Related Reading:Topic | Messari 2022 In-Depth Research Report on Encryption Industry

The original text is from Messari, the original title is "Crypto Theses for 2022", translator | W3.Hitchhiker

Topic | Messari 2022 In-Depth Research Report on Encryption Industry

The original text is from Messari, the original title is "Crypto Theses for 2022", translator | W3.Hitchhiker

Chapter 1 Top Ten Investment Topics in the Encryption Market

secondary title

1. The collapse of institutional trust

Why do we need to know about this?

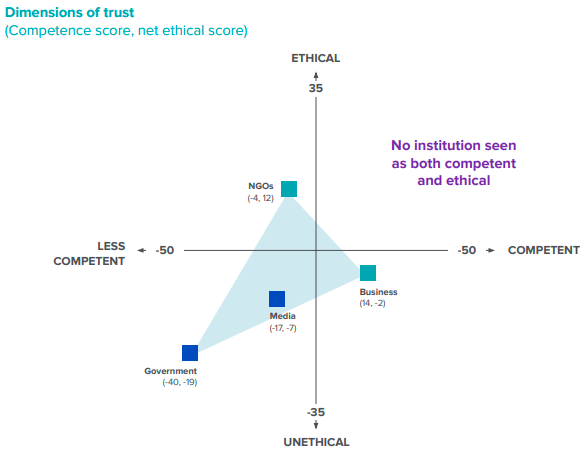

Maybe you're just a populist -- from the "left" or the "right" -- outraged to learn of the "evil" behavior of Wall Street, which caused the last financial crisis and was largely unaffected by it , and even want to benefit from the federal government's policies. Or maybe you're worried about big companies monopolizing markets, censorship, and the privacy of your personal data. So for you, cryptocurrency is the "silver bullet" that breaks through all of this.

