the perfect end to a decade of misguided cryptocurrency policy by the SEC.

Public market investors have missed out on the Bitcoin market’s 1,000-fold appreciation since the Winklevoss twins first filed for a spot ETF. filed their spot ETF application in mid-2013. Now they too can give Wall Street a loss of 10% a year...and even less upside.

I forecast these products will all be less than 1% overall, but will exceed 5% of their cost net of contract volumes in 2022 (75% confidence).

secondary title

2. Goldman Sachs Gary and Company Redemption

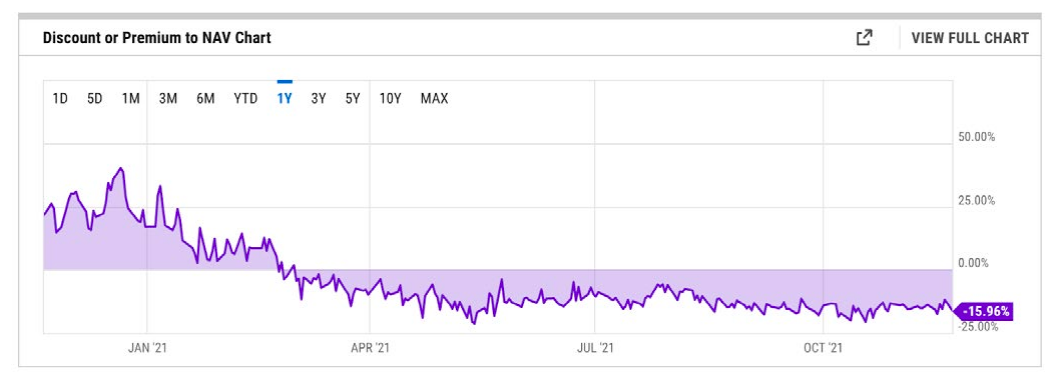

The ultimate reason Gary Gensler is a liar and fraudster when it comes to his penchant for protecting retail investors in the cryptocurrency market has to do with Grayscale’s Bitcoin Trust/GBTC product, which remains the most misunderstood product in cryptocurrency.

I'll do my best to briefly explain how it works, but it could easily take many pages. These

Information about trusts is public, but you need some experience to know what you're looking at

something seen in the file.

I'll try to briefly explain how it works, but the explanation could easily be 15 pages. Information about these trust funds is public, but you have experience to know what you see in these documents.

First, you need to understand this org chart:

GBTC is the public float of the spot-based Grayscale Bitcoin Trust. The trust holds $40 billion in bitcoin and has an annual fee of 2%.

Grayscale is the sponsor of the trust, sponsoring families of similar trusts.Grayscale is the sponsor of the trust and sponsors a series of similar trusts.

Digital Currency Group is the parent company (100% owner) of Grayscale.

Then you need to understand the difference between Grayscale's products and an ordinary ETF.

A common spot-based commodity ETF (such as gold's GLD) has "authorized participants" (brokers) who create and redeem "baskets" of stocks by trading the underlying asset and the stocks they represent, until each The share price is equal to the underlying net asset value (“NAV”). If the demand for the ETF is greater than the potential intraday demand, then >NAV dynamics will attract brokers to buy Bitcoin, create new shares by sending Bitcoin to a trust vehicle, and then sell the newly created shares on the open market. When the stock price is

Not so with Grayscale Trust.

The GBTC stock you see today entered the market through a loophole in the securities laws

There is no redemption mechanism to get your Bitcoin back by converting the underlying shares. This last point is important, as we'll see later. This is a one-way flow of money.

(source:ycharts)

The Rule 144 loophole paved the way for accredited investors to flood into Grayscale Trust early and then funnel them to the retail market for huge premiums after the lock-up period. Demand for publicly traded bitcoin instruments has long outstripped supply, with GBTC shares the only legitimate game in play while the SEC drags its feet on other ETF proposals. This consistent public market premium has been a great bootstrap mechanism for Grayscale's trust fund, with early investors making staggering amounts of money off the spread. Billions of dollars totaled, at the expense of the retail industry, and with the tacit approval of the SEC.

