Related Reading:Topic | Messari 2022 In-Depth Research Report on Encryption Industry

The original text is from Messari, the original title is "Crypto Theses for 2022", translator | W3.Hitchhiker

Related Reading:

Topic | Messari 2022 In-Depth Research Report on Encryption IndustryThe original text is from Messari, the original title is "Crypto Theses for 2022", translator | W3.HitchhikerChapter 4 Cryptocurrency Policy in the United States

Cryptocurrency policy used to evolve at breakneck speed. Exchanges and Custody WalletsHas been under the supervision of dozens of regulatory agencies around the world, the token team has operated under the watchful eye of securities regulators from the very beginning. But regulation has only kicked into high gear in the past six months, especially in the US. When you're over $3 trillion in market cap, you're heavily regulated, and cryptocurrency policy becomes a priority you have to pay attention to in order to survive.This fall, the Financial Markets Working Group (PWG), calling on Congress to pass new emergency legislation to "fill the regulatory gap." Biden's infrastructure bill passed, retaining its disastrous definition of "broker" and intrusive expansion of KYC requirements under the Bank Secrecy Act,stable currencySuch an extension would create a personal compliance burden

. SEC Chairman Gary Gensler claims he has controlstable currency, and reiterated his tough rhetoric on enforcement, as well as his insistence that most crypto assets are unregistered securities.The U.S. is not the only country struggling to find a balance when it comes to developing effective cryptocurrency policy. As discussed in the previous chapter, in order to prevent”disorderly expansion of capital", banned most cryptocurrency activities in the country. India's attitude became more and more open, but laterPublicized its hostility to cryptocurrencies

. Israel proposes a dystopian financial reporting rule that would requireCitizens report all assets over $61,000 (Encrypted privacy = felony).Other regions are more thoughtful, such as the Financial Services Agency of Japan, which established a department toDealing with DeFi’s Regulatory Issues

,Portugal

, exempts foreign income from taxes, and has been recruiting cryptocurrency innovators. In the U.S., states like Miami and Wyoming have also been establishing cryptocurrency safe havens.

Even with skepticism about decentralized finance, most countries seem keen to move forward with their central bank digital currency plans, (this trend will be covered in Chapter 5).

As the beginning of an in-depth study of policy, the situation in the United States will first be introduced.

secondary title

1. Setting the Stage: The American Battlefield

"It's an incredibly fast-growing industry. It's growing 1.5 to 2 times faster than the internet in terms of adoption. As a politician, if you say: 'Oh, we don't,' you Just an idiot.” — Novo (D)

“America can accept crypto and profit, or ban crypto and disintegrate.” — TBI (R)

Cryptocurrencies have been deemed "politically forward-looking" in recent months. Given the appeal of cryptocurrencies to Democrats and Republicans and their global potential, this is actually a good thing.

In fact, Republican regulators (so far) seem more sympathetic and reasonable when it comes to cryptocurrencies. This year's sweeping relegation of many of the Executive Department's appointees to the Financial Stability Oversight Board, as well as other congressional positions of authority, was not an unexpected adjustment, but I definitely wouldn't consider Ted Cruz our number one in the Senate ally number one. Any smart person knows that being an ally in the Senate pays off for an industry growing exponentially.open letterWhat we really need are more crypto advocates like Democratic Senator Ron Wyden, because we clearly don't have many friends, or even any friends, in the Biden administration or the progressive wing of his party . Senator Elizabeth Warren, one of the most influential senators in financial services, hates cryptocurrencies, as do other newly minted Democrats. Perhaps we should be thankful that these people don't take more legislative action, because that would be very bad, and the hostility of progressives is not well justified.

A Pro-Cryptocurrency Letter From a Young Progressive to Elizabeth Warren

, underscoring the importance of cryptocurrencies to the Democratic agenda. Not only does cryptocurrency democratize financial services, it encourages collectively owned, open alternatives to tech monopolies, and provides liquidity to the historically disenfranchised, and its success could drive tax revenue and possibly even green investment .

We need to win the support of these technological advancers as soon as possible, because we never want to lose the US market. The policy of the United States will determine: whether we can have a ten-year golden growth period like the 1990s; whether other Western countries will slowly follow our footsteps to create a global central bank digital currency CBDC scenario. If Balaji's predictions are followed, the status quo in the United States will become quite dark, and Balkanization and ethnic division may even occur. But Punk6529's idea is more in line with my point of view, let's fight and win in America as much as we can.

In the remainder of this chapter, I will list: a) the players and key issues that need attention in the U.S. policy struggle; b) six substantive issues that need to be addressed head-on, stablecoins and bank risks, anti-money laundering, and tax avoidance , investment fraud and exchange regulation; c) the lack of technology in the two FUD (fear, uncertainty and doubt) issues of security rules and privacy; d) if we fight a protracted war in Washington, what kind of small victory.

secondary title

2. Setting the stage: real risk and self-regulation

We must at least maintain the moral high ground in our struggle against superior forces. Most of the real policy risks posed by cryptocurrencies are solvable, and there are significant opportunities to build relationships with policymakers and eliminate crises before they arise:

Transaction risk: Users’ encrypted funds are not FDIC-insured, and hacking, transaction disruption, and identity theft are all possible. On the other hand, if the user loses the key, or makes an oolong mistake, he may lose his own assets forever. Managed services should educate users on encryption risks and security best practices.

Stablecoin/Lending Risk: Central bank executives cannot respond to cryptocurrency booms and busts with adjustable monetary policy, nor can they act as lenders of last resort. This is a feature. But we should recognize that crypto does weaken monetary sovereignty in some regions (Argentina), a trend that will accelerate as assets like Bitcoin become the unit of account (El Salvador). Either the Fed loses control of the explosive crypto Eurodollar system (Tether), or it is wise to embrace projects like USDC and Paxos.

Bank integration risk: Bank access for cryptocurrency companies has always presented a single point of failure risk for the industry. Up and down access to the "real world", arguably the industry's only need for survival. We need more compliant, chartered cryptocurrency banks to prevent closure risks, as well as individual de-platforming risks.