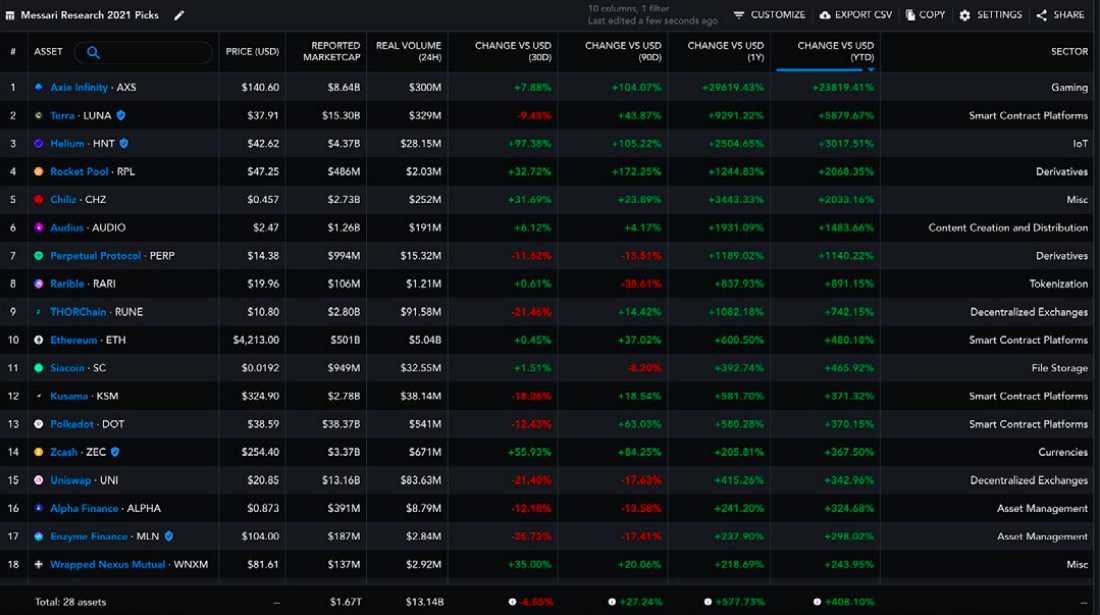

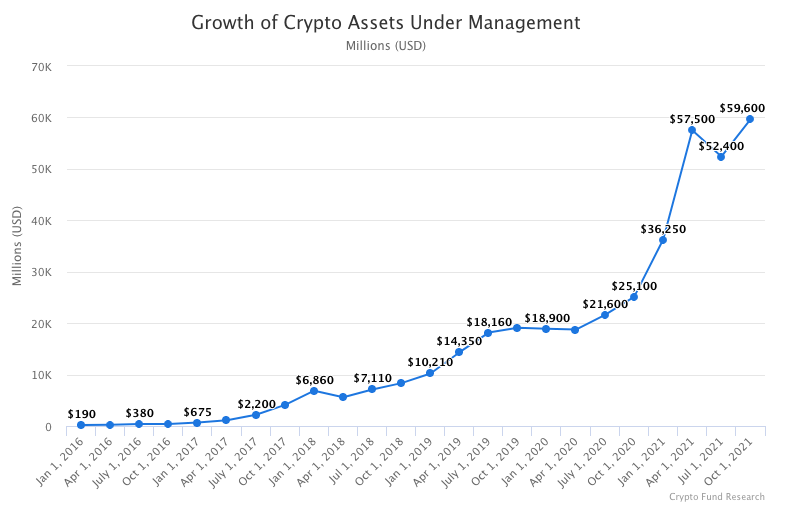

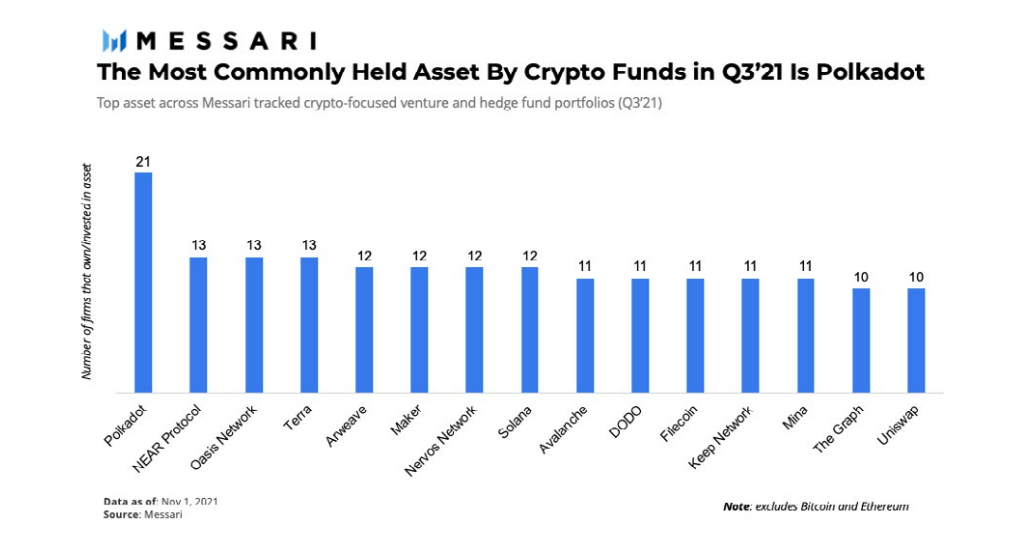

(source:Whether you are a "preacher" or a speculator in the encryption world, you will find that the power that set off this encryption movement is our pursuit and yearning for the belief in decentralization. Web3 (the organic combination of decentralized web and financial system) is an excellent solution to replace the declining traditional institutional system. Which brings me to my first prediction for 2022: unless we all live in a more real world, everything will only get worse. Inflation will remain above 5% through 2022 (70% probability), while rate hikes at the end of the year will dampen stock market momentum and hurt growth stocks (60% probability, and the S&P will fall next year). In the short term, these signals will be beneficial to the development of cryptocurrencies, but in the medium term, the risks of the cryptocurrency market will rise, because more users will be forced to "strip" the market, and cryptocurrency companies will face various risks. Comprehensive review of banking institutions and governments."secondary title 2. The arrival of encryption world/Web3 is inevitable This is the only bearish forecast in this report. The encryption world (recently popular term is "Web3 ), in the long run, its development momentum is unstoppable. Chris Dixon called it "an Internet that is owned by builders and users through the medium of tokens." Eshita describes the evolution of Web1 to Web2 to Web3 as going from "read-only to read-write to write-read-own". No matter which model you prefer, in the long run, users' benefits in web3 are higher than those in web2 (monopoly Internet economy). In this report, we will analyze and interpret many contents step by step, but there is only one theme: We are moving from the Internet hegemony era of "lease land" to a new era full of infinite possibilities. On this frontier, the development of cryptocurrencies seems to have set off an inevitable revolution, and it scares all profiteers in monopoly economies. In fact, we already have all the key ingredients needed for success: Talent: Talented, passionate, visionary young people are pouring in and building the crypto world Capital: The cryptocurrency market has raised a large number of venture capital funds, cryptocurrency startups have begun to raise funds, and the number of emerging liquidity protocols on the Internet is also growing rapidly. Time node: During the last bear market, the key infrastructure of the encryption world has been deployed. At this time, launching the "encryption movement" (a technological revolution with a certain political nature) is easier to be accepted and tolerated by society. In a recent article by Eric Peters, he mentioned that we are in a period of social transition. The younger generation is keen on emerging investments, and they are unwilling to invest in the traditional investments that the older generation likes, because at present, traditional institutions will only help the older generation who have accumulated a large amount of assets to continue " Create wealth”, and these emerging investment methods have the opportunity to disrupt (or even bankrupt) those traditional investments. This tension is inevitable, and young people have come to realize that traditional institutions are exploiting them. DeFi offers savers a 5% annualized return, compared to Wall Street's 0.5%. The emergence of NFT (Non-Fungible Tokens) provides creators with greater opportunities to make money, and will not take a 50% cut like Hollywood. The emergence of GameFi and SocialFi has broken the monopoly situation, leading Internet companies will lose 100% of the market share, and institutional risks have also been reduced. I have 99% confidence that the cryptocurrency market will have an order of magnitude growth by 2030, because this market has a strong attraction with huge expectations. We are in a period of comprehensive transformation of the global economy. The emergence of cryptocurrencies will have a greater influence than mobile communications and even the Internet. Although we are vacillating in the special cycle of the encryption market, it seems that the market is still hot and the capital market is still undercurrent. Therefore, I divide the follow-up trend into three situations: The entire industry soared into the sky, directly creating a bubble