The GBTC premium has lasted much longer than most expected. But as it became easier for institutional investors to enter Bitcoin, overcrowded grayscale transactions turned negative. Newly created shares flooded the market in the first quarter, and we now have a consistent, deep discount.

image description

(source:

Remember, if this was a true ETF, the premium wouldn't exist, and accredited investors wouldn't dump to retail investors for years. It also means that the trust's huge (and now potentially permanent) discount to NAV will be closed overnight, as investors will choose to redeem GBTC shares in the trust in exchange for shares on the spot market Bitcoin is worth 15% higher and will rationally do so until the NAV gap closes. The committee's refusal to approve spot ETFs continues to punish investors who have been locked in, waiting for a return on net asset value that may never come, and charged by Grayscale with a 2% annual fee.

For Grayscale investors, though, there's a third way and an escape hatch!

While Grayscale can't do a "serial" of new stock and offer a redemption program at the same time (they got slapped by the SEC in 2016 for doing this!!!), they can pursue so-called Reg M redemptions because they're already in Issuance of new shares is suspended during the GBTC discount period. The thing is -- if you're anticipating wild swings and three misses from the SEC, you're correct -- Grayscale can pursue this at any time, but is under no obligation to pursue Reg M redemptions because if they're also pursuing ETFs Switch, which they did the day after their October futures-based ETF was approved.

Grayscale actually said a few things that were true, but not the whole truth: "We got into trouble with the Reg M redemption program in 2016, that's why we suspended it" and "GBTC investors in the open market Liquidity is available and we're trying to close the NAV gap by converting trusts to ETFs." That's all true and the route they chose, but the whole truth is a redemption plan is possible, but they choose not to pursue it .

Grayscale views their asset management as operating leverage with the SEC in the ETF conversion program. The SEC's ETF conversion plan, but more importantly, but more importantly, given BIT's current California hotel structure, they see it as a $1 billion guaranteed tax train and permanent capital. Grayscale, as the initiator of BIT, is the final decision maker when it comes to whether they own:

An ETF converted file (they did it)

Execute the RegM redemption plan (they won't)

Liquidate its trust fund (yes, right)

At the same time, every DCG-GrayScaleGBTC buyback is not a signal of confidence in itself, but rather an attempt to avoid shareholder anger from diverting funds from one pocket to another. They have no incentive to allow redemption.

Can you blame them?

The SEC is turning a blind eye here, and Gensler is complicit in allowing a $6-10 billion gap between GBTC and the NAV of the trust. Grayscale is "going after" an ETF they know won't come from the SEC with 0% urgency. "We won't redeem until the SEC approves the ETF" is a smart negotiating phrase so they don't face a media backlash. This thing is complex enough not to piss people off, so investors lose and Gensler and Grayscale win

Uninformed investors think DCG can bridge the NAV gap (impossible given the size of the trust), but what really happens is that either a) the ETF converts, GBTC goes back to par, and DCG realizes the GBTC gain, b) AUM sits there, DCG "self-pays" (via Grayscale) the 2% admin fee on their GBTC stock, or c) they end up rolling out a Reg M redemption program, or liquidate Bitcoin and get their Bitcoin back to face value .

After I wrote this last month, a lawyer pointed out, "These cases are always going to go to court, especially if Grayscale continues to charge fees and do nothing about discounts, which is certainly a possibility. Please Remember, they have a fiduciary duty to the trust." Well, well, but remember, they can argue that they're taking steps to close that gap by buying back and applying for ETFs. In that regard, they may be untouchable. But I think people should warn new investors about the toxicity of Grayscale's new trusts, which tend to perform worse.

Prediction: Barry Silbert is Gary Gensler's dad. (100% confidence) Grayscale wins and continues to mock the SEC. Investors lost heavily as GBTC traded at an average discount to NAV of 15%+ (75% confidence) without a Reg M scheme or ETF (95% confidence). .

(DCG's recent $10 billion valuation is further proof that Barry is a master of the secondary market, as well as its informational and legal asymmetries, for a nearly $1 billion annual EBIT with a balance sheet For multi-billion dollar companies, it feels like a 60–70% discount). )

secondary title

3. Lender Reserves

This makes me sad, but the regulation of stablecoins and lending products is a good thing for the industry. Once we started seeing some of the assets stablecoin issuers and lenders put on their balance sheets this year, we kind of lost our high ground. Including Grayscale stock!

Tether may hold many commercial assets (see later in this chapter), but Blockfi's assets may be more eye-opening. I'm going to fault them because a) I have assets there so I think it's safe, b) they're already in regulatory sightings (so they're relevant), and c) they're on a bad deal (so you can see it's not just theoretical)) they are very well capitalized (so the bankruptcy proposal is not credible), e) it's all public information.