Anti-money laundering monitoring risk: Illegal activity accounts for only 0.34% of cryptocurrency transactions (lower than TradFi), but the borderless and anonymous nature of cryptocurrencies makes bans and blacklists difficult or impossible to enforce. From the war on terror, the war on drugs, and the war on COVID, what people are paying, illicit activity in cryptocurrency exchanges is narratively bad in a political field driven by nirvana. We should continue to reduce illicit activity, while at the same time pointing out that the monitorability of the blockchain is very convenient for law enforcement.

Risk of tax evasion: If the government finds out that you have misreported your crypto transactions, or suspects that you have private transactions that you did not report, or thinks that you have a separate transaction with the wrong person, they may come to you with a gun. Most serious tax compliance issues center on incomplete and confusing information. So exchanges should accept tax reporting responsibilities on behalf of their users.

Preserving Privacy: When discussing the privacy of transactions, we cannot always agree. Reporting of peer-to-peer transactions, disclosure requirements for self-custodial assets are unconstitutional excesses. Please show the search warrant, or we'll see you in court.

This list is not exhaustive, but outlines significant issues. Before we delve into these issues, we need to understand both the currency circle and government regulation. The good news in this regard is that when you were looking for the gorilla NFT this summer, the uncles with severe brain damage were still playing cosplay in Washington (when the currency circle experienced NFT Summer, the regulatory officials in Washington had a vegetarian meal).

Leaving Congress aside, let's turn our attention to the regulators who will interpret, formulate, and enforce cryptocurrency policy over the next few years.

secondary title

3. Setting the stage: The dominance of the Financial Stability Council (FSOC) and Securities and Exchange Commission (SEC)

In the US, cryptocurrencies are at the mercy of the Financial Services Oversight Council (FSOC) and its 10 voting members. Also the Federal Reserve (Fed), Treasury Department, Commodity and Futures Trading Commission (CFTC), Securities and Exchange Commission (SEC), Office of the Comptroller of the Currency (OCC), Federal Deposit Insurance Commission (FDIC), Consumer Financial Protection Bureau (CFPB), and A number of other institutions less directly related to cryptocurrencies.

FSOC is a spin-off of the Dodd-Frank Act (Dodd-Frank) and is responsible for identifying risks and emerging threats to the financial system, which means that it has statutory powers to organize policy responses to emerging technologies such as encryption. The committee is chaired by the Secretary of the Treasury Chair, aimed at ensuring that the U.S. financial regulatory framework has no blind spots. Since the US accounts for 38% of the world's financial markets, the FSOC's impact is virtually global.

In the following sections I discuss how each regulator fits into our policy response, starting with a look at where each regulator stands today in the crypto space to understand where the future is headed.

***Treasury Department:***While Stephen Mnuchin is not an ally of cryptocurrencies, Janet Yellen is more against cryptocurrencies, and colleagues who work with her at FSOC are all in her league. Janet Yellen pushed the crypto brokerage provision during the infrastructure bill battle (remember: they were all against bipartisan amendments), and she showed a clear interest in strengthening tax enforcement, which is very unfavorable. Her support for a wealth tax also raises the prospect of a future IRS disclosure of cryptocurrency holdings.

*** SEC: *** Gary Gensler is an ambitious and capable political figure who has been calling for more powers to regulate crypto tokens and exchanges . Relying on his "patrolman" image, he tends to regulate through law enforcement. He even won concessions to take a leading role in stablecoin regulation, convincing a government task force that the assets amounted to “stable value funds.” So much so that Hester Peirce had to drop some bombshells to protect us from our 'protector' Gary Gensler.

*** CFTC: *** We lost "Father of Cryptocurrency" Chris Giancarlo (approved BTC futures), followed by Heath Tarbert (approved ETH futures), then Brian Quintenz (at least he went to a16z ). The new chairman, Rostin Behnam, is Gary Gensler's old CFTC team. None of the current commissioners are crypto-friendly, and vacant seats are not being filled quickly. Is this the rhythm of DeFi's law enforcement actions?

*** Consumer Financial Protection Bureau: *** Consumer Financial Protection Bureau is the child of Elizabeth Warren, and she hates cryptocurrency and wants the Consumer Financial Protection Bureau to crack down on the "abuse" of cryptocurrency. New chairman Rohit Chopra listed stablecoins as a key area of review by the team.

*** FDIC: *** Chairman Jelena McWilliams told the audience at Money 20/20: “We must recognize that our American values, culture and influence face increasing competition from abroad, competition There is also pressure to focus on fostering technological innovation and taking over the U.S. regulatory system." Thanks to Jelena McWilliams for the voice! Unfortunately, however, the FDIC’s role in cryptocurrencies is small compared to other agencies. I mention Jelena just to show that not all regulators are that bad.

It can be said that the cryptocurrency alliance in Washington has scheduled work for the next year.

secondary title

4. Encryption Alliance

In Washington, there are essentially five major players in cryptocurrency policy, mostly backed by businesses. Grassroots participation has been limited, aside from cryptocurrency-related Twitter accounts providing aerial support during major battles such as infrastructure bills. While not perfect, they've lifted their weight this year and gotten stronger.

**Token Hub:** OG Think Tank, Bitcoin-centric, cool inventor and bookworm gathering, keeps the team intentionally small. They are all people who focus on education and advocacy versus corporate lobbying, tending to focus on the big picture and constitutional issues (privacy, code as speech, and why cryptocurrencies matter and should be treated fairly). Coin Center chooses its own battles.

**Blockchain Association: **Top trade association, backed by major cryptocurrency startups, growing fast, lobbying hard and more aggressive. They also have to balance ego and consistency among members, a challenge for any trade association but perhaps especially acute in the crypto space. Ripple is a member, as is Messari. Binance US became a member, which led to the defection of Coinbase. Still, the Blockchain Association is the best, and this fall they got stronger (see Kristen Smith, Chapter 2).

**Crypto Innovation Council:** New trade association, spearheaded by Paradigm, elite supporters but little infrastructure. They have plenty of money, but too much to do and not enough time. This means that before the team is actually in place, during this cycle, it may be more influential as a coordinating member rather than as an actual organization.

**a16z Policy Team:** The large number of employees and top consulting talents, huge financial resources, influential founders and crypto fund GPs represent the extensive investment portfolio of the a16z policy team. Given the immediate threats we face right now, their "we're moving the agenda fast" approach is a necessary evil. They suggest a great starting point for Web3 policy. It's unclear whether Washington takes the a16z policy team seriously, or sees them as a West Coast novelty, but given their ability to move quickly, their success is arguably the most critical of the group.