of 20 trillion US dollars, which lasted for a whole year, comparable to the current prosperous Internet industry-although this is more like a joke, but considering the global loose monetary policy, It's not out of the question that government deficits have been widening and the cryptocurrency market is gaining momentum. Ironically, the most bearish scenario for the market here (entering a bear market after the outbreak in the first quarter of 2021) may be the most bullish scenario for long-term investment, and vice versa. At this stage of our development, "hyperbitcoinization" and a permanent rise in the cryptocurrency market can only happen in a very "dystopian scenario". secondary title 3. Bridges, NFTs and DAOs "Web3" can be said to be all-encompassing, it covers cryptocurrencies (digital gold and stable coins), smart contracts (L1&L2), decentralized hardware infrastructure (video, storage, sensors, etc.), non-homogeneous tokens NFT (digital ID and property rights), DeFi (financial services for exchanging and mortgage web3 assets), Metaverse (creating digital land in a game-like environment), and community governance (DAO, Decentralized Autonomous Organization). I expect the growth of the entire Web3 to involve various areas, but three areas are particularly underdeveloped: NFT infrastructure, DAO-related construction, and cross-chain bridges. We are witnessing a rapid growth of innovation in the NFT field, like a Cambrian explosion, and this is just the beginning. I am not sure how big the bubble of a single NFT in the market can rise, but I know that there is still a lack of reliable and universal NFT infrastructure. NFT trading platforms, financialization primitives, developer tools, community-oriented business models, and decentralized identity/credit management systems are all in their infancy. These core infrastructures will be one of the hottest investment areas in 2022. One of the core issues lies in the "channel" of cryptocurrency: scaling and interoperability solutions. If these concepts sound foreign, that’s okay, you can carefully read the NFTs part (Chapter 6), DAO part (Chapter 9) and L1 interoperability part (Chapter 8) of this report. secondary title 4. Decoupling of the crypto market Different areas of the encryption world have different value orientations. Our perception of the industry has changed from "everything is cryptocurrency" to "can be divided into tokens, smart contract protocols, DeFi applications, decentralized network platforms, NFT, W2E (work-to-earn) market ..." “During this cycle, the market validated that non-mainstream digital currencies still have uses. In previous cycles, it didn’t make sense to be an expert in the field of cryptocurrencies. 4 years ago, Defi and NFTs basically didn’t exist. Big Most of the other "sectors" don't exist and don't make sense. We used to think that "decentralized file storage", "smart contract platforms", "privacy", etc. had a separate relationship with cryptocurrency, and then it turned out that this perception Very arbitrary and ridiculous. Now, a defi yield farmer or NFT speculator can become a full-time career, and you even need a small team to follow each track to keep up with the pace of the market.” Cryptocurrency funds are going through the biggest moment of their lives right now, and that momentum will likely continue well into the new year. The amount of capital that has entered the crypto market this year is mind-boggling. (source:Crypto Fund Research) These dedicated cryptocurrency funds have raised record volumes and grown their core assets. Some of these funds (such as Multicoin) may be among the best performing investment houses of all time, and it's not hard to understand why they can access a lot of liquid cash without pressure. image description (source: It is difficult to imagine the size of the private cryptocurrency fund market at the moment. When DCG raised $25 million in 2015, it was one of the largest funding rounds among cryptocurrency investment firms at the time. By now, Polychain, Paradigm, a16z, Multicoin, 3AC, and a few others each manage billions of dollars (sometimes $10 billion or more), with 2,500 every once in a while in their mid-size transactions million dollars in cash flow. Hedge funds plan to invest 7% of their assets in the encrypted market within 5 years, and pensions can also be used for direct purchases. In the context of negative interest rates, large capital allocators are