Here's what we know about BlockFi's first quarter...

The Block reported in January that BlockFi generated less than $100 million in revenue in 2020, about $30 million of which came from GBTC premiums on Grayscale transactions and $55 million from institutional loans. BlockFi was one of two firms (along with Three Arrows Capital) that slammed the Grayscale deal, triggering the SEC 13G disclosure. As of Feb. 11, BlockFi was sitting on $1.7 billion in GBTC shares and about $150 million in unrealized gains. A few days later, the price of GBTC began a two-week 25% drop compared to NAV. Whatever the exact amount Blockfi failed to turn a profit in that time period immediately rolled over to an unsettled loss of $1-150 million.

The company announced a $350 million Series D round a few weeks later. Is it a coincidence or an improvement in solvency? I think it's the former, but the announcement seems to be being fast-tracked.

Is BlockFi the main reason why Grayscale finally broke? Here's a plausible explanation for what happened in February:

As the GBTC premium narrows and the opportunity cost rises, the BlockFi venture team will naturally want to trim that position. Given BlockFi's enormous risk (remember, this liability will only grow as the price of Bitcoin rises), unwinding could lead to a vicious sell-off, below the Equity Mendoza Line, until the BlockFi Venture Team feels it can move the remaining of underwater positions and implement strategies to write off remaining distressed investments.

In fact, as of June 24th, BlockFi had shed 45% of their position, which means they probably still own over $1 billion worth of undisclosed GBTC, which they hold at an unrealized loss of 10%, plus There is a 2% grayscale management fee, plus BlockFi's depositor interest rate.

It doesn't matter!

BlockFi will survive, even if the position is completely lost, their balance sheet can absorb the shock. Maybe BlockFi is out of trading altogether by now (I doubt it), and/or it has made up bad bets with other DeFi bets and institutional loans. However, the fact remains that this poses a potential risk even to the $10 billion+ crypto lender, which currently has 500,000 retail customers, through financial disclosures in third-party filings. (This also highlights the challenges GBTC will face in rallying back to NAV. Whales can either eat the 2% fee and pray for ETF approval, or sell rallies that exceed 90% of NAV.)

Matt Levine writes best about Coinbase Lend's problems and gets to the crux of the matter.

4. CeFi vs.TradFi

“Listen, I get it. From the point of view of Coinbase and its customers, and frankly, from the point of view of most normal people interested in crypto: people are willing to lend their bitcoin. It doesn’t feel like Security. A 1946 Supreme Court case said it was... [but also] it wasn't a stock, a bond, a "note", an "investment contract", a personal IOU or a syndicated loan, which is kind of annoying and outdated. It's a full mortgage bank account with a reserve ratio of 100%. The bank holds your money, uses it to fund the loan, pays you interest, pays you back even if the loan defaults, the whole thing is seamless to you, etc. Wait. It's just a bank account."

As I said in the last chapter, we must hold the commanding heights! It's kind of silly to store large amounts of risk on your balance sheet; one that could lead to major solvency problems; never disclose the composition of reserves or lending books; and then don't expect policy makers to respond. We require proof of reserve from the lender and custodian.

I think I touched on this in the last section, but I think crypto lenders will face heavy regulation this year. The B2B sector (essentially securities lenders) will be fine, but retail lenders may not be popular in the US before the end of the year.

secondary title

Sure, there will be corporate innovation groups, crypto execs, and press releases, but crypto companies are just bigger, faster, more active, and unencumbered by maintaining a 50-year-old parallel TradFi infrastructure. The talent pool is only moving in one direction too...into crypto, where we're still decades early in the migration of financial, technical, and creative talent to crypto.

Institutional FOMO:View this NFT on OpenSea

5.CEX Ed

Investors don't go to Goldman Sachs for off-exchange lending until they go to the groundbreaking blockchain companies that created $100 billion in loans in less than 2.5 years.

For futures, they will not choose CME but Binance or FTX. They didn't even look at Fidelity (which currently counts 10 of the top 100 hedge funds as clients) before looking at Coinbase Institutional, which is arguably the best of the traditional players when it comes to crypto innovation. The FDIC will use Anchorage to manage the orderly liquidation of banks.

image description

secondary title

Decentralized forex growth has been insane. These protocols generally offer a better user experience (asset coverage, accessibility) than their centralized counterparts, and they do a good job of absorbing liquidity from global exchanges (Chainalysis says 200 CEXs close each year, increased to 650 year-on-year). For long-tail assets and new synthetic tools, the DEX momentum will continue, as open source-based decentralized markets will, by definition, be broader and more dynamic than centralized markets.