There are other groups to watch, including the DeFi Education Fund and Fight for the Future. A number of tools are emerging to aid policy engagement (links to Congress), and we need a more grassroots organization to engage the base and ensure that populist voices in cryptocurrencies are adequately represented. I have been vocal about this need and will personally support grass roots with the right leadership. Messari will also invest in policy research.

We are looking for a leader to guide our policy work. (Join the fight, donate to Binance Central, apply to join the Blockchain Association)

5 Setting the Stage: Regulatory Scrimmage

5. Setting the stage: Regulating 'scrimmage'

Contrary to mainstream belief or political lines of attack, crypto entrepreneurs and investors want smarter crypto policies. We just don't want this technology to disappear because of regulations in the United States.

Don’t get me wrong, cryptocurrencies have benefited so far from the lack of a clear and unambiguous single regulatory body and regulatory rules. Exchanges will complain that they are spending too much money to satisfy Treasury, SEC, CFTC, OCC, DOJ, but that's the usual cost of doing business as a fintech money transmitter, and "jumping the ball" "Usually in their favor, because cryptocurrencies (obviously) thrive in gray areas.

Next year, this gray area will become even more black and white, and we must be proactive in getting policy right, while keeping the message flowing. In short, the crypto agenda boils down to seven key questions:

Ensuring financial stability through clear stablecoin rules and prudent bank consolidation (Fed/OCC)

Develop clear KYC/AML reporting guidelines while protecting privacy (FinCEN)

Clarify tax rules and develop Exchange Reporting Standards (IRS)

Creating a Safe Harbor for Community Governed Coins (SEC)

Introduce DAO as new organizational structure (Congress)

Unified Exchange Oversight (Creation of "Web3 Council")

Congress likes acronyms, and the above content can be combined into a proposal called SPECIAL, that is, 'special bill', which can cover everything—S: stablecoins stable currency, P: privacy privacy, E: exchange tax reporting exchange tax report , C: community Safe Harbors community safe harbor, I: Incorporated DAOs joint DAO, A and L: American Web3 Council Local experimentation.

Smart legislation seems like a big ask for a gridlocked Congress. Still, it is critical to U.S. economic competitiveness and national security, enjoys bipartisan support, and earns the government more tax revenue. Instead, stupid policies squander our early leads and send transformative tech ecosystems overseas.

In the next six sections, I will outline some areas where there is a philosophical consensus among cryptocurrency leaders and policymakers that some regulation is needed. But it is frustrating for policymakers to ignore these ideas and propose “solutions” that are at odds with actual policy goals.

secondary title

6. Crypto Eurodollars and Systemic Risk

“Crypto is the new shadow banking, but without consumer protection or financial stability as the underpinnings of legacy systems. It is spinning straw into gold.” – Satan

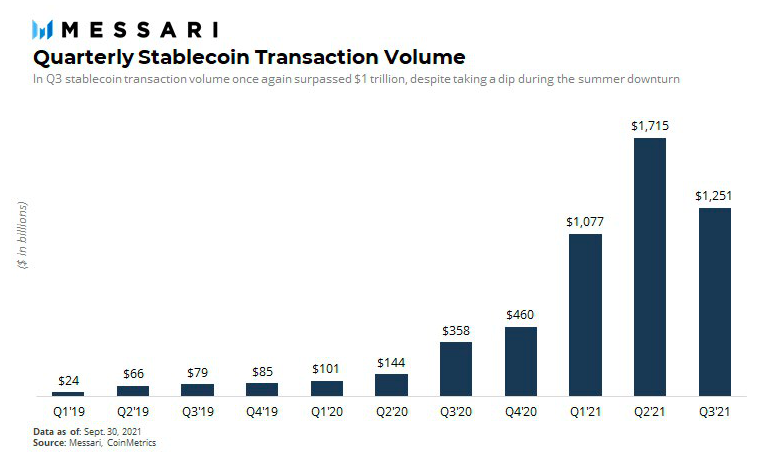

The first is arguably the biggest problem we face: the regulation of dollar-pegged stablecoins, which is a double whammy for policymakers.

First, there are concerns that stablecoin issuers are helping to create a parallel digital dollar economy outside of modern financial surveillance systems. To a certain extent it is true.

Cryptocurrencies are like digital cash. Banks keep the associated dollar deposits, ATMs (or in cryptocurrencies, exchanges) dispense the cash, and what happens to the cash after that is somewhat opaque. It can be "off the books" in a cash economy, or someone takes it back to the bank, which then tracks the deposit back into the regulated (and fully monitored) financial system. Cash monitoring is usually a FinCEN/IRS issue: AML and tax compliance fall under the purview of the Treasury Department. But with the development of stablecoins, the Federal Reserve has become more uncomfortable with the potential systemic risks brought about by its growth.

As an asset class worth $3 trillion, with more than $150 billion in stablecoins, an annualized on-chain transaction volume of more than $5 trillion, and stablecoin floor transactions that may be higher in magnitude, cryptocurrencies have begun to revolve around Follow the regulated banking business, which will affect policy.

Stablecoins power highly speculative banks and dollar-backed markets that offer rates high enough to obliterate its TradFi partners and competitors. DeFi lenders and TradFi lenders (commercial banks) do follow different rules, but banks don't think that's fair. For years, banks have been preaching to regulators — first with fintech, now with cryptocurrencies — “same activity, same risk, same regulation.” Chairman Hsu, acting chairman of the U.S. central bank, stressed that letting “universal banking supply If a merchant" adheres to a standard similar to that of a bank, it reflects what the bank advertises. Regulators are concerned that DeFi’s “operational risk” could spill over to the banks themselves that hold deposits.

FDIC Chairman McWilliams takes a slightly different stance: She believes entities issuing cryptocurrencies outside of the banking sector should receive one-on-one support to explicitly avoid operational risk. But here’s what’s different about today’s cryptocurrency market: To date, most stablecoins and lending activity has been done on a fully collateralized basis. The key, then, is to audit reserves and solvency.