continuing to improve asset allocation efficiency, and most people can no longer ignore the encryption market. It’s okay if you don’t want to have direct exposure to the crypto market. The demand for cryptocurrencies has given rise to a boom in the crypto market, and corresponding hedging exposures have emerged in the market. In fact, such institutions already existed at this time. secondary title 6. Where is the upper limit of the crypto market?We all know that a "crash" is coming, and this time the cycle may be smoother than before, but we said before that there is still "residual heat" in the market, so before the crash, how much room for the market to rise is left? What is the signal of "touching the top"? Is Shiba Inu market caps at $30 billion? Or is there an NFT billboard in Times Square? Now let's talk about what I think are the "peaking" signals, starting with Bitcoin. 1. Bitcoin: The king has no real opponents (I will explain why in Chapter 3). As a non-yielding monetary asset, Bitcoin is often used for pricing and valuation, so it is often compared to its "cousin" - gold. However, Bitcoin still has fundamentals worth tracking. The best judge is probably the "market value to realized value" popularized by Coin Metrics. This is a ratio calculated by comparing the market capitalization of bitcoins in free float (the amount of currency in circulation over the past five years) to its "realized value" (the sum of the price of each bitcoin in circulation on the chain at the current time). When the realized value soars, the market capitalization can remain the same, and vice versa. One is a "snapshot" of Bitcoin's current currency price, while the other is a dynamic measurement indicator with traffic added. If you're not a HODLer and can't stand a four-year bear market, then whenever the MVRV hits 3, that's the best time for you to benefit (sell a kidney to buy when the MVRV falls below 1). In the previous three "double bubbles" - almost only indicators such as MVRV can be used to look at the market, because the previous "bubbles" are hardly recorded on the price chart, and the time when MVRV is above 3 is gradually shortening. In 2011, the MVRV stayed above 3 for four months. In 2013, it was there for 10 weeks and in 2017 for three weeks. Earlier this year it only stayed for 3 days.What would it mean if history repeated itself? When the MVRV reaches 3 again this year, the price of Bitcoin will reach the $100,000–125,000 level! If things develop to this extent, Bitcoin's next goal will be to benchmark the market value of gold! At today's gold prices, parity with gold's market value means that the price of Bitcoin will reach $500,000. So Bitcoin may still have a 10x investment opportunity. But judging from the historical rate of return of Bitcoin, this rate of return is not high. (Of course, unless the ceiling disappears completely, which means that fiat currency is invalid, we have already defaulted to pricing in Bitcoin. 1 BTC = 1 BTC) **2. Ethereum:**Recently, there has been a lot of "hype" talk from the ETH giants. Can ETH Overtake BTC This Cycle? The answer is unlikely. Not only because Ethereum is facing expansion problems, but also because the current public chain competition is fierce, and the market is more inclined to build a multi-chain parallel ecology in the future. I'm still wondering, can all other public chains "jointly overthrow" Bitcoin like FAMGA's market value exceeds M1? (h/t Arthur Hayes metaphor) **4.DeFi:So can Ethereum surpass Microsoft, Apple or Google? At present, Ethereum is 3–5 times worse than them. Can ETH exceed the sum of the market value of FAMGA? That’s 15–20 times worse, and this requirement is quite high. After all, Ethereum currently accounts for 5% of FAMGA’s total market value, and ETH is still very “cheap”. ***5.NFTs:** Upstarts in the crypto world are vying for the No. 3 spot ($60 billion) in the crypto market cap. The same goes for Polkadot ($40 billion) and Avalanche ($30 billion). If these public chain protocols that want to replace Ethereum think that they have a higher beta coefficient than ETH, they will erode Ethereum’s market share and shake its dominance, have you ever thought about Terra ($16 billion), Polygon ($120 billion) billion), Algorand ($11 billion), or Cosmos ($7 billion)? There are two points of market competition, business development (creation and deployment of applications) and ecological drainage (whether it can attract