We have an entire chapter dedicated to DeFi, and we’ll talk more about DEXs in Chapter 7. For now, we will stick to discussing large centralized exchanges for cryptocurrencies.

Today, there are basically three layers. The top three "God-level" exchanges are Coinbase, Binance, and FTX, where primacy may depend on new products and regulatory wins. Then there are Kraken, Huobi, Kucoin, Gemini, OKEx and Bitfinex in the "trading volume laggards" camp, but if any of the top three decline or stagnate, "these few exchanges could still dominate". There is likely to be a healthy dynamic in this group, where market share ebbs and flows. There will also be regional winners: Upbit in Korea, bitFlyer in Japan, Bitso in Latin America, CoinswitchKuber in India, Luno in Africa, and more.

I am only going to cover the top three exchanges here. If that disappoints, then you can write your own end-of-year book.

Coinbase has analyst coverage now, if you want to read more about them. I also mentioned some of their strengths in the Emilie Choi section. Incredible growth, first mover advantage, "free marketing" for being the first crypto IPO, liquid equity that they can use to splurge on additional accretive acquisitions (given their installed base, they've proven to be Very profitable), the most stable regulatory positioning outside of the top exchanges today. But probably the most interesting is their Web3 plans. I've been following their Coinbase wallet and DAO plans, not to mention their upcoming NFT marketplace.

Binance is the most interesting exchange of the Big Three, not to mention the largest. Arguably, it's too big to fail, but they certainly have work to do to clean up their regulatory image. They've been hunted all over the world for the past year or so, and CZ sounds like someone who's finally ready to settle down after a good run as a judicial bachelor. I bet the government might need to be accepted as an investor at this point? Maybe Singapore? They are so large that regulatory remedies may need to be achieved through treaties rather than private negotiations. Regulatory troubles have drawn some attention to the company's performance. Everyone’s talking about Coinbase and FTX this year, and the BNB token — which accounts for just 20% of the exchange’s profits — topped $100 billion in market cap for the first time this fall.

Still, if you're wondering where the heat is headed, I'd point to FTX. A lot has been written about Sam Bankman-Fried this year. Richest people under 30. Effective altruists. Sizechad impersonator. Honestly, it's well deserved. FTX has grown at unearthly speed, building a $25 billion business in less than three years with fewer than 100 employees. They're the fastest growing company ever, ahead of Coinbase, Stripe, and even Binance, and they've done it in the brutally competitive crypto trading market. Here's how they do it, in 10 easy steps!

Leverage the capital and credibility of being one of the top traders on BitMEX.

Market at FTX's startup stage with your sister prop desk.

Products made by traders for traders — such as leveraged tokens and tokenized shares.

Use tokens to incentivize early customer acquisition as switching costs are high.

Shop the largest mobile platform in BlockFolio.

Become the world's second largest donor to a future presidential campaign.

Pick the right layer 1 blockchain to help scale the DeFi ecosystem (Solana).

Use it to be a god to the early bitcoiners gathered outside Ethereum.

Add jaw-dropping amounts.

If Web3 makes everyone an investor, FTX et al want to have internet scale exchanges. By 2030, we will see trillion dollar crypto exchanges. (More must-reads about Messari Pro: Valuation Models of FTT, BNB, and COIN)

6. Crypto Securities (and ILOs)

Having just closed a $150 million Series B round, Republic looks interested in building a secondary trading platform for digital securities, as valuations of private companies soar to record heights and the process of accreditation-only secondary trading gets Standardized, this kind of thing could become more widely interesting. They're also worth keeping an eye on, as they could be major beneficiaries in a doomsday scenario where most cryptocurrency projects are considered securities. Chief executive Kendrick Nguyen hasn't shied away from that reality. "Everything the Republicans do, everything that we touch, we generally treat it as a security and place it under the framework of existing U.S. securities laws.

It's another New Republic product that I'm more interested in, though: the Preliminary Litigation Offer. If the threat to crypto comes primarily from the FSOC regulator, creating a fund to fight back relentlessly through litigation might be a more efficient use of capital than campaign financing.