The alternative to regulatory reserve transparency is a draconian crackdown, which looks more like an outright ban on stablecoins. That's what Senator Warren is advocating. What she calls "wildcat banking" (a term that was hilariously pushed to market by a leading risk modeler at AIG, which then resulted in $185 billion in losses and crashed the global economy), is more precisely , a by-product of years of regulatory neglect combined with a failure to connect cryptocurrency exchanges and banking services.

Of course, we could also pursue a central bank digital currency, but this approach will take time and is not without its problems. Going after a central bank digital currency means ceding leadership of better, faster, cheaper payment technology to other countries, all while trying to protect the old U.S. financial rails from competition. The current “crypto euro” problem will intensify. Foreign banks have created euro balances for transactions that never involved U.S. businesses or banks. Regulatory hostility could accelerate the growth of crypto euros like Tether.

The best would be to integrate cryptocurrencies directly into the US banking system.

secondary title

7. Smart crypto bank integration

“These things are effectively seen by users as bank deposits. But unlike actual deposits, they are not insured by the FDIC, and if account holders start worrying that they can’t get their money out, they could trigger a bank run.” “These are effectively seen by users as bank deposits. But unlike actual deposits, they are not FDIC-insured, and if account holders start to worry about not being able to withdraw their funds, they may try to cause a bank run.” — New York Federal Former Reserve Bank chief Lee Reiners

Another problem cryptocurrencies pose for policymakers is the potential systemic risk of bank runs. Bringing cryptocurrency exchanges into banking regulation may make more sense for policymakers than opening up cryptocurrencies to incumbent banks.

Stablecoins are powerful innovations that improve dollar interoperability, integration, and ultimately dollar export. They have also become systemically important in some markets. For example, a run or strike against Tether could create confusion in "real" markets like commercial paper, while USDT has no clear value to the US.

Introducing cryptocurrencies to TradFi Bank’s balance sheet, on the contrary, could be a scary idea. Standard banking processes may not be compatible with cryptocurrencies. Avanti CEO Caitlin Long, in a recent comment letter to the Fed, pointed out some important structural differences: How should the Fed handle hard forks and stablecoin deposits on blockchains? Considering the volatility of cryptocurrencies and the characteristics of real-time settlement VS current collateral requirements and daily settlement, how can banks deal with the risk of "bank run" within the day? Cryptocurrency lacks reversibility, can the Fed accept it? (No delivery failures, collateral substitutions, etc.)

From a cryptocurrency industry perspective, the direct integration and oversight of stablecoin issuing banks by banking regulators would also help mitigate one of the single point of failure risks, namely the concentration of “real world” uplinks and downlinks.

It's a big deal for anyone. Since the start of the year, Silvergate's book value has more than tripled, from a $300 million stake to more than $1 billion, while its shares have risen 10-fold since last fall. I expect several new crypto banks (such as Avanti) to become unicorns in 2022.

secondary title

8. Cryptocurrency is bad for (bad) business

Claims like "cryptocurrency is for criminals" are absolutely false - only the ignorant and the deliberately misleading will continue to spread the rumor. As mentioned earlier, according to Chainalysis, illicit activity accounted for only 0.34% of crypto transactions, which is lower than the incidence of illicit activity in “regulated” financial services. Among the 'regulated' financial services, banks have been a well-established conduit for money laundering by notorious cartel groups and tax-evading super-rich.

There seems to be a weekly reminder that using cryptocurrencies for illicit purposes can leave an excellent criminal trail for prosecutors. Those who manufacture products for black market services almost never escape jail time. Law enforcement will only get more resources and better tools: The Treasury Department has asked for more funding to track and fight crypto crime, and the U.S. Department of Justice has created a national cryptocurrency enforcement team.

If you use cryptocurrencies for illegal activities, you are more likely to get caught than cash crimes. The one exception (and acknowledged challenge) is ransomware. It creates a lot of headline risk, it's a big problem, and it doesn't have a very effective solution. That is, even if cryptocurrencies are "banned" globally, ransomware powered by cryptocurrencies will still exist, and cryptocurrencies will only be a black market currency. This is a small issue right now, and we need to call on businesses and government infrastructure to take action and make critical security upgrades.

Cryptocurrencies are not a panacea. Like any new open technology, criminals can use it too. This does reduce its value. The State Department seems to agree, and they pay anonymous cybercrime whistleblowers in cryptocurrency (which is "dangerous" but effective).

secondary title

9. Tax enforcement and tax products

Let's be real: No one wants to pay more taxes than they have to.

Tax laws are complex enough, but cryptocurrencies’ decentralized tools, lack of exchange reporting standards, and evolving financial models can make it especially difficult to track and consolidate taxable income each year. I understand why we got bogged down with the 'broker' language of the infrastructure bill, and how the Joint Committee on Taxation, scored improved cryptocurrency tax compliance as a $28 billion "payback" even though they didn't disclose that they were How to come up with these numbers.

Cryptocurrency accounting is a nightmare — and tax reporting even more so. Cryptocurrency investors are less likely to evade taxes, and it’s even harder for them to report clean data.

As an example, these are some of the problems you might encounter on a $10 billion+ exchange (they are all disasters).

Not having an on-chain transaction history of withdrawals for the past 90+ days makes it nearly impossible for wallets to identify transfers and track underlying costs.

No transactions and transaction history prior to 2020.

Orders are not consolidated, meaning that each order can take back 100 transactions, and each transaction must be disclosed on Form 8949.

Short sale tracking is not available in current tax preparation software because it would break the transaction validation engine of some services.

Add to that the challenges of valuing airdrops or illiquid forks, writing off complex DeFi transaction costs, or explaining seigniorage shares or partial NFTs to the IRS. What the United States is seriously considering now is to tax the unrealized gains! So besides the so-called "investor protection", what impact can it have on the illiquid cryptocurrency market?

The cryptocurrency tax report has drawn attention to the Fourth Amendment that caused unreasonable searches and seizures, but what should really be cited in the tax audit defense is the Eighth Amendment. I think cryptocurrency users, would be excited to have reliable tax reporting software that correctly classifies income, wallet transfers and capital gains and tracks cost basis while identifying liabilities and potential tax loss sales .

TaxBit is not a $1.3 billion company because crypto users refuse to pay what they are owed. It's a unicorn because it keeps people from going crazy.