developers to build projects on non-Ethereum blockchains). The "Ethereum Killers" all have enough capital to compete fiercely, but as an investor, your choice is only the winner, or buy the basket (looking at the dominance of Ethereum). Either way, these assets are pegged to ETH. ***Given that NFTs are unforgeable and extremely illiquid, it is difficult to make any kind of generalization about the "market capitalization" of NFTs. DappRadar estimated the market capitalization of NFTs at $14 billion in early September, a figure that has been rising until now. Since NFT has opened up a design space for cryptocurrency users and created another encrypted economic system, the development prospect of this field is quite good, and the expected scale is terrifying. Meltem believes that the market value of the NFT market can reach at least the level of LVMH ($375 billion), while Su Zhu believes that the market value of NFT will reach 10% of the entire encryption market ($225 billion). I don't think they are wrong, but to a greater extent this just shows that there is still a lot of opportunity for NFT minters, and there is still a lot of room for market infrastructure construction, and it does not explain the investability of most specific NFT projects . (See Chapter 6). secondary title 7. The bear market is long We love the cryptocurrency markets, we love them for the long and short term, but the medium term is the most fascinating. "When is the market going to crash?" I don't think you'll really understand it unless you've been through the long bear market in the crypto world. In the cold winter (very long bear market) of the crypto world, many people will lose faith, unable to bear the breakdown from the soul and years of suffering. "The government may step in to regulate", "It is still too early for these products to be launched" “I told you it was a bubble” will be a lot of bearish statements like this. In addition to huge paper (or real) losses, you'll see people break down, go bankrupt due to excessive leverage (or poor tax planning), become pessimistic and apathetic, abandon other promising projects, and generally lose Long-term expectations for the crypto market. To make matters worse, the next bear market will be a regulatory nightmare, and we will not have a bull market atmosphere to help us defend against the problems we face, such as the protection of consumer rights, market fraud and product abuse, systemic risk , ESG and market conduct compliance, etc. At the same time, the number of "grassroots" groups in the encryption market will drop significantly, because when you lose 90% of your savings, you will have to find a real job, and it will be more difficult to "fight" against the traditional market. It all sounds brutal, but this time maybe it's not so bad. After the market collapses, you must first return to your original heart. Whether you still believe in everything in the encrypted world, you need to ask the following questions silently in your heart. Is the centralized world really in decline? In the future, is Web3 the "chip" we are looking forward to against the traditional world? Are the building blocks of the new domain we envision (bridges, DAOs, NFTs) still worth investing heavily in the next phase? In the next down cycle, is it easier to find projects with strong fundamentals? Is there still ample funding available to fund interesting projects? Do you still believe that the crypto market will return to the bull market in 5–10 years? If you still believe in all this, put on your helmet, embrace the winter, and heed these "winter survival tips": Leverage early, spot tax timing, cash out in time, don't try to speculate on "peak" time. About leverage: This should be self-explanatory: if you are not a professional trader, your leverage is just a money transfer in the eyes of professionals. Cryptocurrencies are very volatile and have huge upside. You don't need to gamble here and get in debt for it. On taxes: most people know not to go into debt for unnecessary investments (like buying Dogecoin with a credit card), but also ignore their "leverage" without adequate planning - in December, Remember to sell and cash out as there will be taxes to pay. If you start with $10,000 on January 1, 2021, trade, hold $100,000 on December 31, and lose $25,000 on January 1, 2022. Then you owe more money to the government than you own assets, your "show" ends here, thanks for participating. About