7. Bearer (and Bearer)

text

Custody is where the roads cross between Crypto and TradFi. Custody of client funds opens the door for registration, lending, market making, governance participation, and more. This is an obvious area where cryptocurrency companies should be (and are being) regulated. Over the next few years, most of the M&A activity we will see TradFi entering crypto will be on the custody side, most of the investors and network participants we will see entering the crypto economy will choose custody over self-custody, to ensure safety and security.

Dedicated custodians like Anchorage, BitGo, Fireblocks, and Ledger have all recently become unicorns as interest from traditional funds has exploded. Coinbase Cloud (Bison Trails infrastructure) shows how lucrative the market for hosted nodes and staking services can be for these groups. They brought in $80 million in staking revenue in Q3 alone, and other infrastructure companies such as Blockdaemon, Figment, and Alchemy have raised significant funds to follow suit.

secondary title

8. Coinlist: Global Token Issuance Platform (Except US and North Korea)

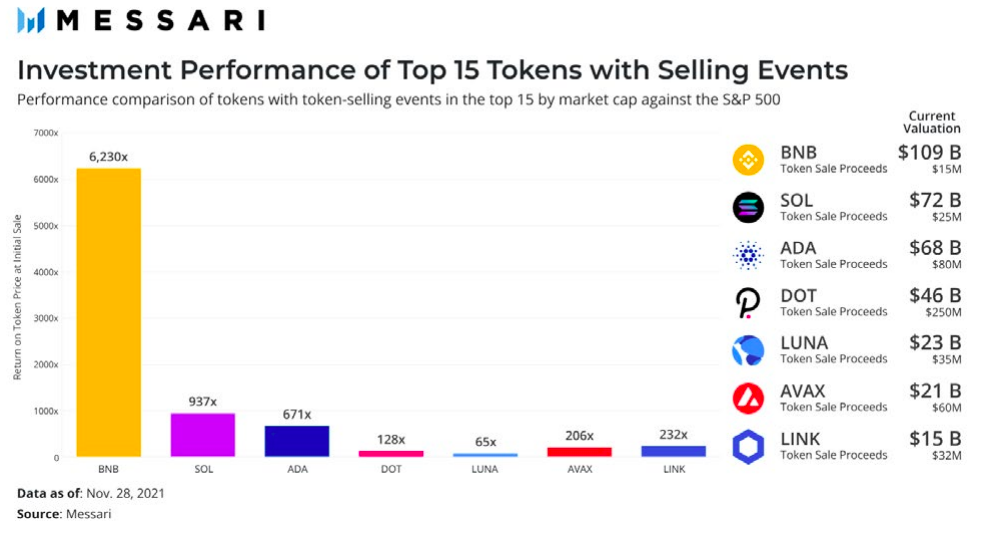

In fact, token sales have outperformed the S&P as an investment class — by more than an order of magnitude. Token sales have raised about $20 billion to date. Binance (BNB) alone delivered 5x the entire initial investment. Here's the actual math, ranking the top 15 seven token sale projects by market capitalization.

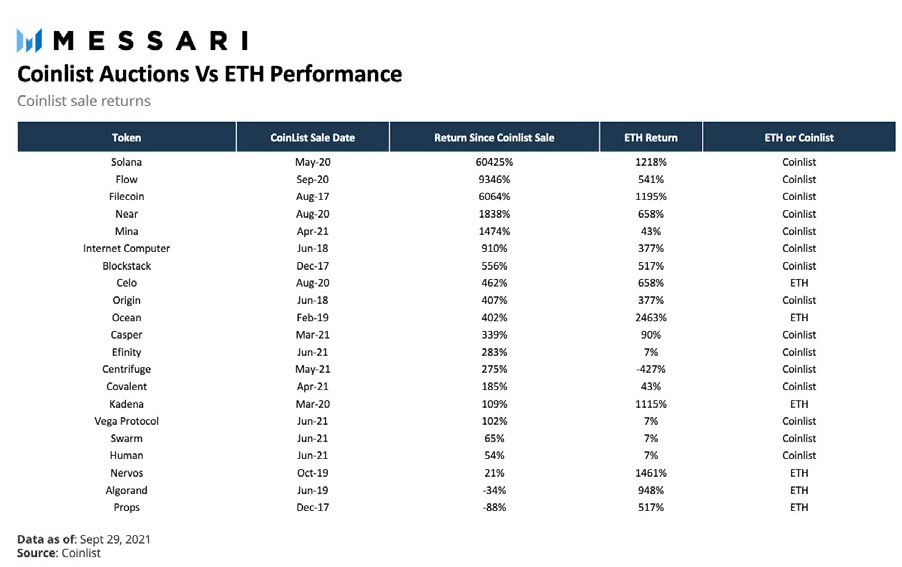

(source:Messari Pro: CoinList Sales vs. ETH)