I predict that in 2022 we will see a wave of mergers and acquisitions in the crypto tax accounting space as exchanges see signs of the ominous and comply with the new tax reporting laws laid out in the 'brokers' clause Invest (and frankly, it's very necessary). Unfortunately, I think at least one crypto tax accounting firm will go bankrupt and sell to the US government on a variable fee model to reward them for finding potential tax shortfalls.

I also predict that we'll also see little clarification from the IRS on dozens of cryptocurrency tax reporting issues (but you already know I'm low on confidence). One thing we do know: this may be the last year that cryptocurrency laundering vulnerabilities can be exploited.

secondary title

10. Dear Gary Gensler: Are you a partial or total fraud?

This year, I've been quite aggressive in tweeting about current SEC Chairman Gary Gensler. I'm going to try harder now. I think he's a liar, and I'll tell you why.

Before I unload, I should reiterate that I strongly believe in the mission of the SEC:

Protect investors - mainly to prevent information asymmetry in the investment market;

Ensuring the fair and efficient functioning of financial markets;Facilitating capital formation in the United States.That same mission underpins what we do at Messari.

We organize and curate large-scale cryptocurrency data in an attempt to level the information playing field, highlight risks and opportunities in the space, and ultimately drive well-informed decision-making—on new investments, new integrations, new governance proposals, and more. In my 2017 post I wrote about the need for a. Hester Peirce’s draft Safe Harbor and its disclosure framework closely aligns with the information we have been gleaning from the cryptocurrency community.existSo yes, I'm a fan of this quest and have been doing it full-time for as long as the token has existed. This pissed off some people, but I'll say it anyway: Ipersonalexistprotect investorsfree fromInformation asymmetry

In terms of impact than the SEC

More effective

. If we look at the spirit of the law, Messari will continue to outperform the SEC at its core mission.

We do not dispute the spirit of the securities laws, but rather their applicability to cryptocurrencies. The SEC seems hell-bent on asserting its authority over the entire cryptocurrency market: Web3 protocols, exchanges, the decentralized financial ecosystem, and even issuers of stablecoins. But before we give them that power, we should look at what options we have for oversight of cryptocurrencies. There are three types:

Allow cryptocurrencies to flourish with little regulation;

Strict application of securities laws to cryptocurrencies, inhibiting token innovation;

Accept the cooling-off period and safe harbor, and wait for Congress to provide a new, measured regulatory framework.Liberals would prefer #1. The SEC chair seems to prefer #2. Pragmatists will love #3.No regulator would willingly relinquish the powers they might demand, so No. 1 is out of the question. Relinquishing leadership pays no political points, and it's Congress' job to clarify where regulatory power begins and ends. Still, with Congress gridlocked, a smart regulator might assess whether their current approach is working. As far as the SEC is concerned, is regulation through enforcement action effective? Or is a new strategy necessary? Let's take a look at what the SEC is doing.Gensler is overstretching his staff,so much so that they may strike, while cryptocurrency builders are leaving their comfortable 9-to-5 place to join the 24/7 cryptocurrency wars. Cryptocurrencies have the distinct advantage of enthusiasm, as the builders here think their cause is just. When SEC policy favorssupport wall street

with the retail industry, or they block those who can help artists, gamers, musicians and other creators break free from exploitativeplatform freedomand innovation, do they deserve respect?

The SEC’s job itself is complex, expensive, and time-consuming — a game of whack-a-mole, given the exploding size and complexity of cryptocurrencies. When they pick a fight, they can end up antagonizing former senior colleagues who are now making multiples for another team. Imagine being in a high-stakes law enforcement casefight your former chairmanWhat is it like?

And when they do win, the wins come in handy: their most significant settlement was a deal over Block.One's $4 billion sale of EOS tokens back in 2017.

A paltry $24 million slap in the face

, the event was actually on a promotional billboard in Times Square. EOS token sellers kept the proceeds and then redeployed the $10 billion (EOS sale proceeds plus gains!) to a new private exchange. Token holders were given access to a broken, devalued network, while the original developers were effectively forced to walk away lest their efforts make EOS "look like a security." Meanwhile, Block.One transferred a historic fortune to privatization.

Is anyone on staff happy with this "victory"? can they

Projects applying to the SEC for a license run into a brick wall. SEC involvement either technically destroys the product, costs years and millions of dollars in legal fees for non-existent benefits, kills the product before it is launched, or charges the parties involved in court . In the cryptocurrency space, no one trusts the SEC, nor should they. (Others can't say that, I can say that).

The SEC’s expansive interpretation of securities law regarding cryptocurrencies doesn’t work, and it’s embarrassing to be honest that Hester Peirce seems to be the only leader at the SEC who recognizes the need to do things differently.

You might say: "Let's give Gary some time!". It's only his first year on the job, and he's juggling a bunch of different priorities. He didn't bring up Ripple's case, but Jay Claton did. He didn't block a bitcoin ETF for eight years, and he finally let one go through. He didn't write the DAO report, he didn't solve the Block.One case, and he certainly didn't write Howey's opinion. He's just working with outdated tools because Congress hasn't tackled cryptocurrency yet.

That's fair. So let's take a look at where he stands so far:

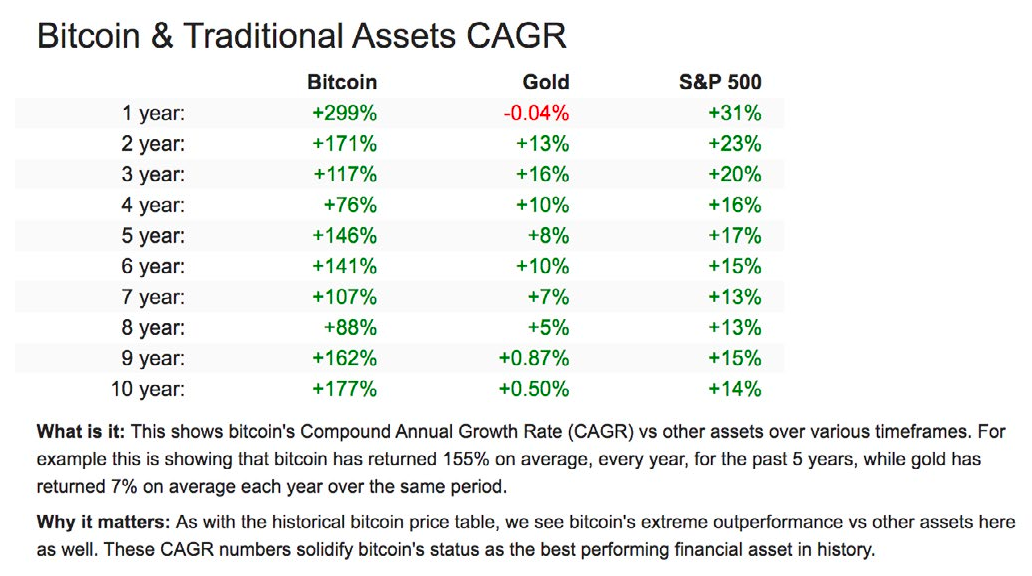

**Cryptocurrency ETFs:** I will elaborate on my feelings about Toxic Bitcoin ETFs in Chapter 5. Now, you know that the eight-year delay in SEC approval caused investors to miss out on an 800-fold appreciation in underlying assets. It was a catastrophic failure for the SEC's capital formation mandate.

It's not on Gensler. But here's the thing: Prioritize futures-based ETFs that incur hidden costs of 5–10% per year in "contract roll" (good for Wall Street), while spot-based ETFs are modeled after the world's largest Commodity Fund (SPDR Gold ETF). Why approve an exotic structure instead of a superior option with 80% lower fees and 40x higher liquidity? Well, Gensler wants to put the blame on the CFTC (the agency that oversees Bitcoin futures) and hold out until Congress grants him oversight over the cryptocurrency spot market and its exchanges. It’s a hostage-taking and an attempt to slow institutional inflows into cryptocurrencies, as few mutual fund managers would choose to hold such a toxic, expensive futures asset in their funds. When Gensler denies this obvious fact, he is operating in bad faith.

** SAFE HARBOR: ** Safe harbor against Hester Peirce is one thing. It's another thing to feign ignorance and lie to Congress. That's what Gensler did when he was asked directly about safe harbors by Rep. Patrick McHenry in October. He evades an answer (see for yourself) with a sly misdirection, and McHenry nails him with a follow-up question! ".

PM: "Have you reviewed Safe Harbor?"

GG: "I didn't review your bill."

PM: "Have you reviewed Commissioner Pierce's safe harbor?"

GG: "We're actively discussing a few things."

PM. "Specifically, have you reviewed Safe Harbor itself?"

GG: "We've talked about her thoughts on safe harbor."

PM: "Senator Serkis, you have the floor."SS: "Chairman Gensler, I don't care about the x chat with Commissioner Peirce. Answer the damn question: Have you read the document itself? It's eight pages and addresses your concerns about information asymmetry and Lots of concerns about investor protection. Have you read it? Have you read it or haven’t?”]

I know I'm being naive, but if you're in a position of power and you want an industry to trust your intentions, you shouldn't be lying to Congress and saying you know of a critical, well-publicized, clumsy, ineffective replacement for you ten-year strategic plan.

No Action Relief & Reg A+ Registration (No Action Relief & Reg A+Rsgistration):

Three years ago, former U.S. Securities and Exchange Commission Commissioner Bill Hinman suggested that emerging cryptocurrency networks, as they scale, may become "sufficiently decentralized" so that the exchange of their underlying assets may no longer represent public interest. Securities Transactions Governed by Disclosure Rules. Even if these projects were previously launched through token sales. If safe harbors don’t please, perhaps the SEC might advise on a path to “sufficient decentralization,” or at least expedite the Reg A+ process of bringing tokens to market?

Don't hold your breath. Props closed in August this year after raising $21 million in 2019. “Our failure to develop the Props token in a way that would lead to commercial success, and with no reasonable prospect of future given the regulatory framework, [made it impossible for us] to follow any proper product development akin to 'launch, measure, iterate'. "Blockstack spent $2 million and two years of legal work, but they at least survived the Reg A+ process themselves. They are now ranked 75th by market capitalization, although it is unclear whether any users have read their documents, and their tokens cannot be traded in the United States. It relies on overseas exchanges for its liquidity. What exactly can Reg A+ issuance bring to you? And Gensler wants new projects to continue to register and talk to the SEC this way?

** ATS Stonewalling: ** Gensler's most dishonest stance may be related to the now infamous exchange's "Come in, talk to us" line. Coinbase CEO Brian Armstrong went so far as to call the SEC’s actions “sketchy,” claiming the commission refused to meet with his company’s leadership or provide any written clarification on its rationale for blocking a new Coinbase lending product.

This behavior is gross. Coinbase and other exchanges have struggled to comply for years, and several have even acquired broker dealers. It was the SEC that got their broker application in trouble. over the years. See attorney Collins Belton's explanation.

This shouldn’t be a surprise! Gensler himself has said that it may not be possible to bring cryptocurrency exchanges into regulation, and that the path forward may need to be through the exchange’s incumbents! (“Should they even be allowed to register? The world will move on without these 200 exchanges. Someone else will fill the space. I know it might be a drama, but maybe it’s okay.

Message: The damage has been done, only national stock exchanges should be able to trade cryptocurrencies. This is blatant. And, since cryptocurrency experts aren't crazy, and we're notoriously difficult, we don't trust this guy. We know exactly who he is.We also learned from Ripple’s court proceedings that invitations to engage with the SEC were used as evidence against the aggressive party. Gensler recently told the Securities Enforcement Forum: "I have asked staff to reduce their meetings with those who want to discuss the arguments that Wells submitted." Come in and talk to us. We'll use that against you and then resist clarifying discussions. All right, Gary.

Peirce noted (of course) that the SEC’s invitation to crypto entrepreneurs is absurd given the SEC’s enforcement-focused approach: “Of course, Poloniex could try to register as a securities exchange, or more likely For brokerdealers, to operate alternative trading systems [and] wait...wait...wait a little longer. Given our slow progress in determining how regulated entities interact with cryptocurrencies, market participants may be surprised to see To the point where we’re now on the scene with law enforcement guns and arguing that Poloniex isn’t registered or operating under an exemption, as it should be.” That’s why she’s the only head of the SEC with an ounce of credibility in cryptocurrency.