the short: Please do not short. Even if you're right, you're likely to blow yourself up by not timing it well. If you lose, people will dance on your grave because they won. Even if you win, no one will like you, and you lose long-term expectations. PS: I'm just here to remind everyone, I don't ask you to do it. Another thing is to remind those speculators that they will feel that this is an excellent time to buy cheap coins in a bear market. But the market can definitely collapse more than you think, the currency price will fall lower than you think, and the bear market will be longer than you think. The memes-like state of the encrypted market is like a drug from hell. It is easy for people to get high. You will slowly feel the pain disappear, but it will take a while to detoxify. If you are an employee of an aspiring Web3 company, it is definitely not a bad choice to work for an "infrastructure company" with a lot of money. Before the job is signed, remember to ask the recruiter about their company's track situation and cash situation (most of them should be fine at this time). In a bear market, you no longer need to consider digital currencies on your personal balance sheet, and you need to be more cautious at this time. secondary title 8. The public's choice: Coinbase opens the door to traditional markets Will cryptocurrencies outperform the companies that back them? While Coinbase's market cap at $70 billion was awe-inspiring, Coinbase's market cap hasn't kept pace with Bitcoin since their Series B round in 2013. And such examples are not uncommon, and many other infrastructure companies that are considered "blue chip stocks" are also struggling to keep up with the pace of cryptocurrencies. On the bitcoin front, decentralized investment firm Digital Currency Group is a veritable crypto asset burner, with its market cap down about 80% in BTC terms since 2015. This number gets uglier when you compare these companies to tokens from mainstream public chains like ETH. The birth of cryptocurrency IPOs and ETFs is more important to attract institutions and strengthen mainstream acceptance of cryptocurrencies than to help retail investors earn returns. Coinbase is poised to become a trillion-dollar company. BITO ETF is the fastest ETF ever to raise $1 billion. These ETFs open to the public are like tickets to the crypto world, they may be important to your parents (referring to the older generation), but not so much to your friends, they can get better Cryptocurrency-native instruments (including tokenized derivatives and related indices). (In Chapter 4, learn more about Gary Gensler, and in Chapter 5, learn more about the unreasonable things that happened to ETFs) secondary title 9. Imitation plate and wind direction Sometimes in the crypto market you don't need to think too much. The positioning of venture capital in the crypto market is changing, with gains reaping for both builders and those investors who quickly catch on. Because the market is inefficient but reflects trends too quickly, it is necessary to suppress the winners and eliminate the losers. As the currency price of SOL rebounded, more funds poured into the solana ecology, and the assets on the solana ecology earned more than those on Ethereum, and the applications on solana were also constantly being updated, and new applications attracted More gazes, and the virtuous circle continues. These are driven by top traders, but skeptics see them as Ponzi schemes. Now there are more information channels. You can listen to FTX explaining how to hype assets, or read articles written by big Vs on social media (such as Twitter), or you can look at the top 20 funds and compare them. Assets held to enrich your investment portfolio.* Messari Pro Q3 Fund Analysis*) (source: secondary title 10. Information disclosure (not investment advice) Our analyst team discloses their asset holdings on a monthly basis. Our team is getting bigger, so this section is getting longer. The following content analysts each provide an overview: 5% or more of their current portfolio holdings; TBI The best/bad year in my heart in 2021; Their expectations and thoughts for 2022. The following is not investment advice, so do not sue us for disclosing these potential risks. Also, don't take portfolio advice from second rate idiots, past performance is not indicative of future results. FEI*, OpenSea* Best of the Year: LUNA +5,746% Worst of the year: ANT +52% Aidan Positions: BTC, ETH, LUNA, PERP, RUNE, ZEC, TRIBE/TBI *Assets marked up in my portfolio Expectations or Ideas: The expectations of the team are my vision Best of the Year: AXS (+23,621% YTD return, hard to beat) Chase Worst of the year: YAX -80% (Aidan selected the best and worst of the year from the team) Positions: AXS, BTC, ETH, RUNE, FTM, RGT, MKR, YFI, ANY, MLN, renZEC Dustin Expectations or ideas: DeFi1.0 project "Renaissance" (revenue has an upper limit in a bull market, but a lower limit in a bear market); ATOM: bearish; predict RON > SLP but it is difficult to say (Once Ronin's LM rewards are exhausted, SLP is difficult to last ) Position status: ETH, SOL, ALCX, HNT, OHM, TOKE, OCEAN, RUNE Eric Expectations or thoughts: Decentralization of Ethereum, historical proof of solana, SBF, more influx of users, infrastructure protocols (wireless, liquidity, data, etc.), no-clearance lending, DeFi developers Position status: ETH, SOL, RGT, AURY, Expectations or ideas: Modular ecosystem + ETH expansion solution (bearish monolith). Bullish on metaverse infrastructure (RON is an example), but current games are shit. Optimistic about decentralized cloud computing (RNDR, AKT, etc.). Optimistic about cash flow on the chain (hyperliquidity leads to undercollateralization) Best of the Year: RUNE +739% Rshita Worst of the year: CVP -22% Position status: BTC, ETH Jack Expectations or ideas: optimistic about all multi-chain ecosystems and second-tier applications, all Ethereum killers have high valuations, so bearish Jerry Positions: ETH, SOL, BTC Expectations or thoughts: app-to-infrastructure transition for all web3, NFT (data storage, DeFi use cases, games + music), DAO building, BTC Maartje Best of the Year: HNT +3,046% Position status: BTC, ETH, SOL, OHM, CAKEcrypto.comExpectations or ideas: The rise of Ethereum, numerous L1 public chains, pledge agreements, the combination of DeFi and TradFi (non-chain collateral, methods to avoid over-collateralization, tokenization of real assets, etc.) DeFi can be more diverse in 2022 , web3 infrastructure, GameFi aggregator and metaverse infrastructure Mason Position status: BTC, ETH, CRV Expectations or ideas: ETH, media and entertainment facilities with great potential, the combination of DeFi and TradFi, the construction of DAO, , a special purpose DAO Best of the Year: AXS +23,621% Worst of the year: ANT +52% Tomas Positions: BTC, ETH, ATOM, HNT, INDEX Expectations or ideas: modularization, NFT platforms (RARI, RARE), MVI, Web3 infrastructure (AR, GRT, AKT, LPT), POOL, creators can be profitable (such as Mirror), the combination of NFT and DeFi (such as NFTX, Fractional.art), Cosmos Hubs (ATOM, OSMO), data availability layer (Ceramic, Celestia) Watkins ), ZK-Rollups, Coinbase and USDC, metaverse infrastructure, governance optimization. PS: Not optimistic about the overvaluation of the bull market Position status: BTC, ETH, RUNE, LUNA Expectations or ideas: multi-chain projects, Metaverse and games (P2E game financialization), Ethereum expansion solutions (especially ZK-Rollups), DeFi blue chips, liquid mortgages Best of the Year: LUNA +5,746% Wilson Worst of the year: CREAM -39% Position status: ETH, LUNA, SOL, SYN, HNT, AR Expectations or ideas: Cash, multi-chain infrastructure (long modularization), Web3 infrastructure (Web3 before "Web3"), ZK-Rollups, Cosmos ecology, decentralized stablecoin protocol and DAO infrastructure (difficult but momentum violent). In the end, I am cautiously optimistic about DeFi and think it will return in 2022. Best of the Year: HNT +3,046% Positions: HNT, ETH, ATOM, OSMO, DOT, ACA/KAR, and some SOL-LUNA-AVAX Expectations or ideas: Modular L1s with customizable execution layers (of which Solana is the most feasible), multi-chain infrastructure and tools, "heroes" who contribute to modularity (storage like Arweave, shared security and data Usability like Celestia, indexer and data query protocols like The Graph and Covalent, computing like Akash), liquidity staking protocols (Lido, Rocket Pool, Acala, Umee), and DeFi hubs and Cosmos ecosystems (Osmosis, Terra, Umee) , ZK-Rollups, StarkWare, ZKSync, and also watch out for projects like Aleo that can open up a new type of market for cryptocurrency applications.this screenerOur analytics team is growing so we can't list everyone, but we'll update our monthly report with our holdings.The market moves higher slowly and steadily, forever. (“Super cycle” theory).