That's $350 billion in value created on a mere $500 million in invested capital... more than enough to wipe out nearly 20 times the losses of all the losers themselves. This does not include the $550 billion market value that Ethereum created in 2014 with just $18 million in crowdfunding proceeds. For token sales that underperformed, didn’t deliver at all, or were outright scams, a good safe harbor can turn these flimsy “unregistered securities” cases into sweeping fraud cases.

Claiming that tokens as a class are bad for investors is nonsense. If so, they're a sort of indictment against the SEC. Investors want and need an alternative to today's stock market. Participation in the token economy—almost any degree of diversification—has historically produced winners. Take Mason's recent analysis of CoinList sales, which also makes a mockery of Crenshaw's claim. While the U.S. is second only to North Korea on the list of excluded countries participating in most of Coinlist’s sales, here’s how a $100 investment actually performed in their top 20 sales:

image description

The only question in this analysis is whether the Coinlist investment outperformed the ETH investment, not whether it delivered a positive return. During the evaluation period, only two tokens traded for less than what they were sold on Coinlist. One of them, Props, was effectively destroyed due to their decision to comply with SEC reporting and securities restrictions under Reg A, which made their network unusable. Another offers Coinlist buyers an embedded put option. If you invest $100 in every Coinlist sale except for SEC-approved projects, you pay $2,000 and get $150,000 in return, a 100% hit rate.

This is disgusting, and your wrath should be felt by the current SEC leadership.

To add insult to injury, Coinlist, a spin-off from Angellist that helped create the JOBS Act in an attempt to loosen existing securities laws, recently raised $100 million at a $1.5 billion valuation, though it was unable to offer U.S. investors sell.

This infrastructure exists to facilitate a compliant, user-friendly, fair, long-term oriented network decentralized token sale on the US platform. The SEC was just grossly negligent.

secondary title

If you want to get into the crypto battlegrounds as an investor or contributor, but also want to feel like a Wild West sheriff trying to bring order to the frontier, the crypto regulatory tech game is a good place to start. Low-cost regulatory technology leaders are the front line of our defenses, and they are often the bridge to more reasonable and well-meaning regulators on the other side of the aisle. (Remember, a16z’s Katie Haun was a federal prosecutor before joining Coinbase’s board!).

It was indeed a stellar year for AML solutions such as Chainalysis ($100 million from Coatue, Benchmark, and Accel at a $4 billion valuation), Elliptic ($60 million from Evolution and SoftBank), and Ciphertrace (from ThirdPoint $27 million). The same goes for tax solutions, with TaxBit catapulting into the unicorn club ($130M from Paradigm, Insight, and Tiger Global). Crypto data and governance platform, SEC killer and superhero factory Messari also had a good year ($21M raised from Point72 Ventures and all major US crypto exchanges).

You don’t need to be a total rebel to have some building fun in cryptocurrency.

secondary title

10. Payment Innovation

text

Again, this section could be a complete report in itself. I intend to omit a lot, or devolve it to the stablecoin section in due course, for further presentation.

Probably the most exciting trend in cryptocurrency payments is obvious to me. Stablecoins have exploded. Both Bitcoin and Ethereum have seen settlement volumes increase by several orders of magnitude over the past few years. Every time I send USDC to fund an investment, I cry with joy because I don't have to initiate a wire transfer on the bank interface - a way that looks like it was devised by someone who still plays Frogger in his spare time.

These are all obvious. I'd rather talk about all the unique upgrades we've seen so far this year: in payroll integration, frictionless stream payments, secondary payments, and integrations with new clients like charities and more. I'm going to pitch my angel investment here because none of these companies have tokens, and they're killer payments infrastructure businesses that have seen vertical growth this year.

Payroll (Juno). For years, I have been advocating the need for cryptocurrency payroll solutions. These tools can simplify integration with large payroll providers, allowing employees to seamlessly receive salary in cryptocurrency, while also meeting the needs of tax compliance. We are using Juno to pay our salaries in cryptocurrency, I even recommended it to the mayor of Miami. (How does this add value to investors?