Anti-ETH Pressure:

The SEC is also sneakily ramping up anti-crypto pressure in less obvious ways. They raised the temperature on Act 40 funds (the $30 trillion mutual fund and ETF industry) that consider adding exposure to non-Bitcoin crypto securities, like Grayscale’s ETHE. A fund manager told me his firm had received approval to hold ETHE from one of the SEC's regional offices, and a few months later the D.C. office politely called back with a roll of attorneys to let them know , “Actually, no, we haven’t blessed any crypto securities outside of a Bitcoin trust.” Several other fund lawyers confirmed that the SEC has been hostile to non-Bitcoin securities, essentially echoing Hinman’s previous Ethereum’s public comments cast doubt on it. Not even Bitcoin is bullish. It's just been grandparented.

**Stable Value Coins:** The most transparent power grab we’ve seen has to do with Gensler’s push for oversight of the stablecoin market, which he’s tipped U.S. securities exchanges by cleverly renaming “stablecoins” to “stable value coins.” This power was obtained in tribute to the "Stable Value Fund" overseen by the Commission. To be honest, I have less of an issue with this than with his other positions. As previously discussed, solving our bank integration challenges may be better than continuing to back stablecoins with commercial paper or other illiquid products.

**America Crypto vs. China Stonks:** I know "what doctrine" is not great, it's a debate based on facts. But it should make you angry that Chinese companies trade freely on U.S. stock exchanges while willfully circumventing securities disclosure laws, while U.S. cryptocurrency innovators are not given the same tolerance, despite more bona fide participation.

**Who is protecting, who is it? **Cryptocurrencies are beginning to highlight the destructiveness of the 80-year-old "40 Act" and its outdated accredited investor rules. These rules prevent users from being rewarded with earned tokens. They prevent companies from going public until most of their growth is captured privately. Something like investment company ownership rules doesn't prevent fraud, it makes it possible. (I've seen it myself.) The income and wealth thresholds for certification are inherently exclusionary and racist. Of course, someone sober enough to insist on avoiding the title "Chairman" while embarrassingly insisting on referring to Satoshi as "she" would be interested in the popularity of cryptocurrencies in the underserved community, and note that to their vote of no confidence in TradFi. Is it right?

(source:Case Bitcoin)

Underrepresented groups are indeed voting with their wallets (13% of white investors have been exposed to crypto compared to 18% of black, 21% Hispanic and 23% of Asian investors) , but the SEC continues to work to stop them. This paternalistic approach is especially stunning given that cryptocurrencies have delivered the goods. It's the "only" asset class where retail makes more money every step of the way than institutions, with more opportunity. The industry has simply outperformed everything. It is the ultimate tool to protect the investors who need it most – the historically disenfranchised.

image description

(source:

That's a lot of evidence against Gensler. However, "liar and fraud" are terms that imply malicious intent. Could it be innocence and dishonesty?

To hell with the SFC mission. He's holding an entire nascent industry hostage -- partly at the behest of Senator Warren -- as he courts his ascent to Treasury secretary.

Look, I've dealt with some smart, talented, serious and well-meaning professionals at the SEC. I won't mention their names here (for reasons that may be obvious now... I don't want to get them into trouble), but I do respect them and in a perfect world I'd love to be more involved in our shared mission close cooperation.

Gensler held them back. He is a liar. American investors and SEC staff deserve better.

secondary title

11. Ripple vs SEC vs Safe Harbor

How should I put it, I'm not a Ripple fan. I call the company the Jekkyl and Hyde of crypto: cool, real-time gross settlement and remittance tech, but shady MLM-level marketing and retail dumping of its concentrated hidden XRP. If you've been in the cryptocurrency space for long, you know that Ripple CEO Brad Garlinghouse and I don't exchange Christmas cards. But since the day the SEC took enforcement action against them last fall, I've been rooting for them to win against the SEC because the case feels dirty and could create a terrible precedent.

We know from Ripple’s court proceedings that despite three years of meetings with company executives, the SEC never told Ripple or its partners that the Commission considered the company’s digital currency, XRP, to be a security until they initiate enforcement action. That alone is convincing. I'm not a lawyer, but I know that enticing a company to participate for three years and then suing with no prior warning is not a good way to create policy around an emerging market.

Especially since, unlike many other crypto tokens, XRP has actually been used legally as a bona fide currency for cross-border payments. In "I Saw You XRP," I published a critical article three years before the SEC's enforcement action (which would protect investors from the 95% XRP that emerged after my article) % above correction), I outlined the problem.

“XRP could rapidly emerge as a viable potential “bridge currency”^ that could serve as a reserve asset held by institutions that do not trade certain currency pairs frequently, e.g. correspondent banking systems wishing to settle transactions in local currencies Find a foothold outside of Tier 2 banks. XRP “rewards” can act as an incentive to make it more attractive and reduce costs for early partners. If Bank A in Africa doesn’t do business with Bank B in Latin America very often , how do they settle their peso-denominated debt? Often they settle through another correspondent bank that uses the larger reserve currency — multiple hops to complete the same transfer, with each middleman getting a cut of the action. XRP This process can be simplified, early adopter banks can save money and win from holding XRP early, and the network can gradually decentralize. Unlikely, but possible.”In my analysis, I did not take issue with the company's use of XRP, but rather with its selective disclosure around XRP sales, deliberately blurring the lines when touting its growing XRP volumes (at the time due to exaggeration/faking by overseas exchanges volume), and often hint at new liquidity and buy-side interest from institutions and retail. This was dirty marketing, and the company deliberately confused (and still does) all of its related party transactions and XRP-related sales. We tracked the funds and updated XRP’s market cap accordingly as we discovered that insiders were selling billions of dollars in tokens each year that had been counted as part of the “circulating supply.” We found insiders selling billions of dollars in tokens that were already counted as part of the asset’s “circulating supply” each year.

That’s the safe harbor situation, in a nutshell: If Ripple complies with the ongoing reporting in Commissioner Peirce’s draft proposal, this XRP supply asymmetry will disappear.*(iii)(D) There is sufficient information for a third party to create a tool (such as a blockchain or distributed ledger) to verify the token transaction history. *

This will ensure that Ripple supports freely available and forkable block explorers.*Prior Token Sale. The date of the sale, the number of tokens sold prior to submitting a notice relying on the safe harbor, any restrictions on the transferability of the tokens sold, and the type and amount of consideration received.