Ethereum has reached the upper limit of capacity this year, so other public chains have begun to take over the market value that Ethereum cannot accept. The value of many public chains has exploded by 50-100 times, and investors have also turned their attention The new public chain ecology and profit from it. But all public chains (plus L2 on Ethereum) need to communicate with each other, so the pain point in the cryptocurrency world today may be the lack of cross-chain bridges. If the future is a multi-chain architecture, then whoever can launch better cross-chain connectors and help assets circulate freely between parachains, relay chains and the second layer will be able to grasp the huge wealth of the future digital world.

This is an important stage of development, and one in which private investment funds will have a huge and sustained competitive advantage. At present, there is a large amount of information asymmetry in the protocol "report" of the market, and the technology learning curve is steep, and the risk management infrastructure is limited, which makes the threshold of cryptocurrency investment very high.

According to Dove Metrics, in the third quarter, $8 billion in 423 deals was private investment, nearly half of all investments since the start of the year ($17.8 billion), which is more than the previous six years combined. In the history of the encryption world, nearly 90% of those huge transactions occurred this year, and this does not include the direct listing of Coinbase. Roughly 75% of the funding is focused on infrastructure and centralized exchanges, and all of this is ahead of the FTX and DCG announcements (and possibly the upcoming Binance funding announcement).

** DeFi has excellent long-term expectations, so short the banks (be careful what you say). Although DeFi has achieved amazing results in 2020, the transaction volume of DeFi is less than 1% of the market value of global banks. In the long run, the DeFi market still has a lot of room for growth. Prices for some of the top DeFi protocols have stagnated, but if you firmly believe that the cryptocurrency market will replace traditional centralized institutions, it may reward you with a pretty good risk reward opportunity (bigger than any risk reward opportunity in the market today) . At present, the competition among protocols is fierce, and they are about to face regulatory scrutiny, while technical loopholes are everywhere, systemic risks may also paralyze the entire market, and high gas fees are weakening unit economics. Judging by several indicators (mainly turnover and price-earnings ratio), DeFi is still compelling, but the current calculation is only useful for "whales".

Those who made a lot of money in the short term will evaporate from then on, but the unicorns of the next cycle will emerge in the downturn of the market. Surprisingly, much of the success of cryptocurrencies lies in their staying power. "We're all going to make it" is a funny bull market memes, but in a bear market, it seems like it's a little better to yell "we're all going to survive" when everyone is laughing at you, the market is down 80%, the industry Competitors are going bankrupt and customers are disappearing.

Regarding these nascent ETFs (COIN and BITO), the biggest role is to help the cryptocurrency do a free marketing, from which outsiders can learn about the native encryption market. With Coinbase, you can track their non-trading lines to get a good idea of which custodial services are emerging. SBF also loves this kind of free intelligence. With top-level products like BITO and futures ETFs as "public relations", we can ruthlessly slap Gary Gensler, chairman of the US Securities and Exchange Commission, and expose him as a liar. Therefore, in addition to digital currency, holding some of these securities products is also beneficial.

image description