Secondary payment (Gitcoin). Well, ´Gitcoin has a token, and I'm (unfortunately) not an early angel investor. But they are the first major project to incorporate quadratic payments, a killer cryptocurrency prototype. Gitcoin powers "public goods" fundraising projects that are scalable (the community votes on proposals, not committees), openly debated, and democratic rather than upstart. This is how the DAO treasury will finally be effectively unlocked at scale.

Charitable donations (The Giving Block). Before cryptocurrency, I started a charity payments company. When I first entered the space, I thought about translating this concept to apply to crypto assets. It was early days, but my argument remains unchanged: donating appreciated crypto assets provides a double benefit to the donor: you avoid capital gains tax on the donated "property", and you can write off the full liquid value of the gift . This year, Giving Block smashed the idea by bringing it into the mainstream. They'll be processing $100 million+ in donations, and they're just getting started.

Emerging Markets (Valiu). In most developed countries, we still take currency stability for granted. That may slowly change as inflation hits 6%, but it is already a fact of life for people in emerging markets like Venezuela, who have lived through catastrophic currency crises and political turmoil. I want to keep betting on the top remittance platforms that bring payment stability to crisis areas regardless of their physical location, using stablecoins.

Again, I am not doing justice to everything that has happened this year in terms of cryptocurrency payments. This is simply too big. Coinbase announced a partnership with Visa and launched the Coinbase Card. BlockFi Announces Bitcoin Rewards Credit Card. Stripe is hiring a cryptocurrency team and adding Paradigm co-founder Matt Huang to its board. Mastercard partnered with Bakkt. Visa moved closer to the spirit of punk rock by buying Punk. Ramp raised funding at $300 million. Moonpay raises funding at more than $3.4 billion. This is all too bullish. I can not accept.

secondary title

11. The National Security Case for Cryptocurrencies

One of the things that got me into Bitcoin in 2013 was the "big short" discourse about the capabilities of the US government. I think our national leadership—largely due to the accelerated degradation of our bipartisan system and the media—will lack the ability to address structural challenges in any meaningful way, and even if they did, they would do so in the style of alcoholics. Efficiency does this.

This argument has proven largely correct. Political polarization has gotten worse, deficits have reached World War II levels (because no one can agree on a responsible budget), and with interest rates near zero, we have chosen to massively devolve our debt into currencies change. Since the beginning of 2020, about 40% of the dollars that have ever entered circulation have been printed. All of this led to my initial bearish thesis being rewarded over 500x by Bitcoin longs.

So you might be surprised to know that I'm actually very bullish on the dollar due to national security concerns, and because I happen to like the country even though I'm unhappy with many of its leaders. That said, I believe one of the only ways out of our current predicament is to take advantage of the time we have left over wielding the world's major reserve currency and start exporting crypto dollars. A digital cash instrument that has the full trust and credit of the US Treasury, but can be transacted anonymously (auditable supply) would be amazing and appealing to global counterparties. A closed-loop Fed-maintained central bank digital currency (dualistic excess) would likely fail because no normal nation-state would invite such granular foreign oversight into its banking system.

“An existing, thriving ecosystem of private dollar-denominated stablecoins could help the U.S. move quickly to win the emerging geopolitical arms race in financial innovation. The U.S. should condemn the surveillance authoritarianism embodied in China’s digital yuan project — rather than trying to emulate it. U.S. policymakers should be cautious about building a large-scale centralized payments infrastructure. Doing so would place unprecedented demands on the government’s limited ability to build critical technology platforms, posing significant privacy risks , and create an attractive target for attackers."

12.DCEP

A regulated stablecoin could coexist with a more limited CBDC and add resilience to our future financial system by removing single points of failure.

I agree, I believe the only way to keep the dollar as the world's preferred reserve currency is for the US to embrace cryptocurrencies. As Bitcoin becomes more liquid and financial institutions and foreign governments hedge against U.S. creditworthiness, we could see Bitcoin and other forms of cryptocurrency displacing their reserves and national debt. Alternatively, we could see central bank digital currencies with strong monetary policy safeguards more easily chip away at the dollar's lead. The game theory here is that the US bans its alternatives, or buys in as a life buoy.

The former won't last long. The latter must be the case.

secondary title

To be honest, it took me about 15 minutes to read about central bank digital currencies this year. I read what I needed when the concept was first proposed a few years ago, and since then, basically every headline I've seen has boiled down to "Wow! This is awesome! We can totally monitor citizens' finances Trade, and make rates negative if you want!" I don't like it.