*This is all real Ripple historical sales including lockup period and business partners.

(v) (B) a description of the number of tokens or rights to tokens owned by each member of the initial development team, and any restrictions or restrictions on the transferability of tokens held by such persons;

This will track Chris Larsen's Brad. Garlinghouse's, and Jed McCaleb's ongoing sales, as well as sales from foundations affiliated with the company.

Under the safe harbor, Ripple will have three years to develop a distribution and decentralization strategy. That would be pro-growth, pro-innovation policy. And, either the company would clean up its ongoing reporting, or Ripple and its executives would face enforcement action — not for violations of securities registration, but for fraud.

The policy goal of the safe harbor should be to weed out fraudsters and scammers through transparency of choice. Retain those involved in cryptocurrencies with serious and laudable goals, help foster innovation in the startup phase, encourage decentralization of tokenized networks, and pursue big ideas without tripping up to protect investments the laws of the On top of that, open standards are evolving much faster than 80 years of pre-computer securities law.

I predict that the SEC will continue to be a drag on US crypto companies, that things will get worse before they get better, and that Gensler will continue to ignore Peirce's safe harbor proposal for as long as his master, Senator Warren, tells him.

secondary title

12. The Privacy Controversy

It's sad, but our digital privacy rights are an afterthought for policymakers. Under the banner of "national security," "catch the bad guys," and "collect taxes," they think, they'll be able to peer into our digital lives without limit. The worst parts of the infrastructure bill — the expanded “broker” language and the 6050i reporting provisions — put the industry in a particularly precarious position, potentially violating First and Fourth Amendment rights, and will be challenged in court.

The "broker" language in the infrastructure bill is both dangerous and vague. It can be used to capture individuals writing code, validators processing transactions, and active cryptocurrency governance participants. The language is ostensibly to ensure that DeFi transactions can be monitored and taxable events reported to the IRS. But with the Treasury seriously considering a wealth tax, the "ambiguity" appears to be more intentional. To recall again, the Treasury opposed the amendment proposed by the Cryptocurrency Alliance as a fix.

The other big battle, of course, is over 6050i, which generally requires businesses to file reports (including names and Social Security numbers) when they receive more than $10,000 in cash from counterparties. The Infrastructure Act updates 6050i to include cryptocurrency reporting. According to the Proof-of-Stake Coalition, which initially seized the provision, the new rule would go beyond the Bank Secrecy Act by empowering Americans to collect and report information on their fellow citizens that the government itself cannot obtain without a warrant. of this information.

"The bank is a third party in the transactions of its customers. Bank users voluntarily hand over transaction information to the bank as a condition of using the bank's services, and the bank retains this information for legitimate business purposes. This is the essence of the so-called "third party" theory , which exempts the Fourth Amendment from the authorization requirement.”

In peer-to-peer transactions, there is no third party. However, according to the new 6050i language, Alice and Bob can exchange BTC and ETH and be widely reported by each other. In these cases, the extreme interpretation of the 6050i is that non-compliance could result in felony charges and up to five years in prison. This would effectively prohibit intermediary-less transactions, as it would make compliance in certain marketplaces (NFT art sales) functionally impossible. Does that keep us from the terrorists, Dad?

If these two provisions are not directly amended, they will be challenged by the Constitution when the time is right.

13. Incorporating DAOs (Incorporating DAOs)

ZK Snarks vs Surveillance Capitalism

The smartest policy advice I've seen this year comes from a16z. In their presentation to lawmakers and regulators, they start with the reasoning behind "Web3" — that user ownership promotes financial inclusion by making people owners and democratic voters of the platforms they use, which creates One that opens up the big tech companies to competition and ensures that the future of the internet will be open to corporate or authoritarianism.

It struck a chord. It also helps us push our focus beyond DeFi and cryptocurrencies to grab things like non-fungible tokens (NFTs), internet connections, and data storage networks. The future of the Internet itself.

image description

But a16z also did something important that wasn't obvious: they removed the emphasis on tokens and put them where they should be: DAOs as a new legal structure.

certainly!

The trillion-dollar question for cryptocurrencies is “how do we effectively decentralize” and “how can we govern the open internet well”.

This is the right path forward, but it also begs another question: If commodities have the CFTC, currencies have the OCC, and securities have the SEC. Do Tokens Still Need a Regulator?

Maybe.

(Further reading: A16z Win the Future, An Agenda for Policymakers, Jesse Pollak's note)

secondary title

14. US Web3 Council

Besides the regulation of stablecoins, which probably should be handled by some combination of the OCC and FDIC (rather than the SEC), crypto is big enough, and transformative enough, that it needs its own regulator, and one that might oversee a crypto custodian and the self-regulatory body of the exchange. Ironically, this regulator may look like a combination of the OCC and FSOC.

The regulator's focus is likely to be on entities such as Coinbase and Kraken, as well as Anchorage and BlockFi, which handle cryptocurrency custody for clients. But it can also act as a coordinating body to coordinate with other agencies. Break jurisdictional ties and close the door to attempts to seize power.

The U.S. Web3 Commission could work on things like implementing Hester Peirce's Safe Harbor, referring cases of fraudulent and bona fide securities offerings to the SEC. It can work with the CFTC on the supervision of DeFi market makers and the regulation of the perpetual market. It could work with the IRS to develop tax reporting standards to address 1099 issues with cryptocurrencies. It could work with the IRS and other agencies to create a new taxable legal structure for the DAO.

Most importantly, it can get ahead of new cryptocurrency policy priorities that we have not yet considered or have yet to emerge. Emerging how we can address issues of privacy, data permanence, intellectual property, and more in the blockchain and metaverse. How do we approach accountability and oversight of token governance networks like DAOs?

Coinbase proposed a dedicated regulator/SRO combination in their recent policy proposals, and I think they do a good job of laying out the broad outlines:

Given the unique properties of digital assets, create a new framework around digital assets

Appoint a dedicated regulator to deal with the challenges of the digital asset market

Prevent fraud and market manipulation in these markets

promote interoperability and competition