China will roll out DCEP in time for the Winter Olympics in a few months, and my concern is that major western governments will see its launch as an incredible success and try to imitate the new product as quickly as possible. Of course they will fail because those with the technical acumen to pull off such a project (Novi of Meta) are reviled by our government leaders instead of allying and cooperating with them.

DCEP — like all of the Chinese Communist Party’s cryptocurrency policy — is ultimately about closing loopholes in the country’s capital controls. One analyst said DCEP would reduce capital fleeing to Macau by $600 billion.

My biggest concern is that this is only the first step in a long-term effort to replace the dollar as an exportable reserve currency. If China can build a two-level DCEP payment system — a system that facilitates anonymous circulation abroad and fully supervised transactions domestically — it will function similarly to something like ZCash. Only, instead of a shielded pool of Z-addresses and a pool of transparent T-addresses, you can have two transparent pools of RMB: a foreign pool of RMB with monitoring at points of interaction with China, and a completely unprotected A shielded domestic renminbi pool, with the Chinese communist authorities holding the second key.

In other words, DCEP could soon become the leading digital euro candidate. China is now a major trading partner for most countries, including the EU. If they offered even a small degree of privacy in a digital yuan circulating abroad, it would pose a real threat to the dollar’s reserve paradigm.

secondary title

13. FedCoin and Western CFDCs

Our trajectory in the US (and Europe) includes state-managed digital currency payment rails that would allow ubiquitous transaction monitoring, censorship and negative interest rates, stealing deposits as a mechanism to enforce a wealth tax or punish during periods of spending slump saver. We're trying to build a worse version of China's DCEP, but without the necessary authoritarian values to warrant it in the West.

We don't have any competitive advantage - they will go faster, have better coordination and execution, and start with a larger trade network. Our only interesting strengths (respect for privacy, openness, commitment to the rule of law, etc.) will be more or less lost in the design of a CBDC that would further empower our payments companies to spy on customers and even threaten to dissolve them .

Snowden called them CFDCs (the "f" stands for "fascist"), and I like the idea. Modern governments are not good stewards of public trust. It would be crazy not to fight their efforts to install themselves in 50% of the transactions. Especially when governments (subject to court checks and balances) can already act as effective 2–3 multisigers in modern bank accounts, and even more especially when better alternatives already exist.

In testimony to the Senate Banking Committee, Fed Chairman Jerome Powell seemed to agree! He told the committee that he remained "legitimately undecided" whether the benefits of a CBDC outweighed its potential risks. He told the committee that he remained “legally undecided” as to whether the benefits of a CBDC would outweigh its potential risks, and suggested that a better solution might simply involve clean regulation of stablecoins.

secondary title

14. USDC and Brother Jeremy

When I started this report, "Jeremy Allaire could be the savior of the world" wasn't in my outline. But hear me out. Actually, go see Jeremy's rap first. Then listen to me again.

The “Jeremy as Crypto-Dollar Jesus” essay is divided into four parts.

We should be rallying around liquid, well-regulated stablecoins for inclusion in the entire cryptocurrency ecosystem, and Circle’s USDC and Paxos are the only serious contenders today.

USDC is the only stablecoin that is already interoperable between Binance, Coinbase, and Kraken (as well as Huobi and OKEx), and it is a stronger DeFi bridge than Paxos. To absorb Tether's market share, the winning stablecoin has to be ubiquitous, and USDC is an order of magnitude larger than Paxos.

If the dollar loses its status as a reserve currency, it would be very bad for global geopolitics. I'm not sure such an epic transition of power would be peaceful.

Doesn't sound so crazy anymore!

There is a lot to like about USDC. It is already multi-chain and available on Ethereum (and its layer 2), Solana, Algorand and more. It is the most liquid stablecoin in DeFi. Circle publishes a monthly audit report on USDC reserves provided by top five auditor Grant Thornton. The creators of USDC (Circle and Coinbase) have street cred and since 2012 have been passionate about building a compliant cryptocurrency payments infrastructure. Once Circle goes public through a SPAC, it could also benefit from the public company halo effect and add nearly $500 million in additional cash to its balance sheet.

If financial inclusion and humanitarian aid are priorities for this administration, Circle is already doing some work on that too...in partnership with the US government! USDC is one of the most promising currencies out there for the underserved Community-wide, affordable payment access and legal and regulatory compliance.

secondary title

15. When Paxos meets Novi